Publication #: FHWA-HEP-09-015 | JANUARY 2009

Prepared for the

U.S. Department of Transportation

Federal Highway Administration

Prepared by

Wilbur Smith Associates

and S.R. Kale Consulting LLC

This section of the guidebook discusses how to engage the private sector in freight planning activities with or without the involvement of freight stakeholder groups. The discussion begins with a general discussion of public involvement procedures. This is followed by 1) the identification of specific planning and programming activities in which to engage the private sector, and 2) a review of public involvement procedures that can be and have been used for obtaining input from freight stakeholders. Section 5 concludes with a brief discussion of challenges and issues relating to considerations about ways to involve the private sector.

To help agencies understand public involvement procedures for transportation planning, FHWA has develop a web site on Technical Resources for Transportation Capacity Building (http://www.planning.dot.gov/technical.asp#pub). The web site covers a variety of topics, including Public Involvement Techniques for Transportation Decision-Making (http://www.planning.dot.gov/PublicInvolvement/pi_documents/toc-foreword.asp). Especially relevant for this guidebook are the following five steps identified for setting up and implementing a public involvement program.

Sections 3 and 4 of this guidebook address steps one and two. Section 5 addresses steps three, four, and five as shown in the following discussion.

Table 1 and Table 2, based on materials from NCHRP reports 570 and 594, show a wide range of planning and programming activities for which to consider involving public and private sector freight stakeholders. As can be seen in Table 1, outreach and partnership needs range from low to high depending on whether the transportation agency is using the basic approach or the advanced approach in working with freight stakeholders. Under a basic approach, most activities require a low or moderate level of outreach or partnership needs. Under an advanced approach, most activities require a moderate or high level of outreach or partnership needs.

As can be seen in Table 2, most involvement activities fit into one of the following areas: needs identification, plan development, programming, and project development. Private sector involvement is most important for developing a state or regional freight industry profile, identifying needs, conducting a hotspot or bottleneck analysis, and linking freight and land use planning.

Table 1: Outreach and Partnership Needs - Basic and Advanced Approaches

| Planning Area | Outreach Needs (Low, Moderate or High) | |

|---|---|---|

| Basic Approach | Advanced Approach | |

| Freight Policy Directive | Low. Requires internal staff coordination. | Moderate. Requires discussions with private sector stakeholders to facilitate development of freight policies. |

| Regional Freight Profile | Moderate. Requires completion of a limited number of interviews and contact and engagement of local freight organizations. | High. Requires completion of interviews, focus groups, and surveys and the development of a freight TAC. |

| Freight Needs and Deficiencies | Low. Requires limited interviews and focus groups with a small number of private partners. | High. Requires completion of significant interviews and focus groups with a small number of private partners and the organization and implementation of a freight TAC. |

| Freight Long-range Plan Element | Moderate. Requires limited outreach to private partners through interviews and focus groups. Builds on earlier outreach efforts. | High. Requires significant outreach to private partners through interviews, focus groups, public meetings, and a freight TAC. |

| Freight Project Identification | Low. Requires limited outreach to a small number of private partners to validate projects identified as beneficial to freight. | High. Requires significant outreach to private partners through interviews, focus groups, general public, and a freight TAC. |

| Freight Analysis in Corridor Studies | Low. Requires inclusion of private partners in general outreach activities. Existing advisory committees can provide valuable input. | High. Requires involvement of private partners in all the planning outreach activities, conduct of interviews and focus groups, and engagement of a freight TAC. |

| Freight Project Evaluation Criteria | Low. Requires limited outreach to private partners to verify evaluation criteria. | Same as for the basic approach. |

| Freight Performance Measures | Moderate. Requires outreach to private partners to solicit feedback on proposed freight performance measures. | Same as for the basic approach. |

| Funding and Innovative Financing Techniques | High. Requires significant outreach to private partners to build support for projects. Activities should consist of interviews, focus groups, and formal freight Technical Advisory Committee (TAC) meetings. | Same as for the basic approach. |

| Freight Project Impact Assessment | High. Requires significant outreach to private partners to build support for projects. Activities should consist of interviews, focus groups, and formal freight technical advisory committee (TAC) meetings. | Same as for the basic approach. |

| Data and Analytical Tools | Moderate. Requires outreach to private partners through interviews, focus groups, surveys, and formation of a freight TAC to support a wide range of activities that rely on data and input. | Same as for the basic approach. |

| Training and Education | Moderate. Requires outreach to private partners to collect data on the freight system as well as collecting and reviewing available research and data from available sources (e.g., other MPOs, state DOTs, FHWA). | Same as for the basic approach. |

| Freight Project Impact Assessment | >High. Requires significant outreach to private partners to build support for projects. Activities should consist of interviews, focus groups, and formal freight technical advisory committee (TAC) meetings. | Same as for the basic approach. |

| Data and Analytical Tools | Moderate. Requires outreach to private partners through interviews, focus groups, surveys, and formation of a freight TAC to support a wide range of activities that rely on data and input. | Same as for the basic approach. |

| Training and Education | Moderate. Requires outreach to private partners to collect data on the freight system as well as collecting and reviewing available research and data from available sources (e.g., other MPOs, state DOTs, FHWA). | Same as for the basic approach. |

Source: Based on materials from TRB NCHRP Report 570

Table 2: Levels of Private sector Involvement in Planning Processes

| Elements of the Freight Planning and Programming Process | Activities | Private sector Involvement |

|---|---|---|

| Needs Identification | Developing a freight industry profile | XXX |

| Engaging the private sector in the needs identification process | XXX | |

| Conducting a hotspot or bottleneck analysis | XXX | |

| Plan Development | Identifying corridors and facilities of statewide or regional significance | XX |

| Developing freight performance measures | XX | |

| Linking freight and land use planning | XXX | |

| Programming | Developing freight specific evaluation criteria | XX |

| Evaluating economic and other public benefits of freight improvement projects | X | |

| Using alternative funding and financing approaches | XX | |

| Project Development | Addressing National Environmental Policy Act requirements within freight projects | XX |

| Incorporating context sensitive solutions into freight projects | XX | |

| Less Important XXXXXXXXXX More Important | ||

Source: based on materials in TRB NCHRP Report 594.

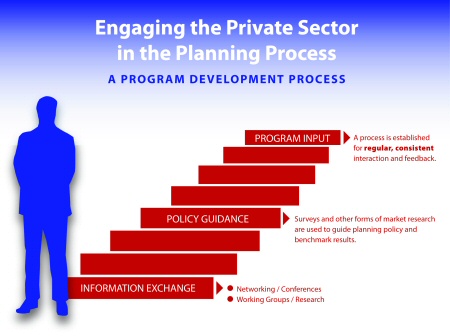

Examples of procedures for engaging the private sector include information exchange, surveys and interviews, and regular input through stakeholder groups such as freight advisory committees (Figure 4). While the graphic in Figure 4 suggests that engaging the private sector for the purposes of making programmatic investment decisions is a journey, it doesn't have to be. For most MPOs and state planning agencies engaging freight stakeholders is a progressive learning experience. Note, none of the examples referenced in the graphic are mutually exclusive.

Figure 4: Examples of Procedures for Obtaining Private sector Input

Source: FHWA, Workshop on "Engaging the Private Sector in Freight Planning"

Exchanging information enables public sector planners and decision-makers to better understand issues and concerns of freight stakeholders, and enables private sector representatives to better understand how public transportation planning and funding processes work. Information exchange may occur in a variety of ways, such as:

Information exchange through formal and informal networking is one of the most common ways for public agencies to involve the private sector in freight planning activities. The FHWA's monthly "Talking Freight" seminar series, for example, provides opportunities for freight planners to learn more about private sector issues and concerns as well as how other freight planners have engaged the private sector.

Additionally, several transportation agencies have conducted seminars or forums where representatives from the public and private sectors exchange information. State-level examples include:

The Colorado DOT, which in 2008 hosted a one-day Colorado FAC Seminar where public and private sector representatives made presentations on various freight-related topics

The Minnesota DOT co-sponsors an annual half-day Freight and Logistics Symposium with the Twin Cities Roundtable of the Council of Supply Chain Management (CSCMP). The event is planned and hosted by the University of Minnesota's Center for Transportation Studies. One of the goals of the annual symposium is to bring together public and private sector freight professionals to explore timely issues. For more information visit: http://www.cts.umn.edu/Events/FLOGSymposium/2008/

At the MPO level there are also a variety of means that planning agencies have undertaken to broaden freight information exchange opportunities, for example:

The Baltimore MPO has paid the membership fees for some freight staff to join and participate in activities of the Baltimore CSCMP Roundtable.

The Delaware Valley Regional Planning Commission has hosted several networking events, including a "Freight for a Day" event in 2006 (http://www.dvrpc.org/announce/2006-04_freight.htm)

Other public sector organizations hold events that provide for information exchange between agencies, the private sector, and the general public. Port districts or authorities in many states are public agencies that work extensively with the private sector on transportation, economic development, and other initiatives. Some ports hold outreach activities to tell what they do and how what they do impacts regional economies. An example is the Port of Portland's (Oregon) annual Seaport Celebration (http://www.portofportland.com/PortDispatch/PortDispatch.aspx?contentFile=Issue_2008_09/Content/page2.ascx) which provides visitors with an opportunity to view exhibits and demonstrations about port facilities and to tour a container terminal.

Formal interviews and surveys go beyond information exchange by enabling public agencies to obtain information and/or data in a structured format administered uniformly across businesses and stakeholders. Interviews and surveys may be useful for helping decision-makers set policy to guide planning activities. Other types of research and evaluation may help decision-makers establish benchmarks for existing programs as well as develop targets for future performance.

Private sector representatives can provide policy guidance in several ways. The most common way probably is through providing input to the development of multimodal and modal transportation plans. This could include helping develop freight-related language for goals, objectives, policies, strategies, actions, priorities, performance criteria and targets, and other plan components. Results from the AASHTO and AMPO surveys, referenced in Section 2 of this guidebook, showed that multimodal and modal plans, along with special studies, were the most common types of activities in which state and metropolitan transportation agencies had involved private sector participants.

The AASHTO and AMPO surveys and other sources have shown that public agencies seek freight stakeholder policy guidance in a variety of ways, including through:

Committees for specific purposes, such as plan development, often are disbanded after reaching specific endpoints such as plan adoption, but may be re-formed later for other planning initiatives where private sector input is desired. Input may be ongoing from formal meetings of carrier, shipper, and other freight-related groups, including modal and multimodal advisory committees.

A recent Freight Plan Showcase meeting is an example of freight stakeholder involvement in policy development. On October 15, 2008, the Delaware Valley Regional Planning Commission (DVRPC) sponsored the showcase to support development of the 2035 long-range transportation plan for the Philadelphia metropolitan area in Pennsylvania and New Jersey. Participating private and public sector representatives explained various steps of moving commodities through a supply chain from origin to destination. DVRPC staff also presented a draft set of projects intended to maintain and improve the region's freight network as identified through research and discussion with the region's stakeholders. See the following for more information about the showcase: http://www.dvrpc.org/announce/2008-09_freight.htm.

Developing freight-related performance measures is another from of policy guidance. Numerous planners and researchers have developed performance measures in reports completed or in progress such as the following:

Freight Performance Measures Guide (http://www.utexas.edu/research/ctr/pdf_reports/index.html), prepared in 2006 for the Texas DOT

Development of Measurement Sources for Freight Performance Indicators (http://www.lrrb.org/pdf/200812.pdf), prepared in 2008 for the Minnesota DOT

Forecasting Statewide Freight Toolkit (http://www.trb.org/Main/Public/Blurbs/159781.aspx), prepared in 2008 for the Transportation Research Board, National Cooperative Highway Research Program

"Freight Performance Measures: Approach Analysis," research in progress for the Oregon DOT (http://gulliver.trb.org/MarineTransportation1/Blurbs/Freight_Performance_Measures_Approach_Analysis__163491.aspx )

"Performance Measures for Evaluating Multi-state Projects," research in progress for the Mississippi Valley Freight Coalition (http://www.wistrans.org/cfire/Research/MVFC/11/index.html)

"Performance Measures for Freight Transportation," project #03 in progress for TRB's National Cooperative Freight Research Program (NCFRP) (http://www.trb.org/TRBNet/ProjectDisplay.asp?ProjectID=1575)

Web links to additional information on freight performance measurement are available on an FHWA web page at (http://ops.fhwa.dot.gov/freight/freight_analysis/perform_meas/index.htm).

Establishing regular and consistent stakeholder feedback and interaction over time may be a target or goal for agencies wanting to demonstrate ongoing engagement with the private sector in the development of transportation plans and improvement programs. With regular feedback over time, freight stakeholders are meaningfully involved with the development of specific projects and investments, share strategies with infrastructure providers, and see the development of infrastructure that responds to freight mobility needs (Figure 5). Freight stakeholders actively participate in identifying needs and projects and in recommending project priorities. Public agencies obtain information and data directly and indirectly from private sector stakeholders for usage in evaluating needs and projects and for improving freight components of travel models. With input, data, and other information from stakeholders, public sector decision-makers can choose projects and investments that respond to freight mobility needs and other policy goals and targets.

Working with a freight stakeholder group may be the most effective way of obtaining private sector involvement over time. Such a group would meet at regular intervals and would have specific goals, objectives, or other guidance about what the group seeks to accomplish or is legislatively directed to accomplish. Freight stakeholder groups may be modal or multimodal in nature. In some states, modal stakeholder groups have been formed for air, motor carriers, rail (freight and passenger), and/or waterways/ports. In a few states, multimodal freight stakeholder groups have been established. Section 6 of this guidebook provides more detail on state and metropolitan freight stakeholder groups.

Figure 5: Attributes of Active Freight Stakeholder Involvement

Source: FHWA, Workshop on "Engaging the Private Sector in Freight Planning"

A major issue is determining the appropriate level of staff and other resources to allocate toward engaging the private sector, and correspondingly, finding the budget to conduct the desired set of activities. This will depend in part on the specific activities for which the public sector wants to obtain private sector involvement, but at a minimum should include obtaining their input for state and metropolitan multimodal plans and transportation improvement programs. For state transportation agencies, the activities and budgeted amounts may be shown when identifying planning-related activities to be carried out with funding obtained through the federal state planning and research (SPR) program. For MPOs, the activities and budgeted amounts are often formalized through unified planning work programs.

Related issues include developing skills of planning staff to a level adequate for gaining credibility with the private sector, and the commitment of high-level public sector managers/decision-makers to incorporating freight issues and concerns into plans, improvement programs, and other freight-related activities. The specific methods for engaging the private sector and obtaining their input will depend on how commitment from publicagency decision-makers, staff skills and availability, and private sector interest and involvement uniquely come together in a state or metropolitan area.