To provide insights to how SIBs are utilized nationwide, identify marketing techniques and to provide customer feedback to the Center for Innovative Finance Support (CIF$).

Survey Response Rate

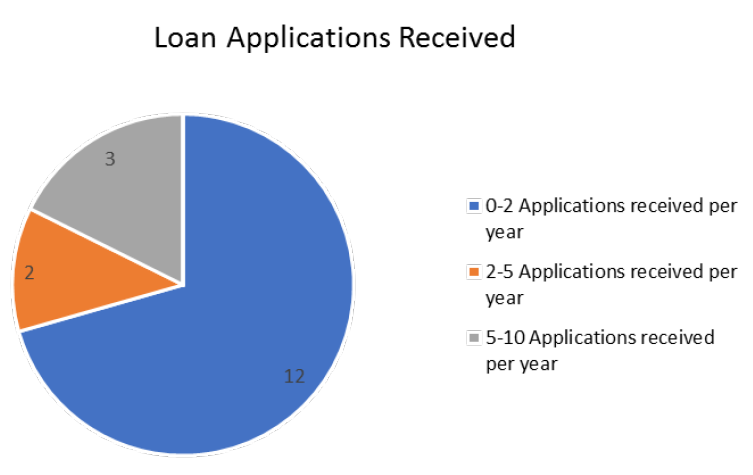

The majority of SIBs receive between 0-2 applications a year.

Loan Applications Received chart as table data

| Loan Applications Received | Number of Respondents |

| 0-2 Applications received per year | 12 |

| 2-5 Applications received per year | 2 |

| 5-10 Applications received per year | 3 |

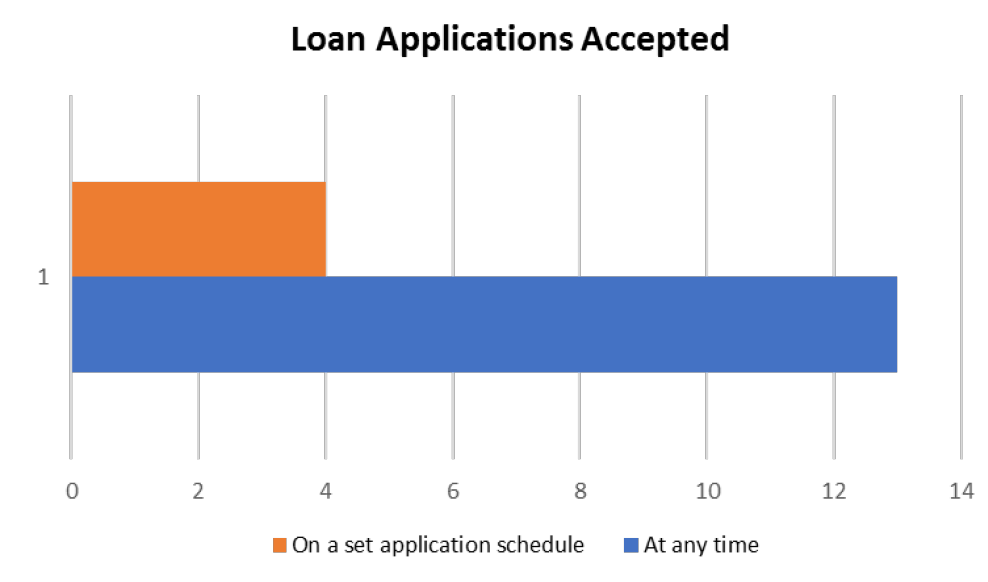

The majority of SIBs accept loan applications at any time.

Loan Applications Accepted graph as table data

| Loan Applications Schedule | Number of Respondents |

| On a set application schedule | 4 |

| At any time | 13 |

| State | Minimum/Maximum terms |

|---|---|

| Colorado | First come, first served to the SIB. The amounts lent depend on the request total, and qualifications of the borrower. |

| Florida | $1 million minimum. |

| Michigan | No minimum amount. No maximum amount but generally not over

$2 million. State will work with applicants to identify other potential sources for larger projects. |

| Minnesota | Yes |

| Missouri | MoDOT staff can accept loan request for $10 million or less. Any loan requests greater than $10 million require pre-approval by MoDOT's Executive Director. The minimum loan amount is $50,000. Terms of a loan over 10 years, require pre-approval by the MoDOT's Executive Director. |

| Ohio | 1-10 Years for Loans Loan requests greater than $5 million may be referred to the SIB Bond Program. Interest rates set by SIB Loan Committee and must be at or below market rate as of loan approval date. |

| Texas | Two programs currently - First-Come, First-Served for all

SIB loans for TxDOT projects less than $10 million. No minimum

limit. Other program is a SIB Program Call which is a TxDOT

project > than $10mm or any Non-TxDOT project. We further limit the SIB Loans to the following guidelines:

|

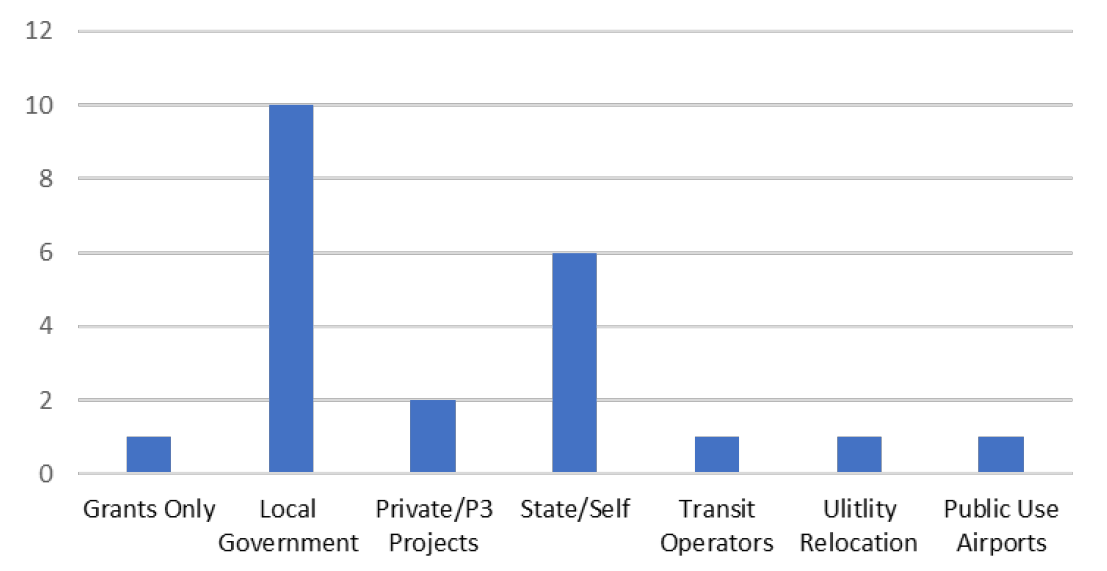

Most Frequent Borrowers graph as table data

| Type of Borrower | Number of Respondents |

| Grants Only | 1 |

| Local Government | 10 |

| Private/P3 Projects | 2 |

| State/Self | 6 |

| Transit Operators | 1 |

| Utility Relocation | 1 |

| Public Use Airports | 1 |

| State | Response |

|---|---|

| CO | CDOT uses an external financial advisor to review borrower responses on the application, as well as our internal SIB Committee, and CDOT staff. |

| FL | Certified Annual Financial Reports (CAFR), debt service coverage ratios, historical revenue analysis, personal guarantees, rating analysis, asset based financing, collateral, sinking funds, debt service reserve accounts, etc... |

| MI | Nothing formal but the State reviews the applicants Act 51 distribution amounts (State law that distributes transportation funds to counties and local agencies...) outstanding SIB loans, and project terms. |

| MN | After MnDOT certifies project eligibility, the Minnesota Public Facilities Authority (PFA) requires that the applicant provide a TRLF loan application for underwriting review, including annual audit reports, estimated project costs, anticipated repayment source, and existing debt service requirements. Subject to PFA underwriting approval, loan funding requires the applicant provide its G.O. Note as commitment support for a term consistent with the loan maturity. |

| MO | If the entity is rated by a rating company (Standard & Poor's), MoDOT staff uses this rating. If the entity is Not rated, MoDOT staff uses an interest rate criteria to determine a rating by reviewing the times coverage, additional dedicated revenue and term of the loan. MoDOT staff also reviews the application and financial statements in detail before approving the loan. |

| OH | ODOT Financial Advisor reviews application to determine

borrower's ability to repay loan, financial statements required

for application package. ODOT Financial Advisor provides recommendation. Application presented to SIB Loan Committee and is Approved, Disapproved, or Approved with Modifications. |

| TX | Every loan receives a legal and financial analysis to determine ability to repay - and continued monitoring of the borrower during the loan term. |

| VA | The analysis is part of larger efforts for projects procured as Public-Private Transportation Projects. By direction in the Code of Virginia, the SIB loan is only available to a private operator as provided for in the Public-Private Transportation Act of 1995 (as amended). |

| VT | Municipal Application: Cash flow availability, municipal

backing If private: Same underwriting as commercial loans. This

includes additional analysis of financial viability of business

and the product. If private: Same underwriting as commercial loans. This includes additional analysis of financial viability of business and the product. |

![]()

Software Information graph as table data

| Type of Software Used | Number of Respondents |

| Business Objects | 1 |

| Excel | 3 |

| No / No Response | 10 |

| Nortridge | 1 |

| State Financial System | 4 |

| Yes, Unspecified | 1 |

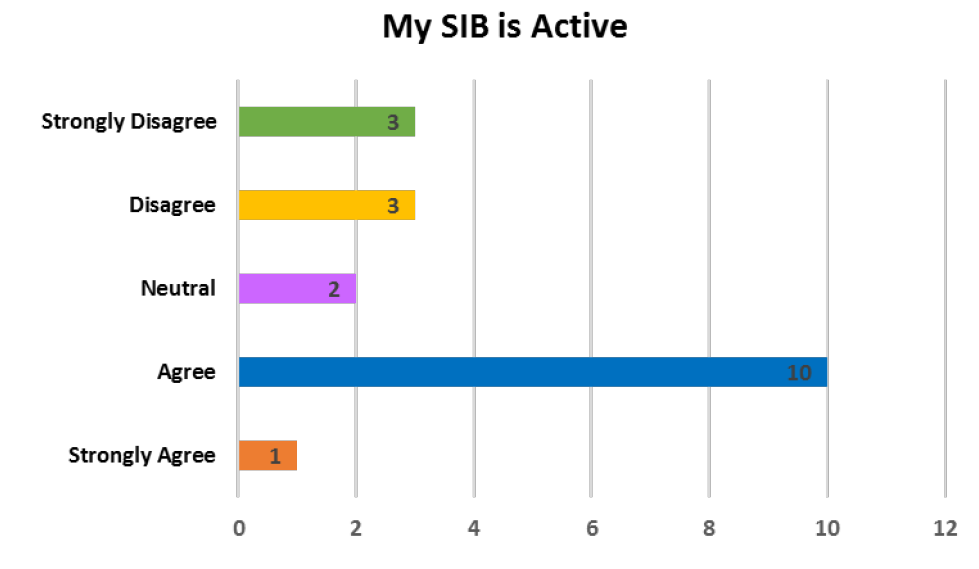

My SIB is Active graph as table data

| My SIB is Active | Number of Respondents |

| Strongly Disagree | 3 |

| Disagree | 3 |

| Neutral | 2 |

| Agree | 10 |

| Strongly Agree | 1 |

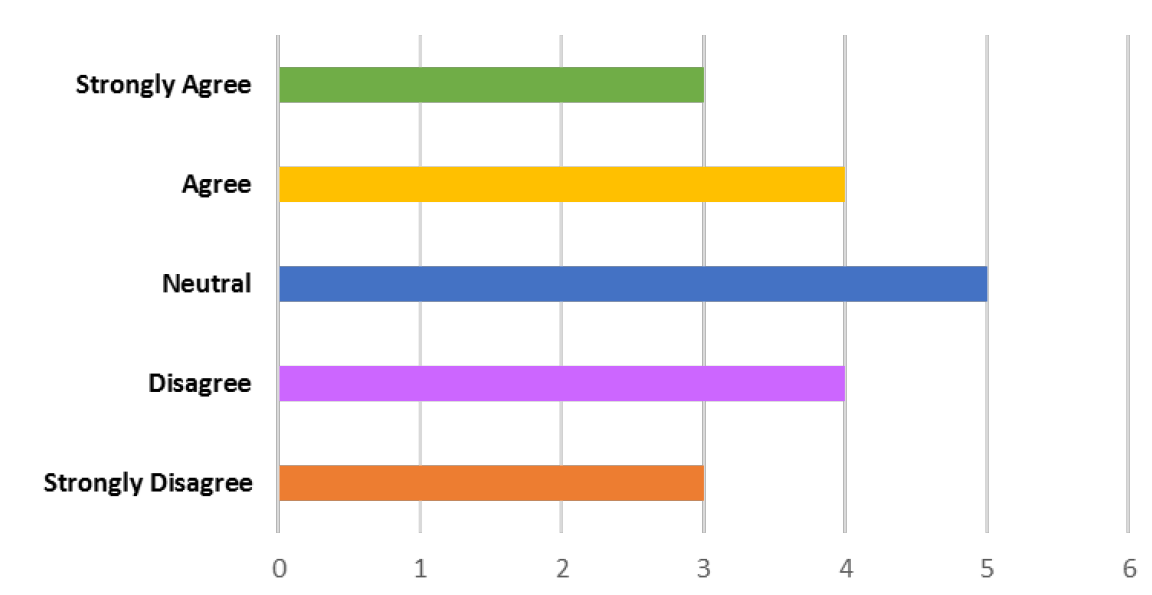

MY DOT Actively Promotes the SIB graph as table data

| My DOT Actively Promotes the SIB | Number of Respondents |

| Strongly Agree | 3 |

| Agree | 4 |

| Neutral | 5 |

| Disagree | 4 |

| Strongly Disagree | 3 |

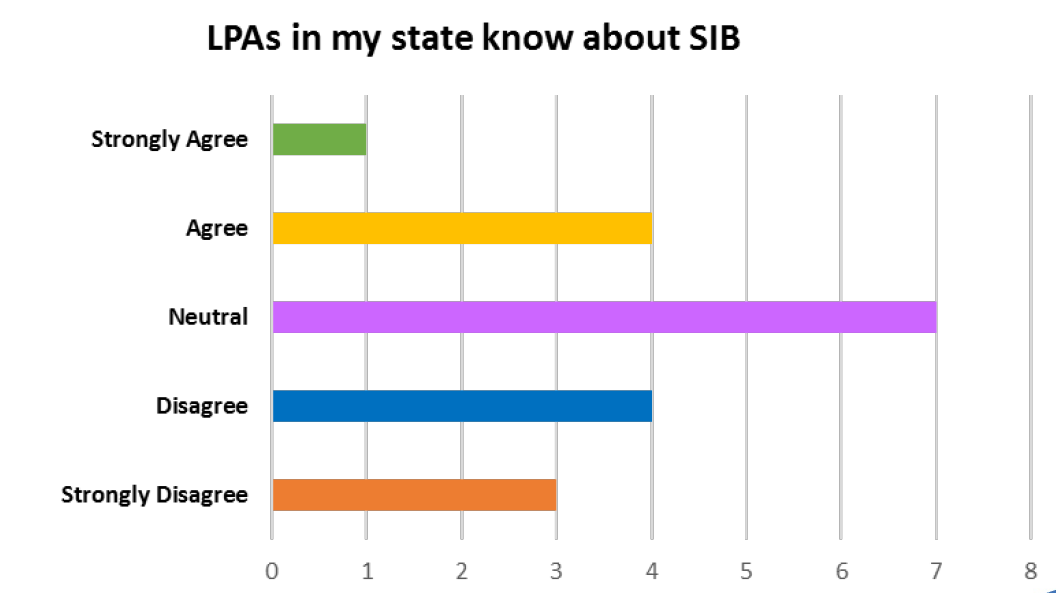

LPAs in my state know about SIB graph as table data

| LPAs in my state know about SIB | Number of Respondents |

| Strongly Agree | 1 |

| Agree | 4 |

| Neutral | 7 |

| Disagree | 4 |

| Strongly Disagree | 3 |

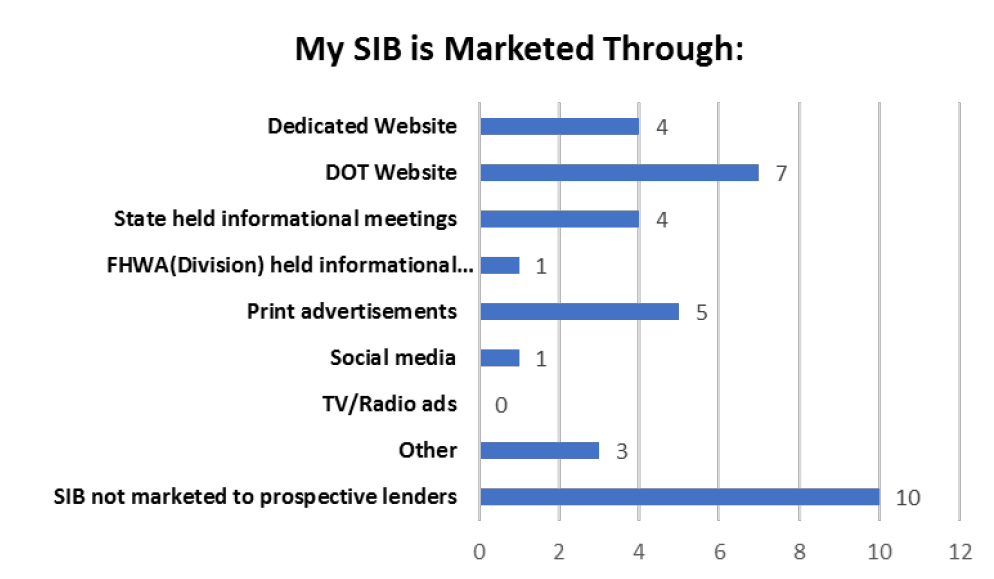

SIB Marketing Graph as table data

| My SIB is marketed through: | Number of Respondents |

| Dedicated Website | 4 |

| DOT Website | 7 |

| State held informational meetings | 4 |

| FHWA (Division) held informational meetings | 1 |

| Print advertisements | 5 |

| Social media | 1 |

| TV/Radio ads | 0 |

| Other | 3 |

| SIB not marketed to prospective lenders | 10 |

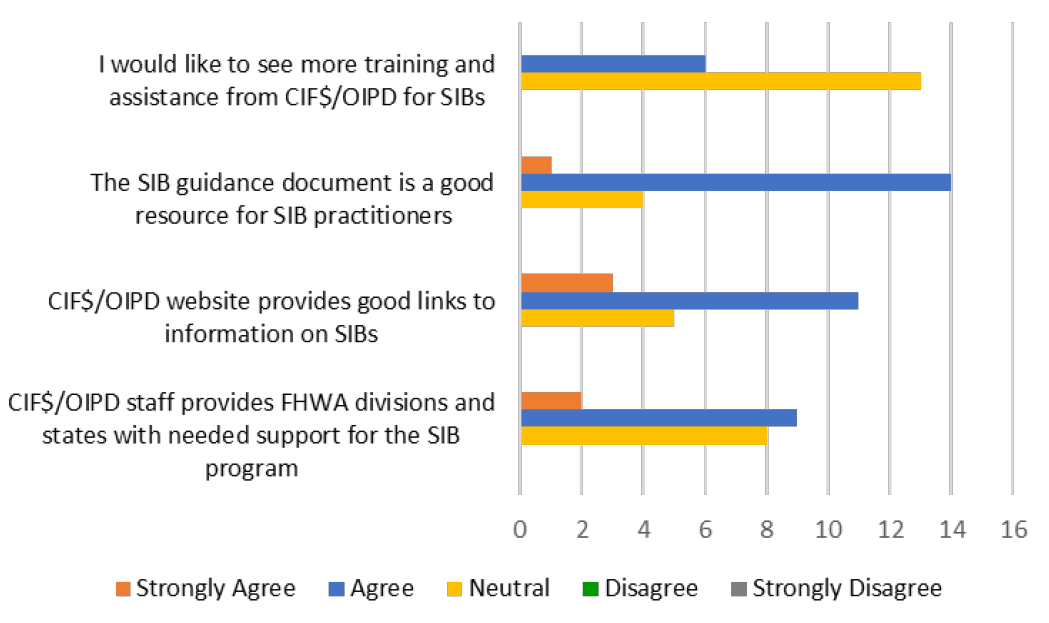

What can CIF$ do to Help graph as table data

| What can CIF$ do to help you and your SIB? | Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree |

| I would like to see more training and assistance from CIF$/OIPD for SIBS | - | 6 | 13 | - | - |

| The SIB guidance document is a good resource for SIB practitioners | 1 | 14 | 4 | - | - |

| CIF$/OIPD website provides good links to information on SIBs | 3 | 11 | 5 | - | - |

| CIF$/OIPD staff provides FHWA divisions and states with needed support for the SIB program | 2 | 9 | 8 | - | - |

Thank you to all the FHWA Divisions and State DOT partners that took the time to reply to this survey!

Your responses will help us provide valuable technical assistance and promote innovative financing tools, like the SIB, to all users.