The Federal Highway Administration (FHWA) Center for Innovative Finance Support (CIFS), part of the Office of Innovative Program Delivery (OIPD), provides guidance and technical assistance to the States and FHWA Division Offices for the administration of the Grant Anticipation Revenue Vehicle (GARVEE) Program. This guidance document, updated in 2018, provides a summary of stewardship practices for managing the GARVEE Program and summarizes legislative requirements. The document also includes recommendations based on previous GARVEE Guidance and best practices identified by field practitioners in FHWA-sponsored roundtable discussions held in 2017.

Copies of this document are available for download at the following URL: https://www.fhwa.dot.gov/ipd/finance/resources/federal_debt/

This guidance incorporates the following significant changes and additions to the previous GARVEE Guidance, published in 2014:

Questions regarding the information in this document should be directed to:

Peter Mancauskas

Innovative Finance Program Manager

Center for Innovative Finance Support (CIFS)

Office of Innovative Program Delivery (OIPD)

(202) 503-9850

peter.mancauskas@dot.gov

The Center for Innovative Finance Support will evaluate and update this guidance to incorporate new best practices and lessons learned. We encourage, therefore, the users of this document to provide constructive feedback to the program manager listed above.

United States Code, title 23, section 122 (23 U.S.C. 122), "Reimbursements to States for Bond and Other Debt Instrument Financing Costs," was revised by the National Highway System Designation Act of 1995 (NHS Act), section 311, to expand the eligibility of debt-related costs for Federal reimbursement. The NHS Act also revised the definition of "construction" in 23 U.S.C. 101, to include bond-related costs, including principal and interest payments, issuance costs, insurance, and other costs incidental to the sale of eligible financing instruments. This expanded program is referred to as the GARVEE Program.

A GARVEE 1 is a bond, note, certificate, mortgage, lease, bank loan (including a State Infrastructure Bank loan), private placement, or other debt financing instrument issued by a State, a political subdivision of a State, or a public authority, the proceeds of which are used to fund a project eligible for assistance under title 23, U.S.C.

For purposes of this document, the term "bond" is used generically to mean an eligible debt financing instrument.

A "GARVEE project" is a Federal-aid project subject to 23 U.S.C. 122, where the State or local government requests that Federal-aid highway funds participate in debt-related costs as a 'cost of construction' with Federal reimbursements occurring when the debt-related costs are incurred, in lieu of reimbursements on a progress basis as construction costs are incurred.

Debt-related costs include payment of principal and interest, issuance costs, and other eligible costs recognized under section 122. The definition above clarifies that a GARVEE project is a Federal-aid construction project eligible under title 23, U.S.C. that is financed in whole or in part by a bond or another credit instrument. The bond issue itself is not the project, but is a finance source for an eligible Federal-aid project or projects. In order to ensure eligibility of Federal-aid reimbursements for debt-related costs, Federal-aid recipients must obtain an FHWA Division Administrator's written approval prior to the incurrence of these debt-related costs. Such treatment is consistent with 23 CFR 1.9(a) which states, in part, "Federal funds shall not be paid on account of any cost incurred prior to authorization of the Administrator...".

A GARVEE is a debt-financing instrument (commonly a 'bond') authorized to receive Federal reimbursement of debt service and related financing costs. Except for the reimbursement process described in 23 U.S.C. 122(c), projects funded with the proceeds of a GARVEE bond are subject to the same requirements as other Federal-aid projects. Instead of reimbursing construction costs as they are incurred, the costs financed by the GARVEE bonds are reimbursed when debt service is due. These projects may allow for a more effective use of obligation authority by authorizing the project as advance construction (AC) (see section 4.6). The AC amount is then partially converted to obligated Federal-aid funds to coincide with the debt service payments. (Partial conversions refer to the practice of converting AC projects in stages, in lieu of a single conversion, so that the amounts obligated and reimbursed on the project may coincide with the fiscal year in which the funds are needed.)

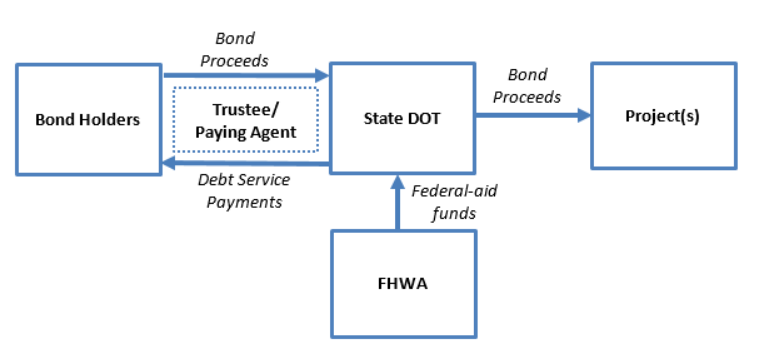

The following chart illustrates a GARVEE financing. The proceeds from the GARVEE bonds are used to pay project costs as the construction costs are incurred. Rather than seek reimbursement on a progress basis as construction costs are incurred, the State Department of Transportation (DOT) will bill FHWA for the Federal share of debt service payments over the term of the bonds. While the bond proceeds and the debt service payments may be administered by an agent other than the State DOT, both the bond proceeds and the Federal funds that are committed to reimburse debt service generally flow through the State DOT.

1. Bond Holders » Bond Proceeds through Trustee/

Paying Agent » State DOT » Bond Proceeds » Project(s)

2. Bond Holders » Bond Proceeds through Trustee/

Paying Agent » State DOT » Debt Service Payments through Trustee/

Paying Agent » Bond Holders » Bond Proceeds through Trustee/

Paying Agent » State DOT » Bond Proceeds » Project(s)

3. Bond Holders » Bond Proceeds through Trustee/

Paying Agent » State DOT » Bond Proceeds » Project(s)

& FHWA » Federal-aid funds » State DOT » Bond Proceeds » Project(s)

4 Bond Holders » Bond Proceeds through Trustee/

Paying Agent » State DOT » Debt Service Payments through Trustee/

Paying Agent » Bond Holders » Bond Proceeds through Trustee/

Paying Agent » State DOT » Bond Proceeds » Project(s)

& FHWA » Federal-aid funds » State DOT » Bond Proceeds » Project(s)

Appendix A includes project illustrations providing more detail as to how GARVEE projects are administered.

GARVEE bonds, like other municipal bonds issued by a public agency, generate up-front capital for highway projects at generally tax-exempt interest rates, enabling a State to construct a project earlier than if the State or local government was required to rely upon pay-as-you-go grant resources or State revenues. Unlike traditional municipal bonds, however, the interest costs and other bond-related costs of a GARVEE bond may be eligible for Federal reimbursement as a cost of construction, which for some States has provided expanded access to the capital markets. By financing Federal-aid highway construction using bonds, the State can distribute the cost of a project over a period of time that more closely relates to the useful life of the facility, rather than incur the up-front cost within the construction period.

While the projects financed with GARVEE proceeds incur interest costs and other bond-related costs, these costs may be offset by lower construction costs due to the impact of inflation or by avoiding the additional costs associated with continued deterioration of a facility that requires reconstruction. Perhaps most important is that earlier construction advances the project's economic, congestion mitigation, and safety benefits to the public.

Candidate projects for GARVEE bonds are typically large projects (or programs of projects) that have the following characteristics:

GARVEEs may be an attractive financing mechanism to bridge funding gaps and to accelerate construction of major projects.

The eligibility of a GARVEE bond's debt service costs for reimbursement with future Federal-aid funds, to the extent such funding may be available, does not constitute a commitment, guarantee, or other obligation by the United States to provide for payment of principal or interest, or create any right of a third party against the U.S. Government for payment (23 U.S.C. 122(e)). GARVEE issuers should seek the expert advice of bond counsel regarding the tax status of these debt instruments. An additional best practice is to include a statement in the bond documents that the GARVEE bond is not guaranteed by the Federal Government.

Under the Treasury Offset Program (Code of Federal Regulations, title 31, part 285.5 (31 CFR 285.5)), the U.S. Treasury may withhold part or all of a debtor's Federal payment to satisfy the debtor's delinquent debt owed to the U.S. Government. While transportation funds are rarely affected by offsets, it is possible for an FHWA payment to be intercepted by the U.S. Treasury to satisfy a delinquent debt of the State or territory owed on another Federal program. This could be problematic for a State or territory if a payment for GARVEE debt service is intercepted, and such a situation would have to be resolved by the State or territory working with the creditor agency.

GARVEEs may be issued by any Federal-aid recipient, including a State or a political subdivision of a State, such as a city, county, or public authority (23 U.S.C. 122(a)).

If a State Infrastructure Bank (SIB) is serving as the issuer of GARVEE bonds for purposes of capitalization, the reimbursement of debt service costs with Federal-aid funds will not be treated as SIB capitalization grants. The SIB capitalization grants refer to the Federal and State funds used to establish the SIB.

If GARVEE bonds are issued by a local entity, the State DOT (as the State agency accountable to FHWA for Federal-aid expenditures) should enter into an agreement with the local agency responsible for administering the project(s) to ensure compliance with Federal requirements relating to GARVEE projects.

To document administrative and oversight roles, the State and FHWA Division counterpart should execute a GARVEE Memorandum of Understanding (MOU) describing how the State's GARVEE bond program will be administered as facilitating effective internal control consistent with 2 CFR 200.303. An MOU template is provided in Appendix B of this guidance. During development of the MOU, the FHWA Division should direct questions to the Innovative Finance Program Manager, Center for Innovative Finance Support (CIFS).

Once the MOU is drafted, the FHWA Division will submit it to CIFS for FHWA headquarters review and approval, and advises the FHWA Division when the review is complete.

The best practice is to maintain a single MOU covering the State's GARVEE bond program general policies, procedures, requirements, and the pertinent expectations of the parties involved in carrying out the program. This MOU should be amended, as necessary, to reflect additional GARVEE bond issuances and adjustments to the State's GARVEE bond program, including refunding bonds (see section 5.2).

While key program administration provisions are intended to remain largely unchanged over time, supplemental appendices may be attached to the MOU for each GARVEE bond issuance indicating the specific projects approved by FHWA for Federal debt service cost reimbursement under 23 U.S.C. 122. If a local entity is responsible for the administration of a GARVEE project(s) and the enforcement of Federal requirements, this should be reflected in the MOU. More detailed project-related data may be tracked by other means, as agreed upon by the State and the FHWA Division Office.

While the amount of Federal funds dedicated to GARVEE bond debt service is a State decision, it is a best practice for the State to establish legal or administrative fiscal policies regarding its GARVEE issuances and the percentage of annual Federal-aid Highway Program apportionments/allocations or obligation limitation that may be used for debt service. Financial markets may also influence a State on the amount of Federal-aid dedicated to debt service payments.

Many issuers of GARVEE bonds have established policies limiting GARVEE debt service to a specified percentage (generally not exceeding 20%) of their annual Federal-aid program.

As with any Federal-aid project, a GARVEE project is included in the metropolitan Transportation Improvement Program (TIP) (23 U.S.C. 134(j)) and the Statewide Transportation Improvement Program (STIP) (23 U.S.C. 135(g)).

For a GARVEE-funded project, the Federal share of the debt-related costs anticipated to be reimbursed with Federal-aid funds over the life of the bonds must be designated as AC (see section 4.6) in the transportation plan/program document showing GARVEE bond proceeds as the funding source. The State must document, by year, the Federal and non-Federal funds needed to reimburse the debt service costs. 2

Prior to Federal authorization of a project as AC, the project must be included in the Federally-approved STIP (see 23 CFR 630.705 and 23 CFR 450.216). The project will be demonstrated as supporting the fiscally constrained element of the STIP using all or some combination of State, local, and private funds. The financial limit on the amount of AC is set by the State's or MPO's ability to demonstrate fiscal constraint of the STIP or TIP respectively.

Generally, when an AC project is converted to a federally funded project, the STIP will document the full or partial conversion of the project as an individual project or as part of a project grouping. This project or group of projects must meet all STIP/TIP requirements, including the designation of the Federal funding categories that are intended to be used for the conversion. In accordance with 23 CFR 450.216(m), the State must demonstrate fiscal constraint for the individual categories of Federal-aid funds. The amount of conversion is limited by the amount of apportioned Federal funds available in the category to be converted and the amount of obligation authority available at the time of the conversion. As with any project, it should be noted that the State is not bound to the category of funds identified in the approved STIP/TIP. However, should the approved AC conversion substantially change the current STIP/TIP's fiscal constraint determination, the STIP/TIP may need to be amended. The fiscal constraint determination should be supported by demonstrating the individual project or group of project conversions in the STIP/TIP or by showing the total amount and source(s) of Federal funds to be converted as part of the financial plan for the STIP/TIP.

A GARVEE project must be eligible for Federal-aid funding from one or more program categories as set forth in title 23, U.S.C. Likewise, any reimbursements of debt-related costs must be made with obligations of eligible categories of Federal-aid funds. The AC amount designated at the time of project approval will consist of one or more eligible Federal funding categories, although the State retains the flexibility to decide which category to obligate via the AC conversion process each year. The State also retains the right to use non-Federal funds in lieu of Federal-aid funds for debt service costs.

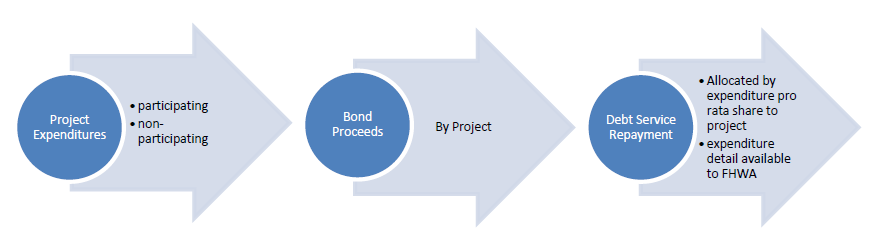

Once a project (or projects) is selected for bond financing, the project is submitted to the FHWA Division Office for approval as an AC project under 23 U.S.C. 115 (see section 4.6). The approved project agreement defines the terms of the project and ensures that the project will follow all applicable Federal requirements. The AC authorization makes the project eligible for Federal reimbursement. To federally reimburse for debt service payments, AC amounts are converted to Federal funds. If multiple projects are funded with the proceeds of a bond issue, each project must be allocated a prorated share of the debt-related costs. 3

It is important to note that FHWA approves only the underlying project(s) to be debt-financed in order for the State to receive debt service reimbursements, not the bond issue, which is under State authority.

States should obligate Federal funds by converting a portion of the designated AC amount for the project at the beginning of a Federal fiscal year in the amount needed to make debt service payments scheduled for the remainder of the year. Obligating funds early in the fiscal year for the entire year's debt service payments may provide additional assurance to bond investors regarding the State's commitment of Federal funds to the GARVEE project(s) and may be a positive consideration for the credit quality of the bonds.

However, there are occasions where Federal obligation authority is limited due to a delayed appropriation bill or a continuing resolution, in which case, it may be reasonable to delay the AC conversions, provided the State can ensure that funds will be obligated prior to the scheduled debt service payments, and the State is not required by the bond provisions to obligate early in the year.

Recognizing that obligation authority may be limited due to legislative delays or restrictions, it is considered a best practice for States to avoid scheduling debt service payments in the early months of the Federal fiscal year.

The maximum Federal share of the eligible costs associated with a GARVEE project is the applicable Federal share for the type of project under 23 U.S.C. 120 (23 U.S.C. 122(d)). The Federal share is established at the time of authorization of the project agreement (23 CFR 630.106(f)) and may be revised when the construction contract is awarded. For GARVEE projects, the Federal share is applied to all eligible costs available for reimbursement including the amount of bond proceeds applied to the project, and payments of bond-related costs such as capitalized interest, issuance expenses, and credit enhancement fees.

GARVEE projects must comply with established FHWA policies and procedures in calculating the Federal share. For example, the non-Federal share may include "in-kind" contributions, such as the value of donated property, or soft match, such as toll credits (23 U.S.C. 120(i) and 323).

If the State desires to use non-Federal funds to pay for actual construction costs, resulting in an increase in the non-Federal match in the early years of the project, then the FHWA Division Office should coordinate with the Center for Innovative Finance Support and the Office of Financial and Management Programs (OFMP), part of the Office of the Chief Financial Officer (HCF), for appropriate concurrences with the process. The construction costs paid with non-Federal funds cannot not be included in the bond financing of the project.

States should request FHWA authorization of a GARVEE project as an AC project under the provisions of 23 U.S.C. 115. An AC authorization enables the project to be eligible for Federal funds, but no Federal funds are required to be obligated until the State seeks a Federal reimbursement. 4 When a project is first authorized, the amount of AC designated on a GARVEE project is the estimated Federal share of eligible project costs. When Federal funds are obligated on a partial conversion basis to coincide with debt service payments, the AC amount is adjusted to reflect the estimated Federal share of the eligible project costs less the amount of Federal funds obligated on the project to date.

The Federal-aid project agreement will be revised as needed to reflect changes in the AC amount consistent with 23 CFR 630.110(a):

Obligating Federal funds in order to reimburse periodic debt service payments on the bonds would represent conversions of designated AC amounts. The State could obligate Federal funds annually over the life of the bonds to help retire permanent financing, or the State could make the conversion in one lump sum upon project completion to help take out construction financing.

The FHWA makes no commitment to fund the portion of the project approved as AC. Funding is only committed when Federal-aid funds are obligated. States should not consider the designated AC amounts as accounts receivable in their accounting systems and financial reports.

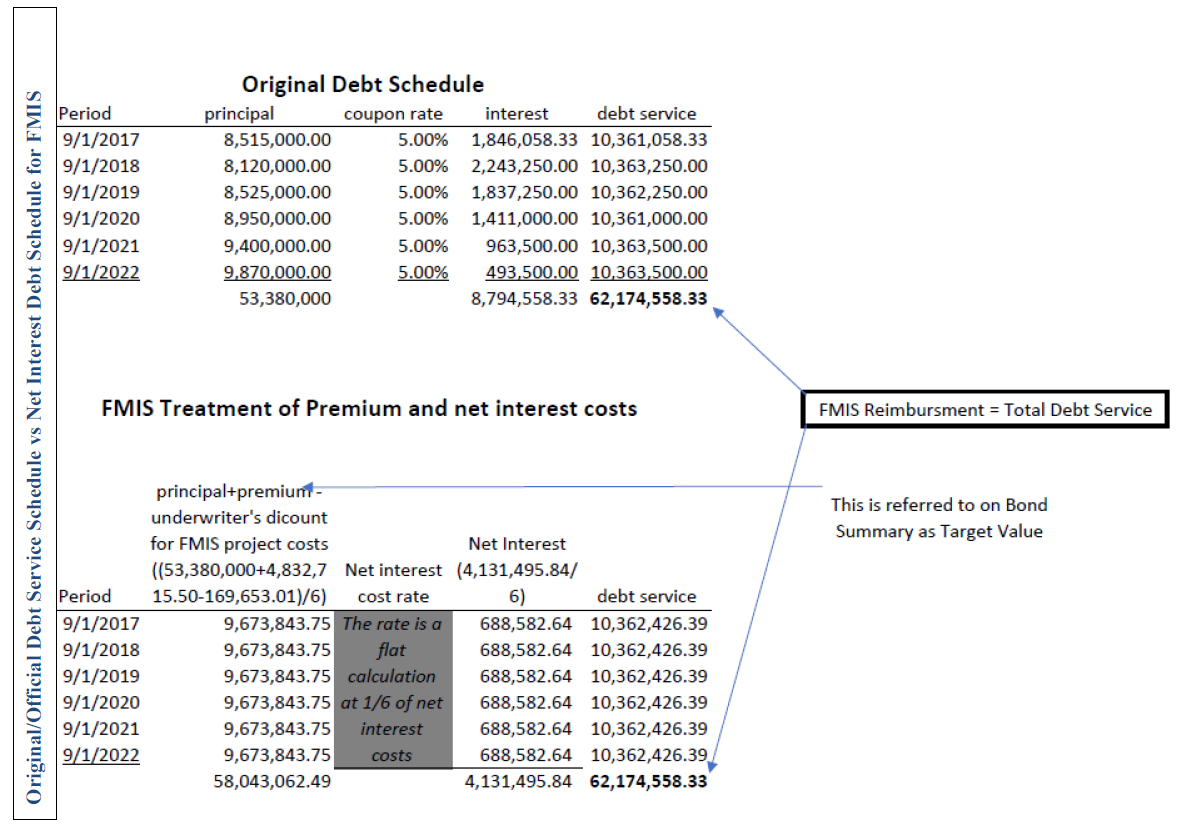

In accordance with FHWA accounting requirements, GARVEE projects will be entered into the Fiscal Management Information System (FMIS) like any other Federal-aid project 5 . To identify GARVEE projects in FMIS, a detail line item using improvement type 45, "Debt Service", is included on each project showing the debt-related costs of the project. The debt-related costs shown on this line include interest, issuance costs, insurance, and other costs incidental to the financing. Debt-related costs under improvement type 45 do not include repayment of bond principal. The costs related to preliminary engineering, right-of-way, construction, etc., are shown as separate line items using the appropriate coding. Any proposed variation to FMIS procedures should be submitted to HCF for approval. If bond premium proceeds are gained as a result of a bond issuance over the par amount, the net interest costs should be reflected in FMIS. For more information on this topic refer to Appendix E, "Treatment of Bond Premium Proceeds in FMIS."

Issuances that include more than one GARVEE project should be linked in FMIS using the "Related Projects" field.

It is a best practice for the FHWA Division or State DOT to enter the total amount of anticipated debt service costs (principal and interest) allocated to the project in a State/Division Defined Field (screen number FSPR0020) named "GARVEE Debt Service." This amount would reflect the amount shown in Attachment A of the MOU and should be revised if the amount of debt service allocated to the project changes.

States may seek Federal-aid reimbursements on authorized Federal-aid projects for eligible bond-related costs as these costs are incurred. Issuance costs, debt service payments, redemption payments for term bonds, and incidental costs (such as paying agent/trustee fees) represent costs incurred that may be reimbursed with Federal-aid funds to the extent such costs are deemed eligible, without regard to the construction status of the project. 6

If the GARVEE bond proceeds are not the only source of funding for the project, Federal funds may be used to pay for actual construction costs as they are incurred, provided that GARVEE bond proceeds are not being used to pay for those same costs.

States may receive Federal payments in a manner consistent with their GARVEE bond documents and Federal-aid project agreements, while minimizing the time between receipt of Federal-aid reimbursements and debt service payment dates. Federal payments should be made to a State in sufficient time to ensure that debt service payments are made as scheduled in accordance with Cash Management Improvement Act requirements, 31 CFR part 205.

States should distribute debt service costs to GARVEE projects on an allocable basis in accordance with Federal cost principles (2 CFR 200 Subpart E), and as established in the MOU between the State and FHWA, if applicable. See Appendix D for a detailed example of cost allocation between GARVEE projects in FMIS.

Issuance and other bond-related costs funded from bond proceeds and eligible for reimbursement under 23 U.S.C. 122(b)(3)-(5) will be reimbursed as part of the debt service payments. Other bond-related costs funded directly by the State (such as annual trustee or paying agent expenses) are eligible for separate reimbursement. In determining which costs are eligible for reimbursement, the State DOTs and FHWA Division Offices will rely on established FHWA policies and Federal cost principles, 2 CFR 200 Subpart E. For additional guidance, section 5.4 contains a discussion of certain allowable and unallowable debt-related costs.

The State must maintain adequate documentation to establish eligibility of costs consistent with 2 CFR 200.333 and the government-wide cost regulations within 2 CFR 200 Subpart E.

The GARVEE projects may be administered by a local government, including the submission of claims by the local government for debt service reimbursements under 23 U.S.C. 122. However, regardless of the entity administering the GARVEE project, the State DOT, as the recipient of Federal-aid, is responsible for ensuring that projects are carried out in accordance with Federal requirements.

As previously stated in section 3.3, if GARVEE bonds are issued by a local entity, it is a best practice for the State to enter into an agreement with the local agency responsible for administering the project(s) to ensure compliance with Federal requirements.

Local government recipients authorized to issue GARVEE bonds are any entities receiving sub-allocations of Federal-aid funds, including cities, counties, and Metropolitan Planning Organizations. Issuance of such GARVEE bonds is subject to State concurrence as well as legal authority for the subrecipient to issue debt. 7

For accounting purposes, a GARVEE project remains active until the GARVEE bonds have been fully retired (i.e., the last debt service payment reimbursement has been made) and any adjustments to the Federal share of project costs have been finalized. The GARVEE bonds may be fully retired at final maturity or via early defeasance or full repayment.

Other closeout processes related to physical construction/completion of the underlying project, such as final inspection reports, material certifications, etc., would occur when construction is completed under normal Federal-aid procedures. The State DOT is also required to maintain all payment and construction documentation related to the Federal-aid project for three years after final payment of the bond and project closeout. 8

As defined in 23 U.S.C. 122(a), an eligible debt financing instrument is a bond, note, certificate, mortgage, lease, or other debt financing instrument issued by a State, political subdivision of a State, or a public authority, the proceeds of which are used to fund a project eligible for assistance under title 23, U.S.C.

A current or advance refunding issue also would be considered an eligible debt financing instrument, if the issue was a refunding of an outstanding GARVEE bond issue approved under the provisions of 23 U.S.C. 122 and conforms to the limitations in section 5.2.

The 2017 Tax Cuts & Jobs Act signed December 22, 2017 (Pub. L. 115-97), eliminated state and local governments' ability to use tax-exempt bonds to advance refund outstanding bonds, as of January 1, 2018.

A refunding bond issue may be an eligible debt financing instrument if the issue is a refunding of an outstanding GARVEE bond issue approved under the provisions of 23 U.S.C. 122. Refunding is a procedure whereby an issuer refinances outstanding bonds by issuing new bonds. A State might choose to undertake a refunding of GARVEE bonds to achieve savings on debt service costs, restructure outstanding debt, and/or change bond covenants.

States may issue a GARVEE refunding bond if there are debt service cost savings on a net present value basis (a standard industry practice), or if the aggregate nominal debt service cost scheduled to be reimbursed with Federal funds is reduced. States must consult with FHWA prior to issuing any GARVEE refunding bond to obtain approval for Federal participation in the revised debt service costs. Any fees or other costs associated with early bond redemptions are factored into the refunding decision. If the refunding bond results in debt service cost savings and reduces the Federal reimbursements, then such fees or costs may be deemed appropriate. Generally, advance refunding extending the debt service period without a demonstrated cost savings can make issuance costs and net higher interest costs ineligible for Federal reimbursement. 10

If a State seeks to refund GARVEE bonds to restructure debt service or change bond covenants and the refunding will not generate present value savings and will increase the Federal reimbursements, the FHWA Division Office should consult with the CIFS to determine whether the State has sufficiently demonstrated and properly documented its need to increase the Federal funding participation in the GARVEE project(s) prior to issuance of the refunding bonds. If the State proceeds with these refunding bonds without FHWA concurrence, any additional costs associated with the bonds, including the cost of the bond refunding, may not be eligible costs for Federal participation.

Following issuance of a GARVEE refunding bond for any eligible purpose, the State DOT must submit to FHWA a Federal-aid project agreement modification as required by 23 CFR 630.110 for each GARVEE project. State DOTs should attach a new debt service payment schedule to the project agreement modification and must include the schedule in a supplemental appendix to the MOU between the State and FHWA governing the administration of the GARVEE bond program.

A State may decide to refund multiple series of bonds, including non-GARVEE bonds, as part of a single debt issuance transaction. Since GARVEE bonds are approved for specific projects, the costs of refunding the bonds must be properly allocated among the GARVEE and non-GARVEE series of bonds and related projects. 11 In submitting the modified Federal-aid project agreement(s) and debt service payment schedule(s) to the FHWA Division Office, it is considered a best practice for the State to clearly demonstrate that the refunding costs associated with multiple bond series have been properly allocated.

It is a best practice to issue all GARVEE bonds on a fixed interest rate basis. Issuing GARVEE bonds on a fixed interest rate basis enhances program management and integrity by removing significant sources of uncertainty about project costs and Federal reimbursements for debt service.

If a State seeks to issue variable rate GARVEE debt (including synthetic fixed rate debt created by combining variable rate debt with a floating to fixed rate swap), the FHWA Division Office should consult with the CIFS to ensure that proper procedures are in place to review and approve variable project costs and Federal reimbursements in a timely manner, and that the State is aware of current Federal policies and regulations concerning the use of derivative and hedging instruments common to variable rate debt. Costs associated with such instruments (such as swap termination fees) are not eligible for Federal reimbursement.

In accordance with 23 U.S.C. 122, allowable bond-related costs eligible for reimbursement include:

Issuance costs include the following: underwriters discount; rating agency fees; printing, publication, or advertising expenses with respect to the bonds; all fees, expenses, and costs of registrars and paying agents; and all fees, expenses, and costs of attorneys, financial advisors, bond counsel, accountants, feasibility consultants, or other experts employed to aid in the sale and issuance of bonds. Credit enhancement fees include bond insurance premiums, letter of credit fees, and standby bond purchase agreement fees. All these costs must be allocable to the Federal-aid projects or otherwise the State is required to pro-rate the costs between Federal-aid projects and other benefiting cost objectives in accordance with the cost principles of 2 CFR 200 Subpart E.

The capitalization from bond proceeds of a debt service reserve fund or contingency fund required by (or incidental to) the debt issuance is considered an eligible Federal-aid expense, but only to the extent proceeds are allocable to Federal-aid projects. In accordance with bond covenants, the funds deposited in such a reserve account, along with any interest earnings, must be used for project costs - either on a current basis (including interest) or as a final payment to the bondholders. Funds in a reserve account cannot be released and disbursed to any other party for any other purpose. If the reserve account is to be liquidated to make the final debt service payment, the final debt service payment will not be eligible for Federal-aid reimbursement. Likewise, if unused bond proceeds are applied to pay principal and/or interest, such payments will not be eligible for Federal reimbursement.

If a debt service reserve fund is used to make timely debt service payments due bondholders because of an interruption or insufficiency of pledged Federal-aid funds, the State may request reimbursement for the debt service payment when Federal-aid funds become available in order to replenish the debt service reserve fund directly, consistent with 23 U.S.C. 121(c) and 122(b). If the debt service reserve fund supports GARVEE and non-GARVEE debt, then Federal reimbursement will be limited to the GARVEE portion of the debt.

If a surety provider, including a bond insurer, makes the debt service payment under the surety agreement, reimbursement of the debt service payment depends upon the terms and conditions of the surety agreement between the surety provider and the issuer. To the extent that an issuer is required to repay the debt service payment to the surety provider, reimbursement with Federal-aid funds is a cost incurred relating to a principal and interest payment. In such case, reimbursement may be made either to the State or the surety provider consistent with 23 U.S.C. 121(c) and 122(b). If the surety provider supports GARVEE and non-GARVEE debt, then Federal reimbursements will be limited to the GARVEE portion of the debt.

To the extent that the surety provider simply insures the risk of non-payment or late payment and makes a third-party payment to the bond trustee, and the State does not have a legal obligation to reimburse the surety, there is no cost incurred for Federal reimbursement. In either case, any interest or penalties associated with the surety payment are not reimbursable under 23 U.S.C. 122 because the risk of nonpayment or interrupted payment of Federal-aid funds lies with the State.

Costs associated with fines and penalties related to noncompliance with Federal, State, local or Tribal laws or regulations (such as arbitrage penalties) are unallowable for Federal reimbursement 12. The FHWA Division Office should consult with CIFS/OFMP regarding any questions about the Federal reimbursement eligibility of costs associated with financing instruments or fines and penalties.

Costs identified in this section as allowable or unallowable are not all-inclusive. The FHWA may determine the status of additional cost items as they arise.

If the cost of the project(s) planned to be funded with the GARVEE bond proceeds is less than anticipated and excess GARVEE bond proceeds result, the issuer of the GARVEE bonds should consult with bond counsel, the bond trustee, and other advisors to ensure compliance with Internal Revenue Service requirements. The State must also confer with FHWA with respect to compliance with specific requirements for GARVEE bonds, which may be addressed in the MOU between the State and FHWA governing the administration of the GARVEE bond program. The issuer should comply with the financing agreement (bond resolution or trust indenture) provisions that direct the application of excess bond proceeds.

In some cases, the MOU may list potential "substitute projects" in the event the original planned project or projects is delayed. The use of any substitute projects must be approved by the pertinent Division Office. In any case, Federal reimbursements to a State will always be based on the amount of bond proceeds used to fund eligible Federal-aid projects.

Interest earned on the investment of GARVEE bond proceeds is not treated as Federal funding. The State may use interest earnings (including interest earned on sinking funds) subject to the financing agreement provisions that typically govern the use of interest earnings associated with bond issuances.

The FHWA Division Office will conduct a periodic review of the State's GARVEE bond program. These reviews ensure that the program and projects are being administered in accordance with Federal requirements, ensure that only costs allocable to the Federal-aid highway program are charged to Federal-aid funds, and determine if certain processes can be improved in accordance with identified best practices. Appendix C contains a list of sample questions that may be included in a review program.

GARVEE-related financial management FAQs are located at: https://www.fhwa.dot.gov/ipd/finance/tools_programs/federal_debt_financing/garvees/faqs.aspx

The GARVEE database user guide is located on the SharePoint landing page for the database, https://usdot.sharepoint.com/teams/fhwa-CIFSInputTool/SitePages/Home.aspx *login required.

Purpose

The use of GARVEEs to finance surface transportation projects enables Federal reimbursement of certain costs incurred on a debt-financed project. The eligibility of these costs is authorized in 23 U.S.C 122, which also recognizes a debt service payment as a cost incurred for the purpose of Federal reimbursement. The FHWA developed this document as an appendix to the GARVEE Guidance to illustrate the calculation and presentation of certain financial information on GARVEE projects.

Illustrations

Three illustrations are portrayed: a major project funded by GARVEE bonds; a program of multiple projects funded by GARVEE bonds; and a project that is initiated as a pay-as-you-go project but converted to a GARVEE project during the first year of construction.

Illustration 1: GARVEE-Financed Major Project

For a major Federal-aid project with estimated construction costs of $500.0 million, the State will develop a financial plan pursuant to 23 U.S.C. 106(h). This illustration highlights elements of that plan for a project financed with GARVEE bonds.

Illustration 2: GARVEE-Financed Program of Projects

States often issue bonds that will finance multiple projects. This illustration describes a process for allocating the debt service costs among several Federal-aid projects and shows how the allocation is impacted by a cost overrun on one of the projects. This illustration also recognizes that bond proceeds may be used to finance both Federal-aid and non-Federal projects.

Illustration 3: Combination Pay-Go/GARVEE-Financed Project

This illustration focuses on a project that was initially authorized to be funded as a pay-as-you-go Federal-aid project but was revised during the first year of construction to be a GARVEE-financed project. This illustration describes the calculation of advance construction (AC) prior to and following the GARVEE issuance as well as the calculation of State and Federal shares with multiple sources of funds.

GARVEE Bond Issuances

While GARVEE projects may be financed with various types of debt instruments, they typically are financed with publicly-offered tax-exempt bonds. Therefore, each GARVEE illustration is presented as being financed with bonds. For the sake of simplicity, the bonds are assumed to be issued in September with debt service payments due in March and September of subsequent years, but the debt service payments are shown as a total annual amount.

Transaction costs (sometimes referred to as costs of issuance) in the illustrations are assumed to equal 2 percent of the bond issuance amount. Transaction costs are typically paid from the bond proceeds and reimbursed as part of the debt service payments along with interest costs. Interest costs in the illustrations are 3 percent per year.

Fiscal Management Information System (FMIS)

The FMIS identifies GARVEE projects by including the Improvement Type 45, "Debt Service." For the purposes of the illustrations, the costs shown in FMIS on the Debt Service line are referred to as "debt-related expenses" that include eligible bond-related costs other than the principal amount used to pay for construction costs. The only debt-related expenses identified in this document are transaction costs and interest costs. Also, note that for simplicity, the sample FMIS entries in this document show all other costs (not debt-related expenses) as "construction" costs although in reality these costs would likely include other activities such as preliminary engineering, right-of-way acquisition, etc.

Advance Construction (AC)

An important tool for GARVEE projects is the use of AC authority with partial conversions. The AC amount is the planned Federal share of the project costs that is not obligated.

Illustration Figures

The amounts shown in the figures represent end-of-year, annual amounts. The numbers are rounded to the nearest hundred thousand dollars, resulting, in some cases, in slight distortions to calculations such as Federal share.

ILLUSTRATION 1: GARVEE-FINANCED MAJOR PROJECT

Illustration Objectives

The following concepts are illustrated:

Project Description

The project is a bridge replacement on an Interstate Highway with eligible upfront capital costs, referred to simply as "construction costs," estimated at $500.0 million and with transaction costs of the GARVEE issuance equivalent to 2 percent of bond proceeds ($10.0 million). The project will be constructed over a four-year period using Federal National Highway Performance Program (NHPP) funds at a 90 percent Federal share.

Financing

The project is financed entirely with GARVEE bonds on a 10-year level debt service basis, with FHWA and the State contributing to each debt service payment on a 90/10 ratio. The bonds are issued in September of fiscal year (FY) 0 with debt service payments beginning in FY 1. The simplified sources and uses of funds for this GARVEE example are shown in Figure 1.

| GARVEE Sources and Uses of Funds (Dollars in Millions) |

|

|---|---|

| Sources | |

| Bond Proceeds | 510.0 |

| Uses | |

| Construction Costs | 500.0 |

| Transaction Costs | 10.0 |

| 510.0 | |

Major Project Financial Plan

The financial plan shows the estimated cost of the Federal-aid project as $510.0 million as shown in Figure 2.

| Annual Bond Proceeds Cash Flow (Dollars in Millions) |

|||||

|---|---|---|---|---|---|

| FY1 | FY2 | FY3 | FY4 | Total | |

| Sources | |||||

| Bond Proceeds | 60.0 | 200.0 | 200.0 | 50.0 | 510.0 |

| Uses | |||||

| Construction Costs | 50.0 | 200.0 | 200.0 | 50.0 | 500.0 |

| Transaction Costs | 10.0 | - | - | - | 10.0 |

| 60.0 | 200.0 | 200.0 | 50.0 | 510.0 | |

In this illustration, the financial plan includes a copy of the debt service schedule. Figure 3 shows the amount of Federal and State funds needed to pay debt service each year. Figure 3 also includes the amount of AC authorized at the end of each year (the unobligated or unconverted Federal share of project costs, discussed further below).

| Debt Service Schedule - State and Federal

Share; AC Amounts (Dollars in Millions) |

||||

|---|---|---|---|---|

| Fiscal Year | Annual Debt Service | State Funds 10% | Federal Funds 90% | Advance Construction |

| 0 | - | - | - | 538.0 |

| 1 | 59.8 | 6.0 | 53.8 | 484.2 |

| 2 | 59.8 | 6.0 | 53.8 | 430.4 |

| 3 | 59.8 | 6.0 | 53.8 | 376.6 |

| 4 | 59.8 | 6.0 | 53.8 | 322.8 |

| 5 | 59.8 | 6.0 | 53.8 | 269.0 |

| 6 | 59.8 | 6.0 | 53.8 | 215.2 |

| 7 | 59.8 | 6.0 | 53.8 | 161.4 |

| 8 | 59.8 | 6.0 | 53.8 | 107.6 |

| 9 | 59.8 | 6.0 | 53.8 | 53.8 |

| 10 | 59.8 | 6.0 | 53.8 | - |

| Total | 598.0 | 60.0 | 538.0 | |

Advance Construction

As shown in Figure 3, the initial amount of AC approved on the project is $538.0 million. This amount reflects the total nominal amount of the Federal share of GARVEE debt service costs over the life of the bonds, including payment of principal and interest. The AC amount is decreased each year as Federal funds are obligated and used to reimburse 90 percent of the annual debt service payments.

Fiscal Management Information System (FMIS) Entries

The 'Construction' line item in FMIS includes the actual construction costs of the project of $500.0 million and the 'Debt Service' line item includes the debt-related expenses (interest costs and transaction costs) of $98.0 million, the sum of these equaling the total amount of debt service payments as depicted in Figure 3.

Figure 4 shows the initial entry in FMIS with the 90 percent Federal share of the Construction costs ($450.0 million) and the 90 percent Federal share of the debt-related expenses ($88.0 million) authorized as AC.

| Initial FMIS Entry (Dollars in Millions) |

||||

|---|---|---|---|---|

| Total | Federal Funds | State Funds | Advance Construction | |

| Construction | 500.0 | - | 50.0 | 450.0 |

| Debt Service | 98.0 | - | 10.0 | 88.0 |

| Total | 598.0 | - | 60.0 | 538.0 |

Figure 5 shows that at the end of FY 1, the Federal share of the first debt service payment of $53.8 million is obligated by converting AC. The Debt Service line reflects the Federal share of debt-related expenses included in the debt service payment of $14.7 million. (Debt-related expenses were $15.3 million of interest cost and $1.0 million of transaction cost for a total of $16.3 million with the Federal share of $14.7 million. The interest cost will decline each year as shown in Figure 14-A of Illustration 2.) The remaining portion of the debt service payment is shown on the Construction line.

| FMIS Entry FY 1 (Dollars in Millions) |

||||

|---|---|---|---|---|

| Total | Federal Funds | State Funds | Advance Construction | |

| Construction | 500.0 | 39.1 | 50.0 | 410.9 |

| Debt Service | 98.0 | 14.7 | 10.0 | 73.3 |

| Total | 598.0 | 53.8 | 60.0 | 484.2 |

Statewide Transportation Improvement Program (STIP) Entries

Since the State has authority to issue GARVEE bonds, the proceeds of the bonds used to finance the Federal-aid project are "reasonably expected to be available" in accordance with STIP requirements and can, therefore, be included in the STIP as a funding source. The Federal funds needed to pay debt service should not exceed a reasonable percentage of the State's Federal-aid apportionments currently available in order to provide a reasonable expectation that sufficient Federal funds will be available to pay the Federal portion of the debt service over the life of the bonds. As shown in Figure 6, the STIP indicates that GARVEE bonds will finance project construction costs with $358.8 million ($322.8 million of Federal NHPP funds and $36.0 million of State funds) needed in the first six years (period covered by the STIP) to pay debt service costs. Beyond FY 6, Federal share costs are shown as AC amounts.

| STIP Entry (Dollars in Millions) |

||||

|---|---|---|---|---|

| Fiscal Year | Annual Debt Service | State Funds 10% |

Federal NHPP Funds 90% |

Beyond FY 6 Advance Construction |

| 1 | 59.8 | 6.0 | 53.8 | |

| 2 | 59.8 | 6.0 | 53.8 | |

| 3 | 59.8 | 6.0 | 53.8 | |

| 4 | 59.8 | 6.0 | 53.8 | |

| 5 | 59.8 | 6.0 | 53.8 | |

| 6 | 59.8 | 6.0 | 53.8 | |

| Total | 358.8 | 36.0 | 322.8 | 215.2 |

Eligible Costs

With the GARVEE designation, the direct project costs paid from the bond proceeds are not eligible costs for Federal participation. Instead, the debt service payments will be costs incurred for the purpose of Federal-aid reimbursement. It is customary for underwriting fees and other transaction costs to be paid with bond issue proceeds. As shown in this illustration, the debt service costs are eligible for reimbursement "as a cost incidental to construction" (23 U.S.C. 101(a)(4)) even though they exceed the physical construction costs (as shown in Figures 2 and 3, for example, the FY 1 eligible debt service costs are $59.8 million while physical construction costs total $50.0 million).

FHWA Approvals

While FHWA does not approve the terms of the bond issue, it does approve the project and the eligibility of the associated debt service payments for reimbursement with Federal-aid funds. Any action proposed by the State to obligate additional Federal funds on the project will need FHWA approval.

ILLUSTRATION 2: GARVEE-FINANCED PROGRAM OF PROJECTS

Illustration Objectives

The following concepts are illustrated:

Project Description

This illustration involves a program of three highway improvement projects including two Federal-aid projects and one non-Federal project. The total cost of the three projects is $100.0 million.

Financing

The Federal share of the Federal-aid projects is 80 percent, with matching funds provided by the State. The projects, including the non-Federal project, will be funded from the proceeds of a ten-year bond issue to be repaid with level debt service.

Construction Costs

Figure 7 shows the actual construction costs incurred for each project by year.

| Actual Costs Incurred (Dollars in Millions) |

||||

|---|---|---|---|---|

| Fiscal Year | Fed-Aid Project A | Fed-Aid Project B | State Project C | Total |

| 1 | 5.0 | 5.0 | - | 10.0 |

| 2 | 20.0 | 15.0 | 5.0 | 40.0 |

| 3 | 15.0 | 20.0 | 5.0 | 40.0 |

| 4 | - | 10.0 | - | 10.0 |

| Total | 40.0 | 50.0 | 10.0 | 100.0 |

Allocation of Debt Service Costs to Projects

The bonds are issued by the State in September of Fiscal Year (FY) 0 with construction beginning on Projects A and B in FY 1. Construction on Project C begins in FY 2. All project costs are paid from the bond proceeds. For reimbursement purposes, the costs incurred on the two Federal-aid GARVEE projects are the debt service costs of the bonds allocated to those projects. The bond proceeds are provided to projects on a first-come basis. The formula used to allocate the debt service costs to projects is shown in Figure 8.

Figure 8

Allocation Formula:

Debt service allocation for Project X in Year Y =

Cumulative total debt service through Year Y *

(Cumulative costs for Project X through Year Y ÷

Cumulative total costs for all projects through Year Y) -

Cumulative debt service allocated to Project X through Year Y-1

Debt service costs are only allocated to projects that have been authorized. As shown in Figure 9, in FY 1, the debt service costs are fully allocated only to Projects A and B based on the amount of bond proceeds applied to those projects (which equals construction costs in this case). Each year (beginning with FY 1) the total amount of debt service is allocated among all active/authorized projects such that the cumulative amount of debt service allocated to a project through that year corresponds to that project's share of cumulative costs actually incurred through that year.

Each year the debt service allocation is adjusted to reflect the cumulative utilization of bond proceeds among the projects up through that point in time. The annual allocations required to make the cumulative adjustments will depend on the expenditure patterns of the various projects. As shown in Figure 9, the allocation formula will result in the appropriate amount of debt service charged to each project over the term of the bonds.

| Debt Service Allocations by Project (Dollars in Millions) |

||||||

|---|---|---|---|---|---|---|

| Fiscal Year | Annual Debt Service | Fed-Aid Project A | Fed-Aid Project B | State Project C | Federal | State |

| 0 | - | - | - | - | - | - |

| 1 | 12.0 | 6.0 | 6.0 | - | 9.6 | 2.4 |

| 2 | 12.0 | 6.0 | 3.6 | 2.4 | 7.7 | 4.3 |

| 3 | 12.0 | 4.0 | 6.4 | 1.6 | 8.3 | 3.7 |

| 4 | 12.0 | 3.2 | 8.0 | 0.8 | 9.0 | 3.0 |

| 5 | 12.0 | 4.8 | 6.0 | 1.2 | 8.6 | 3.4 |

| 6 | 12.0 | 4.8 | 6.0 | 1.2 | 8.6 | 3.4 |

| 7 | 12.0 | 4.8 | 6.0 | 1.2 | 8.6 | 3.4 |

| 8 | 12.0 | 4.8 | 6.0 | 1.2 | 8.6 | 3.4 |

| 9 | 12.0 | 4.8 | 6.0 | 1.2 | 8.6 | 3.4 |

| 10 | 12.0 | 4.8 | 6.0 | 1.2 | 8.6 | 3.4 |

| Total | 120.0 | 48.0 | 60.0 | 12.0 | 86.2 | 33.8 |

Impact of a Cost Overrun

Figure 10 shows a cost overrun of $5 million in FY 3 on Project A, resulting in a revised allocation of debt service costs starting in FY 3, as shown in Figure 11. To accommodate the cost overrun on Project A, $5.0 million in bond proceeds originally to be allocated to Project B in FY 4 is reallocated to Project A. As a result, the amount of bond proceeds provided to Projects A and B to pay for construction costs is now equal at $45.0 million for each project. In order to complete Project B, the State must come up with $5.0 million of additional funding to supplement the bond proceeds.

| Actual Costs Incurred with Overrun on

Project A (Dollars in Millions) |

||||

|---|---|---|---|---|

| Fiscal Year | Fed-Aid Project A | Fed-Aid Project B | State Project C | Total |

| 1 | 5.0 | 5.0 | - | 10.0 |

| 2 | 20.0 | 15.0 | 5.0 | 40.0 |

| 3 | 20.0 | 20.0 | 5.0 | 45.0 |

| 4 | - | *10.0 | - | 10.0 |

| Total | 45.0 | 50.0 | 10.0 | 105.0 |

| * Funded with $5.0 million of GARVEE bond proceeds and $5.0 million of pay-go funding. | ||||

As a result of the bond proceeds reallocation discussed above, Project A and Project B receive an equal allocation of debt service of $54.0 million, as shown in Figure 11. The Federal share of the debt service remains the same as the original estimate (shown in Figure 9), with the 20 percent State share of Projects A and B plus the full cost of Project C equaling $33.8 million.

| Debt Service Allocations by Project

- Revised (Dollars in Millions) |

||||||

|---|---|---|---|---|---|---|

| Fiscal Year | Annual Debt Service | Fed-Aid Project A | Fed-Aid Project B | State Project C | Federal Share | State Share |

| 7 | 12.0 | 5.4 | 5.4 | 1.2 | 8.6 | 3.4 |

| 8 | 12.0 | 5.4 | 5.4 | 1.2 | 8.6 | 3.4 |

| 9 | 12.0 | 5.4 | 5.4 | 1.2 | 8.6 | 3.4 |

| 10 | 12.0 | 5.4 | 5.4 | 1.2 | 8.6 | 3.4 |

| Total | 120.0 | 54.0 | 54.0 | 12.0 | 86.2 | 33.8 |

As a result of the cost overrun on Project A, there will be insufficient bond proceeds to complete Project B (since Projects A and C are completed with the bond proceeds in FY 3), requiring an additional $4.0 million of Federal and $1.0 million of State funds to complete Project B in FY 4 (this assumes the State will claim Federal funds for these additional costs). These funds are used to pay for construction costs incurred in FY 4 with Federal reimbursements occurring in FY 4. The total Federal share for Project A and Project B, therefore, equals $90.2 million, as shown in Figure 12.

| Total Federal Spending with Overrun on Project A (Dollars in Millions) |

||

|---|---|---|

| Year | Project A / B Debt Service | Project B Pay-Go |

| 0 | - | - |

| 1 | 9.6 | - |

| 2 | 7.7 | - |

| 3 | 8.5 | - |

| 4 | 8.8 | 4.0 |

| 5 | 8.6 | - |

| 6 | 8.6 | - |

| 7 | 8.6 | - |

| 8 | 8.6 | - |

| 9 | 8.6 | - |

| 10 | 8.6 | - |

| Total | 86.2 | 4.0 |

The construction costs of the three projects originally total $100.0 million. The debt-related expenses of $20.0 million are allocated among the projects based on the amount of bond proceeds provided to each of the projects. The overrun on Project A results in a change to the allocation of debt service costs and, therefore, the debt-related expenses as shown in Figure 13. The debt-related expenses for Project A and Project B will be reflected in FMIS on the Debt Service line.

| Allocation of Debt-Related Expenses (Dollars in Millions) |

||||||

|---|---|---|---|---|---|---|

| Project A | Project B | Project C | ||||

| Costs | Allocation | Costs | Allocation | Costs | Allocation | |

| Initial | 40.0 | 8.0 | 50.0 | 10.0 | 10.0 | 2.0 |

| Revised | 45.0 | 9.0 | 45.0 | 9.0 | 10.0 | 2.0 |

Figure 14-A below shows the breakdown each year of the debt service payments ($12.0 million annually as shown in Figure 11) between the amounts of bond proceeds provided to the projects for construction costs (totaling $100.0 million) and the debt-related expenses (totaling $20.0 million and comprised of $18.0 million of interest cost and $2.0 million of transaction cost). The allocation between construction and debt-related expenses is proportional to the amount of debt service associated with principal (less transaction costs) and interest/transaction expense, and reflects the fact that interest costs decline each year under the assumed level debt service structure (interest expense in FY 1 is $3.1 million and declines annually to $0.3 million in FY 10 with added transaction costs of $0.2 million each year). The Federal share amounts shown in Figure 14-B (80 percent of the total cost amounts shown in Figure 14-A) are the amounts obligated each year in FMIS. As the interest costs decline each year, the amount of debt-related expenses obligated in FMIS on the Debt Service line would also decline.

| Total Debt Service (Dollars in Millions) |

|||||||

|---|---|---|---|---|---|---|---|

| Year | Project A | Project B | Project C | Total | |||

| Construction | Debt-Related Expenses | Construction | Debt-Related Expenses | Construction | Debt-Related Expenses | ||

| 0 | - | - | - | - | - | - | - |

| 1 | 4.4 | 1.6 | 4.4 | 1.6 | - | - | 12.0 |

| 2 | 4.5 | 1.5 | 2.7 | 0.9 | 1.8 | 0.6 | 12.0 |

| 3 | 3.9 | 1.2 | 4.2 | 1.3 | 1.1 | 0.3 | 12.0 |

| 4 | 3.6 | 0.9 | 5.1 | 1.4 | 0.8 | 0.2 | 12.0 |

| 5 | 4.4 | 1.0 | 4.4 | 1.0 | 1.0 | 0.2 | 12.0 |

| 6 | 4.6 | 0.8 | 4.6 | 0.8 | 1.0 | 0.2 | 12.0 |

| 7 | 4.7 | 0.7 | 4.7 | 0.7 | 1.0 | 0.2 | 12.0 |

| 8 | 4.8 | 0.6 | 4.8 | 0.6 | 1.1 | 0.1 | 12.0 |

| 9 | 5.0 | 0.4 | 5.0 | 0.4 | 1.1 | 0.1 | 12.0 |

| 10 | 5.1 | 0.3 | 5.1 | 0.3 | 1.1 | 0.1 | 12.0 |

| Total | 45.0 | 9.0 | 45.0 | 9.0 | 10.0 | 2.0 | 120.0 |

| Federal Debt Service (Dollars in Millions) |

|||||

|---|---|---|---|---|---|

| Year | Project A | Project B | Total | ||

| Construction | Debt-Related Expenses | Construction | Debt-Related Expenses | ||

| 0 | - | - | - | - | - |

| 1 | 3.5 | 1.3 | 3.5 | 1.3 | 9.6 |

| 2 | 3.6 | 1.2 | 2.2 | 0.7 | 7.7 |

| 3 | 3.1 | 1.0 | 3.3 | 1.1 | 8.5 |

| 4 | 2.9 | 0.7 | 4.1 | 1.1 | 8.8 |

| 5 | 3.5 | 0.8 | 3.5 | 0.8 | 8.6 |

| 6 | 3.7 | 0.6 | 3.7 | 0.6 | 8.6 |

| 7 | 3.8 | 0.5 | 3.8 | 0.5 | 8.6 |

| 8 | 3.8 | 0.5 | 3.8 | 0.5 | 8.6 |

| 9 | 4.0 | 0.3 | 4.0 | 0.3 | 8.6 |

| 10 | 4.1 | 0.2 | 4.1 | 0.2 | 8.6 |

| Total | 36.0 | 7.1 | 36.0 | 7.1 | 86.2 |

Fiscal Management Information System (FMIS) Entries

Figure 15 shows the FMIS entries for the first four years. The initial FMIS entry shows each project authorized as AC with no Federal funds obligated. In FY 1, the first year debt service is paid and split between the two Federal-aid projects, AC is reduced by the amount of Federal funds obligated. In FY 2, State Project C is authorized and the debt service is allocated to the three projects. In FY 3, Project A incurs an overrun of $5.0 million which changes the construction cost for the project, and the debt-related expenses are reallocated among the projects. In FY 4, the bond proceeds are exhausted and Project B obligates an additional $4.0 million (80 percent share of $5.0 million) of Federal funds to cover remaining costs.

The amounts obligated each year under the Federal funds column for Construction and Debt Service (debt-related expenses) are derived from Figure 14-B. In each year, the amount of AC at the end of the year represents the unobligated balance of the estimated Federal share.

| FMIS Entries (Dollars in Millions) |

||||||||

|---|---|---|---|---|---|---|---|---|

| Project A | Project B | |||||||

| Total | Federal Funds | State Funds | Advance Construction | Total | Federal Funds | State Funds | Advance Construction | |

| Initial FMIS Entry in FY 0 | ||||||||

| Construction | 40.0 | - | 8.0 | 32.0 | 50.0 | - | 10.0 | 40.0 |

| Debt Service | 8.0 | - | 1.6 | 6.4 | 10.0 | - | 2.0 | 8.0 |

| Total | 48.0 | 9.6 | 38.4 | 60.0 | 12.0 | 48.0 | ||

| Revised Entry in FY 1 | ||||||||

| Construction | 40.0 | 3.5 | 8.0 | 28.5 | 50.0 | 3.5 | 10.0 | 36.5 |

| Debt Service | 8.0 | 1.3 | 1.6 | 5.1 | 10.0 | 1.3 | 2.0 | 6.7 |

| Total | 48.0 | 4.8 | 9.6 | 33.6 | 60.0 | 4.8 | 12.0 | 43.2 |

| Revised Entry in FY 2 | ||||||||

| Construction | 40.0 | 7.1 | 8.0 | 24.9 | 50.0 | 5.7 | 10.0 | 34.3 |

| Debt Service | 8.0 | 2.5 | 1.6 | 3.9 | 10.0 | 2.0 | 2.0 | 6.0 |

| Total | 48.0 | 9.6 | 9.6 | 28.8 | 60.0 | 7.7 | 12.0 | 40.3 |

| Revised Entry in FY 3 | ||||||||

| Construction | *45.0 | 10.2 | 9.0 | 25.8 | 50.0 | 9.0 | 10.0 | 31.0 |

| Debt Service | **9.0 | 3.5 | 1.9 | 3.6 | 9.0 | 3.1 | 1.9 | 4.0 |

| Total | 54.0 | 13.7 | 10.9 | 29.4 | 59.0 | 12.1 | 11.9 | 35.0 |

| Revised Entry in FY 4 | ||||||||

| Construction | 45.0 | 13.1 | 9.0 | 22.9 | 50.0 | ***17.1 | 10.0 | 22.9 |

| Debt Service | 9.0 | 4.2 | 1.9 | 2.9 | 9.0 | 4.2 | 1.9 | 2.9 |

| Total | 54.0 | 17.3 | 10.9 | 25.8 | 59.0 | 21.3 | 11.9 | 25.8 |

| *$5.0 million cost overrun on Project A revises construction costs **Debt service allocation is increased on Project A and decreased on Project B ***$4.0 million of Federal funds obligated on Project B to supplement bond proceeds |

||||||||

For Project A, the Federal share was initially $38.4 million, which is the total amount of Federal Funds and AC in FY 1 and FY 2. In FY 3, the $5.0 million overrun resulted in a $1.0 million increase in debt-related expenses for a total revised cost of $54.0 million. The Federal share increased to $43.1 million ($36.0 million for Construction and $7.1 million for Debt Service) which is shown in the revised total of Federal Funds and AC for FY 3 and FY 4.

For Project B, the Federal share was initially $48.0 million which is the total amount of Federal Funds and AC in FY 1 and FY 2. In FY 3, the total cost of the project was reduced to $59.0 million as a result of the reallocation of debt-related expenses. The Federal share decreased to $47.1 million ($40.0 million for Construction and $7.1 million for Debt Service) which is shown in the revised total of Federal Funds and AC for FY3 and FY 4. The Federal Funds for Construction costs increased by $4.0 million in FY 4 when the additional amount was obligated to pay for current year construction costs.

ILLUSTRATION 3: COMBINATION PAY-GO/GARVEE-FINANCED PROJECT

Illustration Objectives

The following concepts are illustrated:

Initial Project Description and Funding Plan

The project involves a highway safety improvement with construction costs estimated at $50.0 million. Initially, the project was to be constructed over a three-year period and was intended to be funded with State and Federal Surface Transportation Program (STP) funds at an 80 percent Federal share on a pay-as-you-go basis as shown in Figure 16.

| Construction Costs and Sources of Funds (Dollars in Millions) |

||||||

|---|---|---|---|---|---|---|

| Fiscal Year | Uses of Funds | Sources of Funds | ||||

| Initial Plan | Revised Plan | |||||

| Construction Costs | State Funds | Federal STP Funds | State Funds | Federal STP Funds | GARVEE Proceeds | |

| 1 | 10.0 | 2.0 | 8.0 | 2.0 | 8.0 | |

| 2 | 20.0 | 4.0 | 16.0 | 9.2 | 0.8 | 10.0 |

| 3 | 20.0 | 4.0 | 16.0 | 20.0 | ||

| Total | 50.0 | 10.0 | 40.0 | 11.2 | 8.8 | 30.0 |

Revised Funding Plan

During the first year of construction, the State decided to use GARVEE bond proceeds to complete the project. This instance, as all instances, of tapered match should be submitted to FHWA for prior approval. As shown in Figure 16, State and Federal STP funds are used to pay for actual construction costs of $20.0 million during the first two years of the project. GARVEE bond proceeds then are used to finance the remaining $30.0 million of project costs in the second and third years. The State contributes its required 20 percent match upfront during construction so that 100 percent of the debt service of the GARVEE bonds, which are issued in September of FY 1, can be paid with Federal Highway Safety Improvement Program (HSIP) funds (the FHWA Division Office should coordinate the upfront match proposal with the CIFS and the CFO's Office of Financial and Management Programs). This revised funding plan requires additional State funds in FY 2 to satisfy the 20 percent match requirement of the increased total project cost of $56.0 million ($20.0 million of construction costs covered with pay-as-you-go funding in FY 1-2 and $36.0 million of debt service costs associated with the $30.0 million of GARVEE bond proceeds used to fund construction costs in FY 2-3). Thus, the total State funding contribution increases from $10.0 million to $11.2 million.

GARVEE Bonds Debt Service

GARVEE bonds are issued in September of FY 1 with debt service payments beginning in FY 2. As shown in Figure 17, the additional cost associated with the $30.0 million bond issuance (debt-related expenses) is $6.0 million. This includes transaction costs of $0.6 million and interest costs of $5.4 million. The bonds are issued for a ten-year term with level debt service of $3.6 million per year.

| Project Costs by Source of Funds and

Advance Construction (Dollars in Millions) |

|||||

|---|---|---|---|---|---|

| Year | State Funds | Federal Funds | |||

| STP (Pay-GO) | HSIP (Debt Service) | Total | Advance Construction | ||

| 0 | - | - | - | - | *40.0 |

| 1 | 2.0 | 8.0 | - | 8.0 | **36.8 |

| 2 | 9.2 | 0.8 | 3.6 | 4.4 | 32.4 |

| 3 | - | - | 3.6 | 3.6 | 28.8 |

| 4 | - | - | 3.6 | 3.6 | 25.2 |

| 5 | - | - | 3.6 | 3.6 | 21.6 |

| 6 | - | - | 3.6 | 3.6 | 18.0 |

| 7 | - | - | 3.6 | 3.6 | 14.4 |

| 8 | - | - | 3.6 | 3.6 | 10.8 |

| 9 | - | - | 3.6 | 3.6 | 7.2 |

| 10 | - | - | 3.6 | 3.6 | 3.6 |

| 11 | - | - | 3.6 | 3.6 | - |

| Total | 11.2 | 8.8 | 36.0 | 44.8 | |

| * Reflects the Federal share amount of $40.0

million prior to issuance of GARVEEs **Reflects additional Federal share amount of $4.8 million ($44.8 million) less $8.0 million obligation |

|||||

Advance Construction (AC)

The initial amount of AC approved on the project is $40.0 million, reflecting the 80 percent Federal share of the $50.0 million project. When the GARVEE bonds are issued at the end of FY 1, the project costs are revised to $56.0 million, revising the Federal share to $44.8 million. Figure 17 shows the AC amount at the end of each year as Federal funds are obligated to pay for construction costs in FY 1-2 and debt service costs in FY 2-11.

The amount of AC in FY 1 is reduced by the obligation of $8.0 million of STP funds and increased by the $4.8 million Federal share of $6.0 million in debt-related expenses associated with the GARVEE bonds. In FY 2, AC is decreased by the obligation of $0.8 million of STP funds and $3.6 million of HSIP funds for the payment of debt service.

Fiscal Management Information System (FMIS) Entries

The initial FMIS entry as shown in Figure 18 reflects the pay-as-you-go project authorized as AC. At this point, the State anticipates using STP funds for 80 percent of the construction costs.

| Initial FMIS Entry in FY 0 (Dollars in Millions) | ||||

|---|---|---|---|---|

| Total | Federal Funds | State Funds | Advance Construction | |

| Construction-STP | 50.0 | - | 10.0 | 40.0 |

| Total | 50.0 | - | 10.0 | 40.0 |

As shown in Figure 19, FMIS is modified in FY 1 to reflect the issuance of GARVEE bonds at the end of the fiscal year and the State's decision to pay 100 percent of debt service with Federal HSIP funds. Two line items are added to FMIS showing the State's intent to use HSIP funds to pay debt service. The breakdown of total debt service payments is $30.0 million to pay construction costs and $6.0 million for debt-related expenses.

| Revised FMIS Entry in FY 1 (Dollars in Millions) | ||||

|---|---|---|---|---|

| Total | Federal Funds | State Funds | Advance Construction | |

| Construction-STP | 20.0 | 8.0 | 11.2 | 0.8 |

| Construction-HSIP | 30.0 | - | - | 30.0 |

| Debt Service-HSIP | 6.0 | - | - | 6.0 |

| Total | 56.0 | 8.0 | 11.2 | 36.8 |

As shown in Figure 20 below, FMIS is modified in FY 2 to reflect the obligation of $8.8 million of STP funds and $3.6 million of HSIP funds. The STP funds were reduced to $8.8 million to allow the State to provide its full share of $11.2 million (20 percent of $56.0 million total cost). HSIP funds are used to pay 100 percent of the first debt service payment of $3.6 million, with $2.6 million allocated to Construction and $1.0 million to Debt Service (reflecting proportional amounts of debt service costs associated with principal repayment, less transaction costs, and interest/transaction expense). The $1.0 million of debt-related expenses includes the first-year interest costs of $0.94 million and transaction costs of $0.06 million. The interest costs will decline each year as was shown in Figure 14-A for Illustration 2.

| Revised FMIS Entry in FY 2 (Dollars in Millions) | ||||

|---|---|---|---|---|

| Total | Federal Funds | State Funds | Advance Construction | |

| Construction-STP | 20.0 | 8.8 | 11.2 | - |

| Construction-HSIP | 30.0 | 2.6 | - | 27.4 |

| Debt Service | 6.0 | 1.0 | - | 5.0 |

| Total | 56.0 | 12.4 | 11.2 | 32.4 |

TEMPLATE INSTRUCTIONS

The State DOT and the FHWA Division Office should execute a GARVEE Memorandum of Understanding (MOU) to document how the GARVEE program in that State will be administered as facilitating effective internal control consistent with 2 CFR 200.303. The MOU may conform to the format provided in this template, recognizing that the MOU details will be modified to conform to the particular circumstances of the State's program. This template identifies some items likely to be modified by inserting them within [brackets]. Any provisions not applicable to the State's GARVEE program may be removed while other information deemed pertinent for a clear understanding of the State's GARVEE program may be added. 13 The MOU is intended to facilitate State implementation and FHWA oversight of the GARVEE program.

Another best practice is to use a single MOU covering the State GARVEE program's general policies, procedures, and requirements. This single MOU should be amended, as necessary, to reflect additional GARVEE issuances and adjustments to the State's GARVEE program. While the key GARVEE program administration provisions of the MOU are intended to remain largely unchanged over time, brief supplemental appendices should be attached to the MOU for each GARVEE bond issuance indicating (at a minimum) the specific projects approved by FHWA for Federal debt service cost reimbursements under title 23 U.S.C., section 122. Other, more detailed, project-related data may be tracked by other means (apart from the MOU as appended) as agreed upon by the State and the FHWA Division Office. The State and FHWA Division Office should periodically review the MOU to determine if revisions are needed.

Memorandum of Understanding

This Memorandum of Understanding (MOU) is entered into between the Federal Highway Administration [State name] Division (FHWA) and the [State name] (the State) (collectively, the Parties) on [date]. [This MOU supersedes the MOU executed on (date)].

The State intends to finance the construction of certain Federal-aid projects or a single Federal-aid project (the Projects or Project) through the sale of one or more series of Grant Anticipation Revenue Vehicle (GARVEE) Bonds (the Bonds). The purpose of this MOU is to document the procedures for managing the Bonds and their proceeds to be used for the purpose of financing all or a portion of the costs of transportation projects eligible for Federal-aid assistance under title 23 of the United States Code (23 U.S.C.).

The Bonds will be issued by [entity authorized to issue bonds]. The State [DOT office] will have primary responsibility for ensuring compliance with this MOU.

The Federal legal authority enabling reimbursement of eligible debt service, issuance, and certain other bond-related costs is set forth in 23 U.S.C. 122. The State legal authority supporting the issuance of the Bonds is provided in [insert statutory reference].

General Provisions

The Projects to be financed from the Bond proceeds are identified in Attachment A. The State may revise the Projects by submitting a revised Attachment A to FHWA.

Subject to available funding and obligation authority, FHWA will participate in the payment of debt-related costs associated with the Projects under the following conditions:

The State will provide a final Debt Service Schedule at the close of any new Bond series. The schedule must fully allocate the debt obligations (principal, interest, cost of issuance, and other eligible costs) by project (Project Allocations) and show the final maturity date for the respective series of bonds. FHWA will withhold approval and payment of debt service until the final debt service schedule is submitted and accepted. Attachment B provides the Debt Service Schedules and Project Allocations for all of the State's GARVEE bonds.

The Project Allocations, as may be amended from time to time, will serve as the ceilings on the amounts that may be billed against the Projects for payment of debt obligations.

The final maturity dates on the project allocation schedules will be the final dates by which any debt obligations may be reimbursed by FHWA for a project and may not be extended unless the State issues additional bonds with a new final maturity date to finance additional eligible project costs that have not been previously funded.

The Project Allocations may be amended by the State to adjust for overruns or shortages in projects based on actual expenditures as well as for the purpose of substituting or adding Federally-eligible projects. The State will submit any Project Allocation amendment to FHWA for approval.

The State acknowledges that the eligibility of a GARVEE Bond issuance for Federal-aid reimbursement shall not constitute a commitment, guarantee, or obligation on the part of the United States to provide for payment of principal or interest on the Bonds, nor create a right of a third party against the United States for payment of the Bonds. This statement will be included in any Bond official offering document relating to GARVEE Bond issuance.

Additional Bonds / Refunding Bonds

Prior to the issuance of additional Bonds, including Bonds used to refund outstanding Bonds, the State and FHWA will amend all necessary attachments to this MOU with Debt Service Schedules and Project Allocations (Attachment B) as may be needed to reflect any such additional Bonds.

Prior to the sale of refunding Bonds, the State will certify and demonstrate to FHWA that (i) there are debt service cost savings on a net present value basis or (ii) the aggregate nominal debt service costs scheduled to be reimbursed with Federal funds are reduced.

[If the State seeks to refund GARVEE Bonds to restructure debt service or change bond covenants, or for another purpose, and the refunding will not generate positive net present value savings, the FHWA Division Office will consult with the CIFS to ensure that the State has sufficiently demonstrated and properly documented its need to increase the amount of Federal funding in the GARVEE project(s) prior to issuance of the refunding bonds. The MOU will be modified to address this situation.]

The State will obtain FHWA approval prior to issuing any GARVEE refunding Bond and will modify the relevant project agreement(s) to reflect the revised project cost and Federal share based on the revised debt service payment schedule. Following the issuance of a GARVEE refunding Bond for any purpose, the State will promptly submit to FHWA a Federal-aid project agreement modification for each project along with a new debt service payment schedule and updated project allocation, as an amended Attachment B to this MOU, to ensure the continued eligibility of Federal reimbursements of bond costs.

Bonds Issued by Local Governments

[If GARVEE Bonds are issued by a local entity, the State agrees to execute an agreement with the local entity that sets forth the State and local responsibilities for administering the project(s) to ensure compliance with Federal requirements relating to GARVEE projects. The State is responsible as the recipient of Federal-aid highway funds for ensuring that any projects assisted through the local program are carried out in accordance with Federal requirements as provided by 23 U.S.C. 302, 23 CFR 1.3 and 2 CFR 200.331.

General Provisions

The Projects will be administered in accordance with the laws, regulations, and procedures applying to Federally-assisted projects.

The Federal-aid project agreement(s) will include a statement that the Project authorization is requested under the provisions of 23 U.S.C 115 and 122.

The State will enter the Projects in the Fiscal Management Information System (FMIS) in accordance with normal FMIS procedures provided that the additional costs associated with the Bonds (interest, issuance, and other bond related costs) will be entered as Improvement Type 45, "Debt Service." The Projects entered in FMIS should reconcile with the Projects listed in Attachment A.

The Projects will be authorized using Federal advance construction (AC) procedures and the State's current Federal-aid authorization process. The use of AC procedures as permitted by 23 U.S.C. 115 will preserve eligibility for the Projects without providing a commitment, guarantee, or obligation on the part of the United States, acting by and through the FHWA to provide for payment of project costs. The AC amount for each project will reflect the unobligated Federal share of the project including the project's estimated share of additional costs associated with the Bonds that have been issued.

Project Accounting

The State will maintain a system that accurately allocates eligible debt service payments, issuance costs, and other bond-related costs back to the Projects. This process is described in Attachment B.

The State affirms that procedures and expenditure controls are in place to ensure that all construction and Bond-related costs are eligible for Federal-aid funding.

Any interest earned from deposited bond proceeds will be used on projects eligible under title 23.

Billing and Reimbursement