Brien Desilets

Managing Director,

Claret Consulting

Patrick DeCorla -Souza

P3 Program Manager,

Federal Highway

Administration

This presentation will introduce Chapters 1- 4.

Infrastructure Delivery Options

View larger version of Infrastructure Delivery Options flow chart

Design, Bid, Build » Design, Build » Design, Build, Finance » Design, Build, Operate and Maintain » Design, Build, Finance, Operate, Maintain » Privitization

(Moves from Public Sector to Private Sector with risk increasing towards Private Sector)

Degree of ownership, development integration, risk

transfer and extent of private financing

| Design-Bid-Build | P3 |

|---|---|

| Public sector takes on most risks (except construction) | Risks shared between public and private sectors |

| Public financing (mostly) | Private financing (mostly) |

| Lowest bidder | Best value for least net present cost |

| Operations and Maintenance (O&M) and ongoing rehabilitation (if any) carried out by public agency (or under fee for prescribed services) once constructed | O&M carried out by private sector; ongoing rehabilitation overseen by public sector stewardship of P3 |

View larger version of P3 Delivery Models graph

View larger version of Typical Toll Concessions P3 Structure graph

View larger version of Typical Availability P3 Structure graph

Submit a question using the chat box

| Public Sector | SPV | Subcontractor | |

|---|---|---|---|

| Development Phase | |||

| Planning & environmental process | ✔ | ||

| Political will | ✔ | ||

| Regulatory | ✔ | ||

| Site | |||

| Permitting | ✔ | ✔ | ✔ |

| Procurement | ✔ | ✔ | |

| Financing | ✔ | ||

| Construction Phase | |||

| Engineering & construction | ✔ | ||

| Changes in market conditions | ✔ | ||

| Operation Phase | |||

| Traffic | ✔ | ||

| Competing facilities | ✔ | ||

| Operations and maintenance | ✔ | ||

| Appropriation | ✔ | ✔ | |

| Financial default risk to public agency | ✔ | ||

| Refinancing | ✔ | ||

| Political | ✔ | ||

| Regulatory | ✔ | ||

| Handback | ✔ | ||

View larger version of SPV Arrangements flow chart

Submit a question using the chat box

View larger version of Sources of Financing chart

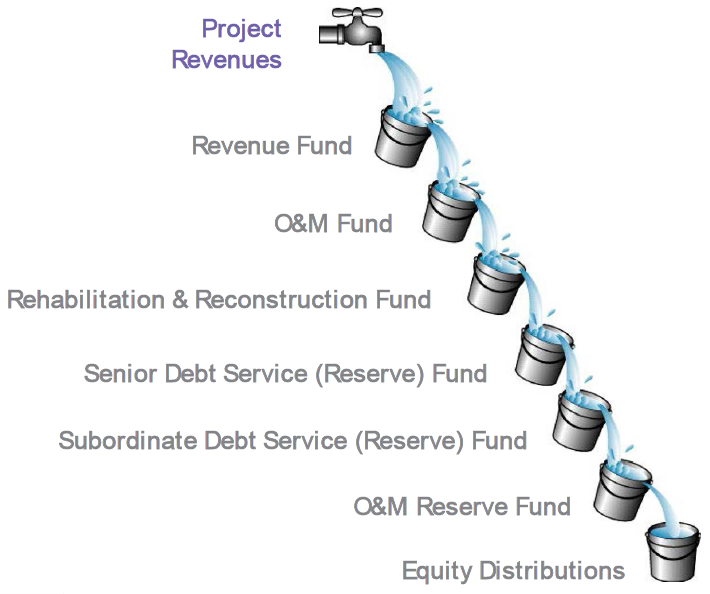

Text of Typical Cash Flow Waterfall diagram

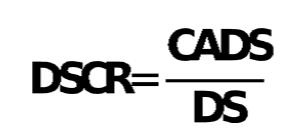

Where DSCR = Cash Available for Debt Service (CADS) divided by debt service (principal + interest)

| Series |

Maturity |

Principal (US$) |

Coupon |

Yield* |

|---|---|---|---|---|

| A | 1/1/2022 |

670,000 | 4.25% | 4.45% |

| B | 1/1/2023 | 685,000 | 4.50% | 4.60% |

| C | 7/1/2023 | 1,775,000 | 5.00% | 4.60% |

| D | 1/1/2024 | 1,760,000 | 5.00% | 4.75% |

| E | 7/1/2024 | 2,900,000 | 5.00% | 4.75% |

| F | 1/1/2025 | 3,080,000 | 4.75% | 4.90% |

| G | 7/1/2025 | 4,875,000 | 5.00% | 4.90% |

| H | 1/1/2026 | 5,290,000 | 5.00% | 4.95% |

| I | 7/1/2026 | 6,700,000 |

5.00% | 4.95% |

| J | 1/1/2027 | 6,150,000 | 5.00% | 5.00% |

| K | 7/1/2027 | 8,480,000 | 5.00% | 5.00% |

| L | 1/1/2032 | 91,795,000 | 5.25% | 5.25% |

| M | 1/1/2037 | 209,185,000 | 6.00% | 5.32% |

| N | 1/1/2042 | 320,405,000 | 5.50% | 5.50% |

| *The rate is the rate offered to bond buyers. When bonds are sold, they often do not sell at face value but at either a premium or a discount. The yield indicates the actual return offered to bondholders based on the actual price paid. Source: Midtown Tunnel Official Statement available from MSRB EMMA database, CUSIP 928104LK2. | ||||

Advantages

Disadvantages

Transportation Infrastructure Finance and Innovation Act (TIFIA) also provides a form of subordinate debt

| Project | Amount | Rate (%) | Term (years) |

|---|---|---|---|

| I-95 HOT Lanes | $300.0 | 2.76 | 35.0 |

| Presidio Parkway Tranche A | $90.0 | 0.46 | 3.5 |

| Presidio Parkway Tranche B | $60.0 | 2.71 | 28.0 |

| Midtown Tunnel | $422.0 |

3.17 | 44.0 |

| LBJ-635 Corridor | $850.0 | 4.22 | 40.5 |

| North Tarrant Express | $650.0 | 4.51 | 35.0 |

| Port of Miami Tunnel | $341.0 | 4.31 | 35.0 |

| I-595 |

$603.0 | 3.63 | 35.0 |

| SH-130 Segment V-VI | $430.0 | 4.45 | 35.0 |

| I-495 HOT Lanes | $589.0 | 4.40 | 40.0 |

| TIFIA has been involved in almost all major US greenfield P3s and approximately a third of the projects in the TIFIA portfolio are P3s | |||

Submit a question using the chat box

No investor guarantee on returns and no investment recourse

| Investor | Strategy/Objective | Project Transaction Example |

|---|---|---|

| Subcontractors engaging in Design Build and Operations & Maintenance | Broadening participation and potential financial returns over the project term | Midtown Tunnel: Skanska is a 50% equity investor in the SPV and member of the DB contractor team |

| Financial institutions | Provide development capital and typically exit once the project is up and running or even before | Denver Fastracks Eagle P3: Macquarie sold its stake after the project reached financial close. |

| Pension funds and insurance companies | Seek long-term return; they prefer a larger share of the concession's cash flows | Florida I-595: TIAA-CREF acquired a 50% stake when the project neared substantial completion |

| Project/Investor | Amount ($millions) |

|---|---|

| East End Crossing | |

| Walsh Investors | $26.00 |

| VINCI Concessions SAS | $26.00 |

| Bilfinger Berger | $26.00 |

| I-95 HOT Lanes | |

| Fluor | $24.20 |

| DRIVe USA | $217.80 |

| Presidio Parkway | |

| Hochtief | $23.00 |

| Meridiam | $23.00 |

| Midtown Tunnel | |

| Skanska | $99.45 |

| Macquarie | $121.55 |

| LBJ-635 Corridor | |

| Cintra | $364.00 |

| Meridiam | $266.00 |

| Dallas Police / Fire Pension Fund | $70.00 |

| North Tarrant Express | |

| Cintra | $241.50 |

| Meridiam | $141.90 |

| Dallas Police / Fire Pension Fund | $42.60 |

| Port of Miami Tunnel | |

| Bouygues | $8.00 |

| Meridiam | $72.30 |

| I-595 | |

| ACS Iridium | $207.70 |

| SH-130 Segment 5-6 | |

| Cintra | $136.40 |

| Zachry | $73.40 |

| I-495 HOT Lanes | |

| Flour | $35.00 |

| Transurban | $315.00 |

| Phase | Risk-free Rate | Project Risk | Phase Risk | Equity Return |

|---|---|---|---|---|

| Construction | 6% | 2-4% | 4% | 12-14% |

| Ramp up | 6% | 2-4% | 2% | 10-12% |

| Long-term operation | 6% | 2-4% | - | 8-10% |

| Source: Adapted from Yescombe, E.R. (2007) Public-Private Partnerships: Principles of Policy and Finance. Oxford UK: Elsevier Ltd. | ||||

View larger version of Equity Share on US Transportation Projects

View larger version of Upfront Government Contributions on US P3 Projects

| Source of Funds | Terms and Conditions | Value | Availability |

|---|---|---|---|

| Cash reserves | Funded at financial close | Project specific | Immediate (*) |

| Cash reserves | Funded from project cash flows | Project dependent | Immediate once constituted |

| Letters & Lines of credit | On call from a financial institution Supports project cash flows during construction to avoid impact on schedule. | About 5-10% of contract value | Immediate (irrevocable and unconditional) |

| Parental guarantee | Guarantee of performance by ultimate parent of the Construction or the Operations & Maintenance contractor | Based on probable loss | Immediate subject to credit worthiness |

| Performance bond | Surety bond provides core performance support in case of contractor failure | 100% of contract value | Conditional and subject to process |

| Insurance | Provided by third party to subcontractors and SPV | Priced on coverage, insured | Conditional and subject to process |

| Notes (*) Lenders will only consent to use of the reserves for their designated purpose. In other words the debt service reserve is not available for maintenance purposes. | |||

Submit a question using the chat box

Project Development

|

||

|

||

Bid Preparation

|

||

Commercial & Financial Close

|

||

|

||

Concession Period

|

||

View larger version of P3-Value 2.0 Flow Chart

| Risk Assessment | Value for Money Analysis | ||

|

|||

| Financial Viability Assessment | Project Delivery Benefit-Cost Analysis | ||

Submit a question using the chat box

Introductory

Advanced Analysis

To register for the webinars, please visit:

https://www.fhwa.dot.gov/ipd/p3/toolkit/toolkit_webinars/default.aspx

| Fact Sheets |

|

| Primers |

|

| Guides |

|

| Discussion Papers |

|

| Analytical Tools |

|

| Informational Reports |

|

Brien Desilets

Managing Director

Claret

Consulting

(703) 760-4491

bdesilets@claretconsult.com

Patrick DeCorla-Souza

P3 Program Manager

USDOT Build America Bureau

& FHWA Center for

Innovative Finance Support

(202) 366-4076

Patrick.DeCorla-Souza@dot.gov