« PreviousNext »

2. Transportation Reinvestment Zone Basics

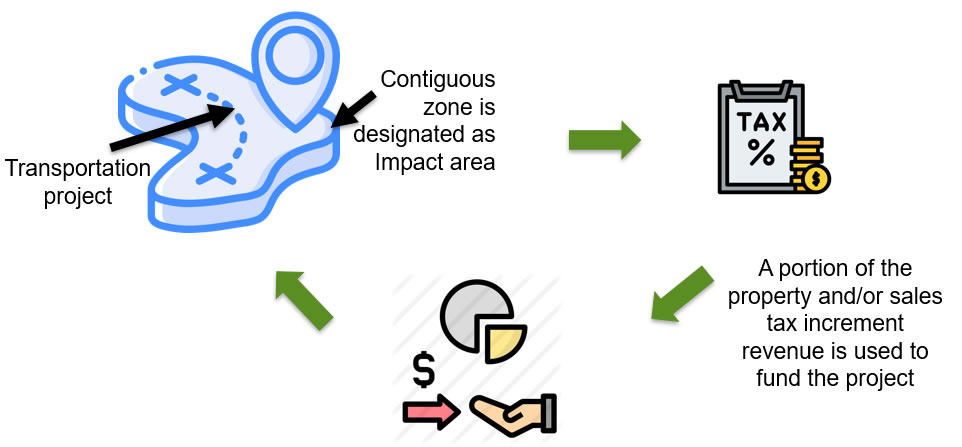

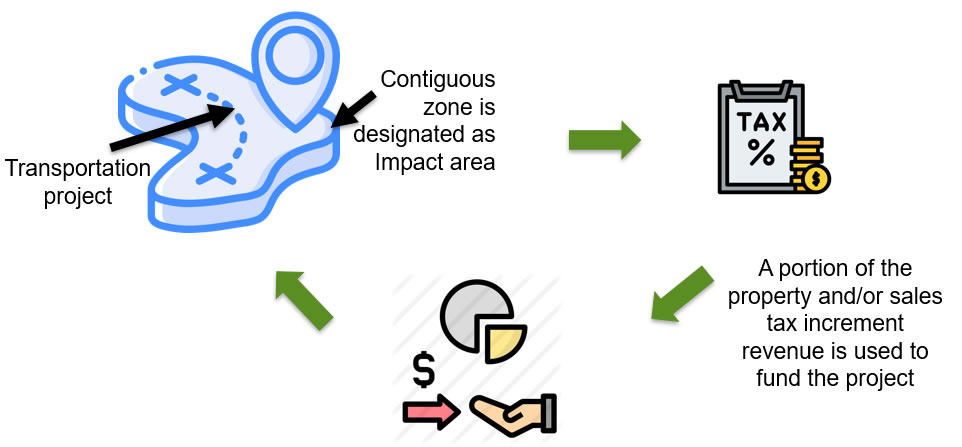

TRZ Definition

A contiguous area where a portion of the annual increment in future local property and/or sales tax revenues resulting from the growth in the zone’s tax base is to be captured and used to support funding and financing of the project.

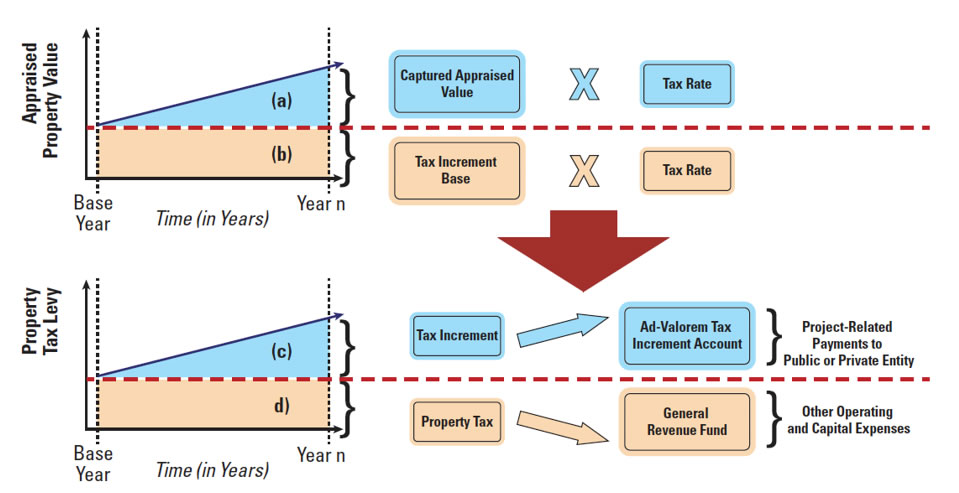

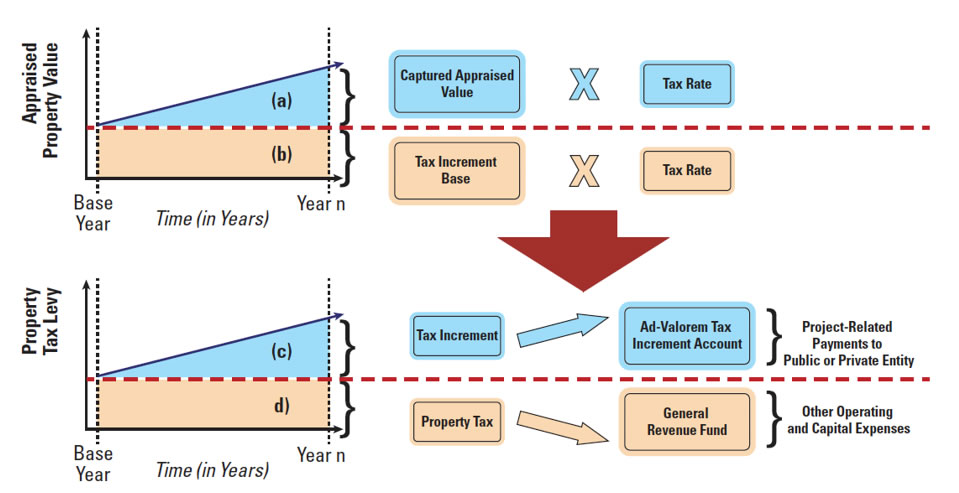

Useful TRZ Tax Increment Definitions

Source: Aldrete, et al., Leveraging the Value of Land and Landside Access to Fund Port Infrastructure in Texas, Transportation Research Record, 2018, vol. 2672.

TRZs vs. Tax Increment Finance (TIF) Districts: Similar, but Different

Similarities

- Both use the TIF mechanism to fund public investments within the zone

Difference

- TRZs:

- Are dedicated only to transportation improvements

- Are easier to create

- Have a simple oversight and management structure

- TIF Districts:

- Used for a wide range of improvements, including transportation

- Have a complex initiation process

- Have a complex oversight and management structure

What Is the Role of TRZs in Project Delivery?

- TRZs capture part of the economic growth expected from a project to leverage traditional and non-traditional funding sources

- Federal and State transportation funds

- Tolls

- Value capture

- TRZs are generally not a project’s sole funding source

- Rather, they are used as:

- Complementary source to close funding gap

- Local matching funds for other funding sources – when required

- One TRZ can support single or multiple projects within the zone

Circumstances Motivating Creation of TRZs

Addressing regional needs

Neighboring or overlapping local governments can establish TRZs within their jurisdiction and jointly fund regional projects:

- Fund individual project segments within their boundaries

- Fund project outside their boundaries (i.e., joint support)

Promoting equity and economic efficiency

Those who benefit from the project investment pay –in proportion to the benefit received –for some of its capital costs:

- Property owners and developers

- Business owners

« PreviousNext »