The Downtown Tunnel and the Berkley Bridge east of the Southern Branch of the Elizabeth River, South Hampton Roads, VA.

The Downtown Tunnel and the Berkley Bridge east of the Southern Branch of the Elizabeth River, South Hampton Roads, VA.Value for Money (VfM) analysis is a process used to compare the financial impacts of a Public-Private Partnership (P3) project against those of the traditional public delivery alternative. It is frequently used to evaluate P3 proposals at early stages of project development or procurement, as well as after bids are received from private development entities. The analysis is undertaken from the perspective of the procuring agency.

The methodology for carrying out a VfM analysis involves:

Generally, a P3 proposal must cost less than the PSC in order to be preferable to a traditional procurement approach. When a P3 presents overall savings, it is said to provide "value for money." This value is usually expressed as the percent difference by which the PSC cost exceeds the P3 cost. Small changes in the assumptions underlying the analysis can tip the balance. So, it is important to carefully consider all inputs to the analysis and undertake a sensitivity analysis to understand the critical assumptions. Also, qualitative factors not included in the quantitative analysis must be considered.

VfM analysis does not estimate the value of non-financial public benefits. For example, the public benefits from accelerating the delivery of a project is one of the key reasons that State and local governments in the U.S. pursue P3s. Yet the VfM approach used in current practice does not account quantitatively for benefits to travelers and others from delivering a project earlier than would have been possible under conventional procurement. Few attempts have been made to quantify and monetize benefits from accelerated project delivery or from other differences in service quality between traditional and P3 project delivery. Benefit-Cost Analysis (BCA) can complement VfM analysis to address these issues and contribute to transparency and accountability in the P3 procurement process.

The perspective taken with BCA is much broader than that taken with quantitative VfM analysis. Societal costs and benefits broader than those that accrue mainly to the public sponsor are quantified and monetized to the extent practicable. Thus, BCA is a more appropriate framework to use than VfM in answering the question: "From society's perspective, will P3 delivery constitute an improvement compared to the conventional approach?"

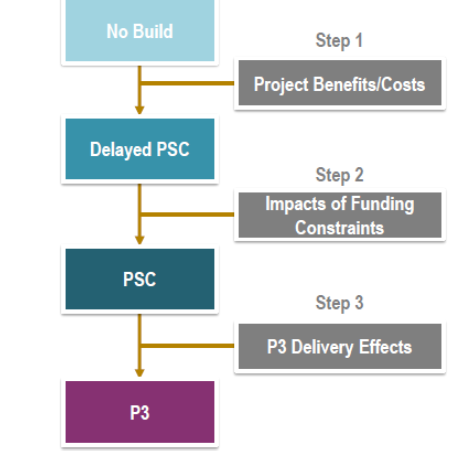

In the context of P3 project delivery, BCA may be conducted in three steps:The first two steps assume conventional delivery of the project. In the final step, the efficiency impacts that relate directly to P3 procurement are estimated relative to accelerated conventional delivery of the project. This will include impacts of a P3 on costs, schedule, quality of service, and travel demand relative to accelerated conventional delivery, as well as impacts of any modifications to scope proposed by a P3 bidder in response to a request for proposal (RFP). The economic efficiency analysis in the final step parallels VfM analysis, which (necessarily) assumes that conventional procurement is possible in the same timeframe as the P3.

A basic assumption in VfM analysis is that conventional procurement is possible with public financing in the same time frame as the P3. However, this may not be true if the procuring agency is faced with budgetary or debt capacity constraints that limit its ability to tap into future revenue streams to pay for investment today. Thus, benefits to users that may accrue from earlier delivery of the project under a P3 are not considered in quantitative VfM analysis, although they may be considered in a qualitative fashion.

Secondly, an assumption in VfM analysis is that the project scope under the P3 option will be exactly the same as under conventional delivery. Thus, any innovations that involve modifications to scope proposed in a P3 bid would need to be included in the conventional delivery option to make the VfM evaluation valid. BCA, on the other hand, can compare projects with differing scope, and is able to capture benefits or disbenefits from changes in scope proposed in a P3 bid.

Thirdly, VfM analysis does not quantitatively capture benefits or costs to users from differences in service quality provided to users under alternative delivery methods. For example, there may be differences among project delivery alternatives with respect to pavement ride quality, incident response, or traffic disruption during construction and maintenance activities. BCA can account for these differential impacts on users quantitatively, while VfM either ignores them or relegates them to qualitative assessment.

Finally, since VfM analysis is a financial analysis that takes the perspective of the public agency sponsor, it requires the estimation of several components, such as toll revenues, interest rates on debt, rates of return on equity and tax consequences, which must be considered because they affect the public sector’s financial position. But many of these components are difficult to forecast. In BCA, however, these components are considered to be “transfers” and are ignored, because when one takes a societal perspective, cash flowing from one part of society to another part of society is a cost for one that is an exactly equal benefit for the other. Many of these “transfer” components have raised controversies with regard to VfM analysis. So, taking a societal perspective, as in BCA, can eliminate many of these controversies.

FHWA has developed an Excel-based screening tool that can perform both VfM analysis and BCA. The tool assists FHWA in its P3 training efforts. For further Information: See FHWA's P3-VALUE Analytical Tool, available at: https://www.fhwa.dot.gov/ipd/p3/

Benefit-Cost Analysis Framework

Text of Benefit-Cost Analysis Framework flow chart

The FHWA Center for Innovative Finance Support is a one-stop clearinghouse for expertise, guidance, research, decision tools, and publications on highway program delivery innovations. Our website, workshops, and myriad resources support transportation professionals in the use of innovative approaches for delivery of highway projects.

The FHWA Center for Innovative Finance Support's P3 program focuses on resources and capacity building for consideration and use of design-build-finance-operate-maintain (DBFOM) concessions funded through tolls or availability payments.

The FHWA Center for Innovative Finance Support's Alternative Project Delivery program provides information on contractual arrangements that allow for greater private participation in infrastructure development by transferring risk and responsibility from public project sponsors to private sector engineers, contractors and investors.

The FHWA Center for Innovative Finance Support's Project Finance program focuses on alternative financing, including State Infrastructure Banks (SIBs), Grant Anticipation Revenue Vehicles (GARVEEs), and Private Activity Bonds (PABs).

The FHWA Center for Innovative Finance Support's Federal Tolling and Pricing program focuses on the use of tolling and other road user charges as a revenue source to fund highway improvements, and the use of variably-priced tolls as a tool to manage congestion.

The FHWA Center for Innovative Finance Support's Value Capture program explores strategies for tapping into the added value that transportation improvements bring to nearby properties as a means to provide new funding for surface transportation improvements.