Instructors

Patrick DeCorla-Souza

P3 Program Manager

Center for Innovative Finance Support

Marcel Ham

Vice President

IMG Rebel

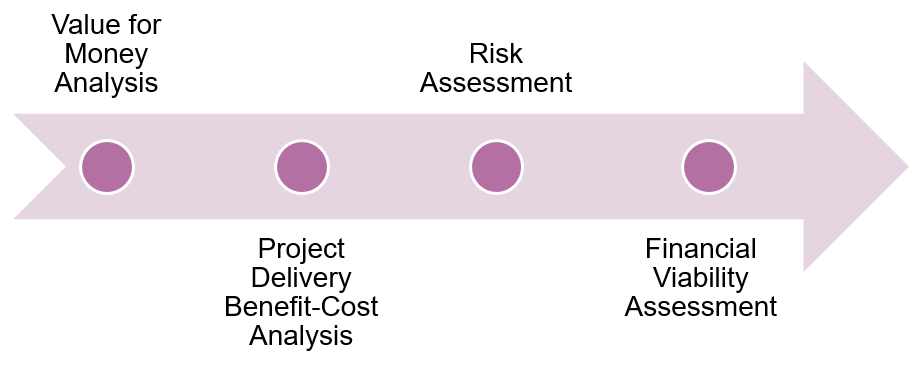

P3-VALUE 2.0 Webinars

- P3: Public Private Partnership

- P3-VALUE 2.0: Analytical tool to help practitioners

understand processes used to quantitatively evaluate P3 options

- This is one of a series of webinars on P3-VALUE

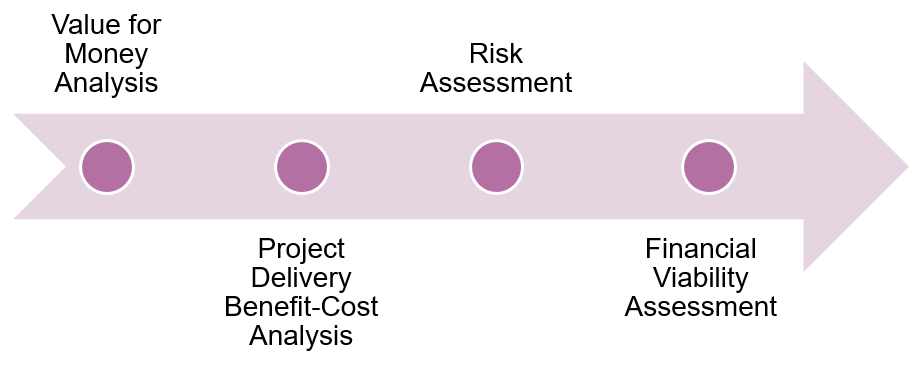

- P3 Evaluation Overview (January 25, 2016)

- Value for Money Analysis (February 8, 2016)

- Value for Money Exercise (Feb. 16, 2016)

- Project Delivery Benefit-Cost Analysis (Feb. 22)

- Project Delivery BCA Exercise (Feb. 29, 2016)

- Risk Assessment (March 7, 2016)

- Risk Assessment Exercise (March 14)

- Financial Viability Assessment (today)

Webinar Outline

Part 1 - P3 Project Financing

Part 2 - P3 Financial Structure

Part 3 - Traffic & Revenue Forecasting

Part 4 - Financial Viability Analysis

Part 5 - Financial Models

Part 6 - Using P3-VALUE for Financial Viability Assessment

Recap - Summary of Webinar

Webinar Objectives

After this webinar you should be able to:

- Explain how P3s are structured

- Describe the process for toll revenue forecasting

- Describe the key metrics used to evaluate the financial viability

of a P3 project

- Describe the role of financial models and list key inputs and

outputs

Part 1 - What is P3 Project Financing

What is Financing?

Method by which an investment is paid for:

- A temporary provision of funds in exchange for a return paid

to investors from future revenues

- Bridges mismatch in timing between ultimate funding source (e.g.

tolls/availability payments) and required investments (e.g. capex)

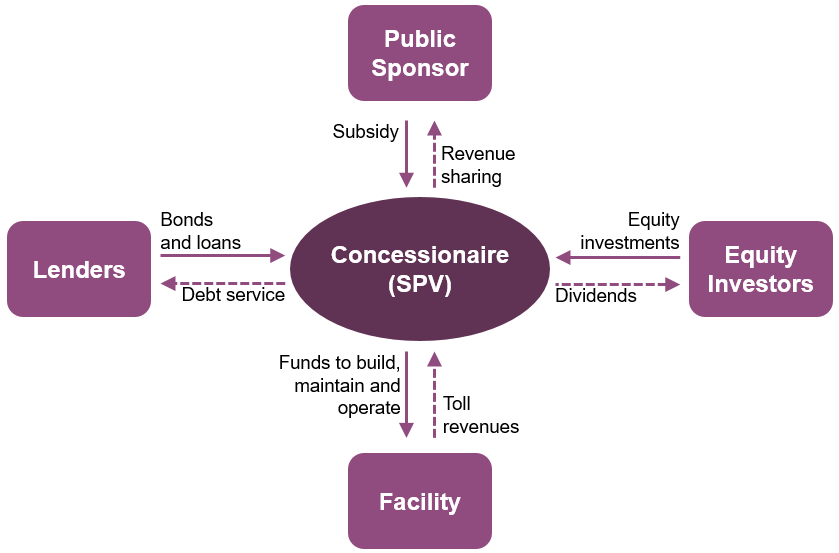

What is Project Finance?

- Financing of (infrastructure) projects based on future project

cash revenues (typically tolls or availability payments for roads)

- Non-recourse debt secured by project assets and repaid from

project cash flows only

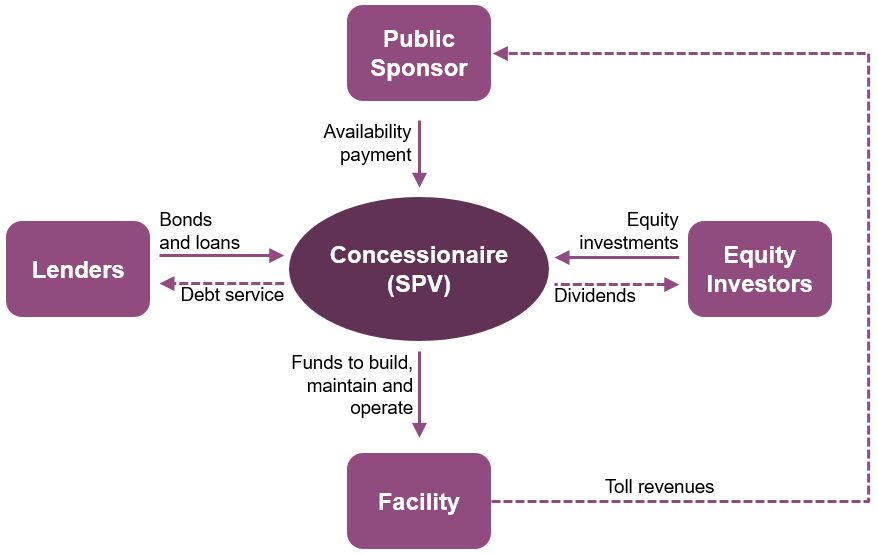

View larger version of the chart

Special Purpose Vehicle

- Set up to finance the activities of a specific project

- Created to ring fence project's assets and cash flows from

private sponsor's other activities

- No recourse to private sponsor's balance sheet, limiting

exposure of private sponsors in case of bankruptcy

- Financiers may ignore the private sponsor's other activities

that are not part of the project

Typical Toll Concession

View larger version of the Typical Toll Concession flow chart

Typical Availability Payment P3

View larger version of the Typical Availability Payment P3 flow chart

Test Your Knowledge

True or False

- An SPV's debt providers have no recourse to the private sponsor's

balance sheet in case of bankruptcy of the SPV.

Questions?

Submit a question using the chat box

Part 2 - P3 Financial Structure

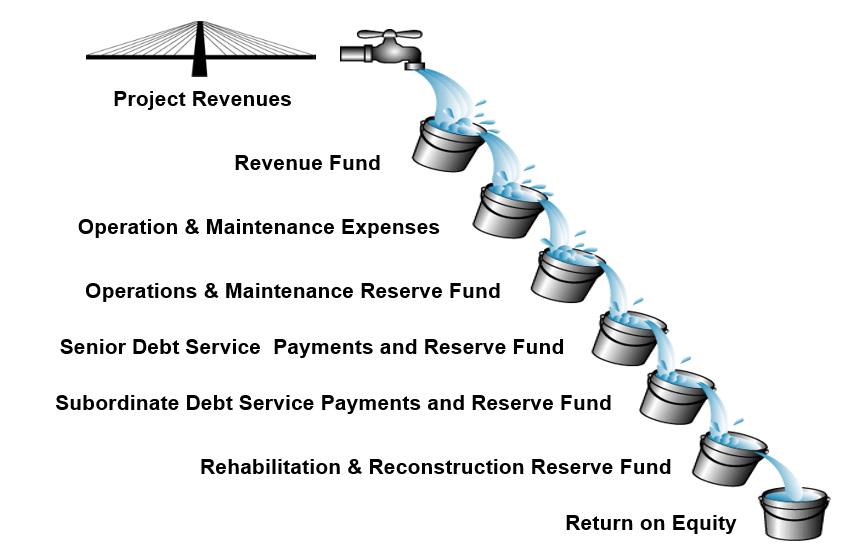

Typical Cash Flow Waterfall

View larger version of the Cash Flow Waterfall

Text of Typical Cash Flow Waterfall

- Project Revenues

- Revenue Fund

- Operation & Maintenance Expenses

- Operations & Maintenance Reserve Fund

- Senior Debt Service Payments and Reserve

Fund

- Subordinate Debt Service Payments

and Reserve Fund

- Rehabilitation & Reconstruction

Reserve Fund

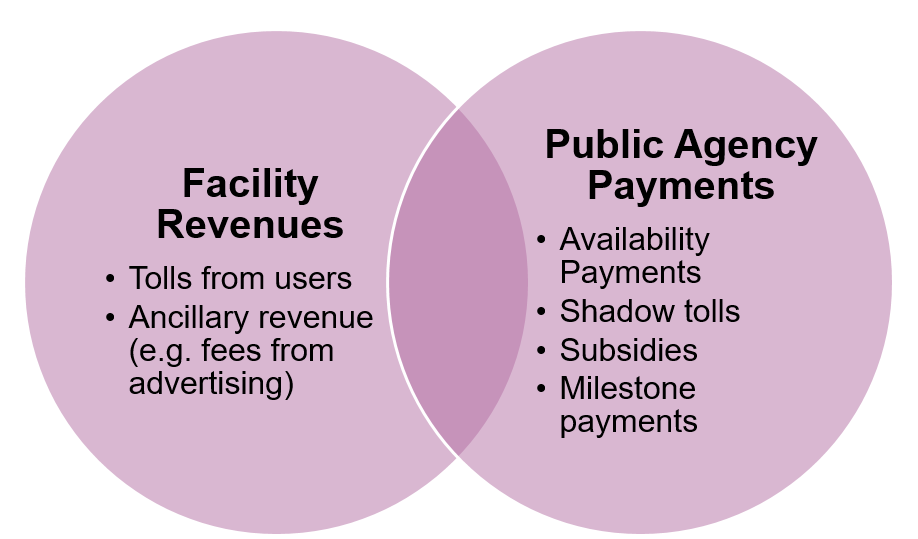

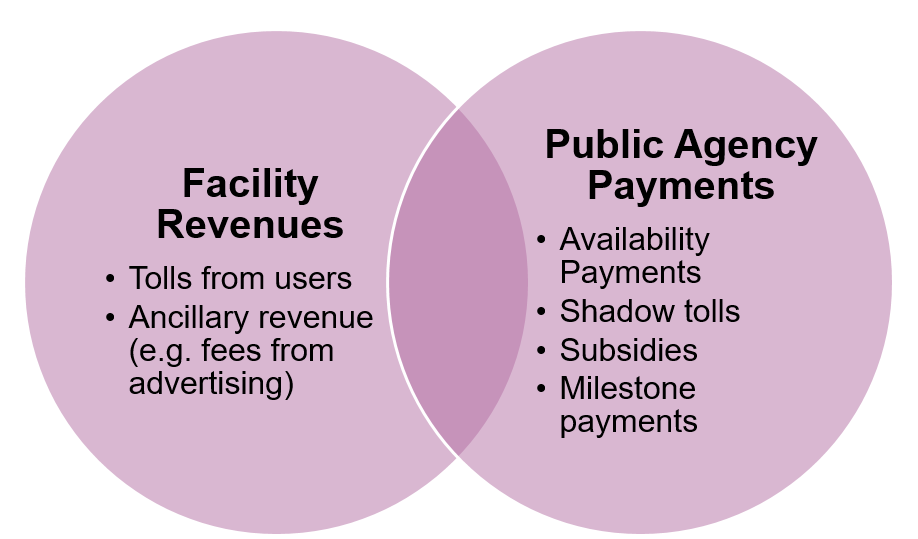

Sources of Project Revenues

Text of graphic

| Facility Revenues |

Public Agency Payments |

- Tolls from users

- Ancillary revenue (e.g. fees from advertising)

|

- Availability Payments

- Shadow tolls

- Subsidies

- Milestone payments

|

Sources of Project Financing: Equity

- Infrastructure development companies

- Private equity and infrastructure funds

- Pension funds, foundations, insurance companies, etc.

Sources of Project Financing: Debt

Loans

- Private bank loans

- TIFIA loans

Bonds

- Private Activity Bonds (PABs)

- Project revenue bonds

Debt Repayment

Annuity type:

- Equal payment amount every period

- Multiple tranches may be used with differing maturities

Interest only:

- "Bullet" payment of principal at maturity

Sculpted repayment:

- Debt service payment is a mix of interest and principal that

is "sculpted" to match the revenue stream profile

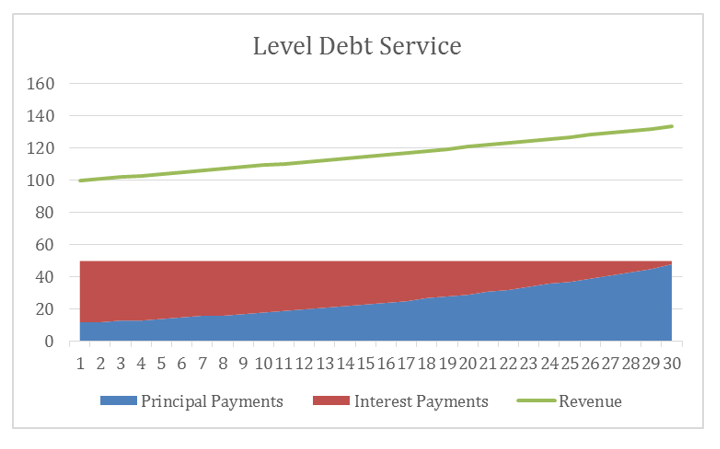

Annuity Debt Repayment

Example of annuity type debt service: Equal debt service payments

in all years

View larger version of the Level Debt Service chart

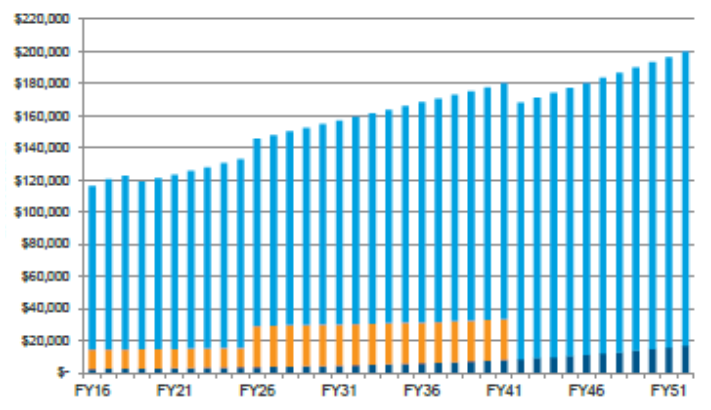

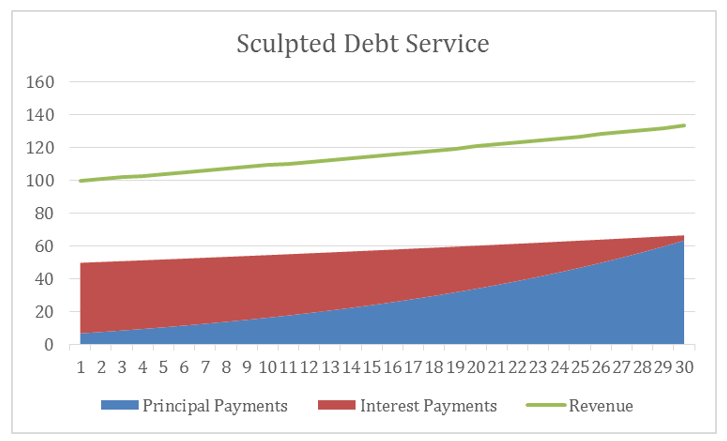

Sculpted Debt Repayment

Example of sculpted debt service: Debt service follows net revenue

profile, hence optimizing debt capacity

View larger version of the Sculpted Debt Service chart

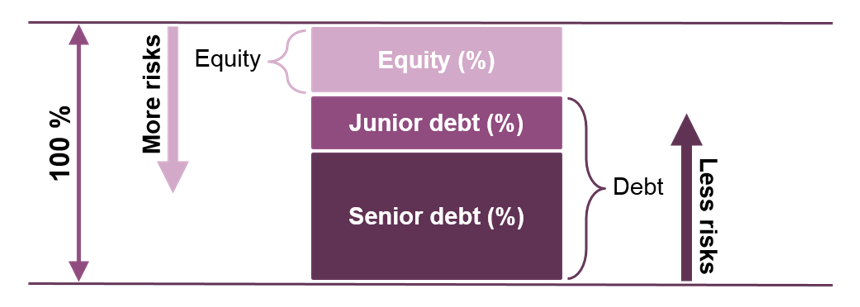

Risk and Leverage

- Leverage (or gearing or debt-to-equity ratio) indicates debt

as a share of total required financing

- As debt service is paid before dividends, equity finance forms

a buffer for debt, making debt less risky

- Lenders require less equity for projects with lower risks

View larger version of the equity and debt risk and leverage chart

Leverage vs. Required Revenues

| |

50/50

leverage |

90/10

leverage |

| Project cost (millions) |

$1,000 |

$1,000 |

| (a) Debt |

$500 |

$900 |

| (b) Equity |

$500 |

$100 |

| (c) Required rate of return on equity |

15% |

15% |

| (d) Annual return on equity: (b) x (c) |

$75 |

$15 |

| (e) Annual interest rate on debt |

5% |

6% |

| (f) Interest payment: (a) x (e) |

$25 |

$54 |

| Annual revenue required to pay for financing: (d)

+ (f) |

$100 |

$69 |

Note: his simplified example assumes "bullet"

repayments of the principal on debt and the equity investment at the

end of the concession term. It also does not consider minimum DSCR requirements

(see later).

Equity in US Transportation P3s

| Project |

Concession Type |

Equity (% of

Financing) |

Equity (% of Cost) |

| I-95 HOT Lanes |

Toll |

35% |

32% |

| LBJ-635 Corridor |

Toll |

31% |

25% |

| North Tarrant Express |

Toll |

29% |

21% |

| I-495 HOT Lanes |

Toll |

23% |

18% |

| Midtown Tunnel |

Toll |

17% |

11% |

| SH-130 Segment V-VI |

Toll |

16% |

16% |

| I-595 |

AP |

13% |

11% |

| Presidio Parkway |

AP |

12% |

12% |

| Port of Miami Tunnel |

AP |

11% |

7% |

| East End Crossing |

AP |

10% |

10% |

Source: Official bond statements

Credit Enhancements

External

- Letters and lines of credit

- Bond insurance

- Construction risk guaranties

- Governmental guaranties

Internal

- Cash reserves

- Debt tranches (senior vs. junior)

- Cash flow optimization (apply excess cash to prepay ahead of

scheduled amortization)

Test Your Knowledge

True or False

- A sculpted debt repayment schedule is able to optimize debt

capacity.

Questions?

Submit a question using the chat box

Part 3 - Traffic & Revenue Forecasting

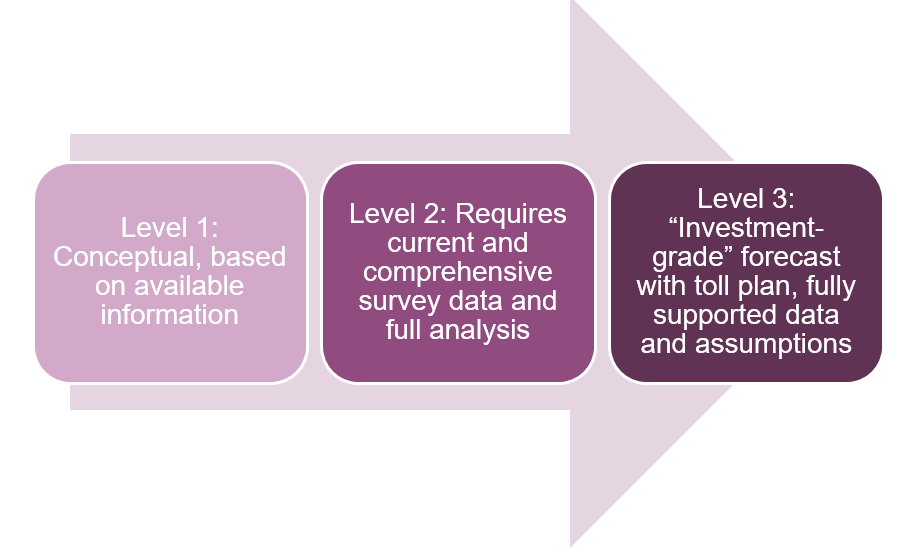

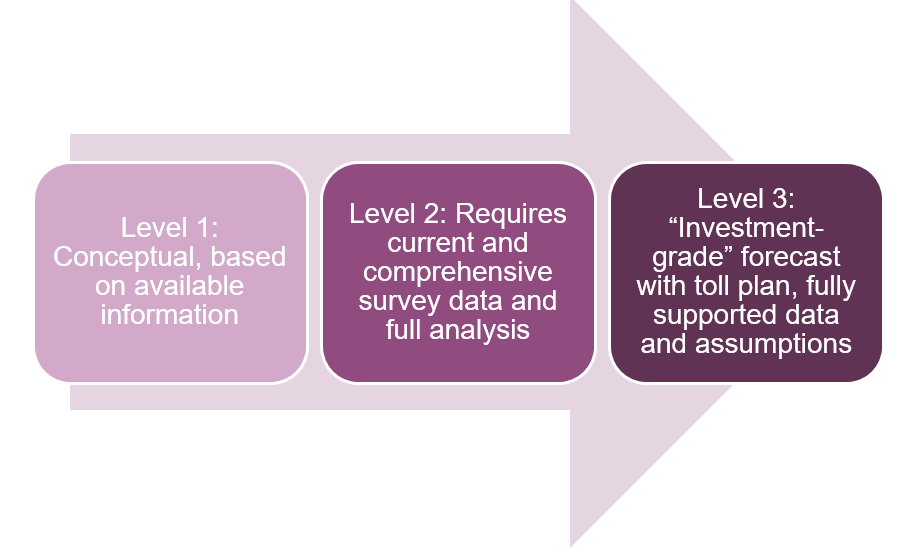

Traffic & Revenue Forecasts

Text of graphic

Level 1: Conceptual, based on available information

Level 2: Requires current and comprehensive survey data and

full analysis

Level 3: "Investment- grade" forecast with toll

plan, fully supported data and assumptions

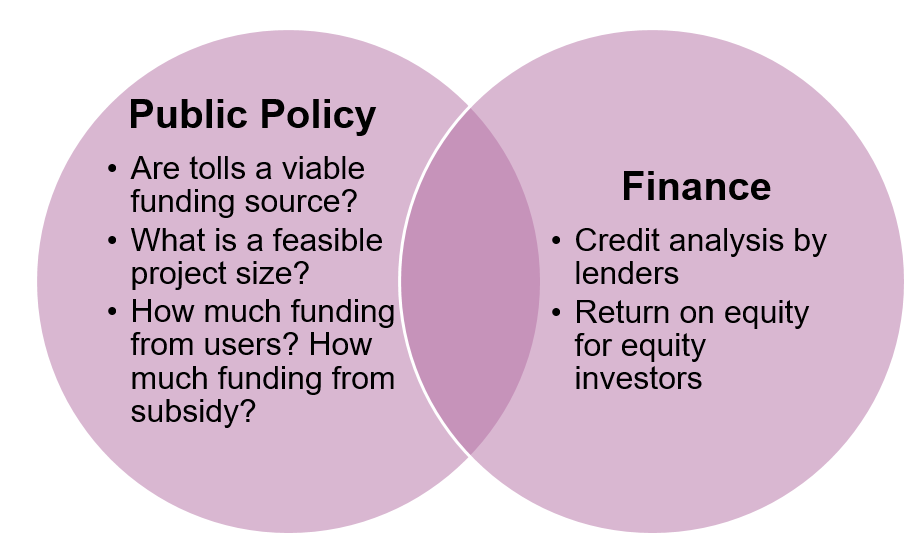

Use of Traffic & Revenue Forecasts

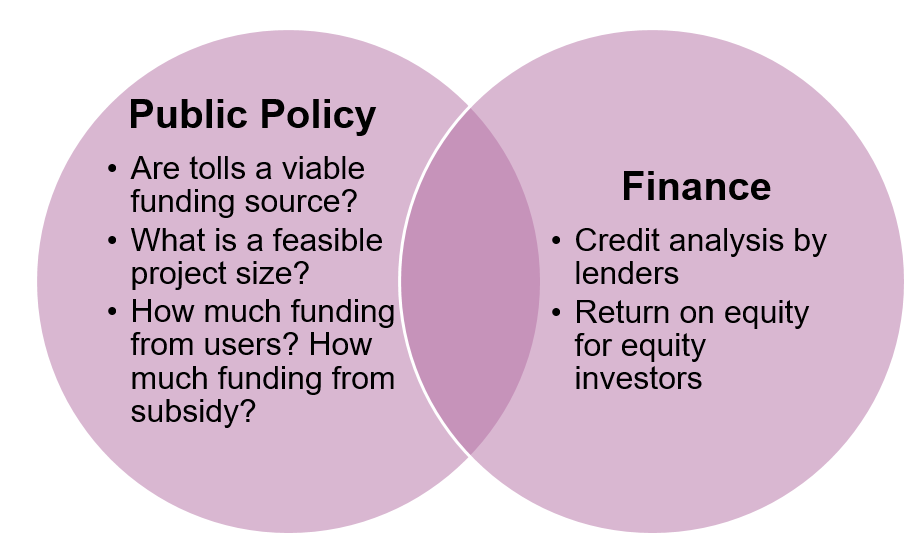

Text of graphic

| Public Policy |

Finance |

- Are tolls a viable funding source?

- What is a feasible project size?

- How much funding from users? How much funding

from subsidy?

|

- Credit analysis by lenders

- Return on equity for equity investors

|

Debt Rating

Credit agencies rate transaction (not forecast):

- Stress test the traffic & revenue (T&R) forecasts

- Assess security of the finance structure (DSCR, leverage)

- Borrowers typically structure a finance plan to the standards

of a specific, desired "investment grade" rating

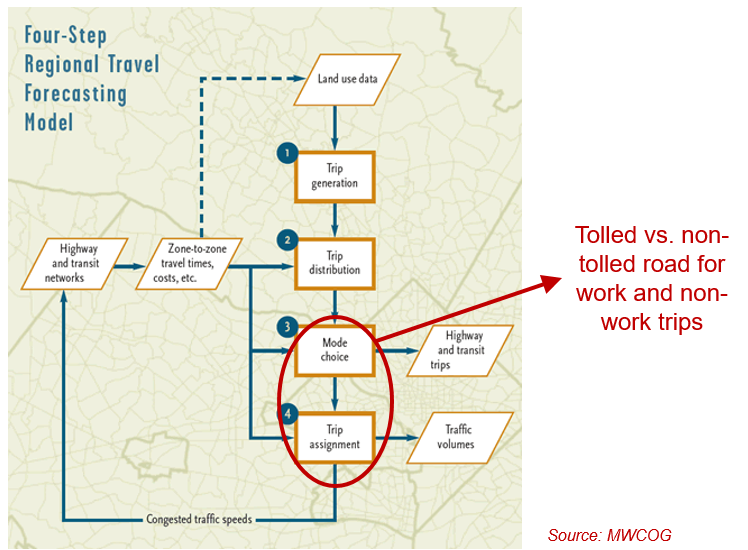

Regional Travel Forecasts

View larger version of the Regional Travel Forecasts map

Source: MWCOG

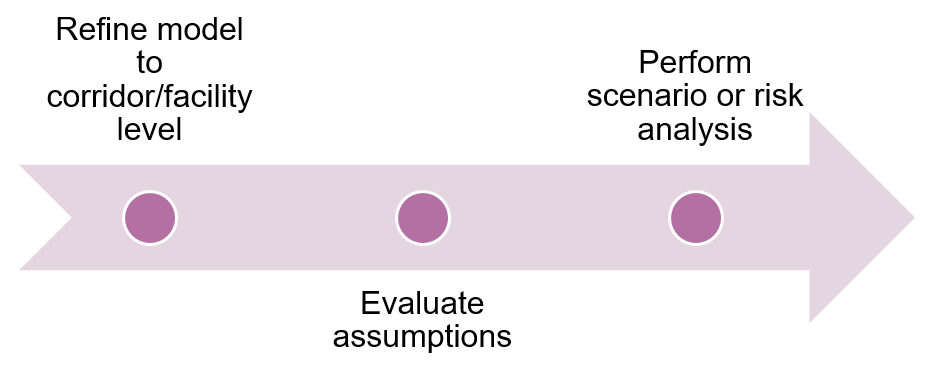

Project Traffic & Revenue Forecast

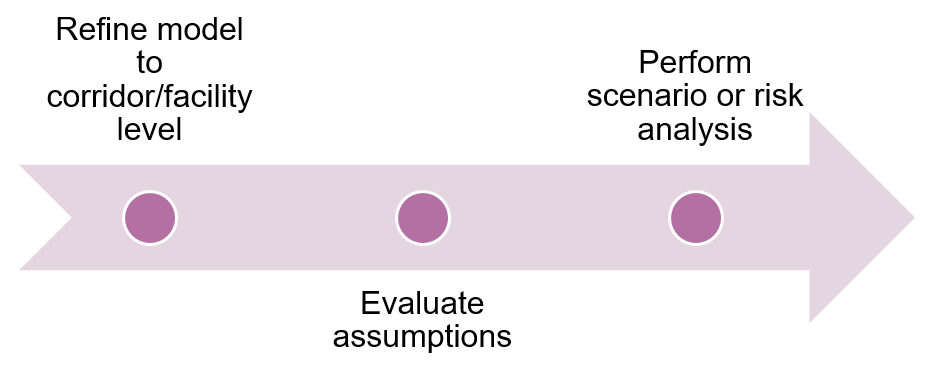

text of graphic

- Refine model to corridor/facility level

- Perform scenario or risk analysis

- Evaluate assumptions

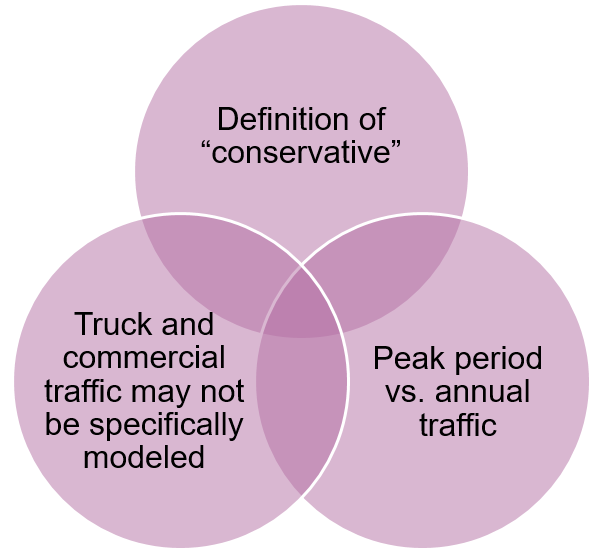

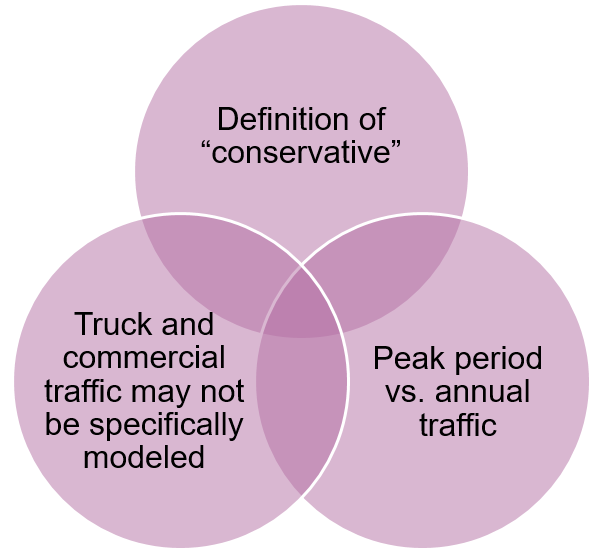

Modeling Considerations

text of graphic

- Definition of "conservative"

- Truck and commercial traffic may not be specifically

modeled

- Peak period vs. annual traffic

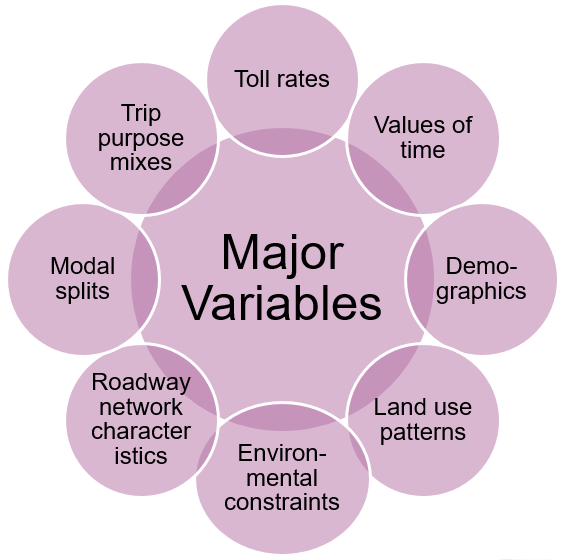

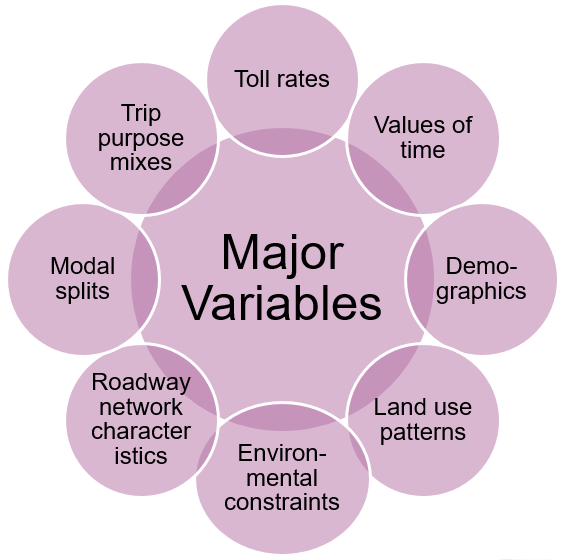

Major Variables

text of graphic

Major Variables

- Trip purpose mixes

- Toll rates

- Values of time

- Modal splits

- Demographics

- Roadway network characteristics

- Environmental constraints

- Land use patterns

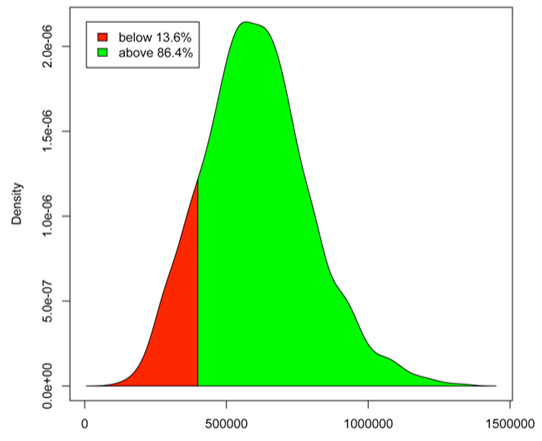

Probabilistic Forecast

- Perform sensitivity analyses for each major variable (separately)

to estimate its relative significance

- Develop probability distribution functions for revenues

View larger version of the Probabilistic Forecast chart

Probabilistic Confidence Levels

- P50: 50% probability of revenue attainment

"Most likely" case, may be used by equity investors

- P90: 90% probability of revenue attainment

"Severe downside" case, may be used by debt providers

Test Your Knowledge

True or False

- Traffic forecasts obtained from regional travel models developed

by MPOs are more than adequate for the purpose of rating debt.

Questions?

Submit a question using the chat box

Part 4 - Financial Viability Analysis

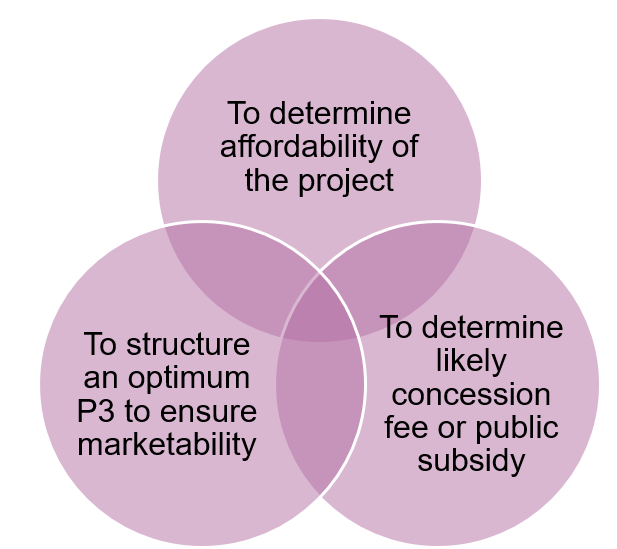

Purpose

text of graphic

- To determine affordability of the project

- To structure an optimum P3 to ensure marketability

- To determine likely concession fee or public subsidy

Key Metrics for Public Agency

- Concession fee - for "NPV positive" projects

- Public subsidy - for "NPV negative" projects

- Toll rates

- Concession term

Key Financial Metrics

- Debt service coverage ratio (DSCR)

- Gearing (or debt-to-equity ratio)

- Equity internal rate of return (Equity IRR)

- Weighted average cost of capital (WACC)

Debt Service Coverage Ratio (DSCR)

- Debt service coverage ratio (DSCR) =

Cash Flow Available for Debt Service

(CFADS)

Required Annual Debt Service

Higher minimum debt service coverage ratio requirement reduces

debt capacity

2. Gearing

- Gearing (or debt-to-equity ratio) =

Debt Amount

Equity Amount

Higher gearing is the result of higher debt capacity and a lower

equity requirement

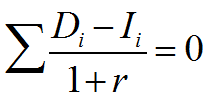

3. Equity Internal Rate of Return

- Equity IRR is the discount rate at which the NPV of equity cash

flows is zero

- Solve for r in the formula:

Where

Di = Equity distributions

Ii = Equity investments

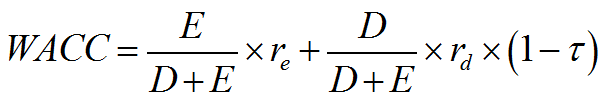

Weighted Average Cost of Capital

- WACC is calculated by combining both cost of debt and equity

- Text book formula (applicable only if gearing is constant):

Where

Where

E = equity amount

D = debt amount

re= required equity return

rd=

debt interest rate

(1- r) = tax shield

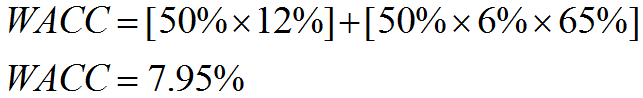

WACC Calculation: Textbook Example

- Equity amount = 50% of total financing

- Required equity return = 12%

- Debt amount = 50% of total financing

- Interest rate = 6%

- Tax rate = 35%, tax shield = 65%

WACC Calculation in Project Finance

- In project finance, debt-to-equity ratio changes over time,

so text book WACC formula cannot be applied

- WACC can be calculated by determining the internal rate of return

(IRR) of all financing cash flows, i.e., the Project IRR:

- Debt drawdown & debt service

- Equity investment & dividend payments

- Reserve movements

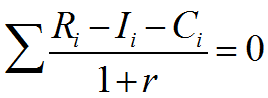

Project Internal Rate of Return

- Project IRR is the discount rate at which the NPV of financing

cash flows is zero

- Solve for r in the formula:

Where Ri= Revenues

Ii=

Investments

Ci= Operating costs

Test Your Knowledge

True or False

- A higher required minimum DSCR will allow a project to obtain

a higher amount of debt

Questions?

Submit a question using the chat box

Part 5 - Financial Models

Financial Calculations

| Funding/financing sources |

Uses of funds |

- Equity & debt

- Subsidies/Agency budget

- Toll revenues

|

- Capital expenses

- Operating expenses

- Debt service

- Tax & dividends

|

|

|

| P3-VALUE 2.0 Financial

Model |

|

- Capacity of project revenues to repay debt

- Capacity to attract equity

- Required public subsidy payments

|

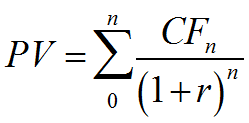

Discounting of Cash Flows

- Converts future costs and revenues to "present value"

terms

- Discount rate reflects risk and the time value of money

Where PV= Present Value

CFn=

Cash Flow in year n r = discount rate

n = year

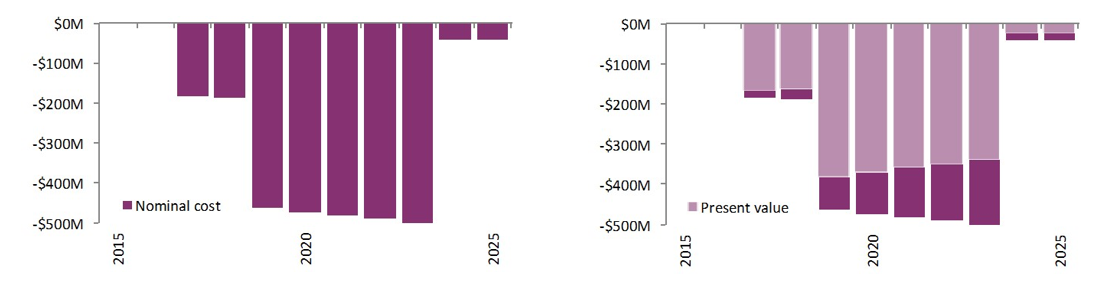

Effects of Discounting

- Cash flows later in a concession period will have a relatively

lower impact

- In the example depicted below, the nominal and present value

of the cost cash flows in year 2020 are:

- Nominal value: $472M

- Present value: $370M

View larger version of the effects of discounting charts

Use of Financial Modeling

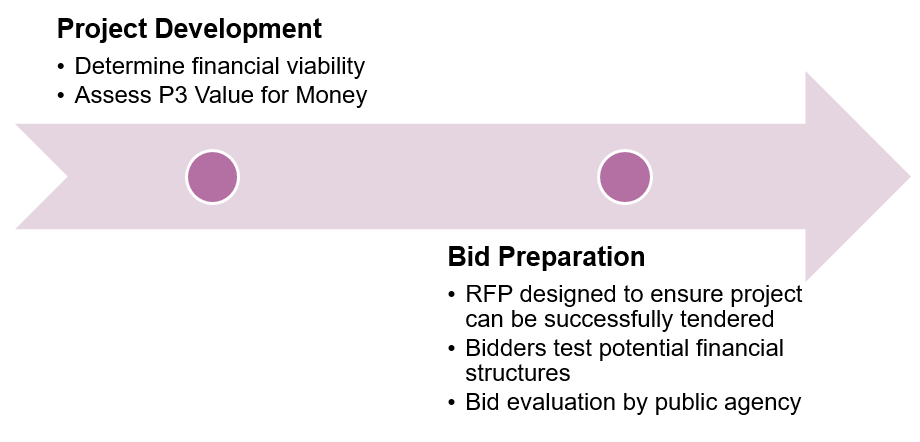

View larger version of the Financial Modeling steps

text of graphic

Project Development

- Determine financial viability

- Assess P3 Value for Money

Bid Preparation

- RFP designed to ensure project can be successfully tendered

- Bidders test potential financial structures

- Bid evaluation by public agency

Use of Financial Modeling

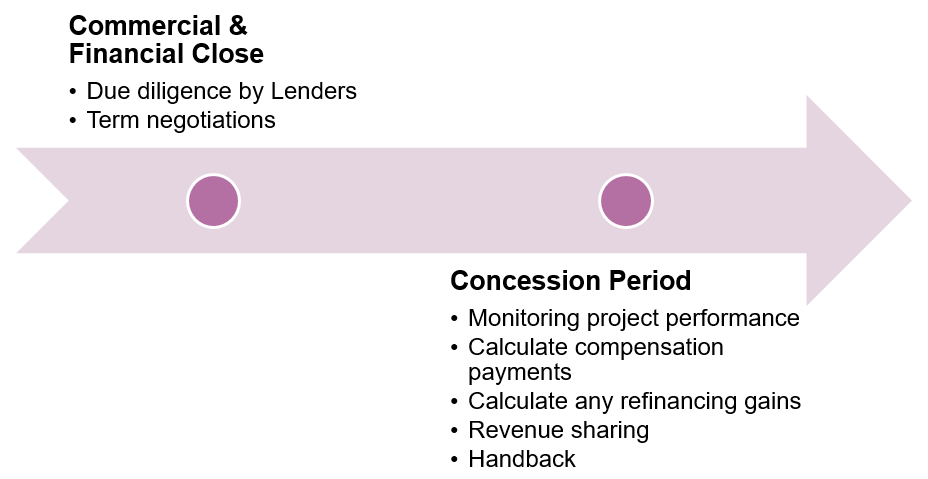

View larger version of the second Financial Modeling steps

text of graphic

Commercial & Financial Close

- Due diligence by Lenders

- Term negotiations

Concession Period

- Monitoring project performance

- Calculate compensation payments

- Calculate any refinancing gains

- Revenue sharing

- Handback

Test Your Knowledge

True or False

- Using a high discount rate with a stream of future cash flows

will result in a lower NPV

Questions?

Submit a question using the chat box

Part 6 - Using P3-VALUE for Financial Viability Assessment

FHWA's P3-VALUE 2.0

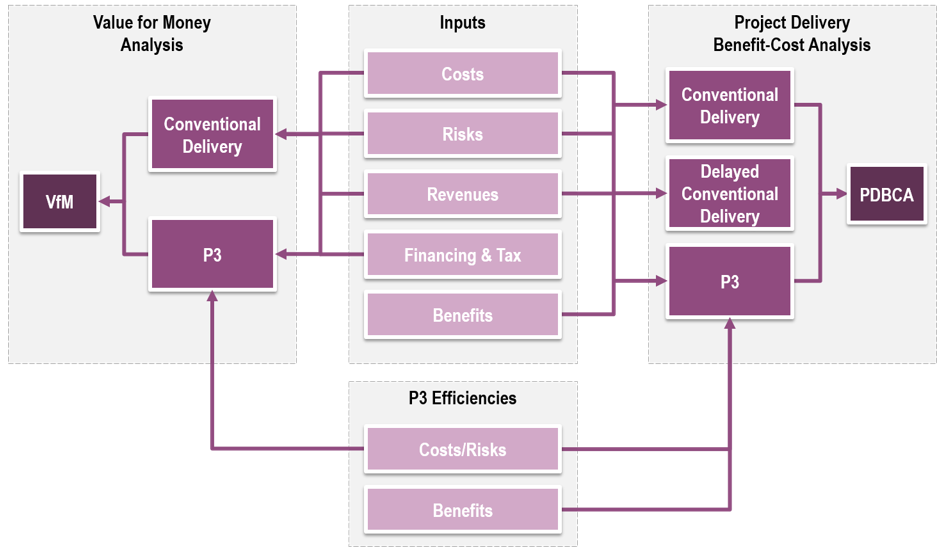

View larger version of the P3-VALUE content flow chart

Training Modules

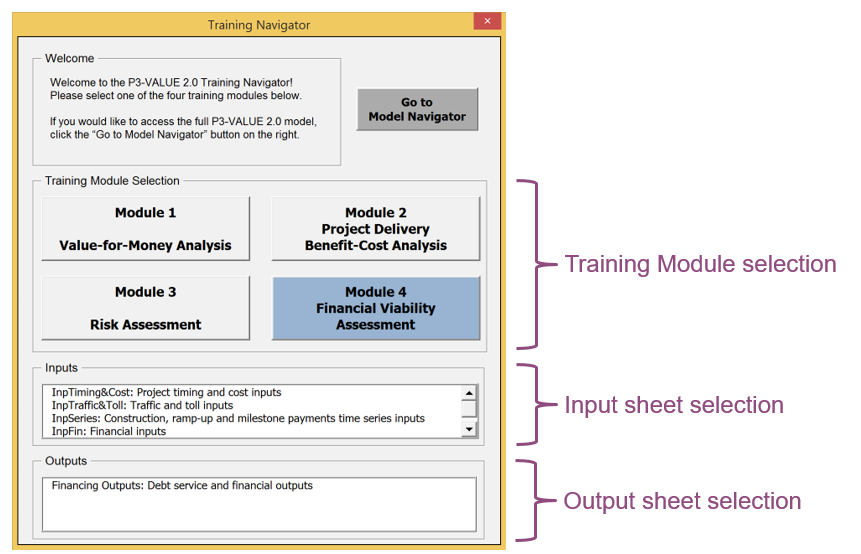

Training Navigator User Interface

View larger version of the Training Navigator User Interface screen

Demonstration of Financial Module

Please stand by as we open the Excel file

Tool and References

Questions?

Submit a question using the chat box

Webinar Summary

Webinar Recap

Part 1 - P3 Project Financing

Part 2 - P3 Financial Structure

Part 3 - Traffic & Revenue Forecasting

Part 4 - Financial Viability Analysis

Part 5 - Financial Models

Part 6 - Using P3-VALUE for Financial Viability

Assessment

Resources

FHWA's Center for Innovative Finance Support Website: https://www.fhwa.dot.gov/ipd/

P3 Website: https://www.fhwa.dot.gov/ipd/p3/

Financial Assessment Exercise

- Exercise instructions may be downloaded from the web room

- Technical assistance options:

- Exercise review webinar - March 28 at 12:30pm EST

To access the Exercise Review webinar, please

use the following link and telephone number:

Link: https://connectdot.connectsolutions.com/p3/

Telephone: 1-888-363-4749, Passcode: 6139168#

Contact Information

P3 Program Manager

Center for Innovative Finance Support

Federal Highway Administration

(202)

366-4076

Patrick.DeCorla-Souza@dot.gov

Where