Value Capture: Capitalizing on the Value Created by Transportation - Presentation

October 22, 2018

Presenters

- Lindsey Svendsen, Office of Real Estate Services, FHWA

- Jim Thorne, Office of Planning, FHWA

- Ken Atkins, Contract Administration Engineer, FHWA Technical Services Team (former Osceola County), Osceola County, FL Case Study

- Eric Bourassa, Director of Transportation Division, Metropolitan Area Planning Council (Boston). Assembly Square, Somerville MA Case Study

Agenda

- What is the EDC-5 Value Capture initiative?

- Why is Value Capture needed?

- Value Capture Overview and Benefits

- FHWA Role

- Case Study

- Q&A/Do you know?

What is the EDC-5 Value Capture initiative?

EDC 5 Value Capture Initiative

Promotes the use of value capture mechanisms as part of a mixed funding and innovative finance strategy to accelerate project delivery and provide equitable funding for sustainable transportation investments.

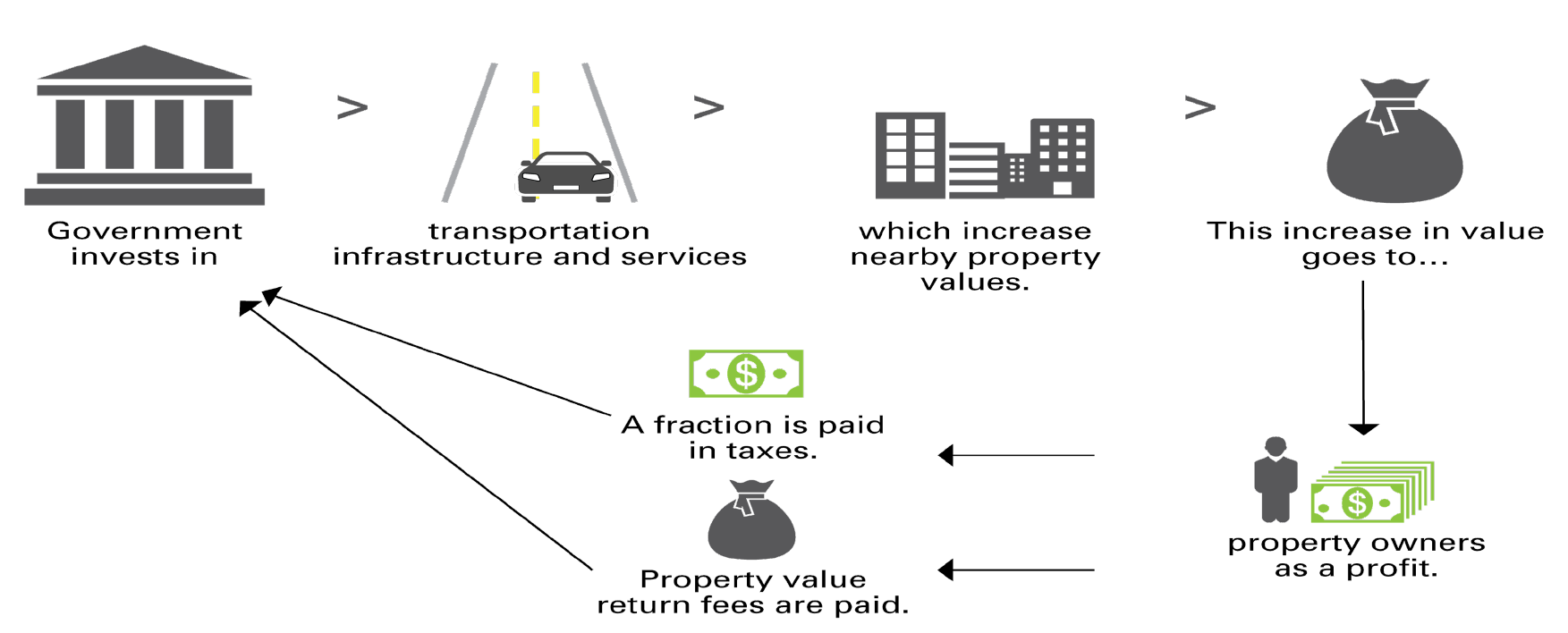

What is Value Capture?

- Government invests in infrastructure and services which increase nearby property values.

- This increase in value goes to property owners as a profit.

- A fraction is paid in taxes.

- Property value return fees are paid.

Example: Value Capture Funds Corridor Improvement

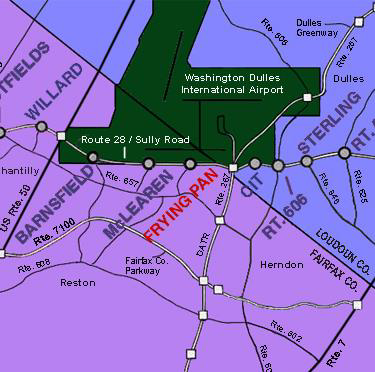

Virginia Route 28 Transportation Improvement District

- District formed in 1987 jointly by Loudon and Fairfax Counties

- Maximum tax rate of $0.20 per $100 of assessed value

- Raises ~ $23 million in revenue

- $138 million, 14-mile widening from two to six lanes completed in 1991

- District and State share project costs 75/25

Virginia Route 28 Transportation Improvement District project profile

Why is Value Capture Needed?

The Case for Value Capture

- Federal funding availability

- Local project funding

- Untapped revenue source

- Equitable

- Sustainable economic development

FHWA Roles in Value Capture Tools

- FHWA seeks to improve consideration of all revenue and finance options in the project development process

- FHWA seeks to build capacity for consideration and implementation of revenue options/value capture tools

- USDOT's Build America Bureau offers innovative financing through the TIFIA and RRIF programs that can leverage value capture monies

Value Capture Overview & Benefits

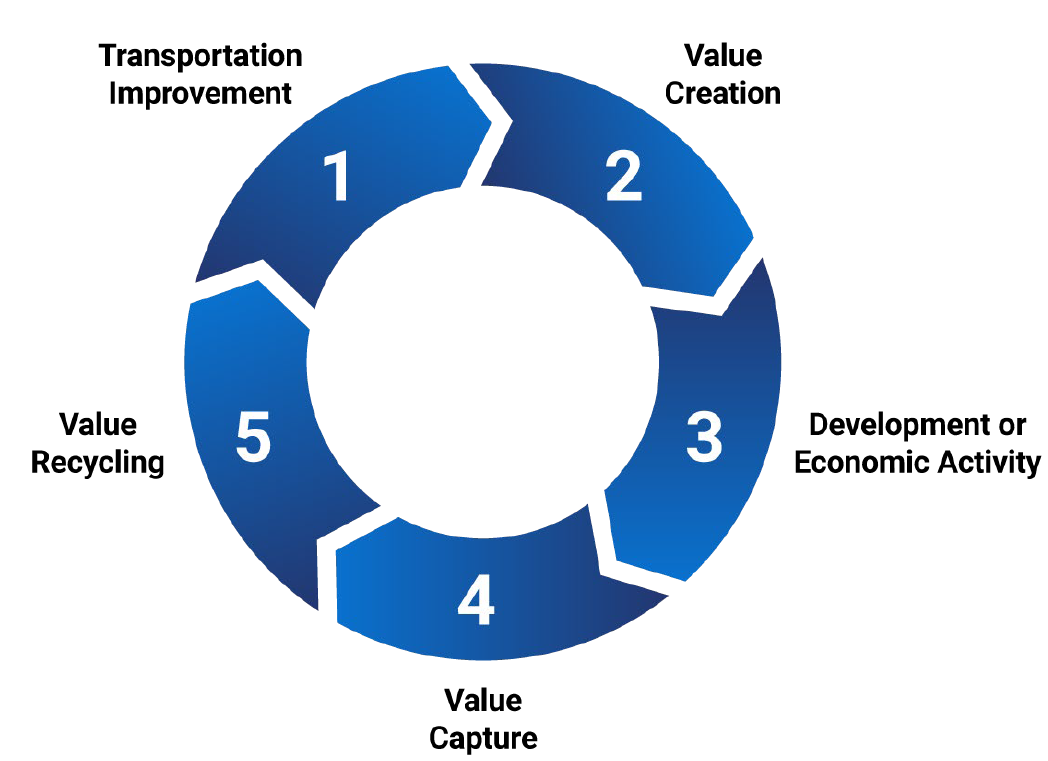

What is Value Capture?

- Transportation Improvement

- Value Creation

- Development or Economic Activity

- Value Capture

- Value Recycling

Value Capture Beneficiaries

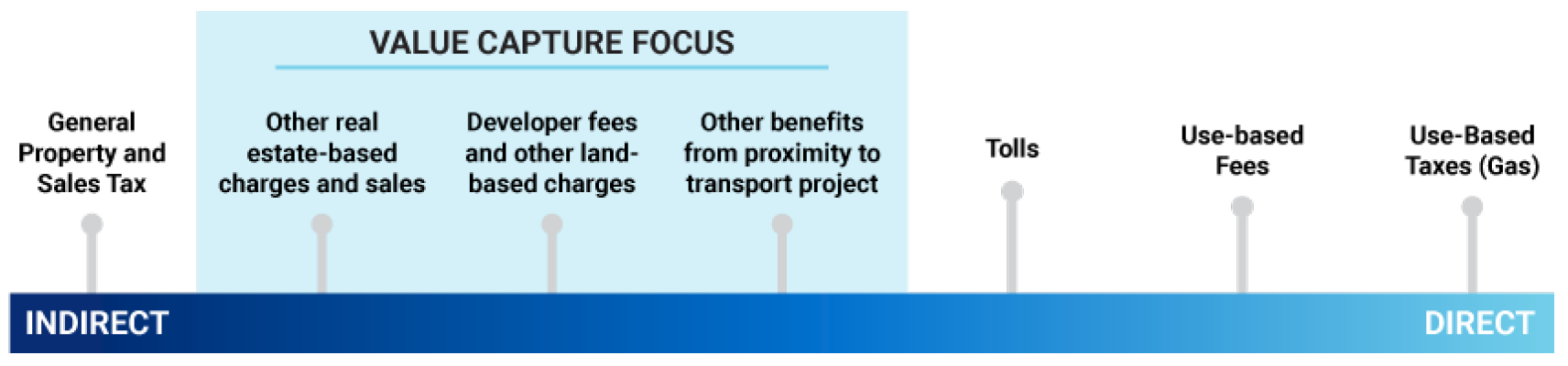

Text of Value Capture Focus chart

- General Property and Sales Tax

- Other real estate-based charges and sales (Value Capture Focus)

- Developer fees and other land-based charges (Value Capture Focus)

- Other benefits from proximity to transport project (Value Capture Focus)

- Tolls

- Use-based Fees

- Use-Based Taxes (Gas)

Potential Benefits of Value Capture

Provide gap funding sources for highway improvements & infrastructure life cycle costs

- Facilitate access to ongoing revenue stream to Local Public Agencies

- Accelerate project delivery & safety Improvements

- Induce private investment

Value Capture Mechanisms

How is the Value Captured?

- Developer Contributions

- Impact fees

- Negotiate Exaction and Ongoing developer contributions

- Transportation Utility Fees (TUFs)

- Special Tax and Fee Approaches

- Special assessment district

- Sales tax district

- Business improvement district

- Land value tax

- Incremental Growth Approaches

- Tax increment financing (TIF)

- Transportation reinvestment zones (TRZ)

- Joint Development

- ROW Use Agreements

- Concessions, leasing

- Airspace (above or below)

- Parking

- Fiber-optic leasing

- Pipelines or other utilities not addressed by Utility Accommodation Policies or State Law

- ROW Use Agreements

- Advertising Rights and Sales

- Naming rights

- Other

- Transportation Corporation (TC)

- Section 63-20 Corporation

Challenges

- Every jurisdiction is different

- Must target projects with economic benefits for leveraging

- Stakeholder involvement process can be lengthy, due to:

- Coordination between multiple jurisdictions

- Discussions with private developers and property owners

- Establishing project location and design

- Considering legal issues

- Securing political support

- Perceived as another tax

- Requires accuracy of activity and real estate projections:

- If I build it, will they come?

- If I build it, will developers build on nearby property?

- Identify the magnitude benefits & boundary of value capture technique

Ingredients of a Successful Value Capture Project

- Identified in long-term planning/capital improvement program - primarily local

- Incorporated early in the project development process

- Right technique selected for the right project

- Integrated funding and finance strategy

- Community support generated through effective outreach

Value Capture Summary

Value Capture is...

- A set of powerful funding tools that can help address funding gaps. (USDOT supports Value Capture)

- Can be part of the mix of funding sources for transportation improvement solutions

- Can accelerate project delivery, save time and money when done properly

Federal Roles

FHWA Roles in Value Capture

- Build capacity among partners

- Assemble VC Implementation Team

- Interact with key stakeholders

- Develop VC Implementation manual

- Develop clearinghouse for VC resources

- Conduct various peer exchanges, training, and technical assistance activities

- Funding

Value Capture Implementation Team

- Co-Leads

- Thay Bishop, FHWA Office of Innovative Program Delivery

- Stefan Natzke, FHWA Office of Planning, Environment, and Realty

- Members

- Jennifer Ahlin, Virginia Department of Transportation

- Janine Ashe, FHWA District of Columbia Division

- John Duel, FHWA Office of Planning, Environment, and Realty

- Ben Hawkinson, FHWA Transportation Policy Studies

- Kathleen Hulbert, FHWA Infrastructure Office

- Chip Millard, FHWA Freight Management & Operation

- Diane Mobley, FHWA Chief Counsel Office

- Kevin Moody, FHWA Resource Center

- Ben Orsbon, South Dakota Department of Transportation

- Jill Stark, FHWA Office of Planning, Environment, and Realty

- Lindsey Svendsen, FHWA Office of Planning, Environment, and Realty

- Jim Thorne, FHWA Office of Planning, Environment, and Realty

- Marshall Wainright, FHWA Resource Center

VCIT Focus Areas

- Communication

- Developing the tools to help FHWA staff and others promote Value Capture to local public agencies (Value Capture Implementation Manual)

- Technical assistance

- Providing technical assistance to local public agencies interested in pursuing Value Capture (Peer Program)

- Clearing House

- Identification of best practices and lessons learned and promoting further discussion on innovative funding options for local public agencies, lessons learned from past and current efforts, etc. Clearing House website.

Key Stakeholders

- State Department of Transportations

- Federal Agencies (HUD, USDA, FTA)

- Metropolitan Planning Organizations (MPOs, RTPOs)

- Local & Tribal Governments

- Transportation Providers (Transit Operators)

- Business Communities

- Developers

- Community residents

Value Capture Activities

- Webinars

- Workshops

- Peer Exchanges

- Case Studies

- Sponsorships (local, regional, & national events)

- Technical Assistance

- Website (Clearinghouse)

Value Capture Clearinghouse

- Currently under development

- Value Capture Manual "How to" implement value capture under development

- Clearinghouse for best practices/lessons learned

Case Study - Osceola County Florida

Transportation Impact Fees & Funding

Ken Atkins, FHWA

Osceola County Case Study

John Young Parkway / Osceola Parkway Interchange

Osceola County Overview

- Named for Indian leader Osceola

- Created in 1887

- Covering 1,506 square miles

- Population grew to 47,619; 88.5 % increase from the 1970 census; and by 55.8 % in 2010

- Infrastructure was not equipped to support growth

- The impact fees were finally approved in 1989

Value Capture Advances Roadway & Bridge Program

- Projects bundled using Alternative Contracting Methods (ACMs)

- Countywide 11 projects with 13 bridges

- Bridges were part of roadway projects

- 1 billion dollar program - started w/ bundling $350- million

- 100% locally funded by Value Capture -impact fees

The Results

- Most accelerated program in Nation

- 11 Major Roadways in 1-year

- Returned $80 million to local economy in first 4 months of construction

- 11 times previous production

- Returned 36 million dollars in savings to the County's budget

- Start of design to ground breaking as fast as 15 months

- Saved numerous local contractors from going out of business

Value Capture Advances Roadway & Bridge Program

- Osceola County impact fees are assessed on new development to provide funding for the County to create improvements needed to serve that development's users

- Impact fees are assessed at the time a building permit is issued and are paid prior to the issuance of a Certificate of Occupancy

- See: https://www.fhwa.dot.gov/ipd/alternative_project_delivery/defined/

bundled_facilities/case_study_osceola_county_bridge_roadway.aspx

Minimize The Frustration

- Periods of Dynamic Growth Are Frustrating

- Crowded Roads

- Developers were frustrated w/ County

- Poor Levels of Service

- Locals were frustrated w/ changing culture

- Strategic Planning Minimizes The Problems

- Vision of The End Product Helps

The Single Greatest Obstacle - Transportation

- The Quality of Commerce and Lifestyle Both

- Depend On Adequate Transportation Systems

- Upgrade of Existing Roads Needed

- Planning For Future Roadways

- Integration Of Transit; Include Future Transit Patterns

- Pathways, Bikeways, and Trails; Pedestrian Mobility

Transportation Impact Fee Background

- Approved in 1989

- Implemented in 1990

- Last update in 2007

- Suspension/ moratorium in 2011 & Repealed 2012

- Replace with Mobility Fee, effective date June 22, 2015

Impact Fee Definition

- One-time capital charge to new development

- Covers the cost of new capital facility capacity

- Implements the Capital Improvement Plan

Why Impact Fees?

- Revenue source for new infrastructure needed due to growth

- Revenue is generated as growth occurs

- Equity

- Those who create the need pay for it

- Equitable in terms of impact of each land use

- Equitable by limiting burden on existing population

- Growth Management Tool

- Maintain/ Restore Level-of-Service Standards (LOS)

- Calculate cost of growth

- Potential large developments

- Most needed when:

- Expected future growth; Potential revenue sources

- Limited funding

Transportation Impact Fees

- Roadway-based

- Multimodal approach in the Cities requires a minimum of:

- City's Comprehensive Plan to include mobility goals/strategies

- A Capital Plan for bicycle lanes and sidewalks

- A map of local collector roads as wells bicycle lanes and sidewalks

Impact Fee

Pros:

- Proportionate to the benefit

- No voter approval is required

- Does not go against other revenues

- Frees up general revenues for maintenance/operations

Cons:

- Can only be used for capital addition projects

- Frees up more general revenue

- Revenues must be spent for specific capital facilities

- Need to demonstrate that fee is related to costs of facilities and demand generated by development

- Revenues fluctuate with development activity

Legal Requirements

- Must adopt Level of Services (LOS) standards

- Must apply same standard to existing and new development

- Can apply higher standard if financial plan in place

- Must be spent on facilities for which collected

- Cannot spend on operations and maintenance

- Must be spent in reasonable time period (within 6-7 yrs.)

Transportation Mobility Fee

Transportation system charge on development that allows local governments to assess the proportionate cost of transportation improvements needed to serve the demand generated by development projects.

MOBILITY FEE =

Additional transportation demand from development

X

Identified cost for transportation improvements to mitigate associated development impact

Mobility Fee Requirements

- May not be used to deny, time, or phase an application

- Revenue collected is used to implement needs of local gov't plan

- Comply with rational nexus test

- Cannot fund existing transportation deficiencies

- Consistent with enabling legislation Section 163.3180

Section 163.3180 New Tools and Techniques

- Long-term strategies to facilitate development patterns that support multimodal solutions

- Area wide level of service standards not dependent on any single road segment function or multimodal level of service standards

- Exempting/discounting impacts or impact/local access fees of locally desired development (i.e. urban, MMTDs, redevelopment, mixed use, or affordable housing)

- Primary prioritization of ensuring a safe, comfortable, and attractive pedestrian environment with convenient interconnection to transit

Benefits

- Provides an alternative to concurrency

- Allows greater flexibility in use of collected funds

- Funds transit supportive capital improvements & operations

- Promotes compact, mixed-use development

- Supports the development of new tools & techniques

Distinguishing Features

- Trip basis of fee - How is the trip accounted? (ends vs. length)

- Cost basis of fee - What is included in the cost calculation?

- Disposition of expenditures - How are the collected funds spent?

- Credits and discounts - What project elements reduce cost of fees?

No two mobility fees are the same!

Case Study - Assembly Square, Somerville MA

Eric Bourassa, Boston Metropolitan Area Planning Council

Value Capture Case Study: Assembly Square, Somerville Massachusetts

Eric Bourassa

Director of Transportation Planning

Metropolitan Area Planning Council - Boston

October 24, 2018

ebourassa@mapc.org

The Value Capture Concept

Capturing growth in property values generated by public improvements to pay for public improvements

Value Capture Tools More Commonly Used in Massachusetts

Negotiated Developer Contributions

Tax Increment Financing (District Improvement Finance Program)

Joint Development & Air Rights

Advertising & Naming Rights

Infrastructure Investment Incentive Program (I-Cubed)

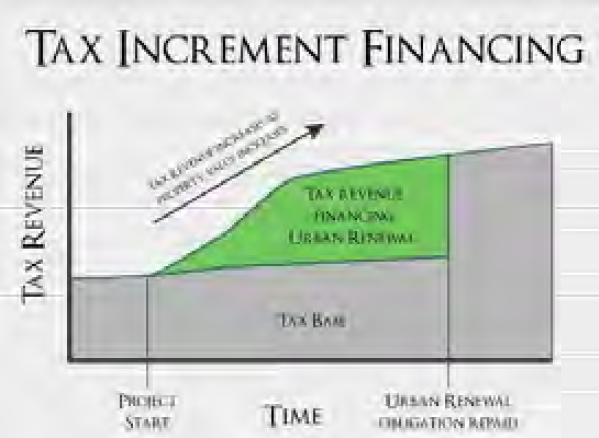

Tax Increment Financing

This chart shows that tax revenue goes up over time, with the tax base remaining stable but the value added taxes increasing throughout the live of the project. Urban Renewal Obligations are repaid by the end of the project.

Infrastructure Investment Incentive (I- Cubed)

- A Massachusetts program that allows the state to borrow $600 million for public infrastructure.

- Maximum of 3 projects per municipality and no municipality can use more than 31% of the funds.

- Infrastructure financing applications must be between $10 and $50 million. Can be applied for in stages.

- Main qualifier is that the infrastructure project has to create net new state tax revenue beyond what the state is borrowing. Types of revenues include:

- Payroll/Income Taxes

- Sales Taxes

- Hotel Taxes

- Business Taxes

- Construction Wages and Sales Taxes on Construction Materials

- Project must be approved and certified by the Commonwealth after a rigorous review process by a consultant and the Department of Revenue including projected coverage of debt service by net new tax revenues of 1.5x.

Assembly Square Somerville

Assembly Square - 1995

Assembly Square Redevelopment Vision

Development

- Federal Realty Investment Trust

- $1.5 Billion of private investment

- 500,000 SF retail (80 stores)

- 2,100 residential units

- 2 Million SF office space

- 155 room hotel

Infrastructure Needed

- Internal Roads and Streetscape

- Water and Sewer

- New MBTA Orange Line Station

Value Capture Mechanisms Used

- $25 Million TIF District to support road access ($14 Million in ARRA)

- $40 Million of I-Cubed for streetscape and utility improvements.

- $15 Million developer contribution for new Orange Line Station (half the cost).

When and Where to Consider Using Value Capture

|

|

| Limited Value Capture Potential | Strong Value Capture Potential |

|---|---|

Weak real estate market Limited development potential Project perceived as creating limited new value for property owners and developers Multiple jurisdictions Many property owners Significant competing needs and limited municipal resources Lack of political support Projected revenues insufficient to justify transaction costs Limited availability of other funding sources and debt financing |

Strong real estate market Significant development potential Project creates significant value for nearby properties One or a small number of jurisdictions Relatively few property owners Strong municipal fiscal position Political support and municipal capacity Projected revenues of sufficient scale to justify transaction costs Availability of other funding sources and debt financing |

Questions & Answers

Do you know? Value Capture Techniques

Thank You

Lindsey Svendsen & Jim Thorne

Co-leads:

Stefan Natzke: Stefan.Natzke@dot.gov

Thay Biship: Thay.Bishop@dot.gov