A Snapshot of Transportation Planning: Oregon Department of Transportation (ODOT)

2.0 Background

2.1 Oregon Overview

Geography

Oregon is located in the Pacific Northwest region of the United States. Oregon's neighboring states include Washington to the north, Idaho to the east, and Nevada and California to the south. The state has 36 counties and covers a land area of 95,988 square miles. It is the ninth-largest state in the nation and the 27th most populated.

Population

Oregon's population in 2012 was 3.9 million, or about 39.9 persons per square mile. According to the US Census Bureau, Oregon's population is expected to reach 4.3 million by 2020-a growth rate of 1.3 percent per year, which is significantly higher than the national average growth rate of 0.9 percent. More than 70 percent of Oregon's population and employment is located in the 120-mile-long Willamette Valley, which includes nine counties in the northern part of the state between the Coast Range and Cascade Range mountains.

Employment

Oregon's total non-farm employment in 2013 was 1,673,700. The following table presents overall employment, by industry category, in Oregon.

Table 2‑1: Oregon Employment Industries

Oregon Employment Industries (2013) |

Total Employment |

Mining and logging |

7,600 |

Construction |

73,700 |

Manufacturing |

174,900 |

Trade, transportation and utilities |

318,600 |

Information |

43,900 |

Financial activities |

91,200 |

Professional and business services |

208,800 |

Educational and health services |

242,600 |

Leisure and hospitality |

176,700 |

Other services |

58,300 |

Federal government |

27,600 |

State government |

81,000 |

Local government |

180,600 |

Source: Oregon Labor Market Information System: olmis.org

Exports

Oregon's trade with other states far exceeds foreign exports. Oregon, however, is one of the most trade-dependent states in the nation and exported $18.6 billion of goods in 2013. Oregon's top five export trade partners are presented in Table 2‑2.

Table 2‑2: Oregon's Largest Export Partners/Oregon's Largest Export Industries

| |

Oregon's Largest Export Partners (2013) |

Total Exports |

1 |

China |

$3.4 billion |

2 |

Canada |

$3.1 billion |

3 |

Malaysia |

$1.9 billion |

4 |

Japan |

$1.5 billion |

5 |

South Korea |

$984 million |

| Source: International Trade Administration - www.trade.gov/mas/ian/statereports/states.or.pdf |

| |

Oregon's Largest Export Industries (2013) |

Total Exports |

1 |

Computer and electronic products |

$6.7 billion |

2 |

Agricultural products |

$2.4 billion |

3 |

Machinery, except electrical |

$2.2 billion |

4 |

Chemicals |

$1.6 billion |

5 |

Transportation equipment |

$1.1 billion |

Source: International Trade Administration - www.trade.gov/mas/ian/statereports/states.or.pdf |

ODOT traces its roots to 1913, when the Oregon Legislature created the Oregon Highway Commission to "get Oregon out of the mud." In 1969, the legislature created ODOT and moved the Department of Motor Vehicles, State Highway Department, Parks Division (then part of Highway), State Board of Aeronautics, State Ports Commission, and the newly created Mass Transit Division under ODOT.

Today, ODOT works to provide a safe, efficient transportation system that supports economic opportunity and livable communities for Oregonians. ODOT develops programs related to Oregon's system of highways, roads, bridges, railways, public transportation services, transportation safety programs, driver and vehicle licensing, and motor carrier regulation.

ODOT's Goals

- Safety. Engineering, education, and enforcement for a safe transportation system.

- Mobility. Keeping people and the economy moving.

- Preservation. Preserving and maintaining transportation infrastructure.

- Sustainability. Sustaining the environment and communities.

- Stewardship. Maximizing value from transportation investments.

Oregon Transportation Commission (OTC)

The Transportation Commission establishes state transportation policy and guides the planning, development and management of a statewide integrated transportation network that provides efficient access, is safe, and enhances Oregon's economy and livability. The commission meets monthly to oversee ODOT's activities relating to highways, public transportation, rail, transportation safety, motor carrier transportation, and drivers and motor vehicles.

The governor appoints five commissioners, ensuring that different geographic regions of Oregon are represented. One member must live east of the Cascade Range; no more than three members can belong to one political party.

Area Commissions on Transportation

Area Commissions on Transportation (ACT) are the 12 advisory bodies chartered by the OTC. ACTs address all aspects of transportation-surface, marine, air, and transportation safety-with primary focus on the state transportation system. ACTs consider regional and local transportation issues that affect the state system. They work with other local organizations dealing with transportation-related issues.

ODOT Divisions

ODOT is composed of the Director's Office and nine divisions:

- Directors Office. Oversees the agency's biennial budget and manages Oregon's statewide transportation policy and development of surface transportation, driver and vehicle safety and licensing, and motor-carrier programs. Includes the offices of Employee Safety, Civil Rights, Workforce Development and Small Business Support, Government Relations, and Sustainability.

- Central Services Division. Provides services and support to all other ODOT divisions. Central Services includes the offices of Audit Services, Budget, Business Services, Facilities, Financial Services, Human Resources, Information Systems, and Procurement.

- Communications Division. Helps citizens understand transportation programs and issues through ODOT's outreach and information efforts, which include community relations, public information, employee and emergency communications, and media relations. Also provides support for the Office of the Director, the OTC, and numerous citizen advisory committees.

- Driver and Motor Vehicle (DMV) Services Division. DMV contributes to public safety by licensing only qualified persons and vehicles to drive on Oregon's roads. DMV issues titles to protect the financial and ownership interests in vehicles. DMV is headquartered in Salem, Oregon, with 64 field offices located throughout the state. DMV serves an average of 12,000 customers per day.

- Highway Division. ODOT's largest division is responsible for design, construction, maintenance, and operation of more than 8,000 miles of state highways. There are 14 district maintenance offices statewide.

- Motor Carrier Transportation Division. Regulates the commercial trucking industry in Oregon, ensures safe operations, and collects heavy truck registration fees and weight-mile taxes. Includes headquarters in Salem and enforcement offices at ports of entry and other locations throughout the state.

- Public Transit Division. Administers programs that support public transit agencies and activities throughout the state, including enhancing urban and rural public transportation options, supporting mobility choices for elderly and disabled people, and encouraging use of transit as an alternative to driving alone.

- Rail Division. Responsible for passenger and freight-rail planning, operations, and safety.

- Transportation Development Division. Responsible for research, data collection and analysis, planning, and related activities that inform current and future transportation system operations and development. Provides technical and planning assistance to local governments and organizations and coordinates multiple funding and grant programs.

- Transportation Safety Division. Provides Oregonians with a safe transportation system by offering information, services, grants, and contracts to the public and partner agencies and organizations statewide. Each year, the division administers more than 550 grants and contracts that deliver safety programs to Oregon citizens.

ODOT Region Offices

ODOT also has five regional offices that are responsible for a variety of transportation operations in their respective geographic areas. Each region has several smaller district offices that maintain transportation systems in those areas. ODOT's regional offices are transitioning from highway-centric to multimodal as the industry moves to offer more transportation options.

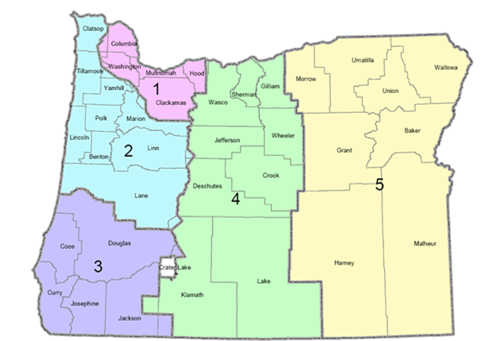

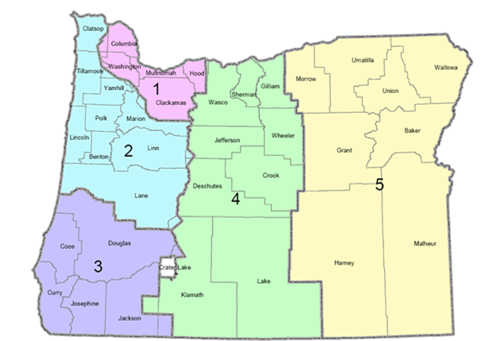

ODOT's regions are:

- Region 1-Portland Metro. Columbia, Multnomah, Washington, Clackamas, and Hood River counties.

- Region 2-Northwest Oregon. Clatsop, Tillamook, Yamhill, Polk, Marion, Lincoln, Benton, western Washington, Linn, and Lane counties.

- Region 3-Southwest Oregon. Coos, Douglas, Curry, Josephine, and Jackson counties.

- Region 4-Central Oregon. Wasco, Sherman, Gilliam, Jefferson, Wheeler, Crook, Deschutes, Klamath, and Lake counties.

- Region 5-Eastern Oregon. Morrow, Umatilla, Union, Wallowa, Baker, Grant, Harney, and Malheur counties.

Figure 2‑1: ODOT Transportation Regions and Counties

2.4 Financing and Budget

ODOT Revenue Sources

Transportation in Oregon is funded through three main revenue sources: 1) State Highway Fund; 2) Federal Funds; and 3) Local Funds.

State Highway Fund

Net revenues from the following state taxes and fees are deposited into Oregon's State Highway Fund:

- Motor vehicle registration and title fees.

- Driver license fees

- Motor vehicle fuel taxes.

- Motor carrier weight-mile taxes.

With minor exceptions, Oregon's constitution dedicates State Highway Fund revenues solely to build, improve, maintain, operate and use public highways, roads, streets, and roadside rest areas.

The State Highway Fund is a shared revenue source; it is divided among ODOT, counties, and cities according to the formula presented in Table 2‑3.

Table 2‑3: Oregon State Highway Fund Distribution

State Highway Fund Recipient |

Funding Distribution |

Basis for Distribution |

Oregon cities |

16% |

Population |

Oregon counties |

25% |

Number of registered vehicles |

State of Oregon (ODOT) |

59% |

Remaining balance |

ODOT's share of State Highway Fund resources are currently committed to three areas:

- Debt service on transportation bonds.

- The cost of running the agency.

- Maintaining and preserving Oregon's highways.

Federal Funds

Federal fuel and transportation taxes and fees, including the motor-fuels tax, tire tax, heavy-truck and trailer-sales tax, and annual heavy-truck-use tax, provide the funds for highway and transit programs nationwide. These taxes and fees are deposited into the federal Highway Trust Fund. The trust fund has two accounts: a Highway Account and a Mass Transit Account. Congress apportions the federal Highway Trust Fund to the states.

The federal surface transportation program currently invests more than one-half billion dollars in Oregon highway and transit projects each year.

Federal forest funds earmarked for road purposes are also distributed to eligible counties.

Local Funds

City and county local road funds come from several sources, including property taxes, local fuel taxes, local improvement district assessments, traffic-impact fees, bonds, general fund transfers, parking meters and fines, receipts from other local governments, various fines and permit fees, and private contributions.

Biennial State Budget Cycle

The State of Oregon follows a biennial budget cycle that begins on July 1 of odd-numbered years. The current state budget period began on July 1, 2013 and will end on June 30, 2015.

Total revenue for ODOT's 2013-2015 legislatively adopted budget is $5.299 billion, and is presented in Table 2‑4.

Table 2‑4: ODOT Revenue Sources

2013-2015 ODOT revenue sources |

Revenue ($ millions) |

Percent of revenue |

Federal Funds |

$810 |

15.3% |

State Revenues |

$3,134 |

59.2% |

Beginning balance |

$283 |

|

Motor fuels tax |

$1,066 |

|

Weight mile tax |

$593 |

|

Driver and vehicle licenses |

$661 |

|

Transportation Licenses and fees |

$106 |

|

Transfers to ODOT |

$271 |

|

General Fund |

$2 |

|

Lottery proceeds |

$94 |

|

Sales and charges for service |

$20 |

|

All other revenue |

$40 |

|

BondCOP Sales |

$1,353 |

25.5% |

Total ODOT Revenue |

$5,299 |

100 % |

Source: 2013 - 2015 Legislatively Adopted Budget

ODOT's 2013-2015 biennial agency budget is $4.069 billion, which does not include the State Transportation Improvement Program (STIP) and mandated programs or transfers to other agencies. Expenditure categories are presented in Table 2‑5.

Table 2‑5: ODOT Revenue Uses

2013-2015 ODOT Uses of Funds |

$ Millions |

State Highway Program |

$2,617 |

| |

Maintenance |

454 |

| |

Preservation |

249 |

| |

Bridge |

372 |

| |

Highway Operations |

123 |

| |

Modernization |

825 |

| |

Special Programs |

210 |

| |

Local Government Assistance |

367 |

Other ODOT Programs |

$1,452 |

| |

Transportation Safety |

32 |

| |

Public Transit |

89 |

| |

Rail |

76 |

| |

Transportation Program Development |

224 |

| |

Driver and Motor Vehicles |

173 |

| |

Motor Carrier |

65 |

| |

Central Services |

192 |

| |

Debt Service |

580 |

| |

Capital Improvement, Construction and Non-Limited Programs |

21 |

ODOT Biennial Budget |

$4,069 |

STIP and Mandated Programs |

$335 |

Mandated Transfers to Other Agencies |

$903 |

| |

Cities |

330 |

| |

Counties |

484 |

| |

Other Agencies |

81 |

Source: 2013 - 2015 Legislatively Adopted Budget