Value Capture: Capitalizing on the Value Created by Transportation - Presentation

October 18, 2018

Presenters

- Stefan Natzke, Team Leader, National Systems & Economic Development FHWA Office of Planning, Environment, and Realty

- Ben Hawkinson, Operations Research Analyst, FHWA Office of Transportation Policy Studies

- Catherine M. Owens, LEED AP, PE, Director of Program Management, Atlanta BeltLine, Inc

- John Duel, Realty Specialist, FHWA Office of Real Estate

Agenda

- What is the EDC-5 Value Capture initiative?

- Why is Value Capture needed?

- Value Capture Overview and Benefits

- Project Examples

- FHWA Role in Value Capture Initiative

- Q&A/Do you know?

What is the EDC-5 Value Capture initiative?

EDC 5 Value Capture Initiative

Promotes the use of value capture mechanisms as part of a mixed funding and innovative finance strategy to accelerate project delivery and provide equitable funding for sustainable transportation investments.

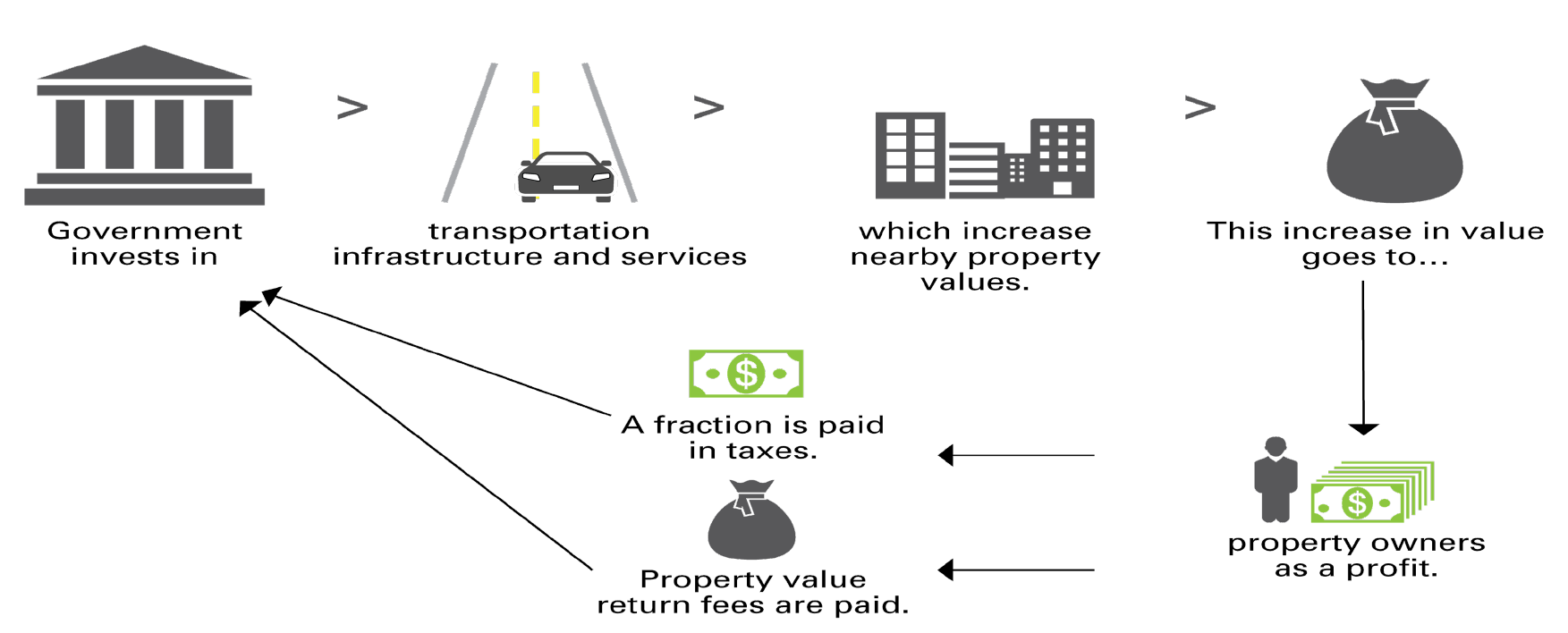

What is Value Capture?

- Government invests in infrastructure and services which increase nearby property values.

- This increase in value goes to property owners as a profit.

- A fraction is paid in taxes.

- Property value return fees are paid.

Example: Value Capture Funds Corridor Improvement

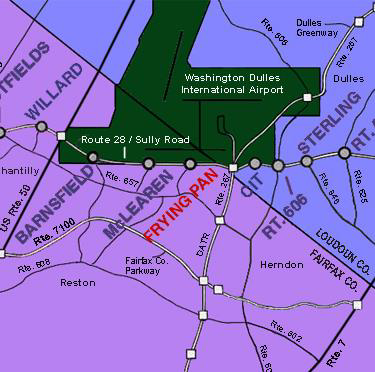

Virginia Route 28 Transportation Improvement District

- District formed in 1987 jointly by Loudon and Fairfax Counties

- Maximum tax rate of $0.20 per $100 of assessed value

- Raises ~ $23 million in revenue

- $138 million, 14-mile widening from two to six lanes completed in 1991

- District and State share project costs 75/25

Virginia Route 28 Transportation Improvement District project profile

Why is Value Capture Needed?

The Case for Value Capture

- Federal funding availability

- Local project funding

- Untapped revenue source

- Equitable

- Sustainable economic development

FHWA Roles in Value Capture Tools

- FHWA seeks to improve consideration of all revenue and finance options in the project development process

- FHWA seeks to build capacity for consideration and implementation of revenue options/value capture tools

- USDOT's Build America Bureau offers innovative financing through the TIFIA and RRIF programs that can leverage value capture monies

Value Capture Overview & Benefits

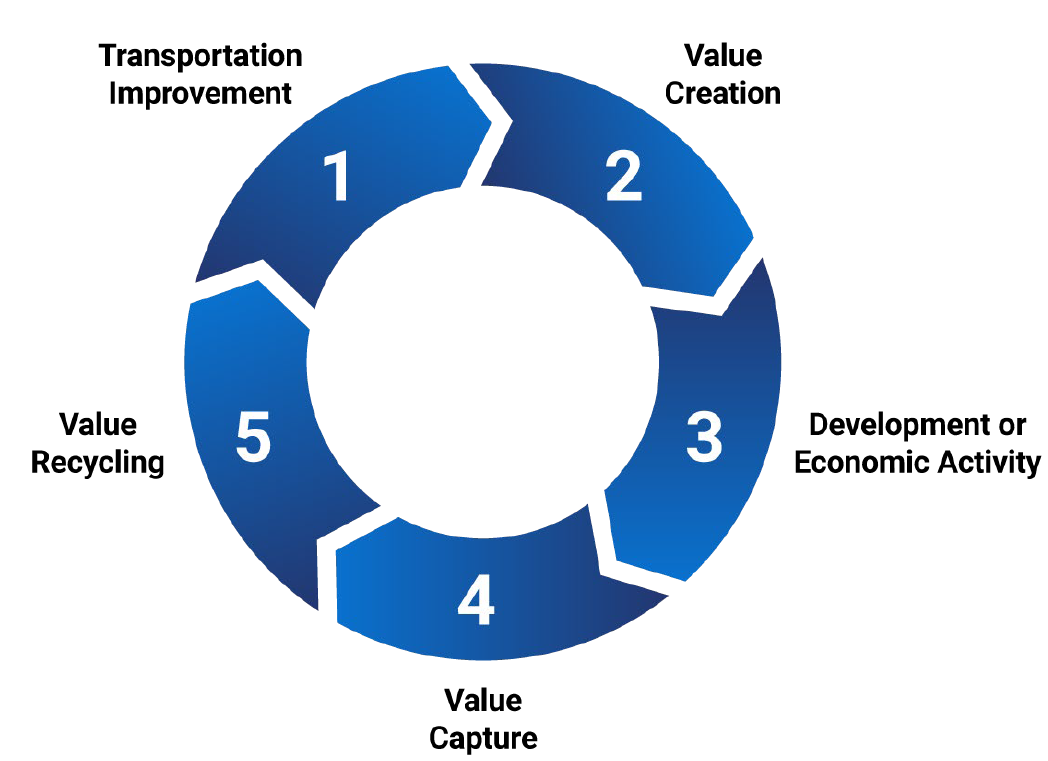

What is Value Capture?

- Transportation Improvement

- Value Creation

- Development or Economic Activity

- Value Capture

- Value Recycling

Value Capture Beneficiaries

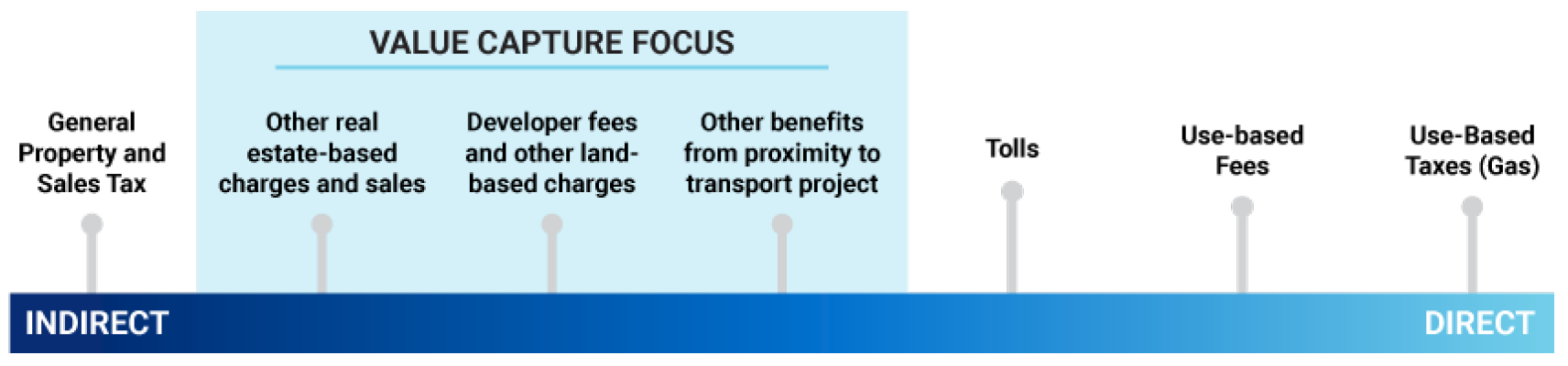

Text of Value Capture Focus chart

- General Property and Sales Tax

- Other real estate-based charges and sales (Value Capture Focus)

- Developer fees and other land-based charges (Value Capture Focus)

- Other benefits from proximity to transport project (Value Capture Focus)

- Tolls

- Use-based Fees

- Use-Based Taxes (Gas)

Potential Benefits of Value Capture

Provide gap funding sources for highway improvements & infrastructure life cycle costs

- Facilitate access to ongoing revenue stream to Local Public Agencies

- Accelerate project delivery & safety Improvements

- Induce private investment

Value Capture Mechanisms

How is the Value Captured?

- Developer Contributions

- Impact fees

- Negotiate Exaction and Ongoing developer contributions

- Transportation Utility Fees (TUFs)

- Special Tax and Fee Approaches

- Special assessment district

- Sales tax district

- Business improvement district

- Land value tax

- Incremental Growth Approaches

- Tax increment financing (TIF)

- Transportation reinvestment zones (TRZ)

- Joint Development

- ROW Use Agreements

- Concessions, leasing

- Airspace (above or below)

- Parking

- Fiber-optic leasing

- Pipelines or other utilities not addressed by Utility Accommodation Policies or State Law

- ROW Use Agreements

- Advertising Rights and Sales

- Naming rights

- Other

- Transportation Corporation (TC)

- Section 63-20 Corporation

Challenges

- Every jurisdiction is different

- Must target projects with economic benefits for leveraging

- Stakeholder involvement process can be lengthy, due to:

- Coordination between multiple jurisdictions

- Discussions with private developers and property owners

- Establishing project location and design

- Considering legal issues

- Securing political support

- Perceived as another tax

- Requires accuracy of activity and real estate projections:

- If I build it, will they come?

- If I build it, will developers build on nearby property?

- Identify the magnitude benefits & boundary of value capture technique

Ingredients of a Successful Value Capture Project

- Identified in long-term planning/capital improvement program - primarily local

- Incorporated early in the project development process

- Right technique selected for the right project

- Integrated funding and finance strategy

- Community support generated through effective outreach

Value Capture Summary

Value Capture is...

- A set of powerful funding tools that can help address funding gaps. (USDOT supports Value Capture)

- Can be part of the mix of funding sources for transportation improvement solutions

- Can accelerate project delivery, save time and money when done properly

Case Studies

The Atlanta BeltLine

FHWA EDC-5 Summit

18 Oct 2018

@atlantabeltline

@atlantabeltline

@atlantabeltline

@atlantabeltline

@atlantabeltline

@atlantabeltline

Organizational Structure

Text of Organizational Structure flow chart

- Project Sponsors - Fulton County, Resurgence Atlanta, Atlanta Public Schools

- Public Redevelopment Authority - Invest Atlanta

- Private Non-profile Redevelopment Corporation (Implementation Agent) - Atlanta BeltLine

- Private Non-profit 501c3 Partner - Atlanta BeltLine Partnership

- Private Non-profile Redevelopment Corporation (Implementation Agent) - Atlanta BeltLine

- Public Redevelopment Authority - Invest Atlanta

Strategic Partnerships

- Introduction and Background

- The Texas TRZ

- Evolution of the TRZ Legal Framework

- The TRZ Implementation Process

- Opportunities and Limitations

- Active Texas TRZs

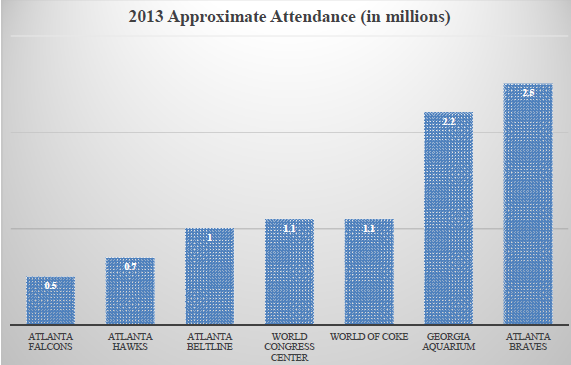

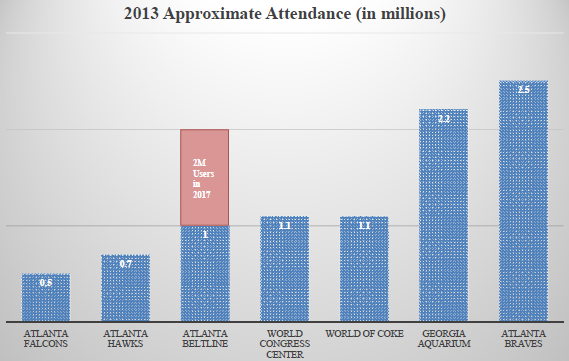

Bringing 45 neighborhoods Together

- 22 miles of transit

- 46 miles of streetscapes and complete streets

- 33 miles of urban trails

- 1,300 acres of new greenspace

- 700 acres of renovated greenspace

- 1,100 acres of environmental clean-up

- $10-20B in economic development

- 48,000 construction jobs

- 30,000 permanent jobs

- 28,000 new housing units

- 5,600 affordable units

- Corridor-wide public art, historic preservation, and arboretum

- Framework for a multi-use and transit corridor in the heart of the region

- Links many of Atlanta's historical landmarks and cultural destinations

- Connects four historic rail corridors

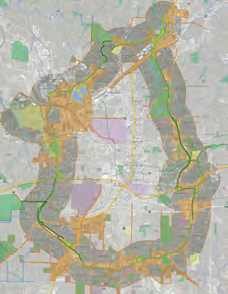

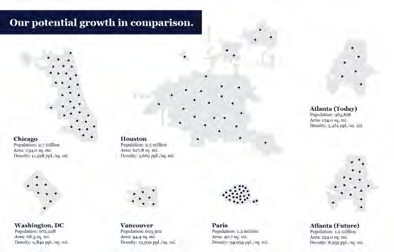

The Atlanta BeltLine TAD

- Area: 6,500 acres

- Part of Total Planning area:15,000 acres

- 22% of the City of Atlanta population is within the planning area

- 19% of the City's land is within the planning area

Proposed Streetcar System

- Planning Area overlaps with Streetcar System Plan

- Transit has been at the heart of the Atlanta BeltLine from the start

- SSP focused on the Atlanta BeltLine and connectivity with MARTA and the City's core

- Policy framework for 50+ miles of streetcar service

- Adopted by City Council in Dec 2015

Atlanta Streetcar NEPA Clearance

- Gateway to Federal Funds

- 16+ Miles so far

- 2018-2020, clear remaining 50 mi

Why?

1.2 million

If we assume the region will grow to 8 million people and 15% of those people want to live in the City of Atlanta, then the population of the city will grow to 1.2 million.

What are we Working Towards?

How it's Gotten Done, so far...

Investment to Date

Public & Private investment to date:

$500 million

(Over $53m in private donations )

Development to Date

Private development is following Public & Private investment:

- Over 130 projects complete or underway within Planning Area*

- More than 7 million SF of new commercial space completed

- Over 8 to 1 return on investment through 2017

* Projects larger than 10 dwelling units or 10,000 square feet

More than $4.1 billion in development to date

Economic Development: Priority Activities

KEY ACTIVITIES

- Job Attraction (permanent & construction)

- Private Investment Attraction

- Product Development

- Supporting Good Development

- Establishing Viable Commercial and Light Industrial Product

- Corridor Activation/New Revenue

- Existing Business Engagement

- Technology Innovation

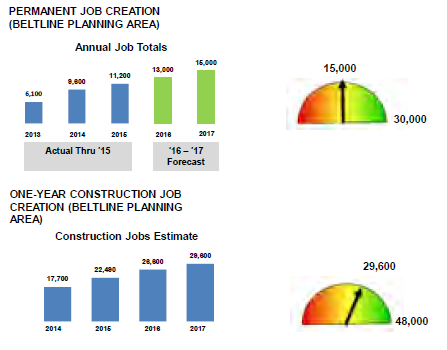

Job Creation

CONTEXT

Actual jobs through 2015 pending Census Data Update for '16 & '17

2016 - 2017 conservative forecast considers (full Ponce City Market Activation, Piedmont Hospital growth, SW Atlanta Film and Digital Media activity)

Construction activity has been consistently trending up

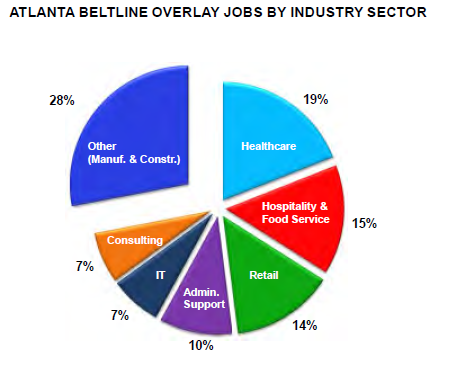

Job Breakout by Sector

Context

- Healthcare, Hospitality & Food Services are leading job types but overall job types are diverse

- The "Other" category includes Manufacturing, Real Estate, Construction and Logistics

- Digital Media & Film in SW are emerging & a number of technology firms are located in the NE and SE

- Leading job nodes are Piedmont Hospital, Armour Yards, Ponce City Market & West Midtown

- 28% Other (Manuf. & Constr.)

- 19% Healthcare

- 15% Hospitality & Food Service

- 14% Retail

- 10% Admin. Support

- 7% IT

- 7% Consulting

Equity & Affordability

NEW FUNDING STRATEGY

- $18+ million commitment of TAD revenue over next three years:

- 20% of available TAD increment

- $11.6M from 2016 bond issue

- 75% of any mid-year increment

PROGRAMS

- Affordable Housing Trust Fund incentives

- Acquisition and predevelopment

PARTNERSHIPS (in addition to Invest Atlanta and City of Atlanta)

- Atlanta Housing Authority: Englewood partnership

- Atlanta BeltLine Partnership: Homeowner education workshops

Trails & Parks

Eastside Trail

Fourth Ward Park

Westside Trail

The Washington DC I-395 Capitol Crossing Project

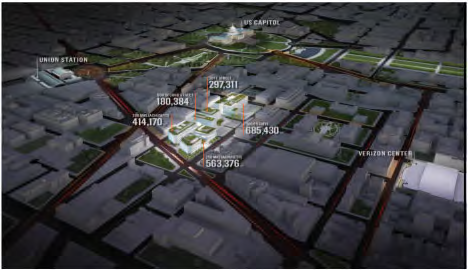

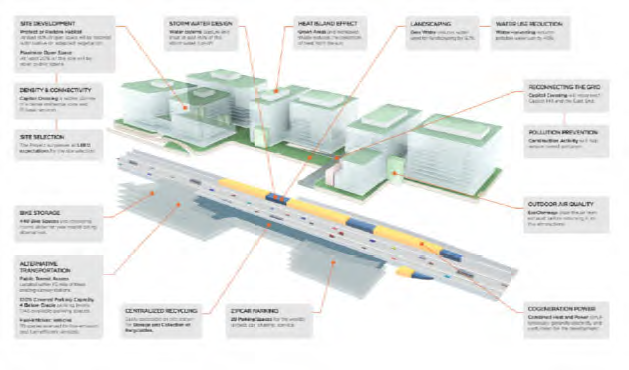

Background: Washington D.C. I-395 Capitol Crossing

- The construction of the I-395 in the late 1960's created divisions between the Capitol Hill and East End Districts.

- The idea of decking over the Interstate 395 dates to 1989

- The area is one of the largest areas in development in downtown Washington, DC

- In 2012, the District awarded the right to develop the property to Property Group Partners (PGP)

- The largest air rights project ever undertaken in Washington D.C.

- The Capitol Crossing project broke ground in May 2015. The entire project is expected to be completed by 2021

- $1.3 billion highway, local, street, and real estate development project in Washington, D.C.

- Located above I-395 between E Street and Massachusetts Ave and 2nd and 3rd Streets NW

- Five mixed-use buildings with 2.2 million square feet

- Seven-acre decked development site above I-395

Development Detail

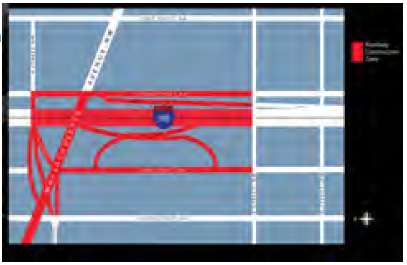

3rd Street Tunnel Project (Transportation portion of the Capitol Crossing Project)

$270 million in transportation improvements/costs paid by the private sector real estate developer

- Restoration of the original street grid (F and G Streets, NW)

- Enhanced vehicular, pedestrian and bicycle connections around and across I-395

- Utility relocations

- Reconfiguration of I- 395 ramps at 2nd and 3rd Streets, NW

From the Facebook page of Capitol Crossing

https://www.facebook.com/search/top/?q=Capitol%20Crossing%20construction

Capitol Crossing Value Capture

Property Group Partners (PGP) acquired the air rights from the District of Columbia in 2012 for a fee of up to $120 million

The completed project will generate an estimated $40 million in annual new property tax revenue

PGP will fund the $270 million Third Street Tunnel Project

- Employment

- 4,000 construction jobs

- 8,000 permanent jobs

Sustainability

Examples of Value Capture used in Highway System

Right of Way Use Agreements, Joint Development

- I-395 Air Rights Development/Capital Crossing

- Massachusetts Turnpike Air Right Parcels 23 and 15 (I-90)

Special Assessment

- Virginia Route 28 Transportation Improvement District

- Foothill/Eastern and San Joaquin, California Toll Roads

- City of Fort Worth Transportation Impact Fee

Transportation Utility Fee

- Hillsboro, Oregon uses a Transportation Utility Fee to pay for street repairs

Developer Impact/Traffic Mitigation Fees

- Idaho Eagle Road SH 55 and Fairview Ave Intersection

- State Route 4 Bypass, Eastern Contra Costa County, CA

Resources

- NCHRP Synthesis 459, Using the Economic Value Created by Transportation to Fund Transportation, 2014.

http://www.trb.org/Publications/Blurbs/170750.aspx - TCRP Research Report 190, Guide to Value Capture Financing for Public Transportation Projects, 2016.

http://www.trb.org/Main/Blurbs/175203.aspx - NCHRP 19-13, Guidance for Use of Value Capture to Fund Transportation, TBD.

http://apps.trb.org/cmsfeed/TRBNetProjectDisplay.asp?ProjectID=4058 - OIPD project profiles link

https://www.fhwa.dot.gov/ipd/project_profiles/ - Council of Development Finance, TIF State-by-State Map

https://www.cdfa.net/cdfa/tifmap.nsf/index.html - Innovative Finance Support Value Capture Resources.

https://www.fhwa.dot.gov/ipd/value_capture/

Capitol Crossing - Questons?

Federal Roles

FHWA Roles in Value Capture

- Build capacity among partners

- Assemble VC Implementation Team

- Interact with key stakeholders

- Develop VC Implementation manual

- Develop clearinghouse for VC resources

- Conduct various peer exchanges, training, and technical assistance activities

- Funding

Value Capture Implementation Team

- Co-Leads

- Thay Bishop, FHWA Office of Innovative Program Delivery

- Stefan Natzke, FHWA Office of Planning, Environment, and Realty

- Members

- Jennifer Ahlin, Virginia Department of Transportation

- Janine Ashe, FHWA District of Columbia Division

- John Duel, FHWA Office of Planning, Environment, and Realty

- Ben Hawkinson, FHWA Transportation Policy Studies

- Kathleen Hulbert, FHWA Infrastructure Office

- Chip Millard, FHWA Freight Management & Operation

- Diane Mobley, FHWA Chief Counsel Office

- Kevin Moody, FHWA Resource Center

- Ben Orsbon, South Dakota Department of Transportation

- Jill Stark, FHWA Office of Planning, Environment, and Realty

- Lindsey Svendsen, FHWA Office of Planning, Environment, and Realty

- Jim Thorne, FHWA Office of Planning, Environment, and Realty

- Marshall Wainright, FHWA Resource Center

VCIT Focus Areas

- Communication - Developing the tools to help FHWA staff and others promote Value Capture to local public agencies (Value Capture Implementation Manual)

- Technical assistance - Providing technical assistance to local public agencies interested in pursuing Value Capture (Peer Program)

- Clearing House (website) - Identification of best practices and lessons learned and promoting further discussion on innovative funding options for local public agencies, lessons learned from past and current efforts, etc.

Key Stakeholders

- State Department of Transportations

- Federal Agencies (HUD, USDA, FTA)

- Metropolitan Planning Organizations (MPOs, RTPOs)

- Local & Tribal Governments

- Transportation Providers (Transit Operators)

- Business Communities

- Developers

- Community residents

Value Capture Activities

- Webinars

- Workshops

- Peer Exchanges

- Case Studies

- Sponsorships (local, regional, & national events)

- Technical Assistance

- Website (Clearinghouse)

Value Capture Clearinghouse

- Currently under development

- Value Capture Manual "How to" implement value capture under development

- Clearinghouse for best practices/lessons learned

Questions & Answers

Do you know? Value Capture Techniques

Thank You

Stefan Natzke: Stefan.Natzke@dot.gov

Thay Bishop: Thay.Bishop@dot.gov