Highway Information Seminar - Motor Fuel Session - November 16, 2004

PowerPoint presentation:

mfbigpic.ppt (1,150 KB)

The Big Picture

- FHWA determines how much federal Highway Trust Fund tax money comes from each State

- Compared to how much each State receives from FHWA

- Derives a "for every dollar in, how much does my State receive" ratio

The Big Picture II

- This analysis is extremely important to CONGRESS, FHWA, and the STATES

- It's important that the data be correct.

Background

Uses of State motor fuel data:

- Federal-aid highway funds Apportionment

- Federal motor fuel Attribution

Importance

- 20 years ago, historical records

- Today, drives the distribution of significant federal funds

- Tomorrow, indications are the data will remain significant

Apportionments

Funds for several FHWA programs are apportioned to the States:

- Formula based

- Set by law

- About 85 % of Federal highway funds are apportioned

Under TEA-21, about $12 billion (40% of Federal Highway Programs) was annually apportioned based on motor fuel data.

Apportionment and Motor. Fuel Data:

Programs:

- Surface Transportation: Approximate Annual Funding = $6 Billion, Motor Fuel Factor = 35%, Apportionment based on Motor Fuel = $2 Billion

- Interstate Maintenance: Approximate Annual Funding = $6 Billion, Motor Fuel Factor = 33.3%, Apportionment based on Motor Fuel = $2 Billion

- National Highway System: Approximate Annual Funding = $6 Billion, Motor Fuel Factor = 30%, Apportionment based on Motor Fuel = $2 Billion

- Minimum Guarantee: Approximate Annual Funding = $6 Billion, Motor Fuel Factor = 100%, Apportionment based on Motor Fuel = $6 Billion

The Attribution Process

- FHWA attribution supports the apportionment process

- How FHWA calculates attribution

- The role of State data

How Attribution Works I: State-by-State contributions to the Federal Highway Trust Fund are not available from the Internal Revenue Service (IRS)

How Attribution Works II:

- Typical federal motor fuel taxpayer is an oil company or oil wholesaler

- 8,000 are licensed with IRS

- Federal tax is imposed as the fuel crosses the rack

- Where is the fuel consumed?

- IRS didn't know, but has begun to address fuel tracking

How Attribution Works III

- IRS reports tax receipts for each motor fuel tax type

- HTF contributions from highway users in each State are estimated using State motor fuel data

- States report the motor fuel taxed under each State's procedures

- FHWA uses established procedures to derive a consistent, compatible dataset for attribution

How Attribution Works IV

- Measure on-highway gallons of motor fuel: (Gasoline - Gasohol - Special fuels)

- Sum to derive the national total (by type)

- Derive each State's share of the national total

- Use those shares to determine revenue shares

How Attributrion Works V

For the federal truck taxes:

- Tire tax

- Truck and trailer retail sales excise tax

- Heavy vehicle use tax

Attribution to each State is in proportion to the highway use of special fuels

Attribution and Data Quality

- FHWA's goal is an accurate data-set with which to determine attribution

- To improve data quality, FHWA needs to work with State data providers to achieve accurate reporting

In Summary:

Processes:

- Apportionment process

- Attribution process

Importance:

- Measurement of motor fuel data

- Equitable treatment for all States

FHWA needs your commitment

FHWA Motor Fuel Reporting:

Accomplishments, Challenges, and Changing Environment

Accomplishments:

- Re-Assessment

- Input procedures

- Motor fuel reviews

- Data verification

- Outreach

Accomplished: Re-Assessment

Time Line: Began in late 1998 and shortly after TEA-21 passed

Methodology:

- Expert advisory group

- Identify issues

- Propose solutions

Accomplished: Re-Assessment

General Accounting Office (GAO)

- Concurrent assessment

- Cooperative effort

- Substantial agreement on conclusions

GAO identified several actions

- Review & verify State MF reporting

- Document FHWA attribution methodology

- Independent review of FHWA methodology

- Evaluate EXSTARS-EXFIRS for validation

Accomplished: Re-Assessment

FHWA identified areas for further study/revision:

- Federal Register Notice

- General support for the proposals

Publication: Attribution and Apportionment of Federal Highway Tax Revenues: Process Refinements

Accomplished: Input Procedures

Implemented a submittal process:

- All motor fuel data since January 2002

- Generally considered easy-to-use

Computer security requirements:

- Secure submittal site

- Required change to Input Tool use: 1) Data providers received USERID 2) Managed by Division Offices

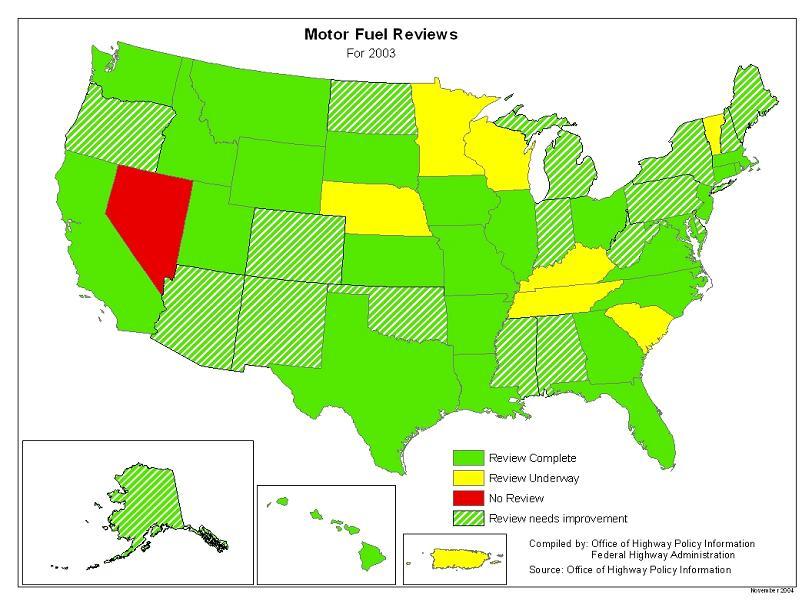

Accomplished: MF Reviews

- Division Office reviews

- Continuous Process Improvement Model

- 45 States have done reviews

- Quality varies

Accomplished: Data verification

- Process review versus data verification

- Why verify?

- Old procedure - data hand-entered

- Data needs checking until new procedures

- Verification memo

- Sent in March - June each year

- Typically, several States revise their data

- So several iterations occur

Accomplished: Publications

- Attribution and Apportionment of Federal Highway Tax Revenues: Process Refinements

- Your State's Share: Attributing Federal Highway Revenues to Each State

- Guide to Reporting Highway Statistics has been revised and approved by OMB

Accomplished: Revised Guide to Reporting Highway Statistics

- Data requirements have changed

- Data providers need to be aware of these changes

- It will require some effort on the State's part to be aware and make these changes

- FHWA will discuss these with you at any time, if you need assistance

Challenges:

- Motor fuel reviews and follow-up: 1) Quality of reviews 2) Quality improvements 3) Risk assessment

- Verification of data

- Communication

Challenges: MF Reviews

Quality of reviews/Quality improvements:

- Need to bring up the average

- Three core items: 1) Procedures document 2) Procedures assessment 3) Oversight plan

Risk Assessment

Challenges: Communication

- Goal: Keep stakeholders in loop:

- Methods: Workshop-Video conference options:

- November workshops on Highway Statistics

- January-February motor fuel workshops

- Special request/event video conferences

Challenges: Verification of Data

- About 20 are reviewing the data

- Apparently, about 30 are not reviewing the data

- It's the States last chance to make sure what they reported is correct

Challenges: Communication II

Community of Practice:

- Location for all publications/materials

- Bulletin-board style listserv

http://knowledge.fhwa.dot.gov/cops/hcx.nsf/home?openform&Group=Motor%20Fuel%20Reporting%20and%20HTF%20Attribution

Changing Environment:

- Reauthorization

- Reporting changes

- Attribution analysis changes

- Gasohol data

- Federal law changes combating tax evasion

Changing Environment: Reauthorization

- TEA-21 ended September 30, 2003

- Administration-proposed legislation

- 8 month extension until May, 2005

- What Congress will do is unknown

- No significant MF changes expected

Changing Environment:.Reporting & Analysis Changes

FHWA will be treating some data differently:

- On-highway public diesel use

- Alternative fuels reporting

- Loss allowance treatment

Reporting changes:

- Computer security

- Data uniformity

- State responsibilities

Changing Environment:.Gasohol Revenue

Hot topic in reauthorization.

American Jobs Creation Act of 2004:

- Highway Trust Fund compensated for gasohol subsidy

- How this will be treated administratively is still to be determined

- Will mean increased revenue to the Trust Fund

Changing Environment:.Fuel Tax Evasion

Federal law changes:

- Mobile machinery

- Aviation grade kerosene

- Dye injection equipment

- Intercity buses

- Pipeline/vessel registration

- Other administrative changes

Contact: Linda Morris at FHWA (Linda.Morris@fhwa.dot.gov)

In Summary

Identified and discussed:

- Accomplishments

- Challenges

- Changes in the MF environment

FHWA Motor Fuel Reporting:

Data Submittal Process and Discussion of Improvements

Background I

- 2002 and beyond motor fuel data submitted electronically

- Submitted by State DOT's, DOR's, or FHWA

- Form 551M submitted monthly

- Form 556 submitted annually

Background - II

- Reported using Smart Input Tool

- Submitted using :

- Instructions for reporting - Guide to Reporting Highway Statistics - Chapter 2

Motor Fuel Reporting: We begin here.

Motor Fuel Reporting

- Gallons from tax returns of seller

- Depending on point of taxation in State:

Motor Fuel Reporting

Gasoline and Gasohol Gross Volume Reported Includes:

- Fully taxed

- Exempt sales

- Fully refunded sales

- Partially exempted sales

- Partially refunded sales

- Taxed at reduced rates

- Assessments

Motor Fuel Reporting

Diesel and LPG Gross Volume Reported Includes:

- Only Highway Use of Diesel and LPG

- Include Public Use Diesel

- Revised Chapter 2 of Guide - March 2003

Motor Fuel Reporting

Other State Fuel Data:

- Alternative fuels a) Per gallon equivalent and b) Registration fees in lieu of per gallon taxes

- Aviation Fuels

- Transit Fuels

Motor Fuel Reporting

Consistency in Data Entries:

- Enter text and data on same line each month

- New text and data - Identify the entry in the comments section on page 2

Motor Fuel Reporting

New Feature in DBMS:

- Data that is incorrectly submitted will be rejected

- State will be notified that their submittal has been rejected and comments to explain why

Motor Fuel Reporting

- Stop reporting Off-Highway Diesel fuel

- Enter zero or nothing in the cell(s)

- Remember to remove the gallons from the Highway Diesel/LPG Gross Volume Reported in line 1

Motor Fuel Reporting

- Report current State tax rates every January, and in any month there is a change

- Enter all rates that apply in your State

- Enter the effective date

- Important because the FHWA DBMS uses these entries as input

Motor Fuel Reporting

Form Section Defaults Allows you to:

- Customize the form for your State

- Set a time period for the custom settings

- Revise the settings if your State legislature changes motor fuel tax law

Motor Fuel Reporting- Conclusions

- Report accurate data

- Enter text and data consistently each month

- Use Form Section Defaults

- Enter tax rates

- Stop reporting off-highway diesel

- New Procedure - FHWA ability to reject data

- Revised Chapter 2 - March 2003

|