Transportation officials at all levels of government are challenged to identify ways to pay for improvements to our Nation's transportation infrastructure. Despite record levels of investment in surface transportation infrastructure in recent years, traditional funding sources have not kept pace with the investment demands of an aging and increasingly complex U.S. transportation system.

For almost two decades, the Federal government has responded to this investment gap by providing new techniques that complement and enhance existing grant reimbursement programs. This Project Finance Primer describes those techniques and provides examples of such techniques as applied by State and local partners. The methods described in this primer will continue to evolve, and U.S. Department of Transportation (DOT) staff hopes that this publication also lays the groundwork for the identification of additional innovative strategies for financing surface transportation investments.

This primer provides basic information about transportation project finance, including definitions and concepts.

Brief examples illustrate how these new project finance techniques have been used by States to finance specific projects. The resource section at the end of the primer provides information on available resources about project finance.

Although this primer provides a starting point for those who are considering ways to fund projects more quickly and to expand investment levels, it is no substitute for direct consultation with the Federal Highway Administration (FHWA) and its Center for Innovative Finance Support (formerly Innovative Program Delivery). The majority of strategies included in this document are the result of diligent efforts by project sponsors committed to finding a better way to pay for facilities. FHWA welcomes discussions with State, local, and private project sponsors on new financing ideas, as undoubtedly those discussions will form the basis for a larger array of strategies to complement the ones discussed in the following pages.

Project finance refers to specially designed techniques that supplement traditional highway financing methods, improving governments' ability to deliver transportation projects. Project finance typically entails borrowing money through bonds, loans, or other financing mechanisms. Borrowing money for project implementation helps accelerate implementation of needed infrastructure, but just like borrowing money for a mortgage or college education, project finance techniques require a repayment source. In many instances, using project finance strategies requires the development and imposition of new revenue streams to pay back bonds or loans issued to support investment. Table 1 provides a list and brief description of revenue sources that can support project finance.

Project finance is typically used for large capital projects in cases in which using "pay-as-you-go" does not make good planning and programming sense, because the project's capital needs would consume most, if not all, available funding and still often fall short of being fully funded. Further, given the long-term benefits of transportation infrastructure, it can be economically sound to spread the project costs over the asset's life-cycle; however, project finance comes at a cost, because interest is paid over the long term for the money that is borrowed today. The additional cost of financing might be justified if it is less than the potential project cost increase due to inflation or if it is outweighed by the benefits of having the project available in the near term. Project finance in the context of this primer refers to any mechanism used to help pay for capital projects in which there is a revenue source to repay financed costs.

The Federal Highway Administration's (FHWA's) Center for Innovative Finance Support (formerly Innovative Program Delivery) provides a one-stop source for expertise, guidance, research, decision tools, and publications on program delivery innovations. The Center for Innovative Finance Support's Web page, workshops, and other resources help build the capacity of transportation professionals to deliver innovation.

The Center for Innovative Finance Support provides expertise in the following areas:

For more information, see the Web site: https://www.fhwa.dot.gov/ipd/

| Source | Description |

|---|---|

| User fees | Revenues collected from transportation-system user |

| Tolling and pricing | Tolls are fees collected from drivers for use of a specific facility, such as a limited access highway, bridge, or tunnel. Tolls can be fixed or variable. Pricing refers to the use of variable pricing or tolls to manage demand on transportation facilities. |

| Parking fees | A tax or fee imposed on parking. Parking fees are currently used in many areas in the United States, including several major cities (e.g., Chicago, New York, and San Francisco). |

| Rental car fees | A tax or fee imposed on car rentals. |

| Local-option taxes | Dedicated local taxes, in most cases subject to approval by popular vote, to support transportation investment. Often, when approved, revenues are dedicated to specific projects or programs. |

| Fuel | In general, fuel is an excise tax levied on a per-gallon basis. Fuel taxes are widely used by State governments to fund transportation, but only 15 States currently authorize local-option fuel taxes. Local-option fuel taxes have been widely used in Alabama, Florida, Hawaii, Illinois, and Nevada. |

| Sales | Local-option sales taxes have become increasingly popular to support transportation investment, especially for transit projects. |

| Property | Dedicated property taxes are generally used for local road and street capital and maintenance needs, although some States have authorized dedicated property taxes for transit. |

| Vehicle | Many States authorize local governments to levy local vehicle registration fees that can be used for local transportation needs. |

| Income/payroll | A few States provide authority to local governments to levy income or payroll taxes specifically dedicated to transportation. |

| Hotel | Dedicated hotel taxes can provide funding for transportation investments needed for improved accessibility and mobility in areas with high tourism and/or business activity. |

| Value capture | Value capture attempts to capture some of the increase in value due to infrastructure improvements. |

| Impact fees | One-time charges to developers on new development. Revenues are used to pay for infrastructure improvements - such as schools, sewers, and roads - to support growth generated by development. |

| Special assessments | These are levied on special property-taxing districts, self-imposed by residents and/or business owners to support infrastructure needs. The cost of infrastructure is paid for by the owners of properties that are deemed to benefit from the improvements. |

| Tax increments | Captures a portion of the increase in property value as a result of redevelopment that infrastructure improvements may facilitate. Tax-increment financing is typically structured through property taxes. |

| Development contributions | In addition to impact fees, development contributions (also known as exactions) can take the form of land donations or in-kind donations, such as construction of public infrastructure, parks, or the provision of public services. Development exactions are negotiated and agreed on as part of the permitting process of development. |

| Joint development | A formal arrangement between a public entity and a private developer for the development of a specific asset on publicly owned or controlled property. |

| Road-utility/franchise fees | The road-utility fee is a local utility charge to property for access to the trunk highway. Road-utility fees are typically used for local road maintenance and repair and are estimated by using factors such as motor vehicle trip generation estimates, the number of parking spaces, the number of employees, front footage, or a flat fee, depending on land use. |

| Franchise fees charge utility companies for the privilege of using public right-of-way for installing infrastructure, such as fiber optic cable or communication antennas. |

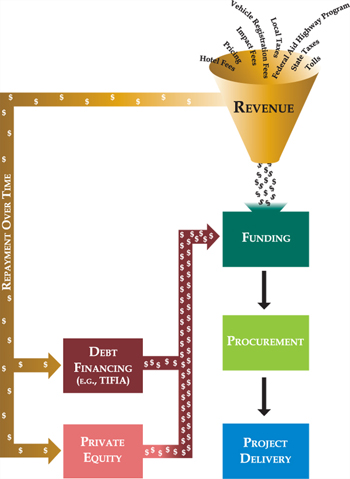

The delivery of transportation projects is comprised of the following elements, as depicted in the adjoining figure:

The delivery of transportation projects is comprised of the following elements, as depicted in the adjoining figure:

Each of these elements is important for advancing implementation and delivering transportation projects in an effective manner.

This Project Finance Primer emphasizes the "debt finance" component of project delivery. The "procurement" component of project delivery is addressed in a separate primer on P3s.

DOT and FHWA have advanced a broad range of project finance techniques that can be used in combination with traditional transportation funding programs. The resulting toolbox of project finance techniques and strategies has been put to use for hundreds of projects nationwide, resulting in the acceleration of critical infrastructure investments and attracting new resources to transportation investment. These techniques can be classified into two groups: bonds and credit assistance. Bonds are debt instruments issued by State and local governments and provide access to the capital markets. Credit assistance allows project sponsors to borrow money or to leverage funding from the Federal government. Again, in both cases, a source of revenue is needed to repay the debt.

In 1994, FHWA launched a major initiative to identify barriers to highway infrastructure investment and to develop strategies to overcome them. This "test and evaluation" program initiative, designated as TE-045, broke new ground by asking States to identify flexible approaches to blending Federal and non-Federal highway funds and to leverage existing Federal resources. The States responded enthusiastically, and the TE-045 initiative ultimately incorporated this fresh thinking into an array of project financing techniques. New techniques supplement traditional financing techniques and move the transportation financing process from a single strategy of Federal funding on a "grant reimbursement" basis to a diversified approach that reduces the time needed to get projects underway and extends, or leverages, the value of existing resources.

Many of the innovations proposed under the TE-045 initiative were enacted into law under the National Highway System Designation Act (NHS Act) of 1995. As a result, a number of techniques previously considered experimental, and therefore requiring special approvals, became common practice. The Transportation Equity Act for the 21st Century (TEA-21), enacted in 1998, made further strides in broadening project sponsors' options for financing Federally assisted highway projects. Most notably, the legislation established the TIFIA credit program, under which the Federal government can provide direct loans, loan guarantees, and lines of credit to public and private sponsors of major surface transportation projects.

What happened to the term innovative finance?

FHWA in the past had coined the term innovative finance to describe the techniques used to leverage traditional highway funding methods; however, now that many of these techniques have been in use for almost two decades, they are no longer considered innovative. Rather, they are part of the mainstream approach for delivering transportation projects in the United States. For this reason, FHWA has adopted the term project finance to describe those techniques that can accelerate or leverage existing funds to advance transportation projects.

The Safe, Accountable, Flexible, Efficient Transportation Equity Act: A Legacy for Users (SAFETEA-LU), enacted in 2005, expanded existing programs (e.g., TIFIA and SIBs), provided more flexibility to use tolling to finance infrastructure improvements, and created new programs (e.g., PABs, Special Experimental Project Number 15) to further attract the private sector to participate in highway infrastructure projects, bringing new ideas and resources to the table. More recently, in response to the economic crisis that started in 2008, the U.S. Treasury has made BABs available to States in an effort to support project finance, while at the same time stimulating the economy and creating jobs through capital investment.

Some transportation projects or programs of projects are so large that their costs exceed available current grant funding and tax receipts, or they consume so much of these current funding sources as to delay many other planned projects. For this reason, when States and local agencies consider ways to pay for these large projects, they often look to borrowing.

The most common method of borrowing is to issue bonds that are purchased by investors. The bond issuance yields an immediate influx of cash in the form of bond proceeds. The borrower then retires the debt obligation by making principle and interest payments to the investors over time.

Issuance of debt requires a revenue source pledged for repayment. A few examples of repayment sources include general State and local taxes, fuel taxes or vehicle-related fees, toll receipts, or the implementation of new revenue sources dedicated to support debt service (see Table 1). Bonds do not represent "new" money but are a way of advancing future revenues of an existing source. The length, or maturity, of the bonds can vary, but a typical repayment period for long-term debt is from 10 to 30 years.

Although bond financing imposes interest and other debt-related costs, bringing a project to construction more quickly than otherwise possible can sometimes offset these costs. Delaying projects can impose costs from inflation, lost driver time, freight delays, wasted fuel, and forgone or deferred economic development. Analysis of the financial costs and benefits of debt financing weighs the costs of borrowing against the economic, safety, and mobility benefits of completing the project sooner than would be possible with pay-as-you-go funding. Both the private and public sectors can issue bonds for their capital investment, known as corporate bonds and government bonds (or municipal bonds, also referred to as munis), respectively.

The private sector can access the capital markets by issuing commercial debt, which is generally taxable for Federal income tax purposes. This, coupled with the riskier nature of private investments, makes private debt carry higher interest rates compared with municipal bonds. PABs, which are described later in this section, allow private investors to access the tax-exempt capital markets and borrow at lower interest rates.

Government, or municipal, bonds are issued by the public sector to finance public facilities' capital costs. The principle characteristic that differentiates municipal bonds from corporate bonds is that they are typically issued on a tax-exempt basis, meaning that the interest rate earned by investors is exempt from Federal income tax. For that reason, interest rates are typically lower than the rates on taxable bonds, which in turn results in lower financing costs.

There are two main types of municipal bonds:

The advantages and limitations of GO and revenue bonds are listed in Table 2.

GARVEEs, BABs, and PABs are specific types of tax-exempt debt instruments available to project sponsors. The remainder of this chapter discusses these three debt financing techniques and includes a discussion of the 63-20 issuance option. Table 3 briefly describes and summarizes each of these bond and debt financing instruments.

GARVEEs enable States to pay debt service and other bond-related expenses with future Federal-aid highway apportionments. The law authorizing GARVEEs, however, makes it clear that a debt financing instrument's eligibility for reimbursement with future Federal-aid highway funding does not constitute a commitment, guarantee, or other obligation by the United States, nor does it create any right of a third party (such as an investor) against the Federal government for payment.

| Advantages | Limitations |

|---|---|

GO Bonds

|

|

Revenue Bonds

|

|

There are two primary types of GARVEEs: direct and indirect.

Direct GARVEEs are secured by specific Federal-aid apportionment categories, and proceeds are used to pay for a specific project (or projects). A direct GARVEE requires FHWA Division Office approval of the project authorization and debt-service schedule. The FHWA Division Office and the State should be able to identify eligible Federal-aid activities funded by the GARVEE proceeds.

When GARVEE debt is backed by other State or local revenues (e.g., State fuel tax or toll revenues), in addition to future Federal-aid apportionments, it is known as a backstopped GARVEE. In this case, the State can issue debt at lower interest costs by reducing the risk from the inherent uncertainty of Federal-aid highway funding.

Indirect GARVEEs* are secured by anticipated Federal-aid reimbursements on project(s) that are eligible for Federal funding but that were paid with State funding. The project(s) paid with indirect GARVEE proceeds do not have to be Federally eligible, and FHWA Division Office approval is not required. Once the State receives reimbursement, the Federal funding is considered "State funds," losing its Federal designation and any Federal requirements (rules and guidance) associated with Federal funding. As State funds, the Federal reimbursements can be used for any purpose authorized by State law, including debt-service payments.

*Because indirect GARVEEs do not require FHWA Division Office approval, inclusion here is only for reference purposes. The remaining information on GARVEEs pertains to direct GARVEEs.

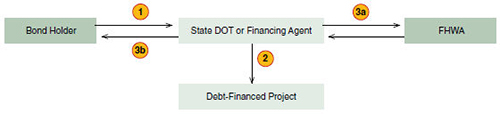

Figure 1. GARVEE Bonds.

Note. DOT = U.S. Department of Transportation, FHWA = Federal Highway Administration.

A GARVEE is a debt financing instrument authorized to receive Federal reimbursement of debt service and related financing costs under Section 122 of Title 23, U.S. Code. GARVEEs can be issued by a State, a political subdivision of a State, or a public authority. States can receive Federal-aid reimbursements for a wide array of debt-related costs incurred in connection with an eligible debt financing instrument, such as a bond, note, certificate, mortgage, or lease. Reimbursable debt-related costs include interest payments, retirement of principal, and any other cost incidental to the sale of an eligible debt instrument.

In general, projects funded with the proceeds of a GARVEE debt instrument are subject to the same requirements as other Federal-aid projects with the exception of the reimbursement process. Instead of reimbursing construction costs as they are incurred, the reimbursement of GARVEE project costs occurs when debt service is due. For a GARVEE, a State may request partial conversion of an advance construction 1 project(s) to coincide with debt-service payments, allowing for effective use of obligation authority (see Figure 1).

It is important to note that in order to issue GARVEEs, States or the issuing entity must have legal authority to issue debt. States have the flexibility to tailor GARVEE financings to accommodate State fiscal and legal conditions.

States are finding GARVEEs to be an attractive financing mechanism to bridge funding gaps and to accelerate construction of major corridor projects. The GARVEE financing mechanism generates up-front capital for major highway projects at generally tax-exempt rates and enables a State to construct a project earlier than when using traditional pay-as-you-go grant resources. With projects in place sooner, costs may be lower because of inflation savings, and the public realizes accelerated safety and economic benefits. GARVEEs can expand access to capital markets as a supplement to general obligation or revenue bonds.

Candidates for GARVEE financing are typically large projects (or a program of projects) that have the following characteristics:

Enabling legislation for GARVEEs was passed in August 2005, authorizing the issuance of $900 million. The first GARVEE (for $287.6 million) was issued in October 2007; a second issuance closed in August 2009. The preliminary plan calls for additional GARVEEs to be issued in 2011 and 2013 (FHWA, 2009).

North Carolina designed its GARVEE program with an "evergreen" structure, which allows DOT to issue additional bonds over time, subject to certain legislative requirements. Highlights of North Carolina's GARVEE legislation include the establishment of conservative annual debt service relative to anticipated Federal revenue, geographic distribution of the bond proceeds to finance improvements to the Federal Highway System, flexibility in project selection, and legislative authority for continuing use of the bonds (FHWA, 2009).

North Carolina DOT estimates that 29 strategic projects have been accelerated at an average time savings of 3.4 years with an estimated cost savings after debt service of $135 million through the initial October 2007 GARVEE issuance. The agency also estimates that $509 million will be saved through the GARVEE projects included in its adopted 2009-2015 Statewide Transportation Improvement Program (STIP; FHWA, 2009).

BABs were authorized by the American Recovery and Reinvestment Act, which was enacted in February 2009. BABs are taxable bonds that are eligible for an interest payment subsidy paid directly from the U.S. Treasury. States and local governments can issue BABs through December 2010, and Congress is considering extending the authority to issue BABs beyond December 31, 2010. Surface transportation projects are among other public infrastructure projects (e.g., public buildings, courthouses, schools, water and sewer projects, etc.) that are eligible for BAB financing (AASHTO & DOT, 2010).

BABs were created to supplement State and local governments' capacity to access conventional corporate debt markets for public infrastructure instead of issuing traditional tax-exempt debt. The BAB program is designed to provide a Federal subsidy for a portion of the borrowing costs of State and local governments, rather than traditional tax-exempt bonds, to stimulate the economy, create jobs, and encourage investments in capital projects in 2009 and 2010 (U.S. Treasury Department, 2009). BABs' subsidy is generally equal to 35 percent of the interest payment, which results in lower net borrowing costs.

There are various types of subsidy arrangements under BABs. There is the direct-payment (or qualified) BAB, the most common, in which the issuer (i.e., the State or local government) receives a payment of 35 percent of the interest cost from the U.S. Treasury. Within this subsidy arrangement, the recovery zone BAB has a higher subsidy payment (45 percent of the interest cost); however, these are capped at $10 billion nationwide and can only be used in economically distressed areas (U.S. Treasury Department, 2009). There is also the tax-credit BAB, in which the bondholder receives a tax credit equal to 35 percent of the coupon interest (U.S. Treasury Department, 2009). The U.S. Treasury has published guidance on the use of the BABs program and procedures for applying for refundable credits (IRS, 2009).

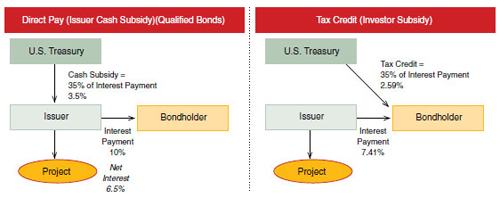

To characterize the differences between direct payment BABs and tax-credit BABs, consider the following scenario:

Assuming a $1,000 bond with an interest rate of 10 percent . . .

Direct-payment BAB - The issuer would pay 100 percent of the taxable rate interest cost to the investor ($100) and apply for a refundable tax credit himself from the U.S. Treasury in an amount equal to 35 percent of the gross interest paid by the issuer ($35). For the issuer, the effective interest rate is thereby reduced to approximately 6.5 percent.

Tax-credit BAB - The issuer would pay $74.07 in interest, and the investor would receive a supplemental credit equal to 35 percent of the interest the issuer paid ($25.93) to provide the total desired annual return of $100. In this manner, the effective interest rate for the issuer is reduced by 26 percent to a rate of 7.41 percent. The investor can apply the tax credits against regular income tax liability and alternative minimum tax, and unused tax credits may be carried forward to the next year.

Figure 2 illustrates the differences between direct payment and tax-credit BABs.

BABs may result in net lower interest costs compared with municipal tax-exempt debt, and there is no cap on the amount of BABs that can be issued through the end of 2010. As of May 24, 2010, a new bill is moving through Congress that would extend BABs through the end of 2012, albeit at lower subsidy rates. The bill calls for a reduction of the tax credit from 35 percent to 32 percent in 2011 and to 30 percent in 2012.

Tax-credit BABs can be used for the same purposes as any tax-exempt borrowing (i.e., new construction, refunding bonds, and working capital). Direct-payment BAB proceeds, however, are strictly limited to new construction. As of November 2009, all BAB debt issued was direct payment, and about 14 percent of the proceeds ($7.3 billion) had been identified for transportation uses (Mercator Advisors, 2009).

The Illinois State Toll Highway Authority (ISTHA) issued $780 million in BABs in 2009 (two separate issuance) to finance a portion of its Congestion Relief Program (CRP) Open Roads for a Faster Future. The total cost of the program, which was initiated in 2005, is currently estimated at $6.1 billion (Illinois Tollway, 2009). The plan of finance for the program is $3.5 billion from bond proceeds, all of which have been issued, and the remainder is from authority funds.

CRP investments to the ISTHA system include (a) converting the entire system to open road tolling (complete), (b) adding capacity by widening 88 miles of the system, (c) rebuilding or rehabilitating over 95 percent of existing pavement, (d) extending I-355 south from I-55 to I-80 (complete), and (e) upgrading and adding interchanges to meet the needs of local communities (Loop Capital Partners & J.P. Morgan, 2009).

As of September 2009, $4.7 billion of the program had been awarded, and completion of the program is scheduled for 2016 (Illinois Tollway, 2009). ISTHA's 2010 budget included $227.5 million in expenditures for the CRP in 2010. ISTHA estimates that using BABs resulted in savings of $90 million.

Figure 2. The Differences Between Direct-Payment BABs and Tax-Credit BABs at an Interest Rate of 10 Percent (Mercator Advisors, 2009).

PABs are debt instruments issued by State or local governments in which bond proceeds are used to finance a public-use project developed by a private entity or where there is significant private involvement.

In general, tax-exempt financing precludes private activity under the Internal Revenue Code; however, Section 11143 of Title XI of SAFETEA-LU amended Section 142(a) of the Internal Revenue Code to add highway and freight-transfer facilities to the types of privately developed and operated projects for which PABs may be issued. This change allows private activity on these types of projects while maintaining the tax-exempt status of the bonds.

The law limits the total amount of such bonds to $15 billion and directs the Secretary of Transportation to allocate this amount among qualified facilities. The $15 billion in exempt facility bonds is not subject to any individual State's PAB volume cap. State and local projects receiving a PAB allocation must also receive Title 23 or Title 49 assistance.

Passage of the PAB legislation reflects the Federal government's desire to increase private sector investment in U.S. transportation infrastructure. Providing private developers and operators with access to tax-exempt interest rates lowers the cost of capital significantly, enhancing investment prospects. Increasing the involvement of private investors in highway and freight projects generates new sources of money, ideas, and efficiency.

It is estimated in a technical paper prepared for the National Surface Transportation Policy and Revenue Study Commission (2007) that, in present value terms, the Federal tax-exemption subsidy for PABs is approximately 15-20 percent of the amount borrowed.

With approval from DOT to issue PABs, a State or local government issues tax-exempt debt on behalf of the private entity undertaking the project. The private entity finances and delivers the project and is responsible for debt service on the PAB. As of January 2010, almost half of the authorized $15 billion in PABs had been approved by DOT for seven projects. The first project for which bonds have been issued is the Capital Beltway/I-495 High-Occupancy Toll Lanes project.

The legislation requires that at least 95 percent of the net proceeds of bond issues be expended for qualified highways or surface freight-transfer facilities within a 5-year period from the date of issue. If this does not occur, the issuer must use all unspent proceeds to redeem bonds of the issue within 90 days after the conclusion of the 5-year period. As an alternative, the issuer may request an extension of the 5-year period if it can establish that the failure to expend the funds was due to circumstances beyond its control.

Qualified Projects

Qualified highway or surface freight-transfer facilities include:

Examples of facilities for the transfer of freight from truck to rail or rail to truck include cranes, loading docks, and computer-controlled equipment that are integral to such freight transfers.

Capital Beltway/I-495 High Occupancy Toll (HOT) Lanes, Virginia

The Capital Beltway/I-495 HOT Lanes Project in Virginia includes the construction of four HOT lanes added to the Capital Beltway/I-495 between the Springfield Interchange and just north of the Dulles Tollway. The HOT lanes - two in each direction - will use state-of-the-art electronic tolling technology and dynamic pricing to continuously adjust toll rates, based on traffic levels, and to manage traffic flow. The project is being advanced under an 85-year concession agreement (5-year construction period, plus 80-year operating concession) with the Virginia DOT (VDOT) and Capital Beltway Express, LLC (private concessionaire). This project is designed to help alleviate congestion on Virginia's busiest highway in the third worst congested region in the United States. Certain users, including high-occupancy vehicles (HOV) with three or more people, buses, and emergency vehicles ("HOV3+"), will be exempt from tolls. Tolls will be based on demand and will fluctuate throughout the day to reflect real-time traffic conditions and to maintain free-flow traffic on the HOT lanes.

Financing for the nearly $2-billion project includes $585.6 million in PABs and $585.5 million from a TIFIA direct loan, combined with a State grant, private equity, and interest income. This is the first project to issue PABs of the eight projects that were approved to issue PABs under the $15-billion SAFETEA-LU allocation. Construction began in spring 2008, and the project is scheduled for completion by 2013.

The PABs were issued by a newly created not-for-profit entity in compliance with provisions of Internal Revenue Service Revenue Ruling 63-20, which allows certain private entities to issue tax-exempt debt on behalf of a unit of government.

For more information, see the following Web sites:

State and local governments can issue tax-exempt debt through the creation of nonprofit corporations pursuant to Internal Revenue Service (IRS) Revenue Ruling 63-20. Bond proceeds issued by the nonprofit corporation can be used by private developers to finance and build transportation facilities.

A nonprofit corporation is a private, non-stock corporation formed under the nonprofit corporation act of a State. The formation does not require special legislation, nor does it require a referendum in the local or sponsoring jurisdiction. A nonprofit corporation may be formed for any lawful purpose other than for pecuniary profit including, without limitation, any charitable, benevolent, educational, civic, or scientific purpose (AASHTO & DOT, 2010).

Nonprofit corporations are regulated by the State Attorney General for compliance with the Nonprofit Corporation Act, by State-tax authorities for compliance with the requirements relating to their State income tax exemption, and by the IRS for compliance with the use of a nonprofit project sponsor, which may also enable a project to receive public funds, because the revenues generated by the project will not benefit any private party. It may also be possible for the nonprofit sponsor to issue public or privately placed debt if it can enter into long-term contracts for the use of the facility or if the facility generates revenues from direct-user fees (AASHTO & DOT, 2010).

At the project level, FHWA does not approve 63-20 credit. FHWA, however, approves STIPs, which may include projects to be advanced through a 63-20 corporation.

The creation of 63-20 nonprofit corporations allows for the issuance of debt at lower tax-exempt interest rates, reducing the financing costs of the project. The 63-20 conduit issuance can be used to finance a transportation project when there is:

Another advantage of 63-20 credit is that it does not count toward a State or local government statutory debt limitation, providing access to debt for a project that has a dedicated revenue source (e.g., user fees).

In the past, public benefit and nonprofit corporations have been used as vehicles to finance public infrastructure, such as schools, courthouses, and other public buildings. Over the past decade, private developers in association with public agencies around the country have also begun to utilize the nonprofit structure to develop major transportation projects, particularly those involving innovative contracting and P3s. Rather than issuing debt through an established conduit, debt issuance is done through the 63-20 nonprofit corporation (AASHTO & DOT, 2010). Examples of toll roads partially financed with Section 63-20 credit include the Pocahontas Parkway in Virginia (initial construction financing; see sidebar) and the Southern Connector in South Carolina. Toll revenues were dedicated to support tax-exempt debt issued for these projects.

Any transportation project with a secured revenue source could be financed through the formation of a 63-20 corporation. The use of a nonprofit project sponsor does not preclude the use of public funds to support project finance.

In order for a nonprofit corporation to issue tax-exempt debt, it must satisfy the following criteria established by the IRS (AASHTO & DOT, 2010; FHWA, 2010):

The rules for determining whether the governmental unit has the requisite "beneficial interest" in the nonprofit corporation are likewise quite straightforward (FHWA, 2010).

Pocahontas Parkway (Initial Construction Financing)

The Pocahontas Parkway (Route 895) is an 8.8-mile tolled highway 7 miles south of Richmond, VA. The four-lane road connects Chippenham Parkway at I-95 in Chesterfield County with I-295 south of the Richmond International Airport in Henrico County. Construction began in the fall of 1998, and the Parkway was opened to traffic in stages beginning in May 2002.

The project was the first unsolicited proposal for a highway project developed under Virginia's Public-Private Transportation Act of 1995. The project was delivered through a design-build contract and included the creation of a nonprofit 63-20 corporation, the Pocahontas Parkway Association (PPA), which had the authority to issue tax-exempt bonds to provide a share of the project financing. The initial design and construction were funded through:

Note: In 2006, Transurban (a private concessionaire) negotiated with VDOT a new concession agreement under which Transurban, operating as T-895, acquired the rights to enhance, manage, operate, maintain, and collect tolls on the Parkway for a period of 99 years. Under the terms of the agreement, Transurban refinanced the project, defeasing all of PPA's outstanding debt. The refinancing for this new agreement included equity and private debt, in combination with a $150- million TIFIA loan.

For more information, see the Web site:

https://www.fhwa.dot.gov/ipd/project_profiles/va_pocahontas.aspx

| Finance Tool | Source of Up-Front Funding | Source of Repayment | Process | Eligibility and Limitations |

| GARVEEs | Capital markets | Federal-aid funds, plus State match and any other revenue State pledges | State seeks approval from FHWA for projects that will be financed with GARVEEs. State works with bankers to sell bonds. |

Must have State-enabling legislation; projects must be Federally eligible, follow all Federal requirements, and be included in fiscally constrained STIP. |

| BABs | Capital markets | Any non-Federal revenue | State or local government works with bankers or advisers to sell bonds. | Authority to issue bonds may be extended beyond December 31,2010; there are no caps on the amount to be issued. Direct payment vs. tax credit:

|

| PABs | Capital markets | Any | State or local government seeks DOT allocation; must have separate legal authority to issue bonds. | Project must be eligible to receive Title 23 or 49 funding, including surface transportation projects (e.g., highways, toll roads, truck-only lanes, transit projects), international bridges and tunnels, and rail-truck transfer facilities. Segment that receives funding must follow Federal requirements, which may not apply to rest of project. There is $15 billion available nationwide, available until spent. |

| 63-20 Issuance or issuer | Capital markets | Any | Unit of government approves creation of not-for-profit and the sale of debt by the nonprofit on behalf of government for a public purpose. | Government unit must have legal title to financed project and facilities when bonds are paid. |

Note. GARVEE = Grant Anticipation Revenue Vehicle, STIP = Statewide Transportation Improvement Program, BAB = Build America Bond, PAB = Private Activity Bond, DOT = U.S. Department of Transportation.

One of the most significant developments in Federal transportation finance during the 1990s was the advent of new ways to help project sponsors access credit, that is, to borrow more easily. These strategies are known collectively as Federal credit assistance.

Federal credit assistance can take one of two forms: loans, in which a project sponsor borrows Federal highway funds directly from a State DOT or the Federal government, and credit enhancement, in which a State DOT or the Federal government makes Federal funds available on a contingent (or standby) basis. Credit enhancement helps reduce risk to investors and thus allows the project sponsor to borrow at lower interest rates. Loans can provide the capital necessary to proceed with a project or reduce the amount of capital borrowed from other sources. In this case, Federal loans can serve a dual function. Not only do they provide capital directly, but also under certain conditions, they can serve a credit-enhancement function by reducing the risk borne by other investors.

Federal transportation funds can provide credit assistance - rather than grant funding - through several mechanisms. First, the TIFIA program allows DOT itself to provide special credit assistance funding to project sponsors directly. Second, States may use their regularly apportioned Federal-aid highway funds, under specific Federal legislative provisions, to capitalize revolving loan funds (in the transportation sector, these are known as SIBs). Third, States may directly lend their apportioned Federal-aid highway funds to individual projects through Section 129 loans. Table 4 briefly describes and summarizes each of these credit assistance mechanisms.

TIFIA allows DOT to provide direct credit assistance to sponsors of major transportation projects.

The TIFIA credit program offers three distinct types of financial assistance:

These instruments are designed to address the varying requirements of projects throughout their life cycles. The amount of Federal credit assistance may not exceed 33 percent of total eligible project costs. TIFIA project sponsors may be public or private entities, including State and local governments, special purpose authorities, transportation improvement districts, and private firms or consortia. The program is designed to fill market gaps and leverage limited Federal resources and substantial co-investment by providing projects with supplemental or subordinate debt rather than grants.

Any type of project eligible for Federal assistance through existing surface transportation programs (STPs; both highways and transit) is eligible for TIFIA assistance. In addition, the following types of projects are eligible: international bridges and tunnels, intercity passenger bus and rail facilities and vehicles, public freight-rail facilities or private facilities providing public benefit for highway users, intermodal freight-transfer facilities, access to such freight facilities, and service improvements to such facilities including capital investment for intelligent transportation systems. A recent amendment to the TIFIA program under SAFETEA-LU allows the use of TIFIA loan and loan guarantee proceeds to refinance long-term project obligations or Federal credit instruments if such refinancing provides additional funding capacity for the completion, enhancement, or expansion of new transportation infrastructure.

Projects applying for TIFIA credit assistance must be supported in whole or part from user charges or other non-Federal dedicated funding sources and be included in the State's transportation plan. The project is subject to all Federal requirements. Qualified projects are evaluated and selected on the basis of eight criteria, which have been defined by statute in Title 23, U.S. Code 602(b). In December 2009, the TIFIA Joint Program Office provided clarification of some of these criteria as they relate to Federal policy objectives, including livability, economic competitiveness, safety, sustainability, and state of good repair. Before TIFIA assistance can be committed, the project must receive an investment grade rating on its senior obligations and have a completed environmental action.

The eight criteria (and relative weights) include:

| Finance Tool | Source of Up-Front Funding | Source of Repayment | Process | Eligibility and Limitations |

|---|---|---|---|---|

| TIFIA | Highway Trust Fund (does not count against a State's apportionments) | Any dedicated, non-Federal revenue source | Borrower applies to DOT. | Projects must be Federally eligible, follow all Federal requirements, and be included in fiscally constrained STIP. Minimum size $50 million or 1/3 apportionments; ($30-million minimum for ITS projects); loan cannot exceed more than 33 percent of eligible costs. |

| SIBS | State apportionments/ seed funding | Any revenue (may be Federal aid) | Borrower applies to State DOT or SIB board. | Projects must be Federally eligible, follow all Federal requirements, and be included in fiscally constrained STIP. SIBs authorized under the 1995 NHS Act may treat repaid funds as State funding and then make loans for any Title-23-eligible purpose. |

| Section 129 | State apportionments | Any dedicated, non-Federal revenue source | Borrower applies to State DOT. | Projects must be Federally eligible, follow all Federal requirements, and be included in fiscally constrained STIP. |

Note. TIFIA = Transportation Infrastructure Finance and Innovation Act, DOT = U.S. Department of Transportation, ITS = intelligent transportation systems,

SIB = State Infrastructure Bank, NHS = National Highway System, STIP = Statewide Transportation Improvement Program.

The I-595 Corridor Roadway Improvements project consists of the reconstruction and widening of the I-595 mainline and all associated improvements to frontage roads and ramps, from the I-75/Sawgrass Expressway interchange to the I-595/I-95 interchange in Central Broward County, for a total project length of approximately 10.5 miles. A major component of the project is the construction of three at-grade reversible express toll lanes to be known as 595 Express, serving express traffic to/from the I-75/Sawgrass Expressway from/to east of SR 7, with a direct connection to the median of Florida's Turnpike. These lanes will be operated as managed lanes with variable tolls to optimize traffic flow and will reverse directions during peak travel times (eastbound in the morning and westbound in the evening).

The project is being implemented as a P3 between Florida DOT (FDOT) and I-595 Express, LLC (private concessionaire) to design, build, finance, operate, and maintain the roadway for a 35-year agreement term. FDOT will provide management oversight of the contract; will install, test, operate, and maintain all tolling equipment for the express lanes; and will set the toll rates and retain the toll revenue. FDOT will make monthly performance-based availability payments during the operating period of the project. A maximum annual availability payment of $65.9 million (in 2009 dollars) begins in 2014 and escalates annually. If quality and performance requirements stipulated in the contract, as well as availability of the roadways to traffic, are not met, then the availability payments will be subject to downward adjustment in accordance with the contract.

The finance plan for the $1.8-billion project includes:

Source: AASHTO Center for Excellence in Project Finance and the U.S. Department of Transportation. (2010). Retrieved June 30, 2010, from http://www.transportation-finance.org

For more information, see the following Web sites: https://www.fhwa.dot.gov/ipd/project_profiles/fl_i595.aspx

http://www.transportation-finance.org/projects/i_595_corridor_improv.aspx

What Are the Benefits?

TIFIA assistance provides improved access to capital markets, flexible repayment terms, and potentially more favorable interest rates than can be found in private capital markets for similar instruments. TIFIA can help advance large, complex projects that otherwise might be delayed or deferred because of size, complexity, or uncertainty over the timing of revenues. With TIFIA, the government can be a flexible, patient investor by providing capital that may not be available through the capital markets on attractive terms. This is particularly important on new toll roads or projects backed by other innovative revenue sources (such as proceeds from tax-increment financing) for which revenues may be highly uncertain and difficult to predict. The flexibility provided by TIFIA can then enable senior debt in the project to demonstrate higher coverage margins and attain investment-grade bond ratings.

Reflecting the ability of TIFIA to help close finance gaps for significant projects, the TIFIA program has leveraged $29 billion in project investment since its creation and has provided $7.7 billion in TIFIA assistance for 21 projects.2 Because of their size, many of the approved TIFIA projects were either unfunded in the near term or had large funding gaps. For some projects, TIFIA assistance enhanced market access and reduced borrowing costs; for others, it provided an alternative to grant funding, enabling the project sponsor to conserve regular Federal funds for smaller projects that could not be supported through user charges or dedicated revenue streams.

In particular, toll road projects have benefited from TIFIA credit assistance. With TIFIA, these projects have been able to defer debt-service payment for up to 5 years after substantial completion, which allows project sponsors to use toll revenues during this "ramp-up" period to pay for operating expenses and senior debt. TIFIA credit assistance has also been an important financing approach for P3s, mixing public and private capital and attracting private investment to facilitate the implementation of large, complex transportation projects. TIFIA credit assistance has also been an important financing tool to advance transit and intermodal projects.

SIBs are revolving infrastructure investment funds for surface transportation that are established and administered by States.

A SIB functions as a revolving fund that, much like a bank, can offer loans and other credit products to public and private sponsors of Title 23 highway construction projects or Title 49 transit and rail capital projects. Federally capitalized SIBs were first authorized under the provisions of the NHS Act. The pilot program was originally available to only 10 States and was later expanded to include 38 States and Puerto Rico. TEA-21 established a new pilot program for the States of California, Florida, Missouri, and Rhode Island. SAFETEA-LU expanded authority to all States and territories to establish SIBs and also allowed the creation of multi-State SIBs.

The initial infusion of Federal and State matching funds was critical to the start-up of a SIB, but States have the opportunity to contribute additional State or local funds to enhance capitalization. Under SAFETEA-LU, States can capitalize their SIB account(s) with Federal funds as follows:

SIB assistance may include loans (at or below market rates), loan guarantees, standby lines of credit, letters of credit, certificates of participation, debt-service reserve funds, bond insurance, and other forms of non-grant assistance. Maximum loan terms are set at 30 years, and repayment must begin no later than 5 years after substantial project completion. As loans are repaid, a SIB's capital is replenished and can be used to support a new cycle of projects. For SIBs authorized under TEA-21 or SAFETEA-LU, new loans funded from previously repaid loans must comply with all Federal requirements; however, for those SIBs created under the 1995 NHS authorization, when SIB loans are repaid, the funding used for capitalizing the SIB loses its Federal designation and becomes State funds, which can then be used to finance any Title-23-eligible transportation project subject to State laws.

FHWA retains oversight, monitoring, and reporting responsibilities. SIB eligibility is generally determined by FHWA Division Offices, in consultation with FHWA Headquarters, when necessary.

SIBs can also be structured to leverage additional resources. A "leveraged" SIB would issue bonds against its capitalization, increasing the amount of funds available for loans.

SIBs complement traditional funding techniques and serve as a useful tool to meet project-financing demands, stretching both Federal and State dollars. The primary benefits of SIBs to transportation investment include:

Although the authorizing Federal legislation establishes basic requirements and the overall operating framework for a SIB, States have customized the structure and focus of their SIB programs to meet State-specific requirements. A variety of types of financing assistance can be offered by a SIB, with loans as the most popular form of SIB assistance. As of December 2008, 32 States and Puerto Rico had entered into 609 SIB loan agreements with a total dollar value of $6.2 billion.

Florida was one of the first 10 States authorized under the 1995 NHS Act to create a SIB and was also one of the four States authorized to participate in the pilot program under TEA-21. In June 2000, State legislation was enacted, which provided additional flexibility by creating a State-funded SIB. Subsequent legislation has provided additional flexibility on the use and project eligibility for State-funding SIB loans, as well as providing additional money to capitalize the bank and the ability to leverage repayment streams for issuing bonds that would provide additional money for loans.

There are five different areas that are referred to when defining the differences between State and Federal-funded SIBs. The five areas (as shown in Table 5) are project eligibility, metropolitan planning organization plan requirements, right-of-way acquisition, project standards, and Transportation Improvement Program/STIP. Florida's SIB is very active, with 64 loan agreements from both the Federal and State SIB accounts executed through the end of 2008 at a value of $1.1 billion.

Texas was one of the 10 States chosen to test the SIB pilot program created under the 1995 NHS Act. In 12 years, the SIB has helped fund and expedite more than $3.4 billion in transportation projects through 88 loans with a total dollar value of $374.6 million.

Over 21 percent of approved SIB loans in Texas are for transportation improvements in the Texas-Mexico border region. More than $53.3 million in approved loans have gone to border-area projects as a way to address the needs related to increased trade due to the North American Free Trade Agreement. Texas ports of entry are used by 79 percent of all United States-Mexico border truck traffic (Texas DOT, 2010).

The largest of these border-area SIB loans is a $29.4 million loan to the City of Laredo for construction of the Laredo Northwest International Bridge IV (World Trade Bridge). Texas DOT approved a SIB loan for the Laredo International Bridge IV project, which will be repaid over a 28-year period at 4.1 percent interest (Texas DOT, 2010).

Section 129 loans allow States to use regular Federal-aid highway apportionments to fund loans to projects with dedicated revenue streams.

A State may directly lend apportioned Federal-aid highway funds to toll and non-toll projects. A recipient of a Section 129 loan can be a public or private entity and is selected according to each State's specific laws and process. A dedicated repayment source must be identified and a repayment pledge secured. Dedicated revenues for debt service can include user fees (e.g., tolls, registration fees, etc.) or taxes (e.g., income, sales, motor fuel).

The Federal-aid loan may be for any amount up to the maximum Federal share of 80 percent of the total eligible project costs. A loan can be made for any phase of a project, including engineering and right-of-way acquisition, but cannot include costs prior to loan authorization. A State can obtain immediate reimbursement for the loaned funds up to the Federal share of the project cost.

Loans must be repaid to the State beginning 5 years after construction is completed and the project is open to traffic. Repayment must be completed within 30 years from the date Federal funds were authorized for the loan. States have the flexibility to negotiate interest rates and other terms of Section 129 loans. The State is required to spend the repayment funds for a project eligible under Title 23 or for credit-enhancement activities, such as purchasing bond insurance or funding a capital reserve to improve credit market access or lower interest rates.

States can use Section 129 loans to assist P3s by enhancing start-up financing for toll roads and other privately sponsored projects. Because loan repayments can be delayed until 5 years after project completion, this mechanism provides flexibility during the ramp-up period of a new toll facility.

Loans can also play an important role in improving the financial feasibility of a project by reducing the amount of debt that must be issued in the capital markets. In addition, if the Section 129 loan repayment is subordinate to debt-service payments on revenue bonds, the senior bonds may be able to secure higher ratings and better investor acceptance.

Because the Section 129 structure allows States to make loans directly rather than using the more time-consuming process of first capitalizing a SIB and then making loans, the result may be a quicker distribution of loan proceeds and may be superior where cash flow is especially tight.

If a project meets the test for eligibility, a loan can be made at any time. Federal-aid funds for loans may be authorized in increments through advance construction procedures and are obligated in conjunction with each incremental authorization. The State is considered to have incurred a cost at the time the loan, or any portion of it, is made. Federal funds will be made available to the State at the time the loan is made.

Use of Section 129 loans for project financing has been very limited. One reason for this was the creation of the TIFIA program, which established a Federal-administered program - as well as a new pot of funding - for the same kinds of projects that would likely use Section 129 loans. However, for projects that do not meet the cost threshold required for TIFIA projects (generally $50 million) or do not otherwise fit the profile of TIFIA projects, Section 129 loans remain a good alternative.

| Area | State SIB | Federal SIB |

|---|---|---|

| Project eligibility | Transportation facility project is on the State highway system, provides increased mobility on the State's transportation system, or provides intermodal connectivity with airports, seaports, rail facilities, and other transportation terminals or projects of the Transportation Regional Incentive Program (TRIP) Emergency loans for damage incurred to public-use commercial deepwater seaports, airports, and other transit and intermodal facilities that are within an area that is part of an official State declaration of emergency | Projects eligible for assistance under Title 23, U.S. Code (USC) or capital projects as defined in section 5302 of Title 49 USC |

| Metropolitan Planning Organization (MPO) plan requirements | Consistent, to the maximum extent feasible, with local PO

and local government comprehensive plans |

Must be included in the adopted comprehensive plans of the applicable MPO |

| Right-of-way acquisition | Must conform to policies and procedures within applicable and Florida statutes | Must conform to all State Federal laws and rules |

| Project standards | Appropriate standards for the transportation system | Must conform to all State and Federal standards |

| TIP/STIP | Must conform to all State standards | Must conform to all State and Federal standards |

Note. TIP = Transportation Improvement Program, STIP = Statewide Transportation Improvement Program.

Source: Florida DOT, 2009.

President George Bush Turnpike, Texas

The President George Bush Turnpike is a 30-mile outer beltway north of Dallas, providing a second east-west limited access highway through the center of the rapidly growing "Telecom Corridor," which contains corporate headquarters for several large firms. The facility has four to eight toll lanes (the Turnpike) in addition to four to six toll-free frontage road lanes (designated State Route 190) linking seven cities in three counties. The North Texas Tollway Authority owns and operates the facility. Construction of Segment I was completed in 2001. An extension is currently under construction and scheduled for completion by 2011.

The project exemplifies how a Section 129 loan can play an essential role in the total financing package. Given the high cost of the turnpike project, it was difficult to finance solely with toll revenue bonds. The solution was a combination of low-interest, long-term Section 129 loan and revenue bonds. The Section 129 loan was disbursed in five payments of $20 million, $35 million, $20 million, $40 million, and $20 million over a 4-year period. Texas DOT used a partial conversion of advance construction to spread the designation of Federal obligation authority over 4 years rather than incurring the upfront $135-million impact to its Federal obligation authority. This $135-million loan was critical in ensuring the affordability of the project's senior bonds. Completion of this important beltway extension was accomplished at least a decade sooner than would have been possible under traditional pay-as-you-go financing.

For more information, see the Web site:

https://www.fhwa.dot.gov/ipd/project_profiles/tx_central_turnpike.aspx

AASHTO Center for Excellence in Project Finance and the U.S. Department of Transportation. (2010). Web site retrieved

June 30, 2010, from http://www.transportation-finance.org

Federal Highway Administration. (2009, Fall). North Carolina

Takes Flexible Approach to GARVEE Bond Issuance. Innovative Finance Quarterly, 14(1).

Federal Highway Administration. (2010). Public-Private Partnerships. Retrieved June 30, 2010, from https://www.fhwa.dot.gov/ipd/p3/

Federal Highway Administration. (2010). TIFIA. Retrieved June 30, 2010, from http://www.transportation.gov/tifia

Florida Department of Transportation. (2009, November).

Web site retrieved June 30, 2010, from http://www.dot.state.fl.us/financialplanning/finance/sib.shtm

Illinois Tollway. (2009, December). 2010 Budget. Retrieved August 6, 2010, from http://www.illinoistollway.com/portal/page?_dad=portal&_schema=PORTAL&_pageid=133,1398313

Internal Revenue Service. (2009, April). Build America Bonds and Direct Payment Subsidy Implementation. Notice 2009-26. Retrieved August 9, 2010, from http://www.irs.gov/pub/irs-drop/n-09-26.pdf

Loop Capital Partners & J.P. Morgan. (2009, December). Illinois State Toll Highway Authority, Toll Highway Senior Priority Revenue Bonds, Taxable 2009 Series B. Retrieved August 8, 2010, from the Electronic Municipal Market Access Web site

at http://emma.msrb.org/

Mercator Advisors. (2009, November 16). Build America Bonds:

A Six-Month Market Update. Paper prepared for the American Association of State Highway and Transportation Officials.

National Surface Transportation Policy and Revenue Study

Commission. (2007, January). Evaluation of Tax-Preferred Investment Products as a Transportation Financing Mechanism. Commission Briefing Paper 5A-14. Retrieved on August 8, 2010, from http://ntl.bts.gov/lib/33000/33400/33441/final_report/pdf/volume_3/technical_issue_papers/paper5a_14.pdf

Texas Department of Transportation. (2010). State Infrastructure Bank (SIB). Retrieved August 9, 2010, from http://www.txdot.gov/business/governments/sib.htm

U.S. Treasury Department. (2009, April 3). Build America Bonds (press release; Office of Public Affairs).

Center for Innovative Finance Support (formerly Innovative Program Delivery) https://www.fhwa.dot.gov/ipd/

SAFETEA-LU Legislation and Fact Sheets https://www.fhwa.dot.gov/safetealu/

Transportation Infrastructure Finance and Innovation Act (TIFIA) Program http://www.transportation.gov/tifia

U.S. Treasury, Guidance on Build America Bonds (last accessed on November 24, 2009) http://www.irs.gov/pub/irs-drop/n-09-26.pdf

AASHTO's Center for Excellence in Project Finance http://www.transportation-finance.org

Florida Department of Transportation http://www.dot.state.fl.us/financialplanning/finance/sib.shtm

National Conference of State Legislatures, "Surface Transportation Funding: Options for States" (May 2006)

http://www.ncsl.org/documents/transportation/surfacetranfundrept.pdf

National Cooperative Highway Research Program (NCHRP), "Future Financing Options to Meet Highway and Transit Needs" Web-only Document 102 (December 2006) http://onlinepubs.trb.org/onlinepubs/nchrp/nchrp_w102.pdf

Texas Department of Transportation http://www.txdot.gov/business/governments/sib.htm

University of Minnesota, Center for Transportation Studies, Value Capture for Transportation Finance Study

http://www.cts.umn.edu/Research/Featured/ValueCapture/index.html

Footnotes

1. Advance construction allows a State to begin a project even if the State does not have sufficient Federal obligation authority to cover the Federal share of project costs. Under partial conversion of advance construction, a State may elect to obligate funds for an advance-constructed project in stages.