Patrick DeCorla-Souza

P3 Program Manager

Office of Innovative Program Delivery

Wim Verdouw

Financial Modeler

IMG/Rebel

Part 1 Recap of Value for Money (VfM) Assessment

Part 2 P3-VALUE 2.1 Enhancements

Part 3 Illustrative Application VfM Assessment

1. Planning - High level screening for financial viability and VfM

2. Project Development - More detailed quantitative assessment of financial viability and VfM

3. Procurement - Refine financial and VfM analyses as cost and revenue estimates are refined and bids are received

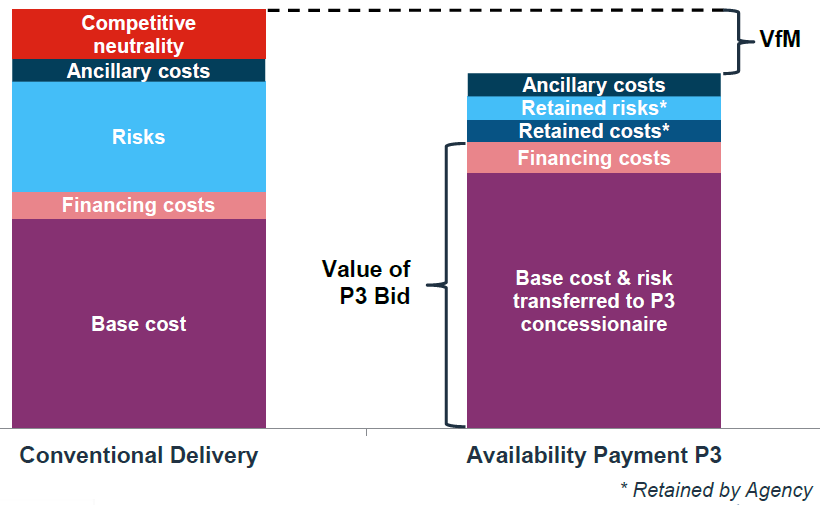

Conventional delivery is made up of:

Availability Payment P3 is made up of:

**Value of P3 Bid is determined using these two costs

*Retained by Agency

VfM is the difference between Conventional Delivery and Availability Payment P3 totals.

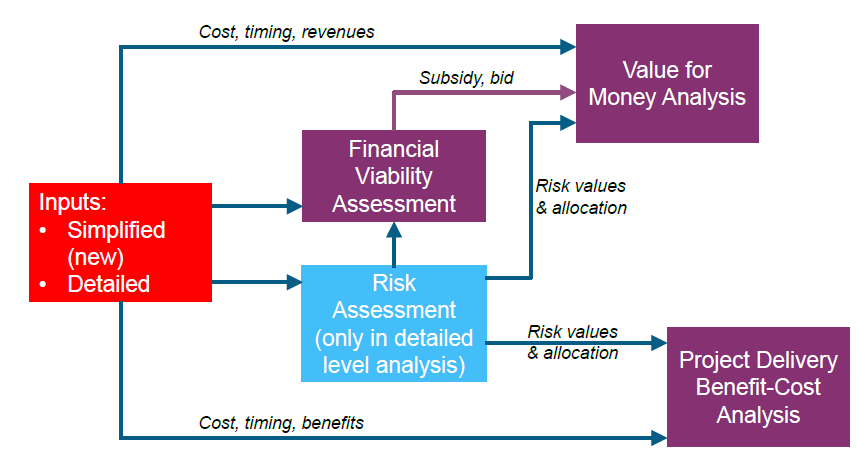

Text description of flow chart

Inputs:

Please stand by while we open the P3-VALUE 2.1 tool to show the enhanced features

| Project Delivery Inputs | PSC | P3 | |

|---|---|---|---|

| Facility tolled? | TRUE | ||

| P3 delivery model | ///////////////////////// | Toll concession | |

| Project Timing Inputs | PSC | P3 | |

| Pre-construction start year | 2018 | 2018 | |

| Pre-construction duration (in years) | 2 years | 2 years | |

| Construction duration (in years) | 4 years | 3 years | |

| Operations duration (in years) | 40 years | 41 years | |

| Delayed PSC pre-construction start year | 2023 | ||

| Capital Cost Inputs (Risk Adjusted)* | PSC | P3* | |

| Public procurement cost (in million $) | $5.0M | $10.0M | 0% |

| Private procurement cost (in million $) | $5.0M | $10.0M | 100% |

| Pre-construction cost (in million $) | $25.0M | $22.5M | 100% |

| Construction cost (in million $) | $400.0M | $367.5M | 100% |

| Financing Inputs | PSC | P3 |

|---|---|---|

| Subsidy/milestone payment (in million $) | $100.0M | $100.0M |

| Cost of equity (in percent) | ////////////////////// | 12.00% |

| Gearing (in percent) | ////////////////////// | 75.00% |

| Debt maturity (from start construction, in years) | 35 years | 30 years |

| Debt interest rate (in percent) | 4.00% | 6.00% |

| Equity bridge loan interest rate (in percent) | ////////////////////// | 6.00% |

| Minimum required DSCR (multiple of debt service) | 1.30x | 1.30x |

| Interest rate on reserves (in percent) | 2.00% | 2.00% |

| Debt issuance/arrangement fee (in percent) | 1.00% | 1.00% |

| Financing Inputs | PSC | P3 |

|---|---|---|

| Subsidy/milestone payment (in million $) | $100.0M | $100.0M |

| Cost of equity (in percent) | ////////////////////// | 10.00% |

| Gearing (in percent) | ////////////////////// | 85.00% |

| Debt maturity (from start construction, in years) | 35 years | 30 years |

| Debt interest rate (in percent) | 4.00% | 6.00% |

| Equity bridge loan interest rate (in percent) | ////////////////////// | 6.00% |

| Minimum required DSCR (multiple of debt service) | 1.30x | 1.20x |

| Interest rate on reserves (in percent) | 2.00% | 2.00% |

| Debt issuance/arrangement fee (in percent) | 1.00% | 1.00% |

| Lifecycle Performance Risk & Revenue Uncertainty Adjustment Inputs | |

|---|---|

| Lifecycle performance risk calculation method (see options below) | Option 1 |

| Lifecycle performance risk aggregate premium (in million $, option 2 only) | $400.0M |

| Revenue uncertainty adjustment calculation method (see options below) | Option 1 |

| Delta between availability payment & toll concession WACC (in percent, option 1 only) | 1.60% |

| Revenue uncertainty adjustment (% of toll revenue collection, option 2 only) | 28.00% |

| Guidance for Valuation Options | |

| Option 1: WACC-based risk premium is calculated to determine the value of lifecycle performance risks/revenue uncertainty adjustment | |

| Option 2: User to provide a risk premium for the value of lifecycle performance risks/revenue uncertainty adjustment | |

| Option 3: Lifecycle performance risks/revenue uncertainty adjustment are ignored in the analysis | |

| Taxation Inputs | State | Federal |

|---|---|---|

| Tax rate (in percent) | 10.00% | 25.00% |

| Tax considered for competitive neutrality adjustment? | TRUE | TRUE |

| Competitive Neutrality Adjustment Inputs | ||

| Value of construction self-insurance (% of transferred construction costs) | 0.00% | |

| Value of O&M and major maintenance self-insurance (% of transferred costs) | 0.00% | |

| Value of credit subsidy or tax benefits under PSC delivery (in million $) | $0.0M | |

| Value of credit subsidy or tax benefits under P3 delivery (in million $) | $0.0M | |

| REVENUES & COSTS (NPV @ 4.00%, 2018) | PSC | P3 | ||

|---|---|---|---|---|

| Toll revenues | ||||

| Toll revenues to Agency | $784M | - | ||

| Toll revenues to P3 Developer | //////////// | $806M | ||

| Toll revenues subtotal | $784M | $806M | ||

| Cost component 1a: Total/transferred base costs (including risks transferred to subcontractors) | ||||

| Total (PSC)/Transferred (P3) pre-construction (including private procurement costs) | ($28M) | ($30M) | ||

| Total (PSC)/Transferred (P3) construction costs | ($374M) | ($347M) | ||

| Total (PSC)/Transferred (P3) O&M costs (including private procurement costs) | ($129M) | ($120M) | ||

| Base cost subtotal 1a | ($531M) | ($497M) | ||

| Cost component 1b: Retained base costs (P3 only) | ||||

| Retained pre-construction costs | //////////// | - | ||

| Retained construction costs | //////////// | - | ||

| Retained O&M costs (including P3 oversight costs) | //////////// | - | ||

| Retained base cost subtotal 1b | - | - | ||

| Base costs subtotal (1a + 1b) | ($531M) | ($497M) | ||

| Cost component 2: Financing costs | ||||

| Financing cost | ($3M) | ($397M) | ||

| Financing cost subtotal | ($3M) | ($397M) | ||

| P3 Shadow Bid (Revenues to P3 minus cost components 1a & 2) | N.A. | ($88M) | Shadow Bid |

|

| REVENUES & COSTS (NPV @ 4.00%, 2018) | PSC | P3 | ||

|---|---|---|---|---|

| Cost component 3: Long-term risks retained by Agency | ||||

| Calculated market value of lifecycle performance risk | ($105M) | //////////// | ||

| Calculated market value of revenue uncertainty adjustment | ($162M) | - | ||

| Long-term risks retained by Agency subtotal | ($267M) | - | ||

| Cost component 4: Ancillary costs & cost savings | ||||

| Procurement & oversight cost in the design-build phase | ($5M) | ($9M) | ||

| No Build cost savings | $250M | $259M | ||

| Ancillary costs & cost savings subtotal | $245M | $250M | ||

| Cost component 5: Competitive neutrality adjustment | ||||

| State taxes | //////////// | $36M | ||

| Federal taxes | //////////// | $81M | ||

| Value of public agency self-insurance | //////////// | - | ||

| Net credit subsidy adjustment (NPV of PSC credit subsidy - NPV of P3 credit subsidy) | //////////// | - | ||

| Competitive neutrality adjustment subtotal | - | $116M | ||

| Total net value after revenue | $228M | $278M | VfM Comparison |

|

| Note: Calculated market value of lifecycle performance risk | ($105M) | //////////// | ||

| Note: Calculated market value of revenue uncertainty adjustment | ($162M) | //////////// | ||

| Social welfare benefits due to P3 delivery (excluding No Build cost savings) | $166M | |||

| Social welfare benefits due to project acceleration | $431M | |||

| REVENUES & COSTS (NPV @ 4.00%, 2018) | PSC | P3 | ||

|---|---|---|---|---|

| Toll revenues | ||||

| Toll revenues to Agency | $784M | $806M | Revenue risk borne by Agency |

|

| Toll revenues to P3 Developer | //////////// | - | ||

| Toll revenues subtotal | $784M | $806M | ||

| Cost component 1a: Total/transferred base costs (including risks transferred to subcontractors) | ||||

| Total (PSC)/Transferred (P3) pre-construction (including private procurement costs) | ($28M) | ($30M) | ||

| Total (PSC)/Transferred (P3) construction costs | ($374M) | ($347M) | ||

| Total (PSC)/Transferred (P3) O&M costs (including private procurement costs) | ($129M) | ($120M) | ||

| Base cost subtotal 1a | ($531M) | ($497M) | ||

| Cost component 1b: Retained base costs (P3 only) | ||||

| Retained pre-construction costs | //////////// | - | ||

| Retained construction costs | //////////// | - | ||

| Retained O&M costs (including P3 oversight costs) | //////////// | - | ||

| Retained base cost subtotal 1b | - | - | ||

| Base costs subtotal (1a + 1b) | ($531M) | ($497M) | ||

| Cost component 2: Financing costs | ||||

| Financing cost | ($3M) | ($180M) | ||

| Financing cost subtotal | ($3M) | ($180M) | ||

| P3 Shadow Bid (Revenues to P3 minus cost components 1a & 2) | N.A. | ($677M) | Shadow Bid |

|

| REVENUES & COSTS (NPV @ 4.00%, 2018) | PSC | P3 | ||

|---|---|---|---|---|

| Cost component 3: Long-term risks retained by Agency | ||||

| Calculated market value of lifecycle performance risk | ($142M) | //////////// | ||

| Calculated market value of revenue uncertainty adjustment | ($184M) | ($190M) | Retained revenue risk |

|

| Long-term risks retained by Agency subtotal | ($326M) | ($190M) | ||

| Cost component 4: Ancillary costs & cost savings | ||||

| Procurement & oversight cost in the design-build phase | ($5M) | ($9M) | ||

| No Build cost savings | $250M | $259M | ||

| Ancillary costs & cost savings subtotal | $245M | $250M | ||

| Cost component 5: Competitive neutrality adjustment | ||||

| State taxes | //////////// | $15M | ||

| Federal taxes | //////////// | $34M | ||

| Value of public agency self-insurance | //////////// | - | ||

| Net credit subsidy adjustment (NPV of PSC credit subsidy - NPV of P3 credit subsidy) | //////////// | - | ||

| Competitive neutrality adjustment subtotal | - | $49M | ||

| Total net value after revenue | $169M | $239M | VfM Comparison |

|

| Note: Calculated market value of lifecycle performance risk | ($142M) | //////////// | ||

| Note: Calculated market value of revenue uncertainty adjustment | ($184M) | //////////// | ||

| Social welfare benefits due to P3 delivery (excluding No Build cost savings) | $166M | |||

| Social welfare benefits due to project acceleration | $424M | |||

P3 Program Manager

USDOT Build America Bureau

& FHWA Center for Innovative Finance Support

(202) 366-4076

Patrick.DeCorla-Souza@dot.gov