Under a Public-Private Partnership (P3) for construction of highway projects, a private partner participates in a long-term contract with a public agency involving some combination of design, construction, financing, operations, and maintenance, including collection of toll revenues. A long-term contract involving financing is a form of highway P3 called a "concession." A concessionaire invests its own funds (known as "equity") and borrows additional funds to pay for construction of a highway project. The concessionaire then maintains and operates the project for a specified period and expects to be repaid for its investment in the project over the period of the concession.

Public private partnerships (P3s) allow public agencies to access private equity capital to finance projects. P3s can accelerate the delivery of necessary projects by helping public agencies raise the upfront capital necessary to construct a major infrastructure project all at once, rather than in stages. In some cases, private capital can mean the difference between developing a project and having no project at all. However, the transaction costs related to implementing P3s are high, making the use of this type of financing inappropriate for smaller scale projects.

"Project financing" is a specific type of financing used in P3s, through which an expected future revenue stream generated from users of a project or committed by a public agency is the primary means for repaying the upfront investment needed to fund it. Project financing is also known as "non-recourse" financing because the project's lenders have no recourse or only limited recourse on the shareholders of the concessionaire in case the project runs into difficulties and the concessionaire is unable to repay them.

Private firms often use project financing for large, high-risk projects because it can help to insulate them from financial risks associated with the project. The capital generated from private finance must be paid back with commitments of a long-term revenue stream to repay lenders and private investors, who typically demand a higher rate of return than investors in tax-exempt municipal bonds.

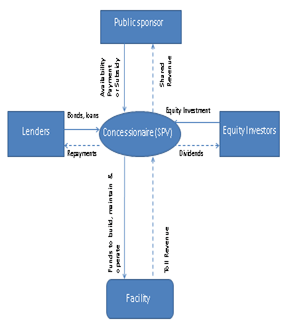

Figure 1 depicts a common financing structure for P3 concession projects. Although a single company may bid on and develop a project, generally several companies form a consortium to develop the project. In order to make a clear separation between the members of the consortium and the project itself, a Special Purpose Vehicle (SPV) or project company known as the concessionaire is generally created after the public agency has awarded the project to the consortium. The members of the consortium then become the shareholders of the SPV and their liability is limited to the amount of shared capital they have invested in the new company.

Using project financing, the concessionaire raises funds from investors and lenders based on the project's future revenue stream or "cash flows." The project's net cash flows (after deducting operating costs and tax payments) must be sufficient to service and repay debt and provide a return to equity. Public agencies may provide direct funding or financing support, guarantees or other risk mitigation measures.

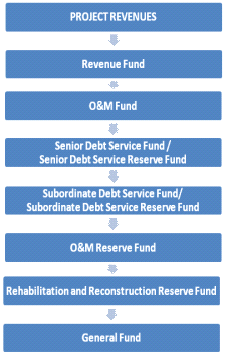

Revenue from the transportation project or from associated revenue is typically channeled through the concessionaire. The cash flow is structured so that accounts for project operations and maintenance (O&M) costs and reserve funds, as well as accounts to repay lenders and investors are sequentially funded. This is commonly referred to as a "cash flow waterfall" (see Figure 2). The cash flow waterfall defines the order of priority for project cash flows as established under the loan and financing documents. In a typical cash flow waterfall, dedicated revenues are used to pay for project O&M costs and debt repayments before surplus revenues are used to pay back investors (or shared with the public sector if the P3 agreement includes revenue sharing provisions).

For further Information: See FHWA's Public-Private Partnership Concessions for Highway Projects: A Primer, available at: https://www.fhwa.dot.gov/ipd/p3/

Public Sponsor flows into Concessionaire (SPV) with availability payment or subsidy

Equity Investors flow into Concessionaire (SPV) with equity investments

Lenders flow into Concessionaire (SPV) with bonds, loans

Concessionaire (SPV) flows into Facility with funds to build, maintain, and operate

Facility flows into Concessionaire (SPV) with toll revenue

Concessionaire (SPV) flows into Equity Investores with dividends

Concessionaire (SPV) flows into Public Sponsor with shared revenue

Concessionaire (SPV) flows into Lenders with repayments

Project Revenue » Revenue Fund » O&M Fund » Rehabilitation and Reconstruction Fund » Senior Debt Service Fund/Senior Debt Service Reserve Fund » Subordinate Debt Service Fund/Subordinate Debt Service Reserve Fund » O&M Reserve Fund » General Fund

The FHWA Center for Innovative Finance Support is a one-stop clearinghouse for expertise, guidance, research, decision tools, and publications on highway program delivery innovations. Our website, workshops, and myriad resources support transportation professionals in the use of innovative approaches for delivery of highway projects.

The FHWA Center for Innovative Finance Support's P3 program focuses on resources and capacity building for consideration and use of design-build-finance-operate-maintain (DBFOM) concessions funded through tolls or availability payments.

The FHWA Center for Innovative Finance Support's Alternative Project Delivery program provides information on contractual arrangements that allow for greater private participation in infrastructure development by transferring risk and responsibility from public project sponsors to private sector engineers, contractors and investors.

The FHWA Center for Innovative Finance Support's Project Finance program focuses on alternative financing, including State Infrastructure Banks (SIBs), Grant Anticipation Revenue Vehicles (GARVEEs), and Private Activity Bonds (PABs).

The FHWA Center for Innovative Finance Support's Federal Tolling and Pricing program focuses on the use of tolling and other road user charges as a revenue source to fund highway improvements, and the use of variably-priced tolls as a tool to manage congestion.

The FHWA Center for Innovative Finance Support's Value Capture program explores strategies for tapping into the added value that transportation improvements bring to nearby properties as a means to provide new funding for surface transportation improvements.