U.S. Department of Transportation

Federal Highway Administration

1200 New Jersey Avenue, SE

Washington, DC 20590

202-366-4000

Office of Highway Policy Information

Federal Highway Administration

May 2023

According to the Spring 2023 Economic Outlook from S&P Global [1], U.S. economic activity, as measured by real GDP, is expected to grow at an average annual rate close to 1.8% between 2019 and 2049. Over the same period, real disposable income per capita is projected to grow at the same rate (1.8% per annum).

Population and employment annual growth are expected to average 0.4% and 0.3%, respectively through 2049.

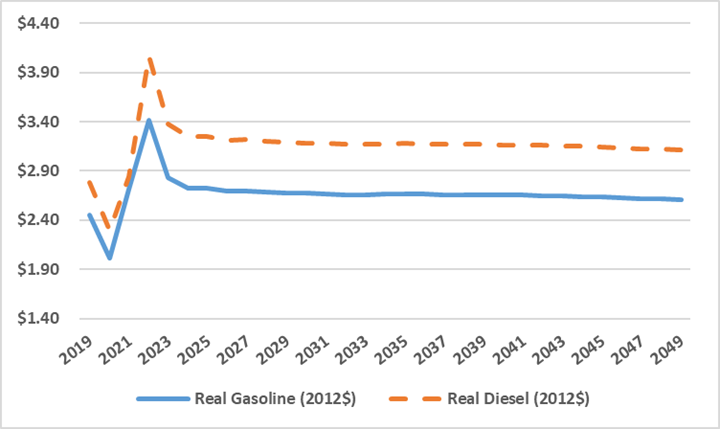

In the near term, real (inflation-adjusted) gasoline and diesel prices are expected to increase in the near term due to upward pressure on oil prices, before declining and by 2026 reaching a long-run constant value through 2049.[2] Over the 30-year forecast horizon, gasoline prices are expected to average about $2.66 per gallon (in constant 2012 dollars), with average diesel prices being slightly higher at $3.16 per gallon.

Total VMT by all vehicle types is projected to grow at an average rate of 0.7% annually through 2039 (Table 1). Over the entire 30-year forecast period (2019 through 2049), the average annual growth rate is projected to be 0.6%, as VMT growth is anticipated to slow gradually during the latter half of the forecast period. This outlook represents a move towards more moderate growth rates and convergence with population growth compared to the higher growth experienced between 1989 and 2019, when total VMT grew at an average rate of 2.0% annually.

Under the baseline outlook, travel by light-duty vehicles—the largest category of total motor vehicle travel—is forecast to grow at an average annual rate of 0.6% between 2019 and 2039 (Table 1). Light-duty vehicle VMT is expected to continue to increase between 2039 and 2049, although at a more moderate rate during the final decade, reducing its annual average over the entire 30-year forecast period to 0.5%.

Combination truck VMT is projected to grow at an average annual rate of 1.4% and 1.2% during the 20- and 30-year forecast horizons, respectively. Growth in travel by single-unit trucks is projected to average 1.8% over the entire 30-year forecast period.

Under the alternative forecasts of U.S. economic growth reflected in the S&P Global pessimistic and optimistic economic outlooks, the 20-year forecast of annual growth in total VMT ranges from 0.5% to 0.9%, while the 30-year forecast of annual growth ranges from a low of 0.4% to a high of 0.9% per year (Table 1).

*See the following sections for detailed descriptions of the baseline and alternative economic outlooks.

The Federal Highway Administration’s Spring 2023 long-term forecasts of nationwide VMT are based on long-term economic and demographic outlooks produced by the economic forecasting firm S&P Global Market Intelligence. [3] FHWA’s national VMT forecasts are produced using statistical models that incorporate a variety of factors affecting historical variation and growth in motor vehicle use; these models are then used to develop forecasts that begin in 2022 for single-unit and combination trucks and 2023 for light-duty vehicles and extended through 2049. [4],[5] The following sections highlight the S&P Global baseline forecasts of key economic and demographic factors influencing future growth in passenger and freight travel, and discuss their effect on the resulting VMT forecasts. Following this is a brief discussion of the alternative forecasts of U.S. economic performance provided by S&P Global and their potential implications for future VMT growth.

Table 2 summarizes the S&P Global Spring 2023 long-term baseline forecast of the key measures of U.S. economic activity used to develop FHWA’s VMT forecasts. The U.S. population is projected to grow by 0.4% annually over the 30-year forecast period, a rate well below its 1.0% annual increase over the previous 30 years. Aggregate economic output, measured by real GDP (2012$) is anticipated to increase 1.8% annually through 2049, which is also lower than the yearly growth rate the U.S. economy has experienced in recent decades.

Demographic and Economic Indicators |

Historical Growth Rate[6] |

Forecast Growth Rate: 2019-2049 |

|---|---|---|

U.S. Population[7] |

1.0% |

0.4% |

Total GDP (Real 2012$) |

2.6% |

1.8% |

Disposable Personal Income per Capita (Real 2012$) |

1.8% |

1.8% |

Imports and Exports of Goods (Real 2012$) |

5.4% |

2.3% |

Consumption of Other Non-Durable Goods[8] (Real 2012$) |

3.2% |

2.6% |

Gasoline Price per Gallon (Real 2012$) |

0.7% |

0.2% |

The S&P Global baseline forecast projects that growth in disposable personal income per capita will average 1.8% annually over the 30-year forecast period, which is in line with historical averages.[9] Growth in the import and exports of goods and consumption of other non-durable goods sectors continue to outpace overall economic growth, however, forecasted growth is expected to moderate compared to previous macroeconomic forecasts used for forecasting VMT.[10] Gasoline prices (pictured in Figure 1 below) are expected to peak in 2022, before sharply declining as the oil price shock caused by recent geopolitical conflicts dissipate, reaching an average of $2.66 per gallon (2012$) by the mid-2030s while continuing to decline marginally by 2049.

Figure 1. Price per Gallon of Diesel and Gasoline (2019-2049, 2012$)

Under the S&P Global baseline economic outlook, steady long-term growth in employment, business investment, and productivity are expected, leading to continuing increases in real economic output (Gross Domestic Product) and real disposable income. In addition, after increasing in the near-term, energy prices are projected to gradually decline. These trends combine with slow population growth to generate sustained increases in both passenger vehicle and truck travel, although at significantly slower rates than those experienced in previous decades.

The historic drop in light-duty vehicle travel, caused by the COVID-19 pandemic and nationwide lockdowns during the spring and summer of 2020, totaled 355 billion vehicle miles. This was a reduction of over 12% in light-duty VMT from 2019 and four times greater than the previous largest drop in VMT travel experienced during the Great Recession of 2008. The significant drop in VMT makes using 2020 as the historical base year for estimating the VMT forecasting model impractical. Therefore, to avoid biased results, and maintain compatibility with previous versions of the long-run VMT forecast, 2019 was set as the base year.

As shown in Table 3, Light-duty VMT growth is projected to average 0.6% per year from 2019–2039. Over the following decade, growth is expected to continue to moderate in light-duty vehicle travel, so that throughout the entire 30-year forecast period it is projected to average about 0.5% per year.

Truck travel in the U.S was not nearly as affected by the pandemic as light-duty VMT, with truck VMT decreasing slightly from 2019 levels by -0.8% and increased by 9.1% in 2021.[11] Similar to the light-duty forecast, the truck travel forecasts are also pegged to the 2019 base year and are reported in Table 3, which shows that growth in truck travel will continue at a rate higher than light-duty vehicle travel.

A more moderate economic outlook lowers projected growth for truck VMT relative to previous VMT forecasts. Single-unit truck VMT growth is projected to average 1.8% per year for the 20- and 30-year forecast periods. This reflects ongoing economic activity in construction, distribution and delivery of consumer goods, and other areas of the economy that depend heavily on local trucking. VMT by combination trucks is also expected to increase, reflecting the outlook for sustained growth in shipping-intensive sectors of the economy: U.S. goods manufacturing and international trade. Combination truck VMT is projected to increase by 1.2% annually over the entire 30-year forecast period (and by 1.4% between 2019 and 2039).

Finally, Table 3 reports that aggregate VMT by all vehicle classes is projected to grow at an average annual rate of 0.7% over the 20 years from 2019–39. Reflecting the projected slowing of travel demand during the last decade of the forecast period, growth in total VMT is expected to average 0.6% annually for the entire 30-year forecast period.

Over the past two decades, sudden and unexpected changes in vehicle use, such as those observed during the 2008–09 recession, have highlighted the uncertainty surrounding forecasts of future growth in motor vehicle travel. Important sources of such uncertainty include concerns about prospects for future economic growth, alternative interpretations of the causes of recent declines in vehicle ownership and use (particularly among younger Americans), and the potential effects on vehicle use of dramatic innovations in technology such as the advent of autonomous vehicles. To acknowledge this uncertainty, FHWA provides a range of alternative forecasts for future VMT growth that reflect uncertainty about the outlook for future economic growth, travel behavior, and vehicle technology.[12]

To develop these alternative forecasts, FHWA used projections of population growth, U.S. economic output and its composition, growth in personal income, and energy prices from the optimistic and pessimistic scenarios reported as part of the S&P Global Spring 2023 30-year economic outlook.

FHWA’s alternative forecast of higher total VMT growth relies on the S&P Global optimistic economic outlook, which projects stronger growth in productivity, labor force participation, employment, and business investment levels than under the baseline outlook. These factors—combined with a more robust housing sector and lower energy prices—produce stronger growth in real GDP, goods production, and disposable income than in the baseline outlook. In turn, under the optimistic economic outlook, these developments generate significantly faster growth in freight shipments and truck VMT.

Under this more optimistic economic growth scenario, with higher personal disposable income growth, passenger vehicle VMT is predicted to outpace the baseline outlook over both the 20- and 30-year forecast periods.

In contrast, FHWA’s alternative forecast of lower growth in vehicle use reflects the pessimistic economic outlook from Spring 2023 forecast. This alternative outlook predicts weaker growth in productivity, labor force participation, and business investment, together with higher interest rates and more rapid price inflation. These factors, combined with less robust activity in the housing sector and higher energy prices, dampen projected future growth in real GDP and personal income relative to the baseline economic outlook. Under this scenario, slower economic growth leads to lower demand for personal travel, so that passenger vehicle use increases primarily as a result of U.S. population growth. At the same time, slower growth in goods manufacturing, freight shipments, and construction activity dampen growth in truck use compared with the levels projected in the baseline forecast.

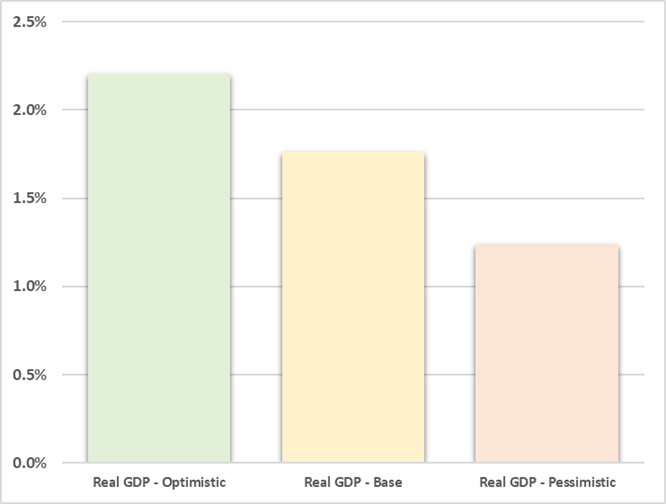

To illustrate the important differences in future economic trends affecting vehicle use among the alternative economic outlooks, the figures below compare forecast growth in real GDP (Figure 2), personal disposable income (Figure 3), and gasoline prices (Figure 4) in the pessimistic and optimistic scenarios to the baseline outlook. As shown in Figure 2 , real GDP is anticipated to grow about 2.2% per year over the 30-year forecast period under the optimistic outlook, compared to 1.8% annual growth projected for the baseline scenario, and is projected to average only about 1.2% annually in the pessimistic scenario.

Figure 2. Projected Growth in GDP under Alternative Economic Outlooks

(Average Annual Growth Rate, 2019-2049)

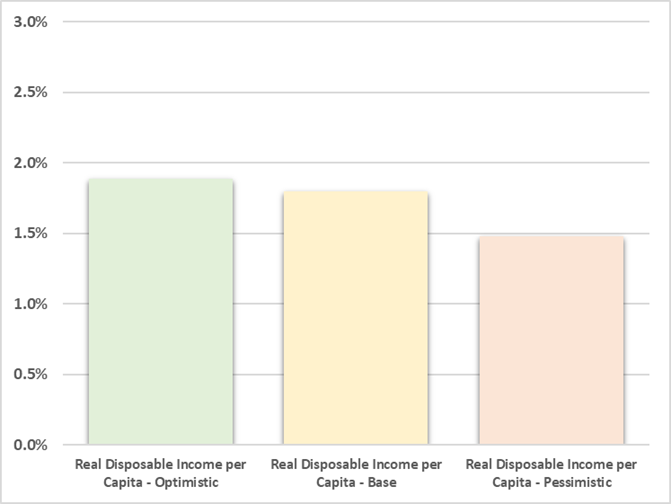

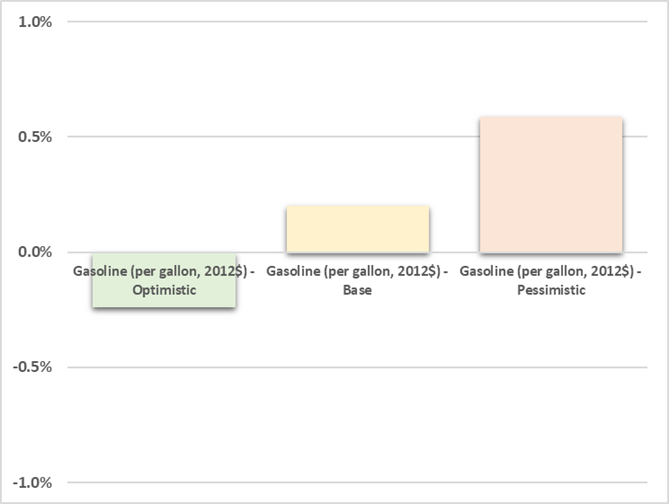

Figure 3 shows that growth in real personal disposable income per capita is forecasted to average 1.9% annually in the optimistic 30-year outlook, with the baseline outlook averaging 1.8% per year. In contrast, growth in real personal disposable income under the pessimistic outlook is expected to be slower, averaging 1.5% annually. Figure 4 illustrates that inflation-adjusted retail gasoline prices are expected to decrease by about 0.2% annually under the optimistic outlook and increase by 0.2% and 0.6% annually under the baseline and pessimistic outlooks.

Figure 3. Projected Growth in Real Personal Disposable Income per Capita under Alternative Economic Outlooks

(Average Annual Growth Rate, 2019-2049)

Figure 4. Projected Growth in Real Gasoline Prices per Gallon under Alternative Economic Outlooks

(Average Annual Growth Rate, 2019-2049)

Table 4 reports alternative forecasts of future growth in VMT under the optimistic and pessimistic economic outlooks; the range between them reflects the effect of uncertainty of future economic growth. These alternative outlooks have a pronounced effect on the forecast of future growth in light-duty vehicle use through 2049, with the difference ranging from 0.8% in the optimistic scenario to 0.3% under the pessimistic scenario.

In contrast, the difference between the forecasts of 20- and 30-year growth in truck travel between the optimistic and pessimistic economic outlooks is much larger, as they reflect fundamentally differing outlooks for consumption, investment, trade and manufacturing. Because light-duty vehicles account for the largest share of total VMT, however, the long-term 30-year forecast of total VMT varies only within a comparatively narrow range between the optimistic and pessimistic economic outlooks.

Volpe, The National Transportation Systems Center, U.S. Department of Transportation has performed the modeling underlying these forecasts and provided technical assistance to the Federal Highway Administration.

[1] S&P Global Market Intelligence (formerly IHS Markit)

[2] Long-run nominal oil prices grow at a near constant rate relative to with inflation (as measured by the personal consumption expenditures index) at 2.0% versus 2.2% over the 30-year period and reach $103 a barrel (in nominal terms) by 2049.

[3] https://www.spglobal.com/marketintelligence/en/

[4] For more information on the VMT models, please refer to the technical document at: http://www.fhwa.dot.gov/policyinformation/tables/vmt/vmt_model_dev.cfm

[5] Historical VMT data for 2021 are sourced from FHWA’s table VM1, while light-duty VMT for 2022 was imputed based on FHWA Traffic Volume Trends. https://www.fhwa.dot.gov/policyinformation/travel_monitoring/tvt.cfm

[6] Historical data: 1989 through 2019

[7] The IHS population forecast is based on the Census Bureau’s long-term population projections.

[8] The indicator for other non-durable goods refers to commodities such as pharmaceutical and other medical products, recreational items, household supplies, and magazines and newspapers.

[9] The specification of the VMT forecasting model attempts to reflect the dual effects of income growth on household travel using light-duty vehicles. On one hand, rising income increases the demand to participate in economic, social, and recreational activities outside the home, which gives rise to increased demand for travel. Meanwhile, rising incomes increase the effective cost of time spent driving, and thus dampen travel demand.

[10] Forecasts for consumption of other non-durables and goods imports and exports have been revised downwards (reduction in compound annual growth of 1%) in the Spring 2023 S&P Global forecast compared to previous forecasts.

[11] Motorcycles and buses, which are excluded from the forecasts reported in Table 3, together accounted for only about 1% of all U.S. motor vehicle travel during 2019.

[12] Uncertainty about future VMT growth arising from the potential for fundamental changes in travel behavior or vehicle technology is likely to be resolved only with the passage of time, the availability of more detailed information about personal travel, and experience with real-world deployment of advanced vehicle technologies. Thus, FHWA’s forecasts of future VMT growth do not attempt to incorporate these sources of uncertainty.