Q&A Regarding FY 2022 Earmark Repurposing

The purpose of these questions and answers (Q&As) is to provide technical advice to the Federal

Highway Administration's (FHWA) division offices and State departments of transportation (State DOTs)

on the repurposing of earmarked funding for Federal-aid projects pursuant to section 124 of the

Department of Transportation Appropriations Act, 2022 (title I of division L of Public Law 117-103)

(hereinafter “Repurposing Provision”). Unless otherwise indicated, the requirements described in these

Q&As are found in the Repurposing Provision.

Except for the statutes and regulations cited, the contents of these Q&As do not have the force and effect

of law and are not meant to bind the public in any way. These Q&As are intended only to provide clarity

to States and territories regarding existing requirements under the law or agency policies.

- Question 1: What is the purpose of the Repurposing Provision?

- Answer 1: The purpose of the Repurposing Provision is to make funding available from earmarks and designated projects that have not been advanced by State DOTs. The limitations in the Repurposing Provision are to ensure the projects are obligated promptly and used in the same geographic area as the original earmark to provide funding for other needed projects eligible under the Surface Transportation Block Grant Program (STBG) (23 U.S.C. 133(b)), or the Territorial and Puerto Rico Highway Program (THP) (23 U.S.C. 165).

- Question 2: Must earmarks be repurposed?

- Answer 2: No. If an earmark is not repurposed, then it will remain unchanged and available for obligation.

- Question 3: Should all earmark repurposing requests be submitted this Federal fiscal year?

- Answer 3: Yes. States may submit a request to repurpose earmarks at any time prior to September 9, 2022. If earmarks are not submitted for repurposing, the earmarks will remain unchanged with the original period of availability.

- Question 4: What is the basis for the requirement that applicable earmarks be designated before

October 1, 2011?

- Answer 4: The Repurposing Provision states that an earmark must be authorized to be appropriated or

appropriated “more than 10 fiscal years prior to the current fiscal year.” The provision became

effective in Fiscal Year (FY) 2022. As such, 10 years before FY 2022 is FY 2012, which began on

October 1, 2011. Thus, for an earmark to be eligible it must be identified in a prior law, report, or

joint explanatory statement, which was authorized to be appropriated or appropriated before the end

of FY 2011.

- Question 5: What does the requirement that the project be within the same geographic area and within 25 miles of the earmark mean?

- Answer 5: The repurposed funds may be obligated only on a new or existing project within 25 miles of

the original earmark designation in the State. The 25-mile area can be determined from any

reasonable point from the location of the earmark, but the new or existing project must remain within

the State.

- Question 6: Can the State choose an "area wide" project, such as a traffic signal upgrade program project in a specific city or county?

- Answer 6: Yes; however, to ensure the integrity of the earmark and use of funds, the “area wide”

project must be limited to work within the 25-mile area of the original earmark, and the project

description should be clearly defined and eligible under FHWA project authorization guidance. For

example, the State may not repurpose an earmark for an unidentified list of resurface projects in the

25-mile area.

- Question 7: If the earmark was for "Highway xx in an identified city," is the 25-mile range from anywhere in the city?

- Answer 7: No. The 25-mile radius is from any point on the specified highway or work location in the identified city.

- Question 8: If an earmark is described as "Statewide" or "anywhere in the State" in the authorizing legislation, how does the 25-mile rule apply?

- Answer 8: Because the earmark is already authorized to be used anywhere in the State, the 25-mile rule is met regardless of where in the State the repurposed project is located. The repurposed funds are only limited for use within the State for which the funds were earmarked.

- Question 9: If Congress changed the description of an earmark at any point prior to the Repurposing Provision, can it still be repurposed?

- Answer 9: Yes. The repurposing should be based on the latest project description, including applicable earmarks for which the original description was subsequently revised by Congress.

- Question 10: If an earmark was repurposed under the FY 2016, FY 2017, FY 2018, FY 2019, FY 2020, or FY 2021 Repurposing Provisions or is repurposed under the FY 2021 Repurposing Provision, can it be changed again?

- Answer 10: No. Once repurposed under the FY 2016, FY 2017, FY 2018, FY 2019, FY 2020, or FY

2021 Repurposing Provisions or the FY 2022 Repurposing Provision, the project description no

longer meets the requirement of the Repurposing Provision that the project be described in

applicable legislation or a report identified by Congress and, as such, cannot be further repurposed.

- Question 11: Can discretionary awards made by the Secretary without Congressional identification be

repurposed?

- Answer 11: No. The Repurposing Provision applies only to funds being administered by FHWA.

Question 13: If an earmark was revised during the 2012 repurposing activity for specific 2003 to 2006

earmarks carried out by the Secretary, can the earmark be repurposed under this action?

- Question 12: Can earmarked funds that were transferred to another agency be repurposed under the

Repurposing Provision?

- Answer 12: No. The Repurposing Provision applies only to funds being administered by FHWA.

Question 13: If an earmark was revised during the 2012 repurposing activity for specific 2003 to 2006

earmarks carried out by the Secretary, can the earmark be repurposed under this action?

- Question 13: If an earmark was revised during the 2012 repurposing activity for specific 2003 to 2006

earmarks carried out by the Secretary, can the earmark be repurposed under this action?

- Answer 13: No. The description of the earmark has been changed by that action and is no longer as

“identified” in applicable legislation.

- Question 14: If earmarked funds were deobligated after October 1, 2021, does the project then qualify

under the “less than 10%” provision and not require project closeouts?

- Answer 14: No. The Repurposing Provision provides a specific cut-off date for the 10% requirement,

which is October 1 of the current fiscal year (i.e. October 1, 2021). The earmark still must be treated

as 10% obligated. Earmarks that are obligated 10% or more as of October 1, 2021, must be closed

in the Fiscal Management Information System (FMIS) and final vouchered before they can be

considered for repurposing. All of the funds deobligated from the closed project(s) for the earmark

may be considered for repurposing. Project closure may occur at any time before the deadline for

repurposing earmarks.

- Question 15: Can funds deobligated after October 1, 2021, also be repurposed?

- Answer 15: Yes. But if the obligation amount exceeded 10% on October 1, 2021, the earmark project(s)

must still be final vouchered and closed in FMIS.

- Question 16: What does “have been closed and for which payments have been made under a final

voucher” really mean for earmarks that are 10% or more obligated?

- Answer 16: A closed project means closed in FMIS. If the project is not a FMIS project, the State must

certify the project is closed. Final voucher paid means the State has requested final payment from

FHWA based on final project estimates. The State should consider if additional funding is needed to

make the started earmark project functional before it considers repurposing the remaining earmark

funds. All projects related to the earmark must have a final voucher and be closed for the funds to

be eligible for repurposing.

- Question 17: If a portion of the funds for an earmark was previously transferred to another agency, can

the remaining balance retained by FHWA be used for repurposing?

- Answer 17: Yes. The State must certify that the project is closed and may repurpose the remaining

balance that is administered by FHWA. Stated differently, if funds were previously transferred to

another agency, only funds returned to FHWA (currently administered by FHWA) can be repurposed

under this provision.

- Question 18: Earmark funds are obligated on two different Federal-aid project agreements, each for 5%

of the earmark amount. Must both project agreements be closed to repurpose the balance?

- Answer 18: Yes. If the total amount obligated from the earmark meets or exceeds the 10% limit, then all

projects must be final vouchered and closed.

- Question 19: Do earmarks that are final vouchered and closed need to have been authorized to be

appropriated or appropriated before FY 2012?

- Answer 19: Yes. All earmarks must have been authorized to be appropriated or appropriated in

legislation before FY 2012 to be considered for repurposing.

- Question 20: What are the requirements to obligate funds repurposed under the Repurposing Provision?

- Answer 20: Standard Federal-aid requirements will apply for obligation. The obligation of the funds

must be for the project identified during repurposing. Please see the FHWA’s Office of the Chief

Financial Officer’s (HCF) memo titled “Project Funds Management Guide for State Grants” dated

May 23, 2018, for additional information.

- Question 21: How long are the funds and obligation authority available for obligation?

- Answer 21: From the date a repurposing request is submitted by the State, funds may be obligated up to

3 years after the fiscal year of the request. Therefore, repurposed funds from requests submitted in

FY 2022 must be obligated by September 30, 2025. Unobligated balances will lapse on that date.

- Question 22: Does the FY 2022 Repurposing Provision change the time by which FY 2016, FY 2017, FY

2018, FY 2019, FY 2020, or FY 2021 repurposed earmarks must be obligated?

- Answer 22: No. The FY 2016, FY 2017, and FY 2018 repurposed earmarked funding not obligated by

September 30, 2019, September 30, 2020, and September 30. 2021 respectively, has lapsed. The

FY 2019 repurposed earmarked funding must be obligated by September 30, 2022, the FY 2020

repurposed earmarked funding must be obligated by September 30, 2023, and the FY 2021

repurposed earmarked funding must be obligated by September 30, 2024.

- Question 23: What happens if earmarked funding repurposed in FY 2019 is not obligated by September

30, 2022?

- Answer 23: Funding repurposed under the FY 2019 Repurposing Provision must be obligated on the

project designated in the FY 2019 repurposing request by September 30, 2022. If the funds are not

obligated by September 30, 2022, then the funds will lapse and will no longer be available for

obligation, resulting in the loss of the funds.

- Question 24: Will FHWA grant any extensions to the September 30, 2022, obligation deadline for the FY

2019 repurposed earmarks?

- Answer 24: No. The Repurposing Provision explicitly states that the repurposed funds expire three

fiscal years after the fiscal year of repurposing. FHWA does not have the authority to extend this

deadline.

- Question 25: How can Divisions/States track the unobligated balances that have been repurposed?

- Answer 25: In FMIS, the Divisions/States can use the repurposed program codes to track the

unobligated balances of funds repurposed. The FHWA Budget Office is also providing monthly

obligation rate information and will be monitoring the unobligated balances at risk of lapsing. The

FHWA Budget Office will be reaching out to the appropriate Divisions as necessary.

- Question 26: Is there a limited time period to expend obligations?

- Answer 26: For funds from the Highway Trust Fund (i.e., contract authority), the obligated funds are

available until expended, but the project can become inactive if it is not proceeding. For funds from

the General Fund (i.e., appropriated budget authority), the funds will be cancelled 5 years after the

period of availability, September 30, 2030, and will no longer be available for expenditure.

- Question 27: Can earmark project funds from expired programs be repurposed?

- Answer 27: Earmark funds that are in an expired fund category for a program can be repurposed only in

limited circumstances. Only expired funds from the Highway Trust Fund that have been deobligated

in the current fiscal year can be repurposed. The repurposed project must then be obligated in the

same fiscal year (e.g., before the end of FY 2022), pursuant to 23 U.S.C. 118(c). The expired status

of the funds cannot be changed, which means that they will lapse at the end of the fiscal year if not

properly obligated. Examples of programs to which this may apply are the Public Lands Highways

Discretionary Program and the Transportation, Community, and System Preservation Program

(TCSP) where Congress designated the projects from these discretionary programs. If the project

was not specifically designated by Congress, then it is not eligible for repurposing. A new program

code will need to be identified and a demo ID provided, after which the State will follow the standard

repurposing process. Due to the need to obligate these funds by the end of the FY 2022, such

requests should be identified for priority processing.

- Question 28: Does the list of earmarks and allocated funds prepared by HCF identify the only

earmarks and allocated funds that can be considered for repurposing?

- Answer 28: No. The list may not include all the earmarks and funding programs that may be eligible

under the Repurposing Provision. However, it will give States a summation of the projects that could

be considered. States should work with their FHWA division offices to ensure all earmarks and

allocated funds listed or otherwise identified meet the repurposing eligibility criteria and the amount

of funds is available. If a State identifies an earmark that is not listed, it should provide the name,

the original amount, and the legislation for the earmark. The funds must be allocated in FMIS before

the repurposing process can take place. In addition, if an earmark is not on the list, it may require

the Financial Systems Team to establish a new program code for the repurposed funding.

- Question 29: Why are some of the demo IDs repeated on the earmark lists?

- Answer 29: Some demo IDs have multiple program codes and were identified from more than one law,

so the report filter created more than one line for the demo ID. Please refer to the FMIS N25A report

for details on the correct program code and the amount of funding available for each program code.

- Question 30: Some earmarks are missing from the published list on FHWA’s website compared to the

lists we obtained from other sources. Where are those projects?

- Answer 30: A few earmarks were allocated under two different program codes, specifically

SAFETEA-LU HPP earmarks. In some instances, one program code was obligated more than 10%

and the other program code was not. If the earmark, in total, has obligations 10% or greater, then it

is not eligible unless the FMIS project agreement(s) has been final vouchered and closed. Such

instances will not be on the FHWA published list of projects less than 10% obligated. Please review

the FMIS N25A report to ensure the earmark meets the less than 10% obligated requirement. The

projects may be on the list of earmarks obligated greater than 10%.

- Question 31: Why are there negative unobligated balances on the FMIS N25A report for some earmarks

(or Demo IDs)?

- Answer 31: Some demo contract authority was permitted to be used on other demos for various

reasons, including advance funding authority under the High Priority Projects program. If your State

has a demo with a negative unobligated balance, you should identify which demo was used to

balance the funds. A State should not transfer funds if the funds were used under a different demo

even if the balance appears on the N25A as unobligated.

- Question 32: Who has the authority to request repurposing of an earmark that appears to be for a local

agency?

- Answer 32: The Repurposing Provision provides the authority for a State to repurpose any earmark that

was designated on or before September 30, 2011 “located within the boundary of the State or

territory”. The only requirement for the State is that the repurposed project must be within 25 miles

of the designation, within the State, and eligible for STBG or THP.

- Question 33: Should the State use the repurposed transfer form (FHWA 1575 (ERP 2022)) to request

repurposing?

- Answer 33: Yes. This form was slightly modified for the earmark repurposing requests and to ensure

the necessary information is provided for HCF to efficiently complete the repurposing process and

meet the requirements of the Repurposing Provision. Please be sure to use the most recent version

(ERP 2022) for the FY 2022 Repurposing Provision.

- Question 34: How detailed does the new project description on the repurpose request need to be?

- Answer 34: The project description should clearly define the scope of work and the project location that

the funds will be obligated on before the end of the availability period. Please see the HCF memo

titled “Project Funds Management Guide for State Grants” dated May 23, 2018, for additional

information. The project description does not need to specify the phase of work, i.e., preliminary

engineering (PE), right-of-way activities, or construction.

- Question 35: Can “placeholder” or “backup” projects be identified during repurposing process?

- Answer 35: No. The actual projects the State plans to obligate funds on must be identified with the

amount of repurposed funds to be obligated on that project. Token amounts of funding for a project

will not be considered.

The State should identify the amount it intends to obligate to each project, understanding that some

adjustments might occur due to estimates. For example, if the earmark has $300,000 available, and

the State identifies 3 projects on which it intends to obligate $100,000 each, each project should get

$100,000, with minor adjustments for estimates. The State should not distribute the funds to

multiple projects and then, for example, obligate all the funding on one of them. Also, see questions

#38, and #39.

- Question 36: Does the Federal-aid number need to be identified at the time of repurposing?

- Answer 36: No, the Federal-aid number can be identified later at the time of obligation.

- Question 36: Does the Federal-aid number need to be identified at the time of repurposing?

- Answer 36: No, the Federal-aid number can be identified later at the time of obligation.

- Question 37: Do any Federal-aid requirements need to be met before the funds can be repurposed to the

new project, including being on the STIP?

- Answer 37: No. Federal-aid requirements must be addressed before obligation (23 CFR

630.106(a)(2)), but not before the earmark funds are approved for repurposing. The only

requirement is identifying the eligible project(s) for use of the earmark funds.

- Question 38: How specific should the amount be for the project identified to receive the repurposed

funds?

- Answer 38: The amount should be a realistic amount the State intends to obligate for the project based

upon the current project cost estimate. “Token” amounts may not be identified with the intent to

provide options for the earmark funding use. See Question #35.

- Question 39: If the project estimate is more than was anticipated when the repurpose form was

submitted, can a State DOT obligate more funds to a repurposed earmark project from other projects

identified on the repurpose transfer form?

- Answer 39: Question #35 specifies that the amount and projects identified on the repurposed transfer

form need to be specific. Thus, only minor modifications should be made between identified projects

on a repurposed transfer form. The State should use other funding sources if the final estimate

significantly exceeds the funds identified for a project rather than significantly redistributing earmark

funds identified for another project.

- Question 40: What is the purpose of the earmark certification box?

- Answer 40: The certification statements for both the State DOT and the FHWA Division Administrator

(DA) provide clearly defined and consistently applied assurance that the requested repurposing

meets the eligibility criteria set forth in the Repurposing Provision.

- Question 41: What is FHWA’s role in determining which earmarks to repurpose and on what projects to

utilize the repurposed funds?

- Answer 41: The FHWA divisions work with States to ensure the Repurposing Provision’s requirements

are met for repurposing, such as the requirements that: an eligible earmark has less than 10% of

the funds obligated or the State has demonstrated that it was complete; the repurposed project is for

an eligible activity; and the repurposed project is within 25 miles of the original location and is in the

same State as the original earmark. However, it is a State’s decision as to which eligible earmarks

to repurpose and on which qualified projects to utilize those repurposed funds.

The DA’s approval of a State’s repurposing request constitutes FHWA’s concurrence that (1) the

repurposed earmark request meets the criteria for repurposing, and (2) any new proposed projects

are STBG (or THP) eligible, was authorized to be appropriated or appropriated more than 10 FYs

prior to the current FY, within 25 miles of the earmark description, and within the State.

- Question 42: Can the DA delegate approval of these requests?

- Answer 42: The DA can delegate the approval to the Deputy Division Administrator (DDA) or Chief

Operating Officer (COO). The DA’s signature (or DDA/COO’s signature, as delegated) is required to

ensure the appropriate level of and multi-discipline review has been completed.

- Question 43: Can States request an extension to submit earmark repurposing requests beyond the

August 26, 2022 deadline, if the State intends to obligate before the end of the fiscal year, or beyond

the September 9, 2022 deadline, if the State does not intend to obligate before the end of the fiscal

year?

- Answer 43: No. Extensions cannot be considered. For requests to be processed before the end of the

fiscal year and to be considered valid for processing, FHWA division offices must submit repurposing

requests to HCF’s “FHWA Transfers” e-mail address by the deadlines provided.

- Question 44: Must the State do any annual reporting?

- Answer 44: Yes. States must submit an annual report as required by the Repurposing Provision.

However, FHWA will facilitate these reports by providing the States a consolidated report containing

the project identified and approved for repurposing during the fiscal year. The State should provide

the FHWA division office a letter certifying the accuracy of the list. The reports are required only

from States that made a request to repurpose earmarks. Once the FY 2022 earmark repurposing

requests are fully processed for all States, FHWA will provide additional information to the States

about the exact process and timeline.

- Question 45: To whom should the State send the certification letter and what does it need to include?

- Answer 45: The State or territory should send the certification letter to the DA. The letter should state

that the funds from the earmark projects shown in the attachment (which HCF will provide) will be

obligated only for the respective projects which are eligible under the Repurposing Provision (section

124 of the Department of Transportation Appropriations Act, 2022, title I division L of Pub. L. 117-103). The letter may address any corrections that are consistent with and that do not change the

original request as submitted on the repurposed transfer form. Please ensure the list of projects is

attached to the letter.

- Question 46: Can FHWA prioritize certain projects for processing?

- Answer 46: Repurposing requests will be processed on a first-come-first-serve basis. If the State needs

a request processed early, it should submit early. If a project is advancing before the repurpose

request can be processed, the State DOT should use an advance construction authorization for the

project. Other funds may not be obligated as a placeholder.

- Question 47: Is obligation limitation associated with repurposed funds subject to August

Redistribution?

- Answer 47: No. While some obligation limitation may be subject to August Redistribution prior to

repurposing, such as the limitation for allocated programs, once funds are repurposed, the

associated obligation limitation is no longer subject to August Redistribution.

- Question 48: Are earmarks that are not subject to obligation limitation required to use annual formula

limitation after repurposing?

- Answer 48: No. Only funds that are subject to obligation limitation and do not have obligation limitation

remaining available will need to use annual formula obligation limitation.

- Question 49: How can the State determine how much obligation limitation is available for the earmark?

- Answer 49: If the funds have not been allocated in FMIS, the relevant program office should be able to

provide that information. If the funds have been allocated, first go to the “Fund Control Menu” in

FMIS and look up the applicable program code. See the “Limitation Type” column. Then go back to

the “Fund control” menu, select “Limitation – Balances”. Select the appropriate limit type and

determine if the limit is “Limit by Demo”.

- Question 50: What is the difference between Contract Authority (CA) and Obligation Limitation (or

authority)? How does it impact the ability to obligate these repurposed funds?

- Answer 50: The CA (also referred to as the “funds”) is the actual amount of funding authorized to be

used for a purpose by Congress in the applicable legislation and may be obligated in advance of

appropriations. The CA is typically provided in multi-year laws. To limit the CA from multi-year

legislation into the annual budget and appropriations process, Congress establishes a maximum

amount of the CA that can be obligated in each fiscal year in an appropriation act. This is referred to

as obligation authority (OA) or obligation limitation (used interchangeably in FHWA). The States

receive annual formula OA based upon a ratio of the amount of CA the State receives that must be

used in conjunction with apportioned funds. States may also receive OA in conjunction with certain

allocated program funds. “Special OA” may be provided for an extended period, such as the fiscal

year plus 3 years, or may be provided as “available until expended.” The amount of OA is typically

less than the CA. For this reason, many of the earmarks have more CA available than OA. In this

case, the State must use annual formula OA for any excess CA if they wish to obligate the balance

exceeding the OA originally provided for the earmark. Annual formula OA will not be impacted when

the funds are repurposed. The annual formula OA will only be impacted in the FY the funds are

obligated.

Finally, some CA is provided as “exempt” from obligation limitation and is not subject to any limitation

when obligated.

It should be noted that most Federal funds, other than those from the Highway Trust Fund, are

provided as appropriated budget authority (BA), typically within an appropriations act. The

appropriated BA does not require additional OA to be obligated because appropriated BA is limited

directly by the appropriations which made it available. Unless stated otherwise in law, appropriated

BA is available to be obligated for one year.

- Question 51: What are the various types of obligation limitation that could be affected by earmark

repurposing??

- Answer 51: Please see the Attachment 1 for an explanation of the obligation limitation.

- Question 52: If the earmark has more CA than OA, and the State does not wish to use the formula OA

for the repurposed funds, does the State need to repurpose the full amount available for the earmark?

- Answer 52: Yes, the State should repurpose the full amount of CA even if it does not plan to use

formula OA to obligate the excess CA. This is an acceptable variance from Question #35 to take

into account the excess CA.

- Question 53: Can the repurposed funds be used to replace previously obligated funds on an existing

project?

- Answer 53: No. Pursuant to 23 CFR 630.110(a), properly obligated funds may not be replaced. A

State may use repurposed funds to add additional funds to a project due to a need for additional

obligations or to convert advance construction as long as that project is identified at the time the

repurposing is originally requested.

- Question 54: If a repurposed project is completed, can excess funds deobligated from the project due to

cost underruns be re-obligated on another project?

- Answer 54: Once a project is repurposed, the project description no longer meets the requirement of

the Repurposing Provision that the project be described in applicable legislation or a report identified

by Congress and, as such, cannot be further repurposed. Therefore, if a repurposed project is

completed and excess funds are deobligated, the unobligated funds may be used only on another

project from the same earmark identified on the previously submitted modified repurposed transfer

request form. In addition, for contract authority funding after the period of availability, the

reobligation must occur in the same fiscal year as the deobligation. Moreover, the original obligation

must have been proper (an amount was not obligated in excess of the estimate to complete the

project authorized or before the project was ready to proceed), and the deobligation must have been

for a valid reason complying with 23 CFR 630.110(a).

- Question 55: Can the repurposed funds be transferred to another agency or Federal Lands to carry out a

project or projects?

- Answer 55: Yes, based upon authorized transfer procedures as described in FHWA Order 4551.1.

If funds are being transferred to another agency, e.g., the Federal Transit Administration, the State

should submit two transfer forms. The State should submit form FHWA-1575 (ERP 2022) to

repurpose the earmark to the new purpose and submit form FHWA-1575C to transfer the funds to

the other agency. Both forms may be submitted at the same time if the receiving agency will

obligate in the current fiscal year. Form FHWA-1575C will show the repurposed funds program

code.

- Question 56: Can the repurposed funds be used to convert advance construction (AC)?

- Answer 56: Yes. As long as the project was properly identified during the repurposing process, the

funds may be used to convert AC.

- Question 57: Can toll credits be used with the repurposed funds?

- Answer 57: If the earmark was previously eligible to use toll credits as non-Federal share, then the

repurposed funds may also use toll credits as the non-Federal share.

- Question 58: Does PE or right-of-way payback apply to the original earmark?

- Answer 58: Answer 58: If the earmark, as written, was specifically for PE (e.g., design activities) or right-of-way

acquisition, then consistent with FHWA Order 5020.1A, “Repayment of Preliminary Engineering

Costs”, dated June 8, 2018, the project is not subject to PE or right-of-way reimbursement to FHWA

because the earmark had a specific limited purpose. If the State did use part of earmarked funds for

PE or right-of-way activities that were intended to include construction prior to repurposing and the

amount obligated was less than 10% of the earmark, the earmark may be repurposed, but the

expended funds for PE or right-of-way activities will be subject the applicable reimbursement

provisions. If the State spent 10% or more of the earmark intended for construction for PE or rightof-

way activities, the project cannot be considered complete. If the State promptly pays back those

activities, the funds could be considered for repurposing.

Attachment 1: Response to Question 51

Question 51: What are the various types of obligation limitation that could be affected by earmark

repurposing?

Answer 51: Earmarks have various types of limitation. The State’s funds and limitation balances on the

FMIS W10A report may change category after repurposing of an earmark. The following are descriptions

of the different limitation types:

1) Special limitation for specific earmarks at the program level.

a) All earmarks from the same program draw its limitation from the associated limitation pool.

The limitation pool amounts may match the allocated funds at 100% or less. Examples of

special limitation at the program level include: Transportation Improvements (program code

LY30); TEA-21 High Priority Projects (program code Q920); and Projects of Regional and

National Significance (program code LY40). To repurpose an earmark which has program

level pool limitation:

(1) Determine the limitation type from the Program Code Crosswalk. See column “PC Type

Description (limitation type)”.

(2) Refresh the Business Objects report “Lim buckets by Demo ID” to get the total amount of

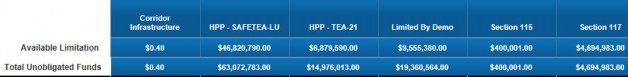

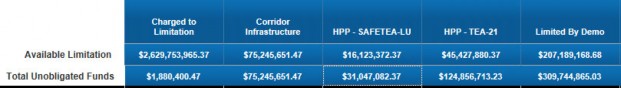

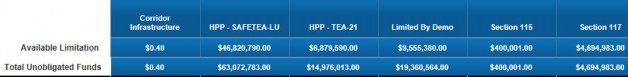

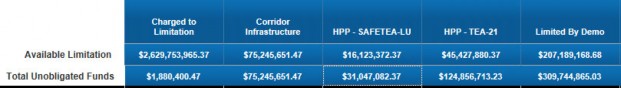

contract authority contrasted to the total amount of limitation which are available for the

program. See example below.

(3) If the total Available Limitation is equal to Total Unobligated Funds, then the total

unobligated balance of the Demo ID would be repurposed to the program code shown on

the crosswalk in column (-B-).

(4) If Available Limitation is less than the Total Unobligated Funds, then the State would

repurpose the earmark fund balance using the program codes shown on the crosswalk in

columns (-B-) and (-C-) depending upon the amount of available limitation the State

determines to use for the repurposed earmark funds. However, the remaining total

limitation balance for the program cannot exceed the remaining total unobligated balance

of funds for all earmarks in the associated program.

2) Special limitation authorized only for a specific earmark within a program.

a) High Priority Projects authorized in SAFETEA-LU section 1602 #1-3676 have limitation

assigned to each earmark (e.g., by Demo ID). The limitation type is Limited by Demo.

To repurpose one of the earmarks from this program:

(1) Look up the amount of available limitation for the specific Demo ID from the FMIS Fund

Control Limitation Balances screen. Filter for your State and Limited by Demo. Then

expand Details and open View Limit by Demo ID.

(2) Lookup the available limitation for both program codes HY10 and LY10. These amounts

must be repurposed to program code RPS5.

(3) The excess contract authority (funds which have no matching obligation authority) must

be repurposed to program code RPF5.

3) Earmarks which draw from annual limitation.

a) Refer to the Program Code Crosswalk and the Business Objects “Lim Buckets by Demo ID”

report to identify by Demo ID or program code which earmarks (or programs) draw from

Charged to Limitation balances

b) When earmarks with discretionary limitation are repurposed from the State’s existing

allocated funds, the State may see a change in their Charged to Limitation account balance.

This limitation was previously allocated to the State for these funds. When funds are

repurposed to RPS5, then the applicable amount of limitation will be moved from the “FUNDS

SUBJ TO ANNUAL OBLIG LIM” section of the W10A “TOTAL ANNUAL OBLIG LIM” to the

special limitation category “TOTAL SPECIAL LIM”.

4) Exempt from limitation and non-Federal-aid limitation.

a) For program codes shown on the crosswalk as Exempt and Non-Federal-aid in the PC Type

column, use the program codes shown on the crosswalk – RPE5 and RN#5. The State’s

limitation balances will not change.

b) The fund amounts on the W10A report will continue to be shown in the Exempt category and

the Other category, as appropriate.

RPF5 note: Funds repurposed to program code RPF5 will draw from the State’s formula limitation

balance at the time that the funds are obligated. If the funds are not obligated and lapse, the limitation

will not be affected.

RPS5 note: Special limitation for funds repurposed to program code RPS5 will expire at the end of FY

2024.

All repurposed funds will show unobligated balances as “Possible Lapse Fiscal Year End” 2025 column

when visible on the W10A report (in FY 2022).