U.S. Department of Transportation

Federal Highway Administration

1200 New Jersey Avenue, SE

Washington, DC 20590

202-366-4000

Federal Highway Administration Research and Technology

Coordinating, Developing, and Delivering Highway Transportation Innovations

| TECHBRIEF |

| This techbrief is an archived publication and may contain dated technical, contact, and link information |

| Publication Number: FHWA-HRT-17-100 Date: April 2018 |

Publication Number: FHWA-HRT-17-100 Date: April 2018 |

PDF Version (505 KB)

PDF files can be viewed with the Acrobat® Reader®

FHWA Publication Number: FHWA-HRT-17-100

FHWA Contact: Richard Duval, HRDI-20, (202) 493-3365,

richard.duval@dot.gov

This document is a technical summary of the Federal Highway Administration report Alternative Contracting Method Performance in US Highway Construction (DTFH61-13-C-00024).

The findings presented in this TechBrief are based on empirical data from the Federal Highway Administration (FHWA) national study Quantification of Cost, Benefits and Risk Associated with Alternative Contracting Methods and Accelerated Performance Specifications.(1) The study includes documented lessons learned associated with alternative contracting methods construction manager/general contractor (CM/GC) and design-build (D-B). D-B is broken down into D-B/low bid (D-B/LB) and D-B/best value (D-B/BV), the latter being projects procured using selection factors in addition to cost. Additionally, the study includes lessons learned associated with the use of alternative technical concepts (ATCs), which are defined by the National Cooperative Highway Research Program (NCHRP) Synthesis 455 as “a request by a proposer to modify a contract requirement, specifically for that proposer’s use in gaining competitive benefit during the bidding or proposal process.”(2)

The FHWA national study collected a first-of-a-kind dataset from 291 completed highway projects. The data currently form the largest empirical database of project information exclusive to highway construction. The findings provide guidance for State departments of transportation (DOTs) to assist in determining when to use alternative contracting methods to maximize project objectives relating to cost, schedule, and intensity performance metrics. Intensity is a critical metric of project performance because projects with a greater intensity can have a shorter impact on the traveling public. This TechBrief addresses the following questions:

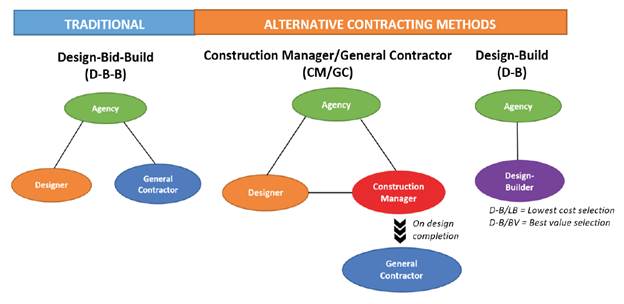

Contracting methods create an environment for successful project delivery. There are three primary contracting methods for federally funded highways: design-bid-build (D-B-B), D-B, and CM/GC. The vast majority of the U.S. highway system was built with the D-B-B delivery method. The use of D-B delivery began in the 1990s; CM/GC delivery began after 2005.(3) By the end of 2014, the number of State DOTs using D-B had grown to 35 and the number using CM/GC to 17.(3) Potential benefits of the two alternative contracting methods, D-B and CM/GC, include saving project costs, lowering operational costs and/or project lifecycle costs, improving constructability, enhancing innovation, reducing risk, expediting project delivery, and shortening construction schedules. Notwithstanding these potential benefits, the two alternative contracting methods can create challenges for both agencies and industry.

Figure 1 provides a graphic depiction of the project delivery methods explored in this study, which are defined as follows:

To lend objectivity to this study, alternative contracting method projects were randomly selected from agencies actively engaging in D-B and/or CM/GC methods. Corresponding D-B-B projects were then selected according to set criteria; ideally, the contract signing/award date and the award cost of the D-B-B projects were within plus or minus 2 years and plus or minus 25 percent, respectively, as compared to D-B or CM/GC projects. Attempts were also made to have projects that were similar in scope and types of work where possible. Despite this rigorous approach to data collection, limitations existed in the data because there were large D-B and CM/GC projects for which no comparable D-B-B projects were available from the respective agencies.

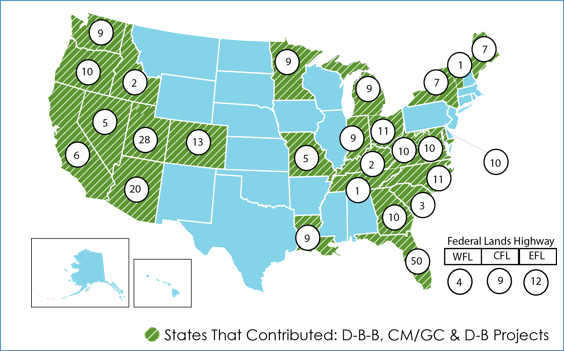

The research team ultimately collected valid data from 291 completed projects. Figure 2 shows the distribution of data collected throughout the United States. The research team achieved a diverse set of data from all regions of the country. Florida contributed the most projects, coinciding with their long-term use of alternative contracting methods. Utah, Arizona, Colorado, Oregon, and Maine all contributed D-B-B, CM/GC, and D-B projects.

This TechBrief begins with a discussion of the population characteristics in terms of the proportions of the project contracting methods, complexity, risk, procurement methods, ATCs, and payment methods. It then describes costs in terms of overall project size and the application of alternative contracting methods on small projects. A discussion of overall project duration and the timing of cost certainty and project intensity follows. The TechBrief concludes with a discussion of how the traditional and alternative contracting methods relate to cost and schedule growth.

Data collection for this study took almost 18 months, and data validation lasted an additional 6 months. The research team is indebted to the agency personnel for their generous time and thoughtful completion of the project questionnaires. As shown throughout the results and discussion, some project representatives were unable to report certain data, and therefore not all data points were available from every project. The team reported the maximum number of data points available, excluding extreme outliers where applicable, for the various variables/metrics as noted in each table and figure (e.g., procurement). Consequently, the reader should expect some variance in the number of projects between analyses of these variables/metrics.

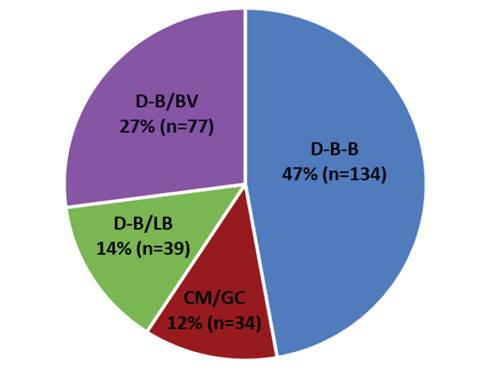

D-B-B projects comprise the largest proportion of the study data (47 percent). CM/GC projects make up the smallest proportion (12 percent)—CM/GC being the newest contracting method—with only 14 agencies stating that they were working on CM/GC projects at the time of this study. Another reason for the low number of CM/GC was that many agencies were still working on their first projects during data collection, and the study required that only completed projects qualified for analysis. Many D-B projects were available because agencies have been using this method for a long time. This large number of D-B projects allows for a comparison of D-B/LB and D-B/BV, which comprise 14 percent and 27 percent of the dataset, respectively. Figure 3 displays the proportions of projects by contracting methods.

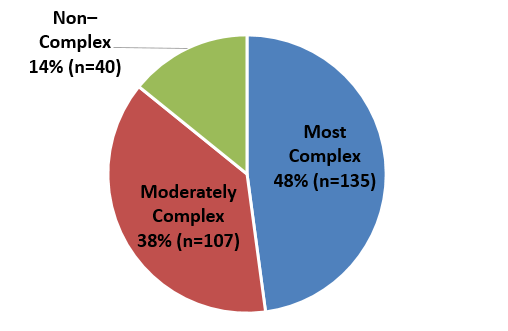

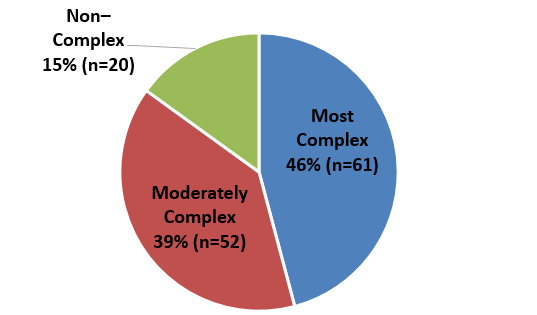

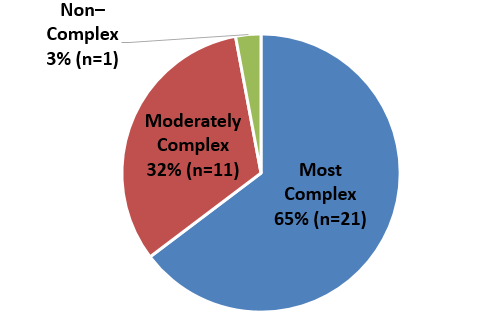

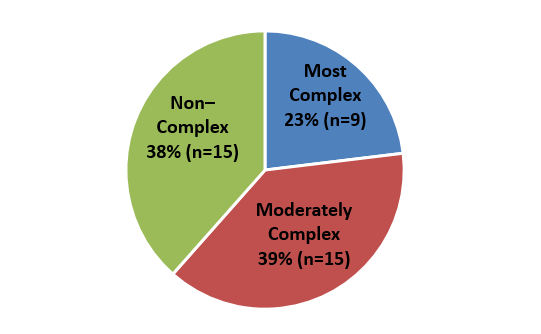

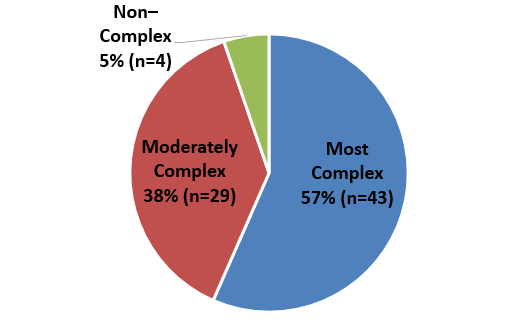

Each project was classified on the basis of complexity definitions found in the NCHRP Report 574.(4) As shown in figure 4, the majority of projects belong to the Most Complex category with 48 percent. Figure 4 also shows that 38 percent and 14 percent of projects are in the Moderately Complex and Non-Complex categories, respectively. Figure 5 through figure 8 show the proportions of each level of complexity within the contracting methods. The D-B/LB projects are less complex than the D-B/BV projects, and the CM/GC projects have the highest proportion of Most Complex projects.

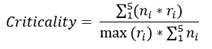

By conducting a thorough literature review and through discussions with agencies, engineers, and contractors, the research team developed a list of 31 risks that could affect project delivery performance. For each project, agencies were asked to rate the impact of these risk factors on the cost and schedule performance of the project on a scale from 1 (insignificant cost or time impact) to 5 (more than a 10-percent cost increase or schedule delay). To rank the risks in terms of impact on project performance, the research team calculated the scores of 31 risk factors associated with each delivery method. The risk score, or criticality, of each risk factor was calculated using the equation below.

(1)

(1)

Where:

ri = rating of each risk factor.

ni = total number of responses associated with the rating ri.

In examining the top risks among the project delivery methods, the following eight risk factors were perceived by questionnaire respondents to have a high impact on project performance regardless of the delivery method (D-B-B, CM/GC, D-B/LB, or D-B/BV):

Two additional risk factors were found to have a substantial influence on D-B-B delivery: scope definition and construction sequencing/staging/phasing. Three additional risk factors were found to have a substantial influence on CM/GC delivery: constructability in design; delays in procuring critical materials, labor, and equipment; and construction sequencing/staging/phasing. Two additional risk factors were found to have a substantial influence on D-B/LB and D-B/BV delivery: environmental impacts and difficulty in obtaining other agencies’ approvals. Agencies should consider these risks when selecting delivery methods, and they should explicitly address them in the procurement and contract documents. The Project Delivery Selection section of this TechBrief provides guidance on how these risks relate to project delivery selection.

Table 1 shows information collected on the procurement methods for each delivery method. As expected, the vast majority of D-B-B projects were procured through low bid. However, there were exceptions, primarily in the use of A+B procurement. Procurement for CM/GC projects was split between best-value and qualifications-based selection. The D-B project procurements were split between best value and low bid. Thirty-nine D-B projects used price as the only procurement factor and were classified as D-B/LB. The other 77 D-B projects used at least one non-price factor in addition to cost and were classified as D-B/BV.

| Procurement Procedure | D-BB (n = 134) |

CM/GC (n = 34) |

D-B/LB (n = 39) |

D-B/BV (n = 77) |

|---|---|---|---|---|

| Low bid | 80% | 0% | 100% | 0% |

| A+B (cost + time) | 13% | 0% | 0% | 18% |

| Best value | 1% | 47% | 0% | 61% |

| Qualification-based | 1% | 41% | 0% | 0% |

| Other or not classified | 5% | 12% | 0% | 21% |

Soliciting ATCs during procurement is a method to invite early contractor input on a project. Agencies can benefit from industry experience and expertise through design and construction proposals determined to be equal to or better than the base scope in the Request for Proposal (RFP). Research shows that ATCs can improve constructability, enhance innovation, shorten schedules, reduce risks, and ultimately save costs on a case-by-case basis. However, no studies have examined the application of ATCs at an aggregate level.

Table 2 shows the use of ATCs on the projects in this study. The FHWA Every Day Counts (EDC) program promotes ATC in all contracting methods. The data collection for this research found that ATCs are used primarily by agencies in D-B/BV. However, the vast majority of these projects were completed prior to the EDC initiatives; this could explain the lower use on D-B-B projects. The lack of ATC use on CM/GC projects resulted because the construction manager portion of the contract provided contractor input with no ATC process; this phenomenon was confirmed through agency interviews after data collection. The lower use of ATCs on D-B/LB projects is attributable to the smaller size and less complex nature of the projects in this pool.

| Categories | ATCs | No ATCs |

|---|---|---|

| D-B-B (n = 123) | 2 | 121 |

| CM/GC (n = 34) | 0 | 34 |

| D-B/LB (n = 38) | 2 | 36 |

| D-B/BV (n = 74) | 40 | 34 |

| Categories | Non-Complex (%) |

Moderately Complex (%) |

Most Complex (%) |

|---|---|---|---|

| D-B/BV with ATCs (n = 40) | 0 | 30 | 70 |

| D-B/BV without ATCs (n = 34) | 12 | 44 | 44 |

Table 3 shows a trend toward the use of ATCs on more complex D-B/BV projects. As revealed in interviews with project personnel, agencies employ ATCs in the Most Complex projects to minimize cost and maximize contractor innovation. Further discussion of the impact of ATCs on engineering estimates and cost growth is presented later in this TechBrief.

The use of payment methods (i.e., the form of contract) correlates with the selection of the delivery method. Table 4 summarizes the payment method results. D-B-B predominantly uses unit price, while both D-B/LB and D-B/BV projects primarily use lump-sum payment methods. CM/GC predominantly uses unit price or guaranteed maximum price; this choice appears to be based solely on the preference of each agency.

| Payment Method | D-B-B (n = 134) |

CM/GC (n = 34) |

D-B/LB (n = 39) |

D-B/BV (n = 77) |

|---|---|---|---|---|

| Lump sum | 2% | 3% | 85% | 91% |

| Cost reimbursable | 2% | 0% | 0% | 0% |

| Unit price | 93% | 38% | 5% | 0% |

| Guaranteed maximum price | 0% | 56% | 0% | 4% |

| Other or not classified | 3% | 3% | 10% | 5% |

Because the studied projects were completed between 2004 and 2015, it was important to adjust them for inflation. The FHWA’s National Highway Construction Cost Index was used to convert all project costs to equivalent costs in June 2015. This conversion allowed a fair comparison of project costs at the same point in time.

At the aggregate level, the average award cost for projects from all contracting methods was $27,140,363. These projects ranged in award cost from a minimum of $69,108 to a maximum of $357,760,287. Table 5 shows the average project cost by contracting method. It should be noted that contractor design costs are included for the D-B projects; no design costs are included for the D-B-B and CM/GC projects.

| Contract Method | Mean Cost | Median Cost | Standard Deviation | Minimum Cost | Maximum Cost |

|---|---|---|---|---|---|

| D-B-B (n = 134) | $20,286,637 | $12,438,075 | $28,422,651 | $183,202 | $252,052,326 |

| CM/GC (n = 34) | $36,328,010 | $19,167,399 | $51,451,029 | $1,390,828 | $235,936,099 |

| D-B/LB (n =39) | $10,646,348 | $4,384,177 | $14,534,668 | $69,108 | $68,826,264 |

| D-B/BV (n = 77) | $43,364,854 | $22,127,526 | $63,149,386 | $622,317 | $357,760,287 |

| Total (n = 284) | $27,140,363 | $13,949,364 | $43,922,075 | $69,108 | $357,760,287 |

Publicized success of large, high-profile D-B and CM/GC projects gives the impression that alternative contracting methods are applicable only to larger projects. The data collected for this study show that alternative contracting methods are widely applied on small projects. As shown in table 6, more than half of the CM/GC and D-B/LB projects are under $20 million in value, and more than half of the D-B/LB projects are less than $5 million in value. On average, D-B/BV is used on larger projects; however, 45 percent of the D-B/BV projects are less than $20 million in value. Agencies appear to use alternative contracting methods on projects of all sizes.

| Contract Method | Contract Award Over $20M (%) |

Contract Award Under $20M (%) |

Contract Award Under $10M (%) |

Contract Award Under $5M (%) |

|---|---|---|---|---|

| D-B-B (n = 134) | 35 | 65 | 41 | 29 |

| CM/GC (n = 34) | 47 | 53 | 29 | 21 |

| D-B/LB (n = 39) | 18 | 82 | 72 | 51 |

| D-B/BV (n = 77) | 55 | 45 | 25 | 12 |

| Total (n = 284) | 39 | 61 | 39 | 26 |

Agencies frequently choose alternative contracting methods to shorten project durations; the data from this study show that they are achieving this objective. Table 7 shows the overall project durations with separate analyses of agency design and construction. These are final project durations that include all contractual changes and/or builder delays. Accurate duration data were more difficult to obtain than project cost data, particularly for agency design. As a result, the mean project durations in table 7 were calculated with fewer projects than in table 5 for project cost. Note that the mean project duration is longer than the sum of the design and construction durations because procurement times and other agency administrative tasks are not shown. Additionally, note that construction duration for D-B projects includes design-builder design and construction duration (i.e., the D-B contract duration from award to completion).

When compared to D-B-B, the mean project duration for the CM/GC projects was 48 percent shorter. The mean D-B/BV project duration was 15 percent shorter than D-B-B. These results are noteworthy considering that the mean project costs for CM/GC and D-B/BV projects are approximately twice that of the D-B-B projects. Essentially, projects that are twice as large are being built in half the time by using alternative contracting methods. The mean D-B/LB project duration was approximately 50 percent shorter than D-B-B, but the mean D-B/LB project cost was approximately half of the D-B-B projects’ mean.

| Contract Method | Mean Cost | Mean Project Duration (Days) |

Mean Agency Design Duration (Days) |

Mean Construction Duration (Days)* |

|---|---|---|---|---|

| D-B-B (n = 74) | $21,687,447 | 1,774 | 932 | 642 |

| CM/GC (n = 24) | $41,368,952 | 929 | 361 | 511 |

| D-B/LB (n = 18) | $12,249,585 | 889 | 268 | 435 |

| D-B/BV (n =21) | $48,532,458 | 1,516 | 662 | 837 |

| Total (n = 137) | $28,010,219 | 1,470 | 710 | 620 |

*Construction duration for D-B projects includes design-builder design and construction (i.e., the D-B contract duration).

The mean agency design durations in table 7 are notably shorter for CM/GC and D-B projects. The extremely short design duration for CM/GC is surprising because, with CM/GC, the agency brings the design to 100 percent completion—similar to D-B-B. This is likely because of multiple factors. Having the construction manager on the team allows the agency to fast-track the design. In addition to gaining contractor input, there is no need to develop full designs for competitive bidding, as in D-B-B. Moreover, there is no need to develop D-B RFPs, which are sometimes voluminous and often have long industry review periods. While not as short as CM/GC, the mean D-B agency design duration is shorter than that of D-B-B. The design percent complete at the RFP was reported to be less than 30 percent for more than 75 percent of the D-B projects reporting this information. Although the RFP process can be complex, it can take less time than developing full designs.

D-B/LB and D-B/BV contract methods had the lowest and highest mean construction durations, respectively. The D-B/LB projects had the shortest construction duration, perhaps because of the smaller size of these projects and the higher level of design completion at the time of award. The longer D-B/BV mean construction duration was probably driven by two factors: D-B/BV methods had the largest mean cost, and the construction durations included the design builder’s design time and coordination with other agencies.

Because the mean costs of the projects in table 7 vary substantially, the research team analyzed two smaller pools of more projects. The first pool involved the smallest projects ranging from $2 to $10 million in award costs. Since D-B-B and D-B/LB are most frequently chosen for projects in this cost range, only these two methods were analyzed. Table 8 includes all projects from the data with verified project, design, and construction durations.

| Contract Method | Mean Cost | Mean Project Duration (Days) |

Mean Agency Design Duration (Days) |

Mean Construction Duration (Days) |

|---|---|---|---|---|

| D-B-B (n = 19) | $4,958,329 | 1,506 | 795 | 508 |

| D-B/LB (n = 10) | $4,745,533 | 773 | 181 | 380 |

| Total (n = 29) | $4,884,951 | 1,253 | 584 | 464 |

As shown in table 8, the mean costs of the D-B-B and D-B/LB projects are similar, allowing for a more accurate analysis of the project, design, and construction durations. The mean D-B/LB project duration was 49 percent shorter than that of D-B-B projects in this dataset. Agencies took approximately 77 percent less time for design for D-B/LB as compared to the mean D-B-B agency design duration on these projects. However, the mean D-B/LB construction time, which included both the design-builder design and construction time, was nevertheless approximately 25 percent shorter on average. D-B/LB appears to be delivering substantially shorter durations on projects in the $2 to $10 million range.

For larger projects, the data provided a natural grouping of projects from $10 to $50 million in size, as shown in table 9. D-B-B, CM/GC, and D-B/BV are included in this analysis because these contracting methods are most frequently used in this cost range. Table 9 includes all projects from the data with verified project, design, and construction durations.

| Contract Method | Mean Cost | Mean Project Duration (Days) |

Mean Agency Design Duration (Days) |

Mean Construction Duration (Days) |

|---|---|---|---|---|

| D-B-B (n = 34) | $21,188,585 | 2,130 | 1,139 | 818 |

| CM/GC (n = 10) | $23,912,981 | 662 | 281 | 349 |

| D-B/BV (n = 10) | $18,604,503 | 1,420 | 638 | 639 |

| Total (n = 54) | $21,214,569 | 1,726 | 904 | 699 |

Table 9 summarizes the D-B-B, CM/GC, and D-B/BV projects in the $10 to $50 million cost range. Although the mean cost of the CM/GC projects was approximately 11 percent higher than D-B-B and 22 percent higher than D-B/BV, the mean CM/GC project duration was 69 percent and 43 percent shorter than D-B-B and D-B/BV, respectively. Shorter CM/GC mean durations were observed in both design and construction. A shorter CM/GC construction duration is likely—at least in part—because of contractor involvement in project design processes. D-B/BV also showed substantially shorter mean durations with 33 percent, 44 percent, and 22 percent shorter project, design, and construction durations, respectively, as compared to D-B-B; these results are consistent with findings from 2 decades of studying project delivery methods. Like CM/GC, this shorter construction duration is likely because of contractor involvement with the design. The duration is also notable considering its inclusion of time for design-builder design. These results suggest that agencies are gaining substantial time savings by using alternative contracting methods.

Table 7 through table 9 display the substantial time savings in project duration from the use of alternative contracting methods. Alternative contracting methods also provide agencies with much earlier cost certainty, which is the point at which the agency has a reliable project cost. Agencies value cost certainty for both project and program management. Table 10 shows the point of cost certainty based on mean design duration (refer to table 8) and procurement duration D-B-B and D-B/LB projects from $2 to $10 million. In D-B-B, the initial contract cost (i.e., point of cost certainty) is known after the design is complete. In D-B/BV, the initial contract cost is known at the point of design-builder selection. For D-B-B and D-B/LB projects in this pool, D-B/LB cost certainty is known more than 60 percent earlier. For these smaller projects, early cost certainty has value for planning, programming, and letting schedules.

| Contract Method | Mean Timing of Cost Certainty (Days) | Mean Project Duration (Days) |

|---|---|---|

| D-B-B (n = 19) | 802 | 1,506 |

| D-B/LB (n = 10) | 297 | 773 |

Table 11 shows the point of cost certainty based on the mean design duration (refer to table 9) and procurement durations for D-B-B, CM/GC, and D-B/BV projects from $10 to $50 million. The explanation for the point of cost certainty in D-B-B and B-B/BV projects was previously explained. The point of cost certainty for CM/GC projects is known after the cost for the last construction package has been agreed upon as CM/GC projects may have one or more construction packages. When compared to D-B-B, the average point of cost certainty for CM/GC is more than 60 percent earlier for the projects in this study. The point of cost certainty for D-B/BV in this range is approximately 40 percent earlier than D-B-B.

| Contract Method | Mean Timing of Cost Certainty (Days) | Mean Project Duration (Days) |

|---|---|---|

| D-B-B (n = 10) | 1184 | 2,130 |

| CM/GC (n = 10) | 329 | 662 |

| D-B/BV (n = 10) | 765 | 1,420 |

Project intensity is a measure of how much money is spent per day on a project.

(2)

(2)

A high project intensity means putting more work in place faster. Projects with a greater intensity can have a shorter impact on the traveling public. With so much highway design and construction occurring in urban settings (i.e., reconstruction and renewal), intensity is an excellent measure of how agencies are serving the traveling public. Table 12 provides the project intensity metrics for each delivery method. The shorter project duration and higher contract cost of the CM/GC and D-B/BV projects, as shown in table 7 through table 9, result in a much higher project intensity than D-B-B. The lower project intensity of D-B/LB can be attributed to the smaller project size.

| Contract Method | Mean Cost | Mean Project Intensity ($/Days) |

Minimum Project Intensity ($/Days) |

Maximum Project Intensity ($/Days) |

|---|---|---|---|---|

| D-B-B (n = 74) | $21,687,447 | 12,802 | 269 | 123,566 |

| CM/GC (n = 24) | $41,368,952 | 46,450 | 3,618 | 159,031 |

| D-B/LB (n = 18) | $12,249,585 | 12,816 | 894 | 49,892 |

| D-B/BV (n = 21) | $48,532,458 | 28,527 | 1,930 | 204,341 |

| Total (n = 136) | $28,010,219 | 21,181 | 269 | 204,341 |

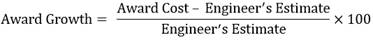

Award growth is one measure of project cost performance; the more common cost-growth metric is discussed later in this TechBrief. Award growth is the ratio of the difference between the contract award cost of a project and the engineer’s estimate, calculated as shown in the equation below. This metric gives an indication of trends in the accuracy of agency cost estimating; it can also show projects that experience significant change in cost during procurement.

(3)

(3)

| Contract Method | Mean (%) |

Median (%) |

Standard Deviation (%) |

Minimum (%) |

Maximum (%) |

|---|---|---|---|---|---|

| D-B-B (n = 129) | –9 | –8 | 18 | –51 | 42 |

| CM/GC (n = 31) | 3 | 3 | 6 | –13 | 15 |

| D-B/LB (n = 37) | –5 | –7 | 32 | –58 | 104 |

| D-B/BV (n = 71) | –7 | –7 | 22 | –51 | 77 |

| Total (n = 268) | –6 | –6 | 21 | –58 | 104 |

As shown in table 13, the mean award growth is lowest for D-B-B projects and highest for CM/GC projects. The data do not provide causes for these trends, but some logical hypotheses can be put forth. For instance, the low award growth in D-B-B projects could be a result of more competition and agencies’ use of historic unit pricing for estimates. Similarly, the positive award growth in CM/GC could result from less competition and the use of negotiated pricing. Notably, the CM/GC projects provide the most award certainty (i.e., the smallest standard deviation). Statistical tests for significance show that CM/GC has a higher average award growth when compared to each of the other three methods at a 95-percent confidence level, (p = 0.00 versus D-B-B, p = 0.03 versus D-B/LB, and p = 0.00 versus D-B/BV). However, cost certainty is significantly more accurate for CM/GC than for the other three methods, as indicated by the narrower dispersion around the mean (standard deviation = 6 percent). From a statistical significance perspective, D-B-B, D-B/LB, and D-B/BV have no difference in means of award growth at the 95-percent confidence level.

This study also examined the impact of ATCs on award growth. Analysis showed that the use of ATCs does not create a statistically significant difference on award growth, leading to the conclusion that it likely does not have an impact on the accuracy of engineers’ estimates. Award growth was found to be –7 percent and –6 percent for the D-B/BV projects with and without ATCs, respectively. While this study could not measure the savings achieved through ATC use, it did determine that ATCs are not correlated with award growth.

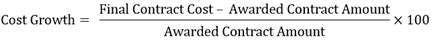

Cost growth—the cost at contract award compared with the final contract cost—is a key performance metric. In this study, cost growth is calculated by the formula below.

(4)

(4)

| Contract Method | Mean (%) |

Median (%) |

Standard Deviation (%) |

Minimum (%) |

Maximum (%) |

|---|---|---|---|---|---|

| D-B-B (n = 129) | 4.1 | 2.3 | 9.5 | –21.8 | 33.1 |

| CM/GC (n = 31) | 0.9 | 0.8 | 6.0 | –12.0 | 14.5 |

| D-B/LB (n = 36) | 2.8 | 0.7 | 5.7 | –5.6 | 19.0 |

| D-B/BV (n = 74) | 4.0 | 1.9 | 5.5 | –4.5 | 19.6 |

| Total (n = 270) | 3.5 | 1.9 | 7.8 | –21.8 | 33.1 |

Table 14 shows the results of cost-growth calculations with extreme outliers removed.

Table 14 displays the mean cost growth for each contract method along with statistics describing the dispersion of the data. The results from comparative statistical tests reveal that there is no statistically significant difference in cost growth between any of the contract methods at the 95-percent confidence level, which includes CM/GC, although the cost growth of the CM/GC projects is the lowest at 0.9 percent. Cost growth for the other delivery types ranges between 2.8 and 4.1 percent. In summary, agencies are expediting the overall project delivery time and gaining early cost certainty (as shown in figure 9 and figure 10) without witnessing additional cost growth in the construction contract. This is particularly notable given the early award of D-B and CM/GC projects.

This study also examined the correlation between ATCs and cost growth. The use of ATCs did correlate with higher cost growth. Cost growth was found to be 6 percent for D-B/BV projects with ATCs and 2 percent for D-B/BV projects without ATCs, a difference that was statistically significant at the 95-percent level. The higher cost growth could contribute to a variety of causes, including the higher project complexity (see table 3). Nonetheless, D-B/BV projects in the study pool with ATCs did experience higher cost growth, and this issue needs additional study.

Table 15 shows the causes of changes within each contracting method as an average percent of the contract award amount. These causes were reported by the project managers in 162 of the projects in the database.

| Change Orders | D-B-B (n = 65) |

CM/GC (n = 19) |

D-B/LB (n = 21) |

D-B/BV (n = 57) |

Total (n = 162) |

|---|---|---|---|---|---|

| Agency directed | 1.2% | 0.7% | 1.6% | 1.9% | 1.5% |

| Plan quantity changes | 1.1% | 0.3% | 0.6% | 0.2% | 0.6% |

| Unforeseen conditions | 2.4% | 1.5% | 1.8% | 1.8% | 2.0% |

| Plan errors and omissions | 0.9% | 0.6% | 0.1% | 0.5% | 0.6% |

| Other | 0.1% | 0.2% | 0.8% | 0.3% | 0.3% |

| Total impact as a percentage of award cost* | 5.8% | 3.4% | 5.0% | 4.7% | 5.0% |

*Total impact as a percentage of award cost differs from the cost growth in table 14

because of the smaller sample size of projects with detailed change order data available.

Overall, unforeseen conditions have the largest change order impact across the contracting methods; this finding coincides with other change order studies. No delivery method seems to be immune to the effect of unforeseen conditions on change orders. However, agencies could be transferring some of the risk for unforeseen conditions to the contractors through alternative contracting methods, as reflected in the lower change order trend with the D-B and CM/GC methods.

Agency-directed change orders have the second greatest impact on change orders. D-B/BV projects have the highest level of agency-directed change orders; CM/GC projects have the lowest. Higher levels of agency-directed change orders could be expected in D-B because of the lower level of design at the time of award. However, agency changes can have either negative or positive impacts on project goals. Negative impacts occur with incomplete scopes or lack of clarity in the RFP. Positive changes can add value to a project that was awarded below budget. Moreover, more than half of the agency-directed change orders in the database occurred in projects in which the project award was lower than the engineer’s estimate. Many of the owner-directed changes could have added value to the project within the budget.

Increases due to plan quantity changes, plan errors, and omission changes agree with what would be expected between delivery methods. D-B-B has the largest percentage of plan quantity changes, which is likely attributable to the designs being performed by the agency and the pricing being predominantly unit price. Plan errors and omissions are also highest in D-B-B. CM/GC plan errors and omissions should be lower because of the early involvement of the general contractor. D-B plan errors and omissions should be lower because the risk for this change is primarily transferred to the design builder.

In the “other” category, respondents provided qualitative descriptions of the reasons for change orders. The most common responses were value engineering by the contractor, changes directed by non-agency stakeholders, and negotiated settlements of multiple claims.

Due to the difficulty in obtaining reliable planned, agency-designed start data, only 49 of the 291 projects were available for this analysis. The project schedule growth findings were that 31 D-B-B projects had an average of 8-percent growth and 8 CM/GC projects had an average of 2-percent growth. Because the dataset included only three D-B/LB and three D-B/BV projects that submitted the required data to make this analysis, their findings are not presented. Given the early procurement of alternative contracting methods, higher schedule growth might be expected, but D-B-B has the highest mean project schedule growth. However, there are not enough data to make any substantial conclusions.

Mean construction schedule growth data were more readily available than overall project-schedule growth data because the start date for construction relates to the contract time. Reliable mean construction schedule data were available for 146 projects as shown in table 16. Construction schedule growth is calculated as follows:

(5)

(5)

| Contract Method | Mean (%) | Median (%) | Standard Deviation (%) | Minimum (%) | Maximum (%) |

|---|---|---|---|---|---|

| D-B-B (n = 63) | 10 | 0 | 38 | –65 | 118 |

| CM/GC (n = 13) | 31 | 0 | 76 | –30 | 199 |

| D-B/LB (n = 20) | –11 | –6 | 18 | –44 | 19 |

| D-B/BV (n = 50) | 15 | 7 | 31 | –71 | 81 |

| Total (n =146) | 11 | 0 | 40 | –71 | 199 |

Construction schedule growth showed a wide range of results for all contracting methods. For all the projects in this pool, there were time savings of up to 71 percent and delays of up to 199 percent. D-B/LB was the only contracting method with an average construction time savings (mean and median). CM/GC had the largest mean construction schedule growth, but this was because of a few projects with extremely high growth. The median construction schedule growth for CM/GC was 0 percent. D-B-B similarly had a median construction schedule growth of 0 percent. D-B/BV had a schedule growth of 15 percent and 7 percent for mean and median, respectively. Unfortunately, the data collection did not address the reasons for construction schedule growth in a similar manner to change orders. However, it can be assumed safely that some of the construction schedule growth for D-B/BV and CM/GC occurred because of value-adding changes. These results should be viewed in light of the substantial time savings that are realized from alternative contracting methods. The time savings shown in table 7 through table 9 are measured from actual project durations, which include construction schedule growth.

To assist agencies in selecting delivery methods, the results of this study have been integrated into a Project Delivery Selection Matrix (PDSM) that was developed through the FHWA and Colorado DOT’s Next-Generation Transportation Construction Management Pooled Fund Study.(5) The PDSM provides a formal approach for selecting project delivery methods for highway projects. The process uses a series of evaluation worksheets and forms to guide agency staff and project team members through a project delivery selection workshop. The result is a brief Project Delivery Selection Report that matches the unique goals and characteristics of each individual project. The primary objectives of the PDSM are as follows:

The PDSM tool can be downloaded at https://www.colorado.edu/tcm/project-delivery-selection-matrix.

The information presented in this TechBrief provides an up-to-date perspective on the types of alternative contracting method projects ongoing in the U.S. highway industry. Agencies are using alternative contracting methods on projects of all sizes to reap potential benefits, as illustrated by the high frequency of use of the CM/GC, D-B/BV, and D-B/LB methods on projects valued under $20 million. As expected, agencies are saving substantial time in project delivery, with 40- to 60-percent savings over D-B-B average project durations. They are also greatly accelerating the point of cost certainty in the project development process. Contrary to intuition, the alternative contracting methods do not seem to have an impact on cost growth when compared to the traditional D-B-B method or among themselves. With regard to project intensity, the alternative contracting methods are facilitating project delivery at a faster pace in terms of the rate of resources invested in the project per day. In summary, this study found that alternative contracting methods are shorter in duration, have an earlier cost certainty, and have a higher project intensity. In essence, agencies are getting more work in place with less disruption to the traveling public. Agencies are also using alternative contracting methods on projects of all sizes and do not appear to be seeing any significant cost-growth issues. With the use of alternative contracting methods increasing nationwide, the analysis of empirical project data in this study provides insightful results that can help agencies select appropriate project delivery methods. However, agencies must realize that the results shown in this TechBrief are based on average performance from many projects. Any single project can perform substantially better or worse than the average. Contracting methods provide the environment for success, but they by no means guarantee it.

Researchers—This study was performed by University of Colorado Boulder, University of Kansas, and Hill International, Inc. for FHWA Contract No. DTFH61-13-C-00024.

Distribution—This TechBrief is being distributed according to a standard distribution. Direct distribution is being made to the FHWA divisions and Resource Center.

Availability—This TechBrief is available in print and online at http://www.fhwa.dot.gov/research.

Key Words—Alternative Contracting Methods, Project Complexity, Risk, Procurement Methods, Alternative Technical Concepts, Project Duration, Cost Certainty, Project Intensity, Award Growth, Cost Growth, Change Orders, Schedule Growth, Project Delivery Selection

Notice—This document is disseminated under the sponsorship of the U.S. Department of Transportation (USDOT) in the interest of information exchange. The U.S. Government assumes no liability for the use of the information contained in this document. The U.S. Government does not endorse products or manufacturers. Trademarks or manufacturers’ names appear in this document only because they are considered essential to the objective of the document.

Quality Assurance Statement—The Federal Highway Administration (FHWA) provides high-quality information to serve Government, industry, and the public in a manner that promotes public understanding. Standards and policies are used to ensure and maximize the quality, objectivity, utility, and integrity of its information. FHWA periodically reviews quality issues and adjusts its programs and processes to ensure continuous quality improvement.