Value Capture: Capitalizing on the Value Created by Transportation - Presentation

October 29, 2018

Presenters

- Jill Stark, Office of Planning, FHWA

- Chip Millard, Office of Freight Management and Operations, FHWA

- Rafael Aldrete, Senior Research Scientist, Texas A&M Transportation Institute. Texas Transportation Reinvestment Zones

- Daniel D'Angelo (facilitator), Applied Research Associates, Principal Civil Engineer

Agenda

- What is the EDC-5 Value Capture initiative?

- Why is Value Capture needed?

- Value Capture Overview and Benefits

- FHWA Role

- Case Study

- Q&A/Do you know?

What is the EDC-5 Value Capture initiative?

EDC 5 Value Capture Initiative

Promotes the use of value capture mechanisms as part of a mixed funding and innovative finance strategy to accelerate project delivery and provide equitable funding for sustainable transportation investments.

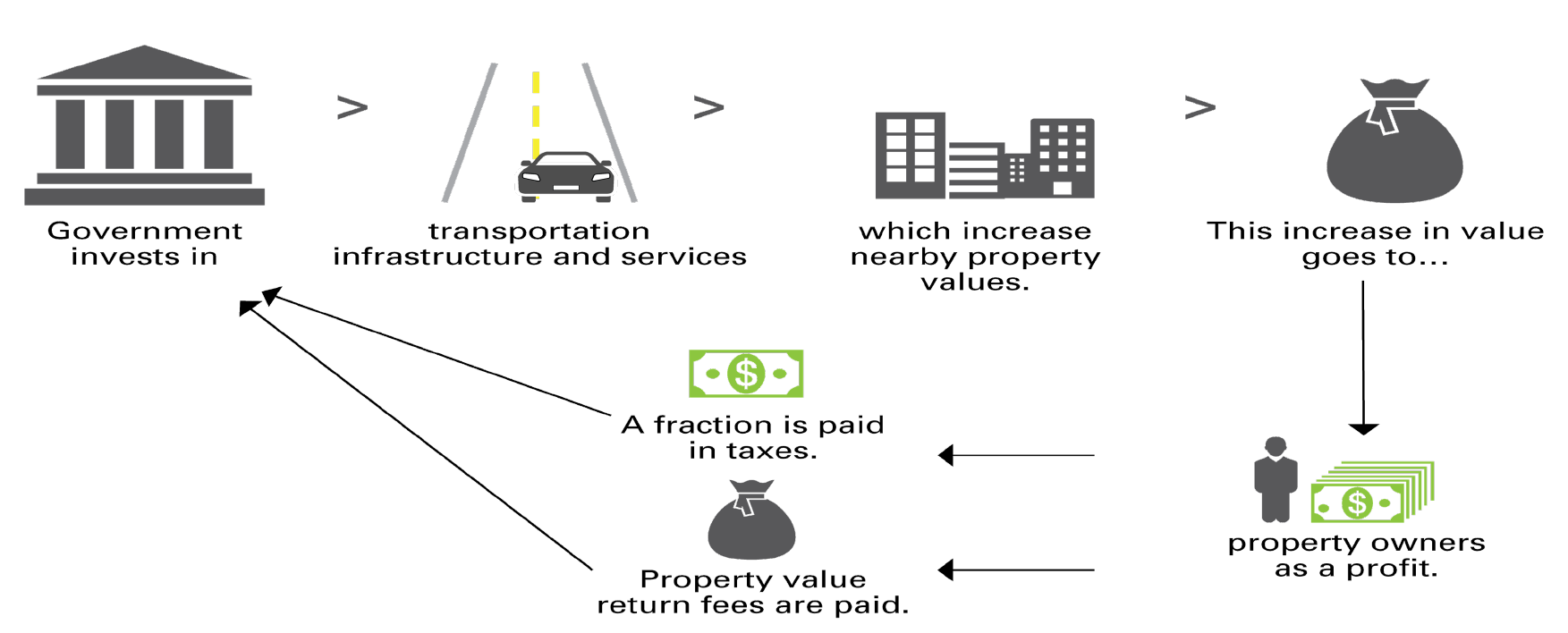

What is Value Capture?

- Government invests in infrastructure and services which increase nearby property values.

- This increase in value goes to property owners as a profit.

- A fraction is paid in taxes.

- Property value return fees are paid.

Example: Value Capture Funds Corridor Improvement

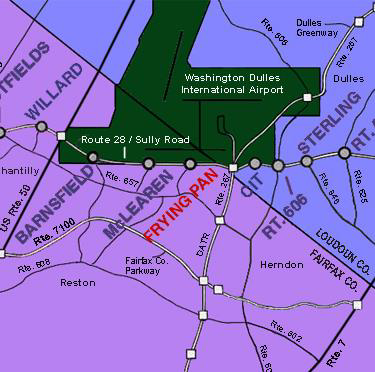

Virginia Route 28 Transportation Improvement District

- District formed in 1987 jointly by Loudon and Fairfax Counties

- Maximum tax rate of $0.20 per $100 of assessed value

- Raises ~ $23 million in revenue

- $138 million, 14-mile widening from two to six lanes completed in 1991

- District and State share project costs 75/25

Virginia Route 28 Transportation Improvement District project profile

Why is Value Capture Needed?

The Case for Value Capture

- Federal funding availability

- Local project funding

- Untapped revenue source

- Equitable

- Sustainable economic development

FHWA Roles in Value Capture Tools

- FHWA seeks to improve consideration of all revenue and finance options in the project development process

- FHWA seeks to build capacity for consideration and implementation of revenue options/value capture tools

- USDOT's Build America Bureau offers innovative financing through the TIFIA and RRIF programs that can leverage value capture monies

Value Capture Overview & Benefits

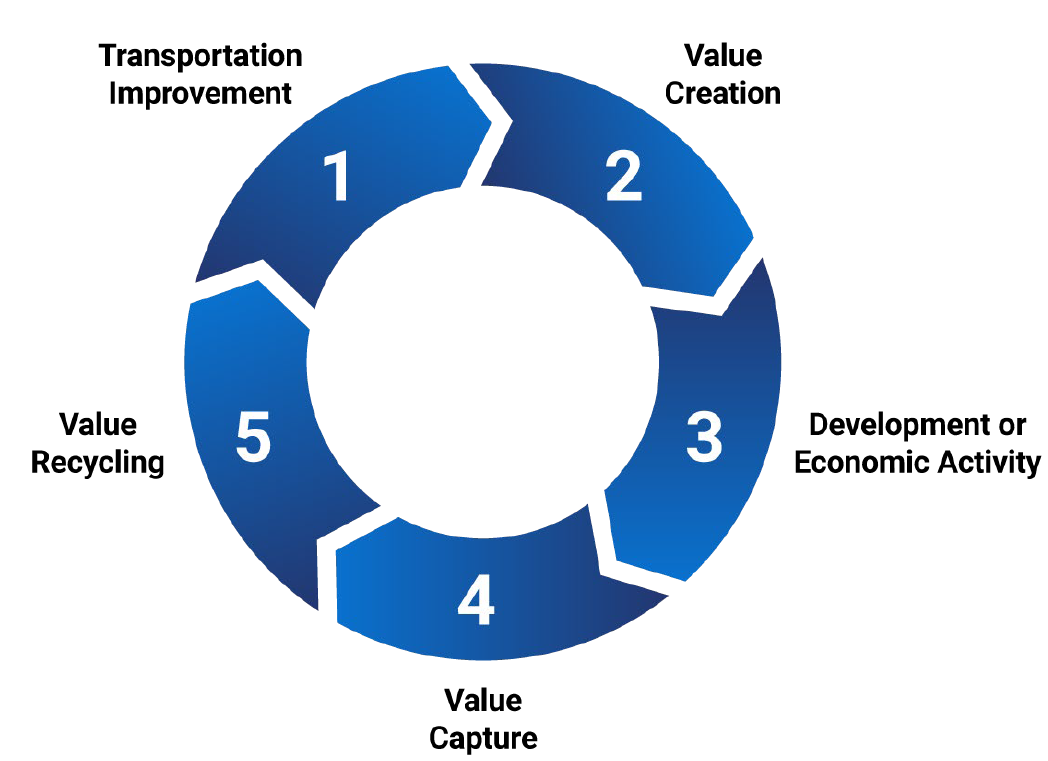

What is Value Capture?

- Transportation Improvement

- Value Creation

- Development or Economic Activity

- Value Capture

- Value Recycling

Value Capture Beneficiaries

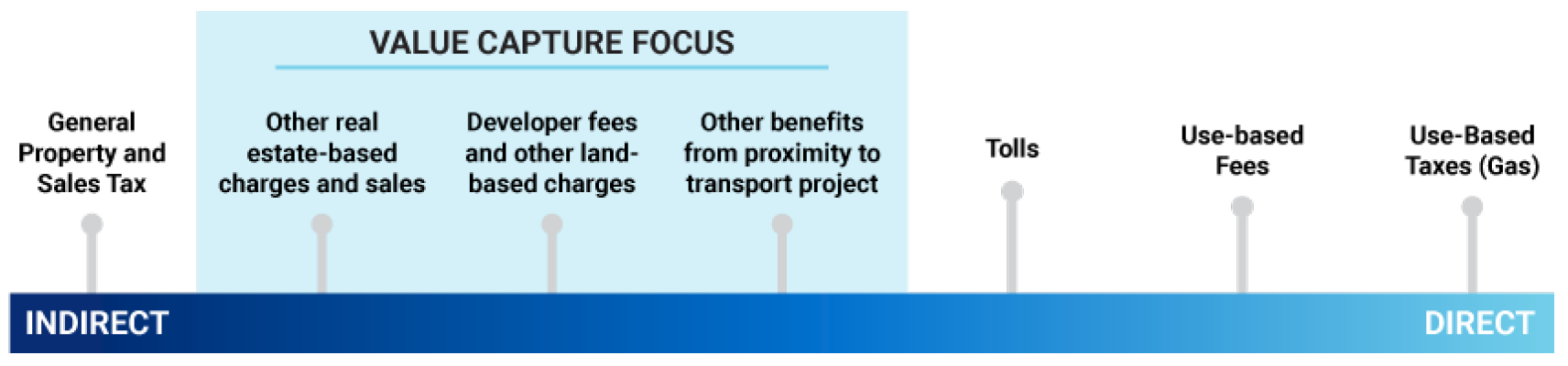

Text of Value Capture Focus chart

- General Property and Sales Tax

- Other real estate-based charges and sales (Value Capture Focus)

- Developer fees and other land-based charges (Value Capture Focus)

- Other benefits from proximity to transport project (Value Capture Focus)

- Tolls

- Use-based Fees

- Use-Based Taxes (Gas)

Potential Benefits of Value Capture

Provide gap funding sources for highway improvements & infrastructure life cycle costs

- Facilitate access to ongoing revenue stream to Local Public Agencies

- Accelerate project delivery & safety Improvements

- Induce private investment

Value Capture Techniques

How is the Value Captured?

- Developer Contributions

- Impact fees

- Negotiate Exaction and Ongoing developer contributions

- Transportation Utility Fees (TUFs)

- Special Tax and Fee Approaches

- Special assessment district

- Sales tax district

- Business improvement district

- Land value tax

- Incremental Growth Approaches

- Tax increment financing (TIF)

- Transportation reinvestment zones (TRZ)

- Joint Development

- ROW Use Agreements

- Concessions, leasing

- Airspace (above or below)

- Parking

- Fiber-optic leasing

- Pipelines or other utilities not addressed by Utility Accommodation Policies or State Law

- ROW Use Agreements

- Advertising Rights and Sales

- Naming rights

- Other

- Transportation Corporation (TC)

- Section 63-20 Corporation

Challenges

- Every jurisdiction is different

- Must target projects with economic benefits for leveraging

- Stakeholder involvement process can be lengthy, due to:

- Coordination between multiple jurisdictions

- Discussions with private developers and property owners

- Establishing project location and design

- Considering legal issues

- Securing political support

- Perceived as another tax

- Requires accuracy of activity and real estate projections:

- If I build it, will they come?

- If I build it, will developers build on nearby property?

- Identify the magnitude benefits & boundary of value capture technique

Ingredients of a Successful Value Capture Project

- Identified in long-term planning/capital improvement program - primarily local

- Incorporated early in the project development process

- Right technique selected for the right project

- Integrated funding and finance strategy

- Community support generated through effective outreach

Value Capture Summary

Value Capture is...

- A set of powerful funding tools that can help address funding gaps. (USDOT supports Value Capture)

- Can be part of the mix of funding sources for transportation improvement solutions

- Can accelerate project delivery, save time and money when done properly

Federal Role

FHWA Roles in Value Capture

- Build capacity among partners

- Assemble VC Implementation Team

- Interact with key stakeholders

- Develop VC Implementation manual

- Develop clearinghouse for VC resources

- Conduct various peer exchanges, training, and technical assistance activities

- Funding

Value Capture Implementation Team

- Co-Leads

- Thay Bishop, FHWA Office of Innovative Program Delivery

- Stefan Natzke, FHWA Office of Planning, Environment, and Realty

- Members

- Jennifer Ahlin, Virginia Department of Transportation

- Janine Ashe, FHWA District of Columbia Division

- John Duel, FHWA Office of Planning, Environment, and Realty

- Ben Hawkinson, FHWA Transportation Policy Studies

- Kathleen Hulbert, FHWA Infrastructure Office

- Chip Millard, FHWA Freight Management & Operation

- Diane Mobley, FHWA Chief Counsel Office

- Kevin Moody, FHWA Resource Center

- Ben Orsbon, South Dakota Department of Transportation

- Jill Stark, FHWA Office of Planning, Environment, and Realty

- Lindsey Svendsen, FHWA Office of Planning, Environment, and Realty

- Jim Thorne, FHWA Office of Planning, Environment, and Realty

- Marshall Wainright, FHWA Resource Center

VCIT Focus Areas

- Communication

- Developing the tools to help FHWA staff and others promote Value Capture to local public agencies (Value Capture Implementation Manual)

- Technical assistance

- Providing technical assistance to local public agencies interested in pursuing Value Capture (Peer Program)

- Clearing House

- Identification of best practices and lessons learned and promoting further discussion on innovative funding options for local public agencies, lessons learned from past and current efforts, etc. Clearing House website.

Key Stakeholders

- State Department of Transportations

- Federal Agencies (HUD, USDA, FTA)

- Metropolitan Planning Organizations (MPOs, RTPOs)

- Local & Tribal Governments

- Transportation Providers (Transit Operators)

- Business Communities

- Developers

- Community residents

Value Capture Activities

- Webinars

- Workshops

- Peer Exchanges

- Case Studies

- Sponsorships (local, regional, & national events)

- Technical Assistance

- Website (Clearinghouse)

Value Capture Clearinghouse

- Currently under development

- Value Capture Manual "How to" implement value capture under development

- Clearinghouse for best practices/lessons learned

Case Study - Texas Transportation Reinvestment Zones - Concepts & Implementation

Federal Highway Administration

Every Day Counts Regional Summit

St. Louis, Missouri

October 29-30, 2018

Rafael Aldrete, Texas A&M Transportation Institute

Outline

- Introduction and Background

- The Texas TRZ

- Evolution of the TRZ Legal Framework

- The TRZ Implementation Process

- Opportunities and Limitations

- Active Texas TRZs

Introduction

- Funding Transportation Needs

- Creative Thinking

- Doing more with less

- Alternative funding sources

- Texas Legislature SB 1266 (2007) Created TRZs

- 14 Local TRZs Since 2007

Background

| Mechanism | Definition | Applicable Purpose | Examples (State) |

|---|---|---|---|

| Impact Fees (IF) |

|

Cost recovery |

|

| Special Assessment District (SAD) |

|

Capture of project expansion benefits |

|

| Sales Tax District (STD) |

|

Capture of project expansion benefits |

|

| Negotiated Exaction (NE) |

|

Capturing opportunity for value creation and cost recovery |

|

| Joint Development (JD or P3) |

|

Capturing opportunity for value creation and cost sharing and revenue sharing with private sector | Massachusetts Turnpike (MA) and Washington Metropolitan Transit Authority (VA) |

| Air Rights (AR) |

|

Capturing opportunity for value creation and cost sharing and revenue sharing with private sector | Massachusetts Turnpike (MA) Interstate 5 (WA) |

| Land Value Tax (LVT) |

|

Capture of project expansion benefits | Pennsylvania counties (PA) |

| Transportation utility fees (TUFs) |

|

Cost recovery: operating and maintenance costs | Oregon TUF for pavement maintenance (OR) |

| Tax increment financing (TIF) |

|

Capture of project expansion benefits | TRZs (TX) |

Source: Vadali, S. NCHRP Synthesis 459. 2014

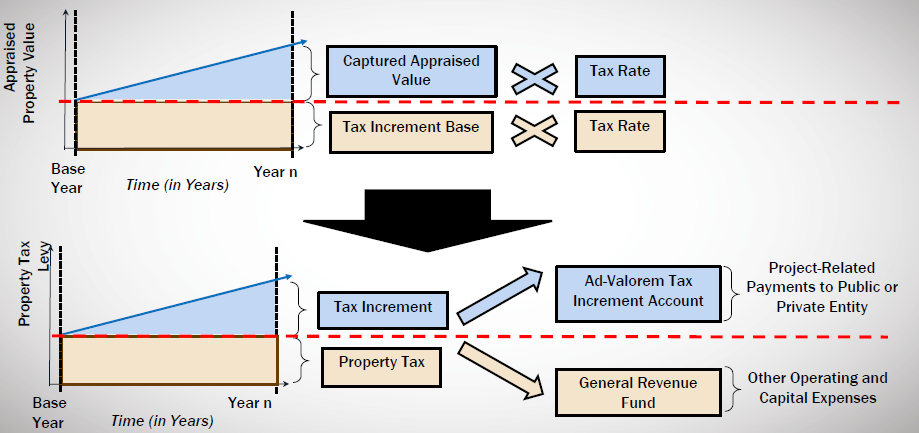

The Texas TRZ - Definition

- Texas TRZs

- Designated contiguous zone around a planned transportation improvement where properties are expected to benefit from the project through land development, value increases

- Legal arrangement to facilitate value capture via the property and sales tax mechanism and allow the local government to use incremental tax revenue as collateral

- Designated contiguous zone around a planned transportation improvement where properties are expected to benefit from the project through land development, value increases

- Texas TRZs are not a new tax

- Tax rates do not change

- Revenue realized only if real property develops / increases in value

- TRZs Expedite Transportation Projects

- Local match contributions

- Multiple funding sources leveraged

- TRZ Legal Framework Has Evolved

- Process / requirements clarified

- Uses / types modified or expanded

- Three TRZ Types

- Municipal

- County

- Port Authority

The Texas TRZ - How it Works

The Texas TRZ - Financing Options

Three Financing Options Available for TRZ Revenue Funds

| Type | Form | Advantage | Disadvantage |

|---|---|---|---|

| Pay-as-you-go |

|

|

|

| Municipal bond financing |

|

|

|

| State Infrastructure Bank (SIB) |

|

|

|

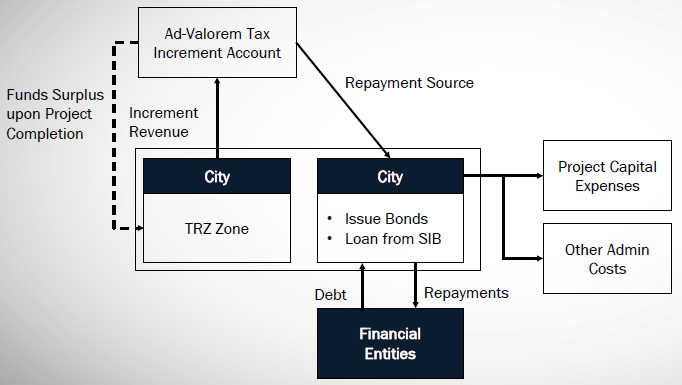

The Texas TRZ - How Funds Flow

Bond and SIB Loan Financing

Start: Public entity borrows money with TRZ revenue as collateral.

Construction: Government starts construction

Operation: Government repays debt using tax increment

Summary of TRZ Funds infographic

- Ad-Valorem Tax Increment Account is the Source of funds

- City - Issues Bonds, Loans from SIB

- City - uses those funds for Project Capital Expenses and Other Admin Costs, also sends repayments to Financial Entities

- City - TRZ pays back increment revenue into the Ad-Volorem Increment Account

- Financial Entities - Repayment income from the City, as well as debt paid back to the City

- Surplus funds upon project completion are given to the City TRZ Zone

- City - Issues Bonds, Loans from SIB

Evolution of the TRZ Legal Framework

| Categories | (SB 1266) | (HB 563) | (SB 1110 HB 2300 & SB 971) | (SB 1305) |

|---|---|---|---|---|

| Project Type |

|

|

|

|

| TRZ Type |

|

|

|

|

| TRZ Management |

|

|

|

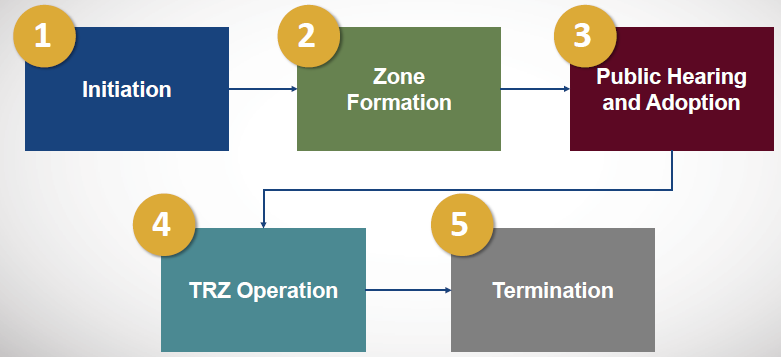

TRZ Implementation Process

Five Steps: Initiation to Termination

- Initiation

- Zone Formation

- Public Hearing and Adoption

- TRZ Operation

- Termination

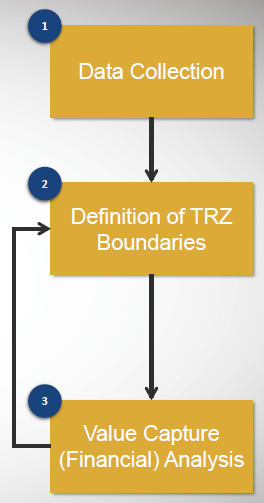

Initiation

- Project Identification and Need

- Specific development/economic benefits from project(s)

- Determine area eligibility/preliminary boundaries

- Conduct preliminary feasibility analysis

- Developing Stakeholder Relations and Champions

Data Collection > Definition of TRZ Boundaries > Value Capture (Financial) Analysis >> return to Definition of TRZ Boundaries step

2. Zone Formation

| Refine | Establish | Provide Notice | Analyze |

|---|---|---|---|

Refine Boundaries, Zones, Parcels

|

Establish Benchmark Year for Tax Increment Collection | Provide 60-day Notice

|

Refine Value Capture Revenue Analysis |

3. Public Hearing and Adoption

| Public Hearing Timing | 30 Days after Hearing |

|---|---|

|

|

4. Operation

| Every Year after TRZ Adoption | Monitoring, Evaluation Become Critical |

|---|---|

|

|

5. Termination

| Dissolution of TRZ | OR | Dissolution of TRZ |

|---|---|---|

Dec. 31 of compliance year with contractual requirement |

Dec. 31 of the 10th year after establishment if not used

|

TRZs: Opportunities

Partnership opportunities (common goal) > Multimodal networks (resulting from project scope) > Easier to operate compared to other finance mechanisms = Opportunities

TRZs: Limitations

SIB: only cost-effective lending Institution > Constitutional restrictions on counties = Limitations

Active TRZs - 14 in Planning or Operation Phase (2017)

| TRZ Name and Location | TRZ Type | Date Established |

|---|---|---|

| City of El Paso TRZ No. 2 | Municipal | December 2010 |

| City of El Paso TRZ No. 3 | Municipal | December 2010 |

| City of El Campo TRZ No. 1 | Municipal | December 2012 |

| Town of Horizon City TRZ No. 1 | Municipal | November 2012 |

| City of Socorro TRZ No. 1 | Municipal | October 2012 |

| City of San Marcos TRZ No. 1 | Municipal | December 2013 |

| Cameron County, TRZ No. 6 | County | December 2015 |

| Hidalgo County TRZ No. 2 | County | December 2011 |

| El Paso County TRZ No. 1 | County | December 2012 |

| Hays County TRZ No. 1 | County | December 2013 |

| Port of Beaumont TRZ No. 1 | Port Authority and Navigation District | December 2013 |

| Port of Arthur TRZ No. 1 | Port Authority and Navigation District | December 2013 |

| Sabine-Neches Navigation District TRZ No.1 |

Port Authority and Navigation District | December 2013 |

| Port of Brownsville TRZ No. 1 | Port Authority and Navigation District | December 2013 |

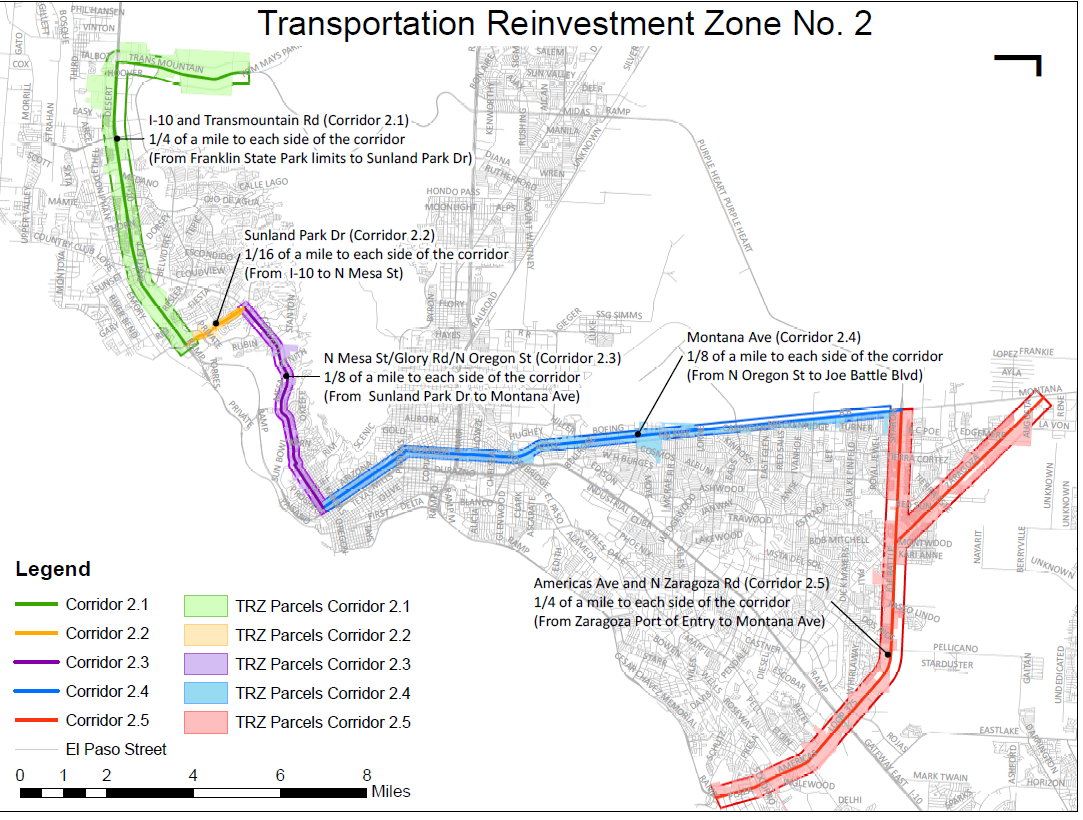

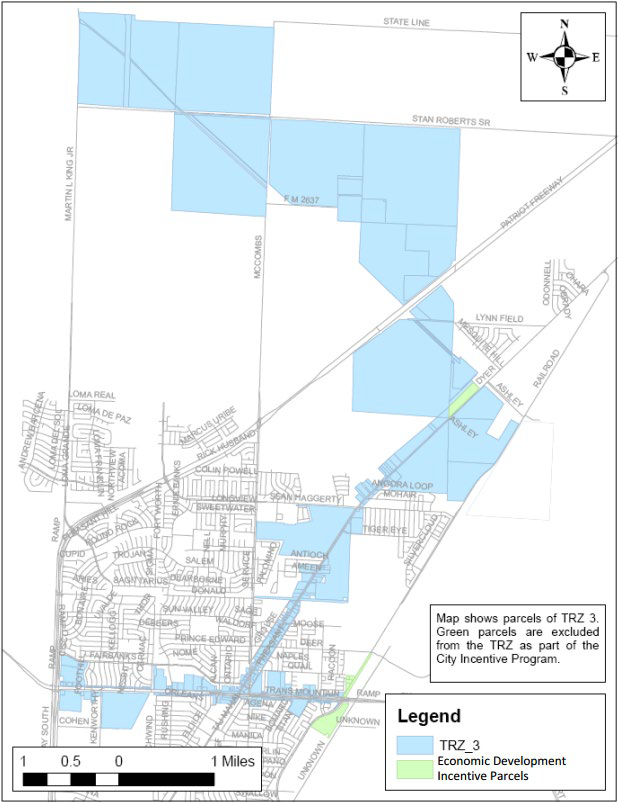

Active Texas TRZs: City of El Paso TRZ

- Comprehensive Mobility Plan 2008 ~ $1 Billion

- TRZ Contribution: $70M (7%)

- TRZ Boundaries Designation:

- 1/16 to 1/4 of a mile, depending on location

- TRZ No.2: 4,434 Acres

- TRZ No.3: 5,513 Acres

- 1/16 to 1/4 of a mile, depending on location

Transportation Reinvestment Zone No. 2

Transportation Reinvestment Zone No. 3

Questions

Rafael Aldrete, Ph.D. Senior Research Scientist

(915) 532-3759 Ext. 14101

r-aldrete@tti.tamu.edu

From the Facebook page of Capitol Crossing

https://www.facebook.com/CapitolCrossingDC/