« Back to Innovative Finance Quarterly Issues List

FALL 2004

On October 6, 2004, the Federal Highway Administration (FHWA) announced a new Special Experimental Project (SEP-15) to encourage tests and experimentation in the entire development process for transportation projects. SEP-15 is aimed specifically at promoting increased project management flexibility, innovation, efficiency, and timeliness, while simultaneously promoting new revenue sources. The FHWA plans to use the lessons learned from SEP-15 to develop more effective approaches to highway project planning, project development, finance, design, construction, maintenance, and operations.

SEP-15 will allow FHWA to test project development approaches that provide the flexibility and timely decision-making often required to attract private capital while still exercising essential FHWA stewardship responsibilities. Partnerships between private investors and public transportation agencies can bring not only greater funding to a project but also more intellectual capital and innovation. The objective of SEP-15 is to identify for trial evaluation and documentation public-private partnership approaches that advance the efficient delivery of transportation projects while protecting the environment and the taxpayers. SEP-15 addresses four major components of project delivery - contracting, compliance with FHWA's National Environmental Policy Act (NEPA) process and other environmental requirements, right-of-way acquisition, and project finance. This experimental authority does require applicants to fully comply with all requirements of NEPA and other state and Federal environmental laws and regulations. States will have to follow the same environmental requirements under SEP-15 as they would for any other project. In order to meet the objective of SEP-15, proposals should describe the specific Federal-aid program areas of experimentation and identify proposed performance measures to evaluate the success of the SEP-15 project. Information on the SEP-15 program will be available in January 2005 on FHWA's public-private partnership web site at https://www.fhwa.dot.gov/ipd/p3/.

Contact: Alla Shaw, TIFIA JPO, 202/366-0740, alla.shaw@fhwa.dot.gov

Contact: Alla Shaw, TIFIA JPO, 202/366-0740, alla.shaw@fhwa.dot.gov

[Top of Article, In This Issue...]

Fiscal year 2004 was a busy year for the Transportation Infrastructure Finance and Innovation Act (TIFIA) program. In total, the TIFIA Joint Program Office (JPO) received four applications and seven Letters of Interest in FY 2004 from sponsors considering the use of TIFIA credit assistance.

The four applications received in FY 2004 were from IdleAire Technologies, Louisiana Transportation Authority, Las Vegas Monorail Company (LVMC), and the Central Texas Regional Mobility Authority (CTRMA). These applications requested a total of $562 million in TIFIA credit assistance to support projects valued at $2.1 billion.

The six FY 2004 Letters of Interest received from project sponsors spanned the country from a Truck Tollway project in Virginia to a Port Expansion project in Alaska. Along with the Letter of Interest received from the CTRMA prior to the submission of its application in July 2004, the TIFIA Credit Program also received six other Letters of Interest for the following projects: the Oceanside-Escondido Sprinter Rail project, the Transbay Terminal project, the Central Puget Sound Regional Transit Authority (Sound Transit), Chicago Transit Authority (CTA) for the Downtown Intermodal Terminal project, Safer Transport and Roadways (Star) Solutions for the Interstate 81 project in Virginia, and most recently the Port of Anchorage for the Port Intermodal Expansion project.

The Port of Anchorage has divided the Port Intermodal Expansion project into two major expansion phases: Road and Rail Development and the Marine Terminal Redevelopment. The Road and Rail Development phase will add more than 16,500 feet of new rail in order to provide on-port ship-to-rail and ship-to-truck cargo transfer facilities. The Marine Terminal Redevelopment phase is further divided into two subphases: the waterside (dock) development and the backlands intermodal development. The waterside dock development subphase will expand the existing dock to include 3,000 feet of berthing space, 8,800 feet of waterside wharf, a new harbor depth of minus 45 feet, and a 150-foot apron to accommodate gantry cranes and a mobile crane. The backlands intermodal development subphase, for which the Port of Anchorage is seeking TIFIA assistance, will expand the intermodal terminal yards and provide new intermodal terminal facilities. The total cost of the port expansion project is estimated at $427 million. The Port of Anchorage is seeking either a loan guarantee or direct loan of $51 million from the TIFIA program.

On December 8, the President signed the Consolidated Appropriations Act of 2005, which includes appropriations and limitations for the FHWA for FY 2005, including funding for the TIFIA Credit Program. However, FHWA funding is still limited by the authorizations included in the eight-month extension act, the Surface Transportation Extension Act of 2004, Part V. As a result, all of the programs under FHWA - including the TIFIA program - are limited to roughly eight-twelfths of what would be expected for the full year. Based on this proportional allocation, the TIFIA program has approximately $1.7 billion in credit assistance available for FY 2005.

In November 2004, the Secretary of Transportation approved the U.S. 183-A Turnpike Project, which is being advanced by the CTRMA, for up to $66 million TIFIA credit assistance in the form of a direct loan. The project, estimated to cost $342 million, is a new 11.6-mile controlled access north-south tolled highway in central Texas. Located in a growing area of the country, the project is expected to relieve congestion, improve safety, reduce fuel consumption, and increase connectivity. This project is a high priority for the region and a critical link in the 122-mile Central Texas Turnpike System. The project, scheduled to open in December 2007, will be constructed as a four-lane highway, but will accommodate ultimate expansion of the facility to six lanes. About 75 percent of the project will be funded via debt proceeds, including an estimated $194 million of tax-exempt senior debt and $66 million of interim construction financing, which is anticipated to be refinanced with the TIFIA loan proceeds. Other sources of funding include over $60 million of Texas Department of Transportation (DOT) equity and $14 million in donated rights-of-way and local government contributions. The TIFIA loan is expected to close in March 2005, simultaneously with the bond closing.

Also in November, the TIFIA JPO received its first FY 2005 letter of interest from the Global Rail Consortium (GRC) for the Florida High-Speed Rail Project. The GRC is seeking $800 million in TIFIA credit assistance, which would represent no more than 33 percent of eligible project costs for a High-Speed Rail (HSR) project between Tampa and Orlando International Airport (OIA) with intermediate stations in Lakeland and the Orlando Entertainment Area. The Florida High-Speed Rail Authority (FHSRA) currently envisions the 84-mile mainline alignment to be located primarily in the median of I-4. State Road 417 right-of-way is currently being reviewed to provide the HSR alignment from I-4 to OIA.

Given projects in the pipeline, FY 2005 should reflect increased TIFIA activity, resulting in the leveraging of significant resources to help meet transportation infrastructure needs.

Contact: Duane Callender, TIFIA JPO, 202/366-9644, duane.callender@fhwa.dot.gov

Contact: Duane Callender, TIFIA JPO, 202/366-9644, duane.callender@fhwa.dot.gov

[Top of Article, In This Issue...]

The "Finer Points of TIFIA" box provides responses to questions posed by our readers and other observers. We hope you find this section useful and that you will submit questions to Mark Sullivan, Chief, TIFIA JPO, 202/366-5785 or mark.sullivan@fhwa.dot.gov.

Question

What types of projects are eligible for TIFIA assistance?

Answer

There is a common misconception that TIFIA is solely geared toward highway or transit projects. In fact, TIFIA is available to fund highway, transit, passenger rail, intelligent transportation systems, and intermodal freight facilities. For example, the Port of Anchorage project featured in this issue of IFQ combines both surface and sea freight transport elements. The U.S. Department of Transportation's interpretation of the TIFIA statute as it applies to Federal funding of publicly owned intermodal surface freight transfer facilities identifies a distinction between the surface freight portion of the facility and the sea freight portion. Specifically, the portion of the facility that relates to surface freight movement including those facilities necessary to transfer freight from or to the surface mode would be eligible for funding, while those elements of the facility that focus primarily on sea side operations would not be eligible. The same interpretation applies to intermodal projects combining both surface and air freight transport elements.

The specific determination of TIFIA eligible costs will depend upon a case-by-case analysis of any application submitted to the TIFIA program.

[Top of Article, In This Issue...]

The Arizona Transportation Board in October 2004 issued $104,385,000 of Series 2004B Grant Anticipation Notes (GANs). This is the fifth series of GANs issued by the Board and will provide the Arizona Department of Transportation (ADOT) with $115 million of funding for accelerated completion of the Maricopa County Regional Freeway System. With this sale, the Board's GAN debt issuance now totals $487 million of which $413 million is outstanding as of December 2004.

The Series 2004B GANs have an average life of eight years and a final maturity of July 1, 2016. The True Interest Cost (TIC) for the issue is 3.356 percent, the lowest TIC of any of the five series of GANs issued to date. The GANs are insured by Ambac and are rated triple-A by all three rating agencies. Underlying ratings on the GANs are Aa3/AA-/AA from Moody's, Standard & Poor's, and Fitch, respectively.

Over the next several years, Arizona currently plans to issue up to $190 million of additional GANs to fund projects in the statewide construction program. This additional debt is allowed under an additional notes test that provides flexibility to ADOT, while supporting the high underlying ratings for the GAN program. Under this test, additional notes can be issued as long as Federal-aid revenues anticipated to be received by ADOT in the year of issuance are not less than 150 percent of the annual debt service in any Federal fiscal year that ends on or before the expiration date of the Federal-aid authorization. For a situation such as currently exists where no reauthorization bill has been passed, the test contains an alternate provision that still allows the issuance of additional notes. In this case, Federal-aid revenues in either of the two years prior to the issuance of the additional notes must exceed 300 percent of the annual debt service in any Federal fiscal year that ends after the expiration date of the Federal-aid authorization.

Contact: John Fink, Arizona Department of Transportation, 602/712-6164, jfink@azdot.gov

Contact: John Fink, Arizona Department of Transportation, 602/712-6164, jfink@azdot.gov

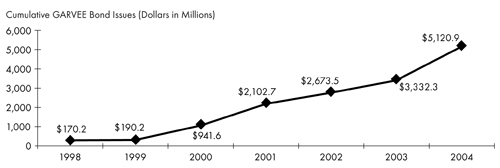

With the recent Arizona bond sale, cumulative Grant Anticipation Revenue Vehicle (GARVEE) issues through November reached $5.1 billion. This activity level represents 28 bond issues sold by 10 states together with Puerto Rico and the Virgin Islands. The next state planning to sell GARVEE bonds is Maine, whose estimated $50 million issue will be priced in December. The bonds, to be issued by the Maine Municipal Bond Bank, will help finance the construction of a new cable-stayed, concrete bridge that will cross the Penobscot River from the Town of Prospect to the Town of Verona. The Winter issue of IFQ will include more details on the Maine bond issue.

Grant Anticipation Notes or Bonds (GANs) have been used by public transportation agencies in the same way as states have used GARVEEs. The mechanism was first used in the early 1990s, when the Tri-County Metropolitan Transit District (TriMet) in Portland, Oregon leveraged a $1 million loan with the anticipation of a $35 million grant for its new light rail system. Due to its relatively high cost and complexity, the mechanism was not used again until the Transportation Equity Act for the 21st Century (TEA-21) was enacted. Minimum Guaranteed Funding Levels and mass transit account funding provided the economic security that financial markets demanded. Since 1997, over $2.7 billion in GANs have been issued for mass transportation, as shown in the table below.

| Issuer | Series | Amount (Dollars in Millions) |

Security | Underlying Rating | Term |

|---|---|---|---|---|---|

| New Jersey Transit | 1997A | 139.0 | FFGA - $604 million | AA | - |

| New Jersey Transit | 2000A | 284.9 | FFGA - $604 million [ Note: These bonds refinance the 1997A series for Hudson-Bergen LRT. The 1997A bonds are not included in the Total to Date] |

A- | 2000-2004 |

| New Jersey Transit | 2000B | 450.0 | FFGA - $500 million | - | 2004-2011 |

| New Jersey Transit | 2000C | 110.0 | FFGA - $142 million | - | 2002-2005 |

| New Jersey Transit | COP1999A | 160.0 | Section 5307 | A, A1 | 2001-2008 |

| New Jersey Transit | COP2000A | 234.0 | Section 5307 | - | 2000-2014 |

| New Jersey Transit | COP2000B | 493.0 | Section 5307 | - | 2000-2013 |

| New Jersey Transit | COP2002B | 94.0 | Section 5307 | - | 2002-2015 |

| City of Phoenix | 2000 | 18.3 | Section 5307 & 5309 | AA | 2000-2012 |

| Bay Area Rapid Transit (BART) | 2001 | 385.0 | FFGA - $750 million | - | - |

| Port Authority Pittsburgh | 1999 | 70.0 | Section 5309 Fixed Guideway Modernization | - | - |

| Chicago Transit Authority | 2003A | 128.8 | FFGA - Blue line | A- | 2003-2006 |

| Chicago Transit Authority | 2003B | 78.5 | FFGA - Blue line | A- | 2003-2005 |

| Chicago Transit Authority | 2004 | 250.0 | Section 5307 | A2, A | 2004-2015 |

| TOTAL TO DATE | - | 2,756.4 | - | - | - |

Notably, these GANs are being issued on a sole pledge basis, backed only by anticipated Federal Transit Administration (FTA) grant receipts. In most cases, the agency has no authority to pledge the full faith and credit of the state, and there are often restrictions on the use of dedicated local revenues such as sales taxes. Thus GANs are becoming a valuable tool for public transportation agencies as they seek to complete major capital projects as close to on-time and on-budget as possible.

Contact: Paul Marx, FTA, 202/366-1675, paul.marx@fta.dot.gov

Contact: Paul Marx, FTA, 202/366-1675, paul.marx@fta.dot.gov

In October, the Chicago Transit Authority (CTA) issued $250 million in grant receipt revenue bonds. This is the most recent transit grant anticipation bond issue. The CTA bonds are secured by annual Section 5307 formula grant funds provided to CTA by the FTA. This is the second bond issuance by CTA backed by FTA grants, with a $207.2 million issuance last year secured by a Full Funding Grant Agreement (FFGA) for rehabilitation of the Cermak (Douglas) branch of the CTA's Blue Line.

Reflecting the anticipated amounts and schedule for receipt of Section 5307 funds from the FTA, the new sale consists of two fixed-rate series - one for $150 million and the second for $100 million - with maturities that extend through 2015, spanning two reauthorization periods. Over the last decade, CTA's Section 5307 funding has grown from $62.9 million in FY 1994 to $116.3 million in FY 2004. The bonds are projected to have coverage ratios of 3.6 in the first few years, growing to 3.9 after 2006; CTA's previous issue has a $10 million claim on Section 5307 receipts in 2005 and 2006. The new bonds were rated A2 by Moody's and A by both Standard & Poor's and Fitch. With insurance provided by Ambac, the bonds were issued with an AAA rating.

CTA has identified $5 billion of capital needs over the next five years. Proceeds from the $250 million bond sale will be used to support renovation of the Dan Ryan branch of the Red Line, expansion of the Brown Line, station and bus garage reconstruction, new rail car procurement, and bus farebox replacement.

Contact: Paul Marx, FTA, 202/366-1675, paul.marx@fta.dot.gov

Contact: Paul Marx, FTA, 202/366-1675, paul.marx@fta.dot.gov

Grant Anticipation Revenue Vehicles (GARVEEs) are state authorized debt instruments issued to advance construction of certain highway projects or, in the case of transit authorities, to advance the purchase of rolling stock or other transit facility improvements. GARVEE debt instruments can supplement traditional pay-as-you-go and tax supported debt financing approaches to state surface transportation projects. The primary security for these debt instruments consists of formula-based Federal-aid - grants for state highway departments or transit authorities. Fitch Ratings' definition of GARVEEs includes both the direct pay and indirect reimbursement-based structures. GARVEE debt instruments are special obligations of the issuing state or transit authority. They do not constitute general obligations of the issuing entity or of the Federal government.

Fitch's current ratings range for GARVEE debt instruments is fairly high compared with that of other transportation credits ('A' through 'AAA'). Coverage by pledged revenues and general strengths associated with the established Federal surface transportation grant programs are key rating considerations, but many GARVEE debt programs have additional structural protections. These can include debt service reserves, self-imposed debt limits, additional bonds test, a limited maturity profile, and the pledging of other unencumbered Federal or state sources for debt service, among others.

A key risk to GARVEE debt instruments is Federal reauthorization, since surface transportation funding typically operates under multi-year authorization cycles. Upon a reauthorization, Congress may alter the amount of money available for surface transportation, the amounts allocated between highways and transit, allocations by state, and even the presence or nature of funding firewalls. The best protections against reauthorization risk are strong debt service coverage and limited maturities. To the extent that debt levels increase, debt service coverage weakens, final maturities lengthen, and security features are eliminated, a lower ratings profile may result.

The prolonged delay in enacting a successor authorization to TEA-21 is another dimension of reauthorization risk. The series of interim authorizations now extending 20 months from the expiry of TEA-21 on September 30, 2003 have substantially narrowed the 24-month window between the expiry of TEA-21 and the expiry of the Federal motor-fuel (gas) tax on September 30, 2005. While surface transportation funding retains broad support and the potential for an interruption in funding is remote, as evidenced by the timely enactment of interim bills to ensure continued flow of funding, and because Congress has the ability to act relatively quickly to ensure continued inflow of the gas tax and funding, the protracted policy debate could begin to insert near-term reauthorization risk, particularly for standalone GARVEEs.

Leveraged Federal Funds

Fitch considers the dedicated pledge of Federal highway grants for GARVEE debt programs to be state money, since this represents Federal grant moneys apportioned or allocated to the states. GARVEE debt program ratings are not directly linked to the credit quality of the U.S. government or to the general credit of the state. Although the source of revenues originates as Federal transportation grants, the flow of funds is dependent on state compliance with Federal regulations, and funds flow either through the state treasury or its DOT. By dedicating this portion of its transportation revenue stream, a GARVEE bond is a special obligation of the state or its transportation authority.

The long and solid track record of the Federal government's surface transportation grants to states is a positive credit consideration, as is the demonstrated ability of states to maintain the flow of eligible transportation grants to their highway and transit programs. The reauthorization risk for Federal surface transportation grants becomes a negative credit consideration to the extent that GARVEE debt maturities extend into more reauthorization cycles. GARVEE bond ratings are also driven by structural considerations, such as debt service coverage, the ability of states to budget for and adequately segregate funds dedicated for the bonds, and other structural protections such as reserves, additional bonds tests, debt limits, and the like.

Highway Reimbursement GARVEEs

Some states, like Massachusetts, Virginia, Michigan, and Mississippi, issued GARVEES secured by the flow of Federal highway grant reimbursements from other grant eligible construction projects. The GARVEE bond proceeds finance the construction of new projects, and debt service payments are secured by the Federal grant reimbursement flow to the state under its portfolio of grant-eligible projects. As mentioned, the pledge is actually a dedicated portion of the state's own transportation revenues, since the Federal reimbursements are already mixed in the pool of state transportation revenues.

Fitch takes a program rating approach to reimbursement GARVEEs, which means that the rating assignment is based on expected or authorized debt issuance under the program. States inform Fitch as to the authorized size of the debt program, the number of planned debt issuances, and the expected annual debt service requirements under the program. The latter is based on when proceeds will be needed for approved capital projects, and estimates of prevailing interest rates at the time of sale. Fitch compares both historical and projected Federal grant reimbursement cash flows with the expected debt service requirements to determine the sufficiency of cash flow.

Credit quality for highway reimbursement GARVEEs is a function of coverage by dedicated revenues, the ability of states to spend money (i.e., to regulate the reimbursement cash flow relative to upcoming GARVEE debt service requirements), and the expected number of reauthorization periods. Debt service requirements can either mean first dollars in to segregate in advance for an upcoming debt service payment or monthly segregations for debt service sized according to the payment schedule. In certain instances, there is a reliance on highly rated states to pay on the date due, even without any legal early segregation; in such a case, the state's ability to dip into broader resources, even if they are not pledged, to mitigate any timing concerns is a rating consideration.

Direct Payment Highway GARVEES

Leveraging of Federal funds under the direct payment program dates back more than two decades. Prior to 1995, Federal sources could only be used to repay the principal component of debt. A few states issued instruments partially backed by Federal funds, as well as state sources. More recently, with the passage of legislation in the mid-1990s, bond-related costs are eligible costs of construction, and states such as Arizona, Colorado, New Mexico, Ohio, California, and Rhode Island issued direct payment GARVEES. Under this structure, states elect to have a direct payment agreement with FHWA to cover amounts in accordance with a GARVEE bond debt service schedule and in lieu of construction grant reimbursements. GARVEE proceeds advance the financing and construction of state and Federally approved highway projects. The timing of debt service payments depends on the annual Federal and state budget appropriation processes and the timely fulfillment of Federal government requirements by the state. However, states have some flexibility given their discretion to reprogram obligation authority as funding categories are not project specific. In addition, once funds are obligated, they are available for at least two years. The contractual obligation on the part of the Federal government is to meet the payment schedule to the extent that revenues are available. Nevertheless, there is no Federal pledge to cover debt service on the GARVEE bonds.

Credit Considerations under the Direct Payment Method

Although Fitch takes a program rating approach to direct payment GARVEEs, there are some key differences with reimbursement GARVEEs. Most importantly, the project agreement in conjunction with the state match provides sum-sufficient coverage of debt service. From this investment-grade ratings threshold, credit quality can be progressively strengthened by the layering in of an additional bonds test, the supplemental pledge of other Federal or state transportation moneys, and covenants to obligate funds for debt service well in advance of due dates, among other security measures. Weaknesses shared by both GARVEE programs are maturities that stretch into more Federal reauthorization periods. Overleveraging of Federal grants for direct payment GARVEEs carries the same risk to the flexibility of the state's highway capital program.

Transit GARVEES - Formula 5307

Transit GARVEEs share some of the rating considerations with their highway counterpart, including the established nature of Federal grant funding, debt service coverage by pledged revenues, Federal reauthorization risk, state appropriation risk, and the transit authority's ability to spend money on projects qualified for FTA reimbursement. A rating consideration that may be unique to transit authorities given the use of lease-leaseback arrangements for transit rolling stock, is the bankruptcy remoteness of the structure to that of private sector manufacturers and servicers. Subsequent Federal reauthorizations that change the nature of funding firewalls or formula allocations could also change the credit profile of transit GARVEEs. As with highway GARVEEs, a key disadvantage to the transit authorities is how the GARVEE debt service payments restrict the flexibility of their capital budgets.

Federal Reauthorization Risk

The major risk under the GARVEE debt programs is Federal reauthorization risk for debt maturities beyond the current Federal transportation funding cycle. Congress during its reauthorization cycles may alter total funding for surface transportation programs, the allocation between highway and transit programs, allocations among states, and even the presence or nature of funding firewalls. Shifts in any of these variables could pose a credit risk to debt under the GARVEE programs. Ironically, interim Congressional delays in adopting a transportation reauthorization (as occurred between the end of the Intermodal Surface Transportation Efficiency Act [ISTEA] and the beginning of TEA-21, and so far since the expiration of TEA-21) will not, as an isolated event, affect these variables. However, extended delays could affect assumed growth rates in Federal grants available for GARVEE payments and, indirectly, the pace of debt issuance under these programs.

While the established nature of Federal support for surface transportation and statutory authority helps to facilitate a pledge of Federal grants, an equally important factor is the Federal budgetary firewall established under TEA-21 that largely protects surface transportation funding from competing for annual Federal funding with most other domestic programs. These firewalls were easier to maintain under TEA-21 and during the Federal government's period of budgetary surplus. With a return of deficit financing and greater competition for revenues, there is the risk that over the next few reauthorization periods these firewalls may be modified, or eliminated. In such an event, high debt service coverage will serve as the primary protection for existing GARVEE programs. Least affected will be states that continue prudent debt limitation measures and forms of supplemental revenues for debt service.

Contact: Cherian George, Fitch Ratings, 212/908-0519, cherian.george@fitchratings.com

Contact: Cherian George, Fitch Ratings, 212/908-0519, cherian.george@fitchratings.com

Scott Trommer, Fitch Ratings, 212/908-0678, scott.trommer@fitchratings.com

[Top of Article, In This Issue...]

Each issue of IFQ features questions and answers on the GARVEE program.

Note that answers to these questions are not regulatory or legislative, but represent FHWA's current administrative interpretations. If you have questions or want to confirm any of this information, please contact your local FHWA Division office. GARVEE guidance is also available at:

https://www.fhwa.dot.gov/finance/resources/federal_debt/garvee_bond_guidance.aspx.

Could a GARVEE be issued by a local government?

There is no Federal prohibition or restriction that would prevent a local government issuing a GARVEE, but local governments may face more legal and financial issues than state governments, as discussed below.

Legal Issues

First, the local government would need to have the authority under the laws of its state to issue debt or otherwise borrow funds. In many states, obtaining such borrowing authority requires a vote of the local governing body, state legislature, and/or approval by voter referendum in the affected area.

Second, a local government would have to assure the capital markets that it has the legal authority to determine use of the Federal-aid funds that are being pledged. Such assurance might take the form of a Memorandum of Understanding (MOU) between the local government and the applicable state DOT. Even if the local government obtained such an MOU, the capital markets would probably take into consideration the history of the relationship between the state DOT and the local government, the process for allocating Federal-aid funds within that state, and the enforceability of any financial commitments under state law.

Financial Issues

Local governments might have more difficulty issuing GARVEEs backed solely by Federal-aid funds (a "stand-alone" GARVEE) because a coverage ratio on a local GARVEE is likely to be much lower than for a state debt issuance. For example, if a local government received (on average) $10 million in Federal funding each year, and proposed to issue a bond with debt service of $7.5 million per year, its coverage ratio would be only 1.33. In most cases, state-based GARVEEs can easily achieve higher coverage ratios, because of the high relative size of state Federal-aid programs to the amount of debt service. With lower coverage ratios, local governments may need backstop pledges, bond insurance, or credit assistance from the Federal or state government to achieve acceptable bond ratings and low interest rates. Programs such as state bond banks or state infrastructure banks could provide credit assistance to local government issuers.

Instead of having local governments issue their own GARVEE debt, some state governments are partnering with local governments in innovative ways. In California, the state GARVEE program issues bonds on behalf of local governments, which can seek capital funding for projects if they pledge future allocations of funding toward repayment. This provides local governments with the benefit of state bonding authority (and its bond rating). In Mississippi, the state bond bank is assisting local projects by issuing debt repaid by future Federal bridge funding.

Federal Highway Administration. Innovative Finance Home Page, containing links to IFQ, SIB, and TIFIA program information, program guidance, and special reports.

American Association of State Highway & Transportation Officials. InnovativeFinance.Org (site discontinued), providing information on innovations in all areas of surface transportation finance.

https://www.fhwa.dot.gov/ipd/finance/

[Top of Article, In This Issue...]

The third quarter of FY 2004 saw a nine percent increase in State Infrastructure Bank (SIB) loan agreements. Ohio led with 18 new agreements, valued at $18 million. Pennsylvania's activity also increased, with nine new agreements. The Pennsylvania Infrastructure Bank (PIB) has introduced three new accounts over the past year, supporting aviation, rail freight, and municipal projects. The PIB is the first in the nation to establish loan accounts for all major transportation modes. After implementing a new structure for administration and operation of its Transportation Finance Bank, the California DOT (Caltrans) has executed its first two SIB loans In total, as of June 2004, 33 states have entered into 407 loan agreements, valued at over $4.8 billion (see table below).

| State | Number of Agreements | Loan Agreement Amount ($000) | Disbursements to Date ($000) |

|---|---|---|---|

| Alaska | 1 | $ 2,737 | $ 2,737 |

| Arizona | 45 | 521,442 | 418,825 |

| Arkansas | 1 | 31 | 31 |

| California | 2 | 1,120 | 1,120 |

| Colorado | 4 | 4,400 | 1,900 |

| Delaware | 1 | 6,000 | 6,000 |

| Florida | 46 | 741,337 | 256,675 |

| Indiana | 2 | 5,715 | 5,715 |

| Iowa | 2 | 2,879 | 2,879 |

| Maine | 23 | 1,635 | 1,635 |

| Michigan | 33 | 22,207 | 22,207 |

| Minnesota | 15 | 95,719 | 77,013 |

| Missouri | 15 | 92,557 | 82,770 |

| Nebraska | 2 | 6,792 | 6,792 |

| New Mexico | 2 | 14,600 | 14,600 |

| New York | 10 | 27,700 | 27,000 |

| North Carolina | 2 | 1,713 | 1,713 |

| North Dakota | 2 | 3,891 | 3,891 |

| Ohio | 59 | 203,132 | 130,953 |

| Oregon | 15 | 19,846 | 18,396 |

| Pennsylvania | 47 | 31,000 | 27,000 |

| Puerto Rico | 1 | 15,000 | 15,000 |

| Rhode Island | 1 | 1,311 | 1,311 |

| South Carolina | 8 | 2,605,000 | 1,765,000 |

| South Dakota | 3 | 28,776 | 28,776 |

| Tennessee | 1 | 1,875 | 1,875 |

| Texas | 46 | 259,260 | 250,683 |

| Utah | 1 | 2,888 | 2,888 |

| Vermont | 2 | 1,975 | 1,300 |

| Virginia | 1 | 18,000 | 17,985 |

| Washington | 3 | 2,376 | 487 |

| Wisconsin | 3 | 1,813 | 1,813 |

| Wyoming | 8 | 77,977 | 42,441 |

| TOTAL | 407 | $4,822,704 | $3,240,111 |

Florida ranks second among states in terms of the dollar volume of SIB loans, with total loan agreement amounts reaching $741 million at the end of June 2004. The state's SIB program has been enhanced by two legislative actions in recent years. In 2002, Florida enacted legislation that expanded the scope of projects eligible for state SIB funding to include airports, seaports, and railways. The following year, Governor Bush signed legislation authorizing the state SIB to leverage existing loan portfolios through issuance of revenue bonds.

The SIB's initial bond issuance is planned for early 2005. The Florida Department of Transportation (FDOT) plans a conservative start to its SIB bond initiative, with the objective to build to an "acceptable" level while maintaining a strong credit rating. FDOT's leveraging approach should conservatively generate up to $50M in annual loan capacity. Bonds that will be issued will be payable primarily from a prior and superior claim on all state-funded infrastructure bank repayments. FDOT has received Cabinet approval to issue up to $300 million in SIB bonds. In addition, underwriter and bond counsel selections have been made, and SIB loans for projects to be funded with the bond proceeds have been awarded. Florida's expansion of its SIB program through bonding will enable the program to grow and evolve as a long-term financial resource for FDOT.

Contact: Phyllis Jones, FHWA, 202/366- 2854, phyllis.jones@fhwa.dot.gov

Contact: Phyllis Jones, FHWA, 202/366- 2854, phyllis.jones@fhwa.dot.gov

[Top of Article, In This Issue...]

Value pricing is a way of harnessing the power of the market to reduce traffic congestion. Tolls are charged electronically while traffic moves at free-flow speeds, so no tollbooths are needed. Tolls vary by the level of traffic demand to ensure demand is in balance with the supply of available road space, thus ensuring free flow of traffic. Tolls generate revenues that can be used to pay for new highway capacity or other transportation improvements.

Pricing encompasses a variety of market-based approaches such as:

HOT Lanes on I-15

Under San Diego's I-15 "FasTrak" pricing program, customers in single-occupant vehicles pay a per-trip fee each time they use the I-15 HOV lanes. The unique feature of this pilot project is that tolls vary "dynamically" with the level of traffic demand on the HOV lanes. Fees vary in 25-cent increments as often as every six minutes to help maintain free-flow traffic conditions on the HOV lanes. The project is self-sufficient, generating $1.2 million in revenue annually, about one-half of which is used to support transit service in the corridor.

91 Express Lanes

One effective way to improve freeway operations is to manage demand for use of specific lanes or the entire freeway through the use of variable tolls. The 91 Express Lanes, four lanes in the median of the 12-lane SR 91 Freeway in Orange County, California, are a good example of the use of value pricing to ensure efficient flow of traffic and maximize vehicle throughput and travel speeds. In 2004, speeds are 60 to 65 mph on the SR 91 express lanes while congestion on the free lanes reduced average peak hour speeds to no more than 15 to 20 mph. Moreover, during the peak hour, which occurs on Friday afternoon (5:00-6:00 p.m.) in the eastbound direction, the two "managed" express lanes each carry almost twice as many vehicles per lane than the free lanes, because of the effect of severe congestion on vehicle throughput in the free lanes.

The 91 Express Lanes opened in December 1995. Toll revenues have been adequate to pay for construction and operating costs. In fact, in 2003 the private company that had the franchise to build and operate the facility sold the franchise to the Orange County Transportation Authority for a profit.

Contact: Patrick

DeCorla-Souza, FHWA, 202/366-4076, patrick.decorla-souza@fhwa.dot.gov

Contact: Patrick

DeCorla-Souza, FHWA, 202/366-4076, patrick.decorla-souza@fhwa.dot.gov

[Top of Article, In This Issue...]

Innovations in Project Delivery and Financing for Surface Transportation Infrastructure

On Sunday, January 9, 2005, the FHWA and the Transportation Research Board's (TRB) Taxation and Finance Committee are sponsoring a two-part workshop focusing on new developments in project delivery and financing approaches to meet transportation infrastructure needs. The workshop will be held from 8:30 a.m. to 5:00 p.m. in Washington, D.C. at the Hilton Washington Hotel, Jefferson East.

In today's constrained fiscal environment, transportation agencies at all levels of government are actively seeking new ways to deliver their infrastructure needs, ranging from greater involvement of the private sector through partnerships to alternative financing mechanisms. The first part of the workshop focuses on the potential use of public-private partnerships (PPPs) to improve the efficiency of constructing, operating, and maintaining highways and other transportation facilities. Speakers will explore what is needed to make PPP ventures work from the perspective of both the private and public sectors. What factors have contributed to successful projects and what has been learned from efforts that have not been viewed as successful? Case studies will highlight the experiences in states that have implemented PPPs, identifying critical success factors. The second part of the workshop focuses on how innovative finance mechanisms can facilitate PPPs. A range of topics will be addressed, including new state initiatives to expand the project finance toolbox and the leveraging potential of innovative finance. The emphasis of the workshop is on sharing experiences of successful strategies from the perspectives of both project sponsors and the private sector. This all-day workshop is intended to build a better understanding of PPPs and non-traditional financing methods. It is structured in an interactive format with time set aside for questions and dialogue with transportation experts.

For more information, visit the TRB Annual Meeting web site at http://www.trb.org/meeting/.[Top of Article, In This Issue...]

In January 2005 at the Transportation Research Board's Annual Meeting, the FHWA will be releasing a new booklet, "Highway Finance and Public-Private Partnerships: New Approaches to Delivering Transportation Services." The booklet provides trend information on highway revenues and highlights activities underway at the FHWA to address the highway finance issues facing Federal, state, and local highway officials. The booklet is intended as a starting point for important discussions regarding how highways will be financed, operated, and maintained in the future. It features the FHWA's new public-private partnership initiatives to promote innovation in the financing and management of our highway systems. These initiatives include workshops, conferences, issues papers, research, and the development of analytical tools to assess alternative financing mechanisms.

Supporting innovation is central to the FHWA's mission. By sharing information on its efforts to explore new ways of doing business, the FHWA hopes to engage stakeholders in a meaningful discourse on innovation that will lead to improvements in how future highway programs will be financed and delivered.

Contact: Jim March, FHWA, 202/366-9237, jim.march@fhwa.dot.gov

Contact: Jim March, FHWA, 202/366-9237, jim.march@fhwa.dot.gov

Julie Zirlin, FHWA, 202/366-1905, julie.zirlin@fhwa.dot.gov

[Top of Article, In This Issue...]

Roger Berg, Cambridge Systematics, Inc.

Duane Callender, TIFIA JPO

Patrick DeCorla-Souza, FHWA

John Fink, Arizona Department of Transportation

Cherian George, Fitch Ratings

Max Inman, FHWA

Phyllis Jones, FHWA

Jennifer Mayer, FHWA National Resource Center

Paul Marx, Federal Transit Administration

Suzanne H. Sale, TIFIA JPO

Alla Shaw, FHWA

Mark Sullivan, TIFIA JPO

Suzanne H. Sale, FHWA

Co-Managing, Editor

602/379-4014

FAX: 602/379-3608

Suzanne.Sale@fhwa.dot.gov

Max Inman, FHWA

Co-Managing Editor

202/366-2853

FAX: 202/366-7493

Laurie L. Hussey, CS Managing Editor

Cambridge

Systematics, Inc.

617/354-0167

FAX: 617/354-1542

lhussey@camsys.com

Reproduction (in whole or in part) and broad distribution of IFQ is strongly encouraged. Permission from FHWA, the editor, or any other party is not necessary.

FHWA DOES NOT MAINTAIN A MAILING LIST AND DOES NOT DISTRIBUTE IFQ DIRECTLY. IFQ IS AVAILABLE AS AN INSERT TO THE AASHTO JOURNAL, AND IS AVAILABLE ELECTRONICALLY THROUGH FHWA's WWW HOME PAGE: https://www.fhwa.dot.gov/innovativefinance/

IFQ IS ALSO PROVIDED TO THE FOLLOWING ORGANIZATIONS FOR REDISTRIBUTION AND/OR AS INFORMATION FOR THEIR MEMBERSHIP: