« Back to Innovative Finance Quarterly Issues List

On June 28, 2002, the U.S. Department of Transportation (U.S. DOT) and the City of Reno, Nevada executed the first of three Transportation Infrastructure Finance and Innovation Act (TIFIA) loan agreements for the Reno Transportation Rail Access Corridor (ReTRAC). When complete in 2006, the $283 million project will feature a below-grade, 2.25-mile rail corridor through downtown Reno with two mainline tracks, an access road, and an Amtrak station stop. Bridges over the corridor will replace 10 at-grade rail crossings. Rail service will remain uninterrupted during construction via a temporary "shoofly" track built as part of the project.

The $50.5 million loan closed in conjunction with the City's issuance of $114.2 million in senior project bonds. Revenues from a county sales tax and a downtown hotel tax secure both the senior bonds and the TIFIA loan. This represents the first public issuance of senior securities with subordinated TIFIA debt as well as the first time TIFIA has participated with a major bond insurer. Up to $23 million of additional TIFIA credit assistance will be provided via two loans to be negotiated in the coming months.

On July 25, 2002, the U.S. DOT and the Texas Transportation Commission (TTC) executed a $917 million loan to support the $3.6 billion "first phase" of the Central Texas Turnpike Project. The Turnpike is composed of three distinct elements: Loop 1, a 3.5-mile north-south route in the Austin vicinity; State Highway (SH) 45 North, a 13.2-mile highway connecting Austin, Round Rock, and Pflugerville; and the northern segment of SH 130, a 49-mile eastern bypass of Austin's congested Interstate 35.

The Texas Turnpike Authority Division of the Texas Department of Transportation (TxDOT) is managing the project. Loop 1 and SH 45 will be constructed using the traditional design-bid-build process, while SH 130 is under an exclusive development agreement with Lone Star Infrastructure. The Turnpike will be completed in segments, with the final segment open to traffic in December 2007.

In conjunction with the TIFIA loan, the TTC issued $1.2 billion in revenue bonds and $900 million in Bond Anticipation Notes (BANs). Turnpike toll revenues will secure both the senior bonds and the subordinate TIFIA debt. The remainder of the project will be financed through TxDOT grants and contributions of right-of-way by the surrounding jurisdictions.

TTC expects to use about $17 million of the TIFIA loan proceeds to fund project construction costs, with the balance allocated to retiring the BANs if cost effective.

Contact: Mark Sullivan, TIFIA JPO, 202/366-5785.

Contact: Mark Sullivan, TIFIA JPO, 202/366-5785.

Over the FY 1999-2003 period, the Transportation Equity Act for the 21st Century (TEA-21) authorized TIFIA credit support of $10.6 billion to directly assist major surface transportation projects. To date, the TIFIA program has committed $3.5 billion of credit assistance to 10 projects representing $15 billion in transportation infrastructure investment, at a budgetary cost to the Federal Government of only $183 million. Up to $2.6 billion in credit assistance will be available in FY 2003. Under its "rolling" application process, the TIFIA program will accept letters of interest from potential applicants at any time.

Contact: Max Inman, FHWA, 202/366-2853.

Contact: Max Inman, FHWA, 202/366-2853.

On Friday, June 7, 2002, the U.S. DOT delivered a Report to Congress regarding the TIFIA Credit Program. The report fulfills the Congressional requirement to summarize, within four years of the June 9, 1998 enactment of TEA-21, the financial performance of projects assisted by TIFIA and to discuss alternatives for achieving the program objectives in the future. The 42-page report reviews the policy objectives of TIFIA and implementation of the program by the U.S. DOT. It analyzes the TIFIA project portfolio in terms of modal, geographic, and financial diversity. The report reviews current TIFIA project commitments in light of the program's stated objectives and additional benefits identified by project sponsors. The report also includes a discussion of credit issues encountered during loan negotiations. Finally, as directed by Congress, the report reviews alternatives for the TIFIA program administration: continuing the program under the U.S. DOT, establishing a government corporation or government-sponsored enterprise, or phasing out the program and relying on the capital markets.

The Report to Congress is available on the TIFIA web site at https://www.transportation.gov/buildamerica/programs-services/tifia.

The speeches have been given, the ribbons have been cut, and the crowds have gone home. Another project is up and running. Now what?

With a typical maturity of 35 years, a TIFIA loan creates a long-term relationship between lender and borrower. Well after agreements are executed, funds disbursed, and projects constructed, ongoing fiduciary responsibilities remain. Through the loan servicing function, the TIFIA credit program not only collects and records loan repayments but also generates management, budget, and accounting information. The U.S. DOT selected the firm of Riggs & Co. to develop and maintain a comprehensive system for TIFIA credit accounting, collections, and financial reporting.

Earlier this year, Riggs completed the first phase of a loan servicing system featuring extensive capabilities and flexibility to meet TIFIA-specific requirements, government-wide financial guidance, and changing management information needs.

Specifically, the TIFIA loan servicing system will:

The TIFIA program is planning a second phase of the system that would allow borrowers and other stakeholders to access the loan data through a secure Internet web site.

Contact: Stephanie Kaufman, TIFIA JPO, 202/366-9649.

Contact: Stephanie Kaufman, TIFIA JPO, 202/366-9649.

[Top of Article, In This Issue...]

The "TIFIA Trivia" box provides responses to questions posed by our readers and other observers. We hope you find this "TIFIA Trivia" section useful and that you will submit questions to Mark Sullivan, TIFIA JPO, 202/366-5785.

Question

The TIFIA statute requires that a project's senior debt be investment grade. What are issues to be aware of?

Answer

The U.S. DOT and the project sponsor must carefully examine and resolve intercreditor issues during negotiation of agreements. If the applicant already has an existing bond indenture, the U.S. DOT must determine whether TIFIA requirements can be met by folding the TIFIA instrument into the existing structure.

[Top of Article, In This Issue...]

State Infrastructure Banks (SIBs) continue to be an important tool in the transportation finance toolbox. As shown in the table to the right, 32 states have entered into 297 SIB loan agreements with a dollar value of over $4.0 billion as of June 30, 2002. This represents growth in the value of loan agreements of 40 percent over the past nine months.

The ability of states to maximize the potential of their SIBs to help finance transportation investment needs can be enhanced through leveraging, which refers to the issuance of bonds against a SIB's capitalization. This issue of IFQ highlights the experience of South Carolina and Minnesota in leveraging their SIBs to provide loan support to needed state transportation projects.

| State | Number of Agreements | Loan Agreement Amount ($000) | Disbursements to Date ($000) |

|---|---|---|---|

| Alaska | 1 | $2,737 | $2,737 |

| Arizona | 40 | 430,266 | 236,662 |

| Arkansas | 1 | 31 | 31 |

| Colorado | 2 | 400 | 400 |

| Delaware | 1 | 6,000 | 6,000 |

| Florida | 32 | 465,000 | 98,600 |

| Indiana | 1 | 3,000 | 1,122 |

| Iowa | 2 | 2,874 | 2,874 |

| Maine | 23 | 1,758 | 1,478 |

| Michigan | 23 | 17,034 | 13,033 |

| Minnesota | 15 | 95,719 | 41,000 |

| Missouri | 11 | 73,251 | 67,801 |

| Nebraska | 1 | 3,360 | 3,360 |

| New Mexico | 1 | 541 | 541 |

| New York | 2 | 12,000 | 12,000 |

| North Carolina | 1 | 1,575 | 1,575 |

| North Dakota | 2 | 3,565 | 1,565 |

| Ohio | 39 | 141,231 | 116,422 |

| Oregon | 12 | 17,471 | 17,471 |

| Pennsylvania | 23 | 17,403 | 17,403 |

| Puerto Rico | 1 | 15,000 | 15,000 |

| Rhode Island | 1 | 1,311 | 1,311 |

| South Carolina | 6 | 2,382,000 | 1,124,000 |

| South Dakota | 1 | 11,740 | 11,740 |

| Tennessee | 1 | 1,875 | 1,875 |

| Texas | 37 | 252,013 | 225,461 |

| Utah | 1 | 2,888 | 2,888 |

| Vermont | 3 | 1,023 | 1,000 |

| Virginia | 1 | 18,000 | 18,000 |

| Washington | 1 | 700 | 385 |

| Wisconsin | 3 | 1,814 | 1,814 |

| Wyoming | 8 | 77,977 | 42,441 |

| Total | 297 | $4,061,517 | $2,087,990 |

With $4.0 billion in loan activity achieved by the nation's SIBs to date, major strides have been made by states in implementing the SIB program and increasing investment in transportation infrastructure. While the pace of SIB implementation has been affected by insufficient capitalization - TEA-21 placed limitations on Federal capitalization, and the economic downturn has affected the capacity of states to provide new infusions of capital to existing SIBs - states have the opportunity to enhance SIB funding through leveraging. Leveraging a revolving loan fund such as a SIB offers significant potential for expanding the pool of projects that can be financed. Of the 32 states participating in the SIB program today, two states - South Carolina and Minnesota - have issued bonds to leverage their SIBs. These states have taken different approaches in structuring their programs, demonstrating the flexibility states have in tailoring SIBs to meet state specific needs.

The South Carolina Transportation Infrastructure Bank (SCTIB) is authorized to issue bonds under the enabling legislation establishing the bank in 1997. The SCTIB is a good example of a large, leveraged SIB. Since its inception, the SCTIB has approved financing and begun development of over $3.0 billion in projects. SCTIB loans are financing most of the costs of these projects. The SCTIB has issued over $1.2 billion in revenue bonds to date to provide funds for approved projects. Another $600 million in a mixture of general obligation and revenue bonds is planned over the next two years to fund loan disbursements. The leveraged SCTIB is helping to compress 27 years of road and bridge projects into a seven-year acceleration program, known as "27 in 7."

Minnesota's SIB is a partnership between two state agencies with bonding accomplished through a conduit agency. The Minnesota Public Facilities Authority is responsible for bond issuance and the financial operations of the bank, while the Minnesota DOT evaluates the technical merits of project applications. Both highway and transit projects are eligible for assistance. Minnesota's SIB, designated as the Transportation Revolving Loan Fund (TRLF), has been capitalized with $35 million in Federal funds and $24 million in state funds. These funds have been leveraged through two bond issues, totaling $37.6 million. The first issue in 1999 in the amount of $17.1 million financed a loan to the Metropolitan Council for transit-related improvements. Then in 2001 a second issue for $20.5 million funded 11 project loans. Loan repayments are pledged for debt service.

As transportation agencies explore the potential of expanding SIBs through leveraging, they also can look to the experience of states in financing environmental infrastructure projects through State Revolving Funds (SRFs) the most widely used model of revolving loan funds operating at the state level. The SRF program, established in 1987, provides funding assistance to water pollution abatement projects through Federal matching grants to capitalize SRFs.

One of the unique features of the SRF program is the capacity of states to leverage their loan funds through the municipal bond market. States have used one of two basic structures to leverage Federal capitalization grants for wastewater and drinking water facilities: the Cash Flow Model or the Reserve Fund Model. State law and program goals have been determining factors in the choice of models. The diagrams to the right describe the two models. Under the cash flow model, loans are funded from bond proceeds and capitalization grants, while under the reserve fund model, Federal capitalization grants and state matching monies are not used to make loans directly.

Leveraging has made a significant impact on SRF activity. As of the June 2001, 23 states have leveraged their wastewater funds, generating almost double the loan dollar volume as the states, which have not leveraged funds. As shown in the table below, bonds have added $10.1 billion to SRF funding.

Revenue bond proceeds are blended with capitalization funds to make loans at subsidized rates and to provide debt service coverage. Debt service reserve is funded from bond proceeds.

Leveraging SIBs - The Reserve Fund Model

All Federal and state capitalization grants/monies fund debt service reserve that provides interest rate subsidy and serves as security for investors.

Recognizing that leveraging is a way to maximize the benefits of the SIB, Ohio is moving forward with implementation of a leveraged SIB. Ohio's SIB program was originally capitalized with $40 million in State General Revenue funds and $120 million in Federal highway funds. Expansion of Ohio's SIB program through bonds will provide additional capital for transportation projects, enabling the state to accelerate construction and obtain both the system and economic benefits sooner than otherwise would have been possible. Bond proceeds are expected to be lent to political subdivisions with loans averaging between $3 million and $10 million. The Ohio DOT will issue the bonds and pledge all current and future SIB loan repayments to secure the bonds issued.

States have the opportunity to learn from the experiences of South Carolina, Minnesota, and Ohio as they evaluate options to enhance SIB capitalization to meet loan demands. The SRF experience also provides useful insights for maximizing a SIB's potential through bonding. The Florida DOT currently is evaluating the leveraging of its SIB. In many states, the lack of legislative authorization has been the primary barrier to SIB bonding. Additional capitalization though an expansion of the SIB pilot program would provide an asset base to increase loan resources through leveraging to meet surface transportation infrastructure needs.

| Dollar Amount of SRF Loans |

Total Federal Capitalization Funds for SRF |

Ratio of SRF Loans to Federal Capitalization |

Dollar Amount Added to Loan Pool by Leveraging |

|

|---|---|---|---|---|

| 23 States Which Have Leveraged |

$22,765 | $10,200 | 223% | $10.1 Billion |

| 28 States Which Have Not Leveraged |

$11,507 | $ 8,073 | 143% | $10.1 Billion |

| Totals | $34,272 | $18,273 | 188% |

Source: EPA Office of Wastewater Management.

Contact: Phyllis Jones, FHWA, 202/366-2854.

Contact: Phyllis Jones, FHWA, 202/366-2854.

[Top of Article, In This Issue...]

Since January 2002, four new Grant Anticipation Revenue Vehicle (GARVEE) bond issues have been brought to market, including the first issue for Alabama (highlighted on the following page).

Also of note is Colorado's recent refunding GARVEE bond issue (designated as TRANS). In August, the Colorado Department of Transportation (CDOT) sold a $400 million refunding bond issue. The proceeds will be used to advance refund a portion of the 2000 and 2001 GARVEE series, reducing annual interest costs.

| State | Date of Issue | Face Amount of Issue | Ratings (Moody's/S&P/Fitch) | Projects Financed | Backstop |

|---|---|---|---|---|---|

| New Mexico | Sept-98 Feb-01 |

$100.2 Million $18.5 Million |

A3/A-/na A2/A/na |

New Mexico SR 44 | No backstop; |

| Ohio | May-98 Aug-99 Sep-01 Sep-02 |

$70 Million $20 Million $100 Million $135 Million |

Aa3/AA-/AA- Aa3/AA-/AA- Aa3/AA/AA- Aa3/AA/AA- |

Various projects including: Spring-Sandusky and Maumee river improvements | Moral Obligation pledge to use state gas tax funds and seek general fund appropriations in the event of Federal shortfall. |

| Arkansas | Mar-00 Jul-01 Jul-02 |

$175 Million $185 Million $215 Million |

Aa2/AA/na Aa2/AA/na Aa2/AA/na |

Interstate Highways | Full faith and credit of state, plus state motor fuel taxes. |

| Colorado | May-00 Apr-01 Jun-02 |

$537 Million $506.4 Million 208.3 Million |

Aa3/AA/AA Aa3/AA/AA Aa3/AA/AA |

Any project financed wholly or in part by Federal funds | Federal highway funds as allocated annually by CDOT; Other state funds. |

| Arizona | Jun-00 May-01 |

$39.4 Million $142.9 Million |

Aa3/AA-/AA- Aa3/AA-/AA- |

Maricopa freeway project | Certain sub-account transfers. |

| Alabama | Apr-02 | $200 Million | Aa3/A/na | County Bridge Program | All Federal construction reimbursements. Also insured. |

| TOTAL | $2,651.7 Million |

In June, Louisiana enacted legislation (SB 80) authorizing the state to issue GARVEEs. SB 80, signed into law by the Governor on June 25, 2002, allows the State Bond Commission to issue revenue bonds secured by a pledge of Federal transportation funds, state matching funds, and other revenues. The aggregate amount of principal and interest on all bonds issued is limited to 10 percent of annual Federal highway funding. The bonds will be used to finance the accelerated construction of certain state transportation projects.

Contact: Jennifer Mayer, FHWA Western Resource Center, 415/744-2634.

Contact: Jennifer Mayer, FHWA Western Resource Center, 415/744-2634.

In April 2000, the Governor of Alabama proposed selling bonds to raise money to replace some 1,600 county bridges that were weight-restricted and could not be used for school bus traffic. The situation created extensive and costly detours around the weight-restricted bridges. The Governor's plan involved borrowing against future Federal bridge rehabilitation funds in order to accelerate bridge replacement projects across the state.

A month later, the Alabama Legislature approved the bond sale contingent on a constitutional amendment for selling $50 million of general obligation bonds to raise money for the local matching share. This constitutional amendment required approval by the state's voters. In November 2000, voters approved the constitutional amendment and the bridge rehabilitation program began.

The $250 million program ($50 million of general obligation bonds for the non-Federal share plus $200 million of GARVEE bonds for the Federal share) will replace approximately 1,300 county bridges in all 67 counties statewide. The state's general obligation bonds were sold in November 2001, and the GARVEEs were sold in April 2002 on a competitive basis. The GARVEE issue was rated A by Standard & Poor's, and achieved a total interest cost of just over 4.65 percent. The first three GARVEE funded projects were approved for advance construction in December 2000, and currently there are about $68 million of advance construction projects underway. Further details about the issue are presented in the table below.

Contact: Lamar McDavid, Alabama DOT, 334/242-6360.

Contact: Lamar McDavid, Alabama DOT, 334/242-6360.

[Top of Article, In This Issue...]

Each issue of IFQ features questions and answers on the GARVEE program. This issue addresses the treatment of GARVEE debt service in state plans. Note that answers to these questions are not regulatory or legislative, but represent Federal Highway Administration's (FHWA) current administrative interpretations. If you have questions or want to confirm any of this information, please contact your local FHWA Division office. GARVEE guidance is also available at:

https://www.fhwa.dot.gov/ipd/finance/resources/federal_debt/garvee_guidance_2014.aspx.

How Should GARVEE Debt Service Appear on the STIP ?

To comply with the intent of the fiscally constrained planning process, the Federal share of the debt-related costs (e.g., interest and principal payments, associated issuance costs, and ongoing debt servicing expenses) anticipated to be reimbursed with Federal-aid funds over the life of the bonds should be designated as advance construction (AC). The planned amount of Federal-aid reimbursement for debt service (AC conversion) should be included in the State Transportation Improvement Program (STIP) in accordance with FHWA procedures relating to STIP preparation.

How Should GARVEE Debt Service Appear on the Long-Range Plan ?

The full cost of planned GARVEE projects (including interest costs) should appear on the Long-Range Plan.

[Top of Article, In This Issue...]

Public/private partnerships are an increasingly popular method of financing transportation projects that benefit both the general public and the private sector. While there are various forms of public/private partnerships, the agreements generally provide for a segregation of financial and operational responsibility between the public and private sectors to facilitate the completion of a project. This segregation of responsibility leverages some of the risk associated with constructing, operating, and maintaining a facility from the public sector to the private sector. An example of a successful public/private partnership is the use of shadow tolling in the agreement between Florida's Turnpike Enterprise (the "Turnpike"), Broward County (the "County"), and the Arena Operating Co., Ltd. and the Arena Development Co., Ltd. (together as the "Operator/Developer").

In 1997, the County and the Operator/Developer requested that the Turnpike build an interchange on the Sawgrass Expressway, one of the toll facilities owned and operated by the Turnpike. The interchange would provide expressway access to a proposed multi-purpose sports and entertainment complex situated adjacent to the Sawgrass Expressway. Use of the expressway would alleviate the expected high volumes of traffic on local roads during arena events. In addition, the interchange would allow for controlled access entering and exiting the arena. Based on the request, the Turnpike assessed the economic viability of the interchange to determine that a specific transportation need would be met and would be supported by the local community. In addition, the project had to meet state environmental impact restrictions. Finally, the projected costs of the construction, maintenance, and operation of the interchange had to be compared to the expected revenues to evaluate the costs and benefits of the interchange. Based on the results of the analysis, the Turnpike concluded that despite the need, local support, and environmental feasibility of the project, the costs of constructing, operating, and maintaining the interchange significantly exceeded the expected revenues.

Since the projected cash flows did not support the Turnpike constructing the interchange on a standalone basis, the Turnpike, the County, and the Operator/Developer entered into an agreement in which the Turnpike provided the $10 million capital outlay for the construction of the interchange. The terms of the agreement require the Operator/Developer to remit annual payments to the Turnpike for the imputed debt service (calculated by amortizing $10 million over 30 years at 5.91 percent interest) and the operating and maintenance costs ($47,700 in the initial year with a three percent annual increase), net of gross toll revenue collected from traffic entering the arena during events and from traffic exiting the arena during non-event periods. Since tolls are suspended for a specified period of time at the completion of an arena event, the Turnpike requires the Operator/Developer to pay a shadow toll equal to the lost revenue. Shadow tolls are tolls paid to the facility operator by someone other than the facility user.

The shadow tolls at the Broward Arena are assessed to the Operator/Developer based on a manual count of vehicles exiting the arena factored by the toll rate that would normally be collected at the toll plaza. The use of shadow tolls has a number of advantages. One of the main advantages is the transfer of traffic risk from the Turnpike to the Operator/Developer. Since the collection of tolls at the conclusion of an event would unnecessarily congest the traffic exiting the arena, it poses a safety risk normally borne by the Turnpike as operator of the toll facility. The use of shadow tolls, however, alleviates the traffic risk to the Turnpike, without the negative financial impact of a toll suspension. Another advantage of the shadow toll is the perceived benefit to the facility users. Patrons of the arena perceive the toll suspension as a benefit to attending the arena events. As such, the patron's perception also benefits the Operator/Developer in the form of increased attendance at arena events. Due in part to the ease with which patrons can access the arena, attendance at events is positively impacted.

Total traffic volume on the interchange has nearly doubled since the first full year of operation, and for the year ended June 30, 2002 was approximately 570,000. Despite the increased use of the interchange, toll revenue has not been sufficient to fund the required annual payment of the Operator/Developer. As such, the Turnpike bills the Operator/Developer for the annual shortfall amount based on the agreement provisions. The success of the public/private partnership between the Turnpike, Broward County, and the Operator/Developer underscores the fact that public projects that benefit private interests can be successfully developed and financed in order to mitigate risks associated with a project as well as to pool needed resources.

As cash flow limitations continue to require the public sector to seek innovative ways to finance needed transportation projects, opportunities for strategic alliances in the form of public/private partnerships will increase. For transportation projects, these alliances may utilize shadow tolling in order to leverage the risks of financial and operational responsibility between public and private sectors.

Contact: William F. Thorp, Florida's Turnpike Enterprise, 407/532-3999, ext. 3141.

Contact: William F. Thorp, Florida's Turnpike Enterprise, 407/532-3999, ext. 3141.

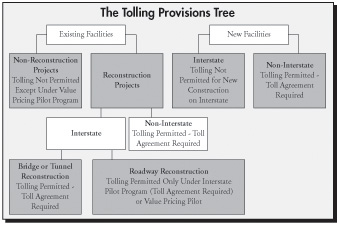

The Federal-aid highway program, when created in 1916, did not allow the use of Federal-aid funds on toll facilities. This position remained unchanged until 1927 when Congress enacted legislation that permitted Federal-aid highway funding to be used to construct toll bridges and approaches. Subsequent legislation provided more flexibility on using Federal-aid highway funds for improvements to toll facilities with the last significant changes being made in 1991 with passage of the Intermodal Surface Transportation Efficiency Act.

Currently, toll activities eligible for Federal-aid highway funding include:

If Federal-aid funds are used for construction of, or improvements to, a toll facility or the approach to a toll facility, or if a state plans to reconstruct and convert a free highway, bridge, or tunnel previously constructed with Federal-aid highway funds to a toll facility, a toll agreement is required (see Title 23, United States Code, Section 129(a)(3)). The toll agreement is executed between FHWA, the state DOT, and the toll authority.

The toll agreement must require that all toll revenues are first used for any of the following: debt service; reasonable return on private investment; and operation and maintenance, including reconstructing, resurfacing, restoring, and rehabilitating work.

The agreement also may include a provision regarding toll revenues in excess of those needed for the required uses outlined above. This provision would allow these excess revenues to be used for highway and transit purposes authorized under Title 23 if the state certifies annually that the toll facility is being adequately maintained.

The issue of whether a toll facility is to become free when debt is retired or at some other future point in time or whether tolls are to be continued indefinitely is a matter to be determined by the state.

Decisions regarding the amount of tolls charged are made by the toll authority subject to requirements under state and local laws and regulations. These decisions require no review or input from FHWA.

Section 1216(b) of TEA-21 established a new pilot program to allow conversion of a free Interstate highway to a toll facility in conjunction with needed reconstruction or rehabilitation of the Interstate highway that only is possible with the collection of tolls. The FHWA Headquarters issued a December 24, 1998 memorandum to its division offices soliciting candidate projects from the states for this pilot. No candidates were submitted. The FHWA Headquarters subsequently issued an April 6, 1999 memorandum to its division offices advising them that the pilot program remained available to the states as an open-ended solicitation and candidates would be accepted on a first-come basis.

FHWA published a report in February 1999 entitled Toll Facilities in the United States (Publication No. FHWA-PL-99-011) which contains selected information on United States toll facilities.

This report can be viewed online at https://www.fhwa.dot.gov/policyinformation/.

The International Bridge, Tunnel and Turnpike Association (IBTTA) maintains an address directory of its membership and serves as an information clearinghouse and research center. It also conducts surveys and studies and publishes a variety of reports, statistics, and analyses. Their web site is located at https://www.ibtta.org.

The American Automobile Association (AAA) compiles a directory of toll facilities containing such current information as rates, load limits, frequency of service, etc. Their web site is located at http://www.aaa.com.

Contact: Jack Wasley, FHWA, Office of Program Administration, 202/366-4658.

Contact: Jack Wasley, FHWA, Office of Program Administration, 202/366-4658.

[Top of Article, In This Issue...]

FHWA has published an innovative finance handbook, or "primer," and companion brochure that highlight new approaches for bridging the funding gap between transportation investment needs and financial resources. The primer and brochure describe techniques advanced by FHWA in partnership with the states, including innovative management of Federal funds, GARVEEs, and credit assistance, such as SIBs and the TIFIA Federal credit program. Several case studies illustrating how states have used these techniques to close project financing gaps are highlighted in the primer. A list of resources including publications, web sites, and expert technical assistance that can help states and other project sponsors make use of these techniques also is provided.

The primer and brochure are available at the FHWA innovative finance web site:

https://www.fhwa.dot.gov/innovativefinance/ifp/

https://www.fhwa.dot.gov/innovativefinance/brochure/

Contact: Max Inman, FHWA, 202/366-0673.

Contact: Max Inman, FHWA, 202/366-0673.

A FHWA workshop on project finance will be held in conjunction with the American Road & Transportation Builders Association's (ARTBA) 14th Annual Conference on Public-Private Ventures. The workshop and conference will be held at the Four Points Sheraton in Washington, D.C., November 20-21, 2002 and will include sessions on best practices and lessons learned, TIFIA, and future expansion of the innovative finance toolbox. The FHWA workshop will launch the two-day program and is scheduled from 9:00 a.m. to noon on November 20.

More information is available on the 2002 Public-Private Ventures Conference web site at:

http://www.artba.org/meetings_events/2002/ppv/2002_public_private_ventures.htm/

Contact: Michael Martin, ARTBA, 202/289-4434.

Contact: Michael Martin, ARTBA, 202/289-4434.

As part of the Transportation Research Board's (TRB) 82nd Annual Meeting in Washington, D.C. from January 12-16, 2003, the TRB Committee on Taxation and Finance and FHWA will co-sponsor a Transportation Finance Workshop on Sunday, January 12. The workshop, which will be held from 1:30 p.m. to 5:00 p.m. at the Hilton Washington Hotel and Towers, Jefferson East Room, will focus on new developments in innovative finance and the best practice application of innovative tools and techniques, including an outlook for the future.

More information is available on the TRB 82nd Annual Meeting web site at:

http://www4.trb.org/trb/annual.nsf

Contact: Mary Kissi, TRB, 202/334-3177.

Contact: Mary Kissi, TRB, 202/334-3177.

The Southern Resource Center is pleased to announce that Jim Hatter (fondly known as the Mad Hatter for his creativity and resourcefulness) has joined the SRC Finance Team as an Innovative Finance Specialist. The SRC spirited Jim away from a private sector firm in sunny California. He is enjoying North Georgia's refreshing climate, low real estate prices, and less harried commutes.

Jim has 27 years of municipal finance experience, including 10 years in the public sector. As an investment banker, Jim has financed hundreds of infrastructure projects with a wide variety of tax-exempt and taxable instruments, including general obligation bonds, industrial development revenue bonds, enterprise revenue bonds, pool revenue bonds, special tax bonds, grant and loan anticipation notes, and tax and revenue anticipation notes. While serving in the public sector, he used loan guarantees, bonds, leases, loan anticipation notes, and grant anticipation notes to advance Federal and California state programs supporting municipal infrastructure.

He is a graduate of California State University, Fresno with both Bachelor's and Master's degrees. Over the next several months, Jim is planning to meet with Division and state personnel throughout the south, southwest, and east. He is planning this "grand tour" to obtain a better understanding of customer needs and issues, thereby assisting the SRC Finance Team in its continuing efforts to meet (and exceed!) customer expectations.

Please join us in welcoming Jim to the FHWA Finance Team. Jim can be reached at 404/562-3929.

The American Association of State Highway and Transportation Officials (AASHTO) in conjunction with the University of Southern California (USC) and with support from the U.S. DOT have established a Project Finance Institute. The Institute is offering Professional Development Workshops on project finance, exploring policy issues and cutting edge practices relating the development and financing of major transportation projects and programs.

The two-and-one-half-day inaugural workshop was held in Los Angeles, California, at USC's School of Policy, Planning & Development, May 13-15, 2002. With the additional sponsorship of TRB, a second workshop will be held at TRB's building at 500 5th Street, N.W., Washington, D.C. from December 9-11, 2002. The December workshop will teach participants how to:

The workshop is designed for public and private sector transportation professionals and draws upon distinguished USC faculty and leading industry practitioners to ensure academic excellence and professional relevance. The workshop format involves a combination of lecture and case study, with an emphasis on classroom discussion, drawing upon participants' professional experiences.

To facilitate interaction, the workshop is limited to 30 participants. The tuition, including all materials, is $1,595. More information can be found at the AASHTO web site: http://www.transportation.org/

Contact: Tammy Sindall, AASHTO, 202/624-3531.

Contact: Tammy Sindall, AASHTO, 202/624-3531.

[Top of Article, In This Issue...]

Roger Berg, Cambridge Systematics, Inc.

Duane Callender, TIFIA JPO

Phyllis Jones, FHWA

Stephanie Kaufman, TIFIA JPO

Jennifer Mayer, FHWA, Western Resource Center

Suzanne H. Sale, FHWA, TIFIA JPO

Mark Sullivan, TIFIA JPO

William F. Thorp, Florida's Turnpike Enterprise

Frederick Werner, FHWA, Southern Resource Center

Suzanne H. Sale, FHWA

Co-Managing, Editor

602/379-4014

FAX: 602/379-3608

Suzanne.Sale@fhwa.dot.gov

Max Inman, FHWA

Co-Managing Editor

202/366-0673

FAX: 202/366-7493

Laurie L. Hussey, CS Managing Editor

Cambridge

Systematics, Inc.

617/354-0167

FAX: 617/354-1542

llh@camsys.com

Reproduction (in whole or in part) and broad distribution of IFQ is strongly encouraged. Permission from FHWA, the editor, or any other party is not necessary.

FHWA DOES NOT MAINTAIN A MAILING LIST AND DOES NOT DISTRIBUTE IFQ DIRECTLY. IFQ IS AVAILABLE AS AN INSERT TO THE AASHTO JOURNAL, AND IS AVAILABLE ELECTRONICALLY THROUGH FHWA's WWW HOME PAGE:

www.fhwa.dot.gov/innovativefinance/

IFQ IS ALSO PROVIDED TO THE FOLLOWING ORGANIZATIONS FOR REDISTRIBUTION AND/OR AS INFORMATION FOR THEIR MEMBERSHIP: