- Selected Highway Capital Investment Scenarios

- Scenario Components

- Scenario Definitions

- Federal-Aid Highway Scenarios

- Federal-Aid Highway Scenario Impacts and Comparison with 2008 Spending

- Federal-Aid Highway Scenario Estimates by Improvement Type and Highway Functional Class

- Sustain Current Spending Scenario

- Maintain Conditions and Performance Scenario

- Intermediate Improvement Scenario

- Improve Conditions and Performance Scenario

- Systemwide Scenarios

- Systemwide Scenario Impacts and Comparison with 2008 Spending

- Systemwide Scenario Estimates by Improvement Type

- National Highway System Scenarios

- NHS Scenario Impacts and Comparison with 2008 Spending

- NHS Scenario Estimates by Improvement Type

- Interstate System Scenarios

- Interstate Scenario Impacts and Comparison with 2008 Spending

- Interstate Scenario Estimates by Improvement Type

- Selected Transit Capital Investment Scenarios

- Sustain Current Spending Scenario

- Preservation Investments

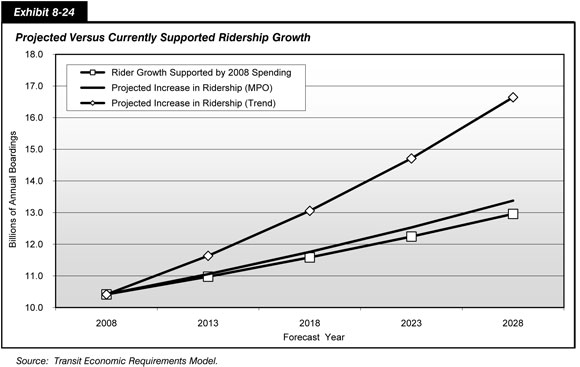

- Expansion Investments

- State of Good Repair Benchmark

- SGR Investment Needs

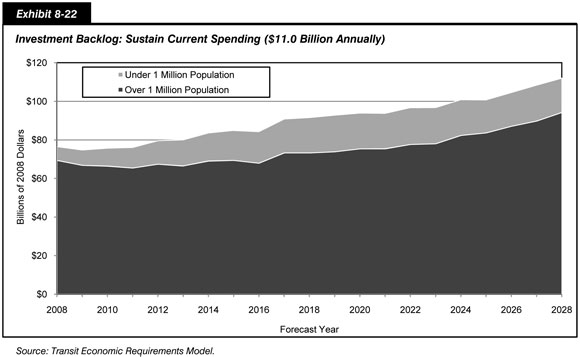

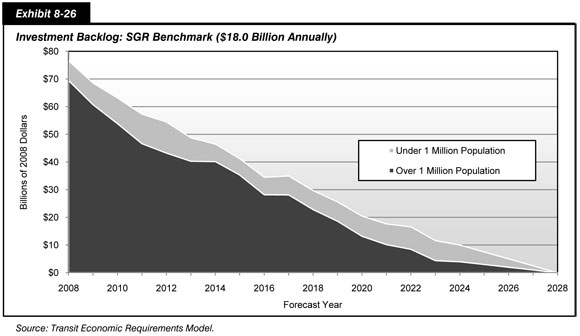

- Impact on the Investment Backlog

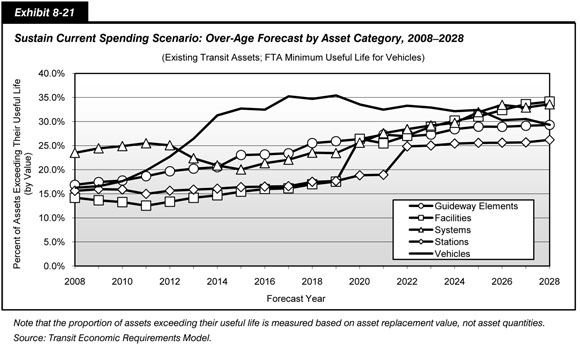

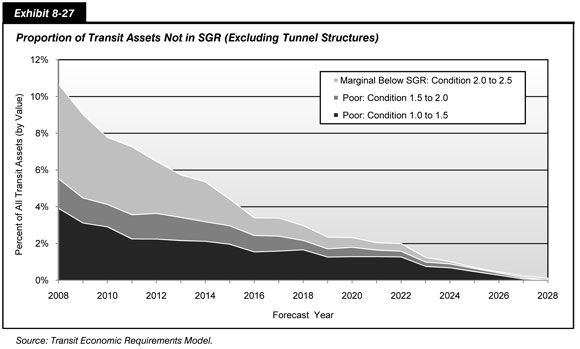

- Impact on Conditions

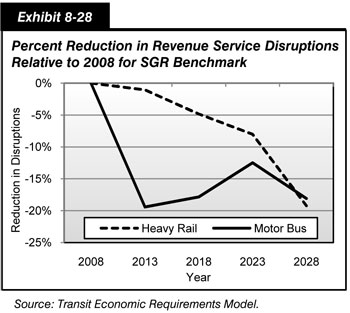

- Impact on Vehicle Fleet Performance

- Low and High Growth Scenarios

- Low Growth Assumption

- High Growth Assumption

- Low and High Growth Scenario Needs

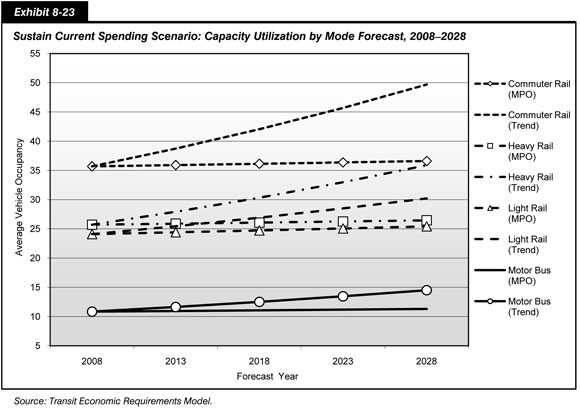

- Impact on Conditions and Performance

- Scenario Benefits Comparison

- Scorecard Comparisons

- Sustain Current Spending Scenario

Selected Highway Capital Investment Scenarios

This section presents a set of future investment scenarios that builds on the Chapter 7 analyses of alternative levels of future investment in highways and bridges. Each scenario includes projections for system conditions and performance based on simulations developed using the Highway Economic Requirements System (HERS) and National Bridge Investment Analysis System (NBIAS). In addition, each scenario considers types of capital investment beyond these models’ current scopes.

After initially focusing on Federal-aid highways, this section examines scenarios for the entire highway system, the National Highway System (NHS), and the Interstate Highway System. A subsequent section of this chapter explores scenarios for future transit investments. All of these scenarios start with a 2008 base year and cover the 20-year period through 2028.

For proper interpretation of these scenarios, the background information presented in the Introduction to Part II is essential. In particular, the scenarios represent rough estimates of what could be achieved with a given level of investment assuming an economically driven approach to project selection, as opposed to what would be achieved given current decision making practices. It is also important to appreciate that the scenarios incorporate various technical assumptions, some of which are based on more limited information than others. Some of the simplifying assumptions made in the models necessarily limit their utility as predictive tools.

Chapter 10 includes a series of sensitivity analyses that explore the impact of altering certain assumptions about market trends and technical parameter values. Of particular importance are the sensitivity analyses concerning the trend rate at which vehicle miles traveled (VMT) would grow in the absence of any change in average user cost of travel (in constant dollars), as this can have a significant impact on the HERS analysis in particular. In addition, Chapter 9 includes some supplemental analyses based on alternative assumptions about future financing mechanisms or system management policies.

The future spending levels associated with investment scenarios presented in this chapter are all stated in constant 2008 dollars. Put another way, the levels are “real” values with a 2008 base year, rather than “nominal” (future dollar) values. As shown in Chapter 9, nominal values can be derived from these results through adjustments that account for actual or predicted inflation beyond 2008. Each scenario retains the assumption from Chapter 7 that changes in the level of investment occur gradually over time, and highlights the average annual level of investment over the entire analysis period. (Note that the average annual investment levels are determined by summing the amounts expended for each year from 2009 to 2028 under the scenario, and dividing by 20).

Scenario Components

For each set of highways considered—Federal-aid highways, all highways, NHS, and Interstate Highways—this section examines the four scenarios described below. These scenarios are intended to be illustrative; none of them is endorsed as a target level of funding. Other investment levels could be equally valid, depending on what system condition and performance outcomes are desired. Each of these scenarios is based on capital investment by all levels of government combined. The question of what portion should be funded by the Federal government, State governments, local governments, or the private sector is beyond the scope of this report.

In addition to the types of investments modeled by HERS and NBIAS, each scenario includes the non-modeled types of highway and bridge investment. The investments modeled by HERS are system expansion and pavement rehabilitation projects on highways eligible for Federal aid. The Highway Performance Monitoring System (HPMS) sample, on which HERS relies for data, excludes the three highway functional classes that are generally ineligible for Federal aid: rural minor collectors, rural local roads, or urban local roads. In addition to system expansion and pavement rehabilitation investments in these classes of highways, the non-modeled category in this chapter’s scenarios includes investments classified as System Enhancements. As discussed in Chapters 6 and 7, System Enhancements include safety enhancements, operational improvements, and environmental projects. Chapter 7 discussed the distribution of 2008 highway and bridge investment among the HERS-modeled, NBIAS-modeled, and non-modeled categories.

In the absence of the data required to rigorously analyze the non-modeled improvement types, the scenarios simply assume that the non-modeled share of bridge and highway investment will remain the same as in the base year, 2008. While the scenarios in this section include this allowance for residual (non-modeled) investment when measuring total spending, they do not include the benefits from such investments when projecting highway and bridge conditions and performance.

The scenarios presented differ in the annual percentage rates at which real investment grows over the 20-year analysis period, and these rates may also differ between the components of investment modeled by HERS and NBIAS. Within each modeled component, the scenarios impose no constraints on the allocation of funding. For example, the distribution of HERS-modeled investment spending among highway functional classes is the allocation HERS determines to be most cost-beneficial without regard to actual current or past allocation patterns. The allocation of NBIAS-modeled investment is likewise determined flexibly through application of benefit-cost principles. For additional discussion of the technical features of HERS and NBIAS, see Appendix A and Appendix B.

Scenario Definitions

The Sustain Current Spending scenario assumes for each of the three broad investment categories (HERS-modeled, NBIAS-modeled, and non-modeled) that real spending remains at the 2008 level over the following two decades. However, the allocation of the HERS-modeled component among resurfacing, reconstruction, and widening is determined by the model’s combination of engineering and benefit-cost criteria, and thus will differ from the actual allocation in 2008. Likewise, the allocation of the NBIAS-modeled component among bridge repair, bridge rehabilitation, and bridge replacement will differ from the actual 2008 distribution. (Chapter 7 presents an alternative funding-constrained analysis that considers what would happen to conditions and performance if the investment modeled by HERS and NBIAS were to decrease by 1.0 percent per year.)

The Maintain Conditions and Performance scenario gears the annual rates of growth in real investment to the target of keeping two key performance indicators at the same level in 2028 as in 2008. These indicators are average speeds (as computed by HERS) and the economic backlog for bridge investment (as computed by NBIAS), and serve as summary measures of the overall conditions and performance of highways and bridges. Although this scenario would maintain these summary indicators at base year levels for the system as a whole, the conditions and performance of individual components of the system would vary. (Chapter 9 presents a supplemental scenario aimed at maintaining conditions and performance separately on individual functional systems. Chapter 7 identifies the investment levels associated with maintaining two other HERS performance indicators: average pavement roughness and average delay.)

| How do the definitions of the selected scenarios presented in this report compare to those presented in the 2008 C&P Report? | |

|

The name and definition of the Sustain Current Spending scenario are unchanged. The Maintain Conditions and Performance scenario is similar to the “Sustain Conditions and Performance scenario” in the 2008 C&P Report except that the performance target has been modified from adjusted average users costs to average speeds. (The implications of this shift are discussed in Chapter 7.)

The definition of the Improve Conditions and Performance scenario is identical to that of the “MinBCR=1.0” scenario in the 2008 C&P Report. The HERS-derived component of the Intermediate Improvement scenario is defined in a manner consistent with the “MinBCR=1.5” scenario; the NBIAS-derived component has been redefined in a manner that reduces its costs and projected impacts (i.e., the bridge investment backlog would be reduced rather than eliminated). The State of Good Repair benchmark is a new addition, while the “MinBCR=1.2” scenario from the 2008 C&P Report has been dropped. (The inputs to that scenario have been retained in Chapter 7.) Chapter 9 includes comparisons of key scenario statistics from this report with comparable scenarios from the 2008 C&P Report and prior editions. |

|

The Improve Conditions and Performance scenario assumes that real investments in HERS-modeled and NBIAS-modeled improvements increase over 20 years at an annual rate projected to be sufficient to fund all potentially cost-beneficial investments (i.e., those with a benefit-cost ratio [BCR] of 1.0 or higher) by 2028. This scenario can be thought of as an “investment ceiling” above which it would not be cost-beneficial to invest, even if available funding were unlimited. This level of funding would eliminate the economic backlog for bridge investment as computed by NBIAS, and would improve various measures of conditions and performance measured in HERS.

The Intermediate Improvement scenario is presented in this report to emphasize that any investment above the level of Maintain Conditions and Performance scenario would tend to result in an overall improvement to the system, and that it is not necessary to reach the level associated with the Improve Conditions and Performance scenario in order to have a significant impact on conditions and performance. The Intermediate Improvement scenario assumes that, between 2008 and 2028, real investment in HERS-modeled improvements increases annually at a rate sufficient to implement all improvements with a BCR greater than or equal to 1.5 (i.e., benefits exceed costs by 50 percent). Applying a minimum BCR cutoff higher than 1.0 tends to reduce the risk of investing in potential projects that might initially appear cost beneficial, but that might not ultimately meet this standard due to unexpected changes in future costs or travel demand. For NBIAS-modeled improvements, this scenario applies the same growth rate in real investments as used for the HERS-based improvements (to the extent that this would continue to pass the NBIAS benefit-cost test) because the benefit-cost procedures in NBIAS are not sufficiently robust to directly support this type of analysis. This approach results in a reduction in the economic investment backlog by 2028. (Chapter 7 also identifies the investment levels associated with a BCR cutoff of 1.2.)

The State of Good Repair benchmark represents the subset of the Improve Conditions and Performance scenario defined above that is directed towards the types of improvements defined as System Rehabilitation in Chapters 6 and 7. Chapter 3 includes a discussion of the state of good repair concept that lays out some key factors that should be considered in defining the term in the content of various types of transportation assets. While there is broad recognition that our Nation’s transportation infrastructure falls short of a “State of Good Repair”; there is no national consensus as to exactly how the term should be applied in the context of various types of transportation assets. The State of Good Repair benchmark presented in this section includes investments that would address deficiencies in the physical conditions of pavements and bridges based on engineering criteria, but only those that pass a benefit-cost test. (This has the effect of screening out assets that may have outlived their original purpose, rather than automatically re-investing in all assets in perpetuity.) While this definition is logical within the context of the other scenarios presented in this section, alternative state of good repair benchmarks with different objectives could be equally valid from a technical perspective. (Because this benchmark is a subset of a larger scenario, it is referenced only in selected locations within this section.)

| Does the State of Good Repair benchmark apply the same criteria for all types of roadways modeled in HERS? | |

|

No. For principal arterials, the deficiency levels in HERS have been set so that the model will consider taking action on a pavement only when its international roughness index (IRI) value has risen above 95 (inches per mile), meaning it would no longer be considered to have “good” ride quality based on the criteria described in Chapter 3.

For roads functionally classified as collectors, the HERS deficiency levels have been set so that pavement actions will only be considered when IRI values have risen above 170, and the roads, thus, no longer meet the criteria for “acceptable” ride quality. The IRI threshold for minor arterials is set at 120. Although the engineering thresholds identified above define when the model may consider a pavement improvement, any such improvement must pass a benefit-cost test in order to be implemented. Even when HERS is given an unlimited budget to work with, it does not recommend improving all principal arterials to the “good” ride quality level, or all collectors to the “acceptable” ride quality level. The specific IRI value at which a pavement improvement will pass a benefit-cost test depends on a number of factors, including the traffic volume and average speeds on that facility. As discussed in Chapter 3, pavement ride quality has a greater impact on highway user costs on higher speed roads. |

|

Federal-Aid Highway Scenarios

Exhibit 8-1 summarizes the derivation of the scenarios constructed for Federal-aid highways, identifying their HERS-modeled, NBIAS-modeled, and non-modeled (other) components. These scenarios incorporate selected funding levels from the analysis in Chapter 7 (the footnotes in Exhibit 8-1 identify the specific Chapter 7 exhibits to which the scenarios are linked). All levels of government spent a combined $70.6 billion on capital improvements to Federal-aid Highways in 2008; $54.7 billion of this total (77.4 percent) was used for types of capital improvements modeled in HERS, $9.4 billion (13.4 percent) was used for types of capital improvements modeled in NBIAS, and $6.5 billion (9.2 percent) was used for other types of capital improvements. By definition, these amounts match the average annual investment levels for the Sustain Current Spending scenario for Federal-aid highways.

| Scenario Name and Description | Scenario Component (Source of Estimate)1 | Component Share of 2008 Capital Outlay | Annual Percent Change in Spending vs. 2008 | Minimum BCR | Average Annual Capital Investment on Federal-Aid Highways | |

|---|---|---|---|---|---|---|

| Billions of 2008 Dollars | Percent of Total | |||||

| Sustain Current Spending scenario (Sustain spending at base year levels in constant dollar terms.) | HERS 2 | 77.4% | 0.00% | 2.42 | $54.7 | 77.4% |

| Sustain Current Spending scenario (Sustain spending at base year levels in constant dollar terms.) | NBIAS 3 | 13.4% | 0.00% | $9.4 | 13.4% | |

| Sustain Current Spending scenario (Sustain spending at base year levels in constant dollar terms.) | Other | 9.2% | $6.5 | 9.2% | ||

| Sustain Current Spending scenario (Sustain spending at base year levels in constant dollar terms.) | Total | 100.0% | $70.6 | 100.0% | ||

| Maintain Conditions and Performance scenario (Maintain average speed and the economic bridge investment backlog at 2008 levels.) | HERS 2 | 77.4% | 1.31% | 2.02 | $62.9 | 78.5% |

| Maintain Conditions and Performance scenario (Maintain average speed and the economic bridge investment backlog at 2008 levels.) | NBIAS 3 | 13.4% | 0.40% | $9.8 | 12.3% | |

| Maintain Conditions and Performance scenario (Maintain average speed and the economic bridge investment backlog at 2008 levels.) | Other | 9.2% | $7.4 | 9.2% | ||

| Maintain Conditions and Performance scenario (Maintain average speed and the economic bridge investment backlog at 2008 levels.) | Total | 100.0% | $80.1 | 100.0% | ||

| Intermediate Improvement scenario (Invest in projects with benefit-cost ratios as low as 1.5 and reduce the economic bridge investment backlog.) | HERS 2 | 77.4% | 3.51% | 1.50 | $80.1 | 77.4% |

| Intermediate Improvement scenario (Invest in projects with benefit-cost ratios as low as 1.5 and reduce the economic bridge investment backlog.) | NBIAS 3 | 13.4% | 3.51% | $13.8 | 13.4% | |

| Intermediate Improvement scenario (Invest in projects with benefit-cost ratios as low as 1.5 and reduce the economic bridge investment backlog.) | Other | 9.2% | $9.5 | 9.2% | ||

| Intermediate Improvement scenario (Invest in projects with benefit-cost ratios as low as 1.5 and reduce the economic bridge investment backlog.) | Total | 100.0% | $103.5 | 100.0% | ||

| Improve Conditions and Performance scenario (Invest in all cost-beneficial projects and eliminate the economic bridge investment backlog.) | HERS 2 | 77.4% | 5.90% | 1.00 | $105.4 | 78.1% |

| Improve Conditions and Performance scenario (Invest in all cost-beneficial projects and eliminate the economic bridge investment backlog.) | NBIAS 3 | 13.4% | 5.36% | $17.1 | 12.7% | |

| Improve Conditions and Performance scenario (Invest in all cost-beneficial projects and eliminate the economic bridge investment backlog.) | Other | 9.2% | $12.4 | 9.2% | ||

| Improve Conditions and Performance scenario (Invest in all cost-beneficial projects and eliminate the economic bridge investment backlog.) | Total | 100.0% | $134.9 | 100.0% | ||

2 The scenario components derived from HERS are directly linked to the analyses presented in Exhibits 7-3 through 7-10 in Chapter 7; these components can be cross-referenced to the exhibits using either the annual percent change in spending relative to 2008, or the minimum BCR identified in this table.

3 The scenario components derived from NBIAS are directly linked to the analysis presented in Exhibit 7-18 in Chapter 7; these components can be cross-referenced to this exhibit using the annual percent change in spending relative to 2008 identified in this table.

Exhibit 8-1 also identifies the annual rates of spending growth associated with the HERS and NBIAS components of each scenario, and the BCR cutoff associated with the HERS component. In addition to providing information relevant to how these scenario components were constructed, these statistics also provide the means to directly link each scenario back a particular row in the more detailed investment/performance tables presented in Chapter 7. For the Sustain Current Spending scenario, the average annual growth rates in HERS and NBIAS spending are assumed to be zero by definition; this level of HERS investment is projected to be sufficient to fund potential capital improvements on Federal-aid highways with a benefit cost ratio of 2.42 or higher.

| Why does this section begin by presenting scenarios for Federal-aid highways rather than all roads? | |

|

The investment analyses for Federal-aid highways are considered to be stronger than those for all roads because the available data are best suited to supporting this type of analysis.

As discussed in Chapter 2, the term “Federal-aid highways” includes roads that are generally eligible for Federal funding assistance under current law. This includes all public roads that are not functionally classified as rural minor collector, rural local, or urban local. Because the HPMS does not contain detailed sample information for these three functional classes, the scenarios based on all roads include a much larger non-modeled component and hence are more speculative. The stratified sample structure within the HPMS is organized around individual functional classes. Consequently, the accuracy of the scenarios based on the Interstate Highway System should be considered to be comparable to those for Federal-aid Highways. The scenarios based on the National Highway System are not quite as robust because the HPMS does not target the NHS separately in its sample design. These distinctions are not as significant for the portions of each scenario derived from NBIAS because the National Bridge Inventory includes comparably detailed information on all of the Nation’s bridges. |

|

To meet the objectives of the Maintain Conditions and Performance scenario for Federal-aid highways (maintain average speed and the economic bridge investment backlog in 2028 at their 2008 levels), investment in the types of capital improvements modeled in HERS would need to increase 1.31 percent per year above the 2008 baseline level in constant dollar terms; this would translate into an average annual investment level of $62.9 billion over 20 years and would be sufficient to fund all potential capital improvements with a BCR of 2.02 or higher. Investment in the types of capital improvements modeled in NBIAS would need to increase 0.40 percent annually in real terms, which translates into an average annual investment level of $9.8 billion in constant 2008 dollars. All of Federal-aid highway scenarios assume that improvements of the types not modeled in HERS or NBIAS—the “other” component in Exhibit 8-1—account for 9.2 percent of the total investment in Federal-aid highways, the same as in 2008. Adjusting for these non-modeled types of capital spending brings the total average annual investment level associated with this scenario up to $80.1 billion.

| How strongly are the scenario investment levels presented in Exhibit 8-1 affected by the underlying assumptions regarding future travel growth? | |

|

Travel growth forecasts are inherently speculative, and can have a significant impact on analyses of the potential future impacts of highway capital investment. The scenarios presented in this chapter rely on forecasts of future vehicle miles traveled (VMT) provided by the States for each individual sample highway section in the HPMS; the composite weighted average annual VMT growth rate based on these forecasts is 1.85 percent. The HERS model assumes that the forecast for each section represents the amount of travel that would occur if average highway user costs per VMT were to remain constant over time.

Chapter 10 includes an analysis of the potential impacts of alternative VMT forecasts on the HERS results. One key observation is that had the HPMS VMT growth forecasts averaged to 1.23 per year, the HERS component of the Improve Conditions and Performance scenario presented in Exhibit 8-1 would have been smaller ($80.2 billion per year rather than $105.4 billion). Had the HPMS VMT growth forecasts averaged only 0.56 percent per year, the HERS component of this scenario would have been only $59.8 billion per year. Lower future VMT growth would reduce the potential benefits of widening projects and reduce annual wear and tear on pavements. A separate analysis presented in Chapter 10 of the impact of alternative VMT forecasts on the NBIAS results shows that this model is much less sensitive to this variable. Therefore, substituting lower VMT forecasts into the scenarios presented in Exhibit 8-1 would have a smaller percentage impact on the overall average annual investment level presented for each scenario than would be the case for the HERS component of that scenario. |

|

As noted above, the Intermediate Improvement scenario is defined to include all potential capital improvements considered in HERS with a BCR of 1.50 or higher. This would require investment in these types of improvements on Federal-aid highways to increase at a real annual rate of 3.51 percent. Applying the same growth rate to the NBIAS-modeled and non-modeled capital improvement types brings the total average annual investment level for this scenario to $103.5 billion for Federal-aid highways.

Implementing all potentially cost-beneficial capital improvements (BCR≥ 1.0) over the 20 years would require HERS-modeled investments on Federal-aid highways to increase 5.90 percent annually and NBIAS-modeled investments to increase 5.36 percent annually. Adjusting for non-modeled investments (so that they represent 9.2 percent of the total cost of the scenario) brings the average annual investment level for Federal-aid highways under the Improve Conditions and Performance scenario to $134.9 billion.

Federal-Aid Highway Scenario Impacts and Comparison with 2008 Spending

For each Federal-aid highway scenario, Exhibit 8-2 compares the associated capital investment levels with actual spending in 2008 and provides selected summary measures of future system conditions and performance.

In the Maintain Conditions and Performance scenario, annual spending averages $80.1 billion, which is $9.5 billion (13.4 percent) higher than the $70.6 billion of actual capital spending on Federal-aid highways in 2008. Attaining this average annual level of spending would require real capital spending to increase over the 20 years by 1.18 percent per year. (As one would expect, this growth rate falls between the growth rates for the HERS and NBIAS components of this scenario identified in Exhibit 8-1.)

| Comparison Parameter | Sustain Current Spending Scenario | Maintain Conditions & Performance Scenario | Intermediate Improvement Scenario | Improve Conditions & Performance Scenario |

|---|---|---|---|---|

| Comparison of Scenarios With 2008 Spending | ||||

| Average Annual Investment (Billions of 2008 Dollars) | $70.6 | $80.1 | $103.5 | $134.9 |

| Difference Relative to 2008 Spending (Billions of 2008 Dollars) | $0.0 | $9.5 | $32.8 | $64.3 |

| Percent Difference Relative to 2008 Spending | 0.0% | 13.4% | 46.5% | 91.0% |

| Annual Percent Increase to Support Scenario Investment1 | 0.00% | 1.18% | 3.51% | 5.82% |

| Projected Impacts of Scenarios on Federal-Aid Highways | ||||

| Percent Change in Average Speed (2028 vs. 2008)2 | -0.7% | 0.0% | 1.2% | 2.6% |

| Percent of VMT on Roads With Good Ride Quality, 2028 3 | 55.0% | 59.4% | 66.6% | 74.1% |

| Percent of VMT on Roads With Acceptable Ride Quality, 2028 3 | 82.4% | 84.6% | 88.0% | 91.7% |

| Percent Change in Average IRI (2028 vs. 2008) 3 | 2.8% | -3.8% | -13.7% | -24.3% |

| Percent Change in Average Delay per VMT (2028 vs. 2008)4 | 6.7% | 3.8% | -1.7% | -7.7% |

| Percent Change in Economic Bridge Investment Backlog (2028 vs. 2008)5 | 6.5% | 0.0% | -55.7% | -100.0% |

2 Values shown correspond to amounts in Exhibit 7-6 in Chapter 7.

3 Values shown correspond to amounts in Exhibit 7-5 in Chapter 7. Reductions in average pavement roughness (IRI) tranlate into improved ride quality.

4 Values shown correspond to amounts in Exhibit 7-7 in Chapter 7.

5Values shown correspond to amounts in Exhibit 7-18 in Chapter 7.

By definition, the Maintain Conditions and Performance scenario would achieve the targets of zero change between 2008 and 2028 in average speed and in the economic bridge investment backlog. For other (non-targeted) measures of conditions and performance on Federal-aid highways, the projections for this scenario indicate some change over the analysis period: average pavement roughness (as measured by the International Roughness Index [IRI] discussed in Chapter 3 and Chapter 7), would decrease by 3.8 percent, while average delay per vehicle-mile traveled would increase by roughly the same percentage. These statistics suggest a tradeoff between improved physical conditions and a worsening of operational performance under this scenario, driven by the mix of projects HERS identified as the most cost-beneficial at this level of investment.

In comparison, the Sustain Current Spending scenario features lower levels of real investment over the analysis period on Federal-aid highways and, thus, worse outcomes for 2028. Relative to values in the base year, 2008, the projections are for average speed to decrease 0.7 percent, reflecting an overall decline in system performance. Further, average pavement roughness is projected to increase by 2.8 percent, average delay is projected to increase by 6.7 percent, and the economic bridge investment backlog is projected to increase by 6.5 percent (in constant dollar terms) by 2028 relative to the 2008 baseline.

The Improve Conditions and Performance scenario features the highest level of investment among the four scenarios presented in Exhibit 8-2 and shows the largest projected impacts on system conditions and performance. Under this scenario, the shares of vehicle miles traveled (VMT) on Federal-aid highway pavements with “good” ride quality and “acceptable” ride quality (as defined in Chapter 3) are expected to rise to 74.1 percent and 91.7 percent, respectively, by 2028. In contrast, the lower investment levels under the Sustain Current Spending scenario are projected to result in only 55.0 percent of Federal-aid highway VMT occurring on pavements with good ride quality and 82.4 percent on pavements with acceptable ride quality.

By definition, the Improve Conditions and Performance scenario would eliminate the economic bridge investment backlog on Federal-aid highways by 2028; this scenario is also projected to increase average speeds by 2.6 percent by 2028. Other measures of Federal-aid highway conditions and performance are also projected to improve; average pavement roughness could decline by as much as 24.3 percent and average delay per VMT could decline by 7.7 percent. The average annual investment level of $134.9 billion for this scenario exceeds actual spending on Federal-aid highways in 2008 by $64.3 billion, or 91.7 percent; spending would need to increase by 5.82 percent per year over 20 years to reach this average annual level.

The performance improvements projected in the Intermediate Improvement scenario are less marked than in the Improve Conditions and Performance scenario but still significant. For Federal-aid highway bridge projects, the economic investment backlog is projected to be reduced by roughly half from the 2008 level (by 55.7 percent) rather than eliminated. Average speed is projected to increase over the analysis period by 1.2 percent; average pavement roughness could decrease by 13.7 percent, and average delay per VMT could decrease by 1.7 percent.

Federal-Aid Highway Scenario Estimates by Improvement Type and Highway Functional Class

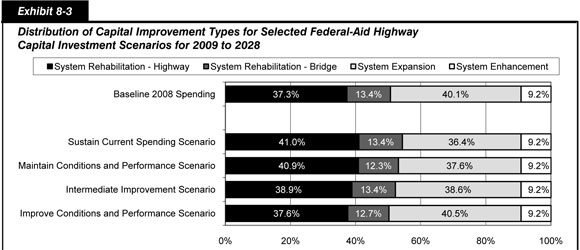

Exhibit 8-3 shows the distribution of spending by improvement type for each Federal-aid highway scenario and compares this distribution with actual spending in 2008. As noted above, capital spending on system enhancements amounts to 9.2 percent of each scenario’s investment total, consistent with the percentage of total capital spending on Federal-aid highways by all levels of government directed to these types of improvements in 2008. By design, the Sustain Current Spending scenario and the Intermediate Improvement scenario each allocates 13.4 percent of spending to the types of bridge improvements modeled in NBIAS (repair, rehabilitation, and replacement), which is the share of actual 2008 spending on Federal-aid highways that was directed to such improvements. In the other scenarios, the level of NBIAS-modeled investment is determined independently. The types of improvements modeled in HERS are reflected in the “System Rehabilitation – Highway” and “System Expansion” categories; the distribution between these categories in each scenario is based on an evaluation of the relative benefits and costs of potential investments in each area.

In 2008, 40.1 percent of capital outlay by all levels of government on Federal-aid highways was directed to system expansion. The Sustain Current Spending scenario reduces this share to 36.4 percent, while other scenarios maintain or increase this share at higher levels of spending. For example, the Improve Conditions and Performance scenario directs 40.5 percent of its total investment towards system expansion.

| Scenario Name | Average Annual Investment (Billions of 2008 Dollars) | |||||

|---|---|---|---|---|---|---|

| System Rehabilitation Highway1 | System Rehabilitation Bridge2 | System Rehabilitation Total | System Expansion 3 | System Enhancement | Total | |

| Baseline 2008 Spending | $26.4 | $9.4 | $35.8 | $28.3 | $6.5 | $70.6 |

| Sustain Current Spending scenario | $29.0 | $9.4 | $38.4 | $25.7 | $6.5 | $70.6 |

| Maintain Conditions and Performance scenario | $32.7 | $9.8 | $42.6 | $30.1 | $7.4 | $80.1 |

| Intermediate Improvement scenario | $40.2 | $13.8 | $54.0 | $39.9 | $9.5 | $103.5 |

| Improve Conditions and Performance scenario | $50.7 | $17.1 | $67.8 | $54.7 | $12.4 | $134.9 |

| State of Good Repair benchmark4 | $50.7 | $17.1 | $67.8 | |||

2 Values shown correspond to amounts in Exhibit 7-18 in Chapter 7.

3 Values shown correspond to amounts in Exhibits 7-6 and 7-7 in Chapter 7.

4 The State of Good Repair benchmark is a subset of the Improve Conditions and Performance scenario.

The Improve Conditions and Performance scenario directs $67.8 billion, or 50.3 percent, of the $134.9 billion in average annual spending it programs for Federal-aid highways towards the types of system rehabilitation actions reflected in the State of Good Repair benchmark. Although this level of investment falls short of the $70.6 billion of total capital spending on Federal-aid highways in 2008, it substantially exceeds the portion of that spending, $35.8 billion, that was used for system rehabilitation improvements. This suggests that the current backlog of cost-beneficial improvements to address pavement and bridge deficiencies is substantial, and that achieving a state of good repair on Federal-aid highways would require either a significant increase in overall highway and bridge investment, or a significant redistribution of investment from other types of improvements towards System Rehabilitation.

Sustain Current Spending Scenario

For the Sustain Current Spending scenario for Federal-aid highways, Exhibit 8-4 compares the scenario distribution of capital investments by improvement type and functional class with the corresponding actual distribution in 2008 (from Chapter 6; see Exhibit 6-10 and Exhibit 6-12). Due to the manner in which this scenario was constructed, the total percentage change identified for the “System Rehabilitation – Bridge,” “System Enhancement” and the “Total” columns in the table are automatically all zero, as are the values for individual functional classes in the “System Enhancement” column.

Although the Sustain Current Spending scenario for Federal-aid highways fixes average annual capital spending on these highways at the actual 2008 level, the portion of this spending it allocates to the “System Rehabilitation – Highway” category is 9.8 percent higher than the corresponding 2008 amount. Conversely, the allocation to “System Expansion” is 9.2 percent lower than the actual 2008 values. When it comes to the distribution of investment by highway functional class, the differences between the scenario and actual 2008 allocations are more pronounced. Relative to the corresponding actual 2008 amounts, the $14.3 billion of average annual investment on rural arterials and major collectors included in this scenario would represent a 47.4 percent decrease, while the $56.3 billion of average annual investment on urban arterials and collectors would represent a 29.8 percent increase.

| Average Annual National Investment on Federal-Aid Highways (Billions of 2008 Dollars) | ||||||

|---|---|---|---|---|---|---|

| Functional Class | System Rehabilitation Highway | System Rehabilitation Bridge | System Rehabilitation Total | System Expansion | System Enhancement | Total |

| Rural Arterials and Major Collectors | ||||||

| Interstate | $1.6 | $0.6 | $2.3 | $1.5 | $0.4 | $4.2 |

| Other Principal Arterial | $1.5 | $0.5 | $2.0 | $0.7 | $0.7 | $3.4 |

| Minor Arterial | $1.7 | $0.5 | $2.1 | $0.4 | $0.5 | $3.0 |

| Major Collector | $2.1 | $0.8 | $2.9 | $0.2 | $0.7 | $3.7 |

| Subtotal | $6.9 | $2.4 | $9.3 | $2.7 | $2.3 | $14.3 |

| Urban Arterials and Collectors | ||||||

| Interstate | $6.0 | $2.6 | $8.6 | $11.5 | $1.0 | $21.1 |

| Other Freeway and Expressway | $2.8 | $1.0 | $3.8 | $4.5 | $0.6 | $8.9 |

| Other Principal Arterial | $4.9 | $1.6 | $6.5 | $3.1 | $1.2 | $10.8 |

| Minor Arterial | $6.1 | $1.3 | $7.4 | $2.7 | $0.9 | $11.0 |

| Collector | $2.3 | $0.5 | $2.8 | $1.1 | $0.5 | $4.4 |

| Subtotal | $22.1 | $7.0 | $29.1 | $23.0 | $4.3 | $56.3 |

| Total, Federal-Aid Highways* | $29.0 | $9.4 | $38.4 | $25.7 | $6.5 | $70.6 |

| Percent Above Actual 2008 Capital Spending on Federal-Aid Highways by All Levels of Government Combined | ||||||

|---|---|---|---|---|---|---|

| Functional Class | System Rehabilitation Highway | System Rehabilitation Bridge | System Rehabilitation Total | System Expansion | System Enhancement | Total |

| Rural Arterials and Major Collectors | ||||||

| Interstate | -50.3% | -3.6% | -42.4% | 1.7% | 0.0% | -28.1% |

| Other Principal Arterial | -63.5% | -32.8% | -58.5% | -85.1% | 0.0% | -66.9% |

| Minor Arterial | -33.7% | -39.7% | -35.2% | -81.5% | 0.0% | -47.8% |

| Major Collector | -16.7% | -30.1% | -20.8% | -82.4% | 0.0% | -30.2% |

| Subtotal | -44.6% | -27.8% | -41.0% | -70.1% | 0.0% | -47.4% |

| Urban Arterials and Collectors | ||||||

| Interstate | 40.6% | 0.7% | 25.3% | 82.5% | 0.0% | 49.0% |

| Other Freeway and Expressway | 90.3% | 164.2% | 105.5% | 105.5% | 0.0% | 91.7% |

| Other Principal Arterial | 23.3% | 7.6% | 19.0% | -52.2% | 0.0% | -18.1% |

| Minor Arterial | 131.1% | 45.8% | 109.9% | -3.7% | 0.0% | 52.2% |

| Collector | 41.1% | -32.0% | 19.8% | -11.4% | 0.0% | 7.7% |

| Subtotal | 58.1% | 15.5% | 45.2% | 20.2% | 0.0% | 29.8% |

| Total, Federal-Aid Highways * | 9.8% | 0.0% | 7.2% | -9.2% | 0.0% | 0.0% |

Overall, the Sustain Current Spending scenario for Federal-aid highways would reduce annual spending below the 2008 level for each rural functional class and for urban other principal arterials. Within the “System Rehabilitation – Highway” category, the same is true for each individual rural functional class, while the opposite holds for each urban functional class (i.e., the scenario spending would exceed the 2008 level). The results for the “System Rehabilitation – Bridges” category are similar, except that scenario spending would also be less than the 2008 level for bridges on urban collectors. For the “System Expansion” category, scenario spending would exceed the 2008 level significantly on the urban portion of the Interstate System and on other urban freeways and expressways, and slightly on the rural portion of the Interstate System; for all other functional systems, the scenario spending would be less than the 2008 level.

These differences between the scenario and actual allocations, while suggestive from a policy perspective, do not necessarily indicate misallocations of actual capital spending. Apart from the errors that may result from limitations of the HERS and NBIAS models and the associated databases, two other considerations argue for caution. First, the actual distribution of expenditures among improvement types and functional classes varies from year to year, and 2008 may be atypical in some respects. Second, even if annual highway and bridge investment were to continue on average at the 2008 level, changing circumstances would alter the economically optimal distribution of this spending. The actual distribution in 2008 could, therefore, make perfect economic sense and still differ significantly from the economically optimal distribution over the following 20 years.

Maintain Conditions and Performance Scenario

Exhibit 8-5 identifies the distribution of capital investments by improvement type and functional class for the Maintain Conditions and Performance scenario for Federal-aid highways. The $16.2 billion of capital investment on rural arterials and major collectors represents 20.2 percent of the $80.1 billion total average annual investment (by all levels of government combined) under this scenario. By design, the rural share of total system enhancement expenditures is 34.6 percent ($2.6 billion out of $7.4 billion), the same as the actual percentage in 2008. Rural roads receive in this scenario 10.2 percent of system expansion expenditures and 24.9 percent of system rehabilitation expenditures.

| Average Annual National Investment on Federal-Aid Highways (Billions of 2008 Dollars) | ||||||

|---|---|---|---|---|---|---|

| Functional Class | System Rehabilitation Highway | System Rehabilitation Bridge | System Rehabilitation Total | System Expansion | System Enhancement | Total |

| Rural Arterials and Major Collectors | ||||||

| Interstate | $1.8 | $0.7 | $2.4 | $1.6 | $0.5 | $4.5 |

| Other Principal Arterial | $1.8 | $0.6 | $2.4 | $0.8 | $0.8 | $4.0 |

| Minor Arterial | $1.9 | $0.5 | $2.4 | $0.4 | $0.5 | $3.4 |

| Major Collector | $2.6 | $0.8 | $3.4 | $0.3 | $0.8 | $4.4 |

| Subtotal | $8.1 | $2.5 | $10.6 | $3.1 | $2.6 | $16.2 |

| Urban Arterials and Collectors | ||||||

| Interstate | $6.5 | $2.7 | $9.2 | $13.1 | $1.1 | $23.5 |

| Other Freeway and Expressway | $3.1 | $1.0 | $4.1 | $5.3 | $0.7 | $10.1 |

| Other Principal Arterial | $5.6 | $1.7 | $7.3 | $4.0 | $1.4 | $12.7 |

| Minor Arterial | $6.7 | $1.4 | $8.1 | $3.3 | $1.1 | $12.4 |

| Collector | $2.7 | $0.5 | $3.2 | $1.4 | $0.6 | $5.1 |

| Subtotal | $24.7 | $7.3 | $32.0 | $27.1 | $4.8 | $63.9 |

| Total, Federal-Aid Highways * | $32.7 | $9.8 | $42.6 | $30.1 | $7.4 | $80.1 |

It is important to note that the goal of the Maintain Conditions and Performance scenario is to maintain average conditions and performance on a systemwide basis; the conditions and performance of individual functional classes may vary. Consequently, the dollar amount shown for each of the functional classes in Exhibit 8-5 does not represent the cost of maintaining the condition or performance of that functional class in isolation. A supplemental scenario is presented in Chapter 9 that identifies the costs of maintaining the conditions and performance of individual system components.

Intermediate Improvement Scenario

Exhibit 8-6 identifies the distribution of capital investments on Federal-aid highways by improvement type and functional class for the Intermediate Improvement scenario. The $20.6 billion of capital investment on rural arterials and major collectors represents 19.9 percent of the $103.5 billion total average annual investment under this scenario. Rural roads receive in this scenario 8.9 percent of system expansion expenditures and 25.3 percent of system rehabilitation expenditures. The relatively modest size of these rural shares reflects partly that rural minor collectors (along with rural local and urban local roads) are not classified as Federal-aid highways. As discussed in Chapter 2, while Federal-aid highways carry over five-sixths of total VMT, they account for less than one-quarter of total mileage. The system rehabilitation needs on the remaining three-quarters of total mileage are significant.

| Average Annual National Investment on Federal-Aid Highways (Billions of 2008 Dollars) | ||||||

|---|---|---|---|---|---|---|

| Functional Class | System Rehabilitation Highway | System Rehabilitation Bridge | System Rehabilitation Total | System Expansion | System Enhancement | Total |

| Rural Arterials and Major Collectors | ||||||

| Interstate | $2.1 | $0.9 | $3.0 | $1.7 | $0.6 | $5.3 |

| Other Principal Arterial | $2.4 | $0.7 | $3.0 | $1.0 | $1.0 | $5.0 |

| Minor Arterial | $2.5 | $0.7 | $3.1 | $0.4 | $0.7 | $4.2 |

| Major Collector | $3.5 | $1.0 | $4.6 | $0.4 | $1.0 | $6.0 |

| Subtotal | $10.4 | $3.3 | $13.7 | $3.6 | $3.3 | $20.6 |

| Urban Arterials and Collectors | ||||||

| Interstate | $7.5 | $3.6 | $11.1 | $17.0 | $1.5 | $29.6 |

| Other Freeway and Expressway | $3.6 | $1.4 | $5.1 | $7.3 | $0.9 | $13.3 |

| Other Principal Arterial | $7.3 | $2.5 | $9.8 | $5.6 | $1.8 | $17.1 |

| Minor Arterial | $7.8 | $2.2 | $10.0 | $4.4 | $1.4 | $15.7 |

| Collector | $3.5 | $0.8 | $4.4 | $2.1 | $0.7 | $7.2 |

| Subtotal | $29.8 | $10.6 | $40.3 | $36.4 | $6.2 | $82.9 |

| Total, Federal-Aid Highways * | $40.2 | $13.8 | $54.0 | $39.9 | $9.5 | $103.5 |

Improve Conditions and Performance Scenario

In the Improve Conditions and Performance scenario for Federal-aid highways, total investment in these highways by all levels of government averages $134.9 billion per year, or nearly double the 2008 level of spending, but rural arterials and major collectors receive only $26.9 billion of this amount, or 1.3 percent less than in 2008. This stems mainly from a substantial reduction in funding for rural other principal arterials. As shown in Exhibit 8-7, this scenario would direct 15.2 percent more per year toward rural system rehabilitation than what was spent in 2008, but would direct 52.3 percent less toward rural system expansion. Among the urban functional classes, the scenario would more than triple the amount currently expended on other urban freeways and expressways; the scenario would more than double the amount currently expended on the urban portion of the Interstate System, urban minor arterials, and urban collectors.

| Average Annual National Investment on Federal-Aid Highways (Billions of 2008 Dollars) | ||||||

|---|---|---|---|---|---|---|

| Functional Class | System Rehabilitation Highway | System Rehabilitation Bridge | System Rehabilitation Total | System Expansion | System Enhancement | Total |

| Rural Arterials and Major Collectors | ||||||

| Interstate | $2.3 | $1.1 | $3.4 | $2.0 | $0.8 | $6.2 |

| Other Principal Arterial | $3.2 | $0.8 | $4.0 | $1.3 | $1.3 | $6.6 |

| Minor Arterial | $3.4 | $0.8 | $4.1 | $0.5 | $0.9 | $5.6 |

| Major Collector | $5.4 | $1.2 | $6.7 | $0.6 | $1.3 | $8.5 |

| Subtotal | $14.3 | $3.8 | $18.2 | $4.4 | $4.3 | $26.9 |

| Urban Arterials and Collectors | ||||||

| Interstate | $8.6 | $4.3 | $12.8 | $21.8 | $1.9 | $36.5 |

| Other Freeway and Expressway | $4.4 | $1.7 | $6.1 | $9.9 | $1.2 | $17.2 |

| Other Principal Arterial | $9.6 | $3.2 | $12.8 | $9.0 | $2.3 | $24.0 |

| Minor Arterial | $9.1 | $3.0 | $12.1 | $6.5 | $1.8 | $20.3 |

| Collector | $4.7 | $1.1 | $5.8 | $3.2 | $1.0 | $9.9 |

| Subtotal | $36.3 | $13.2 | $49.6 | $50.3 | $8.1 | $108.0 |

| Total, Federal-Aid Highways * | $50.7 | $17.1 | $67.8 | $54.7 | $12.4 | $134.9 |

| Percent Above Actual 2008 Capital Spending on Federal-Aid Highways by All Levels of Government Combined | ||||||

|---|---|---|---|---|---|---|

| Functional Class | System Rehabilitation Highway | System Rehabilitation Bridge | System Rehabilitation Total | System Expansion | System Enhancement | Total |

| Rural Arterials and Major Collectors | ||||||

| Interstate | -28.6% | 58.9% | -13.6% | 34.0% | 91.0% | 6.0% |

| Other Principal Arterial | -21.9% | -4.8% | -19.1% | -72.7% | 91.0% | -36.5% |

| Minor Arterial | 34.2% | -3.4% | 25.1% | -72.6% | 91.0% | -2.2% |

| Major Collector | 116.7% | 11.3% | 84.4% | -43.4% | 91.0% | 60.2% |

| Subtotal | 15.7% | 13.4% | 15.2% | -52.3% | 91.0% | -1.3% |

| Urban Arterials and Collectors | ||||||

| Interstate | 101.7% | 63.0% | 86.9% | 244.4% | 91.0% | 157.3% |

| Other Freeway and Expressway | 198.9% | 348.0% | 229.6% | 351.0% | 91.0% | 268.7% |

| Other Principal Arterial | 142.9% | 112.5% | 134.6% | 36.5% | 91.0% | 81.9% |

| Minor Arterial | 244.3% | 238.6% | 242.9% | 133.2% | 91.0% | 181.2% |

| Collector | 183.6% | 64.8% | 148.9% | 151.6% | 91.0% | 142.6% |

| Subtotal | 160.3% | 118.8% | 147.7% | 163.0% | 91.0% | 148.9% |

| Total, Federal-Aid Highways * | 92.3% | 81.0% | 89.3% | 93.1% | 91.0% | 91.0% |

Overall, the average annual investment level under the Improve Conditions and Performance scenario for Federal-aid highways is 91.0 percent higher than the actual amount spent in 2008; spending on system enhancements for each functional class was assumed to grow by this same percentage. System expansion expenditures under this scenario are 93.1 percent higher than in 2008, while system rehabilitation expenditures are 89.3 percent higher.

Systemwide Scenarios

As discussed in Chapter 7 (Exhibit 7-1), the functional classes not counted as Federal-aid highways—rural minor collectors, rural local roads, and urban local roads—received $17.2 billion out of the $91.1 billion invested systemwide in highways and bridges in 2008. Since these functional classes are not represented in the HPMS sample, they are not modeled in HERS. Adding this $17.2 billion to the $6.5 billion spent on system enhancements to Federal-aid highways means that $23.7 billion, or 26.0 percent, of systemwide capital spending was in the residual category not modeled by HERS or NBIAS.

Exhibit 8-8 summarizes the derivation of the systemwide scenarios. Each scenario links back to a specific funding level identified in the HERS and NBIAS analyses presented in Chapter 7. In computing the average annual investment levels over 20 years, the combined projections for the capital spending from the two models were adjusted upwards so that the non-modeled capital improvement types would remain at 26.0 percent of the total cost of each scenario, consistent with their share in 2008. The HERS-derived components of the systemwide scenarios are identical to those identified in Exhibit 8-1 for the Federal-aid highway scenarios. However, the NBIAS-derived components of the systemwide scenarios are different, as sufficient data available are available through the National Bridge Inventory to develop separate estimates, applying the scenario criteria to all bridges rather than just the subset of bridges on Federal-aid highways.

In 2008, $3.4 billion of the $12.8 billion in total bridge rehabilitation spending by all levels of government was directed to bridges on non-Federal-Aid highways. For the systemwide Sustain Current Spending scenario, this additional funding is available for NBIAS to direct to bridges on or off Federal-aid highways, as determined by the optimization algorithms in NBIAS. (In fact, the model would direct 85.4 percent of the $12.8 billion to bridges on Federal-aid highways under this scenario, while only 73.7 percent of this amount was directed to such bridges in 2008.)

The average annual investment level for the systemwide Maintain Conditions and Performance scenario is $101.0 billion. For bridge rehabilitation, NBIAS projects that maintaining the systemwide economic backlog of investment at its 2008 level would require investing over 20 years at an average annual level of only $11.9 billion in 2008 dollars, which is below the $12.8 billion spent in 2008. In the scenario, this reduction in average annual spending would be attained with spending on real expenditures on bridge rehabilitation decreasing 0.70 percent per year. In contrast, Exhibit 8-1 showed that maintaining the economic backlog for bridges on Federal-aid highways only would require rehabilitation spending on these bridges to increase. In combination, these findings suggest that the distribution of bridge spending in 2008 was somewhat better aligned with addressing long-term bridge needs off Federal-aid highways than on Federal-aid highways. (These findings are only suggestive because the modeling process entails many uncertainties and the 2008 spending data are partially estimated for some functional classes).

| Scenario Name and Description | Scenario Component (Source of Estimate)1 | Component Share of 2008 Capital Outlay | Annual Percent Change in Spending vs. 2008 | Minimum BCR | Average Annual Capital Investment on All Roads | |

|---|---|---|---|---|---|---|

| Billions of 2008 Dollars | Percent of Total | |||||

| Sustain Current Spending scenario (Sustain spending at base year levels in constant dollar terms.) | HERS2 | 60.0% | 0.00% | 2.42 | $54.7 | 60.0% |

| Sustain Current Spending scenario (Sustain spending at base year levels in constant dollar terms.) | NBIAS3 | 14.0% | 0.00% | $12.8 | 14.0% | |

| Sustain Current Spending scenario (Sustain spending at base year levels in constant dollar terms.) | Other | 26.0% | $23.7 | 26.0% | ||

| Sustain Current Spending scenario (Sustain spending at base year levels in constant dollar terms.) | Total | 100.0% | $91.1 | 100.0% | ||

| Maintain Conditions and Performance scenario (Maintain average speed and the economic bridge investment backlog at 2008 levels.) | HERS 2 | 60.0% | 1.31% | 2.02 | $62.9 | 62.3% |

| Maintain Conditions and Performance scenario (Maintain average speed and the economic bridge investment backlog at 2008 levels.) | NBIAS 3 | 14.0% | -0.70% | $11.9 | 11.8% | |

| Maintain Conditions and Performance scenario (Maintain average speed and the economic bridge investment backlog at 2008 levels.) | Other | 26.0% | $26.2 | 26.0% | ||

| Maintain Conditions and Performance scenario (Maintain average speed and the economic bridge investment backlog at 2008 levels.) | Total | 100.0% | $101.0 | 100.0% | ||

| Intermediate Improvement scenario (Invest in projects with benefit-cost ratios as low as 1.5 and reduce the economic bridge investment backlog.) | HERS 2 | 60.0% | 3.51% | 1.50 | $80.1 | 60.0% |

| Intermediate Improvement scenario (Invest in projects with benefit-cost ratios as low as 1.5 and reduce the economic bridge investment backlog.) | NBIAS 3 | 14.0% | 3.51% | $18.7 | 14.0% | |

| Intermediate Improvement scenario (Invest in projects with benefit-cost ratios as low as 1.5 and reduce the economic bridge investment backlog.) | Other | 26.0% | $34.7 | 26.0% | ||

| Intermediate Improvement scenario (Invest in projects with benefit-cost ratios as low as 1.5 and reduce the economic bridge investment backlog.) | Total | 100.0% | $133.5 | 100.0% | ||

| Improve Conditions and Performance scenario (Invest in all cost-beneficial projects and eliminate the economic bridge investment backlog.) | HERS 2 | 60.0% | 5.90% | 1.00 | $105.4 | 62.0% |

| Improve Conditions and Performance scenario (Invest in all cost-beneficial projects and eliminate the economic bridge investment backlog.) | NBIAS 3 | 14.0% | 4.31% | $20.5 | 12.1% | |

| Improve Conditions and Performance scenario (Invest in all cost-beneficial projects and eliminate the economic bridge investment backlog.) | Other | 26.0% | $44.2 | 26.0% | ||

| Improve Conditions and Performance scenario (Invest in all cost-beneficial projects and eliminate the economic bridge investment backlog.) | Total | 100.0% | $170.1 | 100.0% | ||

2 The scenario components derived from HERS are directly linked to the analyses presented in Exhibits 7-3 through 7-10 in Chapter 7; these components can be cross-referenced to the exhibits using either the annual percent change in spending relative to 2008, or the minimum BCR identified in this table.

3 The scenario components derived from NBIAS are directly linked to the analysis presented in Exhibit 7-17 in Chapter 7; these components can be cross-referenced to this exhibit using the annual percent change in spending relative to 2008 identified in this table.

The average annual investment levels for the 20-year period through 2028 for the systemwide Intermediate Improvement scenario and the systemwide Improve Conditions and Performance scenario are $133.5 billion and $170.1 billion, respectively. These figures are stated in constant 2008 dollars (as are all of the other scenario investment levels presented in this chapter, as stated earlier).

It is important to note that these scenarios are intended to be illustrative, and any number of alternative scenarios based on different BCR cutoff points, performance targets, or funding targets could be constructed that would be equally valid from a technical perspective.

Systemwide Scenario Impacts and Comparison with 2008 Spending

Exhibit 8-9 compares the systemwide scenarios with 2008 spending. The average annual investment level associated with the Maintain Conditions and Performance scenario is 10.8 percent higher than actual spending by all levels of government on capital improvements to highways and bridges in 2008; the comparable “gap” between the Improve Conditions and Performance scenario and 2008 spending is 86.6 percent.

| Comparison Parameter | Sustain Current Spending Scenario | Maintain Conditions & Performance Scenario | Intermediate Improvement Scenario | Improve Conditions & Performance Scenario |

|---|---|---|---|---|

| Comparison of Scenarios With 2008 Spending | ||||

| Average Annual Investment (Billions of 2008 Dollars) | $91.1 | $101.0 | $133.5 | $170.1 |

| Difference Relative to 2008 Spending (Billions of 2008 Dollars) | $0.0 | $9.8 | $42.4 | $78.9 |

| Percent Difference Relative to 2008 Spending | 0.0% | 10.8% | 46.5% | 86.6% |

| Annual Percent Increase to Support Scenario Investment1 | 0.00% | 0.97% | 3.51% | 5.62% |

| Projected Impacts of Scenarios on All Roads2 | ||||

| Percent Change in Economic Bridge Investment Backlog (2028 vs. 2008)3 | -11.2% | 0.0% | -79.1% | -100.0% |

2 Systemwide performance information for pavement condition and congestion is not available, as the HERS analysis is limited to Federal-aid highways for which HPMS sample data are collected by the FHWA. See Exhibit 8-2 for performance information on Federal-aid highways. Bridge performance information is available on a systemwide basis, as the NBI includes data for all bridges over 20 feet in length.

3 Values shown correspond to amounts in Exhibit 7-17 in Chapter 7.

Exhibit 8-9 also shows the projected impacts on the economic backlog of bridge rehabilitation projects in 2028. For the other conditions and performance indicators, which relate to speed, delay, or pavement condition, the only projections available for this analysis come from the HERS simulations, which cover the Federal-Aid highways alone. Hence, these indicators are absent from Exhibit 8-9, where the focus is systemwide. The Intermediate Improvement scenario projects that the economic investment backlog in 2028 will be 79.1 percent lower than in 2008, while the Sustain Current Spending scenario (in which bridge spending is higher than in the Maintain Conditions and Performance scenario, as noted above) projects an 11.2 percent reduction. For the other two scenarios, the scenario assumptions ensure that the backlog disappears by 2028 (Improve Conditions and Performance scenario) or remains at its 2008 level (Maintain Conditions and Performance scenario).

Systemwide Scenario Estimates by Improvement Type

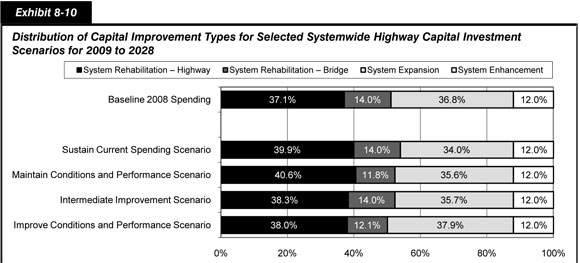

Exhibit 8-10 shows the distribution of highway capital spending by improvement type for each systemwide scenario, as well as the corresponding distribution of actual systemwide spending by all levels of government) in 2008. A comparison of this distribution with that shown in Exhibit 8-3 reveals that the percentage allocations to system expansion are typically a few points lower, and those to system enhancements are typically a few points higher in the systemwide scenarios than in the comparable Federal-aid highway scenarios; these differences primarily reflect corresponding differences in the base year spending patterns. In 2008, the system expansion share of capital spending was 40.1 percent of on Federal-aid highways and 36.8 percent systemwide, while the system enhancement shares were 9.2 percent on Federal-aid highways versus 12.0 percent systemwide.

| Scenario Name | Average Annual Investment (Billions of 2008 Dollars) | |||||

|---|---|---|---|---|---|---|

| System Rehabilitation Highway1 | System Rehabilitation Bridge2 | System Rehabilitation Total | System Expansion 1 | System Enhancement | Total | |

| Baseline 2008 Spending | $33.8 | $12.8 | $46.6 | $33.6 | $11.0 | $91.1 |

| Sustain Current Spending scenario | $36.4 | $12.8 | $49.2 | $31.0 | $11.0 | $91.1 |

| Maintain Conditions and Performance scenario | $41.0 | $11.9 | $52.9 | $36.0 | $12.1 | $101.0 |

| Intermediate Improvement scenario | $51.1 | $18.7 | $69.9 | $47.6 | $16.1 | $133.5 |

| Improve Conditions and Performance scenario | $64.6 | $20.5 | $85.1 | $64.5 | $20.5 | $170.1 |

| State of Good Repair benchmark3 | $64.6 | $20.5 | $85.1 | |||

2 Values shown correspond to amounts in Exhibit 7-17 in Chapter 7.

3 The State of Good Repair benchmark is a subset of the Improve Conditions and Performance scenario.

Of the $170.1 billion average annual investment level for the systemwide Improve Conditions and Performance scenario, $85.1 billion (50.1 percent) would be directed towards the types of system rehabilitation actions reflected in the State of Good Repair benchmark. Although this level of investment is below the $91.1 billion spent for all highway capital improvements in 2008, it significantly exceeds the $46.6 billion spent in 2008 for system rehabilitation improvements.

National Highway System Scenarios

Exhibit 8-11 describes the derivation of the investment levels for each of four NHS capital investment scenarios, which each draw from the HERS and NBIAS analyses presented in Chapter 7. (The footnotes in Exhibit 8-11 identify the specific Chapter 7 exhibits to which the scenarios are linked.) Each scenario covers the 20-year period from 2008 to 2028, and the investment levels shown are all “real,” stated in constant 2008 dollars.

| Scenario Name and Description | Scenario Component (Source of Estimate)1 | Component Share of 2008 Capital Outlay | Annual Percent Change in Spending vs. 2008 | Minimum BCR | Average Annual Capital Investment on All Roads | |

|---|---|---|---|---|---|---|

| Billions of 2008 Dollars | Percent of Total | |||||

| Sustain Current Spending scenario (Sustain spending at base year levels in constant dollar terms.) | HERS2 | 79.3% | 0.00% | 2.26 | $33.3 | 79.3% |

| Sustain Current Spending scenario (Sustain spending at base year levels in constant dollar terms.) | NBIAS3 | 12.9% | 0.00% | $5.4 | 12.9% | |

| Sustain Current Spending scenario (Sustain spending at base year levels in constant dollar terms.) | Other | 7.8% | $3.3 | 7.8% | ||

| Sustain Current Spending scenario (Sustain spending at base year levels in constant dollar terms.) | Total | 100.0% | $42.0 | 100.0% | ||

| Maintain Conditions and Performance scenario (Maintain average speed and the economic bridge investment backlog at 2008 levels.) | HERS 2 | 79.3% | -0.87% | 2.55 | $30.4 | 78.4% |

| Maintain Conditions and Performance scenario (Maintain average speed and the economic bridge investment backlog at 2008 levels.) | NBIAS 3 | 12.9% | -0.09% | $5.4 | 13.8% | |

| Maintain Conditions and Performance scenario (Maintain average speed and the economic bridge investment backlog at 2008 levels.) | Other | 7.8% | $3.0 | 7.8% | ||

| Maintain Conditions and Performance scenario (Maintain average speed and the economic bridge investment backlog at 2008 levels.) | Total | 100.0% | $38.9 | 100.0% | ||

| Intermediate Improvement scenario (Invest in projects with benefit-cost ratios as low as 1.5 and reduce the economic bridge investment backlog.) | HERS 2 | 79.3% | 2.80% | 1.50 | $45.1 | 79.3% |

| Intermediate Improvement scenario (Invest in projects with benefit-cost ratios as low as 1.5 and reduce the economic bridge investment backlog.) | NBIAS 3 | 12.9% | 2.80% | $7.3 | 12.9% | |

| Intermediate Improvement scenario (Invest in projects with benefit-cost ratios as low as 1.5 and reduce the economic bridge investment backlog.) | Other | 7.8% | $4.4 | 7.8% | ||

| Intermediate Improvement scenario (Invest in projects with benefit-cost ratios as low as 1.5 and reduce the economic bridge investment backlog.) | Total | 100.0% | $56.9 | 100.0% | ||

| Improve Conditions and Performance scenario (Invest in all cost-beneficial projects and eliminate the economic bridge investment backlog.) | HERS 2 | 79.3% | 4.91% | 1.00 | $57.3 | 79.8% |

| Improve Conditions and Performance scenario (Invest in all cost-beneficial projects and eliminate the economic bridge investment backlog.) | NBIAS 3 | 12.9% | 4.48% | $8.9 | 12.4% | |

| Improve Conditions and Performance scenario (Invest in all cost-beneficial projects and eliminate the economic bridge investment backlog.) | Other | 7.8% | $5.6 | 7.8% | ||

| Improve Conditions and Performance scenario (Invest in all cost-beneficial projects and eliminate the economic bridge investment backlog.) | Total | 100.0% | $71.8 | 100.0% | ||

2 The scenario components derived from HERS are directly linked to the analyses presented in Exhibits 7-11 through 7-13 in Chapter 7; these components can be cross-referenced to the exhibits using either the annual percent change in spending relative to 2008, or the minimum BCR identified in this table.

3 The scenario components derived from NBIAS are directly linked to the analysis presented in Exhibit 7-19 in Chapter 7; these components can be cross-referenced to this exhibit using the annual percent change in spending relative to 2008 identified in this table.

All levels of government spent a combined $42.0 billion on capital improvements to highways and bridges on the NHS in 2008; as shown in Exhibit 8-11, $33.3 billion of this total (79.3 percent) was used for the type of capital improvements modeled in HERS, $5.4 billion (12.9 percent) for types of improvements modeled in NBIAS, and $3.3 billion (7.8 percent) for other types of capital improvements. By definition, these amounts match the average annual investment levels for the NHS Sustain Current Spending scenario. Each of the other NHS scenarios assume that the share of average annual investment directed towards non-modeled capital improvements will remain at the 2008 level of 7.6 percent.

Exhibit 8-11 also identifies the annual rates of real spending growth associated with the HERS and NBIAS components of each scenario. For the NHS Maintain Conditions and Performance scenario, each of these growth rates is negative, indicating that 2008 spending levels are higher than the amount required over 20 years to meet the performance objectives of this scenario (maintain average speed at 2008 levels and prevent the economic bridge investment backlog from rising above its 2008 level in constant dollar terms). The average annual investment level associated with the NHS Maintain Conditions and Performance scenario is $38.9 billion. The HERS-derived component of this scenario would address all potential capital improvements with a BCR of 2.55 or higher; the comparable value for the Sustain Current Spending scenario is 2.26 (because the model implements improvements in descending order of their BCRs, scenarios with higher investment levels will have lower minimum BCRs).

Addressing all potential improvements with BCRs of 1.50 or higher as computed by HERS would require annual increase in related spending of 2.80 percent per year over 20 years. Applying this same growth rate to all other types of capital spending generates the estimated average annual investment level of $56.9 billion for the NHS Intermediate Improvement scenario.

The goal of the Improve Conditions and Performance scenario is to address all potential highway and bridge improvements with a BCR of 1.0 or higher. As shown in Exhibit 8-11, HERS projects that meeting this goal would require capital spending on the NHS to increase annually by 4.91 percent and 4.48 percent for the types of NHS improvements modeled in HERS and NBIAS, respectively. Funding these cost-beneficial improvements, while keeping the share of non-modeled spending at its 2008 share of 7.8 percent of total spending, would require an average annual investment of $71.8 billion for capital improvements to NHS highways and bridges over 20 years, stated in constant 2008 dollars.

NHS Scenario Impacts and Comparison with 2008 Spending

Exhibit 8-12 compares the capital investment levels associated with each of the selected NHS scenarios with actual NHS capital spending in 2008 and presents the associated projections for summary measures of conditions and performance. By definition, the NHS Maintain Conditions and Performance scenario will result in zero change between 2008 and 2028 in average speed and in the economic bridge investment backlog. The other non-targeted measures include the average IRI, projected to decrease by 9.2 percent (consistent with an improvement in physical conditions), and average delay per VMT, projected to increase by 0.7 percent (consistent with a worsening of operational performance). The $38.9 billion average annual investment level for the NHS Maintain Conditions and Performance scenario is 7.6 percent below the $42.0 billion of actual capital spending on the NHS in 2008. The scenario assumes that this reduction in investment would be achieved with spending decreasing by 0.76 percent per year over 20 years. This result, combined with the finding presented in Exhibit 8-1 that an increase in investment would be needed to achieve the objectives of this scenario for Federal-aid highways, suggests that the distribution spending in 2008 was somewhat better aligned with addressing long-term highway and bridge needs on the NHS than off of the NHS.

As the NHS Sustain Current Spending scenario has a higher average annual investment level than the NHS Maintain Conditions and Performance scenario, it is projected to result in improvements to NHS conditions and performance. As shown in Exhibit 8-12, relative to values in the 2008 base year, the projections are for average speeds to increase by 0.8 percent. Average delay and average IRI are also projected to decline, consistent with general improvements to operational performance and pavement conditions. The size of the economic bridge investment backlog is also projected to be reduced by approximately 1.8 percent over 20 years.

| Comparison Parameter | Sustain Current Spending Scenario | Maintain Conditions & Performance Scenario | Intermediate Improvement Scenario | Improve Conditions & Performance Scenario |

|---|---|---|---|---|

| Comparison of Scenarios With 2008 Spending | ||||

| Average Annual Investment (Billions of 2008 Dollars) | $42.0 | $38.9 | $56.9 | $71.8 |

| Difference Relative to 2008 Spending (Billions of 2008 Dollars) | $0.0 | -$3.2 | $14.9 | $29.7 |

| Percent Difference Relative to 2008 Spending | 0.0% | -7.6% | 35.3% | 70.7% |

| Annual Percent Increase to Support Scenario Investment1 | 0.00% | -0.76% | 2.80% | 4.85% |

| Projected Impacts of Scenarios on Federal-Aid Highways | ||||

| Percent Change in Average Speed (2028 vs. 2008)2 | 0.8% | 0.0% | 3.6% | 5.7% |

| Percent of VMT on Roads With Good Ride Quality, 2028 3 | 73.6% | 70.8% | 83.0% | 89.6% |

| Percent of VMT on Roads With Acceptable Ride Quality, 2028 3 | 93.6% | 92.8% | 95.8% | 97.4% |

| Percent Change in Average IRI (2028 vs. 2008) 3 | -13.4% | -9.2% | -25.2% | -33.6% |

| Percent Change in Average Delay per VMT (2028 vs. 2008) 2 | -2.9% | 0.7% | -16.1% | -26.3% |

| Percent Change in Economic Bridge Investment Backlog (2028 vs. 2008)4 | -1.8% | 0.0% | -56.7% | -100.0% |

2 Values shown correspond to amounts in Exhibit 7-13 in Chapter 7.

3 Values shown correspond to amounts in Exhibit 7-12 in Chapter 7. Reductions in average pavement roughness (IRI) tranlate into improved ride quality.

4 Values shown correspond to amounts in Exhibit 7-19 in Chapter 7.

Under the NHS Improve Conditions and Performance scenario, the percent of NHS VMT on pavements with good ride quality is projected to rise to 89.6 percent, while the percent of VMT on pavements with acceptable ride quality reaches 97.4 percent. By definition, this scenario would eliminate the economic bridge investment backlog on the NHS by 2028; it is also projected to increase average speeds by 5.7 percent by that date relative to 2008. Average pavement roughness is projected to be reduced by 33.6 percent on the NHS, while average delay per VMT on the NHS would decrease by 26.3 percent by 2028. The potential for reductions to average delay per VMT is relatively large (relative to the values identified for Federal-aid highways in Exhibit 8-3) because strategic investments in NHS System Expansion, coupled with the continued deployment of Intelligent Transportation Systems on a growing share of the NHS, has the potential to significantly improve operating performance.

| Can highway capacity be expanded without either building new roads and bridges or adding new lanes to existing facilities? | |

|

Yes. The “System Expansion” investment levels identified in this chapter reflect a need for a certain amount of effective highway capacity, which could be met by traditional expansion or by other means. In some cases, effective highway capacity can be increased by improving the utilization of the existing infrastructure rather than by expanding it. The investment scenario estimates presented in this report consider the impact of some of the most significant operations strategies and deployments on highway system performance; these relationships are described in more detail in Appendix A. The potential implications of accelerating the deployment of operations strategies or implementing congestion pricing are explored in Chapter 9.

The methodology used to estimate the system expansion component of the investment scenarios also allows high-cost capacity improvements to be considered as an option for segments with high volumes of projected future travel, but have been coded by States as infeasible for conventional widening. Conceptually, such improvements might consist of new highways or bridges in the same corridor (or tunneling or double-decking on an existing alignment), but the capacity upgrades could also come through other transportation improvements, such as a parallel fixed-guideway transit line or mixed-use, high-occupancy vehicle/bus lanes. |

|

The average annual investment level for NHS Improve Conditions and Performance scenario of $71.8 billion is 70.7 percent higher than actual spending on the NHS in 2008. NHS spending would need to increase by 4.85 percent per year over 20 years to reach this average annual level. Achieving the less-ambitious objectives of the NHS Intermediate Improvement scenario would require an annual spending increase of 2.80 percent through 2028.

NHS Scenario Estimates by Improvement Type

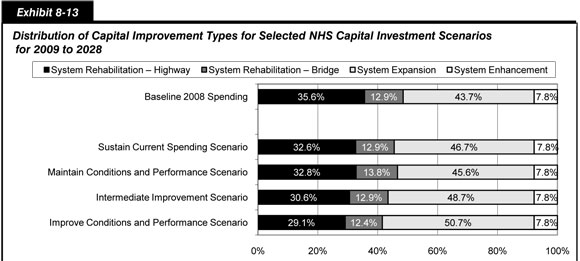

Exhibit 8-13 compares the distribution of highway and bridge capital outlay among the 20-year NHS capital investment scenarios and with actual NHS spending in 2008. As noted above, each scenario was derived in such a manner that capital spending on non-modeled system enhancement would equal 7.8 percent of the average annual investment level for that scenario. The share of the Sustain Current Spending scenario and the Intermediate Improvement scenario capital spending directed to bridge system rehabilitation matches the 2008 percentage of 12.9 percent by design; for the other scenarios, the level of NBIAS-modeled investment is determined independently.

| Scenario Name | Average Annual Investment (Billions of 2008 Dollars) | |||||

|---|---|---|---|---|---|---|

| System Rehabilitation Highway1 | System Rehabilitation Bridge2 | System Rehabilitation Total | System Expansion 3 | System Enhancement | Total | |

| Baseline 2008 Spending | $15.0 | $5.4 | $20.4 | $18.4 | $3.3 | $42.0 |

| Sustain Current Spending scenario | $13.7 | $5.4 | $19.1 | $19.6 | $3.3 | $42.0 |

| Maintain Conditions and Performance scenario | $12.7 | $5.4 | $18.1 | $17.7 | $3.0 | $38.9 |

| Intermediate Improvement scenario | $17.4 | $7.3 | $24.7 | $27.7 | $4.4 | $56.9 |

| Improve Conditions and Performance scenario | $20.9 | $8.9 | $29.8 | $36.4 | $5.6 | $71.8 |

| State of Good Repair benchmark4 | $20.9 | $8.9 | $29.8 | |||

2 Values shown correspond to amounts in Exhibit 7-19 in Chapter 7.

3 Values shown correspond to amounts in Exhibit 7-13 in Chapter 7.

4 The State of Good Repair benchmark is a subset of the Improve Conditions and Performance scenario.

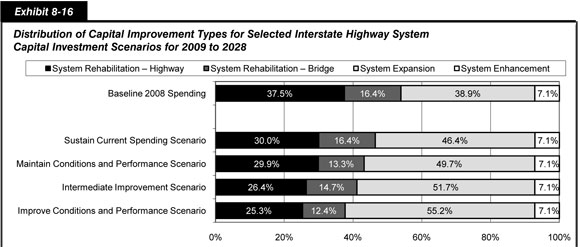

In each of the four scenarios, system expansion receives a higher share of future investment than the 43.7 percent actually received in 2008. The NHS Sustain Current Spending scenario increases this share to 46.7 percent, while the NHS Improve Conditions and Performance scenario would increase it further to 50.7 percent.