- Selected Highway Capital Investment Scenarios

- Scenario Definitions

- Supplemental Scenarios

- Interstate System Scenarios

- Derivation of Scenario Investment Levels

- Investment Scenario Estimates by Improvement Type

- Investment Scenario Impacts

- Comparison of Scenario Investment Levels With Base Year Spending

- National Highway System Scenarios

- Derivation of Scenario Investment Levels

- Investment Scenario Estimates by Improvement Type

- Investment Scenario Impacts

- Comparison of Scenario Investment Levels With Base Year Spending

- Systemwide Scenarios

- Derivation of Scenario Investment Levels

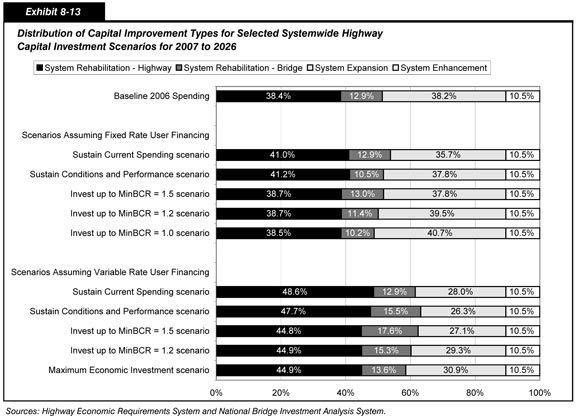

- Investment Scenario Estimates by Improvement Type

- Investment Scenario Impacts

- Comparison of Scenario Investment Levels With Base Year Spending

- Supplemental Scenarios

- Scenario Definitions

- Selected Transit Capital Investment Scenarios

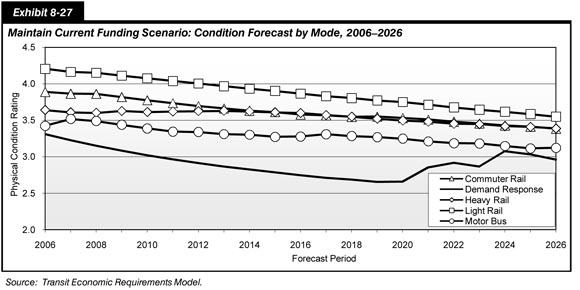

- Maintain Current Funding Scenario

- Rehabilitation and Replacement

- Expansion and Performance Improvement Investments

- Maintain and Improve Conditions and Performance Scenarios

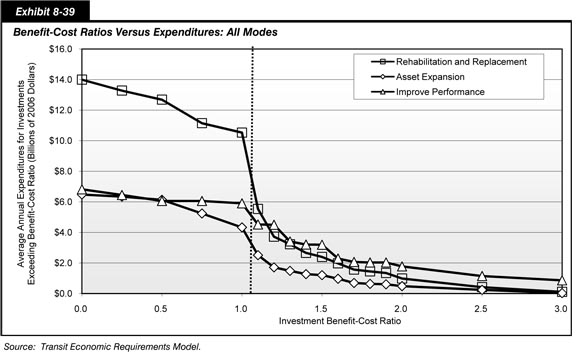

- Scenario Investment Needs: Benefit-Cost Ratio of 1.0

- Investment Estimates by Asset Type

- Scenario Investment Needs: Benefit-Cost Ratio of 1.2

- Maintain and Improve Conditions and Performance Scenarios Assuming Highway Congestion Pricing

- Benefit-Cost Ratio of 1.0

- Benefit-Cost Ratio of 1.2

- Alternative Benefit-Cost Ratio Thresholds

- Maintain Current Funding Scenario

- Comparison

Selected Highway Capital Investment Scenarios

This section presents a set of future investment scenarios for highways and bridges, building on the analyses presented in Chapter 7 regarding the potential impacts of alternative levels of future investment on various measures of system conditions and performance. Each of these scenarios draw upon the results of analyses developed using the Highway Economic Requirements System (HERS) and the National Bridge Investment Analysis System (NBIAS), but also consider other types of capital investment that are currently beyond the scope of these models. This section is divided into three main parts which examine scenarios for the Interstate Highway System, the National Highway System (NHS), and the overall network of U.S. highways and bridges.

The HERS analyses presented in Chapter 7 compare the potential impacts of alternative funding mechanisms, assuming that any additional revenue needed to support a particular level of investment would be generated from one of three broad categories: non-user sources, fixed rate user based sources, or variable rate user based sources. For each scenario presented in this section, two versions are included. One version assumes that funding would be derived solely from fixed rate user based sources, while the other assumes funding from variable rate user based sources such as congestion pricing. The non-user based funding option is not explored in this section.

The technical accuracy of these scenarios depends on the validity of the technical assumptions underlying the analysis. Chapter 10 explores the impacts of altering some of these assumptions. Chapter 9 discusses some of the key implications of these scenarios. The Introduction to Part II provides critical background information needed to properly interpret these scenarios. It is important to note that each of these scenarios represents what could be achieved with a given level of investment assuming an economically driven approach to project selection, as opposed to what would be achieved given current decision making practices.

The future spending levels associated with investment scenarios presented in this chapter are all stated in constant 2006 dollars; to apply these values to a particular future year, it would be necessary to adjust them to account for actual or predicted increases in inflation beyond 2006. While the information presented in this section focuses on average annual investment levels associated with each scenario, the scenarios assume gradual increases or decreases in spending in constant dollars, as discussed in Chapter 7 [see Exhibit 7-2].

A subsequent section within this chapter explores comparable information for different types of potential future transit investments. This is followed by a section comparing key statistics from the highway and transit sections with the information presented in previous editions of this report.

Scenario Definitions

This section focuses on five selected scenarios for the Interstate System, NHS, and the overall system drawing upon the analyses presented in Chapter 7. These scenarios are intended to be illustrative; none of them is endorsed as a target level of funding. Other points along the continuum of alternative investment levels presented in Chapter 7 would be equally valid, depending on what system condition and performance outcomes are desired. Each of these scenarios are based on combined public and private investment. The question of what portion should be funded by the Federal government, State governments, local governments, or the private sector is beyond the scope of this report.

The Sustain Current Spending scenario assumes that capital spending is maintained in constant dollar terms at base year 2006 levels over the 20-year period from 2007 through 2026. The scenario also assumes that the distribution of spending will be split among the types of investments modeled in HERS, types of investments modeled in NBIAS, and types of investments that are not currently modeled, based on the 2006 base year percentages reflected in Chapter 7 [see Exhibit 7-1]. However, within the amounts reserved for HERS-modeled investment, the scenario reflects the distribution of spending that the model finds most economically attractive, and thus may differ from the actual spending distribution among resurfacing, reconstruction, and widening in 2006. Similarly, the distribution of bridge spending recommended by NBIAS may differ from the actual spending distribution among bridge repair, bridge rehabilitation, and bridge replacement in 2006.

| Why is the term "Maximum Economic Investment" applied solely to the variable rate user financing version of the MinBCR=1.0 level? | |

|

The terminology used to describe the various illustrative scenarios in the C&P Report has evolved over time to better communicate the nature of the scenarios, and to reduce the potential for confusion. For this edition, the scenarios tied to minimum benefit-cost ratios were given more technical names (i.e., "MinBCR=1.0 scenario") in order to make it easier to distinguish among them.

While previous C&P reports had used the term "Maximum Economic Investment" to describe any scenario in which a minimum benefit-cost ratio of 1.0 had been applied, the use of the term has been limited to the variable rate user financing version of the "MinBCR=1.0 scenario." This change was made to recognize that alternative financing mechanisms, as well as alternative approaches to investment decision making, can both have significant economic implications.

The variable rate financing version of this scenario reflects conditions under which users would be charged an economically rational price to travel on facilities that would be improved only to the extent that such investment was cost-beneficial.

|

|

The MinBCR=1.0 scenario assumes that combined public and private capital investment gradually increases in constant dollar terms over 20 years up to the point at which all potentially cost-beneficial investments (i.e., those with a benefit-cost ratio or "BCR" of 1.0 or higher) are funded by 2026, and the economic backlog for bridge investment is reduced to zero. This scenario represents an "investment ceiling" beyond which it would not be cost-beneficial to invest, even if available funding were unlimited. The version of this scenario assuming the widespread adoption of variable rate user charges is also described as the "Maximum Economic Investment" level, as it reflects conditions under which users would be charged an economically rational price to travel on facilities that would be improved only to the extent that such investment would be cost-beneficial.

| What are some of the technical limitations of scenarios based on minimum benefit-cost ratios? | |

|

While the MinBCR=1.0 scenarios are interesting from a theoretical technical standpoint, they do not represent practical target levels of investment for several reasons. First, available funding is not unlimited, and many decisions on highway and bridge funding levels must be weighed against potential cost-beneficial investments in other government programs and across various industries within the private sector that would produce more benefits to society. Simple cost-benefit analysis is not a commonly utilized capital investment model in the private sector. Instead, firms utilize a rate of return approach and compare various investment options and their corresponding risk. In other words, a project that is barely cost-beneficial would almost certainly not be undertaken when compared to an array of investment options that potentially produce higher returns at equivalent or lower risk. Second, these scenarios do not address practical considerations as to whether the highway and transit construction industries would be capable of absorbing such a large increase in funding within the 20-year analysis period. Such an expansion of infrastructure investment could significantly increase the rate of inflation within these industry sectors, a factor that is not considered in the constant dollar investment analyses presented in this report. Third, the legal and political complexities frequently associated with major highway capacity projects might preclude certain improvements from being made, even if they could be justified on benefit-cost criteria. In particular, the time required to move an urban capacity expansion project from "first thought" to actual completion may well exceed the 20-year analysis period.

While the MinBCR=1.2 and MinBCR=1.5 scenarios address some of these issues by screening out projects that are only marginally cost-beneficial, they still assume that projects are prioritized based on their benefit-cost ratios. That assumption is not consistent with actual patterns of project selection and funding distribution that occur in the real world. Consequently, if investment rose to these levels, there are few mechanisms to ensure these funds would be invested in projects that would be cost-beneficial. As a result, the impacts of any given budget on actual conditions and performance may be far less significant than what is projected as part of these scenarios.

|

|

The MinBCR=1.2 scenario assumes that combined public and private capital investment gradually increases in constant dollar terms over 20 years up to the point at which all potential capital improvements with a benefit-cost ratio of 1.2 or higher are funded by 2026, and the economic backlog for bridge investment is reduced to zero. This scenario was chosen to reflect that funding is not unlimited, and that targeting alternative minimum benefit-cost ratios is a reasonable method for prioritizing investments in a constrained funding environment. Applying a higher minimum benefit-cost ratio cutoff also tends to reduce the risk of investing in potential projects that might initially appear cost-beneficial, but that might not ultimately meet this standard due to unexpected changes in future costs or travel demand. It should be noted that the higher minimum-ratio cutoff applies only to those investments modeled in HERS because the benefit-cost procedures in NBIAS are not yet considered sufficiently robust to support this type of analysis. NBIAS is discussed in more detail in Appendix B.

The MinBCR=1.5 scenario assumes that combined public and private capital investment gradually increases in constant dollar terms over 20 years up to the point at which all potential capital improvements with a benefit-cost ratio of 1.5 or higher are funded by 2026, and the economic backlog for bridge investment is reduced to zero. This scenario illustrates how alternative benefit-cost ratio cutoff points in HERS can be utilized to simulate the prioritization of investments in a constrained funding environment. Other minimum benefit-cost ratio points associated with alternative funding levels are identified in Chapter 7 [see Exhibit 7-14]. The NBIAS-derived component of this scenario is based on the cost of eliminating the economic bridge investment backlog, rather than being linked to a specific minimum benefit-cost ratio cutoff point.

The Sustain Conditions and Performance scenario assumes that combined public and private capital investment gradually changes in constant dollar terms over 20 years to the point at which two key performance indicators in 2026 are maintained at their base year 2006 levels. These indicators are adjusted average user costs (as computed by HERS) and the economic backlog for bridge investment (as computed by NBIAS). They are intended to serve as summary measures of the overall conditions and performance of highways and bridges. It should be noted that while this scenario would maintain these summary indicators at base year levels for the system as a whole, the conditions and performance of individual components of the system would vary. The analyses presented in Chapter 7 identify the costs associated with maintaining several other alternative measures of system conditions and performance.

| What are some of the technical limitations of scenarios based on sustaining conditions and performance at base year levels? | |

|

The investment scenario estimates outlined in this report represent an estimate of what level of performance could be achieved with a given level of funding, not what would be achieved with it. While the models assume that projects are prioritized based on their benefit-cost ratios, that assumption is not consistent with actual patterns of project selection and funding distribution that occur in the real world. Consequently, the level of investment identified as the amount sufficient to maintain a certain performance level should be viewed as the minimum amount that would be sufficient, if all other modeling assumptions prove to be accurate.

It is important to recognize that the conditions of "today" (i.e., 2006) in this report differ from the conditions of "today" (i.e., 2004, 2002, etc.) as presented in previous editions of the report. Hence, as the level of current system conditions and performance varies over time, the investment scenarios that are based on maintaining the status quo are effectively targeting something different each time. The reader should bear this in mind when comparing the results of different reports in the series.

It should also be noted that this report uses the term "sustain" in certain scenario titles rather than the term "maintain" that has been used in previous editions. This change was made to reduce confusion, as all of these scenarios reflect capital improvements only, and do not consider routine maintenance costs.

|

|

Supplemental Scenarios

Each of the five primary scenarios described above is defined in such a manner that it can draw directly from a single HERS model run and a single NBIAS model run among the range of alternatives presented in Chapter 7. This section also includes two supplemental scenarios that draw from multiple HERS and NBIAS runs in order to estimate the costs of achieving certain objectives beyond those that can be targeted in a single analysis.

The Sustain Conditions and Performance of System Components scenario focuses on maintaining specific performance indicators for individual highway functional systems rather than more general indicators for the system as a whole. This scenario combines three elements: (1) the level of system expansion expenditures associated with maintaining average delay per vehicle mile traveled (VMT), (2) the level of system rehabilitation expenditures associated with maintaining average pavement roughness, and (3) the level of system rehabilitation expenditures associated with maintaining the economic investment backlog for bridges. This scenario does not draw directly from the analyses presented in Chapter 7. Instead, it represents a compilation of parts of many separate HERS and NBIAS analyses in which particular performances measures on particular functional systems in 2026 were maintained at base year 2006 levels.

The goal of the Sustain Conditions and Improve Performance scenario is to maintain the physical conditions of highways and bridges while improving their operational performance. This scenario represents a combination of two other scenarios; the system rehabilitation expenditures reflected in the scenario are drawn from the Sustain Conditions and Performance scenario, while the system expansion expenditures are drawn from the MinBCR=1.0 scenario.

Note that these two supplemental scenarios are presented on a systemwide basis only; comparable values for the Interstate and NHS are not separately identified.

Interstate System Scenarios

Exhibits 8-1 and 8-2 describe the derivation of the investment levels for each of five Interstate capital investment scenarios assuming fixed rate user financing and variable rate user financing, respectively. These scenarios each draw from the HERS and NBIAS analyses presented in Chapter 7. The HERS-derived scenario components link back to selected investment levels identified in Exhibit 7-18, along with the minimum benefit-cost ratio cutoff points identified in Exhibit 7-14. The NBIAS-derived scenario components tie back to selected investment levels identified in Exhibit 7-23. Each scenario covers the 20-year period from 2007 to 2026, and the investment levels shown are all stated in constant 2006 dollars.

| Scenario Name and Description | Scenario Component (And Associated Systemwide Growth Rate) * | Share of 2006 Total Capital Outlay | Average Annual Investment (Billions of 2006 Dollars) Modeled Spending |

Average Annual Investment (Billions of 2006 Dollars) Estimated Non-Modeled |

Average Annual Investment (Billions of 2006 Dollars) Total |

Share of Average Annual Investment |

|---|---|---|---|---|---|---|

| Sustain Current Spending scenario (Maintain spending at base year levels in constant dollar terms) | HERS | 77.5% | $12.8 | $12.8 | 77.5% | |

| Sustain Current Spending scenario (Maintain spending at base year levels in constant dollar terms) |

NBIAS | 15.1% | $2.5 | $2.5 | 15.1% | |

| Sustain Current Spending scenario (Maintain spending at base year levels in constant dollar terms) |

Non-Modeled | 7.4% | $1.2 | $1.2 | 7.4% | |

| Sustain Current Spending scenario (Maintain spending at base year levels in constant dollar terms) |

Total | 100.0% | $15.3 | $1.2 | $16.5 | 100.0% |

| Sustain Conditions and Performance scenario (Maintain adjusted average highway user costs and economic bridge backlog at 2006 levels) | HERS | 77.5% | $20.2 | $20.2 | 81.4% | |

| Sustain Conditions and Performance scenario (Maintain adjusted average highway user costs and economic bridge backlog at 2006 levels) |

NBIAS | 15.1% | $2.8 | $2.8 | 11.1% | |

| Sustain Conditions and Performance scenario (Maintain adjusted average highway user costs and economic bridge backlog at 2006 levels) |

Non-Modeled | 7.4% | $1.8 | $1.8 | 7.4% | |

| Sustain Conditions and Performance scenario (Maintain adjusted average highway user costs and economic bridge backlog at 2006 levels) |

Total | 100.0% | $22.9 | $1.8 | $24.8 | 100.0% |

| MinBCR=1.5 scenario (Invest in projects with BCR's as low as 1.5 and eliminate economic backlog for bridge rehabilitation) | HERS (5.03%) | 77.5% | $31.4 | $31.4 | 80.6% | |

| MinBCR=1.5 scenario (Invest in projects with BCR's as low as 1.5 and eliminate economic backlog for bridge rehabilitation) |

NBIAS (5.15%) | 15.1% | $4.7 | $4.7 | 12.0% | |

| MinBCR=1.5 scenario (Invest in projects with BCR's as low as 1.5 and eliminate economic backlog for bridge rehabilitation) |

Non-Modeled | 7.4% | $2.9 | $2.9 | 7.4% | |

| MinBCR=1.5 scenario (Invest in projects with BCR's as low as 1.5 and eliminate economic acklog for bridge rehabilitation) |

Total | 100.0% | $36.1 | $2.9 | $39.0 | 100.0% |

| MinBCR=1.2 scenario (Invest in projects with BCR's as low as 1.2 and eliminate economic backlog for bridge rehabilitation)) |

HERS (6.41%) | 77.5% | $35.6 | $35.6 | 81.8% | |

| MinBCR=1.2 scenario (Invest in projects with BCR's as low as 1.2 and eliminate economic backlog for bridge rehabilitation) |

NBIAS (5.15%) | 15.1% | $4.7 | $4.7 | 10.7% | |

| MinBCR=1.2 scenario (Invest in projects with BCR's as low as 1.2 and eliminate economic backlog for bridge rehabilitation) |

Non-Modeled | 7.4% | $3.2 | $3.2 | 7.4% | |

| MinBCR=1.2 scenario (Invest in projects with BCR's as low as 1.2 and eliminate economic backlog for bridge rehabilitation) |

Total | 100.0% | $40.3 | $3.2 | $43.5 | 100.0% |

| MinBCR=1.0 scenario (Invest in projects with BCR's as low as 1.0 and eliminate economic backlog for bridge rehabilitation) |

HERS (7.45%) | 77.5% | $38.8 | $38.8 | 82.6% | |

| MinBCR=1.0 scenario (Invest in projects with BCR's as low as 1.0 and eliminate economic backlog for bridge rehabilitation) |

NBIAS (5.15%) | 15.1% | $4.7 | $4.7 | 9.9% | |

| MinBCR=1.0 scenario (Invest in projects with BCR's as low as 1.0 and eliminate economic backlog for bridge rehabilitation) |

Non-Modeled | 7.4% | $3.5 | $3.5 | 7.4% | |

| MinBCR=1.0 scenario (Invest in projects with BCR's as low as 1.0 and eliminate economic backlog for bridge rehabilitation) |

Total | 100.0% | $43.5 | $3.5 | $47.0 | 100.0% |

| Scenario Name and Description | Scenario Component (And Associated Systemwide Growth Rate) * | Share of 2006 Total Capital Outlay | Average Annual Investment (Billions of 2006 Dollars) Modeled Spending |

Average Annual Investment (Billions of 2006 Dollars) Estimated Non-Modeled |

Average Annual Investment (Billions of 2006 Dollars) Total |

Share of Average Annual Investment |

|---|---|---|---|---|---|---|

| Sustain Current Spending scenario (Maintain spending at base year levels in constant dollar terms) |

HERS | 77.5% | $12.8 | $12.8 | 77.5% | |

| Sustain Current Spending scenario (Maintain spending at base year levels in constant dollar terms) |

NBIAS | 15.1% | $2.5 | $2.5 | 15.1% | |

| Sustain Current Spending scenario (Maintain spending at base year levels in constant dollar terms) |

Non-Modeled | 7.4% | $1.2 | $1.2 | 7.4% | |

| Sustain Current Spending scenario (Maintain spending at base year levels in constant dollar terms) |

Total | 100.0% | $15.3 | $1.2 | $16.5 | 100.0% |

| Sustain Conditions and Performance scenario (Maintain adjusted average highway user costs and economic bridge backlog at 2006 levels) |

HERS | 77.5% | $8.0 | $8.0 | 68.8% | |

| Sustain Conditions and Performance scenario (Maintain adjusted average highway user costs and economic bridge backlog at 2006 levels) |

NBIAS | 15.1% | $2.8 | $2.8 | 23.7% | |

| Sustain Conditions and Performance scenario (Maintain adjusted average highway user costs and economic bridge backlog at 2006 levels) |

Non-Modeled | 7.4% | $0.9 | $0.9 | 7.4% | |

| Sustain Conditions and Performance scenario (Maintain adjusted average highway user costs and economic bridge backlog at 2006 levels) |

Total | 100.0% | $10.8 | $0.9 | $11.6 | 100.0% |

| MinBCR=1.5 scenario (Invest in projects with BCRs as low as 1.5 and eliminate economic backlog for bridge rehabilitation) |

HERS (1.67%) | 77.5% | $17.6 | $17.6 | 73.1% | |

| MinBCR=1.5 scenario (Invest in projects with BCRs as low as 1.5 and eliminate economic backlog for bridge rehabilitation) |

NBIAS (5.15%) | 15.1% | $4.7 | $4.7 | 19.4% | |

| MinBCR=1.5 scenario (Invest in projects with BCRs as low as 1.5 and eliminate economic backlog for bridge rehabilitation) |

Non-Modeled | 7.4% | $1.8 | $1.8 | 7.4% | |

| MinBCR=1.5 scenario (Invest in projects with BCRs as low as 1.5 and eliminate economic backlog for bridge rehabilitation) |

Total | 100.0% | $22.2 | $1.8 | $24.0 | 100.0% |

| MinBCR=1.2 scenario (Invest in projects with BCRs as low as 1.2 and eliminate economic backlog for bridge rehabilitation) |

HERS (3.30%) | 77.5% | $20.8 | $20.8 | 75.6% | |

| MinBCR=1.2 scenario (Invest in projects with BCRs as low as 1.2 and eliminate economic backlog for bridge rehabilitation) |

NBIAS (5.15%) | 15.1% | $4.7 | $4.7 | 17.0% | |

| MinBCR=1.2 scenario (Invest in projects with BCRs as low as 1.2 and eliminate economic backlog for bridge rehabilitation) |

Non-Modeled | 7.4% | $2.0 | $2.0 | 7.4% | |

| MinBCR=1.2 scenario (Invest in projects with BCRs as low as 1.2 and eliminate economic backlog for bridge rehabilitation) |

Total | 100.0% | $25.5 | $2.0 | $27.5 | 100.0% |

| Maximum Economic Investment (MinBCR=1.0) scenario (Invest in projects with BCRs as low as 1.0 and eliminate economic bridge backlog) |

HERS (4.45%) | 77.5% | $23.5 | $23.5 | 77.2% | |

| Maximum Economic Investment (MinBCR=1.0) scenario (Invest in projects with BCRs as low as 1.0 and eliminate economic bridge backlog) |

NBIAS (5.15%) | 15.1% | $4.7 | $4.7 | 15.4% | |

| Maximum Economic Investment (MinBCR=1.0) scenario (Invest in projects with BCRs as low as 1.0 and eliminate economic bridge backlog) |

Non-Modeled | 7.4% | $2.3 | $2.3 | 7.4% | |

| Maximum Economic Investment (MinBCR=1.0) scenario (Invest in projects with BCRs as low as 1.0 and eliminate economic bridge backlog) |

Total | 100.0% | $28.1 | $2.3 | $30.4 | 100.0% |

For the scenarios that target minimum benefit-cost ratio cutoff points, the HERS and NBIAS components can each be linked directly to one of the 24 alternative annual percent systemwide funding growth rates analyzed in Chapter 7; the growth rates associated with these scenarios are identified in Exhibits 8-1 and 8-2. This is not the case for scenarios targeting specific spending levels or specific levels of performance (i.e., the first two scenarios in each table); as discussed in Chapter 7, the mix of investments between the Interstate system and other parts of the highway system will be different when such targets are imposed at a systemwide level than if comparable criteria were imposed on the Interstate system alone. As referenced below, certain exhibits in Chapter 7 contain "extra" rows (in addition to the standard set of alternative growth rates) to highlight the Interstate-specific funding levels.

The discussion that follows documents the derivation of the five Interstate scenarios in some detail. This information is provided to serve as a roadmap for how one could construct additional scenarios building off of different inputs from Chapter 7 beyond the selected scenarios presented here. It is important to note that these scenarios are intended to be illustrative, and any number of alternative scenarios based on different benefit-cost ratio cutoff points, performance targets, or funding targets could be constructed that would be equally valid from a technical perspective.

Derivation of Scenario Investment Levels

The average annual investment levels shown for the Interstate Sustain Current Spending scenario are identical in both Exhibits 8-1 and 8-2, and are consistent with the 2006 Interstate spending figures identified in Exhibit 7-1. This scenario assumes the continuation of the percentage splits in spending among HERS-modeled, NBIAS-modeled, and non-modeled improvement types. Of the $16.5 billion of capital investment on the Interstate System in 2006, approximately $12.8 billion (or 77.5 percent) was used for types of improvements modeled in HERS, including pavement resurfacing, pavement reconstruction, and capacity additions to the existing highway and bridge network. (The HERS-modeled impacts on adjusted user costs of sustaining the 2006 level of Interstate investment in constant dollar terms are identified for each of the funding mechanisms [non-user sources, fixed rate user charges, and variable rate user charges] in the second extra row appended to the bottom of Exhibit 7-18.) Approximately $2.5 billion (or 15.1 percent) was used for types of bridge repair, rehabilitation, and replacement improvements modeled in NBIAS. (The impacts of sustaining this level of investment in constant dollar terms are identified in the second extra row appended to the bottom of Exhibit 7-23.) The remaining $1.2 billion (or 7.4 percent) went for types of capital improvements not currently addressed by either HERS or NBIAS, including various safety enhancements, environmental enhancements, and traffic operations improvements.

Each of the Interstate System scenarios assume that the share of average annual investment directed towards non-modeled capital improvements will remain at the 2006 level of 7.4 percent. Consequently, the amounts identified as estimated non-modeled spending in Exhibits 8-1 and 8-2 are proportionally larger or smaller than the 2006 spending level of $1.2 billion, based on the change in modeled spending relative to the 2006 baseline.

| Why does the analysis assume that the share of the future highway investment scenario estimates for non-modeled items would match their share of current spending? | |

|

No data are currently available that would justify an assumption that the percentage of capital spending devoted to these investments would (or should) change in the future. In the absence of such data, it is thus reasonable to assume that their share of future investment under each scenario would approximate their share of current spending.

|

|

The average annual investment levels for the Interstate Sustain Conditions and Performance scenario for 2007 to 2026 assuming fixed rate user financing is $24.8 billion, as shown in Exhibit 8-1; Exhibit 8-2 identifies the comparable annual figure assuming the widespread adoption of variable rate user charges (i.e., congestion pricing) as $11.6 billion in constant 2006 dollars. The HERS-modeled components of these totals are $20.2 billion and $8.0 billion, respectively. (The impacts of sustaining these levels of investment in constant dollar terms over 20 years are identified in the first extra row appended to the bottom of Exhibit 7-18.) The NBIAS-modeled component is identical in both exhibits, totaling $2.8 billion because NBIAS does not consider alternative financing mechanisms. (The impacts of sustaining this level of investment in constant dollar terms are identified in the first extra row appended to the bottom of Exhibit 7-23.) The estimated non-modeled portion of the scenario differs proportionally in response to the differences between the HERS-derived figures.

As shown in Exhibit 8-1, the average annual investment level for the period 2007 to 2026 for the Interstate MinBCR=1.5 scenario assuming financing from fixed rate user charges is $39.0 billion. This includes a HERS-derived component of $31.4 billion, stated in constant 2006 dollars. (Exhibit 7-14 links the benefit-cost ratio cutoff point with an annual spending growth rate of 5.03 percent assuming fixed rate user financing, which in turn is linked to $31.4 billion of spending on HERS-modeled improvements on the Interstate system in Exhibit 7-18.) Exhibit 8-2 identifies an average annual investment for the Interstate MinBCR=1.5 scenario of $24.0 billion stated in constant 2006 dollars assuming financing from variable rate user charges, including a HERS-derived component of $17.6 billion. (Exhibit 7-14 links the benefit-cost ratio cutoff point with an annual spending growth rate of 1.67 percent assuming variable rate user financing, which in turn is linked to $17.6 billion of spending on HERS-modeled improvements on the Interstate system in Exhibit 7-18.) The $4.7 billion NBIAS-derived component shown in both Exhibits 8-1 and 8-2 represents the average annual level of investment to eliminate the economic bridge investment backlog. (Exhibit 7-23 identifies this figure, which is associated with an annual constant dollar growth rate of 5.15 percent.)

The average annual investment level over 20 years for the Interstate MinBCR=1.2 scenario assuming financing from fixed rate user charges is $43.5 billion stated in constant 2006 dollars, including a HERS-derived component of $35.6 billion, as shown in Exhibit 8-1. (This HERS component is linked to an annual spending growth rate of 6.41 percent in Exhibit 7-18, which is the rate associated with a minimum benefit-cost ratio of 1.2 in Exhibit 7-14.) Exhibit 8-2 identifies an average annual investment for the Interstate MinBCR=1.2 scenario of $27.5 billion stated in constant 2006 dollars assuming financing from variable rate user charges, including a HERS-derived component of $20.8 billion. (This HERS component is linked to an annual spending growth rate of 3.30 percent in Exhibit 7-18, which is the rate associated with a minimum benefit-cost ratio of 1.2 in Exhibit 7-14, assuming variable rate user financing.) The $4.7 billion NBIAS-derived component shown in both Exhibits 8-1 and 8-2 represents the average annual level of investment to eliminate the economic bridge investment backlog.

The average annual investment level over 20 years for the Interstate MinBCR=1.0 scenario assuming financing from fixed rate user charges is $47.0 billion stated in constant 2006 dollars, including a HERS-derived component of $38.8 billion, as shown in Exhibit 8-1. (This HERS component is linked to an annual spending growth rate of 7.45 percent in Exhibit 7-18, which is the rate associated with a minimum benefit-cost ratio of 1.0 in Exhibit 7-14.) Exhibit 8-2 identifies an average annual investment for the Interstate Maximum Economic Investment (MinBCR=1.0) scenario of $30.4 billion stated in constant 2006 dollars assuming the widespread adoption of variable user charges such as congestion pricing, including a HERS-derived component of $23.5 billion. (This HERS component is linked to an annual spending growth rate of 4.45 percent in Exhibit 7-18, which is the rate associated with a minimum benefit-cost ratio of 1.0 in Exhibit 7-14, assuming variable rate user financing.) The $4.7 billion NBIAS-derived component shown in both Exhibits 8-1 and 8-2 represents the average annual level of investment to eliminate the economic bridge investment backlog.

Investment Scenario Estimates by Improvement Type

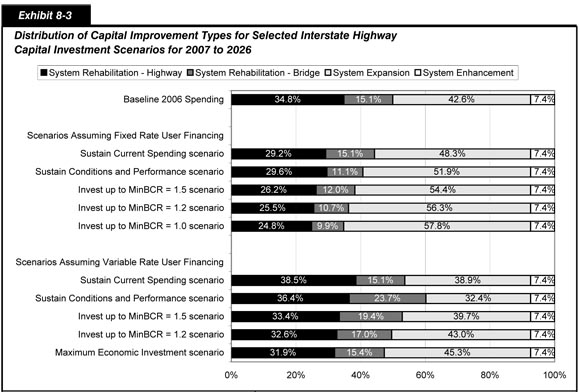

Exhibit 8-3 compares the distribution of highway and bridge capital outlay among the 20-year Interstate capital investment scenarios defined in Exhibits 8-1 and 8-2. The amounts identified as the bridge portion of the System Rehabilitation category correspond to the NBIAS-modeled portion of each scenario, while System Enhancement spending corresponds to the non-modeled portion of each scenario as estimated in Exhibits 8-1 and 8-2. The HERS-modeled portion of each scenario is split between the System Expansion category and the highway portion of the System Rehabilitation category.

| Scenario Name and Description | Average Annual Investment (Billions of 2006 Dollars) | |||||

|---|---|---|---|---|---|---|

| System Rehabilitation Highway 1 |

System Rehabilitation Bridge 2 |

System Rehabilitation Total |

System Expansion 3 | System Enhancement | Total | |

| Baseline 2006 Spending | $5.8 | $2.5 | $8.3 | $7.1 | $1.2 | $16.5 |

| Scenarios Assuming Fixed Rate User Financing | ||||||

| Sustain Current Spending scenario | $4.8 | $2.5 | $7.3 | $8.0 | $1.2 | $16.5 |

| Sustain Conditions and Performance scenario | $7.3 | $2.8 | $10.1 | $12.9 | $1.8 | $24.8 |

| Invest up to MinBCR = 1.5 scenario | $10.2 | $4.7 | $14.9 | $21.2 | $2.9 | $39.0 |

| Invest up to MinBCR = 1.2 scenario | $11.1 | $4.7 | $15.8 | $24.5 | $3.2 | $43.5 |

| Invest up to MinBCR = 1.0 scenario | $11.7 | $4.7 | $16.3 | $27.2 | $3.5 | $47.0 |

| Scenarios Assuming Variable Rate User Financing | ||||||

| Sustain Current Spending scenario | $6.4 | $2.5 | $8.9 | $6.4 | $1.2 | $16.5 |

| Sustain Conditions and Performance scenario | $4.2 | $2.8 | $7.0 | $3.8 | $0.9 | $11.6 |

| Invest up to MinBCR = 1.5 scenario | $8.0 | $4.7 | $12.7 | $9.5 | $1.8 | $24.0 |

| Invest up to MinBCR = 1.2 scenario | $9.0 | $4.7 | $13.7 | $11.8 | $2.0 | $27.5 |

| Maximum Economic Investment scenario (MinBCR = 1.0) | $9.7 | $4.7 | $14.4 | $13.8 | $2.3 | $30.4 |

For the versions of the scenarios assuming fixed rate user financing, the percentage of capital investment devoted to System Expansion rises as the average annual investment level rises. While 42.6 percent of combined public and private capital investment on Interstates was devoted to System Expansion in 2006, the Interstate Sustain Current Spending scenario suggests this percentage should be increased to 48.3 percent, were this level of investment to be sustained over 20 years in constant dollar terms. This suggests that the current performance of the Interstate system is better in terms of physical conditions than in terms of operational performance. If investment were to rise to the Interstate Sustain Conditions and Performance scenario level, the analysis suggests that 51.9 percent of Interstate capital investment be directed to System Expansion; the Interstate MinBCR=1.0 scenario would direct 57.8 percent of capital investment towards System Expansion. These findings suggest that there are substantial opportunities for potentially cost-beneficial investments in Interstate System Expansion if sufficient funding were available to implement them, but that many of these investments have benefit-cost ratios that are relatively low, due to the large construction costs associated with these types of investments.

| Can highway capacity be expanded without building new roads and bridges or adding new lanes to existing facilities? | |

|

Yes. The "System Expansion" investment levels identified in this chapter reflect a need for a certain amount of effective highway capacity, which could be met by traditional expansion or by other means. In some cases, effective highway capacity can be increased by improving the utilization of the existing infrastructure rather than by expanding it. The investment scenario estimates presented in this report consider the impact of some of the most significant operations strategies and deployments on highway system performance; these relationships are described in more detail in Appendix A.

The methodology used to estimate the system expansion component of the investment scenarios also allows high-cost capacity improvements to be considered as an option for segments with high volumes of projected future travel, but have been coded by States as infeasible for conventional widening. Conceptually, such improvements might consist of new highways or bridges in the same corridor (or tunneling or double-decking on an existing alignment), but the capacity upgrades could also come through other transportation improvements, such as a parallel fixed-guideway transit line or mixed-use, high-occupancy vehicle/bus lanes.

|

|

For the versions of the scenarios assuming variable rate user financing, the percentage of capital investment devoted to system expansion would be lower than if only fixed rate user financing were utilized, but would still rise as the average annual investment level rises. If investment were to decline in constant dollar terms to the Interstate Sustain Conditions and Performance scenario level, the analysis suggests that 32.4 percent of Interstate capital investment be directed to System Expansion; this share would rise to 38.9 percent for the Interstate Sustain Current Spending scenario, but would still remain below the 42.6 percent of combined public and private capital investment on Interstates devoted to System Expansion in 2006. If investment were to rise to the Interstate Maximum Economic Investment scenario level, the analysis suggests that 45.3 percent of Interstate capital investment be directed to System Expansion. These findings suggest that the widespread adoption of congestion pricing strategies would reduce the attractiveness of System Expansion relative to System Rehabilitation, though there would still be opportunities for potentially cost-beneficial investments of all kinds.

Investment Scenario Impacts

Exhibit 8-4 summarizes the potential impacts of the 20-year Interstate capital investment scenarios defined in Exhibits 8-1 and 8-2, on selected measures of system conditions and performance. The Interstate Sustain Conditions and Performance scenario would by definition be associated with a 0.0 percent change in adjusted average user costs and the bridge investment backlog, as the scenario is designed to represent a level of investment that could allow the 2026 values for these indicators to match their base year 2006 values. For the version of this scenario that assumes fixed rate user financing, average delay per VMT is projected to increase by 2.1 percent, while average pavement roughness (as measured by the International Roughness Index [IRI] as defined in Chapter 3) would decline by 1.9 percent. This suggests a tradeoff between improved physical conditions and a worsening of operational performance. The opposite is true for the version of this scenario assuming variable rate user financing, under which average delay per VMT is projected to decrease by 19.9 percent while average IRI increases by 22.2 percent. This suggests that the operational performance improvements associated with the widespread adoption of congestion pricing would be sufficient to allow a significant reduction in Interstate capital spending while still having the same net impact on the costs experienced by highway users.

| Why do the fixed rate financing versions of many of the scenarios result in lower average IRI values than their variable rate financing counterparts? | |

|

This difference is largely attributable to the lower overall investment levels associated with the variable rate financing versions of the scenarios. The variable rate user financing version of the Sustain Current Spending Scenario (the one scenario for which the investment levels for both the fixed and variable versions is identical), results in significantly better ride quality than its fixed user financing counterpart.

Another factor pertains to the reduced number of widening actions taken by HERS for the analyses assuming the adoption of variable rate user charges. As discussed in Chapter 7, when HERS adds new lanes to an existing facility, it also resurfaces or reconstructs all of the existing lanes. In some cases, these pavement improvements occur earlier in the life of the pavement than would normally be the case in the absence of the widening action, and would not have been cost-beneficial on their own. Consequently, the reduced number of widening actions taken by HERS under the variable rate funding analyses causes some of these pavement actions to be deferred beyond the 20-year period considered as part of this analysis.

|

|

| Scenario Name and Description | Average Annual Investment (Billions of 2006 Dollars) | Percent Change in: Adjusted Average User Costs 1 |

Percent Change in: Average Delay Per VMT 2 |

Percent Change in: Average IRI 3 |

Percent Change in: Bridge Investment Backlog 4 |

|---|---|---|---|---|---|

| Scenarios Assuming Fixed Rate User Financing | |||||

| Sustain Current Spending scenario | $16.5 | 5.0% | 33.9% | 28.2% | 17.1% |

| Sustain Conditions and Performance scenario | $24.8 | 0.0% | 2.1% | -1.9% | 0.0% |

| Invest up to MinBCR=1.5 scenario | $39.0 | -4.5% | -30.2% | -27.6% | -100.0% |

| Invest up to MinBCR=1.2 scenario | $43.5 | -5.6% | -39.4% | -32.0% | -100.0% |

| Invest up to MinBCR=1.0 scenario | $47.0 | -6.3% | -46.1% | -34.7% | -100.0% |

| Scenarios Assuming Variable Rate User Financing | |||||

| Sustain Current Spending scenario | $16.5 | -2.9% | -31.1% | -4.5% | 17.1% |

| Sustain Conditions and Performance scenario | $11.6 | 0.0% | -19.9% | 22.2% | 0.0% |

| Invest up to MinBCR=1.5 scenario | $24.0 | -4.7% | -42.5% | -18.6% | -100.0% |

| Invest up to MinBCR=1.2 scenario | $27.5 | -5.6% | -48.9% | -25.5% | -100.0% |

| Maximum Economic Investment scenario (MinBCR=1.0) | $30.4 | -6.2% | -53.1% | -29.4% | -100.0% |

Relative to the scenario focusing on sustaining current conditions and performance, those scenarios with higher average annual levels of investment would be expected to result in overall improvements to the system, as measured by their impacts on adjusted average user costs and other performance indicators. The potential for reductions to average delay per VMT is relatively large, as strategic investments in Interstate System Expansion, coupled with the continued deployment of intelligent transportation systems (ITS) on a growing share of the Interstate System, has the potential to significantly improve operating performance, particularly when applied in conjunction with congestion pricing.

Comparison of Scenario Investment Levels With Base Year Spending

Exhibit 8-5 compares the combined public and private capital investment levels associated with each of the selected Interstate scenarios with actual Interstate capital spending in 2006. By definition, the Interstate Sustain Current Spending scenario matches base year spending in constant dollar terms.

Among the versions of the scenarios assuming fixed rate user financing, the difference in average annual investment levels relative to the 2006 baseline ranges from 49.8 percent for the Interstate Sustain Conditions and Performance scenario up to 183.9 percent for the Interstate MinBCR=1.0 scenario. Exhibit 8-5 also identifies the annual increase in combined public and private capital investment that would be sufficient to produce the average annual investment levels identified for each scenario. A constant dollar spending growth rate of 3.71 percent would be sufficient to support the Interstate Sustain Conditions and Performance scenario; the equivalent growth rate associated with the Interstate MinBCR=1.5 scenario would be 7.61 percent.

Among the versions of the scenarios assuming fixed rate user financing, the average annual investment level for the Interstate Sustain Conditions and Performance scenario is 29.7 percent lower than actual Interstate capital spending in 2006; Exhibit 8-5 indicates that spending could decline by 3.49 percent annually in constant dollar terms and still generate sufficient funding to support this scenario. The average annual investment level for the Interstate Maximum Economic Investment scenario exceeds base year 2006 Interstate capital spending by 83.8 percent. Achieving this average annual investment level could be accomplished by increasing combined public and private Interstate capital spending by 5.49 percent per year.

Exhibit 8-5 also identifies the estimated annual revenues that might be generated from the Interstate System assuming the widespread adoption of congestion pricing. These revenues are a subset of the projected revenue from variable rate user charges identified in Chapter 7 for the highway system as a whole [see Exhibit 7-4]. Based on the assumptions underlying the analyses presented in these scenarios, the additional revenues generated from congestion charges on the Interstate System would be more than adequate to support an increase from current Interstate spending up to the Interstate Maximum Economic Investment scenario, if these revenues were used for this purpose.

| Scenario Name and Description | Average Annual Investment (Billions of 2006 Dollars) | Difference Relative to 2006 Spending on Interstates (Billions of 2006 Dollars) |

Difference Relative to 2006 Spending on Interstates Percent |

Annual Percent Increase to Support Scenario Investment 1 | Annual Revenues Generated From Variable Rate User Charges 2 |

|---|---|---|---|---|---|

| Scenarios Assuming Fixed Rate User Financing | |||||

| Sustain Current Spending scenario | $16.5 | $0.0 | 0.0% | 0.00% | $0.0 |

| Sustain Conditions and Performance scenario | $24.8 | $8.2 | 49.8% | 3.71% | $0.0 |

| Invest up to MinBCR=1.5 scenario | $39.0 | $22.5 | 135.7% | 7.61% | $0.0 |

| Invest up to MinBCR=1.2 scenario | $43.5 | $27.0 | 163.1% | 8.52% | $0.0 |

| Invest up to MinBCR=1.0 scenario | $47.0 | $30.4 | 183.9% | 9.15% | $0.0 |

| Scenarios Assuming Variable Rate User Financing | |||||

| Sustain Current Spending scenario | $16.5 | $0.0 | 0.0% | 0.00% | $26.7 |

| Sustain Conditions and Performance scenario | $11.6 | -$4.9 | -29.7% | -3.49% | $29.9 |

| Invest up to MinBCR=1.5 scenario | $24.0 | $7.5 | 45.3% | 3.43% | $23.6 |

| Invest up to MinBCR=1.2 scenario | $27.5 | $11.0 | 66.5% | 4.64% | $21.6 |

| Maximum Economic Investment scenario (MinBCR=1.0) | $30.4 | $13.9 | 83.8% | 5.49% | $20.1 |

National Highway System Scenarios

Exhibits 8-6 and 8-7 describe the derivation of the investment levels for each of five NHS capital investment scenarios assuming fixed rate user financing and variable rate user financing, respectively. These scenarios each draw from the HERS and NBIAS analyses presented in Chapter 7. The HERS-derived scenario components link back to selected investment levels identified in Exhibit 7-15, along with the minimum benefit-cost ratio cutoff points identified in Exhibit 7-14. The NBIAS-derived scenario components tie back to selected investment levels identified in Exhibit 7-22. Each scenario covers the 20-year period from 2007 to 2026, and the investment levels shown are all stated in constant 2006 dollars.

| Scenario Name and Description | Scenario Component (And Associated Systemwide Growth Rate) * | Share of 2006 Total Capital Outlay | Average Annual Investment (Billions of 2006 Dollars) Modeled Spending |

Average Annual Investment (Billions of 2006 Dollars) Estimated Non-Modeled |

Average Annual Investment (Billions of 2006 Dollars) Total |

Share of Average Annual Investment |

|---|---|---|---|---|---|---|

| Sustain Current Spending scenario (Maintain spending at base year levels in constant dollar terms) |

HERS | 80.8% | $30.0 | $30.0 | 80.8% | |

| Sustain Current Spending scenario (Maintain spending at base year levels in constant dollar terms) |

NBIAS | 11.6% | $4.3 | $4.3 | 11.6% | |

| Sustain Current Spending scenario (Maintain spending at base year levels in constant dollar terms) |

Non-Modeled | 7.6% | $2.8 | $2.8 | 7.6% | |

| Sustain Current Spending scenario (Maintain spending at base year levels in constant dollar terms) |

Total | 100.0% | $34.3 | $2.8 | $37.1 | 100.0% |

| Sustain Conditions and Performance scenario (Maintain adjusted average highway user costs and economic bridge backlog at 2006 levels) |

HERS | 80.8% | $31.1 | $31.1 | 80.4% | |

| Sustain Conditions and Performance scenario (Maintain adjusted average highway user costs and economic bridge backlog at 2006 levels) |

NBIAS | 11.6% | $4.7 | $4.7 | 12.1% | |

| Sustain Conditions and Performance scenario (Maintain adjusted average highway user costs and economic bridge backlog at 2006 levels) |

Non-Modeled | 7.6% | $2.9 | $2.9 | 7.6% | |

| Sustain Conditions and Performance scenario (Maintain adjusted average highway user costs and economic bridge backlog at 2006 levels) |

Total | 100.0% | $35.8 | $2.9 | $38.7 | 100.0% |

| MinBCR=1.5 scenario (Invest in projects with BCRs as low as 1.5 and eliminate economic backlog for bridge rehabilitation) |

HERS (5.03%) | 80.8% | $48.4 | $48.4 | 79.7% | |

| MinBCR=1.5 scenario (Invest in projects with BCRs as low as 1.5 and eliminate economic backlog for bridge rehabilitation) |

NBIAS (5.15%) | 11.6% | $7.7 | $7.7 | 12.7% | |

| MinBCR=1.5 scenario (Invest in projects with BCRs as low as 1.5 and eliminate economic backlog for bridge rehabilitation) |

Non-Modeled | 7.6% | $4.6 | $4.6 | 7.6% | |

| MinBCR=1.5 scenario (Invest in projects with BCRs as low as 1.5 and eliminate economic backlog for bridge rehabilitation) |

Total | 100.0% | $56.1 | $4.6 | $60.7 | 100.0% |

| MinBCR=1.2 scenario (Invest in projects with BCRs as low as 1.2 and eliminate economic backlog for bridge rehabilitation) |

HERS (6.41%) | 80.8% | $56.2 | $56.2 | 81.3% | |

| MinBCR=1.2 scenario (Invest in projects with BCRs as low as 1.2 and eliminate economic backlog for bridge rehabilitation) |

NBIAS (5.15%) | 11.6% | $7.7 | $7.7 | 11.1% | |

| MinBCR=1.2 scenario (Invest in projects with BCRs as low as 1.2 and eliminate economic backlog for bridge rehabilitation) |

Non-Modeled | 7.6% | $5.2 | $5.2 | 7.6% | |

| MinBCR=1.2 scenario (Invest in projects with BCRs as low as 1.2 and eliminate economic backlog for bridge rehabilitation) |

Total | 100.0% | $63.9 | $5.2 | $69.2 | 100.0% |

| Maximum Economic Investment (MinBCR=1.0) scenario (Invest in projects with BCRs as low as 1.0 and eliminate economic bridge backlog) |

HERS (7.45%) | 80.8% | $62.6 | $62.6 | 82.3% | |

| Maximum Economic Investment (MinBCR=1.0) scenario (Invest in projects with BCRs as low as 1.0 and eliminate economic bridge backlog) |

NBIAS (5.15%) | 11.6% | $7.7 | $7.7 | 10.1% | |

| Maximum Economic Investment (MinBCR=1.0) scenario (Invest in projects with BCRs as low as 1.0 and eliminate economic bridge backlog) |

Non-Modeled | 7.6% | $5.8 | $5.8 | 7.6% | |

| Maximum Economic Investment (MinBCR=1.0) scenario (Invest in projects with BCRs as low as 1.0 and eliminate economic bridge backlog) |

Total | 100.0% | $70.3 | $5.8 | $76.1 | 100.0% |

| Scenario Name and Description | Scenario Component (And Associated Systemwide Growth Rate) * | Share of 2006 Total Capital Outlay | Average Annual Investment (Billions of 2006 Dollars) Modeled Spending |

Average Annual Investment (Billions of 2006 Dollars) Estimated Non-Modeled |

Average Annual Investment (Billions of 2006 Dollars) Total |

Share of Average Annual Investment |

|---|---|---|---|---|---|---|

| Sustain Current Spending scenario (Maintain spending at base year levels in constant dollar terms) |

HERS | 80.8% | $30.0 | $30.0 | 80.8% | |

| Sustain Current Spending scenario (Maintain spending at base year levels in constant dollar terms) |

NBIAS | 11.6% | $4.3 | $4.3 | 11.6% | |

| Sustain Current Spending scenario (Maintain spending at base year levels in constant dollar terms) |

Non-Modeled | 7.6% | $2.8 | $2.8 | 7.6% | |

| Sustain Current Spending scenario (Maintain spending at base year levels in constant dollar terms) |

Total | 100.0% | $34.3 | $2.8 | $37.1 | 100.0% |

| Sustain Conditions and Performance scenario (Maintain adjusted average highway user costs and economic bridge backlog at 2006 levels) |

HERS | 80.8% | $13.5 | $13.5 | 68.7% | |

| Sustain Conditions and Performance scenario (Maintain adjusted average highway user costs and economic bridge backlog at 2006 levels) |

NBIAS | 11.6% | $4.7 | $4.7 | 23.8% | |

| Sustain Conditions and Performance scenario (Maintain adjusted average highway user costs and economic bridge backlog at 2006 levels) |

Non-Modeled | 7.6% | $1.5 | $1.5 | 7.6% | |

| Sustain Conditions and Performance scenario (Maintain adjusted average highway user costs and economic bridge backlog at 2006 levels) |

Total | 100.0% | $18.2 | $1.5 | $19.6 | 100.0% |

| MinBCR=1.5 scenario (Invest in projects with BCRs as low as 1.5 and eliminate economic backlog for bridge rehabilitation) |

HERS (1.67%) | 80.8% | $28.3 | $28.3 | 76.2% | |

| MinBCR=1.5 scenario (Invest in projects with BCRs as low as 1.5 and eliminate economic backlog for bridge rehabilitation) |

NBIAS (5.15%) | 11.6% | $7.7 | $7.7 | 19.8% | |

| MinBCR=1.5 scenario (Invest in projects with BCRs as low as 1.5 and eliminate economic backlog for bridge rehabilitation) |

Non-Modeled | 7.6% | $2.9 | $2.9 | 7.6% | |

| MinBCR=1.5 scenario (Invest in projects with BCRs as low as 1.5 and eliminate economic backlog for bridge rehabilitation) |

Total | 100.0% | $36.0 | $2.9 | $38.9 | 100.0% |

| MinBCR=1.2 scenario (Invest in projects with BCRs as low as 1.2 and eliminate economic backlog for bridge rehabilitation) |

HERS (3.30%) | 80.8% | $33.8 | $33.8 | 75.3% | |

| MinBCR=1.2 scenario (Invest in projects with BCRs as low as 1.2 and eliminate economic backlog for bridge rehabilitation) |

NBIAS (5.15%) | 11.6% | $7.7 | $7.7 | 17.1% | |

| MinBCR=1.2 scenario (Invest in projects with BCRs as low as 1.2 and eliminate economic backlog for bridge rehabilitation) |

Non-Modeled | 7.6% | $3.4 | $3.4 | 7.6% | |

| MinBCR=1.2 scenario (Invest in projects with BCRs as low as 1.2 and eliminate economic backlog for bridge rehabilitation) |

Total | 100.0% | $41.5 | $3.4 | $44.9 | 100.0% |

| Maximum Economic Investment (MinBCR=1.0) scenario (Invest in projects with BCRs as low as 1.0 and eliminate economic bridge backlog) |

HERS (4.45%) | 80.8% | $38.6 | $38.6 | 77.1% | |

| Maximum Economic Investment (MinBCR=1.0) scenario (Invest in projects with BCRs as low as 1.0 and eliminate economic bridge backlog) |

NBIAS (5.15%) | 11.6% | $7.7 | $7.7 | 15.4% | |

| Maximum Economic Investment (MinBCR=1.0) scenario (Invest in projects with BCRs as low as 1.0 and eliminate economic bridge backlog) |

Non-Modeled | 7.6% | $3.8 | $3.8 | 7.6% | |

| Maximum Economic Investment (MinBCR=1.0) scenario (Invest in projects with BCRs as low as 1.0 and eliminate economic bridge backlog) |

Total | 100.0% | $46.3 | $3.8 | $50.1 | 100.0% |

For the scenarios that target minimum benefit-cost ratio cutoff points, the HERS and NBIAS components can each be linked directly to one the 24 alternative annual percent systemwide funding growth rates analyzed in Chapter 7; the growth rates associated with these scenarios are identified in Exhibits 8-6 and 8-7. This is not the case for scenarios targeting specific spending levels or specific levels of performance; as discussed in Chapter 7, the mix of investments between the NHS and other parts of the highway system will be different when such targets are imposed at a systemwide level that if comparable criteria were imposed on the NHS alone. As referenced below, certain exhibits in Chapter 7 contain "extra" rows (in addition to the standard set of alternative growth rates) to highlight the NHS-specific funding levels.

The discussion that follows documents the derivation of the five NHS scenarios in some detail. This information is provided to serve as a roadmap for how one could construct additional scenarios building off of different inputs from Chapter 7 beyond the selected scenarios presented here. It is important to note that these scenarios are intended to be illustrative, and any number of alternative scenarios based on different benefit-cost ratio cutoff points, performance targets, or funding targets could be constructed that would be equally valid from a technical perspective.

Derivation of Scenario Investment Levels

The average annual investment levels shown for the NHS Sustain Current Spending scenario are identical in both Exhibits 8-6 and 8-7, and are consistent with the 2006 NHS spending figures identified in Exhibit 7-1. This scenario assumes the continuation of the percentage splits in spending among HERS-modeled, NBIAS-modeled, and non-modeled improvement types. Of the $37.1 billion of capital investment on the NHS in 2006, approximately $30.0 billion (or 80.8 percent) was used for types of improvements modeled in HERS, including pavement resurfacing, pavement reconstruction, and capacity additions to the existing highway and bridge network. (The impacts of sustaining this level of investment in constant dollar terms are identified in the second extra row appended to the bottom of Exhibit 7-15.) Approximately $4.3 billion (or 11.6 percent) was used for types of bridge repair, rehabilitation, and replacement improvements modeled in NBIAS. (The impacts of sustaining this level of investment in constant dollar terms are identified in the second extra row appended to the bottom of Exhibit 7-22.) The remaining $2.8 billion (or 7.6 percent) went for types of capital improvements not currently addressed by either HERS or NBIAS, including various safety enhancements, environmental enhancements, and traffic operations improvements.

Each of the NHS scenarios assume that the share of average annual investment directed towards non-modeled capital improvements will remain at the 2006 level of 7.6 percent. Consequently, the amounts identified as estimated non-modeled spending in Exhibits 8-6 and 8-7 are proportionally larger or smaller than the 2006 spending level of $2.8 billion, based on the change in modeled spending relative to the 2006 baseline.

The average annual investment levels for the NHS Sustain Conditions and Performance scenario for 2007 to 2026 assuming fixed rate user financing is $38.7 billion, as shown in Exhibit 8-6, while Exhibit 8-7 identifies the comparable annual figure assuming the widespread adoption of variable rate user charges (i.e., congestion pricing) as $19.6 billion in constant 2006 dollars. The HERS-modeled components of these totals are $31.1 billion and $13.5 billion, respectively. (The impacts of sustaining these levels of investment in constant dollar terms over 20 years are identified in the first extra row appended to the bottom of Exhibit 7-15). The NBIAS modeled component is identical in both exhibits, totaling $4.7 billion, as NBIAS does not consider alternative financing mechanisms. (The impacts of sustaining this level of investment in constant dollar terms are identified in the first extra row appended to the bottom of Exhibit 7-22.) The estimated non-modeled portion of the scenario differs proportionally in response to the differences between the HERS-derived figures.

As shown in Exhibit 8-6, the average annual investment level for the period 2007 to 2026 for the NHS MinBCR=1.5 scenario assuming financing from fixed rate user charges is $60.7 billion, including a HERS-derived component of $48.4 billion, stated in constant 2006 dollars. (Exhibit 7-14 links the benefit-cost ratio cutoff point with an annual spending growth rate of 5.03 percent assuming fixed rate user financing, which in turn is linked to $48.4 billion of spending on HERS-modeled improvements on the NHS in Exhibit 7-15.) Exhibit 8-7 identifies an average annual investment for the NHS MinBCR=1.5 scenario of $38.9 billion stated in constant 2006 dollars assuming financing from variable rate user charges, including a HERS-derived component of $28.3 billion. (Exhibit 7-14 links the benefit-cost ratio cutoff point with an annual spending growth rate of 1.67 percent assuming variable rate user financing, which in turn is linked to $28.3 billion of spending on HERS-modeled improvements on the NHS in Exhibit 7-15.) The $7.7 billion NBIAS-derived component shown in both Exhibits 8-6 and 8-7 represents the average annual level of investment to eliminate the economic bridge investment backlog. (Exhibit 7-22 identifies this figure, which is associated with an annual constant dollar growth rate of 5.15 percent.)

The average annual investment level over 20 years for the NHS MinBCR=1.2 scenario assuming financing from fixed rate user charges is $69.2 billion stated in constant 2006 dollars, including a HERS-derived component of $56.2 billion, as shown in Exhibit 8-6. (This HERS component is linked to an annual spending growth rate of 6.41 percent in Exhibit 7-15, which is the rate associated with a minimum benefit-cost ratio of 1.2 in Exhibit 7-14.) Exhibit 8-7 identifies an average annual investment for the NHS MinBCR=1.2 scenario of $44.9 billion stated in constant 2006 dollars assuming financing from variable rate user charges, including a HERS-derived component of $33.8 billion. (This HERS component is linked to an annual spending growth rate of 3.30 percent in Exhibit 7-15, which is the rate associated with a minimum benefit-cost ratio of 1.2 in Exhibit 7-14, assuming variable rate user financing.) The $7.7 billion NBIAS-derived component shown in both Exhibits 8-6 and 8-7 represents the average annual level of investment to eliminate the economic bridge investment backlog.

The average annual investment level over 20 years for the NHS MinBCR=1.0 scenario assuming financing from fixed rate user charges is $76.1 billion stated in constant 2006 dollars, including a HERS-derived component of $62.6 billion, as shown in Exhibit 8-6. (This HERS component is linked to an annual spending growth rate of 7.45 percent in Exhibit 7-15, which is the rate associated with a minimum benefit-cost ratio of 1.0 in Exhibit 7-14.) Exhibit 8-7 identifies an average annual investment for the NHS Maximum Economic Investment (MinBCR=1.0) scenario of $50.1 billion stated in constant 2006 dollars assuming the widespread adoption of variable user charges such as congestion pricing, including a HERS-derived component of $38.6 billion. (This HERS component is linked to an annual spending growth rate of 4.45 percent in Exhibit 7-15, which is the rate associated with a minimum benefit-cost ratio of 1.0 in Exhibit 7-14, assuming variable rate user financing.) The $7.7 billion NBIAS-derived component shown in both Exhibits 8-6 and 8-7 represents the average annual level of investment to eliminate the economic bridge investment backlog.

Investment Scenario Estimates by Improvement Type

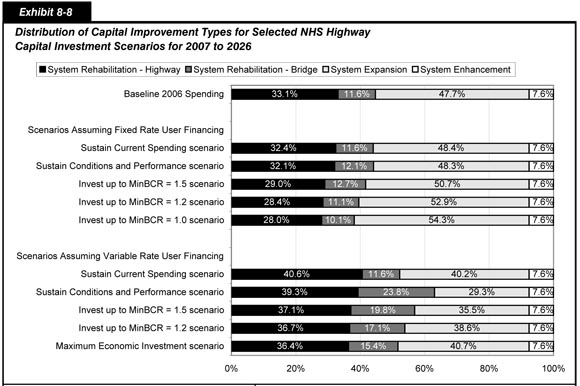

Exhibit 8-8 compares the distribution of highway and bridge capital outlay among the 20-year NHS capital investment scenarios defined in Exhibits 8-6 and 8-7. The amounts identified as the bridge portion of the System Rehabilitation category correspond to the NBIAS-modeled portion of each scenario, while System Enhancement spending corresponds to the non-modeled portion of each scenario as estimated in Exhibits 8-6 and 8-7. The HERS-modeled portion of each scenario is split between the System Expansion category and the highway portion of the System Rehabilitation category.

| Scenario Name and Description | Average Annual Investment (Billions of 2006 Dollars) | |||||

|---|---|---|---|---|---|---|

| System Rehabilitation Highway 1 |

System Rehabilitation Bridge 2 |

System Rehabilitation Total |

System Expansion 3 | System Enhancement | Total | |

| Baseline 2006 Spending | $12.3 | $4.3 | $16.6 | $17.7 | $2.8 | $37.1 |

| Scenarios Assuming Fixed Rate User Financing | ||||||

| Sustain Current Spending scenario | $12.0 | $4.3 | $16.3 | $17.9 | $2.8 | $37.1 |

| Sustain Conditions and Performance scenario | $12.4 | $4.7 | $17.1 | $18.7 | $2.9 | $38.7 |

| Invest up to MinBCR=1.5 scenario | $17.6 | $7.7 | $25.3 | $30.8 | $4.6 | $60.7 |

| Invest up to MinBCR=1.2 scenario | $19.7 | $7.7 | $27.4 | $36.6 | $5.2 | $69.2 |

| Invest up to MinBCR=1.0 scenario | $21.3 | $7.7 | $29.0 | $41.3 | $5.8 | $76.1 |

| Scenarios Assuming Variable Rate User Financing | ||||||

| Sustain Current Spending scenario | $15.1 | $4.3 | $19.4 | $14.9 | $2.8 | $37.1 |

| Sustain Conditions and Performance scenario | $7.7 | $4.7 | $12.4 | $5.8 | $1.5 | $19.6 |

| Invest up to MinBCR=1.5 scenario | $14.4 | $7.7 | $22.1 | $13.8 | $2.9 | $38.9 |

| Invest up to MinBCR=1.2 scenario | $16.5 | $7.7 | $24.2 | $17.3 | $3.4 | $44.9 |

| Maximum Economic Investment scenario (MinBCR=1.0) | $18.2 | $7.7 | $25.9 | $20.4 | $3.8 | $50.1 |

For the versions of the scenarios assuming fixed rate user financing, the percentage of capital investment devoted to system expansion rises as the average annual investment level rises. While 47.7 percent of combined public and private capital investment on the NHS was devoted to System Expansion in 2006, the NHS Sustain Current Spending scenario suggests this percentage should be increased to 48.4 percent, were this level of investment to be sustained over 20 years in constant dollar terms. This suggests that the current performance of the NHS is better in terms of physical conditions than in terms of operational performance. If investment were to rise to the NHS Sustain Conditions and Performance scenario level, the analysis suggests that 48.3 percent of NHS capital investment be directed to System Expansion; the NHS MinBCR=1.0 scenario would direct 54.3 percent of capital investment towards System Expansion. These findings suggest that there are a substantial opportunities for potentially cost-beneficial investments in NHS System Expansion if sufficient funding were available to implement them, but that many of these investments have relatively low benefit-cost ratios, due to the large construction costs associated with these types of investments.

For the versions of the scenarios assuming variable rate user financing, the share of capital investment devoted to System Expansion would rise as the average annual investment level rises, but would remain well below the baseline 2006 value of 47.7 percent. As discussed in Chapter 7, variable congestion pricing would tend to reduce VMT growth in the peak period, thus reducing the need to take widening actions to accommodate the growth. If investment were to decline in constant dollar terms to the NHS Sustain Conditions and Performance scenario level, the analysis suggests that 29.3 percent of NHS capital investment be directed to System Expansion; this share would rise to 40.7 percent for the NHS Maximum Economic Investment scenario. These findings suggest that the widespread adoption of congestion pricing strategies would reduce the relative attractiveness of System Expansion relative to System Rehabilitation, though there would still be opportunities for potentially cost-beneficial investments of all kinds.

Investment Scenario Impacts

Exhibit 8-9 summarizes the potential impacts of the 20-year NHS capital investment scenarios defined in Exhibits 8-6 and 8-7, on selected measures of system conditions and performance. The NHS Sustain Conditions and Performance scenario would by definition be associated with a 0.0 percent change in adjusted average user costs and the bridge investment backlog, as the scenario is designed to represent a level of investment that could allow the 2026 values for these indicators to match their base year 2006 values. For the version of this scenario that assumes fixed rate user financing, average delay per VMT is projected to increase by 5.1 percent, while average pavement roughness (as measured by IRI as defined in Chapter 3) would decline by 1.2 percent. This suggests a tradeoff between improved physical conditions and a worsening of operational performance. The opposite is true for the version of this scenario assuming variable rate user financing, under which average delay per VMT is projected to decrease by 11.4 percent while average IRI increases by 17.7 percent. This suggests that the operational performance improvements associated with the widespread adoption of congestion pricing would be sufficient to allow a significant reduction in NHS capital spending while still having the same net impact on the costs experienced by highway users.

| Scenario Name and Description | Average Annual Investment (Billions of 2006 Dollars) | Percent Change in: Adjusted Average User Costs 1 |

Percent Change in: Average Delay Per VMT 2 |

Percent Change in: Average IRI 3 |

Percent Change in: Bridge Investment Backlog 4 |

|---|---|---|---|---|---|

| Scenarios Assuming Fixed Rate User Financing | |||||

| Sustain Current Spending scenario | $37.1 | 0.3% | 6.7% | 1.1% | 12.8% |

| Sustain Conditions and Performance scenario | $38.7 | 0.0% | 5.1% | -1.2% | 0.0% |

| Invest up to MinBCR=1.5 scenario | $60.7 | -3.6% | -16.8% | -23.4% | -100.0% |

| Invest up to MinBCR=1.2 scenario | $69.2 | -4.7% | -24.3% | -29.0% | -100.0% |

| Invest up to MinBCR=1.0 scenario | $76.1 | -5.4% | -29.8% | -33.2% | -100.0% |

| Scenarios Assuming Variable Rate User Financing | |||||

| Sustain Current Spending scenario | $37.1 | -4.0% | -27.9% | -18.3% | 12.8% |

| Sustain Conditions and Performance scenario | $19.6 | 0.0% | -11.4% | 17.7% | 0.0% |

| Invest up to MinBCR=1.5 scenario | $38.9 | -3.8% | -26.4% | -16.2% | -100.0% |

| Invest up to MinBCR=1.2 scenario | $44.9 | -4.6% | -30.9% | -23.1% | -100.0% |

| Maximum Economic Investment scenario (MinBCR=1.0) | $50.1 | -5.2% | -34.0% | -27.8% | -100.0% |

Relative to the scenario focusing on sustaining current conditions and performance, those scenarios with higher average annual levels of investment would be expected to result in overall improvements to the system, as measured by their impacts on adjusted average user costs and other performance indicators. The potential for reductions to average delay per VMT is relatively large, as strategic investments in NHS System Expansion, coupled with the continued deployment of ITS on a growing share of the NHS, has the potential to significantly improve operating performance, particularly when applied in conjunction with congestion pricing.

It should be noted that while the variable rate user financing version of the Sustain Conditions and Performance scenario is projected to result in higher average IRI than the fixed rate version of the scenario, this is largely attributable to its much lower level of investment. As the Sustain Current Spending scenario demonstrates, given a fixed budget level, variable rate user financing would tend to result in lower average IRI than would fixed rate user financing.

Comparison of Scenario Investment Levels With Base Year Spending

Exhibit 8-10 compares the combined public and private capital investment levels associated with each of the selected NHS scenarios with actual NHS capital spending in 2006. By definition, the NHS Sustain Current Spending scenario matches base year spending in constant dollar terms.

| Scenario Name and Description | Average Annual Investment (Billions of 2006 Dollars) | Difference Relative to 2006 Spending on the NHS (Billions of 2006 Dollars) |

Difference Relative to 2006 Spending on the NHS Percent |

Annual Percent Increase to Support Scenario Investment 1 | Annual Revenues Generated From Variable Rate User Charges 2 |

|---|---|---|---|---|---|

| Scenarios Assuming Fixed Rate User Financing | |||||

| Sustain Current Spending scenario | $37.1 | $0.0 | 0.0% | 0.00% | $0.0 |

| Sustain Conditions and Performance scenario | $38.7 | $1.6 | 4.4% | 0.41% | $0.0 |

| Invest up to MinBCR=1.5 scenario | $60.7 | $23.6 | 63.7% | 4.49% | $0.0 |

| Invest up to MinBCR=1.2 scenario | $69.2 | $32.1 | 86.5% | 5.62% | $0.0 |

| Invest up to MinBCR=1.0 scenario | $76.1 | $39.0 | 105.1% | 6.43% | $0.0 |

| Scenarios Assuming Variable Rate User Financing | |||||

| Sustain Current Spending scenario | $37.1 | $0.0 | 0.0% | 0.00% | $33.9 |

| Sustain Conditions and Performance scenario | $19.6 | -$17.4 | -47.0% | -6.54% | $42.9 |

| Invest up to MinBCR=1.5 scenario | $38.9 | $1.8 | 4.9% | 0.46% | $34.7 |

| Invest up to MinBCR=1.2 scenario | $44.9 | $7.9 | 21.2% | 1.8% | $32.0 |

| Maximum Economic Investment scenario (MinBCR=1.0) | $50.1 | $13.1 | 35.3% | 2.79% | $30.0 |

Among the versions of the scenarios assuming fixed rate user financing, the difference in average annual investment levels relative to the 2006 baseline ranges from 4.4 percent for the NHS Sustain Conditions and Performance scenario up to 105.1 percent for the NHS MinBCR=1.0 scenario. Exhibit 8-10 also identifies the annual increase in combined public and private capital investment that would be sufficient to produce the average annual investment levels identified for each scenario. A constant dollar spending growth rate of 0.41 percent would be sufficient to support the NHS Sustain Conditions and Performance scenario; the equivalent growth rate associated with the NHS MinBCR=1.5 scenario would be 4.49 percent.

Among the versions of the scenarios assuming fixed rate user financing, the average annual investment level for the NHS Sustain Conditions and Performance scenario is 47.0 percent lower than actual NHS capital spending in 2006; Exhibit 8-10 indicates that highway capital spending could decline by 6.54 percent annually in constant dollar terms and still generate sufficient funding to support this scenario. The average annual investment level for the NHS Maximum Economic Investment scenario exceeds base year 2006 NHS capital spending by 35.3 percent. Achieving this average annual investment level could be accomplished by increasing combined public and private NHS capital spending by 2.79 percent per year.

Exhibit 8-10 also identifies the estimated annual revenues that might be generated from the NHS assuming the widespread adoption of congestion pricing. These revenues are a subset of the projected revenue from variable rate user charges identified in Chapter 7 for the highway system as a whole [see Exhibit 7-4]. Based on the assumptions underlying the analyses presented in these scenarios, the additional revenues generated from congestion charges on the NHS would be more than adequate to support an increase in NHS spending up to the NHS Maximum Economic Investment scenario if these revenues were used for this purpose.

Systemwide Scenarios

Exhibits 8-11 and 8-12 describe the derivation of the investment levels for each of five systemwide capital investment scenarios assuming fixed rate user financing and variable rate user financing, respectively. For each of these scenarios, the HERS and NBIAS components can be linked back to one of the 24 alternative funding levels analyzed in Chapter 7. The HERS-derived scenario components link back to selected investment levels identified in Exhibit 7-5, along with the minimum benefit-cost ratio cutoff points identified in Exhibit 7-14. The NBIAS-derived scenario components tie back to selected investment levels identified in Exhibit 7-21. Each scenario covers the 20-year period from 2007 to 2026, and the investment levels shown are all stated in constant 2006 dollars.