U.S. Department of Transportation

Federal Highway Administration

1200 New Jersey Avenue, SE

Washington, DC 20590

202-366-4000

Federal Highway Administration Research and Technology

Coordinating, Developing, and Delivering Highway Transportation Innovations

| REPORT |

| This report is an archived publication and may contain dated technical, contact, and link information |

|

| Publication Number: FHWA-HRT-14-050 Date: June 2014 |

Publication Number: FHWA-HRT-14-050 Date: June 2014 |

To determine the financial benefits to be expected from an adaptive lighting system, a lifecycle cost (LCC) analysis should be considered. A simple payback method of analysis could be used, but this method ignores operating and maintenance expenses, which are key components in evaluating lighting control systems and their expected benefits.

LCC is a simple calculation relating to the energy savings and the equipment required for the implementation of adaptive lighting. It does not consider the cost of a crash or a vehicle –caused fatality, and it assumes that the safety level of the roadway is not affected by the changes to the lighting level.

The first step in preparing an LCC is to quantify all of the costs associated with the lighting system. These costs include the following:

Installation cost of the system.

Expected reductions in energy costs (or change in rate structure offered by the electricity utility).

Expected reduction or increase in maintenance costs for the lighting system, as well as the control equipment and support network.

Expected life of the equipment.

Any energy incentives that may be available for the installation.

After the initial costs have been collected, assemble a simple tabulation of costs over a period of time, without inflation or time –value of money elements. A fixed period of time (e.g., 20 years) can be used, and system replacement costs can be added to the costs depending on expected component life. Another option is to use the expected life of the system and equipment being evaluated as the period of time.

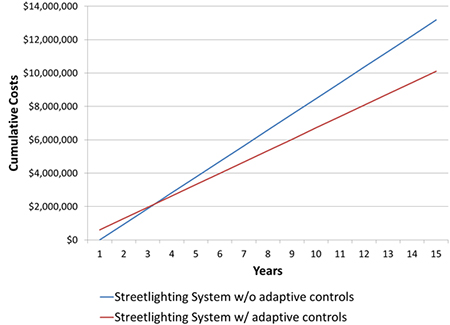

For example, assume that an adaptive control system is being added to a light –emitting diode street lighting system already equipped with dimming drivers and an acceptable photocell receptacle with sufficient pins for control and power connections. The assumed equipment life is 15 years, and the simple LCC analysis is set to that time frame. An example is shown in table 18 and figure 8.

Table 18. Example cost information for an adaptive lighting system.

| Type of Cost | Existing System Without Adaptive Control | Adaptive Control System Costs |

|---|---|---|

| Installed Cost | $0 | $600,000 |

| Annual Energy Cost | $841,000 | $589,000 |

| Annual Maintenance Cost | $100,000 | $90,000 |

| 15-year Total Cost | $14,115,000 | $10,785,000 |

w/o = without

Figure 8. Graph. Example system costs by year for standard and adaptive lighting systems.

To obtain a better picture of the actual costs, the cost of capital and future costs should be brought into the present day by converting them to the present value based on the assumed discount rate. Figure 9 presents the formula for this conversion:

![]()

Figure 9. Equation. Present value.

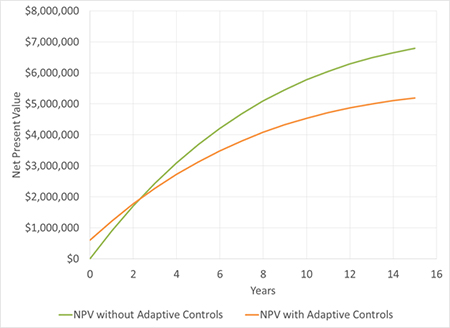

For the example above, a cash flow analysis is shown in table 19 using a 5-percent interest rate.

Table 19. Cash flow comparison for an adaptive lighting system.

| Term | Street-Lighting System Without Adaptive Controls |

Street-Lighting System With Adaptive Controls |

||||

|---|---|---|---|---|---|---|

| Years | Cash Flow | Total Expense | Present Value | Cash Flow | Total Expense | Present Value |

| 0 | $0 | $0 | $0 | $600,000 | $600,000 | $600,000 |

| 1 | $941,000 | $941,000 | $896,190 | $679,000 | $1,279,000 | $1,218,095 |

| 2 | $941,000 | $1,882,000 | $1,707,029 | $679,000 | $1,958,000 | $1,775,964 |

| 3 | $941,000 | $2,823,000 | $2,438,614 | $679,000 | $2,637,000 | $2,277,940 |

| 4 | $941,000 | $3,764,000 | $3,096,652 | $679,000 | $3,316,000 | $2,728,081 |

| 5 | $941,000 | $4,705,000 | $3,686,491 | $679,000 | $3,995,000 | $3,130,187 |

| 6 | $941,000 | $5,646,000 | $4,213,132 | $679,000 | $4,674,000 | $3,487,811 |

| 7 | $941,000 | $6,587,000 | $4,681,258 | $679,000 | $5,353,000 | $3,804,277 |

| 8 | $941,000 | $7,528,000 | $5,095,247 | $679,000 | $6,032,000 | $4,082,695 |

| 9 | $941,000 | $8,469,000 | $5,459,193 | $679,000 | $6,711,000 | $4,325,970 |

| 10 | $941,000 | $9,410,000 | $5,776,924 | $679,000 | $7,390,000 | $4,536,819 |

| 11 | $941,000 | $10,351,000 | $6,052,015 | $679,000 | $8,069,000 | $4,717,777 |

| 12 | $941,000 | $11,292,000 | $6,287,808 | $679,000 | $8,748,000 | $4,871,214 |

| 13 | $941,000 | $12,233,000 | $6,487,421 | $679,000 | $9,427,000 | $4,999,339 |

| 14 | $941,000 | $13,174,000 | $6,653,765 | $679,000 | $10,106,000 | $5,104,217 |

| 15 | $941,000 | $14,115,000 | $6,789,556 | $679,000 | $10,785,000 | $5,187,769 |

The net present value (NPV) is shown in figure 10. The results show that the return on investment for this example is less than 3 years.

Figure 10. Graph. Example NPV for standard and adaptive lighting systems.