« Back to Innovative Finance Quarterly Issues List

On September 12, U.S. Transportation Secretary Normal Y. Mineta joined state and local officials at a groundbreaking ceremony for the southernmost segment of the SR 125 South toll road project in San Diego, CA. SR 125 South was made possible in part by a $140 million loan provided under the Transportation Infrastructure Finance and Innovation Act (TIFIA) Federal credit program. The project is the first supported by TIFIA to be advanced with private bank debt and substantial private sector equity.

"In addition to its other benefits, this project demonstrates how our innovative Federal financing tools can attract private investment to critical transportation projects," Secretary Mineta said. "TIFIA has provided an alternative to grants as a way of doing business, allowing private partners to share with the government the risk and rewards of infrastructure investment, thereby providing transportation, creating jobs, and contributing to economic growth."

SR 125 South is a privately developed, 9.2-mile toll road advanced under California's pioneering AB 680 toll road demonstration program, enacted in 1989. The project is being designed and constructed through a public-private partnership between the California Department of Transportation (Caltrans) and California Transportation Ventures (CTV), a wholly owned subsidiary of Macquarie Infrastructure Group (MIG). Through CTV, MIG is contributing more than $150 million in private at-risk equity. Additionally, four major local real estate developers are donating $48 million of land for right-of-way. In total, private equity and financing account for 78 percent of the project's costs. To connect the roll road to the local highway network, the San Diego Association of Governments (SANDAG) is providing $139 million for northern segments of SR 125.

The TIFIA loan is an essential element of the project's financial plan, providing junior-lien debt with minimum repayments during the project's ramp-up period. Through this structure, TIFIA enhances the credit quality of the senior bank financing, consistent with the program's objective to improve transportation project access to capital markets. The SR South Toll Road project is a model for the future, demonstrating how innovative approaches can help meet today's transportation challenges.

Contact: Suzanne Sale, TIFIA JPO, 602/379-4014, Suzanne.Sale@fhwa.dot.gov

Contact: Suzanne Sale, TIFIA JPO, 602/379-4014, Suzanne.Sale@fhwa.dot.gov

[Top of Article, In This Issue...]

The success of the Florida SIB can be measured in large part by the award to date of $500 million in loans that have leveraged over $3 billion in total project costs. Because of this success, however, the SIB has outgrown its capacity as a "pay-as-you-go" program to meet the needs demonstrated in solid project proposals that exceed available funds.

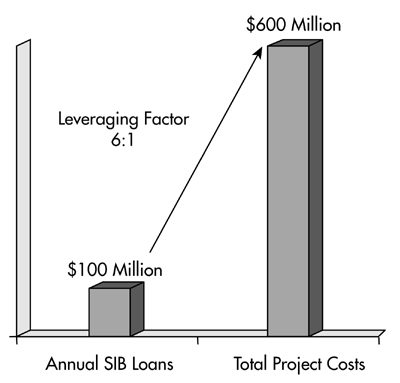

Senate Bill 24A was introduced during the 2003 legislative session to help address these needs. In the bill, the Florida Department of Transportation (FDOT) proposed leveraging the existing state-funded SIB loan portfolio through borrowing in the tax-exempt public bond market. Models developed by FDOT demonstrated that a conservative approach could generate the ability to loan at least $100 million per year through a leveraged SIB beginning no later than July 2003. Assuming a conservative leveraging level of $6 for every $1 of SIB loan proceeds, this approach would leverage/advance about $600 million of project costs each year.

Governor Bush signed Senate Bill 24A, passed as part of the 2003A Special Legislative Session, on June 27, 2003. The bill authorizes FDOT to leverage the existing state SIB loan portfolio repayment stream, through the issuance of revenue bonds to provide a recurring source of loan funds. It also requires that projects selected for SIB loans must become part of FDOT's five-year work program beginning with projects selected for the 2003/2004 program year.

Florida's leveraged SIB incorporates the following key features:

The existing SIB program provides loans at a subsidized interest rate compared to market rates. The SIB funds the subsidy from available capitalized funds. This would continue in a leveraged SIB program. The increased costs would likely include:

FDOT is working with the State of Florida, Division of Bond Finance to prepare a Request for Proposals for solicitations to participate in the financing of the leveraged SIB. Additionally, FDOT currently is accepting loan applications for the 2003/2004 and 2004/2005 fiscal years in anticipation of leveraging the existing loan portfolio. These loans will be awarded in November 2003 and will be contingent on the sale of bonds to provide leveraged proceeds for lending purposes. Beginning with the 2005/2006 work program cycle the leveraged SIB will advertise annually for projects to be included in the work program development cycle.

Additional information on the Florida SIB, activities regarding the leveraging of this program, or contact information is available at: http://www.dot.state.fl.us/financialplanning/finance/sib.shtm

Contact: Gene Branigan, FDOT, 850/414-4421, gene.branigan@dot.state.fl.us or

Contact: Gene Branigan, FDOT, 850/414-4421, gene.branigan@dot.state.fl.us or

Annette Dann, FDOT, 850/441-5528, annette.dann@dot.state.fl.us

New SIB loan agreements over the past quarter are nearing a milestone. As shown in the table below, 32 states have entered into 347 loan agreements with a dollar value of nearly $4.5 billion as of June 30, 2003.

| State | Number of Agreements | Loan Agreement Amount ($000) | Disbursements to Date ($000) |

|---|---|---|---|

| Alaska | 1 | $ 2,737 | $ 2,737 |

| Arizona | 43 | 436,000 | 352,880 |

| Arkansas | 1 | 31 | 31 |

| Colorado | 8 | 5,890 | 5,890 |

| Delaware | 1 | 6,000 | 6,000 |

| Florida | 37 | 515,600 | 244,212 |

| Indiana | 2 | 6,000 | 5,715 |

| Iowa | 2 | 2,874 | 2,874 |

| Maine | 23 | 1,758 | 1,635 |

| Michigan | 23 | 17,034 | 13,033 |

| Minnesota | 15 | 95,719 | 77,000 |

| Missouri | 13 | 92,057 | 72,853 |

| Nebraska | 1 | 3,360 | 3,360 |

| New Mexico | 2 | 14,133 | 14,133 |

| New York | 5 | 15,450 | 12,000 |

| North Carolina | 2 | 1,713 | 1,713 |

| North Dakota | 2 | 3,565 | 1,565 |

| Ohio | 47 | 196,370 | 140,989 |

| Oregon | 14 | 19,221 | 18,321 |

| Pennsylvania | 34 | 24,252 | 21,265 |

| Puerto Rico | 1 | 15,000 | 15,000 |

| Rhode Island | 1 | 1,311 | 1,311 |

| South Carolina | 6 | 2,643,000 | 1,545,693 |

| South Dakota | 1 | 11,740 | 11,740 |

| Tennessee | 1 | 1,875 | 1,875 |

| Texas | 41 | 252,191 | 244,192 |

| Utah | 1 | 2,888 | 2,888 |

| Vermont | 4 | 1,049 | 1,016 |

| Virginia | 1 | 18,000 | 12,739 |

| Washington | 3 | 2,375 | 442 |

| Wisconsin | 3 | 1,814 | 1,814 |

| Wyoming | 8 | 77,977 | 42,441 |

| TOTAL | 347 | $4,488,984 | $2,879,357 |

Florida continues to set the pace for SIB innovations. As reported in the winter 2003 issue of IFQ, the Florida Department of Transportation (FDOT) has established a state-funded SIB, expanded eligibility for a broader range of projects, and provided flexible loan options for its borrowers. This issue of IFQ highlights FDOT's most recent achievement: legislative approval to leverage its SIB, thus gaining even more financing capacity to advance needed transportation projects throughout the state.

Contact: Phyllis Jones, FHWA, 202/366- 2854, phyllis.jones@fhwa.dot.gov

Contact: Phyllis Jones, FHWA, 202/366- 2854, phyllis.jones@fhwa.dot.gov

[Top of Article, In This Issue...]

Letters of Interest and applications for Federal credit assistance under TIFIA are currently being accepted for FY 2004, pending Congressional action on the re-authorization of the Transportation Efficiency Act for the 21st Century (TEA-21). The TIFIA program expires along with TEA-21 on September 30, 2003. However, there is every indication that any short-term extension to TEA-21 will include partial-year funding for the TIFIA program tied to the length of the extension. Therefore the TIFIA program is still very much in business and is anticipated to continue throughout the authorization of the new transportation bill. The Administration's Safe, Accountable, Flexible and Efficient Transportation Equity Act (SAFETEA) proposal includes $2.6 billion in TIFIA credit assistance for FY 2004.

To date the TIFIA program has received six Letters of Interest in FY 2003 from projects seeking funding for transportation infrastructure projects throughout the country, as described below:

| Project | Project Type | Project Cost | Instrument Type | Credit Amount | Credit Rating: Senior Debt Obligations |

Credit Rating: TIFIA Loan |

Primary Revenue Pledge |

Current Status | Federal Budget Score: % of Credit Amount |

Federal Budget Score: Capital Reserve |

|---|---|---|---|---|---|---|---|---|---|---|

| Miami Intermodal Center | Intermodal | $1,349 | Direct Loan | $269.076 | A- | A- | Tax Revenues | Agreement | 0.39% | $1.049 |

| Miami Intermodal Center | -- | -- | Direct Loan | 163.676 | -- | -- | User Charges | Term Sheet | 4.77% | $7.807 |

| SR 125 Toll Road |

Hwy/Bridge | $642 | Direct Loan | 140.000 | BBB- | BB+ | User Charges | Agreement | 7.10% | $9.940 |

| Farley Penn Station | Passenger Rail | $800 | Direct Loan | 140.000 | -- | -- | Other | Term Sheet | 12.51% | $17.514 |

| Farley Penn Station | -- | -- | Line of Credit | 20.000 | -- | -- | Other | Term Sheet | 11.84% | $2.368 |

| Washington Metro CIP | Transit | $2,324 | Guarantee | 600.000 | A- | BBB | Other | Agreement | 1.99% | $11.940 |

| Tren Urbano (Puerto Rico) | Transit | $1,676 | Direct Loan | 300.000 | BBB+ | BBB- | Tax Revenues | Paid in Full | 2.59% | $7.770 |

| Cooper River Bridge | Hwy/Bridge | $668 | Direct Loan | 215.000 | BBB- | BBB- | Other | Agreement | 2.76% | $5.934 |

| Staten Island Ferries | Transit | $482 | Direct Loan | 159.068 | A+ | A+ | Other | Agreement | 0.19% | $0.302 |

| Central Texas Turnpike | Hwy/Bridge | $3,700 | Direct Loan | 916.760 | BBB+ | BB | User Charges | Agreement | 11.26% | $103.227 |

| Reno Rail Corridor | Intermodal | $280 | Direct Loan | 50.500 | BBB | BB | Room and Sales Tax | Agreement | 7.25% | $3.661 |

| Reno Rail Corridor | -- | -- | Direct Loan | 5.000 | -- | -- | Lease Income | Term Sheet | 14.31% | $0.716 |

| Reno Rail Corridor | -- | -- | Direct Loan | 18.000 | -- | -- | Assessment District Revenues | Term Sheet | 1.34% | $0.241 |

| San Francisco Oakland Bay Bridge | Hwy/Bridge | $3,305 | Direct Loan | 450.000 | -- | -- | Toll Surcharge | Term Sheet | 0.29% | $1.305 |

| Warwick Train Station | Intermodal | $216 | Direct Loan | 58.000 | -- | -- | User Charges | Selection | 10.26% | $5.951 |

| Total Dollars | -- | $15,442 | -- | $3,505.080 | -- | -- | -- | -- | -- | 173.775 |

Contact: Duane Callender, TIFIA JPO, 202/366-9644, duane.callender@fhwa.dot.gov

Contact: Duane Callender, TIFIA JPO, 202/366-9644, duane.callender@fhwa.dot.gov

[Top of Article, In This Issue...]

The "TIFIA Trivia" box provides responses to questions posed by our readers and other observers. We hope you find this "TIFIA Trivia" section useful and that you will submit questions to Mark Sullivan, Chief, TIFIA JPO, 202/366-5785 or Theresa Stoll, TIFIA JPO, 202/366-9649.

Question

Why is TIFIA's annual budget authority of $130 million so much lower than the loan limitation of $2.6 billion? Is the loan limitation or the budget authority the constraint on TIFIA lending? How is the budget authority required for an individual project calculated?

Answer

Under the Credit Reform Act of 1990, the budget cost or "subsidy" associated with a credit instrument is the estimated long-term cost to the government on a net present value basis. Since it is expected that most funds lent under the TIFIA program will be repaid with interest at the government's discount rate or Treasury rate, the cost to the government is much lower than the face value of the loans. The average subsidy rate of agreements to date is about five percent. This provides justification for the budget authority level of $130 million, which is five percent of the $2.6 billion loan limitation.

The annual loan limitation of $2.6 billion limits the face value of TIFIA loans, lines of credit, and guarantees that can be extended. The annual budget authority of $130 million limits the budgetary cost the government may incur for credit instruments extended under TIFIA. Either of these limits may be the binding constraint to the program size in a given year. For example, if the credits that are extended have high-subsidy rates, then the TIFIA program may expend its budget authority before it reaches the loan limitation and cannot enter into new agreements. Likewise, if the subsidy rates are low, the loan limitation may be reached before all budget authority is expended. The remaining budget authority cannot be used for new loans in that year, but can be carried forward to the next fiscal year.

Budget authority or subsidy required for an individual project is calculated by subtracting the net present value of expected repayments from the value of the disbursements. The expected repayments are the scheduled repayments minus expected defaults plus expected recoveries. Defaults are estimated using historic default rates for the risk category of the TIFIA instrument. Recoveries are estimated based on the type of revenue securing the TIFIA instrument.

[Top of Article, In This Issue...]

To help meet growing transportation needs, states are pushing ahead with GARVEE bonds, secured with future Federal aid highway funds under the provisions of Section 122 of Title 23, U.S. Code. This summer, Arizona and Colorado brought two issues to market, totaling $249 million. With these two issues, GARVEE debt issuance nationally through August 2003 has reached the $3 billion level.

The Arizona issue of $149 million was sold by the State Transportation Board in July 2003, a combined new money ($125.2 million) and refunding ($23.8 million) issue. The 2003 issue was the third Grant Anticipation Note (i.e. GARVEE) for Arizona. The proceeds of all three issues have been allocated to funding the accelerated completion plan for the Maricopa Freeway System. The Series 2003 notes have a longer maturity than the prior two issues, extending to 2015, compared to the 2000 and 2001 issues that mature in 2004 and 2008, respectively. With the 2003 issue, taking into account the refunding, the total amount of Arizona GANs is $292 million. Over the next two to three years, Arizona anticipates additional issuance of up to $220 million.

| State | Date of Issue | Face Amount |

|---|---|---|

| Arizona | June 2000 | $39.4 Million |

| -- | May 2001 | $142.9 Million |

| -- | July 2003 ($23.8 million refunded outstanding June 2000 bonds) |

$149.0 Million |

| Colorado (Colorado DOT issued $400.2 million in June 2002 to refund prior bonds) |

May 2000 | $524.4 Million |

| -- | April 2001 | $506.4 Million |

| -- | June 2002 | $208.3 Million |

| -- | August 2003 | $100.0 Million |

In August 2003, the Colorado Department of Transportation sold $100 million in transportation revenue anticipation notes or TRANs (its designation for GARVEEs). This was the fourth new money issue for Colorado, bringing its total issuance to date to over $1.3 billion. This total excludes the $400.2 million issue in June 2002 to refund prior bonds. The 2003 TRANS are structured as term bonds, maturing in 2016 and 2017. The TRANs proceeds are funding 28 strategic corridor projects that are part of the Strategic Transportation Investment Program adopted by the Transportation Commission in 1996 to accelerate construction. The strategic corridor projects, which total $8.9 billion, include the multimodal Southeast Corridor project, now known as the Transportation Expansion Project or T-REX. Colorado's next issue in the amount of $125 million is planned for 2004 which would raise the total debt service for TRANs to $2.3 billion, the voter-authorized limit.

Contact: Jennifer Mayer, FHWA National Resource Center, 415/744-2634, jennifer.mayer@fhwa.dot.gov

Contact: Jennifer Mayer, FHWA National Resource Center, 415/744-2634, jennifer.mayer@fhwa.dot.gov

[Top of Article, In This Issue...]

Each issue of IFQ features questions and answers

on the GARVEE program. This issue addresses the treatment of GARVEE debt

service in state plans. Note that answers to these questions are not regulatory

or legislative, but represent Federal Highway Administration's (FHWA) current

administrative interpretations. If you have questions or want to confirm

any of this information, please contact your local FHWA Division office.

GARVEE guidance is also available at:

https://www.fhwa.dot.gov/finance/resources/federal_debt/garvee_bond_guidance.aspx.

What is the Difference Between a GARVEE (Grant Anticipation Revenue Vehicle) and an RVee (Reimbursement Vehicle)?

A GARVEE is any bond, debt, note, or other instrument for which a state claims reimbursement for debt service under Section 122 of Title 23. The proceeds of GARVEE bonds must be used for projects that are eligible for Federal aid and that follow Federal requirements. As debt service becomes due, states bill the Federal government for the applicable Federal share of debt service (typically 80 percent) and receive reimbursement. For example, if a state issued a $100 million bond whose debt service was $12 million annually for 10 years, the state would claim reimbursement for 80 percent of $12 million, or $9.6 million, until the debt is retired. The reimbursement includes any interest and issuance costs associated with the bond.

An RVee (reimbursement vehicle - formerly known as an "indirect" GARVEE) is a bond whose debt service is paid from construction reimbursements from eligible Federal-aid projects, as well as other sources. While the state may pledge its Federal construction reimbursements for debt service, the reimbursements it receives are not linked in any way to the RVee; instead, they are made based on eligible construction expenditures on any Federally eligible projects.

The construction reimbursements that a state uses to pay RVee debt service may be from projects that the bond proceeds paid for or from entirely separate projects. Because the construction reimbursements are not associated with a debt issuance, the state is not eligible to claim reimbursement for interest and issuance costs on RVees. RVees are issued under state laws and requirements, and proceeds from RVees do not necessarily have to be used on Federal-aid projects. However, any project that ultimately receives Federal-aid construction reimbursement must follow all Federal-aid requirements.

Why Would a State Issue a GARVEE Rather Than an RVee, and Vice Versa?

Depending on state laws, a state might be able to issue either type of vehicle. Some states might prefer to issue a GARVEE in order to claim interest and issuance costs and in order to preserve a direct link between the project and the funds used to repay its debt service. Other states may forgo the additional eligibility for interest and issuance, and issue an RVee because it might allow them to use construction reimbursements from a variety of projects for debt service. Some states may find it difficult to issue RVees because construction reimbursements become subject to appropriation by the state legislature when received, or are otherwise restricted by state law.

In either case, a state does not receive any additional Federal-aid through using either vehicle; it simply elects to use its Federal aid funds in different but equally legitimate ways.

For more information about GARVEEs and RVees, contact Jennifer Mayer, Innovative Finance Specialist, FHWA National Resource Center, jennifer.mayer@fhwa.dot.gov, 415/744-2634.

[Top of Article, In This Issue...]

Many transportation agencies today are finding that conventional highway contracting and financing methods are insufficient to meet citizens' demands for new and improved infrastructure. The growing gap between transportation needs and available funds is not unique to the United States. However, as a team of transportation experts learned, European highway agencies over the last several decades have been effectively implementing a variety of innovative techniques to accelerate the delivery of critically needed projects.

A delegation of Federal, state, contracting, legal, and academic representatives traveled to Portugal, the Netherlands, France, and England in June 2001 to investigate how such efficiencies and resources might be implemented in the United States. Through this visit, the delegation concluded that many of the alternative contract and financing techniques in use in Europe have potential for application by U.S. transportation agencies.

Alternative funding sources in Europe include a combination of bond and bank financing, with private financing much more common than in the United States. In some cases, European governments need to use alternative financing because public debt ceilings have already been reached. In other cases, private financing is the best solution for implementing the project.

In determining how European experience could be applied in the United States to advance needed transportation investment, the delegation identified two primary differences in how European transportation projects are funded. First, European countries have a very limited amount of taxes dedicated specifically for transportation needs. Unlike in the United States, gasoline taxes and other transportation-generated revenues are not separated for transportation purposes, but are deposited into a general fund along with other taxes. These general funds then provide money for a variety of needs, including transportation projects, based primarily on political priorities as opposed to the source of the revenues.

Second, European governments do not have the ability to use tax-exempt financing for public transportation projects, as is the case in the United States. While this means that interest rates are higher for European projects, it also means that projects are not subject to the contracting rules applied to U.S. tax-exempt financed projects. For this reason, private financing is much more competitive with public financing for European transportation projects. For example, in the U.K., the interest savings realized when using publicly guaranteed funds as compared to private funds is sometimes less than one percent.

While the primary funding mechanism in Europe is similar to the traditional pay-as-you-go system in the United States, with most of the national investment in transportation projects funded through the annual budget allocation process, the scan revealed several alternative approaches that offer potential for use in the United States. One of these techniques is the use of concessions which have seen limited application in this country.

Concessions extend public agencies' reach by transferring responsibility for a given project, along with related construction and financing risk, to the private sector. By leveraging the culture of innovation and cost control inherent in private sector firms, the public agencies can both accelerate project delivery and reduce costs. At the same time, appropriate contract provisions can be included to ensure that construction quality, facility operations and maintenance, and traffic flow meet specific performance goals over the life of the concession.

Concessions, widely used in Europe over the last 30 years, are an innovative approach to U.S. project delivery and financing. Through concessions, public agencies negotiate long-term contracts with a private sector firm or consortium (referred to as the concessionaire) for the construction and operation of a given transportation project or a network of projects. Payments to the concessionaire are generally based on a measure of facility usage, but also can be based on a schedule of periodic payments from one or more government entities. In some cases, concessionaires receive incentives to promote facility usage in a win-win scenario that increases citizens' mobility options and reduces wear and tear on other government-owned facilities, while at the same time resulting in higher compensation for the concessionaire.

Concession contracts are typically negotiated between a public entity and a private or quasi-private company for a term of 30 years, although in some cases this term can extend substantially beyond 30 years. Companies receiving these contracts agree to design, build, finance, operate and/or maintain a given project over the life of the concession. At the end of this concession period, the original concession is either renegotiated or the facility turned over to an appropriate public entity.

By using concessions, the public sector can 1) leverage its ability to build and finance transportation infrastructure since concessionaires function essentially as extensions of the state and 2) apply the innovation, expertise, and efficiency of the private sector to transportation projects. Moreover, private sector financing is developed as an additional source of capital for transportation infrastructure, albeit at a somewhat higher cost than that of government borrowing. Finally, project completion and delivery are accelerated by up to eight years and project costs are reduced by up to 25 percent.

The delegation developed several case studies demonstrating the benefits of concessions in Europe:

Innovative contracting and financing techniques have been used in Europe over the last several decades. Portugal, France, and the United Kingdom have found that these arrangements have extended the reach of their transportation agencies, identified new sources of project financing, accelerated project delivery, and reduced project costs.

The table below highlights the potential advantages of using concessions.

| Financial Advantages | Economic and Social Advantages | Political Advantages |

|---|---|---|

| Easing of budgetary constraints | Streamlined construction schedule and reliable project | A new role for the public authority |

| Optimal allocation and transfer of risk to the private sector |

Modernization of the economy and improvement of services | Allocation and not "abdication" |

| Realistic evaluation and control of costs implementation |

Access to financial markets, combined with the development of local financial markets | Project stability |

Source: FHWA, Contract Administration: Technology and Practice in Europe, Report No. FHWA-PL-02-016, October 2002, page 71.

The European experience with innovative financing as well as innovative project delivery mechanisms is documented in more detail in a report available at FHWA's International Program website: http://international.fhwa.dot.gov/contractadmin/contractadmin.pdf

Contact: Frederick Werner, FHWA National Resource Center, 415/744-2634, frederick.werner@fhwa.dot.gov

Contact: Frederick Werner, FHWA National Resource Center, 415/744-2634, frederick.werner@fhwa.dot.gov

[Top of Article, In This Issue...]

An FHWA workshop on project finance will be held in conjunction with the American Road and Transportation Builders Association's (ARTBA) 15th Annual Conference on Public-Private Ventures in Transportation. The workshop and conference will be held at the Renaissance Washington Hotel in Washington, D.C., October 22-23, 2003 and will include sessions on how TEA-21 reauthorization and regulatory changes are impacting the prospects for innovative finance and public-private partnerships in transportation. The FHWA workshop sessions, focusing on SAFETEA and innovative finance trends, will be held on Wednesday, October 22, from 1:45 p.m. to 4:30 p.m.

More information is available on the 2003 Public-Private Ventures Conference web site at: http://www.artba.org/meetings_events/2003/ppv/2003_public_private_ventures.htm/

As part of the Transportation Research Board's (TRB) 83rd Annual Meeting in Washington, D.C. from January 11-15, 2004, the TRB Committee on Taxation and Finance and FHWA will cosponsor a comprehensive workshop that will focus on innovative finance trends and opportunities for the future. The emphasis of the workshop will be on options to enhance and expand the "tool box" of project financing approaches to help meet the nation's transportation investment needs. U.S. DOT finance experts will address the innovative finance provisions of SAFETEA and provide a progress report on how new financing approaches are changing the transportation finance landscape. In addition, project sponsors and capital market representatives will share their insights on successful strategies that could serve as a road map for further advancements in project delivery mechanisms. The workshop, intended to build a better understanding of non-traditional financing methods, will be structured in an interactive format with time set aside for questions and answers and dialogue with transportation finance experts. The workshop will be held on Sunday, January 11, from 2:00 p.m. to 5:30 p.m. at the Washington Hilton Hotel and Towers, Jefferson East Room.

More information will be posted at the TRB 83rd Annual Meeting website at: http://www4.nationalacademies.org/trb/annual.nsf

Contact: Suzanne Sale, TIFIA JPO, 602/379-4014, Suzanne.Sale@fhwa.dot.gov

Contact: Suzanne Sale, TIFIA JPO, 602/379-4014, Suzanne.Sale@fhwa.dot.gov

[Top of Article, In This Issue...]

Roger Berg, Cambridge Systematics, Inc.

Gene Branigan, Florida Department of Transportation

Duane Callender, TIFIA JPO

Phyllis Jones, FHWA

Jennifer Mayer, FHWA National Resource Center

Suzanne H. Sale, TIFIA JPO

Theresa Stoll, TIFIA JPO

Mark Sullivan, TIFIA JPO

Frederick Werner, FHWA National Resource Center

Suzanne H. Sale, FHWA

Co-Managing, Editor

602/379-4014

FAX: 602/379-3608

Suzanne.Sale@fhwa.dot.gov

Max

Inman, FHWA

Co-Managing Editor

202/366-2853

FAX: 202/366-7493

Laurie L. Hussey, CS Managing Editor

Cambridge

Systematics, Inc.

617/354-0167

FAX: 617/354-1542

lhussey@camsys.com

Reproduction (in whole or in part) and broad distribution of IFQ is strongly encouraged. Permission from FHWA, the editor, or any other party is not necessary.

FHWA DOES NOT MAINTAIN A MAILING LIST AND DOES NOT DISTRIBUTE IFQ DIRECTLY. IFQ IS AVAILABLE AS AN INSERT TO THE AASHTO JOURNAL, AND IS AVAILABLE ELECTRONICALLY THROUGH FHWA's WWW HOME PAGE:

https://www.fhwa.dot.gov/innovativefinance/

IFQ IS ALSO PROVIDED TO THE FOLLOWING ORGANIZATIONS FOR REDISTRIBUTION AND/OR AS INFORMATION FOR THEIR MEMBERSHIP: