July 2019

Notice

This document is disseminated under the sponsorship of the U.S. Department of Transportation in the interest of information exchange. The U.S. Government assumes no liability for the use of the information contained in this document.

The U.S. Government does not endorse products or manufacturers. Trademarks or manufacturers' names appear in this report only because they are considered essential to the objective of the document.

Quality Assurance Statement

The Build America Bureau and the Federal Highway Administration (FHWA) provide high-quality information to serve Government, industry, and the public in a manner that promotes public understanding. Standards and policies are used to ensure and maximize the quality, objectivity, utility, and integrity of information. The Bureau and FHWA periodically review quality issues and adjust their programs and processes to ensure continuous quality improvement.

| Technical Report Documentation Page | ||||

| 1. Report No. FHWA-HIN-19-003 |

2. Government Accession No. | 3. Recipient's Catalog No. | ||

| 4. Title and Subtitle Guide to 3-VALUE 2.2: Frequently Asked Questions (FAQs) |

5. Report Date July 2019 |

|||

| 6. Performing Organization Code V327 |

||||

| 7. Author(s) Wim Verdouw, IMG/Rebel Marcel Ham, IMG/Rebel |

8. Performing Organization Report No. DOT-VNTSC-FHWA-19-07 |

|||

| 9. Performing Organization

Name And Address Volpe National Transportation Systems Center U.S. Department of Transportation 55 Broadway, Cambridge, MA 02142 |

10. Work Unit No. (TRAIS) | |||

| 11. Contract or Grant No. HW5NA2 |

||||

| 12. Sponsoring Agency Name

and Address Federal Highway Administration Office of Innovative Program Delivery 1200 New Jersey Avenue, SE Washington, DC 20590 |

13. Type of Report and Period Covered | |||

| 14. Sponsoring Agency Code HIN |

||||

| 15. Supplementary Notes Contracting Officer's Technical Representative: Patrick DeCorla-Souza, FHWA Office of Innovative Program Delivery |

||||

| 16. Abstract This document provides answers to frequently asked questions about the 3-VALUE 2.2 analytical tool. The 3-VALUE 2.2 analytical tool can help users understand the processes and considerations that go into a rigorous quantitative analysis of public-private partnership procurement options for transportation projects. |

||||

| 17. Key Words Public-private partnerships, highways, project delivery, project finance, tolling, real toll concessions, availability payment concessions, long-term lease concessions, SEP-15, GARVEE, TIFIA, Private Activity Bond. |

18. Distribution Statement No restrictions |

|||

| 19. Security Classif. (of this report) Unclassified |

20. Security Classif. (of this page) Unclassified |

21. No. of Pages 17 |

22. Price N/A |

|

| Form DOT F 1700.7 (8-72) Reproduction of completed page authorized | ||||

In the VfM analysis, the PSC is compared to the P3 in order to determine the fiscal impact on the Agency of P3 procurement. A key requirement for a VfM analysis to be valid is that the PSC and the P3 are implemented in a similar timeframe. For the PDBCA, there is no such requirement. Under PDBCA, a delayed project can be compared to an accelerated project without any conceptual challenges. The time delay in implementing the project would be estimated based on the budgetary limits and/or debt capacity of the Agency, and when sufficient funds might be available to begin and complete implementation of the project. The Delayed PSC has the exact same characteristics as the PSC, with only one exception: the start date of the project. If, for example, due to fiscal constraints an Agency can only afford to start building a project in 2025 instead of 2018, both the incurred costs as well as the benefits accruing to society will be delayed. Asset quality and value at handback therefore may be different as well. Depending on the exact profile of costs and benefits over time, accelerating a project may result in lower or higher net benefits to society.

The field "private procurement costs (costs of winning bid)" should include an estimate of the costs incurred by the winning bidder in preparing a bid and negotiating an agreement. If losing bidders receive any form of compensation, the cost is borne by the public agency and included in the field of "public procurement costs".

The field "private procurement costs (cost of non-compensated bids)" should include the procurement costs incurred by losing bidders that are not compensated by the public procuring agency. The "private procurement costs (cost of non-compensated bids)" are used in the PDBCA but not in the VfM analysis. Please note that under the simplified inputs option, "private procurement costs (cost of non-compensated bids)" are ignored.

The extent to which various costs are transferred to a P3 concessionaire depends on the presumed structure of the contract, project requirements, and risk sharing and allocation. For example, the public agency can be responsible for preliminary design, right-of-way, and project oversight, but shift all engineering and construction responsibilities to the P3 concessionaire. The percentage transferred cost reflects the cost allocation between the public agency and P3 concessionaire. Users should evaluate the aggregate amount of transferred and retained costs in order to calculate the percentage transferred cost.

P3 projects may result in cost efficiencies by bundling different stages of project delivery under one contract and creating incentives to better manage the project's life cycle costs. However, there are no definitive studies regarding the cost efficiency of P3s in the United States. In studies where public agencies have compared P3 and conventional delivery options they have typically assumed cost efficiencies ranging from 0 to 15 percent. As the tool does not separately account for the cost impact of time efficiency in project delivery, P3 cost inputs should also include the impacts on cost reduction caused by reduced project delivery time.

A comprehensive VfM analysis or PDBCA should not only consider what happens to the facility under different delivery models during the operations period but also what may happen thereafter. Therefore, the analysis period should at least cover the proposed concession period but should also take into consideration the residual value of the facility at handback. If appropriate handback provisions are included in the P3 agreement, the remaining useful life of the facility under conventional procurement may be assumed to be the same as under a P3 delivery at the end of the concession period.

3-VALUE 2.2 can accommodate a variation in residual value of the facility under various delivery models. In order to take this variation into consideration, the user must determine the cost associated with bringing the facility back to the specified standards for each delivery model. By including these costs in the VfM analysis and PDBCA, the user can make a fair comparison of the different delivery models while allowing for variations in residual value of the facility. Please note that under the simplified inputs option, handback costs are ignored.

In 3-VALUE 2.2 major maintenance costs are differentiated from operations and maintenance costs in that major maintenance costs are costs that occur on a periodic basis of multiple years (e.g., every 10 years) whereas operations and maintenance costs are assumed to occur on an annual basis. Major maintenance covers preservation activities that typically increase strength and extend facility service life in addition to restoring serviceability. For example, structural overlay and rehabilitation can be performed every 10-12 years. Routine maintenance is performed primarily to ensure or restore the function of the existing system.

Preconstruction and construction costs can be expressed in either in Year of Expenditure (YOE) or base year dollars. The tool applies "Indexation rate - Construction" to adjust base year dollars to YOE dollars. If preconstruction and construction costs are in YOE dollars, the field "Indexation rate - Construction" should be set to zero. Otherwise, a positive indexation rate should be used to reflect cost inflation during the pre-construction or construction period.

The various indexation rates can be used to account for the inflation of costs or payments during different periods of project delivery. Generally, costs and payments are expressed in base year dollars, and indexation rates are used to estimate Year of Expenditure (YOE) costs and payments. The base year is defined in the field "Indexation base year". The indexation rate for the O&M component of an availability payment can be used to model changes in the annual availability payment over the period of the concession due to changes in operating and maintenance costs. For example, if O&M costs represent about 20% of the overall availability payment in the base year, the "allowable share of indexed O&M component in availability payment" should be set to 20% whereas the indexation rate should be set at the projected inflation rate for such those costs. Please note that under the simplified inputs option, only two indexation rates are used: one for construction, operations, tolls, and subsidy and the other for the O&M component in the availability payments.

Users are expected to provide No Build annual O&M costs (in thousands of dollars per year), which are used to calculate the O&M cost savings achieved by doing the project. The No Build annual O&M amount should include all operational costs that will not have to be incurred if the project is undertaken, including any contributions towards major maintenance.

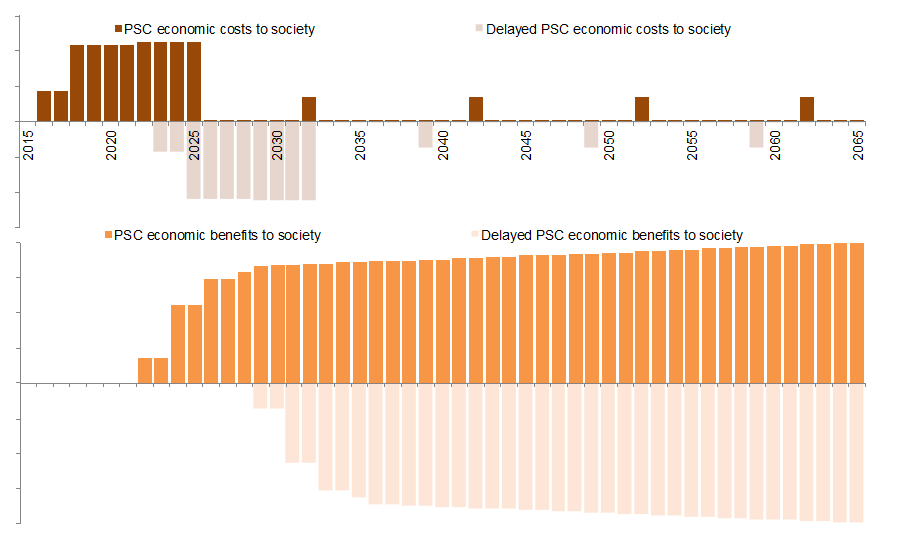

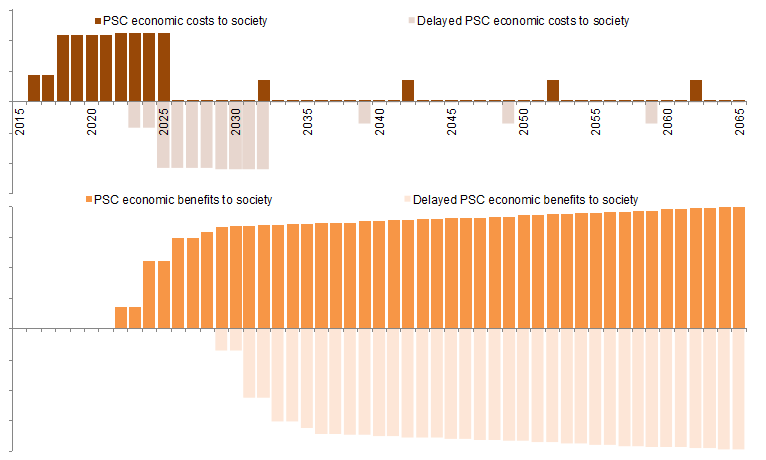

The Delayed PSC has the exact same characteristics as the PSC, with only one exception: the start date of the project. If, for example, due to fiscal constraints an Agency can only afford to start building a project in 2025 instead of 2018, both the incurred costs as well as the benefits accruing to society will be delayed as can be seen in the figure below.

Comparison of economic costs & benefits between Delayed PSC and PSC

Comparison of economic costs and benefits between PSC and Delayed PSC

This figure shows a histogram that compares annual economic costs and benefits under the PSC to annual economic costs and benefits under the delayed PSC. It demonstrates that the delayed PSC differs from the PSC only in the timing of costs and benefits.

The tool cannot easily model this scenario. The best approximation of this scenario may be a unidirectional three lanes alternative. The user needs to change the field "Number of directions in bidirectional traffic" to 1 in cell F87 in the "InpTiming&Cost" sheet. All other inputs must be calibrated carefully to reflect the traffic pattern in this scenario. It may be possible to conduct two separate analyses, one for each direction of travel, and combine the results.

Users are expected to provide a traffic sensitivity factor, which determines what share of the growth in P50 (or most likely) traffic will be considered in the PDBCA module. This factor is applied in order to capture the uncertainty in traffic projections. The factor is a percentage (less or more than 100%) of the P50 (or equivalent) traffic growth above the base year traffic and hence lowers or increases the traffic projections to be considered in the PDBCA sensitivity analysis. If, for example, daily traffic growth forecasted is 15,000 vehicles above base year traffic under P50 and the Agency believes that the traffic growth may possibly be about 20% above or below that forecast, the appropriate traffic sensitivity factors to be used would be 80% and 120%. In that case, the BCA module would be re-run with growth in traffic of 12,000 vehicles per day and 18,000 vehicles per day, in order to calculate the various societal costs and benefits and check whether the economic justification for the project and project delivery still holds. Note that the same factor is applied to both No Build and Build traffic growth forecasts. Furthermore, note that the traffic sensitivity factor is set to 100% under the simplified inputs option.

In short, no, the total number of unidirectional peak and off peak hours do not need to equal 24 hours. The model requires users to input only the number of hours with significant traffic in order to ensure that off-peak congested speed is representative of real world conditions. For example, the amount of traffic carried by a roadway between 12:00 AM and 6:00 AM may be insignificant and in that case would not need to be included.

The tool calculates speeds for each year in the analysis period for the various delivery models. These speeds are used to compute travel time costs, incident delays, O&M-related travel delays, construction-related travel delays, non-fuel costs, fuel costs, emissions costs, transit and carpooling travel time costs. Capacities for peak, off-peak, and weekends are calculated using inputs from InpTraffic&Toll. Then vehicle volume/capacity for peak, off-peak, and weekends are calculated using traffic volumes from the Traffic sheet and capacities calculated in the above step. Speeds for peak, off-peak, and weekends are then calculated using volume delay function (VDF) parameters, free flow speeds from the InpTraffic&Toll sheet, and the V/C ratios calculated above. Delays due to construction, O&M activities, and incidents are also calculated. The concept guide (Chapter 5 in Part II of the Guide to P3-VALUE) explains the procedures in detail.

The users of 3-VALUE 2.2 must provide traffic projections for both the No Build and Build alternatives. Typically, these projections will be generated using a travel demand model. The difference between the No Build and Build traffic projections is induced traffic. These induced traffic projections are then used in the model to calculate the costs and benefits to society of induced traffic.

First, the No Build scenario is only used for the benefit cost analysis and has not impact on the financial value for money analysis. 3-VALUE 2.2 has certain limitations with regard to the type of projects it can analyze for the BCA analysis. For example, there is only one lane type and associated traffic input for the No Build. If the No Build contains both high occupancy vehicle (HOV) lanes and general purpose lanes (GPL), the user would need to combine both types of traffic into a single input. While the combined traffic volumes can be directly input, the vehicle occupancy for the No Build would need to be adjusted to represent both sets of lanes. In addition, HOV lanes and the GPLs may in reality have different congested speeds. Since a single Volume Delay Function (VDF) would be applied to the combined traffic, the estimated congested speeds will not reflect actual conditions. The VDF will overestimate the speed of GPL traffic and underestimate the speed of HOV traffic. Therefore, use of 3-VALUE 2.2 for this type of project will not provide an accurate representation of congestion delays in the No Build scenario.

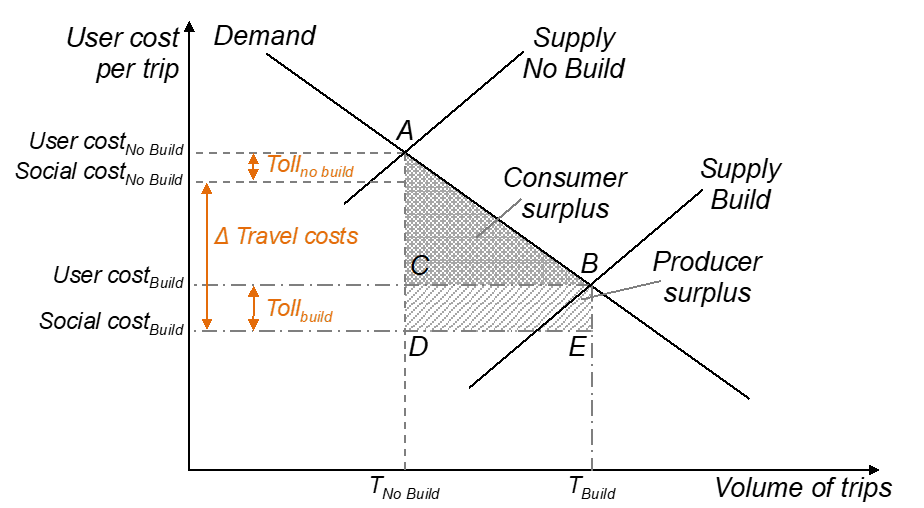

Second, tolls are considered to be a transfer payment and should not be included in calculating the benefits to existing users. For existing traffic, the introduction of tolls or change in toll levels between the No Build and Build alternatives does not modify the calculation of societal benefits. To determine the societal benefits of a facility expansion for existing traffic, the social costs of travel (i.e., excluding tolls which are transfers) for each existing user before and after the expansion are evaluated. The difference in travel costs multiplied by the number of existing users is the net benefit to society of the facility enhancement. For induced traffic, the rule of half can be used to calculate the societal costs and benefits if both the No Build and Build alternatives are not tolled. However, if the road is tolled in the Build or even in the No Build alternative, the rule of half alone can no longer be applied as the shape under the demand curve that represents the net benefits to society now has both a triangular consumer surplus and a rectangular producer surplus, as can be seen in the figure below. The producer surplus is equal to the toll level under the Build alternative multiplied with the induced traffic (CBDE in the figure below), and the consumer surplus calculation includes the consideration of tolls borne by users under both the Build and the No Build cases.

Effect of toll on consumer surplus and producer surplus

Effect of toll on consumer surplus and producer surplus

This figure shows an economic chart demonstrating the differences in consumer and producer surplus under the Build and No Build cases if the facility is tolled. The X axis is "volume of trips" and the Y axis is "user cost per trip." A straight downward sloping diagonal line shows the demand curve. Two upward sloping lines show supply curves. The higher curve is the "No Build" supply curve. The lower curve is the "Build" supply curve, which results in a lower user cost per trip and a higher volume of trips. Producer surpluses and consumer surpluses are labeled. They show that if the road is tolled in the Build case, the shape under the demand curve that represents the net benefits to society has a triangular consumer surplus and a rectangular producer surplus. The producer surplus is equal to the toll level under the Build alternative multiplied with the induced traffic. The triangular consumer surplus area is calculated considering tolls borne by users under both the Build and the No Build cases as well as the difference in travel costs and the increase in volume of trips

Project delivery benefit cost analysis evaluates P3 delivery from the societal perspective. All project capital costs, regardless of funding sources, will be included in the PDBCA analysis. A public agency may produce an agency specific PDBCA by reducing costs reimbursed by the federal government, especially in the case of discretionary grants. For example, if an agency receives federal discretionary grant funding to cover 20% of project capital costs, project costs can be reduced by 20% accordingly. However, assuming that the same amount of federal subsidy is available under both P3 and conventional delivery, the treatment of federal subsidies in the analysis should have no impact on the results of the comparison between delivery methods.

The user should enter the total combined amount of the milestone payments in the appropriate cell in the InpFin sheet. The model assumes that all milestone payments are paid in the last year of construction.

The model does not contain this functionality.

P3 projects typically have complex financing structures, potentially involving a large number of debt and equity instruments. The 3-VALUE 2.2 tool allows users to develop a variety of financing structures. On the P3 side, the financing/funding structure would typically include equity, debt and public Agency subsidy payments. On the PSC side, the financing/funding structure can include debt and public Agency funding.

For both the PSC and P3, debt service can be structured in two ways:

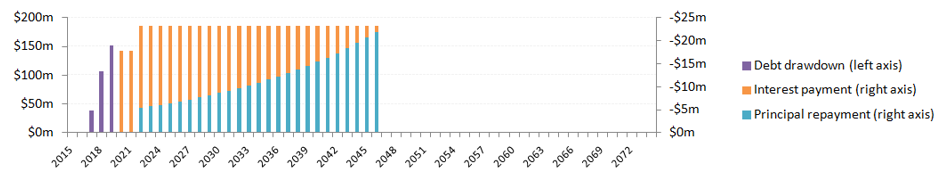

Under annuity-type debt service, no interest capitalization beyond construction is considered. Furthermore, the model enables users to provide a grace period (number of years after substantial completion) during which only interest is due. The remainder of the tenor will be used to repay the principal. The total debt size under annuity-type debt service is determined by the minimum Debt Service Coverage Ratio (DSCR, an input) and the minimum cash flows available for debt service (CFADS), which typically occur in the early years. An example of an annuity-type debt service is shown below.

Annuity-type debt service

Annuity-type debt service

This figure is a histogram showing annual debt service payments under "annuity-type debt service". The debt drawdown is shown in the first three years; the subsequent two years show interest payments only, the next thirty five years show a mix of interest payments and principle repayment. The interest payment gradually decreases while the principal payment gradually increases. Each year the sum of interest payments and principle payments (the total debt service payment) is equal.

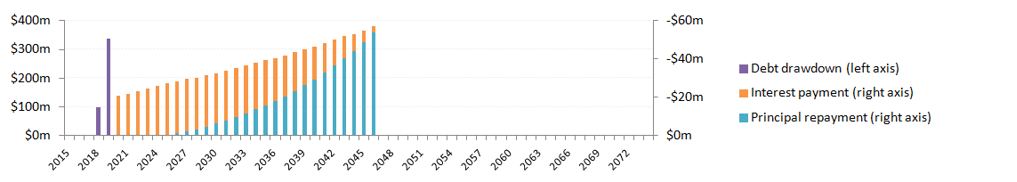

Under a fully sculpted debt service, the model uses the project's cash flows available for debt service (CFADS) in each year to create a perfectly sculpted repayment profile. This means that the DSCR will be constant throughout the debt service period. Under this approach, the total debt size is determined by the minimum DSCR and the CFADS over the entire debt service period. This may also lead to some interest capitalization during the early years of operation if CFADS in these early years is insufficient to make early interest payments. Although the CFADS under both debt service types are equal, a fully sculpted repayment makes more efficient use of these CFADS by "pushing back" debt service to future periods with higher revenues. As a result, the debt capacity of a fully sculpted debt solution will be larger than the debt capacity of an annuity-type debt solution.

Fully sculpted debt service

Fully sculpted debt service

This figure is a histogram showing annual debt service payments under a "fully-sculpted debt service" arrangement. Debt drawdown is shown in the first two years. The subsequent years show interest-only payments for the first five years with principal repayment beginning after that. The total of the interest payment and principal repayment (the total debt service payment) gradually increases each year.

In reality, P3 transactions will typically try to create a more or less sculpted debt profile using various debt instruments. The 3-VALUE 2.2 tool gives users the opportunity to analyze the impact of different financing structures.

The current model indeed includes a single debt tranche whereas infrastructure projects typically use a number of debt instruments. However, a single sculpted debt tranche using a blended interest rate can be a good proxy for the debt financing of large US transportation infrastructure projects, even if these projects use a number of different debt instruments in reality. The reason for this is that typically the different debt tranches are combined in such a way as to create a more or less sculpted debt service profile.

Many financing structures for P3s in the US include TIFIA loans and/or tax exempt debt. These financing sources include subsidies. The financing conditions therefore do not accurately reflect the project's risk profile. The relevant consequences from a state perspective are that:

If the analysis is done from the federal perspective, there are two potential approaches:

To keep things as simple as possible, approach 2 is preferred. 3-VALUE 2.2 allows for both approaches by allowing users to enter the value of any credit subsidy under both Conventional Delivery and P3 delivery.

To ensure a fair comparison between PSC and P3, the model enables users to apply a competitive neutrality adjustment for the following elements:

The competitive neutrality adjustment is included to ensure an apples-to-apples comparison between the PSC and P3. For example, if the P3 is more expensive due to taxation that will flow back to the government, the increased cost due to taxation should logically not negatively impact the evaluation. To offset this effect, the same tax liability can either be added to the PSC as a cost or alternatively subtracted from the P3 cost. Depending on their perspective and preference, users can decide to ignore the competitive neutrality adjustment, or to include a partial adjustment for, for example, only state tax.

If the Agency self-insures under PSC while requiring insurance from the P3 concessionaire in case of a P3, this can lead to a similar issue. 3-VALUE 2.2 allows the user to estimate the value of self-insurance (as a percentage of the construction/O&M costs) in order to adjust the VfM results accordingly. Furthermore, the model allows users to incorporate the difference in credit subsidies under the PSC and P3 into the competitive neutrality adjustment.

If the analyst plans to use the WACC option to estimate the value of risks transferred to the concessionaire, it will be important to use interest rates on PSC debt that do not incorporate a project risk premium. Therefore, it is recommended that GO bond interest rates be used for PSC debt.

Please note that under the simplified inputs option, the user does not have access to inputs related to pure risk and base variability. As such, all costs should be input risk- and uncertainty-adjusted costs where appropriate. FAQ 4.1-4.5 and 4.8-4.9 below are only relevant for users using the detailed inputs option.

4.1 My project budget includes a set-aside for contingencies. Should I include contingency costs as an input? How?All specified project costs should be included in the analysis, including contingency. Contingency costs are an output of the risk assessment process, and should typically be reflected as a risk input. Risk values are input as most likely cost with probability of occurrence. If the contingency value is already known, that value can be input as the "most likely" cost, with 100% probability of occurrence.

Pure risks are also known as event risk and refer to the individual risk events, such as an accident at the construction site. As a first input, the user must determine what probability level should be used for the pure risk analysis. The probability level is input as a percentage. Based on this percentage, the model determines the value of the pure risks at the given probability level.

Pure risks can be identified and their probabilities and consequences assessed through review of historical data on similar projects, discussions with appropriate subject matter experts, or through risk workshops with the project development team. The output of a risk workshop is typically a risk register, which may include a quantitative estimate of the potential financial cost or "risk premium" based on the consequence and likelihood of a risk being realized.

Triangular distribution is applied to risks where a three-point estimate of the impact is possible. Here, discrete values for the minimum, most likely, and maximum risk impacts are defined. Uniform distribution is used for two-point estimates. Any value between the low point estimate and the high point estimate will have an equally likely chance of occurring. It implies that the impact of the risk has an equal chance of being any value within the specified range.

To the extent that political risk can be treated the same way as other pure risks, users can add political risks to the risk register and include it in the analysis.

The risk module included in 3-VALUE 2.2 allows for a relatively basic risk analysis. The model does not include a Monte Carlo simulation and risks are assumed to be independent. For more advanced risk analysis, users should use specialized software packages.

Traffic and revenues are inherently difficult to predict. In their bids for toll concessions, bidders (and their financiers) take revenue uncertainty into consideration through the financing conditions. Public Agencies that take revenue risk (under a PSC or a P3 availability payment concession) also face the same revenue uncertainty. However, it may be difficult for Agencies to value these uncertainties. 3-VALUE 2.2 allows for three different approaches to capture revenue uncertainty. Under the first approach, the user can provide a percentage reduction (an input) to toll revenues flowing to the Agency to account for uncertainty. For example, if the user inputs 20%, this means that the revenues flowing to the public Agency will be reduced by 20%. The second approach uses market-based information to determine the value of revenue uncertainty and will be discussed in more detail below (see below). Under the third approach, the user can decide not to adjust the revenues flowing to the Agency for uncertainty.

Under the second approach, the model views the difference between an availability payment transaction WACC and the project risk-free discount rate as a reflection of the lifecycle performance risk. Furthermore, in a toll concession, the WACC reflects both lifecycle performance risk and revenue uncertainty. 3-VALUE 2.2 uses this logic to determine the magnitude by which revenues flowing to the Agency should be reduced to account for uncertainty. To do so, the model compares the NPV of all transferrable project costs and toll revenues under 1) a market-based WACC for a toll concession and 2) a project risk-free discount rate. The difference between the two NPVs is a measure of the combined value of the lifecycle performance risk and revenue uncertainty adjustment.

The difference between the NPV of lifecycle performance risk under an availability payment concession and the NPV of the lifecycle performance risk and revenue uncertainty under a toll concession is a measure for the revenue uncertainty adjustment. 3-VALUE 2.2 calculates the relative value of the revenue uncertainty adjustment compared to the overall revenues (in NPV terms) to determine the percentage-based reduction that should be applied to the revenues flowing to the Agency.

In the VfM analysis and the risk analysis, the model use a project risk free discount rate (with the exception of cash flows to the P3 concessionaire, which will be discounted by the Weighted Average Cost of Capital, or WACC) to calculate the NPV of costs and revenues to the Agency. The Agency's borrowing rate can potentially be used as a proxy for the project risk free discount rate.

In the PDBCA, the model uses the social real discount rate. However, determining the social real discount rate can be challenging. Theoretically, the social discount rate should represent the opportunity cost of what else the Agency or government could accomplish with those same funds. In practice, it may be difficult to determine what the right value is. As guidance, the user should use the state or Agency's social discount rate or follow the federal office of Management and Budget (OMB) Circular A-94.

The probability level (or P level) input can be selected by the user. It reflects the level of confidence required in the risk costs estimated, i.e., confidence that the actual cost will be at or below the estimated cost X% of the time. Based on the P level selected, the 3-VALUE 2.2 tool will calculate the cost of the risk - no further adjustment by the user is necessary.

In line with the FHWA Guidebook for Risk Assessment in Public-Private Partnerships, 3-VALUE 2.2 recognizes the following risk categories:

The exact magnitude of costs is typically uncertain because of lack of more precise information. In practice, these uncertainties are often covered in a base variability mark-up. This mark-up can be a function of the stage in design development. If the design development is more advanced, typically the mark-up can be reduced. Alternatively, non-systematic uncertainties can be analyzed using probabilistic analysis.

The 3-VALUE 2.2 tool requires the user to provide separate base variability mark ups for pre-construction costs, construction costs and O&M. These mark ups apply to costs only; risks are assumed to already incorporate base variability.

Lifecycle performance risk refers to the risks that cannot be transferred to subcontractors but are retained by the concessionaire. The value of these risks is already accounted for in the concessionaire's bid. However, on the PSC side, these risks are typically not considered. The PSC therefore needs to be adjusted for lifecycle performance risk to ensure a fair comparison between the PSC and P3. This adjustment is effectively an equalizer between the PSC and P3 to account for possible cost overruns, interface risk, systematic risks, etc. on the PSC side.

3-VALUE 2.2 offers three approaches to value lifecycle performance risk:

The tool includes default values for all BCA inputs, except for those directly related to the project. The user can start with the default values and then adjust the values to reflect the characteristics of the region, project, and context.

Construction and O&M activities cause delays and therefore affect social benefits. So do incidents. The user guide provides guidance on the selection decision on speed adjustment inputs.

The default values for the BCA assumptions reflect the latest transportation studies and FHWA or USDOT guidelines. The user guide provides detailed citations of the sources of those default values.

O&M costs savings are equal to the costs of maintaining the facility under the No Build scenario. The O&M costs line item reflects the costs of maintaining the facility under the Build scenarios. Build scenarios, i.e. PSC, delayed PSC, or P3 will eliminate the O&M cost under the No Build scenario. The net cost of the Build scenario is estimated by subtracting the costs that are "saved" (i.e., costs that will not be incurred to maintain the No Build scenario).

To calculate the subsidy required by the developer given the financial assumptions, the tool sets the discount rate equal to the project internal rate of return (i.e., WACC over the project life). By definition, when the cash flows are discounted by the project internal rate of return they equal zero.

The Model Optimizer calculates the optimal subsidy/concession fee (for a toll concession) or availability payment, subject to a given gearing (ratio of debt to overall long-term capital, including both debt and equity) using an iterative optimization approach for the P3. In this context, optimal means the lowest possible cost to the Agency while simultaneously satisfying the following two requirements:

The Model Optimizer iteratively adjusts the subsidy/concession fee or availability payment (depending on what P3 structure is selected) until both criteria are satisfied.

For Conventional Delivery, the Model Optimizer optimizes the minimum subsidy amount required using an iterative approach while ensuring that the public debt amount can be repaid and meets the minimum DSCR requirement. The optimized subsidy amount exactly meets the minimum DSCR requirement.

Although this may not be true in actual practice, the concession fee is assumed to be paid by the concessionaire to the public agency at the end of construction, as is the subsidy payment, if any. Because the VfM Output shows present values, these values are discounted, and therefore will be lower than the year-of-expenditure values shown in the Financial Output.

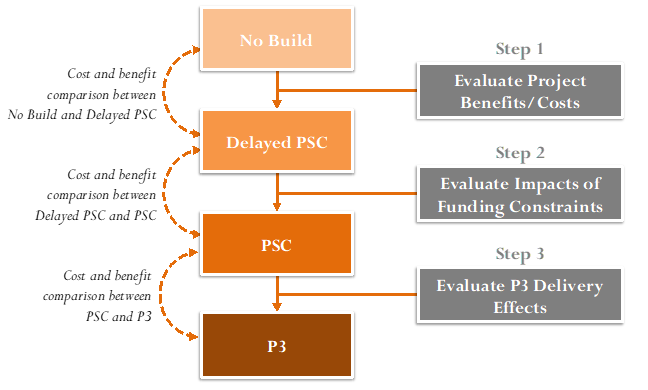

In the VfM analysis, the PSC is compared to the P3 in order to determine the fiscal impact on the Agency of P3 procurement. A key requirement for a VfM analysis to be valid is that the PSC and the P3 are implemented in a similar timeframe. For the PDBCA, there is no such requirement. Under PDBCA, a delayed project can be compared to an accelerated project without any conceptual challenges. This means that the PDBCA framework allows practitioners to evaluate the impact of funding constraints that could delay projects. As shown in the figure below, 3-VALUE 2.2 uses three steps to distinguish between the impacts of public funding constraints on the one hand, and impacts due to P3 cost and benefit efficiencies on the other.

PDBCA framework

PDBCA Framework

This figure shows the three steps P3-VALUE 2.2 uses to distinguish between the impacts of public funding constraints on the one hand, and impacts due to P3 cost and benefit efficiencies on the other. In Step 1, P3-VALUE evaluates and compares the project benefits and costs of the No-Build and Delayed PSC alternatives. In Step 2, P3-VALUE evaluates the impacts of funding constraints to compare the costs and benefits of the Delayed PSC and the PSC. In Step 3, P3-VALUE evaluates the effects of P3 Delivery and compares the costs and benefits of the PSC and the P3 Delivery alternative.

In order to evaluate the impacts of funding constraints (step 2 in the figure above), a third delivery model is therefore introduced: the Delayed Public Sector Comparator (Delayed PSC).

The Delayed PSC has the exact same characteristics as the PSC, with only one exception: the start date of the project. If, for example, due to fiscal constraints an Agency can only afford to start building a project in 2025 instead of 2018, both the incurred costs as well as the benefits accruing to society will be delayed as can be seen in the figure below.

Comparison of economic costs & benefits between Delayed PSC and PSC

Comparison of economic costs and benefits between PSC and Delayed PSC

This figure shows a histogram that compares annual economic costs and benefits under the PSC to annual economic costs and benefits under the delayed PSC. It demonstrates that the delayed PSC differs from the PSC only in the timing of costs and benefits.

Depending on the exact profile of costs and benefits, accelerating a project may result in lower or higher net benefits to society.

Base variability refers to the uncertainty in cost estimates. The exact magnitude of costs is typically uncertain because of lack of (more precise) information. In practice, these uncertainties are often covered in a base variability mark-up. This mark-up can be a function of the stage in design development. If the design development is more advanced, typically the mark-up can be reduced. Alternatively, non-systematic uncertainties can be analyzed using probabilistic analysis.

The base variability is calculated for each delivery model to create base variability cash flows. As an output field, base variability is calculated by importing the base variability inputs for each project phase (pre-construction, construction and operations) from the InpRisk sheet and the costs from InpTiming&Cost. For P3, the base variability is divided into retained and transferred base variability, using the cost transfer percentages from the InpTiming&Cost sheet.

Please note that no base variability is calculated when using the simplified inputs option.

Financing costs such as equity, debt, interest and principal payments and equity dividends, are typically considered to be an internal transfer and therefore excluded from the benefit cost calculation. However, financing fees are included, because they are economic resource costs.

Cells that are highlighted in light yellow are designated as input cells. In addition to these, there are cells highlighted in light orange, which are non-project specific inputs. These inputs are assumptions made for all projects but can also be changed if the user makes a different assumption. For example, a Vehicle Lane Capacity volume of 2,000 cars per lane per hour is assumed for most roads. While this is a standard assumption, any other value can be used to be more specific for the project being analyzed. Values in grey cells are not required to be altered.

If an error check or an alert flag appears at the top of the input and calculation sheets, the user should navigate to the Checks sheet to determine what the cause of the error check or alert may be. Please note that error checks and alerts will appear if the users makes changes to the inputs without optimizing the model. In that case, the user should click on the Model Optimizer button to initiate the optimization process. Upon completion of the optimization process, all error checks should disappear whereas, depending on the project's specifics, some alerts may remain. Users can double click on the relevant error check or alert to be taken to the source of the error or alert. For this function to work, the user needs to enable the "detailed level view" in the Model Navigator.

RED Error checks are critical and require immediate attention. YELLOW Alerts are not critical and are used to inform the user of the occurrence of non-critical events.

The Model Optimizer button aims to calculate the required subsidy/availability payment while simultaneously optimizing the project's financing. Use the model optimizer once you have entered all of the necessary inputs into the model. The speed of the model optimizer depends on the processing speed of the computer on which the tool is operating and the complexity of the model inputs.

In the high level view, the user has access only to the inputs, landing sheets and outputs. Detailed calculation sheets are hidden to provide the user with overall understanding of the model flow and logic. The landing sheets provide an overview of each module's components (elements used as inputs to the calculations in the module, calculations carried out within the module, and a list of outputs and modules that are affected by this module's calculations) in a flow chart format and can also be used to navigate the model. By clicking on any of the buttons in the high level view, the Model Navigator will either list the input and output sheets or take the user to the relevant landing sheet.

In the detailed level view, all sheets are visible and accessible to the user. By clicking on any of the buttons in the detailed level view, the Model Navigator will list all relevant worksheets. Click on any of the listed worksheets to navigate to a particular worksheet. While the high level view enables the user to navigate the model through landing sheets, the detailed level view enables the user to navigate to each individual sheet in the model. Chapters 3, 4, and 6 of the user guide describe the inputs and outputs of the model (visible in both high level and detailed level view), whereas Chapter 5 discusses the model's calculations (visible in detailed level view only).

The simplified inputs option allows the user to perform a simplified high-level analysis without having to enter all inputs used by 3-VALUE 2.2. When using the simplified inputs, the user has access to a subset of all inputs contained under the detailed input option; all inputs are accessible from a single input sheet. The simplified inputs exclude all inputs associated with pure risks and base variability. As such, cost inputs must be risk-adjusted costs when using the simplified inputs. Furthermore, the user does not have access to all BCA inputs under the simplified inputs option.

The detailed inputs option gives the user direct access to all inputs used in 3-VALUE 2.2.

As discussed under question 8.6, the model has two inputs options: simplified inputs or detailed inputs. A key difference between them is that the simplified inputs option excludes all inputs associated with pure risks and base variability. As the model optimizer considers both costs and risks (expressed as costs), it will produce different results for the two different input sets. As a result, if the user optimizes the model using the simplified inputs and then switches to the detailed inputs options (and vice versa), the model is no longer optimized and needs to be reoptimized. When opening the P3-VALUE 2.2 for the first time, the model is optimized using the simplified inputs option. If you want to use the detailed inputs option, please make sure to re-optimize the model.

Currently, there is no feature that allows the export of tables or graphs into other document formats including Excel. Alternatively, output tables and graphs can be copied and pasted into another document.

The time it takes to develop a model in the tool can vary widely. Depending on the complexity of the inputs used, the availability of data, and user familiarity with the tool, developing a model may take anywhere from a couple of hours to a few days.

Useful sources of inputs include a variety of project studies including: