- Potential Highway Capital Investment Impacts

- Highway Economic Requirements System

- National Bridge Investment Analysis System

- Types of Capital Spending Projected by HERS and NBIAS

- Alternative Levels of Future Capital Investment Analyzed

- Impacts of Systemwide Investments Modeled by HERS

- Impacts of NHS Investments Modeled by HERS

- Impacts of Interstate System Investments Modeled by HERS

- Impacts of Systemwide Investments Modeled by NBIAS

- Impacts of NHS Investments Modeled by NBIAS

- Impacts of Interstate Investments Modeled by NBIAS

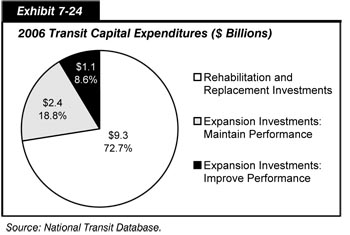

- Potential Transit Capital Investment Impacts

- Comparison

Potential Highway Capital Investment Impacts

This section projects the impacts that alternative levels of future investment in highways and bridges might be expected to have on various measures of system conditions and performance. The analyses presented here focus mainly on types of capital investment that can be directly modeled using the Highway Economic Requirements System (HERS) and the National Bridge Investment Analysis System (NBIAS). The capital investment scenarios presented in Chapter 8 draw upon these analyses, but also consider other types of capital investment that are not currently modeled in HERS or NBIAS.

This section also explores the implications of alternative funding mechanisms on the level of combined public and private investment that would potentially be required to achieve certain performance objectives. The options identified include funding from non-user based sources, funding from fixed rate user based sources, and funding from variable rate user based sources such as congestion pricing.

The accuracy of these projections depends on the validity of the technical assumptions underlying the analysis. Chapter 10 explores the impacts of altering some of these assumptions.

A subsequent section within this chapter explores comparable information for different types of potential future transit investments. This is followed by a section providing a crosswalk between the highway, bridge, and transit sections with the information presented in the previous edition of this report.

Highway Economic Requirements System

The investment scenario estimates shown in this report for highway resurfacing and reconstruction and highway and bridge capacity expansion are developed primarily from HERS, a simulation model that employs incremental benefit-cost analysis to evaluate highway improvements. The HERS analysis is based on data from the Highway Performance Monitoring System (HPMS), which provides information on current roadway characteristics, conditions, and performance and anticipated future travel growth for a nationwide sample of more than 119,000 highway sections. While HERS analyzes these sample sections individually, the model is designed to provide results valid at the national level. HERS does not provide definitive improvement recommendations for individual highway segments.

The HERS model analyzes highway investment by first evaluating the current state of the highway system using information on pavements, geometry, traffic volumes, vehicle mix, and other characteristics from the HPMS sample dataset. It then considers potential improvements on sections with one or more deficiencies, including resurfacing, reconstruction, alignment improvements, and widening or adding travel lanes. HERS then selects the improvement with the greatest net benefits, where benefits are defined as reductions in direct highway user costs, agency costs, and societal costs. In cases where none of the potential improvements produces benefits exceeding construction costs, the segment is not improved. Appendix A contains a more detailed description of the project selection and implementation process used by HERS.

Operations Strategies

The HERS model also takes into account the impact that new investments in certain types of intelligent transportation systems (ITSs) and the continued deployment of various operations strategies can have on highway system performance, as well as on the estimated level of capital investment that would be needed to reach given performance benchmarks. This feature was introduced in the 2004 edition of the C&P report. The types of operations investments and strategies considered include freeway management (ramp metering, electronic roadway monitoring, variable message signs, integrated corridor management, and variable speed limits); incident management (incident detection, verification, and response); arterial management (upgraded signal control, electronic monitoring, and variable message signs); and traveler information (511 systems and advanced in-vehicle navigation systems with real-time traveler information).

| How closely does the HERS model simulate the actual project selection processes of State and local highway agencies? | |

|

The HERS model is intended to approximate, rather than replicate, the decision processes used by State and local governments. HERS does not have access to the full array of information that local governments would use in making investment decisions. This means that the model results may include some highway and bridge improvements that simply are not feasible because of factors the model doesn't consider, such as political issues or other practical impediments. Excluding such projects would result in reducing the "true" level of investment that is economically justifiable. Conversely, the highway model assumes that State and local project selection will be economically optimal and doesn't consider external factors such as the distribution of projects among the States or within each State. In actual practice, projects are often not selected on the basis of their benefit-cost ratios; there are other important factors included in the project selection process aside from economic considerations. Thus, the "true" level of investment that would achieve the outcome desired under the scenarios could be higher than the estimates shown in this report.

Currently, approximately 20 States make some use of benefit-cost analysis in managing their transportation programs; only six States use the technique regularly. This means that the majority of transportation decisions in the United States today are being made with limited reference to the projected benefits and costs of a specific course of action relative to another course of action.

|

|

Future operations investments are implemented in HERS through an assumed, exogenously specified scenario; they are not included directly in the benefit-cost calculations made within the model, and HERS does not directly consider any tradeoffs or complementarities between ITS and other types of highway improvements. The baseline scenario used for this report assumes the continuation of existing deployment trends. This scenario was used for all of the HERS-based analyses presented in Chapters 7, 8, and 9. Chapter 10 includes a sensitivity analysis considering the potential impacts of a more aggressive deployment of operations strategies and ITS. Appendix A includes a more complete description of the operations strategies and their impacts on performance.

Travel Demand Elasticity

One of the key economic analysis features of HERS involves its treatment of travel demand. Recognizing that drivers will respond to changes in the relative price of driving and adjust their behavior accordingly, HERS explicitly models the relationship between the amount of highway travel and the price of that travel. This concept, sometimes referred to as travel demand elasticity, is applied to the forecasts of future travel found in the HPMS sample data. The HERS model assumes that the forecasts for each sample highway segment represent a future in which average conditions and performance are maintained, thus holding highway user costs at current levels. Any change in user costs relative to the initial conditions calculated by HERS will thus have the effect of either inducing or suppressing future travel growth on each segment. Consequently, for any highway investment scenario that results in a decline in average user costs, the effective vehicle miles traveled (VMT) growth rate for the overall system will tend to be higher than the baseline rate derived from HPMS. For scenarios in which highway user costs increase, the effective VMT growth rate will tend to be lower than the baseline rate. A discussion of the impact that future investment levels could be expected to have on future travel growth is included in Chapter 9.

Linking Financing Mechanisms and Investment Impacts

The HERS model has recently been modified to allow the exploration of linkages between different types of financing mechanisms used to generate revenues for highway investment and the relationship between alternative investment levels and future system performance. If the revenues needed to support a higher level of future capital investment were generated from non-user sources (such as property taxes or general governmental revenues), then future travel demand would not be significantly affected by the cost of funding infrastructure improvements. However, if such revenues were generated from fixed-rate user charges (such as a VMT charge or fuel tax), the costs experienced by users would rise, resulting in some reduction to the effective VMT growth rate, which would in turn impact the operational performance of the system. To the extent that such revenues were generated directly from individual users by variable-rate user charges (such as congestion pricing, in which users pay according to the costs they impose on the system), the impact on peak period travel would be more dramatic, resulting in significant impacts on system performance for a given level of highway investment. Appendix A includes more details on how this feature was implemented in HERS.

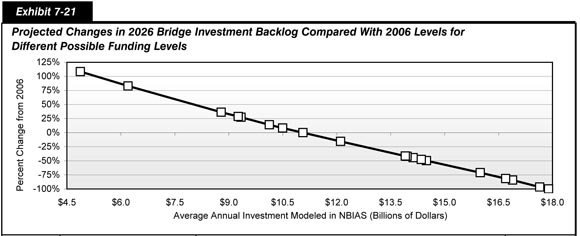

National Bridge Investment Analysis System

The scenario estimates relating to bridge repair and replacement shown in this report are derived primarily from NBIAS. This model incorporates analytical methods from the Pontis bridge management system, which was first developed by the Federal Highway Administration in 1989 and is now owned and licensed by the American Association of State Highway and Transportation Officials. NBIAS, however, incorporates additional economic criteria into its analytical procedures. Pontis relies on detailed structural element-level data on bridges to support its analysis; NBIAS adds a capability to synthesize such data from general bridge condition ratings reported for all bridges in the National Bridge Inventory (NBI). While the analysis in this report is derived solely from NBI data, the current version of NBIAS is capable of processing element-level data directly.

The NBIAS model uses a probabilistic approach to model bridge deterioration for each synthesized bridge element. It relies on a set of transition probabilities to project the likelihood that an element will deteriorate from one condition state to another over a given period of time. The model then determines an optimal set of repair and rehabilitation actions to take for each bridge element, based on the condition of the element. NBIAS can also apply preservation policies at the individual bridge level and directly compare the costs and benefits of performing rehabilitation or repair work relative to completely replacing the bridge.

To estimate functional improvement needs, NBIAS applies a set of improvement standards and costs to each bridge in the NBI. The model then identifies potential improvements—such as widening existing bridge lanes, raising bridges to increase vertical clearances, and strengthening bridges to increase load-carrying capacity—and evaluates their potential benefits and costs. The NBIAS model is discussed in more detail in Appendix B.

Types of Capital Spending Projected by HERS and NBIAS

Chapter 6 identifies three major groups of capital improvement types: System Rehabilitation, System Expansion, and System Enhancement. The types of bridge improvements modeled in NBIAS roughly correspond to the types of bridge improvements classified as System Rehabilitation in Chapter 6. Because NBI data are available for bridges on all functional systems, NBIAS can be used directly to compute the bridge components of future investment scenarios that address the highway system as a whole.

For those functional systems for which data are available, the HERS evaluates types of improvements that roughly correspond to the types of highway resurfacing and reconstruction improvements classified as System Rehabilitation in Chapter 6. HERS also evaluates potential widening improvements, consistent with the types of improvements classified as System Expansion in Chapter 6. As the widening costs considered in HERS reflect both the typical costs of adding lanes per mile of roadway under different circumstances and the costs of modifying a typical number of structures per mile in conjunction with a widening project, the HERS estimates are considered to represent system expansion costs for both highways and bridges. In summary, HERS measures system rehabilitation costs for highways, and system expansion costs for highways and bridges combined; NBIAS measures system rehabilitation costs for bridges.

The HPMS sample segment database used by HERS is limited to Federal-aid highways, and thus excludes roads classified as rural minor collector, rural local, or urban local. Consequently, in order to develop future investment scenarios that address the highway system as a whole, it is necessary to account for these functional systems outside of the modeling process. HERS and NBIAS do not directly evaluate the types of improvements that correspond to the types of improvements classified as System Enhancement in Chapter 6. Thus, developing future investment scenarios that account for these types of improvements also requires external adjustments to be made to the directly modeled improvements generated by HERS and NBIAS. The term "non-modeled spending" is used throughout this chapter and subsequent chapters to refer to spending on capital improvements that is not captured in the HERS or NBIAS analyses.

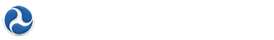

Exhibit 7-1 identifies the portion of total public and private capital investment on highways and bridges in 2006 that corresponds to the types of improvements modeled in HERS and NBIAS. Of the $16.5 billion of capital investment on the Interstate System in 2006, approximately $12.8 billion (77.5 percent) was used for types of improvements modeled in HERS. Approximately $2.5 billion (15.1 percent) was used for types of improvements modeled in NBIAS, while $1.2 billion (7.4 percent) went for types of improvements not addressed by either HERS or NBIAS.

Of the $37.1 billion of capital investment on the National Highway System (NHS) as a whole in 2006, including the Interstate System, approximately $30.0 billion (80.8 percent) was used for types of improvements modeled in HERS. Approximately $4.3 billion (11.6 percent) was used for types of improvements modeled in NBIAS, while $2.8 billion (7.4 percent) went for types of improvements not addressed by either HERS or NBIAS.

| How closely do the capital improvement types presented in Chapter 6 line up with the types of improvements modeled in HERS and NBIAS? | |

|

The reconstruction without added capacity, restoration and rehabilitation, and resurfacing capital improvement types included within System Rehabilitation expenditures in Chapter 6 correspond well to the types of capital improvements modeled in HERS. Reconstruction with added capacity is split between System Rehabilitation and System Expansion in Chapter 6, and must also be split between these categories in the HERS output.

Among the improvement types classified as System Expansion for existing roads, the major widening category from Chapter 6 lines up best with types of improvements modeled in HERS, because such improvements are generally motivated by a desire to address congestion on a facility. The relocation improvement type is also a relatively good fit, although some relocation improvements are motivated primarily by safety concerns more than congestion concerns, and might not be picked up in the HERS analysis.

While HERS does not directly model the construction of new roads and bridges, many such investments are motivated by a desire to alleviate congestion on existing facilities in a corridor, and thus would be captured indirectly by the HERS analysis in the form of additional normal-cost or high-cost lanes. As described in Appendix A, the costs per mile assumed in HERS for high-cost lanes are based on typical costs of tunneling, double-decking, or building parallel routes, depending on the functional class and area population size for the section being analyzed. To the extent that investments in new construction and new bridge categories identified in Chapter 6 are motivated by desires to encourage economic development or accomplish other goals aside from the reduction of congestion on the existing highway network, such investments would not be picked up in the HERS analysis. A study conducted by FHWA's National Systems & Economic Development Team suggests that an estimated $0.5 billion to $2.0 billion per year is spent on highways for economic development purposes. This study is available at: https://www.fhwa.dot.gov/planning/econdev/taskabjan30_1.cfm

The bridge replacement, major bridge rehabilitation, and minor bridge work categories included as part of System Rehabilitation expenditures in Chapter 6 generally correspond to the types of capital improvements for bridges modeled in NBIAS. However, the expenditure data may include work on bridge approaches and ancillary improvements that would not be picked up in the modeling.

The safety, traffic management/engineering, and environmental and other capital improvement categories identified as part of System Enhancement expenditures in Chapter 6 are treated as if they are not captured in the HERS or NBIAS analyses. However, some safety deficiencies may be addressed as part of broader pavement and capacity improvements modeled in HERS. Also, the HERS Operations preprocessor described in Appendix A includes capital investments in operations equipment and technology that would fall under the traffic management/engineering category in Chapter 6.

|

|

On a systemwide basis, the portion of capital spending modeled in HERS is only 61.3 percent, or $48.2 billion out of a total $78.7 billion. This percentage is lower than the comparable values for the Interstate or NHS due to the highway functional systems for which sample section data are not collected through HPMS, which make up $12.1 billion (15.9 percent) of total 2006 capital spending. Approximately $10.1 billion (12.9 percent) of total capital spending was used for types of improvements modeled in NBIAS, while $8.2 billion (10.5 percent) went for system enhancement expenditures which are not addressed by either HERS or NBIAS.

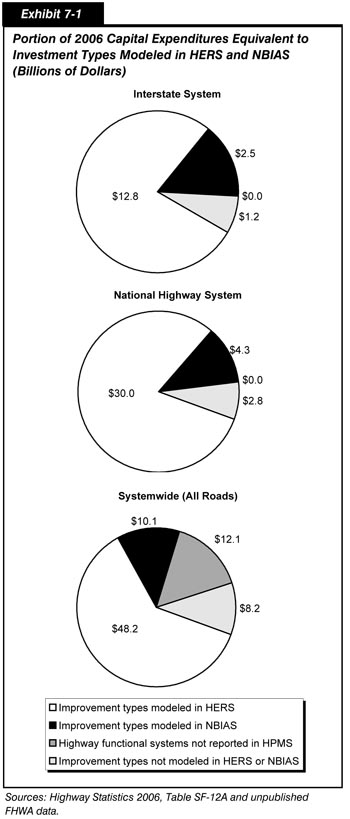

Alternative Levels of Future Capital Investment Analyzed

The specific investment levels reflected in the exhibits in this section were selected from a much larger series of analyses. Each level corresponds to a particular point of interest, such as the amount of investment that is projected to be sufficient to maintain a particular highway or bridge performance indicator at its base year level, or the amount that would finance all potential capital improvements up to a particular benefit-cost ratio cutoff. For each of these analyses, it was assumed that any increase or decrease in combined public and private investment would be phased in gradually, at a constant rate relative to 2006.

| How do the assumptions in this report about the pace of changes in alternative investment levels differ from prior C&P reports? | |

|

For this report, the annual growth rates relative to 2006 levels shown in the exhibits in this section were applied directly in HERS and NBIAS so that the level of investment for each of the years studied rose over time. This approach is considered more realistic than that utilized in the 2006 C&P Report, which assumed that combined public and private capital investment would immediately jump to the average annual level being analyzed, and remain fixed at that level for 20 years.

The 2006 C&P Report was, in turn, an improvement from the 2004 C&P Report with regard to changing investment levels. The 2004 C&P Report assumed that there would be significant front-loading of capital investment in the early years of the analysis as the existing backlog of potential cost-beneficial investments was addressed followed by a sharp decline in later years.

The progression toward a gradual ramping up of spending in the C&P reports reflects an awareness that abrupt increases in spending levels could initially overburden the construction industry and contribute to significant inflation in infrastructure construction costs.

Chapter 9 includes some analysis regarding the timing of investments.

|

|

Exhibit 7-2 shows alternative annual rates of increase or decrease in combined future systemwide public and private capital investment and how these would translate into investment levels for individual years, cumulative investment over 20 years, and average annual investment. The average annual investment levels at an annual growth rate of 0.00 percent correspond to the 2006 investment levels identified above, including $48.2 billion for improvement types modeled in HERS, $10.1 billion for improvement types modeled in NBIAS, and $20.3 billion for nonmodeled spending. Maintaining capital investment in constant dollar terms at 2006 levels would translate to a combined investment of $1.574 trillion over 20 years. As all of the values identified are stated in constant 2006 dollars, it is important to note that additional increases would be needed each year to offset the impact of inflation for the period of 2007 to 2026.

| Annual Percent Change Relative to 2006 | Cumulative 2007-2026 Investment (Billions of 2006 Dollars) | Average Annual Investment (Billions of 2006 Dollars) 1 | |||

|---|---|---|---|---|---|

| Total Capital Outlay | Spending Modeled in HERS 2 | Spending Modeled in NBIAS 3 | Non-Modeled Spending 4 | ||

| 7.76% | $3,778 | $188.9 | $115.7 | $24.3 | $48.8 |

| 7.45% | $3,641 | $182.0 | $111.5 | $23.4 | $47.1 |

| 6.70% | $3,331 | $166.5 | $102.0 | $21.4 | $43.1 |

| 6.41% | $3,219 | $160.9 | $98.6 | $20.7 | $41.6 |

| 5.25% | $2,812 | $140.6 | $86.1 | $18.1 | $36.3 |

| 5.15% | $2,779 | $139.0 | $85.1 | $17.9 | $35.9 |

| 5.03% | $2,741 | $137.1 | $84.0 | $17.6 | $35.4 |

| 4.65% | $2,624 | $131.2 | $80.4 | $16.9 | $33.9 |

| 4.55% | $2,594 | $129.7 | $79.5 | $16.7 | $33.5 |

| 4.17% | $2,484 | $124.2 | $76.1 | $16.0 | $32.1 |

| 3.30% | $2,252 | $112.6 | $69.0 | $14.5 | $29.1 |

| 3.21% | $2,229 | $111.5 | $68.3 | $14.4 | $28.8 |

| 3.07% | $2,195 | $109.7 | $67.2 | $14.1 | $28.4 |

| 2.96% | $2,168 | $108.4 | $66.4 | $14.0 | $28.0 |

| 2.93% | $2,161 | $108.0 | $66.2 | $13.9 | $27.9 |

| 1.67% | $1,881 | $94.0 | $57.6 | $12.1 | $24.3 |

| 0.83% | $1,718 | $85.9 | $52.6 | $11.1 | $22.2 |

| 0.34% | $1,631 | $81.5 | $50.0 | $10.5 | $21.1 |

| 0.00% | $1,574 | $78.7 | $48.2 | $10.1 | $20.3 |

| -0.78% | $1,451 | $72.5 | $44.4 | $9.3 | $18.8 |

| -0.86% | $1,439 | $71.9 | $44.1 | $9.3 | $18.6 |

| -1.37% | $1,366 | $68.3 | $41.8 | $8.8 | $17.7 |

| -4.95% | $963 | $48.2 | $29.5 | $6.2 | $12.5 |

| -7.64% | $757 | $37.9 | $23.2 | $4.9 | $9.8 |

The feasibility of achieving the increases or decreases in constant investment presented in Exhibit 7-2 was not evaluated as part of this analysis. In addition, the upper end of the range of investment levels evaluated exceeds the amount of spending that would be cost-beneficial for some system components and for some forms of highway financing mechanisms. While each of the particular rates of change selected has some specific analytical significance, the analyses presented in this chapter are not intended to constitute complete investment scenarios, but instead provide the building blocks for the selected scenarios presented in Chapter 8.

Impacts of Systemwide Investments Modeled by HERS

Exhibit 7-1 shows that of total public and private capital spending of $78.7 billion on all roads in 2006, $48.2 billion was utilized for the types of improvements modeled in HERS. This section projects the potential impacts on system performance of raising or lowering this $48.2 billion in constant dollar terms by various annual rates over 20 years. These percentage increases are also applied to the $78.7 billion in the findings presented in this section; this acknowledges that the improvements reflected in HERS represent only one piece of total capital investment, and that the types of improvements reflected in NBIAS or those that are not reflected in either model should also be considered when projecting the impacts of different overall levels of combined public and private investment.

Alternative Financing Mechanisms

Several of the exhibits in this section compare the potential impacts of alternative financing mechanisms, estimating their relative impact on system performance at a series of alternative funding levels. For funding levels that exceed the current 2006 level of combined public and private highway capital investment, the analyses assume that the additional revenues needed to support such investment would be generated from one of three broad categories: non-user sources, fixed-rate user based sources, or variable-rate user based sources. The selected future highway capital investment scenarios presented in Chapter 8 draw upon some of the analyses presented in this section assuming fixed-rate user based financing or variable-rate user based financing. The non-user sources financing option is not carried forward into Chapter 8.

| How do the types of funding mechanisms considered in the HERS analysis relate to private sector investment? | |

|

The HERS analysis does not distinguish among Federal, State, local, or private sector highway spending. Generally, private sector investment in highways is dependent on revenue streams (primarily tolls) from users of the privately owned facilities. If a private entity were to impose variable rate tolls on a time-of-day basis, HERS would evaluate the potential impacts on peak period VMT to be identical to those that would occur if a public sector entity had imposed congestion charges at the same rates.

In theory, a private sector investment could take on the characteristics of a non-user based financing mechanism. For example, if a government were to pay a private entity to manage a facility on the basis of a "shadow toll" based on usage, but did not impose a fee on highway users to cover these costs, the impact on VMT on that facility would be the same as if the local government had managed the facility itself using general revenues as a funding source.

|

|

The analyses incorporating funding from non-user based sources assume no linkage between increased spending, increased revenue generation, and highway VMT. The analyses incorporating funding from fixed-rate user based sources assume the application of an inflation indexed charge on a per-VMT basis to generate any funding needed to support a higher level of capital investment. The potential size of this charge was initially determined by computing the difference between the investment level being studied and the current 2006 level of combined public and private highway capital investment, and dividing that amount by total projected VMT. This initial value was then recomputed iteratively to account for the impact that the imposition of such a charge would have on the overall cost of driving, which would lead to some reduction in VMT growth. As the same fixed VMT charge would be levied throughout the day, such charges would not affect peak period travel differently than off-peak travel, and as such would be similar in effect to a fuel tax—another form of fixed rate user charge. In cases in which the investment level being analyzed was less than the current 2006 capital spending level, a negative fixed VMT charge was applied, simulating the effects of a reduction in highway user charges. It is important to note that this report does not directly address the issue of the sustainability of current highway financing structures and does not attempt to identify changes in revenue mechanisms or tax rates that might be required to sustain highway capital spending at 2006 levels in constant dollar terms.

| Why do the analyses of funding from fixed rate user sources assume a charge imposed on a per-VMT basis, rather than a per-gallon basis? | |

|

This report does not attempt to differentiate among the relative impacts of alternative fixed rate funding mechanisms such as flat tolls, VMT charges, or the motor-fuel tax; the fixed rate financing analyses are intended to be generic and to provide a contrast with the analyses assuming non-user financing or variable rate user financing (i.e., congestion pricing).

HERS has the capability to model fixed rate user charges on either a per-gallon or per-VMT basis. The per-VMT option was selected for this report, recognizing that such charges may well play an important role in highway financing by 2026. Utilizing the per-VMT option also has the advantage of reducing computational complexity, as it does not need to factor in the effects of changing fleet mileage (and the change in differential between passenger vehicles and commercial trucks) as would have been the case had the per-gallon option been utilized. Another motivation for applying the per-VMT option for the fixed rate user financing analyses is to facilitate comparisons with the congestion pricing analyses that assume a variable rate charge imposed on a per-VMT basis.

The reaction of individual drivers to a per-gallon charge would differ in some ways from their response to a per-VMT charge; in particular, a per-gallon charge would provide a more direct incentive to shift to driving a more fuel-efficient vehicle. However, the cumulative impacts of raising a specific amount of revenue from users on a fixed rate basis via a per-gallon charge versus a per-VMT charge are likely to be less significant, particularly in terms of the types of issues discussed in this report. Some limited HERS analyses conducted assuming fixed rate charges imposed on a per-gallon basis suggest that the total estimated amount of cost-beneficial investment would not differ significantly from analyses assuming per-VMT charges. The level of investment required to achieve other performance benchmarks would vary somewhat, but would not be uniformly biased either upward or downward.

|

|

Exhibit 7-3 identifies the difference between the alternative levels of combined public and private capital investment that were analyzed, and actual capital spending in 2006. If capital investment were to grow by 7.76 percent per year in constant dollar terms over the 2006 level of $78.7 billion, this would result in an average annual investment level of $188.9 billion for the period from 2007 to 2026 in constant dollar terms, a difference of $110.2 billion. In contrast, if highway capital investment were to shrink by 7.64 per year in constant dollar terms, this would free up an average annual amount of $40.8 billion for other purposes.

| Annual Percent Change Relative to 2006 | Average Annual Investment (Billions of 2006 Dollars) Spending Modeled in HERS 1 |

Average Annual Investment (Billions of 2006 Dollars) Total Capital Outlay |

Difference Between Annual Investment Levels and 2006 Total Capital Outlay In Billions of 2006 Dollars2 |

Difference Between Annual Investment Levels and 2006 Total Capital Outlay Per VMT 3 VMT Modeled in HERS |

Difference Between Annual Investment Levels and 2006 Total Capital Outlay Per VMT Total VMT |

Difference Between Annual Investment Levels and 2006 Total Capital Outlay Per Gallon 4 Total Fuel COnsumption |

|---|---|---|---|---|---|---|

| 7.76% | $115.7 | $188.9 | $110.2 | |||

| 7.45% | $111.5 | $182.0 | $103.4 | $0.033 | $0.028 | $0.582 |

| 6.70% | $102.0 | $166.5 | $87.9 | $0.028 | $0.024 | $0.451 |

| 6.41% | $98.6 | $160.9 | $82.3 | $0.026 | $0.022 | $0.406 |

| 5.25% | $86.1 | $140.6 | $61.9 | $0.020 | $0.017 | $0.348 |

| 5.15% | $85.1 | $139.0 | $60.3 | $0.019 | $0.016 | $0.343 |

| 5.03% | $84.0 | $137.1 | $58.4 | $0.019 | $0.016 | $0.338 |

| 4.65% | $80.4 | $131.2 | $52.5 | $0.017 | $0.014 | $0.258 |

| 4.55% | $79.5 | $129.7 | $51.0 | $0.016 | $0.014 | $0.238 |

| 4.17% | $76.1 | $124.2 | $45.5 | $0.015 | $0.012 | $0.262 |

| 3.30% | $69.0 | $112.6 | $33.9 | $0.011 | $0.009 | $0.174 |

| 3.21% | $68.3 | $111.5 | $32.8 | $0.010 | $0.009 | $0.172 |

| 3.07% | $67.2 | $109.7 | $31.1 | $0.010 | $0.008 | $0.168 |

| 2.96% | $66.4 | $108.4 | $29.7 | $0.010 | $0.008 | $0.160 |

| 2.93% | $66.2 | $108.0 | $29.4 | $0.009 | $0.008 | $0.157 |

| 1.67% | $57.6 | $94.0 | $15.4 | $0.005 | $0.004 | $0.079 |

| 0.83% | $52.6 | $85.9 | $7.2 | $0.002 | $0.002 | $0.038 |

| 0.34% | $50.0 | $81.5 | $2.9 | $0.001 | $0.001 | $0.013 |

| 0.00% | $48.2 | $78.7 | $0.0 | $0.000 | $0.000 | $0.000 |

| -0.78% | $44.4 | $72.5 | -$6.1 | -$0.002 | -$0.002 | -$0.035 |

| -0.86% | $44.1 | $71.9 | -$6.7 | -$0.002 | -$0.002 | -$0.038 |

| -1.37% | $41.8 | $68.3 | -$10.4 | -$0.003 | -$0.003 | -$0.059 |

| -4.95% | $29.5 | $48.2 | -$30.5 | -$0.010 | -$0.008 | -$0.181 |

| -7.64% | $23.2 | $37.9 | -$40.8 | -$0.013 | -$0.011 | -$0.204 |

Exhibit 7-3 also translates these constant dollar differences between alternative annual investment levels and actual 2006 capital outlay into dollars-per-VMT figures. The values identified as "Per VMT Modeled in HERS" represent the actual fixed rate-user charges that were assumed for each of the investment levels analyzed based on the particular VMT estimate computed for that investment level. For example, to cover the $103.4 billion average annual revenue that would be required to support an annual increase of capital investment of 7.45 percent per year, the model imposed a surcharge of $0.033 per VMT. In contrast, for the analysis of a 4.95 percent annual decrease in capital investment, the model imposed a negative surcharge of $0.010 per VMT, simulating a reduction in existing user charges. To put these values into perspective, the $171.1 billion identified in Chapter 6 as the total amount generated in 2006 via motor-fuel taxes, motor-vehicle fees, and tolls equates to $0.039 on a per VMT basis, based on total VMT in 2006.

It is important to note that these differences are based on total capital outlay, rather than simply spending modeled in HERS. Because the NBIAS model has no revenue-linkage features and there is no direct way to simulate the relationship between revenue sources and investment levels for non-modeled items, the HERS analyses reflected in this report assume that the VMT surcharge would have to cover increases in these types of spending proportional to any increases in the level of capital investment directly modeled in HERS.

Exhibit 7-3 also identifies values per total VMT and per total gallons of fuel consumption, which are included for informational purposes only. The actual VMT charges modeled in HERS excluded VMT on functional classes for which HPMS sample data are not available (rural minor collector, rural local, and urban local). Hypothetically, if a fixed-rate VMT charge were imposed on all travel based on odometer readings, it would be more realistic to set the rate based on total VMT. Alternatively, if a fixed-rate user charge were implemented via a mechanism that imposed a toll on selected routes based on transponders, it would be more realistic to set the rate based on a subset of total VMT. The smaller the portion of travel included in a VMT-based financing mechanism, the higher the per-VMT charge would have to be to generate the same level of revenue (assuming that no other additional charges would be used to generate revenue from portions of the system not subject to the VMT charge). Note that the shaded cells in Exhibit 7-3 represent investment levels that were found to exceed the level of potential cost-beneficial investment assuming funding by fixed rate user charges only.

Variable Rate User Based Sources

The analyses incorporating funding from variable user based sources assumed that such charges would be set at a level at which users of congested facilities would pay a cost equivalent to the negative impact that their use has on other drivers. The projected revenue that would be generated from such congestion charges was then applied to cover the difference between the investment level being studied and the current 2006 level of combined public and private highway capital investment; if the revenue from this congestion charge was not projected to be sufficient for this purpose, the analysis assumed the imposition of an additional fixed rate VMT charge to cover the rest of the difference. In cases where congestion pricing revenue exceeded the level needed to support the level of investment being studied, a negative fixed rate VMT charge was applied, simulating the effects of lowering existing fuel taxes, fixed-rate tolls or other fees imposed on highway users. In the absence of such reductions of existing user charges, this surplus revenue could be applied to support increased investment in highways, transit alternatives, or other initiatives.

Exhibit 7-4 identifies the variable and fixed rate charges computed by HERS for each of the alternative levels of combined systemwide public and private capital investment analyzed. If highway capital investment were to grow by 4.55 percent per year in constant dollar terms over the 2006 level of $78.7 billion, this would result in an average annual investment level of $129.7 billion for the period from 2007 to 2026 in constant dollar terms, a difference of $51.0 billion. At this level of investment, HERS estimates that a congestion charge set in the manner outlined above would generate an average of $38.1 billion annually, leaving $12.9 billion to be covered by a fixed rate VMT charge. The variable congestion charge would vary widely by location; in 2026, the amounts imposed on individual highway sections would range from $0.00 to approximately $3.79 per VMT. In those locations in which a congestion charge would be imposed, the average rate applied would be $0.339 per VMT; factoring in the many locations and times of day where no charge would be imposed brings the systemwide weighted average down to $0.012 per VMT. In order to generate sufficient revenues to support this level of investment, an additional fixed rate VMT charge of $0.004 per mile would need to be imposed. It should be noted that the combination of the weighted average variable rate VMT charge and the additional fixed rate charge is roughly consistent with the flat $0.016 cents per VMT charge identified in Exhibit 7-3 based on revenues from fixed rate user charges only for the same level of investment. Exhibit 7-4 does not reflect any potential increases in highway capital investment of more than 4.55 percent per year because such levels were found to exceed the level of potential cost-beneficial investment assuming funding by variable rate user charges.

| Annual Percent Change Relative to 2006 | Average Annual Investment (Billions of 2006 Dollars) Spending Modeled in HERS 1 |

Average Annual Investment (Billions of 2006 Dollars) Total Capital Outlay All Types |

Average Annual Investment (Billions of 2006 Dollars) Total Capital Outlay Difference From 2006 |

Additional Revenues Per Year From VMT Charges 2 (Billions of 2006 Dollars) Variable Rate |

Additional Revenues Per Year From VMT Charges 2 (Billions of 2006 Dollars) Fixed Rate |

Charges per VMT Modeled in HERS 3 Variable Rate Average Rate Where Imposed |

Charges per VMT Modeled in HERS Variable Rate Weighted Average Rate4 |

Charges per VMT Modeled in HERS Fixed Rate |

|---|---|---|---|---|---|---|---|---|

| 4.55% | $79.5 | $129.7 | $51.0 | $38.1 | $12.9 | $0.339 | $0.012 | $0.004 |

| 4.17% | $76.1 | $124.2 | $45.5 | $38.9 | $6.6 | $0.341 | $0.013 | $0.002 |

| 3.30% | $69.0 | $112.6 | $33.9 | $40.7 | -$6.8 | $0.347 | $0.013 | -$0.002 |

| 3.21% | $68.3 | $111.5 | $32.8 | $40.9 | -$8.2 | $0.348 | $0.013 | -$0.003 |

| 3.07% | $67.2 | $109.7 | $31.1 | $41.2 | -$10.2 | $0.349 | $0.013 | -$0.003 |

| 2.96% | $66.4 | $108.4 | $29.7 | $41.5 | -$11.8 | $0.350 | $0.014 | -$0.004 |

| 2.93% | $66.2 | $108.0 | $29.4 | $41.6 | -$12.2 | $0.350 | $0.014 | -$0.004 |

| 1.67% | $57.6 | $94.0 | $15.4 | $44.1 | -$28.7 | $0.359 | $0.014 | -$0.009 |

| 0.83% | $52.6 | $85.9 | $7.2 | $45.5 | -$38.2 | $0.364 | $0.015 | -$0.012 |

| 0.34% | $50.0 | $81.5 | $2.9 | $46.3 | -$43.5 | $0.367 | $0.015 | -$0.014 |

| 0.00% | $48.2 | $78.7 | $0.0 | $47.0 | -$47.0 | $0.370 | $0.015 | -$0.015 |

| -0.78% | $44.4 | $72.5 | -$6.1 | $48.2 | -$54.3 | $0.375 | $0.016 | -$0.018 |

| -0.86% | $44.1 | $71.9 | -$6.7 | $48.3 | -$55.0 | $0.375 | $0.016 | -$0.018 |

| -1.37% | $41.8 | $68.3 | -$10.4 | $49.1 | -$59.5 | $0.378 | $0.016 | -$0.019 |

| -4.95% | $29.5 | $48.2 | -$30.5 | $53.5 | -$84.0 | $0.396 | $0.017 | -$0.027 |

| -7.64% | $23.2 | $37.9 | -$40.8 | $55.5 | -$96.3 | $0.404 | $0.018 | -$0.031 |

| 3.75% | $72.6 | $118.4 | $39.8 | $39.8 | $0.0 | $0.344 | $0.013 | $0.000 |

| How do the estimates of potential revenues from congestion pricing charges identified in this report compare to other estimates? | |

|

The particular approach to modeling variable rate user charges in this report—setting the rates at a level equal to the marginal cost that each new driver on a congested facility imposes on other drivers—is only one of many approaches that could be used. Analyses in which charges are set at levels designed to achieve specific speed or throughput targets or analyses assuming mixed use facilities including both tolled and non-tolled lanes, would naturally tend to produce different results. Alternative assumptions regarding driver responses to a given price change and future traffic volumes would also influence the results, as would the time period covered by the analyses.

Other studies have estimated the revenue potential of congestion pricing to exceed $100 billion per year, which is more than double the level reflected in this report.

|

|

Exhibit 7-4 also shows that the average rates and revenues from variable congestion charges are projected to decline as the level of capital investment rises. This occurs because a portion of the increased capital investment would be directed towards capacity expansion projects that would alleviate some congestion, so that the impact that each additional driver on a congested roadway would have on all other drivers on that section would be smaller. In many cases, the revenues generated from variable congestion charges would exceed the amount of additional revenue needed to support this investment. If highway capital investment were to be held steady at $78.7 billion in constant dollar terms, all of the $47.0 billion projected to be generated from the variable rate congestion charges (averaging $0.370 per VMT where such a charge is imposed) would be available for other purposes, such as reductions to existing fixed rate user charges. This amount is more than sufficient to fully offset all existing motor fuel and motor vehicle taxes imposed at the Federal and local government levels, while allowing some reductions in State-level taxes as well. [See Exhibit 6-1 and Exhibit 6-2 in Chapter 6]. Alternatively, such surplus revenue could be utilized to reduce all existing fixed rate highway user charges at the Federal, State, and local levels by approximately 40 percent in constant dollar terms.

The last data row in Exhibit 7-4 identifies the level of highway capital investment at which HERS predicts that the revenue generated by variable rate congestion charges would be exactly equal to difference between that level of investment and base year 2006 spending. The model estimates that if highway capital investment were to grow by 3.75 percent per year in constant dollar terms over the 2006 level of $78.7 billion, this would result in an average annual investment level of $118.4 billion for the period from 2007 to 2026 in constant dollar terms, a difference of $39.8 billion. This difference matches the amount of revenue that HERS projects would be generated by a congestion charge set in the manner outlined above, so that no additional revenue from fixed rate user charges would be needed to support this level of investment.

Impact of Future Investment on Overall Highway Conditions and Performance

The HERS model defines benefits as reductions in highway user costs, agency costs, and societal costs. Highway user costs include those related to travel time, vehicle operation, and crashes. Recent editions of the C&P report have used changes in highway user costs as a proxy for changes in overall highway conditions and performance. It is important to note that in this context, highway user costs are being used to quantify the impacts that the conditions and performance of the system have on highway users; therefore, they do not include taxes imposed on highway users. Thus, the fixed rate and variable rate VMT charges identified in the preceding section are not included as a component of highway user costs affected by the conditions and performance of the system.

While the user costs in this report are based primarily on 2006 values, the projections of future user costs have been modified to reflect the Energy Information Administration's (EIA) forecast of future fuel efficiency for the vehicle fleet from its Annual Energy Outlook 2008 publication. EIA's forecast incorporates the effect of changes in Corporate Average Fuel Economy (CAFE) standards required by the Energy Independence and Security Act of 2007 (Public Law 110-140). While these fuel efficiency improvements will result in real changes in the costs experienced by highway users, they do not represent impacts that system conditions and performance have on highway users. Applying EIA's projected fuel economy values through 2026 to the base year 2006 data would reduce the HERS baseline estimate of highway user costs by 2.5 percent, from $1.0980 per mile to $1.0703 per mile. For this report, this reduced value is used as the basis for describing changes in "Adjusted User Costs" in order to provide a statistic that better reflects overall system conditions and performance. The analyses presented in this chapter are based on EIA's reference case forecast of future fuel prices; Chapter 10 includes an analysis of the potential impacts of replacing these estimates with values from EIA's high price forecast.

| What changes have been proposed in CAFE standards, and what impacts are these changes expected to have? | |

|

The Energy Independence and Security Act of 2007 (Public Law 110-140) included several provisions to increase the fuel efficiency of the American motor vehicle fleet, including a requirement to raise CAFE standards. On April 22, 2008, the U.S. Department of Transportation proposed a 25 percent increase in fuel efficiency standards over 5 years for new passenger vehicles and light trucks. For passenger cars, the proposal would increase fuel economy from the current 27.5 miles per gallon to 35.7 miles per gallon by 2015. For light trucks, the proposal would increase fuel economy from 23.5 miles per gallon in 2010 to 28.6 miles per gallon in 2015. The impacts of these standards on the fuel economy of the overall vehicle fleet will be felt gradually as new vehicles replace older, less fuel-efficient vehicles.

In announcing the rule, the U.S. Department of Transportation estimated the proposal would save nearly 55 billion gallons of fuel and reduce carbon dioxide emissions by 521 million metric tons annually. The Department also estimated that the plan would save the Nation's drivers at least $100 billion in fuel costs over the lifetime of the vehicles covered by the rule.

The 2008 rulemaking builds on two earlier changes that increased the mileage requirements for light trucks.

|

|

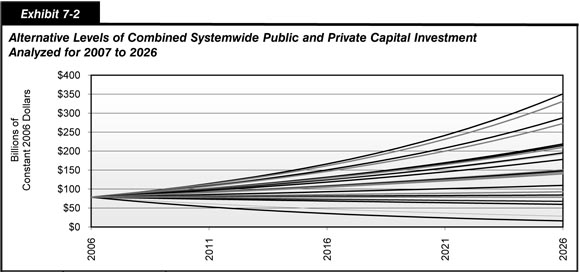

Exhibit 7-5 describes how average total user costs and average adjusted user costs are influenced by the total amount invested in highways, and the financing mechanisms employed to support such investment. While the percentage reductions in highway user costs appear relatively small, it is important to recognize that they include the costs associated with all travel time, not just the additional travel time that results from congestion. A significant portion of travel time is not directly related to delay, but rather is simply a function of the physical separation between trip origins and destinations. There is, therefore, a limit on the ability of highway investment to cause dramatic reductions in this key component of user costs. Similarly, a large portion of vehicle operating costs are independent of the conditions and performance of the highway system, and a significant portion of crash costs are the result of behavioral factors that would be difficult to address solely through highway infrastructure investment.

| Annual Percent Change Relative to 2006 | Average Annual Capital Investment (Billions of 2006 Dollars) 1 Total Capital Outlay |

Average Annual Capital Investment (Billions of 2006 Dollars) 1 Spending Modeled in HERS |

Percent Change in User Costs on Roads Modeled in HERS Average User Costs Funding Mechanism 3 Non-User Sources |

Percent Change in User Costs on Roads Modeled in HERS Average User Costs Funding Mechanism 3 Fixed Rate User Charges |

Percent Change in User Costs on Roads Modeled in HERS Average User Costs Funding Mechanism 3 Variable Rate User Charges |

Percent Change in User Costs on Roads Modeled in HERS Adjusted Average User Costs 2 Funding Mechanism 3 Non-User Sources |

Percent Change in User Costs on Roads Modeled in HERS Adjusted Average User Costs 2 Funding Mechanism 3 Fixed Rate User Charges |

Percent Change in User Costs on Roads Modeled in HERS Adjusted Average User Costs 2 Funding Mechanism 3 Variable Rate User Charges |

|---|---|---|---|---|---|---|---|---|

| 7.76% | $188.9 | $115.7 | -5.2% | -2.8% | ||||

| 7.45% | $182.0 | $111.5 | -5.0% | -5.4% | -2.6% | -2.9% | ||

| 6.70% | $166.5 | $102.0 | -4.6% | -4.9% | -2.2% | -2.4% | ||

| 6.41% | $160.9 | $98.6 | -4.4% | -4.7% | -2.0% | -2.3% | ||

| 5.25% | $140.6 | $86.1 | -3.8% | -4.0% | -1.3% | -1.5% | ||

| 5.15% | $139.0 | $85.1 | -3.7% | -3.9% | -1.2% | -1.4% | ||

| 5.03% | $137.1 | $84.0 | -3.6% | -3.9% | -1.1% | -1.4% | ||

| 4.65% | $131.2 | $80.4 | -3.4% | -3.6% | -0.9% | -1.1% | ||

| 4.55% | $129.7 | $79.5 | -3.3% | -3.5% | -5.1% | -0.8% | -1.0% | -2.7% |

| 4.17% | $124.2 | $76.1 | -3.1% | -3.3% | -5.0% | -0.6% | -0.8% | -2.5% |

| 3.30% | $112.6 | $69.0 | -2.6% | -2.7% | -4.6% | -0.1% | -0.2% | -2.1% |

| 3.21% | $111.5 | $68.3 | -2.5% | -2.6% | -4.6% | 0.0% | -0.1% | -2.1% |

| 3.07% | $109.7 | $67.2 | -2.4% | -2.5% | -4.5% | 0.1% | 0.0% | -2.0% |

| 2.96% | $108.4 | $66.4 | -2.3% | -2.4% | -4.5% | 0.2% | 0.1% | -2.0% |

| 2.93% | $108.0 | $66.2 | -2.3% | -2.4% | -4.4% | 0.2% | 0.1% | -2.0% |

| 1.67% | $94.0 | $57.6 | -1.5% | -1.6% | -3.9% | 1.0% | 1.0% | -1.4% |

| 0.83% | $85.9 | $52.6 | -1.0% | -1.1% | -3.5% | 1.5% | 1.5% | -1.0% |

| 0.34% | $81.5 | $50.0 | -0.8% | -0.7% | -3.3% | 1.8% | 1.8% | -0.8% |

| 0.00% | $78.7 | $48.2 | -0.5% | -0.5% | -3.1% | 2.0% | 2.1% | -0.6% |

| -0.78% | $72.5 | $44.4 | -0.1% | 0.0% | -2.8% | 2.5% | 2.6% | -0.3% |

| -0.86% | $71.9 | $44.1 | 0.0% | 0.0% | -2.7% | 2.6% | 2.6% | -0.2% |

| -1.37% | $68.3 | $41.8 | 0.3% | 0.4% | -2.5% | 2.9% | 3.0% | 0.0% |

| -4.95% | $48.2 | $29.5 | 2.4% | 2.6% | -1.0% | 5.0% | 5.2% | 1.6% |

| -7.64% | $37.9 | $23.2 | 3.8% | 4.0% | 0.0% | 6.4% | 6.7% | 2.6% |

The percent changes in user costs shown in Exhibit 7-5 are also tempered by the operation of the elasticity features in HERS. The model assumes that, if user costs are reduced on a section, additional travel will shift to that section. This additional traffic volume tends to offset some of the initial reduction in user costs. Conversely, if user costs increase on a highway segment, drivers will be diverted away to other routes or other modes, or will eliminate some trips entirely. When some vehicles abandon a given highway segment, the remaining drivers benefit in terms of reduced congestion delay, which offsets part of the initial increase in user costs. The impact of different investment levels on highway travel is discussed in the next section.

Exhibit 7-5 shows that current spending levels would be more than adequate to maintain average user costs in 2026 at 2006 levels, due to projected improvements in vehicle fuel economy. If capital spending on the types of improvements modeled in HERS were increased at an annual rate of approximately 3.21 percent in constant dollar terms, and this increased investment were financed by non-user sources, then it would be possible to reduce average user costs by 2.5 percent (therefore maintaining adjusted user costs at their base year level). If a fixed rate user charge financing mechanism were used instead, then in order to maintain adjusted user costs (equivalent to a 2.5 percent reduction in highway user costs), combined public and private highway capital investment would need to increase at an annual rate of 3.07 percent in constant dollar terms.

If variable rate user charges were instituted on all congested highway sections, then 2006 spending levels are projected to be more than adequate to maintain either average user costs or adjusted average user costs at their 2006 levels. A decrease in spending at an annual rate of approximately 1.37 percent in constant dollar terms would still allow adjusted average user costs to be maintained (equivalent to a 2.5 percent reduction in highway user costs), while an annual decrease of 7.64 percent would still be adequate to maintain average user costs.

Exhibit 7-5 also shows that for any given funding level, average highway user costs (excluding taxes) will be lower when a variable rate user charge is imposed than when fixed rate user charges or non-user sources serve as the funding mechanism. Charging highway users to finance highway investments in general, and charging peak period users to pay for the societal costs associated with peak period highway use in particular, allows the highway system to operate in a more efficient and rational manner from an economic perspective. For example, if combined public and private investment levels were sustained at 2006 levels, HERS projects that average user costs would decrease by 3.1 percent over 20 years if variable rate user charges were employed as a financial mechanism. In contrast, average user costs would decline by only 0.5 percent over 20 years if either fixed rate user charges or non-user sources were employed.

Assuming variable rate user charges were imposed, an annual increase of 4.55 percent over 2006 levels could result in a 5.1 percent decrease in average highway user costs in 2026 relative to 2006. This would translate into annual user costs savings of approximately $202 billion, based on projected future VMT at that level of investment. HERS projects that this is the greatest amount of user costs savings that can be achieved; additional investments beyond this point would not be cost-beneficial. In other words, this level of investment would be adequate to support all potential investments whose discounted stream of future benefits were equal to or exceeded their construction costs, which is mathematically represented by a benefit-cost ratio of 1.0 or higher. The benefit-cost ratios associated with each of the alternative levels of investment presented in Exhibit 7-5 for each funding mechanism are identified later in this chapter.

To a certain extent, additional investment in highway capacity expansion can serve as a partial substitute for the economically efficient pricing of highway facilities, and achieve some reduction in highway user costs. Constant dollar spending could grow at an average rate of 7.45 percent assuming a fixed rate user charge mechanism, or 7.76 percent assuming a non-user based financing mechanism, while still being invested in a cost-beneficial manner. However, as shown in Exhibit 7-5, despite these sharply higher levels of capital investment, neither of these financing mechanisms could reduce average user costs appreciably more than the reduction cited above as achievable at a much lower cost in conjunction with the application of congestion pricing (i.e., variable rate user charges).

Exhibit 7-5 also demonstrates that the performance impacts of financing through non-user sources are not significantly different than those projected for fixed-rate user based financing. These differences become larger as the level of highway investment increases beyond the current spending level because the imposition of fixed rate surcharges to support higher investment levels would offset a portion of the increased VMT that might otherwise occur. Conversely, if spending were to fall below current levels in constant dollar terms, the relative increase in user costs would be higher assuming that the savings were refunded to highway users in the form of lower highway user charges, which would tend to offset some of the reduction in VMT that might otherwise occur.

Projected VMT in 2026

Exhibit 7-6 identifies the projected VMT in 2026 for alternative investment levels and funding mechanisms. The values shown for HERS-modeled roads excludes VMT on functional classes for which HPMS sample data are not available (rural minor collector, rural local, and urban local). The estimated values for all roads were computed by applying the 20-year growth in VMT for HERS-modeled roads to total VMT on all roads in 2006. The projected VMT for all funding mechanisms identified in Exhibit 7-6 are influenced by the changes in user costs identified in Exhibit 7-5. The projected VMT assuming fixed rate user financing are also affected by the fixed charges identified in Exhibit 7-3, while the projected VMT assuming variable rate user financing are affected by both the variable and fixed charges identified in Exhibit 7-4.

| Annual Percent Change Relative to 2006 | Average Annual Capital Investment (Billions of 2006 Dollars) 1 Total Capital Outlay |

Average Annual Capital Investment (Billions of 2006 Dollars) 1 Spending Modeled in HERS |

Projected VMT in 2026 (Trillions of VMT) On HERS-Modeled Roads Funding Mechanism 2 Non-User Sources |

Projected VMT in 2026 (Trillions of VMT) On HERS-Modeled Roads Funding Mechanism 2 Fixed Rate User Charges |

Projected VMT in 2026 (Trillions of VMT) On HERS-Modeled Roads Funding Mechanism 2 Variable Rate User Charges |

Projected VMT in 2026 (Trillions of VMT) Estimated on All Roads Funding Mechanism 2 Non-User Sources |

Projected VMT in 2026 (Trillions of VMT) Estimated on All Roads Funding Mechanism 2 Fixed Rate User Charges |

Projected VMT in 2026 (Trillions of VMT) Estimated on All Roads Funding Mechanism 2 Variable Rate User Charges |

|---|---|---|---|---|---|---|---|---|

| 7.76% | $188.9 | $115.7 | 3.762 | 4.456 | ||||

| 7.45% | $182.0 | $111.5 | 3.758 | 3.662 | 4.452 | 4.338 | ||

| 6.70% | $166.5 | $102.0 | 3.749 | 3.669 | 4.442 | 4.347 | ||

| 6.41% | $160.9 | $98.6 | 3.746 | 3.671 | 4.437 | 4.349 | ||

| 5.25% | $140.6 | $86.1 | 3.733 | 3.678 | 4.422 | 4.357 | ||

| 5.15% | $139.0 | $85.1 | 3.732 | 3.678 | 4.421 | 4.357 | ||

| 5.03% | $137.1 | $84.0 | 3.731 | 3.679 | 4.419 | 4.358 | ||

| 4.65% | $131.2 | $80.4 | 3.726 | 3.679 | 4.414 | 4.359 | ||

| 4.55% | $129.7 | $79.5 | 3.725 | 3.680 | 3.596 | 4.413 | 4.359 | 4.260 |

| 4.17% | $124.2 | $76.1 | 3.721 | 3.680 | 3.596 | 4.407 | 4.360 | 4.260 |

| 3.30% | $112.6 | $69.0 | 3.710 | 3.681 | 3.594 | 4.396 | 4.360 | 4.258 |

| 3.21% | $111.5 | $68.3 | 3.709 | 3.681 | 3.594 | 4.394 | 4.360 | 4.257 |

| 3.07% | $109.7 | $67.2 | 3.708 | 3.681 | 3.594 | 4.392 | 4.360 | 4.257 |

| 2.96% | $108.4 | $66.4 | 3.706 | 3.680 | 3.593 | 4.391 | 4.360 | 4.257 |

| 2.93% | $108.0 | $66.2 | 3.706 | 3.680 | 3.593 | 4.390 | 4.360 | 4.257 |

| 1.67% | $94.0 | $57.6 | 3.692 | 3.679 | 3.588 | 4.374 | 4.358 | 4.251 |

| 0.83% | $85.9 | $52.6 | 3.683 | 3.677 | 3.584 | 4.363 | 4.356 | 4.246 |

| 0.34% | $81.5 | $50.0 | 3.678 | 3.675 | 3.582 | 4.357 | 4.354 | 4.243 |

| 0.00% | $78.7 | $48.2 | 3.674 | 3.674 | 3.579 | 4.352 | 4.352 | 4.240 |

| -0.78% | $72.5 | $44.4 | 3.666 | 3.671 | 3.575 | 4.343 | 4.349 | 4.235 |

| -0.86% | $71.9 | $44.1 | 3.665 | 3.671 | 3.574 | 4.342 | 4.349 | 4.234 |

| -1.37% | $68.3 | $41.8 | 3.660 | 3.669 | 3.572 | 4.335 | 4.346 | 4.231 |

| -4.95% | $48.2 | $29.5 | 3.624 | 3.648 | 3.550 | 4.293 | 4.322 | 4.205 |

| -7.64% | $37.9 | $23.2 | 3.602 | 3.633 | 3.534 | 4.267 | 4.304 | 4.187 |

Exhibit 7-6 shows that if current spending levels were sustained in constant dollar terms, then projected VMT for HERS-modeled roads would rise from 2.561 trillion in 2006 to 3.674 trillion by 2026 assuming financing by either non-user sources or by fixed rate user charges, since the fixed rate charge in this instance would be zero. Assuming that the imposition of variable rate user charges offset by reductions to existing fixed rate user charges would slow the growth in VMT, the projected level in 2026 would be only 3.579 trillion. Similarly, if spending were to grow by 4.55 percent per year in constant dollar terms, projected VMT would be 3.680 trillion assuming fixed rate user financing compared to 3.596 assuming variable rate user financing. These differences occur because traveling at off-peak is not a perfect substitute for peak period travel, and more individuals would be likely to eliminate trips or seek out alternative modes of travel in response to a targeted peak period variable highway user charge than would be the case for a more broadly imposed fixed user charge. The transit section of Chapter 8 includes some analysis of the potential impacts that variable rate highway user charges could have on future transit travel growth and on the operational performance of transit systems. The implications of projected future growth rates are discussed in more detail in Chapter 9.

| Why do the projected VMT values assuming financing through fixed rate user charges start to decline after investment levels reach a certain point? | |

|

The decline in projected VMT for investment assuming fixed rate user financing begins to decline after projected investment rises past an annual growth rate of approximately 3.3 percent. This occurs because, as noted above, the VMT charge assumed by HERS is applied to only the VMT on HERS modeled roads, but was set at a level adequate to support higher funding for all types of capital investment, not just spending modeled in HERS. At a certain point, this charge has a deterrent effect on VMT growth that is stronger than the positive effect on such growth caused by declines in average highway user costs associated with improved conditions and performance.

Had the VMT charge been applied more broadly in this analysis, this decline would be smaller, or would not occur.

|

|

User Cost Components

Travel time costs constitute approximately 48.7 percent of the HERS baseline estimate of highway user costs in 2006 of $1.0980 per mile. Vehicle operating costs constitute approximately 35.0 percent of total user costs, while crash-related costs (which are reflected in vehicle insurance costs and other social costs) make up the remaining 16.3 percent. Exhibit 7-7 describes how travel time costs and vehicle operating costs are influenced by the total amount invested in highways, and the financing mechanisms employed to support such investment.

| Annual Percent Change Relative to 2006 | Average Annual Capital Investment (Billions of 2006 Dollars) 1 Total Capital Outlay |

Average Annual Capital Investment (Billions of 2006 Dollars) 1 Spending Modeled in HERS |

Percent Change in Average User Costs on Roads Modeled in HERS Travel Time Costs Funding Mechanism 3 Non-User Sources |

Percent Change in Average User Costs on Roads Modeled in HERS Travel Time Costs Funding Mechanism 3 Fixed Rate User Charges |

Percent Change in Average User Costs on Roads Modeled in HERS Travel Time Costs Funding Mechanism 3 Variable Rate User Charges |

Percent Change in Average User Costs on Roads Modeled in HERS Vehicle Operating Costs 2 Funding Mechanism 3 Non-User Sources |

Percent Change in Average User Costs on Roads Modeled in HERS Vehicle Operating Costs 2 Funding Mechanism 3 Fixed Rate User Charges |

Percent Change in Average User Costs on Roads Modeled in HERS Vehicle Operating Costs 2 Funding Mechanism 3 Variable Rate User Charges |

|---|---|---|---|---|---|---|---|---|

| 7.76% | $188.9 | $115.7 | -3.4% | -10.3% | ||||

| 7.45% | $182.0 | $111.5 | -3.2% | -3.8% | -10.1% | -10.0% | ||

| 6.70% | $166.5 | $102.0 | -2.6% | -3.2% | -9.8% | -9.6% | ||

| 6.41% | $160.9 | $98.6 | -2.4% | -2.9% | -9.6% | -9.5% | ||

| 5.25% | $140.6 | $86.1 | -1.4% | -1.9% | -9.0% | -8.9% | ||

| 5.15% | $139.0 | $85.1 | -1.4% | -1.8% | -8.9% | -8.9% | ||

| 5.03% | $137.1 | $84.0 | -1.3% | -1.7% | -8.9% | -8.8% | ||

| 4.65% | $131.2 | $80.4 | -1.0% | -1.4% | -8.7% | -8.6% | ||

| 4.55% | $129.7 | $79.5 | -0.9% | -1.3% | -3.9% | -8.6% | -8.5% | -9.5% |

| 4.17% | $124.2 | $76.1 | -0.6% | -0.9% | -3.7% | -8.4% | -8.3% | -9.3% |

| 3.30% | $112.6 | $69.0 | 0.1% | -0.1% | -3.3% | -7.9% | -7.8% | -8.9% |

| 3.21% | $111.5 | $68.3 | 0.2% | -0.1% | -3.3% | -7.8% | -7.8% | -8.9% |

| 3.07% | $109.7 | $67.2 | 0.3% | 0.1% | -3.2% | -7.8% | -7.7% | -8.8% |

| 2.96% | $108.4 | $66.4 | 0.4% | 0.2% | -3.2% | -7.7% | -7.6% | -8.8% |

| 2.93% | $108.0 | $66.2 | 0.5% | 0.2% | -3.1% | -7.7% | -7.6% | -8.7% |

| 1.67% | $94.0 | $57.6 | 1.4% | 1.3% | -2.5% | -6.8% | -6.8% | -8.1% |

| 0.83% | $85.9 | $52.6 | 2.1% | 2.0% | -2.1% | -6.3% | -6.3% | -7.7% |

| 0.34% | $81.5 | $50.0 | 2.4% | 2.4% | -1.8% | -6.0% | -6.0% | -7.4% |

| 0.00% | $78.7 | $48.2 | 2.7% | 2.7% | -1.7% | -5.8% | -5.8% | -7.2% |

| -0.78% | $72.5 | $44.4 | 3.4% | 3.5% | -1.3% | -5.5% | -5.4% | -6.8% |

| -0.86% | $71.9 | $44.1 | 3.5% | 3.6% | -1.3% | -5.4% | -5.4% | -6.8% |

| -1.37% | $68.3 | $41.8 | 3.9% | 4.0% | -1.0% | -5.1% | -5.1% | -6.5% |

| -4.95% | $48.2 | $29.5 | 6.7% | 7.0% | 0.6% | -3.3% | -3.2% | -4.7% |

| -7.64% | $37.9 | $23.2 | 8.6% | 9.0% | 1.7% | -2.2% | -2.2% | -3.4% |

Exhibit 7-7 indicates that vehicle operating costs are expected to decline at all levels of investment, regardless of which financing mechanism is used. As described earlier, the HERS analyses for this report incorporated EIA's forecasts of sharp increases in future fuel efficiency for the vehicle fleet as a result of changes in CAFE standard and other factors.

Exhibit 7-7 shows that the imposition of variable rate user charges to combat congestion would facilitate greater reductions in average user costs than could be achieved if other funding mechanisms were employed, even at much higher levels of investment. For example, if investment were to increase at an annual rate of 4.55 percent in constant dollar terms, and variable rate user charges were imposed, HERS projects that a 3.9 percent reduction in average travel time costs could be achieved. This reduction is more significant than it appears, since a significant portion of travel time costs include the fixed amount of time required to move from one point to another at free-flow speeds, and thus would not be affected by actions that reduce congestion. HERS projects that the best that could be achieved in terms of travel time savings assuming funding by fixed rate user charges would be a 3.8 percent reduction if investment were to increase at an average annual rate of 7.45 percent.

Exhibit 7-7 also shows that variable rate user charges have the potential to partially mitigate the potential impacts of reductions in highway investment on travel time costs. For example, if combined public and private capital investment in highways were to decline by 7.64 percent annually in constant dollar terms, HERS projects a 1.7 percent increase in average travel time costs assuming a variable rate user charge financing mechanism, compared to an 9.0 percent increase assuming fixed rate user financing.

The HPMS database does not contain location-specific information on crashes, or the presence or absence of safety devices such as guard rails or rumble strips. Consequently, the HERS analysis does not identify specific safety-oriented investment opportunities, but instead considers the ancillary safety impacts of capital investments that are directed primarily toward system rehabilitation or capacity expansion. As a result, the overall crash costs calculated by HERS do not vary as significantly at different investment levels as do travel time costs and vehicle operating costs. The HERS analysis projects small increases in crash costs in constant dollars over time, ranging from 0.1 percent at higher levels of investment to 2.4 percent if capital investment is significantly reduced. The analysis suggests that the imposition of variable rate congestion charges may have some minor safety implications as it facilitates higher speeds, which tends to increase crash severity.

Impact of Future Investment on Highway Operational Performance

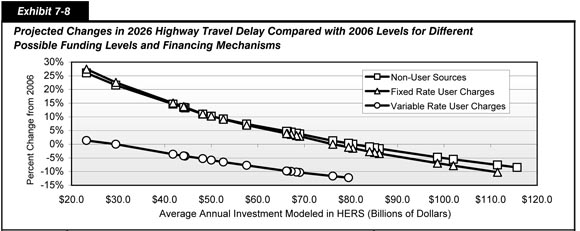

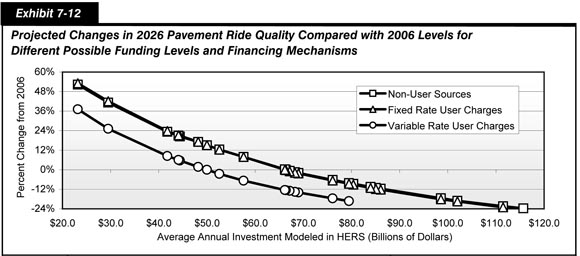

Exhibit 7-8 shows how average delay per VMT is influenced by the total amount invested in highways, and the financing mechanisms employed to support such investment. HERS estimates that if combined public and private highway capital investment were to increase by 4.65 percent annually in constant dollar terms and this increase were funded from non-user sources, then average delay per VMT in 2026 could be maintained at 2006 levels. If fixed rate user charges were employed instead, average delay per VMT could be maintained if capital investment grew by 4.17 percent annually in constant dollar terms; the difference is caused by the impact that the imposition of the fixed rate user charges would have on travel behavior. If current funding levels were sustained in constant dollar terms, it is projected that average delay per VMT would increase by 11.0 percent assuming funding from non-user sources.

| Annual Percent Change Relative to 2006 | Average Annual Investment (Billions of $2006) Total Capital Outlay |

Average Annual Investment (Billions of $2006) Spending Modeled in HERS |

Average Annual Investment (Billions of $2006) HERS System Expansion 2 Funding Mechanism Non-User Sources |

Average Annual Investment (Billions of $2006) HERS System Expansion 2 Funding Mechanism Fixed Rate User Charges |

Average Annual Investment (Billions of $2006) HERS System Expansion 2 Funding Mechanism Variable Rate User Charges |

Percent Change in Average Delay Per VMT on Roads Modeled in HERS Funding Mechanism Non-User Sources |

Percent Change in Average Delay Per VMT on Roads Modeled in HERS Funding Mechanism Fixed Rate User Charges |

Percent Change in Average Delay Per VMT on Roads Modeled in HERS Funding Mechanism Variable Rate User Charges |

|---|---|---|---|---|---|---|---|---|

| 7.76% | $188.9 | $115.7 | $64.3 | -8.5% | ||||

| 7.45% | $182.0 | $111.5 | $61.6 | $61.3 | -7.6% | -10.2% | ||

| 6.70% | $166.5 | $102.0 | $55.8 | $55.5 | -5.5% | -7.8% | ||

| 6.41% | $160.9 | $98.6 | $53.6 | $53.2 | -4.7% | -6.9% | ||

| 5.25% | $140.6 | $86.1 | $45.9 | $45.5 | -1.6% | -3.4% | ||

| 5.15% | $139.0 | $85.1 | $45.3 | $44.8 | -1.3% | -3.0% | ||

| 5.03% | $137.1 | $84.0 | $44.6 | $44.2 | -0.9% | -2.7% | ||

| 4.65% | $131.2 | $80.4 | $42.4 | $42.2 | 0.0% | -1.5% | ||

| 4.55% | $129.7 | $79.5 | $41.8 | $41.6 | $33.3 | 0.4% | -1.1% | -12.3% |

| 4.17% | $124.2 | $76.1 | $39.7 | $39.5 | $31.4 | 1.3% | 0.0% | -11.6% |

| 3.30% | $112.6 | $69.0 | $35.3 | $35.2 | $27.8 | 3.8% | 2.9% | -10.3% |

| 3.21% | $111.5 | $68.3 | $34.9 | $34.8 | $27.4 | 4.0% | 3.2% | -10.2% |

| 3.07% | $109.7 | $67.2 | $34.2 | $34.0 | $26.8 | 4.4% | 3.6% | -9.9% |

| 2.96% | $108.4 | $66.4 | $33.7 | $33.5 | $26.3 | 4.6% | 3.8% | -9.8% |

| 2.93% | $108.0 | $66.2 | $33.6 | $33.4 | $26.2 | 4.7% | 3.9% | -9.8% |

| 1.67% | $94.0 | $57.6 | $28.9 | $28.9 | $21.9 | 7.4% | 7.0% | -7.7% |

| 0.83% | $85.9 | $52.6 | $26.3 | $26.2 | $19.7 | 9.2% | 9.1% | -6.5% |

| 0.34% | $81.5 | $50.0 | $24.7 | $24.6 | $18.4 | 10.2% | 10.3% | -5.8% |

| 0.00% | $78.7 | $48.2 | $23.8 | $23.7 | $17.6 | 11.0% | 11.1% | -5.3% |

| -0.78% | $72.5 | $44.4 | $21.5 | $21.5 | $16.0 | 13.2% | 13.5% | -4.4% |

| -0.86% | $71.9 | $44.1 | $21.3 | $21.3 | $15.8 | 13.4% | 13.7% | -4.3% |

| -1.37% | $68.3 | $41.8 | $20.0 | $20.0 | $14.8 | 14.6% | 15.1% | -3.7% |

| -4.95% | $48.2 | $29.5 | $13.8 | $13.9 | $9.6 | 21.6% | 22.6% | 0.0% |

| -7.64% | $37.9 | $23.2 | $10.5 | $10.5 | $7.1 | 26.0% | 27.5% | 1.4% |

Assuming variable rate congestion charges were imposed broadly, HERS projects that current levels of highway capital investment would be adequate to reduce average delay per VMT, and that maintaining average delay at 2006 levels might still be achievable even if capital investment were to drop by 4.95 percent annually in constant dollar terms. If combined public and private highway capital investment were to rise by 4.55 percent annually in constant dollar terms, a 12.3 percent reduction in average delay per VMT could be achieved. HERS projects that such a reduction could not be achieved in the absence of such variable rate charges, even at much higher investment levels.

Exhibit 7-8 also identifies the portion of the spending modeled in HERS that was directed towards system expansion for each of the alternative investment levels that were analyzed. This is significant because investments in system expansion, such as the widening of existing highways or building new routes in existing corridors, would have a greater impact on delay than would investments in system rehabilitation such as the reconstruction or resurfacing of lanes on existing facilities.

If variable rate user charges were broadly imposed, this would significantly reduce congestion, thus reducing the potential benefits that could be achieved by widening existing highway sections. Consequently, the benefit-cost ratios associated with widening projects would tend to be lower, making it more likely that pavement reconstruction or resurfacing projects would be selected in a constrained funding environment. For example, if combined public and private highway capital investment were to rise by 4.55 percent annually in constant dollar terms, HERS would recommend that an average annual level of $41.8 billion be directed to system expansion assuming the additional funding comes from non-user sources, $41.6 billion assuming funding from fixed rate user charges, and $33.3 billion assuming variable rate user charges are imposed broadly. All of these amounts exceed current investment in system expansion by all levels of government combined, indicating that there are significant opportunities for cost-beneficial investment to add capacity to the highway system, regardless of which funding mechanism is employed.

Congestion Delay and Incident Delay

Exhibit 7-9 identifies the potential impacts of alternative investment levels and financing mechanisms on the congestion delay and incident delay components of the average delay per VMT figures presented in Exhibit 7-8. As noted above, the HERS model assumes the continuation of existing trends in the deployment of certain types of ITS and various operations strategies, which are expected to have a greater impact on reducing delay associated with isolated incidents than with delay associated with recurring congestion. Exhibit 7-9 shows that such deployments would be particularly effective in conjunction with the application of variable rate user charges, allowing reductions in average incident delay per VMT even at significantly reduced levels of highway capital investment. At current funding levels, HERS projects that incident delay would rise, but projects that an annual increase in combined public and private highway capital investment of between 0.83 percent to 1.67 percent in constant dollar terms may be sufficient to maintain incident delay at base year levels. At higher levels of investment, HERS projects that reductions in incident delay of 29.7 to 36.6 percent could be achieved, depending on the funding mechanism used to support this increased investment. Appendix A provides more details on the operations strategies and ITS considered in HERS, and Chapter 10 includes some analysis of the potential impacts of more aggressive deployment patterns than were assumed in the baseline analyses reflected in this chapter.

| Annual Percent Change Relative to 2006 | Average Annual Capital Investment (Billions of 2006 Dollars) 1 Total Capital Outlay |

Average Annual Capital Investment (Billions of 2006 Dollars) 1 Spending Modeled in HERS |

Percent Change in Delay on Roads Modeled in HERS Congestion Delay per VMT Funding Mechanism 2 Non-User Sources |

Percent Change in Delay on Roads Modeled in HERS Congestion Delay per VMT Funding Mechanism 2 Fixed Rate User Charges |

Percent Change in Delay on Roads Modeled in HERS Congestion Delay per VMT Funding Mechanism 2 Variable Rate User Charges |

Percent Change in Delay on Roads Modeled in HERS Incident Delay per VMT Funding Mechanism 2 Non-User Sources |

Percent Change in Delay on Roads Modeled in HERS Incident Delay per VMT Funding Mechanism 2 Fixed Rate User Charges |

Percent Change in Delay on Roads Modeled in HERS Incident Delay per VMT Funding Mechanism 2 Variable Rate User Charges |

|---|---|---|---|---|---|---|---|---|

| 7.76% | $188.9 | $115.7 | -1.8% | -29.7% | ||||

| 7.45% | $182.0 | $111.5 | -4.6% | -28.3% | -33.1% | |||