FHWA is developing several primers and research reports on various issues surrounding highway Public-Private Partnerships (P3s). This primer addresses Financial Structuring and Assessment for P3s. Companion primers on Value for Money Analysis and Risk Assessment for P3s are also available as part of this series of Primers. P3s, risk assessment and value for money analysis, and their inter-relationships, are briefly described in the following sections.

Public-private partnerships (P3s) for transportation projects are drawing much interest in the United States for their ability to access new financing sources and and transfer certain project risks. P3s differ from conventional procurements where the public sponsor controls each phase of the infrastructure development process - design, construction, finance, operations and maintenance. With a P3, a single private entity (which may be a consortium of several private companies) assumes responsibility for more than one development phase, accepting risks and seeking rewards.

Design-Build procurement - under which private contractors are responsible for both designing and building projects for a fixed price - are considered by some to be a basic form of P3. Further along the P3 spectrum, the private sector may also assume responsibility for finance, operations, and maintenance, typically via a long-term (30 years or more) concession from the public sponsor. This document, as well as the series of FHWA primers on P3s, is concerned primarily with forms of P3s where the private sector partner (called the "concessionaire") enters into a long-term contract to perform most or all the responsibilities conventionally procured separately and coordinated by the government.

Public agencies pursue P3s for a variety of reasons, including access to private capital, improved budget certainty, accelerated project delivery, transfer of risk to the private sector, attraction of private sector innovation, and improved or more reliable levels of service. However, P3s - like conventional projects - require revenue in order to pay back the upfront investment.

P3s are complex transactions, and determining that a P3 is likely to provide a better result than a conventional approach is no simple task when considering long-term costs, myriad uncertainties, risks both now and in the future, and complicated funding and financing approaches. For more information on P3s the reader is encouraged to refer to FHWA's primer on Public-Private Partnerships, available at: https://www.fhwa.dot.gov/ipd/p3/toolkit/publications/primers/risk_assessment/.

Project risk must be identified, evaluated and managed throughout a project's life for the project to be successful. Management of risks requires a public agency to proactively address potential obstacles that may hinder project success. P3s are considered to be a form of risk management since the public sector and private sector parties seek to achieve optimal risk allocation in order to minimize overall project risks.

Project risk management is an iterative process that begins in the early phases of a project and is conducted throughout the project's life cycle. It involves systematically considering possible outcomes before they happen and defining procedures to accept, avoid, or minimize the impact of risk on the project. Under a P3 transaction, risk allocation tends to be "by exception," so the concession agreement contains a finite list of "relief events" and "compensation events" that are tightly drafted and highly constrained. Everything else is allocated to the concessionaire. Conversely, under conventional delivery approach, if a circumstance or situation arises that had not been contemplated up-front, that risk (whether or not it could have been foreseen) is owned by the public sector. Risk management follows a clearly identified process, which includes:

Risk analysis is used in the development of a P3 project for a number of reasons:

For more information on risk assessment the reader is encouraged to refer to FHWA's primer on Risk Assessment for Public-Private Partnerships, available at: https://www.fhwa.dot.gov/ipd/p3/.

Value for Money (VfM) is defined as the optimum combination of life-cycle costs and quality (or fitness for purpose) of a good or service to meet the user's requirements - for example, mobility and safety on a highway facility. Value for money processes have been designed and utilized in many countries to help government officials determine whether they are likely to obtain a better deal through a P3 compared to conventional procurement approaches for the same project.

The VfM analysis process is utilized to compare the aggregate benefits and the aggregate costs of a P3 procurement against those of the conventional public alternative. Risks are present from the early development of a highway project and continue through construction and operation. At the core of a P3 agreement is the allocation of project risks between the public and private partners in order to minimize the overall costs of risk by improving its management. VfM analysis may be used to assist in:

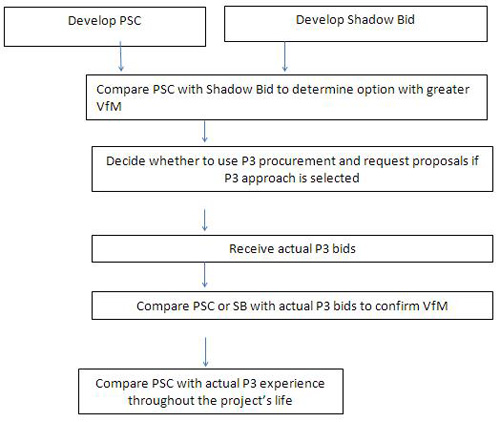

The methodology for carrying out a VfM analysis varies, but (as shown in Figure 1-1) its major elements all involve:

The PSC not only provides a means to analyze value for money, but also promotes an understanding of life-cycle costs at an early stage in project development. It may also create confidence in the rigor of the evaluation process to decide whether a P3 would provide better value than conventional procurement.

For more information on VfM analysis the reader is encouraged to refer to FHWA's primer on Value for Money Analysis for Public-Private Partnerships, available at: https://www.fhwa.dot.gov/ipd/p3/.

Figure 1-1. How a PSC and P3 alternative are compared at different stages of project development

Detailed description of Figure 1.1

How a Public Sector Comparator (PSC) and public-private partnership (P3) alternatives are compared at different stages of project development. At the top of this diagram are two orange rectangles: one labeled "Develop PSC" and the other labeled "Develop Shadow Bid (SB)." Arrows from both of the orange rectangles point downward to a series of 5 descending yellow rectangles (the first yellow rectangle points to the second yellow rectangle and so on). First rectangle: "Compare PSC with SB to determine option with greater VfM (Value for Money)." Second rectangle: "Decide whether to use P3 procurement and request proposals if P3 approach is selected." Third: "Receive actual P3 bids." Fourth: "Compare PSC or SB with actual P3 bids to confirm VfM." Finally in the fifth box, "Compare PSC with actual P3 experience throughout the project's life."

It is important to clarify that VfM assessment is a form of financial assessment of P3s and is distinct from the process of establishing whether a public sector project is a good use of society's resources, which requires a full benefit-cost analysis. Benefit-cost analysis involves a comprehensive assessment of the full range of economic costs, risks and social benefits and takes into account less quantifiable impacts including external costs and benefits. Externalities may include increases in economic development, effects on public safety (e.g., reductions in accidents) and environmental impacts. External benefits in excess of external costs may justify public subsidies if revenue from charges to be paid by the facility's users or other beneficiaries is inadequate.

For more information on benefit-cost analysis the reader may refer to FHWA's Economic Analysis Primer available at: https://www.fhwa.dot.gov/infrastructure/asstmgmt/primer05.cfm

VfM assessment and economic assessment of P3s are distinct from the process of establishing whether or not a project is actually affordable to the government, e.g., whether any needed public subsidies are acceptable to the government, whether the government is able or willing to borrow the amount required, or whether it is able or willing to charge the user fees required. There is no reason to presume that a project that is cost-beneficial or provides good value for money will be affordable or that an affordable project will be cost-beneficial or represent good value for money. Financial assessment, which is undertaken using financial modeling, helps establish whether or not a project is actually affordable to the government. A financial model is also used with VfM analysis to model cash flows for the PSC and the Shadow Bid.

The model typically considers the costs and revenues associated with a project over defined period in the form of "cash flows." Outputs of the model include key financial indicators that can assist a public agency in determining a project's financial feasibility. Outputs of the model also include indicators that help private bidders determine the potential value of the project and help lenders check the project's capacity to repay debt.

Most P3 projects are financed by using a combination of private equity, debt, and (often) public subsidies. For financial assessment of P3s, it is important to understand these sources of capital, how they are combined (referred to as "financial structure"), and how funds invested in a project are repaid. A considerable portion of this primer (Chapters 2 through 5) discusses these aspects of P3s. The basic concepts of project finance for P3s are presented in Chapter 2. Since P3s require revenue to pay back investors and lenders, the primer describes the various types of revenue sources and their advantages and disadvantages with regard to P3s in Chapter 3. Chapter 4 discusses sources of public sector financing for P3s, while Chapter 5 discusses the various sources of private capital and their incentives and capabilities, including how debt repayments may be scheduled to match projected cash flows and project characteristics to make the project financially viable.

Financial modeling and indicators used by public agencies, equity investors and lenders to assess financial feasibility are discussed in Chapters 6 through 9. Chapter 6 discusses the role of financial models, focusing on what is analyzed and interpretation of results rather than the details of the modeling process. Chapters 7, 8 and 9 describe the metrics used for financial evaluation by the public agency, equity investors and lenders respectively. Finally, Chapter 10 provides a summary and concluding remarks.