Exhibits

In order to understand the tax considerations relevant to private sector bidders, a comparative overview of legal entities and tax structuring considerations is necessary. Businesses, including those operating transportation projects through a P3 arrangement in the US, can utilize a variety of legal entities through which to operate. The initial investors 8 must carefully weigh the options and determine the form of business organization that is the most appropriate for the specific transaction. Common legal entities include corporations, partnerships, and limited liability companies. Generally, most US P3s prefer to operate in a "flow-through" tax structure in order to minimize taxes on operating income and capital gains to provide a greater return on the investment.

In choosing amongst the particular forms of legal entities through which to operate a P3 project, investors generally seek to balance various commercial, legal, and tax objectives. In our experience, investors have noted key legal and commercial considerations to include: (1) limiting investors' legal liabilities arising from the business operations, (2) providing an efficient structure for managing the investment, (3) providing flexibility for future transfers of ownership interests and management compensation, and (4) facilitating capital financing needs of the project.

From an income tax perspective, the choice of legal entity will generally depend upon a structure that minimizes the overall tax cost at the entity level and provides flexibility at the investor level (so that investors with different tax profiles may structure accordingly) during the holding period and upon exit. The ability to achieve this objective will help maximize an investor's rate of return for the investment (including, potentially, through more favorable pricing on exit). The ultimate choice of entity will also impact the investment analysis for any potential future investors (e.g., tax attributes such as net operating losses ("NOLs") and tax basis). A brief overview of common entity options follows.

Generally, a corporation is a business organization formed under state law that is a separate and distinct legal entity from its owners. From a legal liability perspective, shareholders of a corporation are generally not liable for the corporation's debts and liabilities. 9

For income tax purposes there are two types of corporations - a C corporation and, if the shareholders elect, an S corporation 10 - the primary difference being the manner in which the corporation's income is taxed. Due to various restrictions applicable to S corporations, including, but not limited to, the number and types of permissible shareholders and the general limitation to a single class of stock, S corporations are not used in P3 transactions. Accordingly, unless otherwise indicated, all references to "corporations" throughout this white paper are to C corporations.

C corporations are subject to an entity level federal income tax. 11 Dividends distributed to shareholders are generally also subject to income tax at the shareholder level 12 and not deductible by the corporation. Accordingly, corporate earnings are typically subject to two levels of taxation, as illustrated in Exhibit D below. All other commercial and regulatory considerations being the same, private sector bidders generally tend to avoid using corporations as the P3 operating entity or special purpose vehicle ("SPV") in order to avoid a double layer of taxation on project income. 13

A partnership is generally a for-profit business or venture carried on by two or more taxpayers. Partners in a partnership may be individuals or other business entities (including partnerships or corporations). Partnerships may be either general or limited partnerships, the distinguishing characteristic of which is that a limited partner's liability for the partnership debts is generally limited to the amount of its contributed capital, whereas a general partner has unlimited liability exposure for such debts. Typically, SPVs utilizing the partnership form are limited partnerships.

For federal income tax purposes, partnerships generally do not pay income tax on their earnings. 14 Instead, the income tax liability for partnership income is the responsibility of the partners, whether or not earnings are distributed to the partner. Partnerships report their items of income, gain, loss and deduction on a US Return of Partnership Income (i.e., Federal Form 1065), and each partner is provided with a Schedule K-1, which reflects its share of these items. The partners then include their share of K-1 items on their own income tax returns. Accordingly, partnership income is subject to only one level of federal income taxation, as illustrated in Exhibit D below. This single layer of taxation on project income is generally preferred by private sector bidders.

Similar to corporations and limited partnerships, an LLC generally shields its members (the owners of the LLC) from personal liability for company obligations beyond the amount of a member's capital investment. The extent of member liability is generally a matter of state law and may depend on the state in which the entity is formed.

For federal income tax purposes, LLCs are classified pursuant to the "check the box" rules. 15 These rules permit taxpayers to choose the federal income tax classification of an LLC formed under the law of a US state. 16 The default federal income tax classification of an LLC with more than one member is a partnership, while an LLC with a single member is disregarded for federal income tax purposes (i.e., its activities are treated as if directly conducted by its owner). 17 If a "check the box" election 18 is made by the LLC (whether multiple-member or single-member), the LLC will be treated as a C corporation for federal income tax purposes and its earnings will be subject to federal corporate income tax (which would result in double-taxation, as described above). In contrast, the income of a multi-member LLC classified as a partnership under the default rules will be subject to single-level federal income taxation in accordance with the general income tax treatment of partnerships described above.

| Corporation | Partnership | |

|---|---|---|

| Entity Taxable Income | $100.00 | $100.00 |

| Entity Level Tax Rate | 35% | 0% |

| Entity Level Tax | $35.00 | $0.00 |

| Funds Available to Distribute After Entity Level Tax | $65.00 | $100.00 |

| Dividend / Distribution | $65.00 | $100.00 |

| Individual Tax Rate** | 23.8% | 43.4% |

| Individual Tax*** | $15.47 | $43.40 |

| Cash to Owner | $49.53 | $56.60 |

| * State income tax consequences are

excluded from Exhibit D ** Assumes entity owner is an individual US resident. Assumes highest marginal federal income tax rate for 2016, plus the current 3.8% "net investment income tax "*** As noted, partners will be taxed on their share of partnership income, whether or not distributed |

||

Exhibit D above describes the difference in taxation and cash to owners between a Corporation and a Partnership. For the same taxable income of $100, different deductions and tax rates are applied, resulting in cash to owner of $49.53 for a Corporation and $56.60 for a Partnership.

The tax treatment of income generated from a P3 investment will vary depending on the type of entity and corresponding income tax classification the investor group selects for the SPV and project operating entity. Thus, the type of entity selected can have a significant effect on the investors' after-tax return on investment. It should be noted that each investor that participates in a P3 investment may have a different tax profile (e.g., different tax rates (including tax exemptions or foreign status) and may be subject to different tax law provisions (e.g., unrelated business taxable income ("UBTI") for non-state domestic pensions). Accordingly, P3 investors often select an entity (e.g., an LLC taxed as a partnership) that permits the investors to accommodate their specific tax structuring requirements at the investor level.

For a variety of reasons, the most common P3 SPV is an LLC treated as a partnership for federal income tax purposes. 19 For legal reasons (not addressed in this white paper), the LLC is typically formed in the state of Delaware.

Accordingly, the following discussion of US tax considerations focuses on LLCs treated as partnerships for federal income tax purposes and, unless otherwise noted, references to an LLC are to an LLC treated as a partnership for tax purposes. Tax observations relevant to LLCs, members, and membership interests are generally applicable to partnerships, partners, and partnership interests, respectively. Notwithstanding this general focus, where relevant, the discussion will include analysis of US income tax considerations relevant to corporations and disregarded entities ("DRE") as well.

The income tax considerations related to entity formation typically include: (i) tax treatment of the contribution, (ii) holding period of ownership interests received in exchange for contributions, and (iii) tax basis of the ownership interest received.

An investor's initial cash contribution to an LLC in exchange for a membership interest is generally not a taxable event. 20 The holding period for the membership interest begins on the date of contribution. Subsequent cash contributions will generally be non-taxable to the member or LLC, however, such contributions result in a "split" holding period.

The tax basis of an LLC interest will be relevant for calculating the amount of gain or loss realized upon a subsequent transfer of the LLC interest. Tax basis is also relevant in determining the income tax treatment of distributions and to the amount of LLC losses a particular member may deduct. A member's initial tax basis in its membership interest generally equals the amount of cash contributed in exchange for the membership interest. Additionally, the tax basis of the membership interest also includes the member's share of the LLC's liabilities. 21 Over time, a member's tax basis in its membership interest is increased by its distributive share of LLC income and any additional contributions, and decreased by its distributive share of LLC losses or any distributions. Similarly, the holding period for an investor's LLC interest is often relevant to the tax treatment of a disposition.

An investor's cash contribution to a corporation in exchange for common stock of the corporation is generally not a taxable event. The tax basis of the investor's stock will equal the amount of cash contributed, 22 and the holding period for the shares will begin on the date of contribution. Subsequent cash contributions will generally also be non-taxable events, but will increase the shareholder's tax basis in corporate stock and will result in a "split" holding period. A shareholder's tax basis in the stock of the corporation will not reflect income or loss generated by the corporation, but may be reduced by distributions not out of corporate earnings. As in the case of an LLC, tax basis and holding period for corporate stock are relevant to the tax consequences of a disposition.

As a general matter, investors will prefer operating in a P3 structure that minimizes the overall tax cost associated with the project. The income tax impact on project net earnings may vary depending on the legal entities used in the overall structure, as some may be tax-paying entities and others may be pass-throughs. This implies that a tax efficient legal entity structure may allow bidders to submit a more competitive bid, by lowering the overall tax burden that needs to be recouped through the project financials.

As noted above, the LLC treated as a partnership for U.S. federal income tax purposes is generally not subject to federal income tax on its income. 23 For federal income tax purposes, the LLC is required to file an information return reporting the taxable income and loss of the entity, the name and taxpayer identification number of each member, and the amount of income or loss allocated to each member. 24

The federal income tax associated with the LLC's income is generally the responsibility of the members. A member (whether an individual or another entity) includes its distributive share of the LLC's income or loss on its own income tax return, 25 and any income will be taxed in accordance with the member's income tax classification. 26 As a general matter, the allocation of the LLC's income and loss among the members is governed by the LLC operating agreement. 27

As noted, LLC members are generally liable for income tax imposed on their distributive share of LLC income even if such income is not actually distributed to the member. However, because an allocation of income may result in a tax liability to the member, an LLC operating agreement can provide for cash or "tax distributions" to the members sufficient to satisfy each member's tax obligation attributable to their income allocation.

As noted above, corporate taxable income is subject to entity-level taxation at a specified corporate rate (current top marginal federal tax rate of 35%). For corporations, ordinary income and capital gains are taxed at the same income tax rate. To the extent the corporate after tax income is distributed to the shareholders, the distribution will generally be taxed again at the shareholder level (at the shareholder's applicable rate). 28

A single-member LLC that has not elected to be taxed as a corporation is treated as disregarded for federal income tax purposes and its activities are treated as conducted directly by its owner. 29 Accordingly, DREs are not subject to federal income tax.

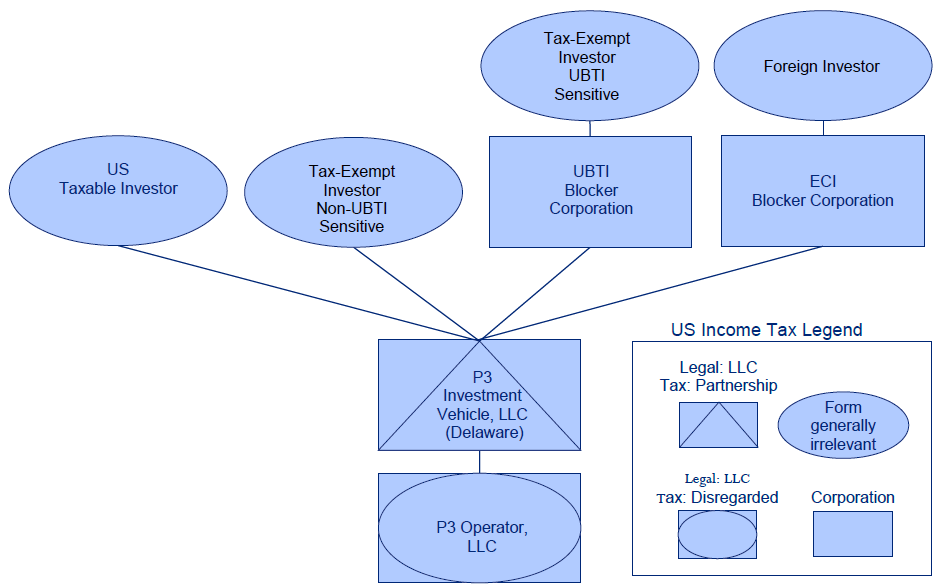

Ordinarily, an LLC offers a more tax-efficient structure than a corporate SPV (i.e., an SPV treated as a partnership for federal income tax purposes avoids double taxation). As a result, most P3s utilize LLCs in order to operate in a "flow-through" tax structure, as illustrated in Exhibit E below. 30

The federal income tax consequences to an investor, who is a US person, upon receipt of cash generally depends on the federal income tax classification of the distributing entity (e.g., partnership or corporation).

As noted above, a member of an LLC is currently taxed on its distributive share of the LLC's income, regardless of whether any cash is actually distributed to the member. Accordingly, distributions of cash are generally non-taxable events to the recipient members, and instead are generally treated as a return of basis. Cash distributions in excess of tax basis, however, are generally taxable as capital gains. 31 Further, an LLC is not taxable upon a distribution of cash to a member.

A non-liquidating distribution from a corporation is treated as a dividend to the extent of the corporation's current or accumulated earnings and profits ("E&P," generally, after-tax profits with certain adjustments). Dividend distributions are non-deductible by the corporation and are generally included in the shareholder's gross income. 32 However, under current tax law dividends received by individual shareholders that are generally treated as "qualified dividend income" are taxed at the preferential long-term capital gain tax rate instead of ordinary income rates. 33

Corporate distributions that are not classified as "dividends" are considered a nontaxable return of the shareholder's investment in the corporation, to the extent of the shareholder's tax basis in the underlying stock. After the shareholder has fully recovered its investment in the stock, further non-liquidating distributions to the shareholder are treated as gain from the sale or exchange of property, generally characterized as capital gain. 34 State income tax treatment of distributions may differ from state to state.

Because distributed earnings from a corporation to its shareholders have already been taxed once at the corporate level before being taxed again to the recipient shareholder, it is generally more tax-efficient for the SPV to operate as an LLC treated as a partnership for U.S. federal income tax purposes, so that operating income is subject to only one level of tax. 35

To the extent an LLC generates a net operating loss ("NOL") during a tax year, the loss generally passes through to the members. The loss may be utilized to offset other taxable income of the member depending on a member's income tax profile. 36 The loss does not carry over to the subsequent tax year of the LLC; but may be carried forward by the individual members subject to certain limitations.

To the extent a corporation recognizes an NOL during a tax year, the NOL may either be carried back two tax years or carried forward twenty tax years to offset the corporation's historical or future taxable income, respectively.

The ability to utilize the NOL carryforward will be subject to an annual limitation (the "Section 382 limitation") if the corporation undergoes a greater than 50% change in ownership within a three-year period (an "ownership change"). 37 The Section 382 limitation is generally equal to the net equity value of the corporation on the ownership change date multiplied by the applicable long-term tax-exempt rate published monthly by the IRS. 38

The holding period of an ownership interest, including membership interests (an LLC ownership interest) and corporate stock, is relevant in determining the tax rate applicable to individuals with respect to any gain recognized on a subsequent transfer of the ownership interest. Taxable gain from the disposition of an ownership interest with a holding period of more than one year is generally eligible for taxation at long-term capital gain rates 39 (currently a marginal rate of 20%, plus the 3.8% net investment income tax). Where the disposition is of an LLC interest (treated as a partnership interest for U.S. federal income tax purposes), a portion of the gain attributable to depreciation recapture (among other items) is treatable as ordinary (taxed at a marginal federal income tax rate of 39.6%). Long-term and short-term capital gain, as a well as ordinary income, are taxable to corporations at the same rate, currently 35%. However, corporate capital losses cannot offset ordinary income.

The sale of a membership interest in an LLC treated as a partnership for U.S. federal income tax purposes to a third party will generally be subject to income tax for the selling member. Except as discussed below with respect to a "technical termination," there is generally no income tax consequence to the LLC or the remaining members upon the sale.

Partial Sale of LLC Interest: Upon a sale of LLC interests, the purchasing member will generally succeed to the selling member's share of the LLC's aggregate tax basis in its assets without a corresponding adjustment to reflect the amount paid for the membership interest. However, if the LLC has an election in place under Section 754 at the time of the sale/purchase, the new member may receive a tax basis adjustment in its membership interest to fair market value similar to acquiring an undivided interest in each LLC asset. 40 Where the purchasing member pays more for the purchased interest than its share of the tax basis in LLC assets, this adjustment (a "tax step-up") typically increases the tax depreciation and amortization for the incoming member going forward. If the partnership has a substantial built in loss in its assets, the adjustment (a tax basis "step-down") is mandatory for the incoming member. 41

A complete redemption for cash of a member's interest in an LLC would generally be taxable to the redeemed member. 42 Such a transaction would not in itself result in a technical termination of the LLC. While a tax basis adjustment may result if the redeeming member recognizes gain or loss if the LLC has a section 754 election in effect, unlike a sale to a third party the adjustment is shared by all the remaining members.

Sale of 100% of LLC Interests: A sale of 100% of an LLC treated as a partnership for U.S. federal income tax purposes is treated by the purchaser as a purchase of assets. Upon a sale of assets, the purchase price is generally allocated first to cash/cash equivalents and tangible assets based on fair market value. Any remaining purchase price is generally allocated to intangible assets (including goodwill). A buyer of assets receives a tax basis equal to the purchase price paid plus liabilities assumed (for U.S. federal income tax purposes).

The selling stockholder will be subject to income tax on the sale of corporate stock to a third party.

Unlike with a sale of membership interests (treated as partnership interests for U.S. federal income tax purposes), the tax bases of corporate assets are generally not adjusted by virtue of the purchase of corporate stock (i.e., no "tax step-up"). 43 Further, a sale of stock resulting in an "ownership change" of a corporation with NOLs may result in a Section 382 limitation, as described above. A redemption of corporate stock is generally treated as a sale by the holder if the holder has sufficiently reduced its interest as a stockholder of the corporation.

Most states impose some form of tax on business entities operating or deriving income from within their state, although the methods used to impose the tax vary among the states. Each state that imposes a corporate income tax has its own system of implementing and determining a corporation's tax liability. 44 Certain localities within a state may impose a local income tax in addition to the state corporate income tax. 45 Although partnerships (including LLCs treated as partnerships for federal income tax purposes) are generally treated for state income tax purposes in the same manner as they are taxed for federal income tax purposes, each state has its own set of rules for taxing LLCs and their members. In addition, most states require LLCs to file composite returns to pay state income taxes on behalf of their nonresident members, to withhold state income taxes on behalf of their nonresident members, or to impose their state income tax on the LLC itself. 46 In certain states, a franchise tax, frequently based on capital or net worth, may also be imposed for the privilege of conducting business within the state. 47

A few states impose entity-level income taxes applicable to all legal forms of business entities. 48 These entity-level income taxes can apply to entities treated as partnerships for federal income tax purposes (including LLCs treated as partnerships), in contrast to their treatment for federal income tax purposes where the entity itself is not subject to tax.

Most states follow the federal income tax classification of flow through entities (e.g., LLCs and partnerships). Accordingly, most entities treated as partnerships for federal income tax purposes (including LLCs treated as partnerships) are also classified as partnerships for state income tax purposes.

The state of incorporation or formation of an entity generally does not substantially impact its state income tax liability (other than certain minimum taxes). The state in which the P3 project is located is generally the relevant jurisdiction for purposes of determining the state income tax consequences to the entity. However, due to the variety of methods of business entity taxation imposed by individual states, state income / franchise tax consequences typically require state-specific analysis. Because P3 projects and assets are generally situated within a single state, 49 the entity and/or the investors will generally be subject to income tax in that state.

P3 investors typically have different tax profiles and may include US taxable investors, different categories of US tax-exempt investors, and non-US investors. Each type of investor has its own unique considerations relevant to tax structuring. The income tax considerations for the various investors in a P3 project will be influenced by the type of SPV utilized - as noted, usually an LLC.

US tax-exempt investors may generally be described in one of two manners. Although generally exempt from federal income tax on their income, some US tax-exempt investors are subject to UBTI on income derived from an unrelated trade or business ("unrelated business taxable income" or "UBTI"). 50 Accordingly, these US tax-exempt investors ("UBTI sensitive investors"), including qualified pension plans, individual retirement accounts, endowments, and state universities, seek to avoid receipt of UBTI to ensure that they are not unexpectedly subject to income tax. On the other hand, certain US tax-exempt investors may not be subject to UBTI and would thus be entirely exempt from income tax, regardless of the nature of the income received ("non-UBTI sensitive investors"). Some pension funds for state and local government employees and governmental affiliates take this position and do not file any federal income tax returns.

Additionally, non-US investors are generally subject to US tax on certain US source income. 51 Non-US investors are subject to US taxation (at applicable U.S. federal income tax rates) on any income that is "effectively connected" with the conduct of a US trade or business ("effectively connected income" or "ECI"). This includes income that "flows through" a P3 project conducted through an LLC. On the other hand, as earnings of a US corporation do not "flow through" to the shareholders, the corporation itself is liable for the US federal income tax.

Non-US investors are generally not subject to US income tax on the sale of corporate stock. However, non-US investors may be subject to the Foreign Investment in Real Property Tax Act ("FIRPTA"), which taxes gain realized (at applicable U.S. federal income tax rates) by a non-US investor from the disposition of a US real property interest ("USRPI"). 52 A USRPI includes direct ownership of US real property (e.g., land, buildings, etc.) as well as stock of a corporation classified as a US Real Property Holding Company. 53 The IRS has indicated that it believes certain concession tolling rights (discussed further below) in some P3 projects are properly classified as USRPI. 54 Accordingly, non-US investors may utilize a C corporation blocker entity as illustrated in Exhibit E to avoid being subject to requirements of filing a US income tax return.

US tax-exempt investors are generally not be subject to tax on (i) dividends received and (ii) gains from the sale of their corporate stock as these are generally not classified as UBTI so long as the investment is not "debt financed."

Dividends received by a non-US investor are generally not subject to tax as ECI but may be subject to US withholding tax at a 30% rate unless the rate is reduced or eliminated by a bilateral tax treaty. Further, as noted above, if a toll concession is treated as a USRPI, the sale of corporate stock (or a distribution with respect to corporate stock treated as a sale) classified as a USRPI by a non-US investor will be subject to FIRPTA withholding tax. 55

The distributive share of income to a UBTI sensitive investor in the SPV constitutes UBTI. 56 Accordingly, in order to avoid receipt of UBTI during the concession period, UBTI sensitive investors generally hold their flow-through investments through "corporate blockers". Corporate blockers are generally U.S. C corporations subject to federal income tax (i.e., the corporate blocker pays federal income tax on its allocable share of the taxable income of the SPV). By using this structure, the income from the tax-paying corporate structure is treated as passive income, and so is not characterized as UBTI. Non-UBTI sensitive investors do not typically hold their investment through a corporate blocker.

A non-US investor's distributive share of income from a direct investment into a P3 LLC would likely constitute ECI. Accordingly, the LLC may have a withholding tax obligation with respect to the corresponding US income tax liability of the non-US investor. 57 Structuring considerations, such as interposing a corporate blocker, may be considered to eliminate a US tax filing obligation by the non-US investor and a withholding tax obligation of the LLC, as illustrated in Exhibit E. 58 Non-US investors may also be subject to FIRPTA withholding (as described above) in the LLC context. A disposition of an LLC interest would generally result in US federal income tax with respect to the pro-rata portion of the USRPI deemed sold and potentially FIRPTA withholding tax on the gross sale proceeds of the LLC interest. 59 Typically, FIRPTA withholding would also be required on the sale of blocker stock.

|

Exhibit E details the typical investment structure for a P3. Foreign investors and tax-exempt investors invest in the P3 investment vehicle typically through UBTI or ECI blocker corporations. U.S. investors and tax-exempt investors invest directly in the P3 investment vehicle (usually Delaware LLC) which in turn owns the P3 Operator company.

8 An investor consortium comprised of private sector bidders may include US and non-US banks, private equity firms, and construction and engineering companies.

9 Legal counsel should be consulted regarding the application of the general principles (described in this Section 2.0) of legal liability and similar matters to any particular case.

10 Corporations that have elected to be treated as S corporations are generally not subject to federal income tax and not subject to many state income/franchise taxes; although such entities are generally required to file federal and state income/franchise tax returns reporting the taxable income or loss of the entity. S corporations pass all items of income, deductions, gains and losses, to their shareholders, who are then taxed on their allocable share of such items.

11 The current top marginal federal tax rate applicable to corporate taxable income is 35%. If the tax amount due is greater, corporations are subject to an alternative minimum tax ("AMT") (20% of "alternative minimum taxable income") (AMT could be higher because different measures of income subject to tax apply to regular tax and AMT). Corporate taxable income may also be subject to state income tax at varying rates.

12 The applicable tax rate for corporate distributions depends on the tax profile of the recipient shareholder and the type of distribution. Currently, distributions to individual shareholders treated as "qualified dividend income" are taxed at long-term capital gain rates (top marginal rate of 20%). IRC § 1(h)(11). An additional 3.8% "net investment income" tax may also apply to dividends. IRC § 1411. Dividends may also be subject to state income tax. Dividends received by a corporation are subject to ordinary tax rates. Note that corporations may be entitled to a dividend received deduction, which would reduce the amount of the dividend subject to federal income tax.

13 As noted below, certain investors in P3 projects may insert a "blocker" corporation as an owner of the SPV for tax reasons.

14 Although not liable for federal income tax, partnerships may be subject to entity-level state tax. Additionally, a partnership may have other federal income tax obligations such as collecting and remitting withholding tax on income allocable to certain partners. See state tax and investor classification discussions further below.

15 The "check the box" rules are found in Treas. Reg. § 301.7701-3, with additional business entity classification rules found in Treas. Reg. §§ 301.7701-1 and -2.

<16">16 Unless otherwise noted, it is assumed herein that any LLC is formed under the law of a state in the US.

17 A single-member LLC may or may not also be disregarded for state income tax purposes. See state tax discussion below.

18 Treas. Reg. § 301.7701-3 also describes the procedure and filing requirements for making the election.

19 While most states follow the federal income tax classification of LLCs, some states (e.g., Tennessee) may not. The state(s) of operation of the LLC, rather than the state of formation, generally determines which tax rules apply.

20 The rules for non-cash contributions to corporations and LLCs differ substantially from those described herein for cash contributions. However, in the P3 context, such non-cash contributions are rare.

21 The tax rules treat a member as making a deemed cash contribution equal to the member's share of the LLC debt. This deemed cash contribution correspondingly increases the member's tax basis in its membership interest.

22 Unlike members in the LLC context, corporate shareholders do not include in the tax basis of stock any portion of corporate debt.

23 See supra note 28 regarding state taxes.

24 Federal Form 1065. The informational returns and filing requirements for each state will vary.

25 For federal income tax purposes, each member's distributive share of the LLC's income or loss is stated on Schedule K-1, which is provided to the members by the LLC. The character of such income or loss (e.g., ordinary or capital) is typically determined based on the character to the LLC.

26 Tax classification of investors, including various tax rates applicable to different types of investors, is discussed below.

27 This general rule for allocation of income and loss is subject to certain other requirements under the tax law and is generally intended to cause cumulative taxable income to be allocated in accordance with cumulative economic income.

28 See supra note 33 and accompanying text. The highest marginal federal income tax rate on the ordinary income of individuals is 39.6% under current law.

29 A single-member LLC may or may not also be disregarded for state income tax purposes.

30 Note that certain tax-exempt and foreign investors may make their P3 investment through a C corporation, subjecting their income to double taxation. Their rationale for utilizing the C Corporation is discussed below in section 2.4 of the white paper.

31 This capital gains treatment is subject to potential re-characterization as ordinary income under the tax rules.

32 For corporate shareholders, only a portion of a "dividend" is included in its gross income. Pursuant to the "dividends received deduction," corporate shareholders may generally deduct 70% to 100% of dividends received depending on the corporate shareholder's level of ownership in the distributing corporation. IRC § 243. Accordingly, the maximum effective regular federal income tax rate on dividends received by corporate shareholders is generally 10.5%.

33 See supra note 33 and accompanying text. The highest marginal federal income tax rate on the ordinary income of individuals is 39.6% under current law.

34 To the extent the recipient is an individual shareholder and the underlying stock has a holding period of more than one year, these distributions may be characterized as long-term capital gain and subject to the lower tax rate, , currently a marginal rate of 20%, plus the 3.8% net investment income tax for top-bracket individual taxpayers. IRC §§ 1 and 1411.

35 See Exhibit D above for comparison of taxation of corporate and partnership income.

36 Significant limitations on offset apply to individuals and some closely held corporations.

37 IRC § 382. There are detailed and complex rules for determining if an ownership change has occurred.

38 IRC § 382(b).

39 State income taxes may also apply.

40 IRC §§ 754 and 743(b). This adjustment is deemed to be applied only with regard to the purchaser's allocable share of LLC asset tax basis (i.e., the fractional interest in the LLC assets attributable to the purchased membership interest). The adjustment does not affect the common tax basis of LLC assets, or the other members.

41 Under complex tax rules pursuant to IRC § 708(b)(1)(b) (the "technical termination" rules), a sale or exchange of 50% or more (but less than 100%) of the total interest in an LLC's capital and profits within a 12-month period results in the closure of the tax year of the LLC. As a further consequence, depreciation of fixed assets is restarted based on the adjusted tax basis at the time of termination and the LLC may be subject to additional compliance requirements, such as filing two federal income tax returns during a 12-month period.

42 Such a transaction would not in itself result in a technical termination of the LLC.

43 The parties can elect in some specified circumstances to treat certain sales of corporate stock as if the sale was instead a sale of the underlying corporate assets. These situations are generally not available in the context of a P3 transaction.

44 Some states, such as Nevada, do not impose a corporate income tax.

45 e.g., many localities in Ohio impose a local income tax.

46 e.g., New York City imposes its Unincorporated Business Tax (the "UBT") at a rate of 4% on LLCs with a taxable presence in New York City.

47 Tennessee imposes an income and a franchise tax on most entities treated as partnerships and certain entities which are disregarded for federal income tax purposes.

48 e.g., the Texas Margin Tax (which is treated as an income tax for financial statement purposes).

49 We note, however, that certain P3 projects have crossed state lines.

50 P3 income which "flows through" an LLC would generally be classified as UBTI for federal income tax purposes (gain on sale of an ownership interest in the SPV may also be classified as UBTI). Dividends and gains from the sale of stock of a corporation would generally not constitute UBTI unless the stock was acquired with borrowed funds (i.e., "debt financed").

51 P3 income may be treated as US source since the income-producing property and/or the compensated services are located in the US.

52 Generally, any FIRPTA tax liability is required to be withheld by the purchaser of the stock acquired from a non-US investor. The details of FIRPTA, including filing and withholding requirements, are beyond the scope of this white paper.

53 A US real property holding corporation is any corporation if the fair market value of the USRPIs it holds on a testing date equals or exceeds 50% of the sum of the fair market values of its USRPIs, interests in real property located outside the US and certain business assets. Treas. Reg. § 1.897-2.

54 Announcement 2008-115, 2008-48 IRB 1228. The Announcement stated that the IRS and Treasury Department were considering issuing regulations that would treat certain licenses, permits, franchises, or similar rights granted by a procuring authority to a concessionaire as a USRPI. See discussions related to toll concessions below. Tolling rights are often the primary asset shown in a P3 concession's balance sheet, especially during the early stages.

55 Announcement 2008-115, 2008-48 IRB 1228. The Announcement stated that the IRS and Treasury Department were considering issuing regulations that would treat certain licenses, permits, franchises, or similar rights granted by a procuring authority to a concessionaire as a USRPI. See discussions related to toll concessions below. Tolling rights are often the primary asset shown in a P3 concession's balance sheet, especially during the early stages.

56 Realized gain or loss on the sale of a partnership or LLC membership may also constitute UBTI in certain circumstances (e.g. if the SPV owns debt-financed property).

57 IRC § 875(1). Current withholding tax rate on a partner's share of ECI is 39.6% for non-corporate partner and 35% for corporate partners.

58 A detailed discussion of non-US sponsor investment structures is beyond the scope of this white paper.

59 FIRPTA withholding tax may be required if a significant portion of the LLC's assets constitute USRPI.