Presentation

Presenters

Benjamin Perez

Principal Consultant

WSP |

Parsons Brinckerhoff

Mark Sullivan

Director

Center for Innovative

Finance Support

Federal Highway Administration

Patrick DeCorla -Souza

P3 Program Manager,

Build America Bureau & Federal Highway Administration

Presentation Overview

- Introduction and Definitions (Chapters 1 & 2)

- Federal Role (Chapter 3)

- Evolution of the U.S. P3 Market (Chapter 4)

- P3 Stories (Appendix)

This presentation will introduce Chapters 1- 4.

Introduction and Definitions (Chapters 1 and 2)

Purpose

- Provide U.S. highway experience with highway public-private

partnership (P3) concessions since 1992, including:

- Evolution of the federal role

- Trends and market developments

- Case studies of all 28 U.S. P3 highway concession projects

that have achieved financial close

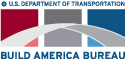

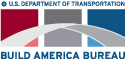

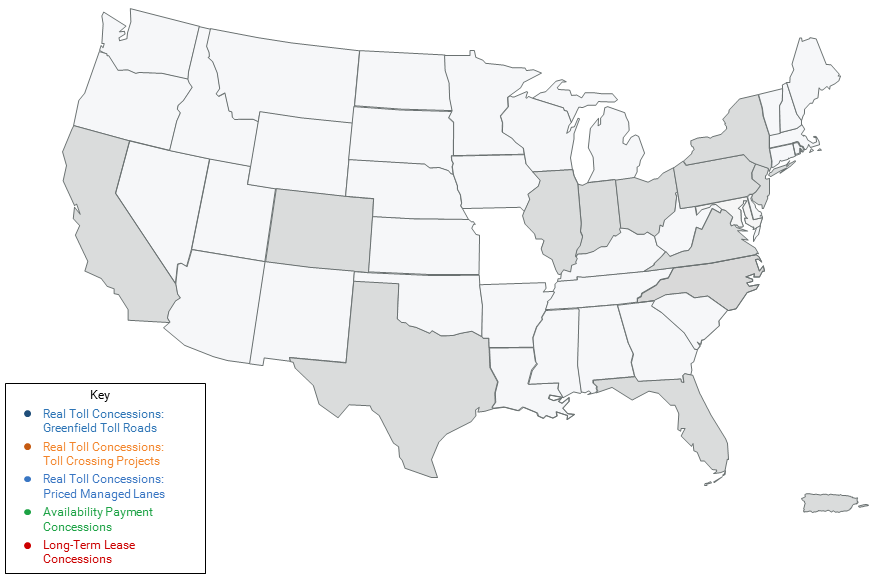

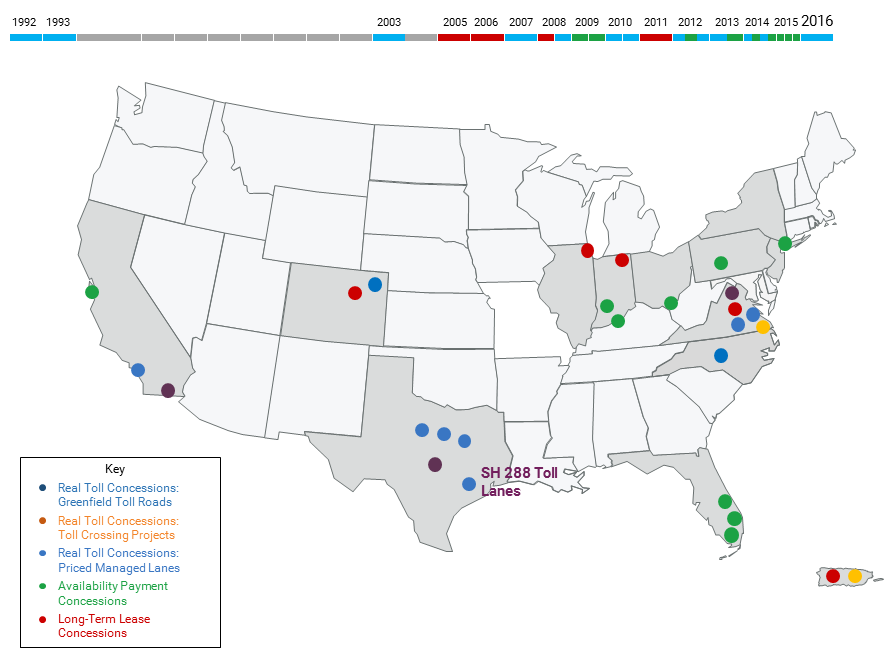

U.S. P3 Concessions by Status

View

larger version of P3 Concessions by Status map

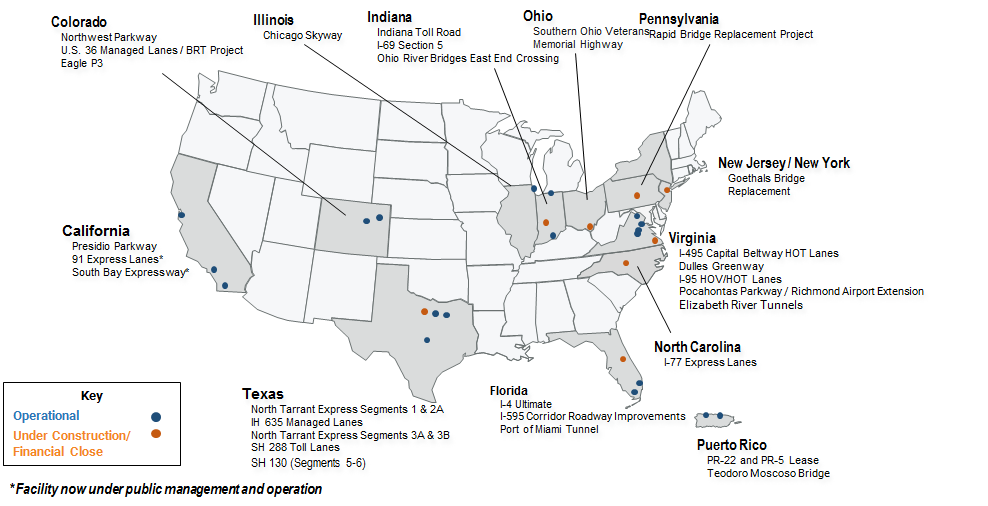

Spectrum of Project Delivery Options

View

larger version of Project Delivery Options chart

DBFOM Concession Types

New Build Projects

- Real Toll Concessions

- Greenfield Toll Roads

- Fixed Crossings

- Priced Managed Lanes

- Availability Payment Concessions

Existing Toll Roads

- Long-term Lease Concessions

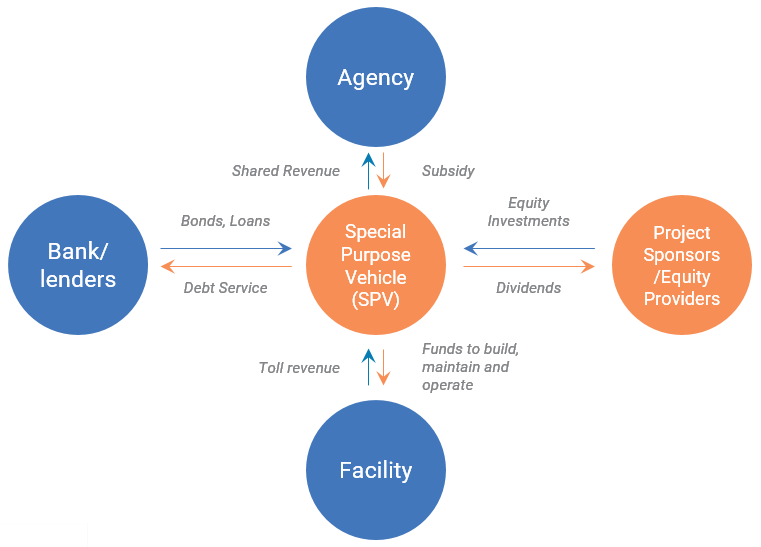

Typical Toll Concession P3 Structure

View larger version of Typical Toll Concessions P3 Structure flow chart

Real Toll Concessions

- Used to develop three types of projects:

- Greenfield toll roads

- Fixed crossings

- Priced managed lanes

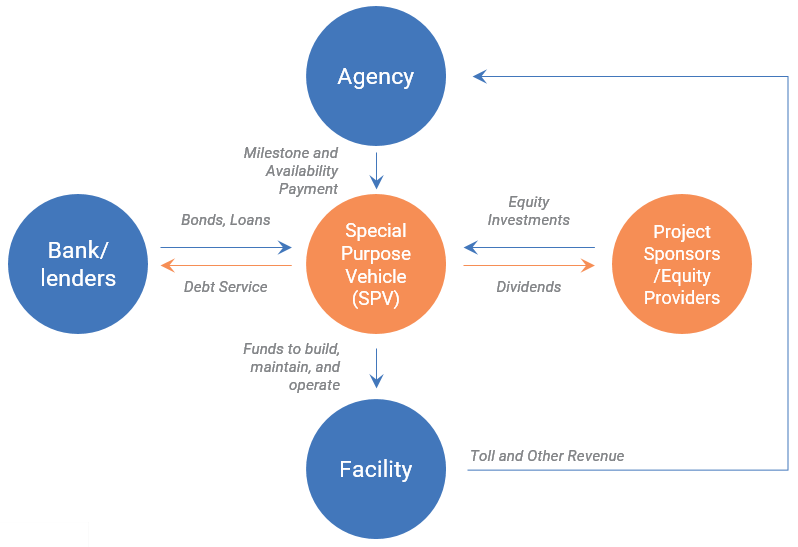

Typical Availability P3 Structure

View larger version of Typical Availability P3 Structure flow chart

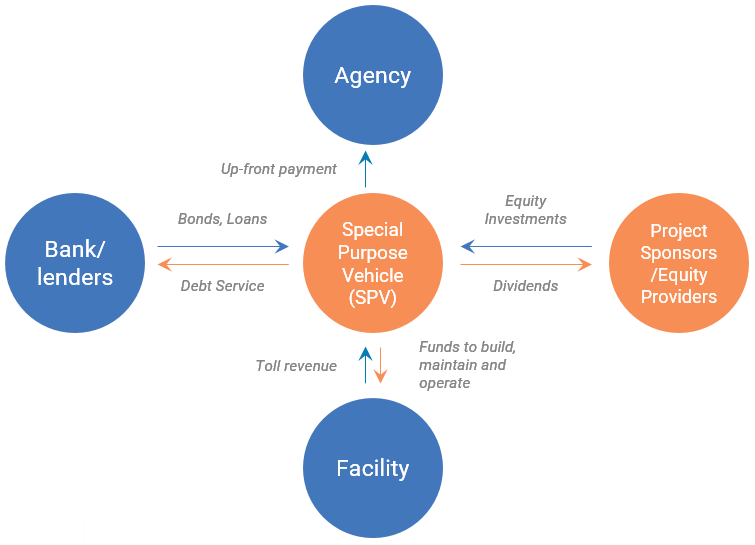

Typical Long-term Lease Concession P3 Structure

View larger version of Typical Long-term Lease Concession P3 Structure

flow chart

Federal Role (Chapter 3)

TE-045

- 1994: TE-045 - initiative to test and evaluate ideas from states

on new financial strategies

- Matching

- Toll Credits

- Advance Construction

GARVEE Bonds

- 1995: Grant Anticipation Revenue Vehicle (GARVEE bond)

- Allows states to leverage future Federal Aid Highway Program

receipts in the municipal credit market

TIFIA

- 1998: Transportation Infrastructure Finance and Innovation Act

(TIFIA)

- Provides loans, guarantees and lines of credit for qualified

revenue-generating projects

- Covers up to one third of eligible costs

- Attractive low interest rates tied to U.S. Treasury bonds

Private Activity Bonds

- 2005: Private Activity Bonds (PABs)

- Allows private developers of highways and freight transfer

facilities to borrow funds in the tax-exempt municipal credit

market

- Total volume of PABs limited to $15 billion

SEP-15

- Special Experimental Program 15 (SEP-15)

- An experimental process for FHWA to identify and test new

P3 approaches

- Provides states with the opportunity to gain exceptions

from or changes to federal policies or procedures

Other USDOT Support

- Build America Bureau and FHWA Center for Innovative Finance

Support

- Analytical Tools

- Educational Materials

- Research

- Peer Exchanges

- Capacity Building

- Technical Assistance

- Environmental Streamlining

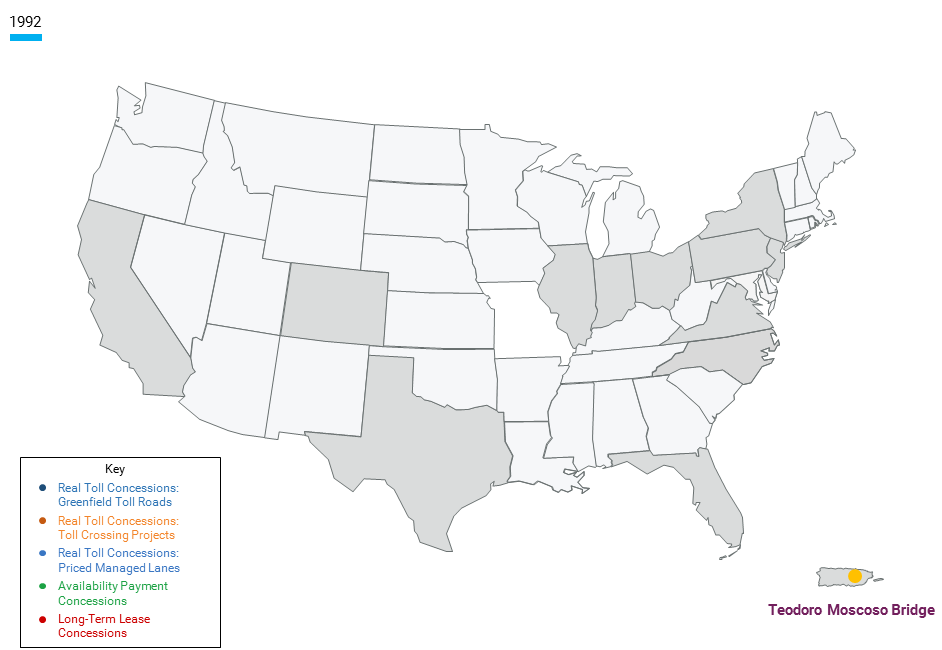

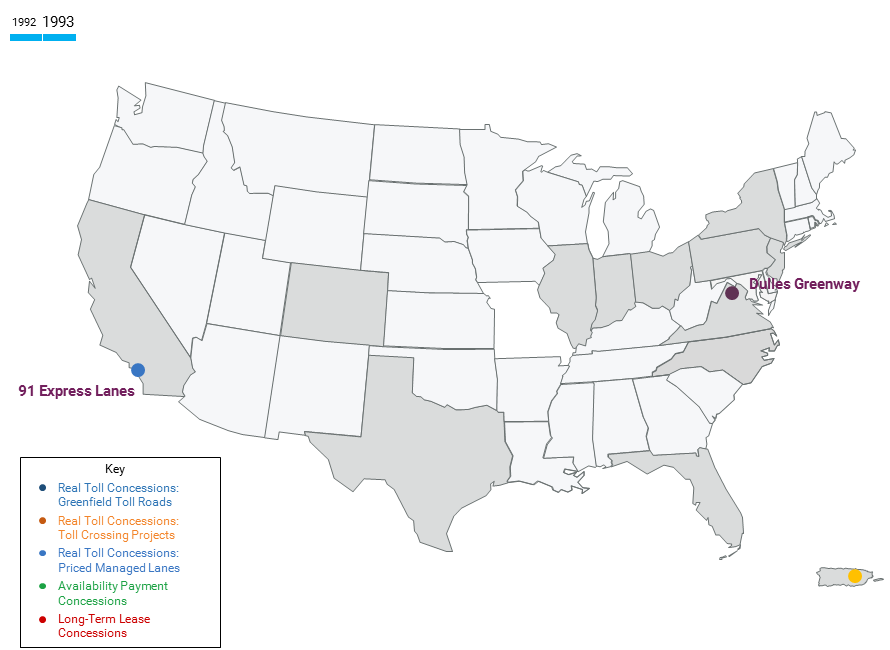

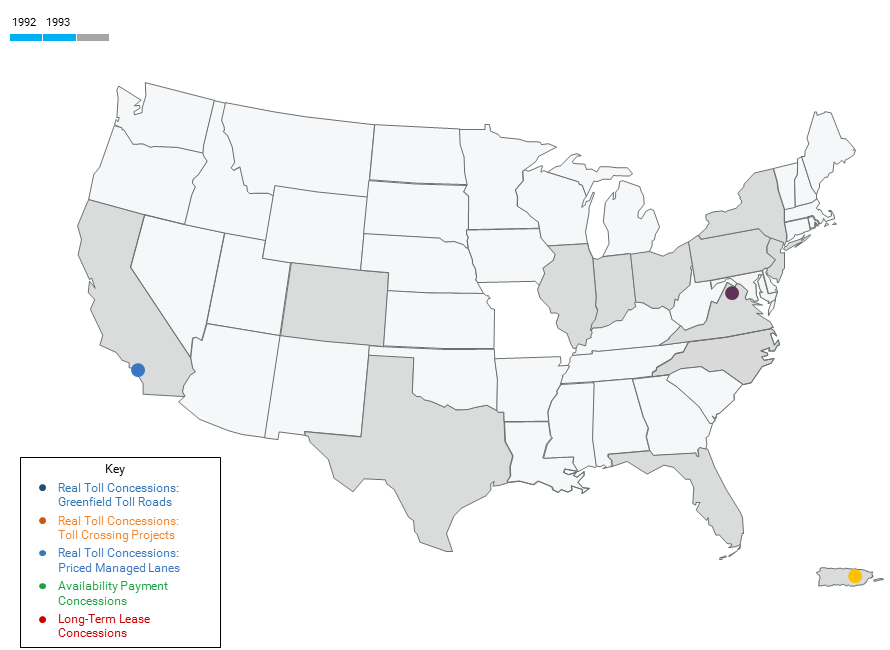

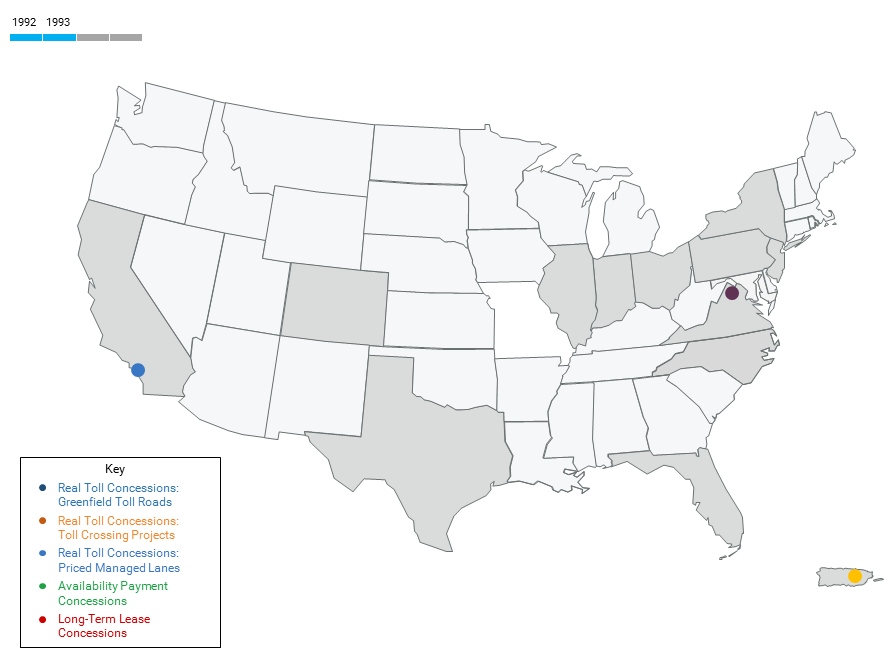

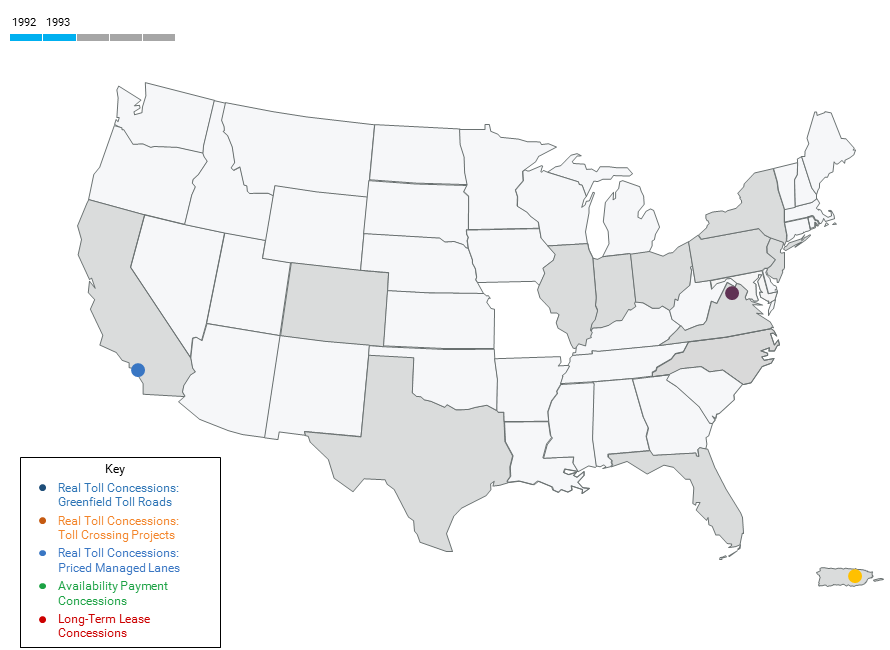

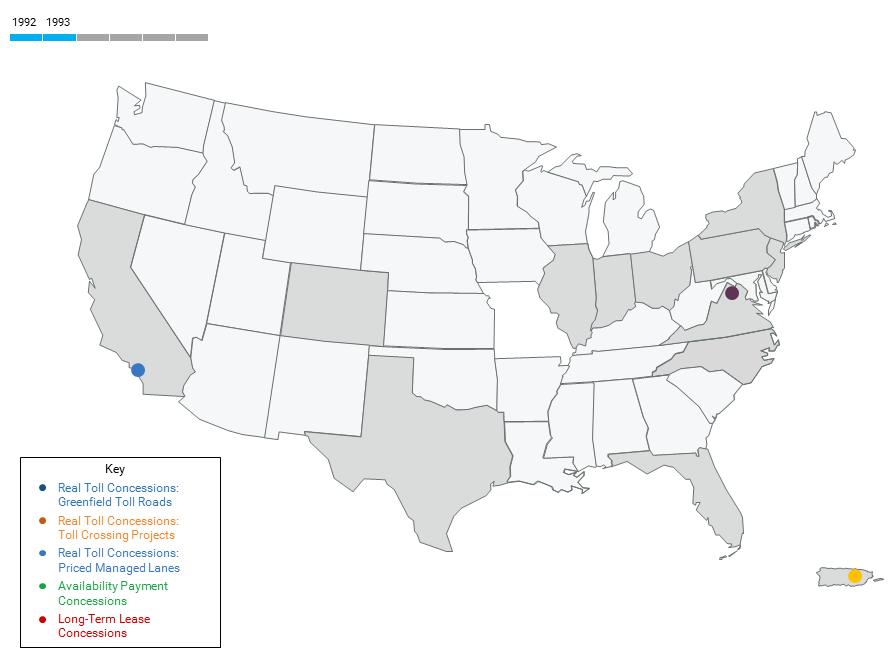

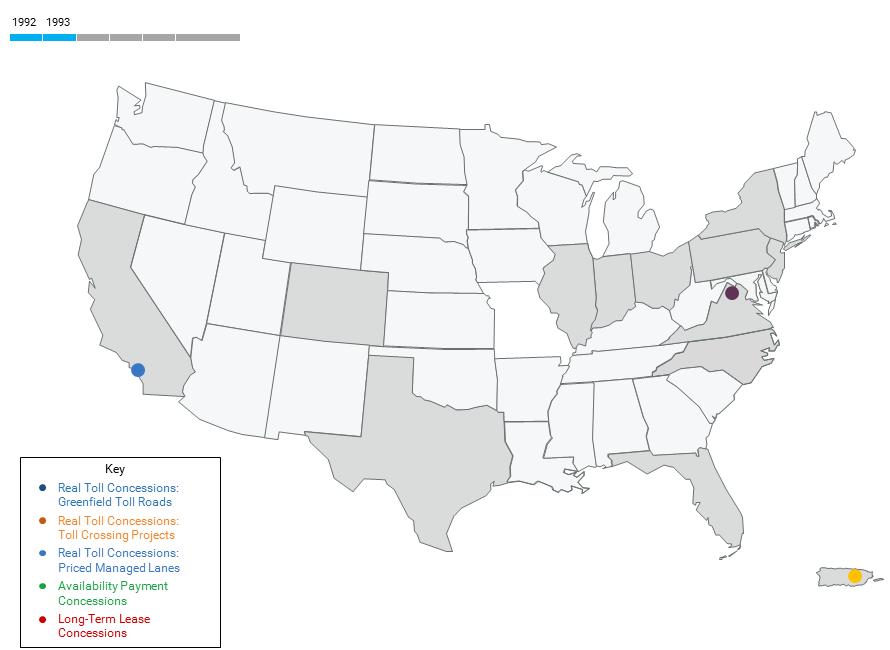

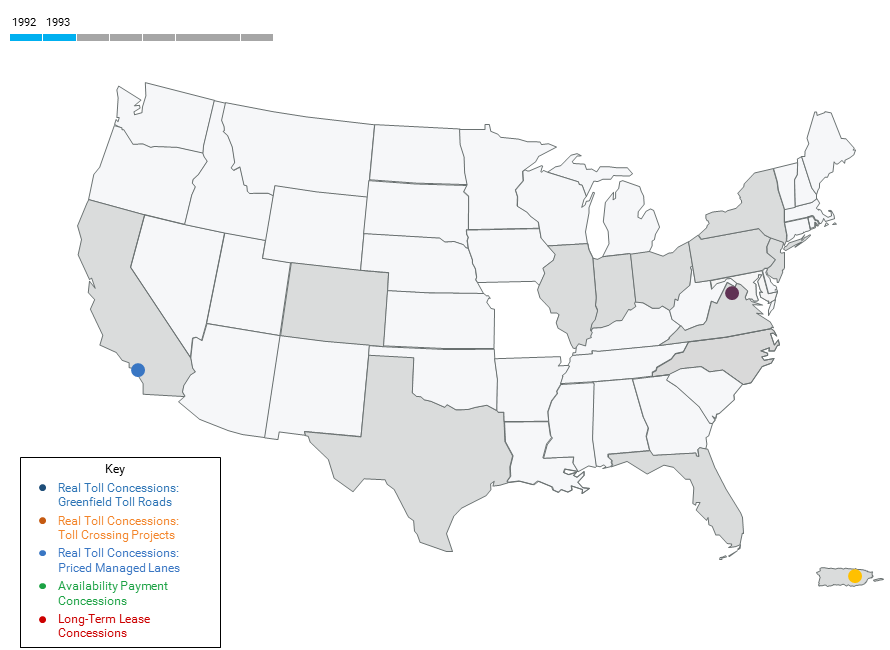

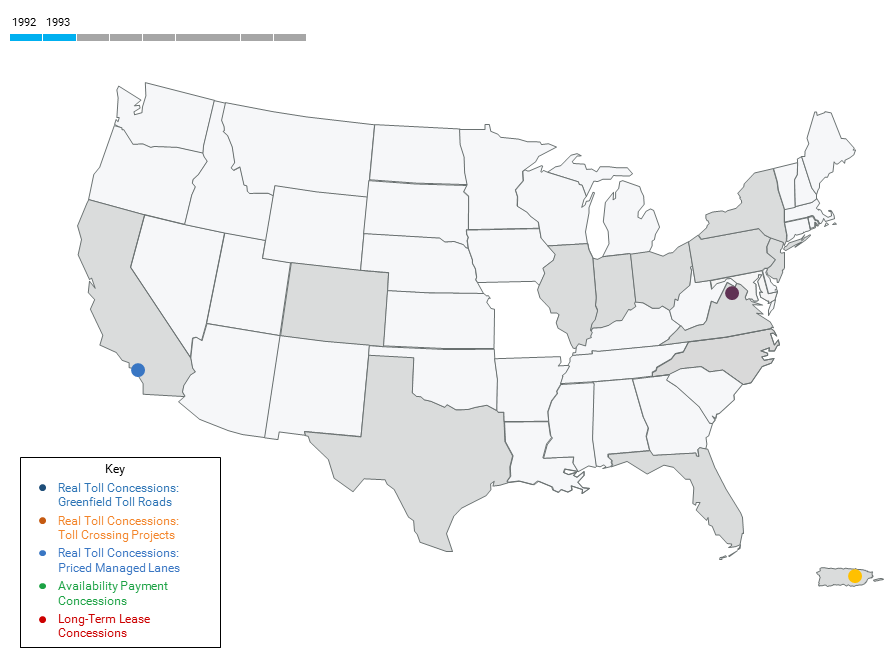

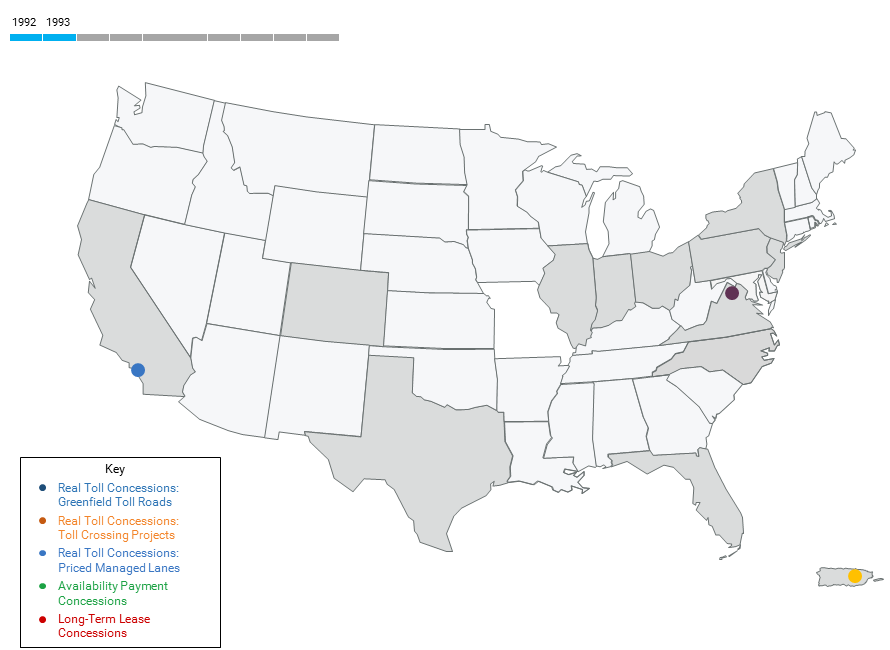

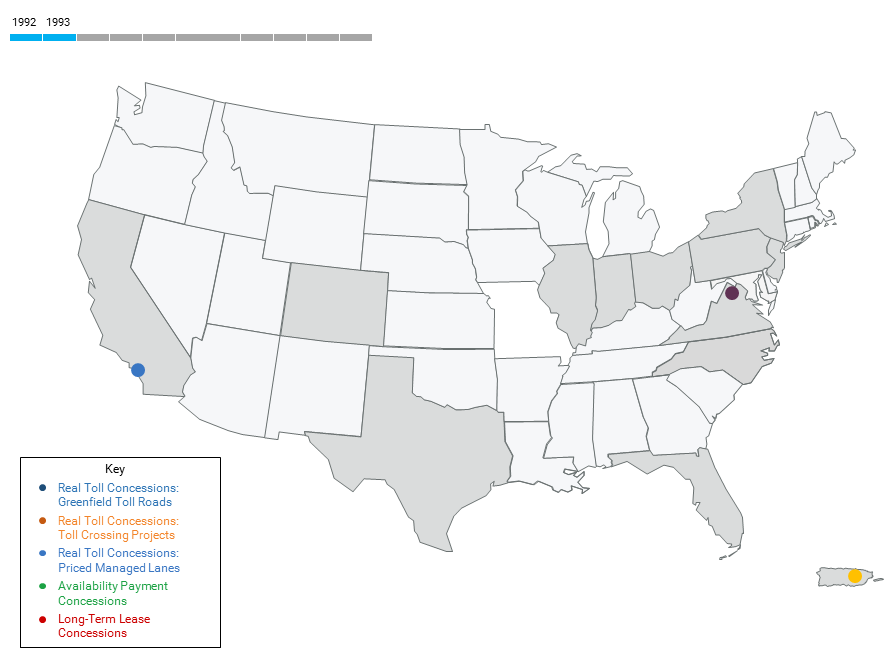

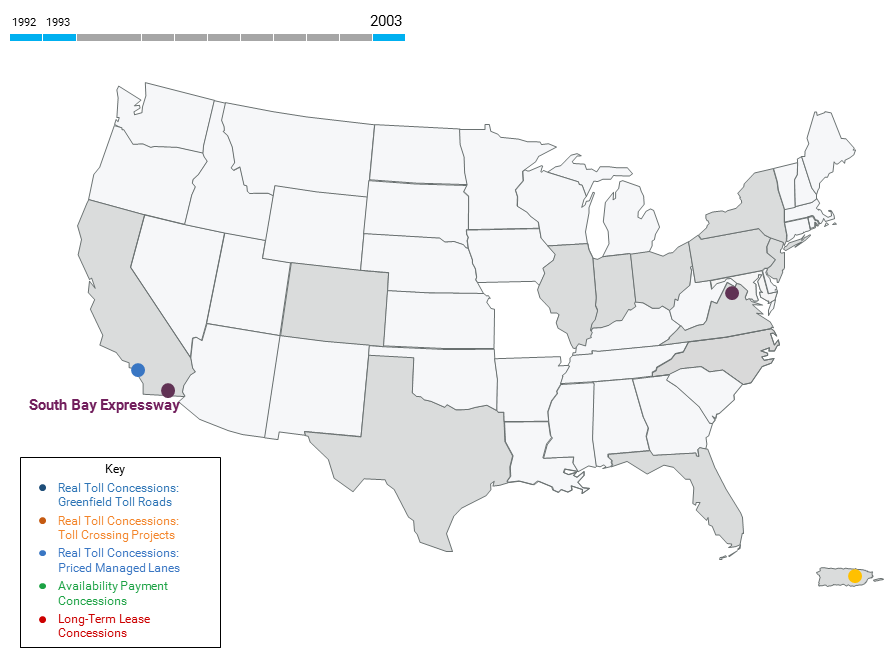

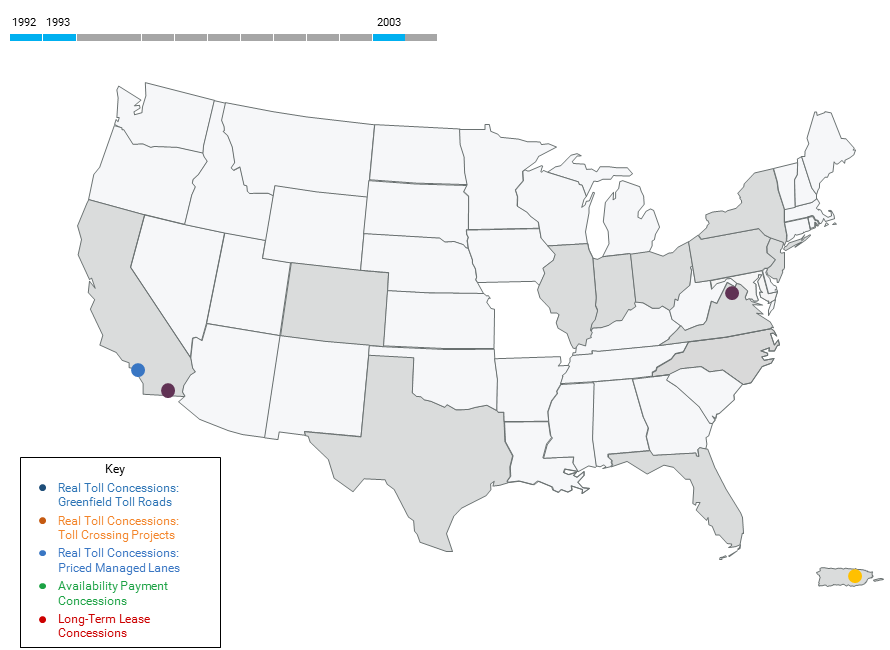

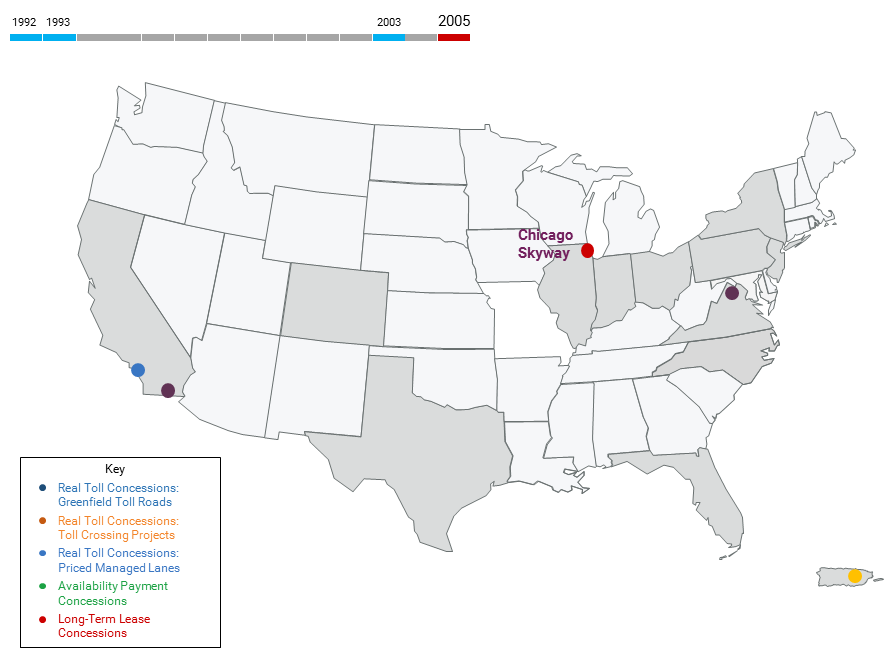

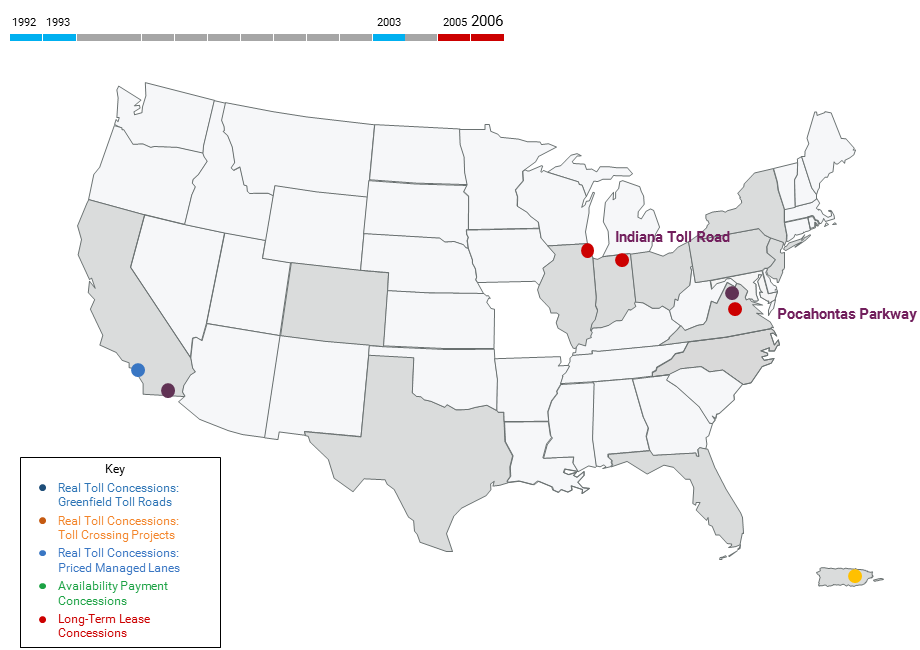

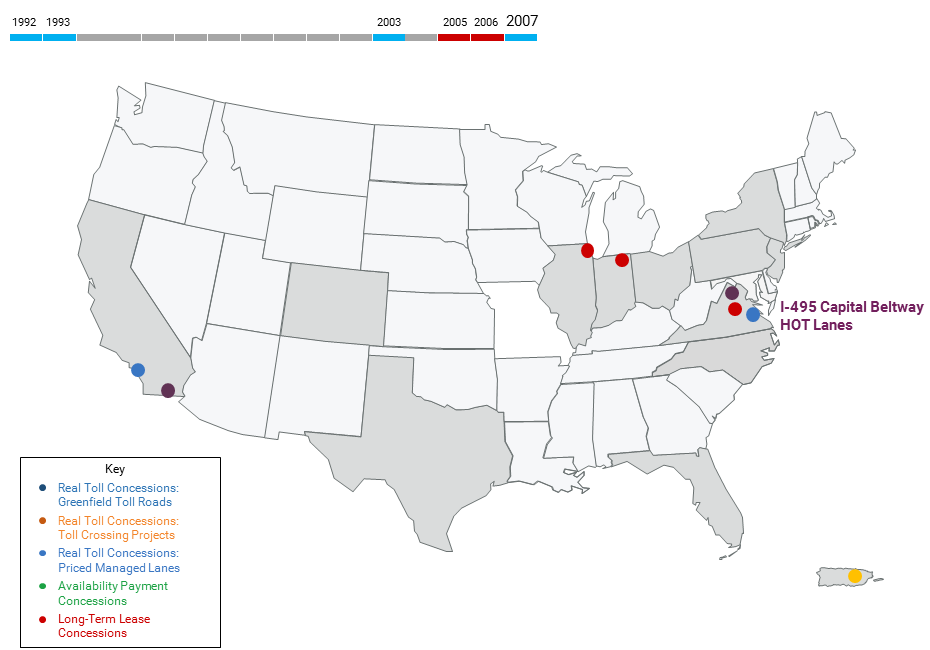

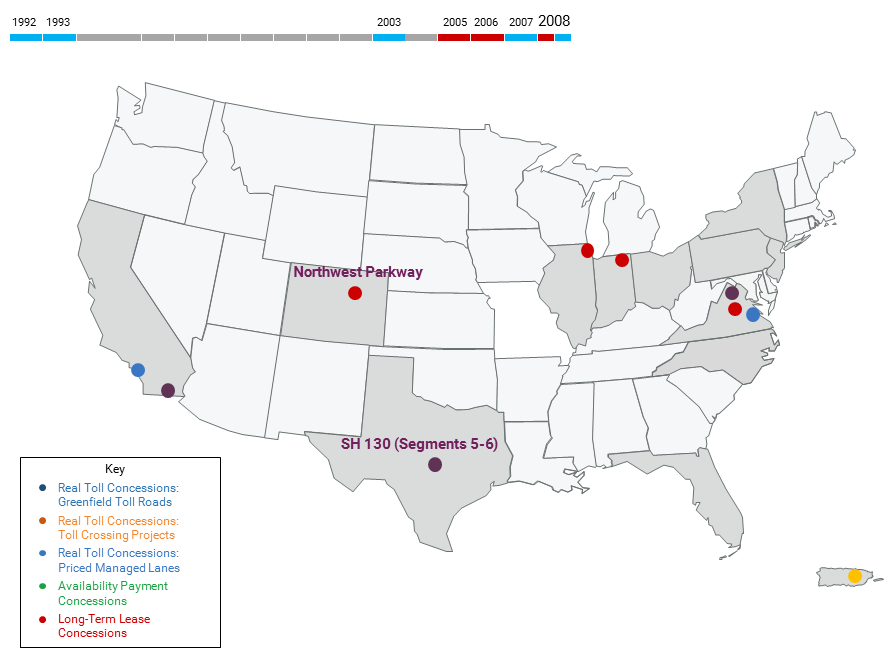

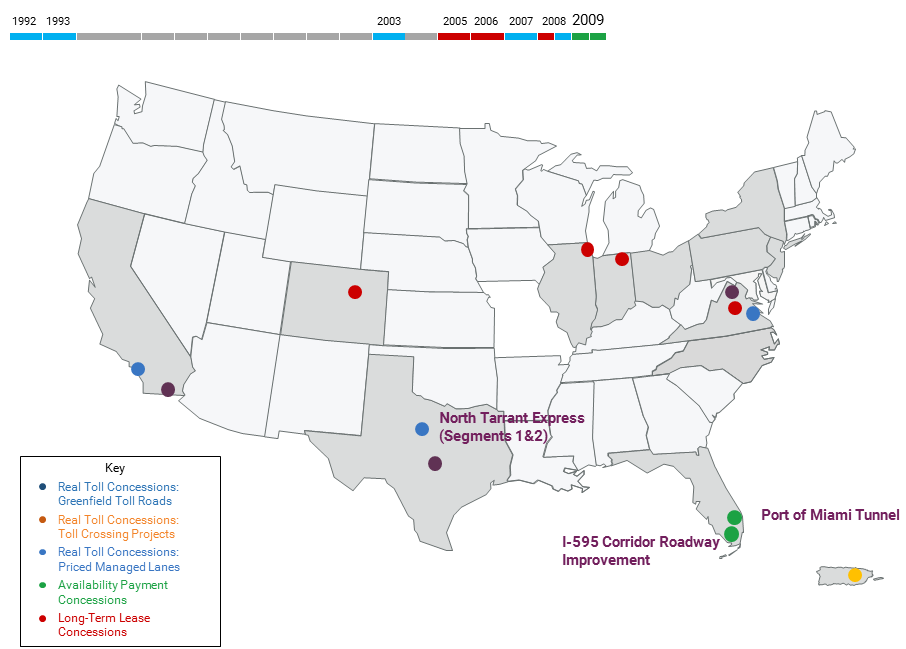

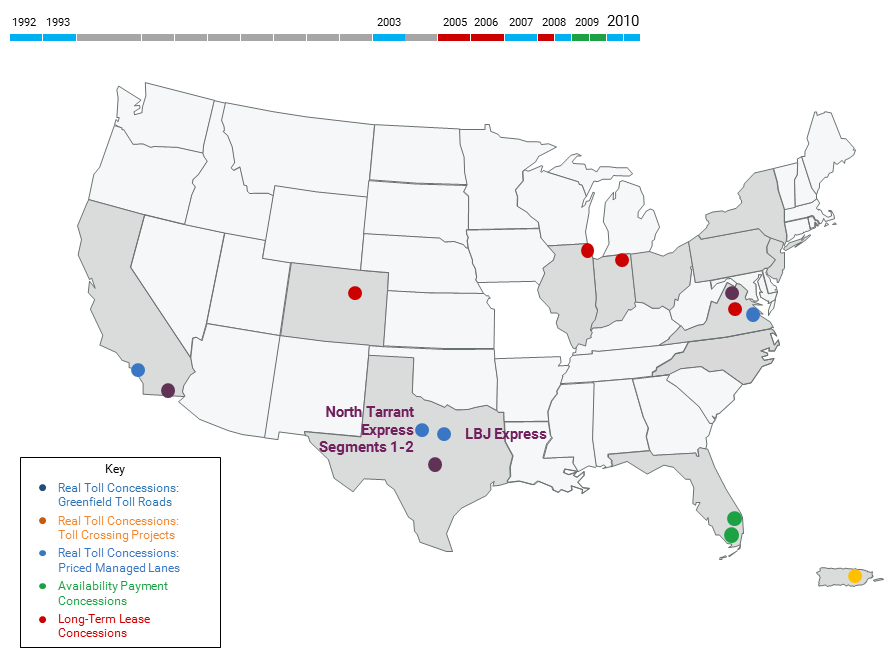

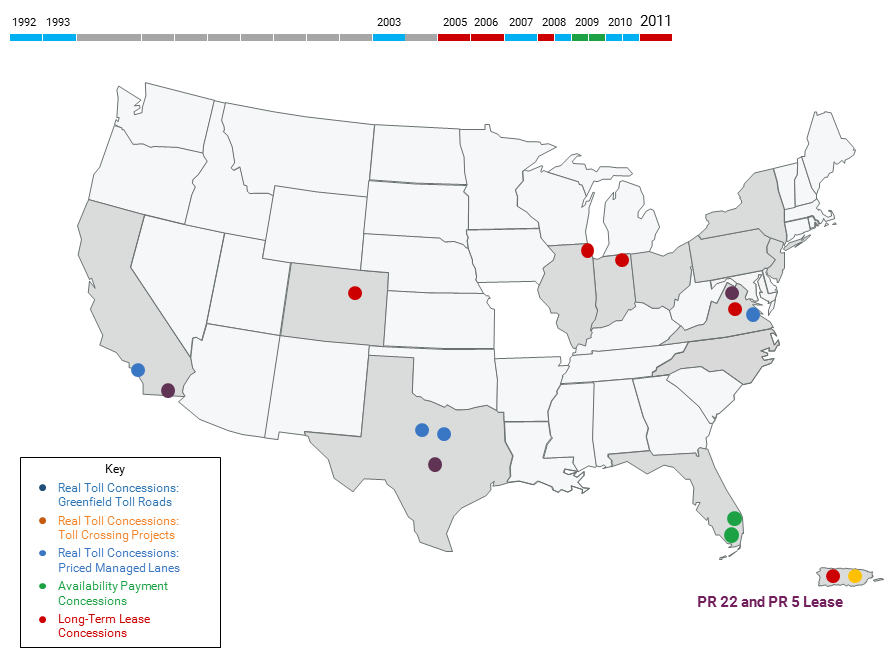

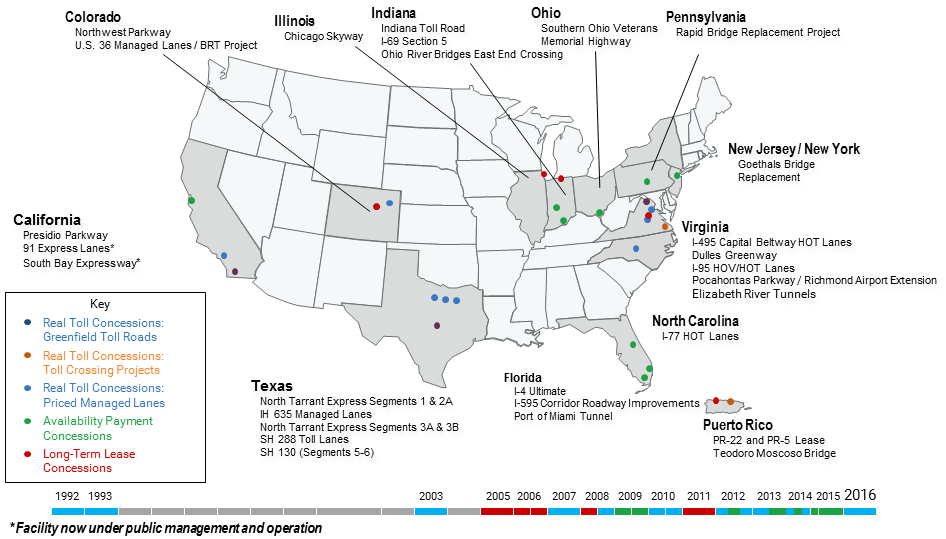

Evolution of the P3 Market (Chapter 4)

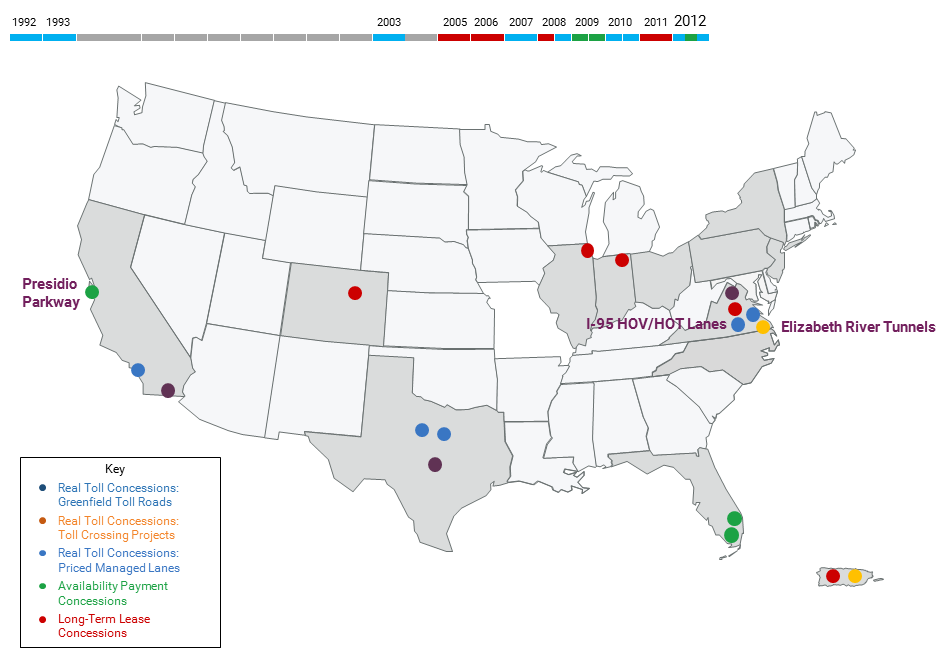

View

larger version of map

View

larger version of map

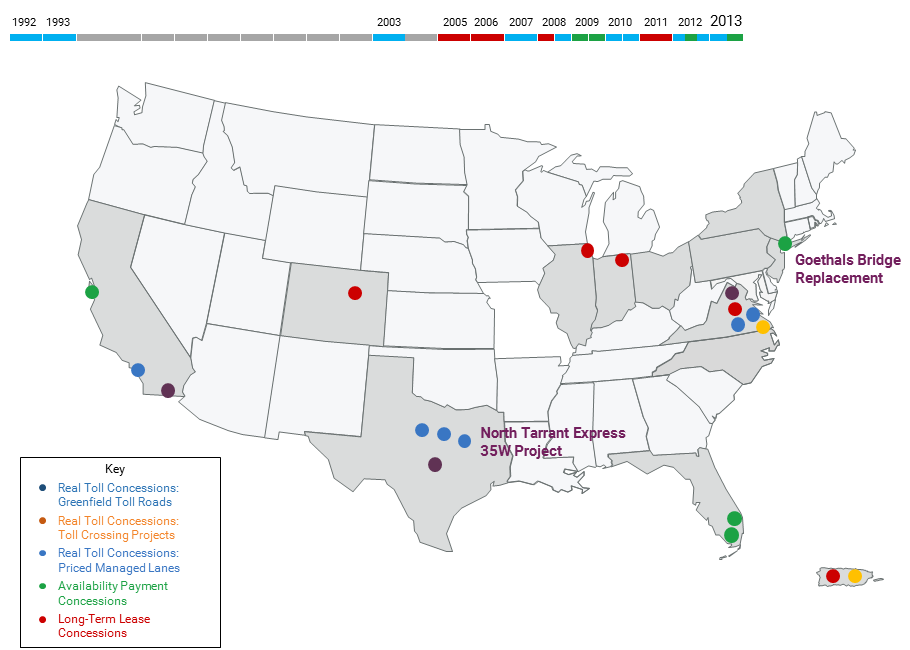

View

larger version of map

View

larger version of map

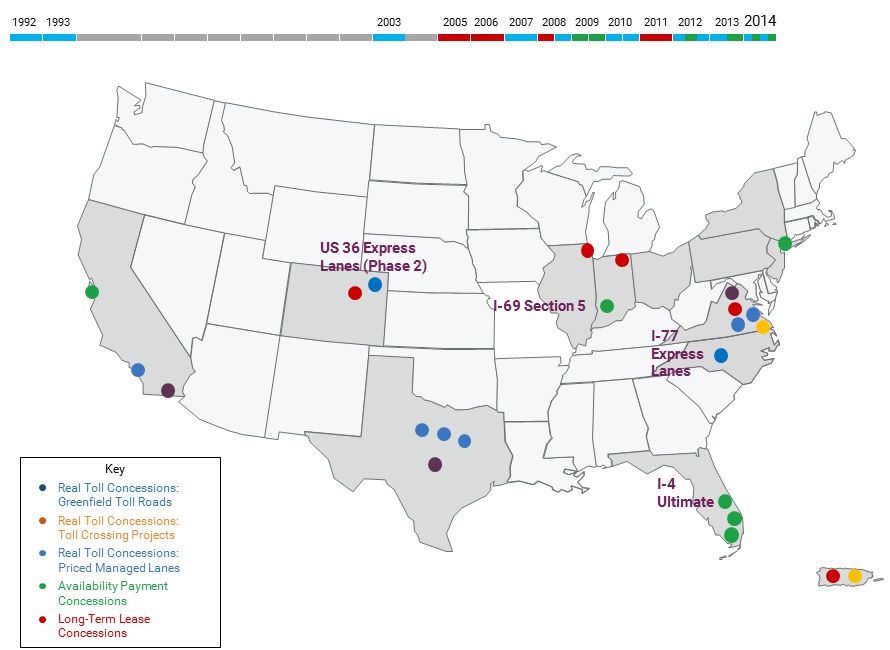

View

larger version of map

View

larger version of map

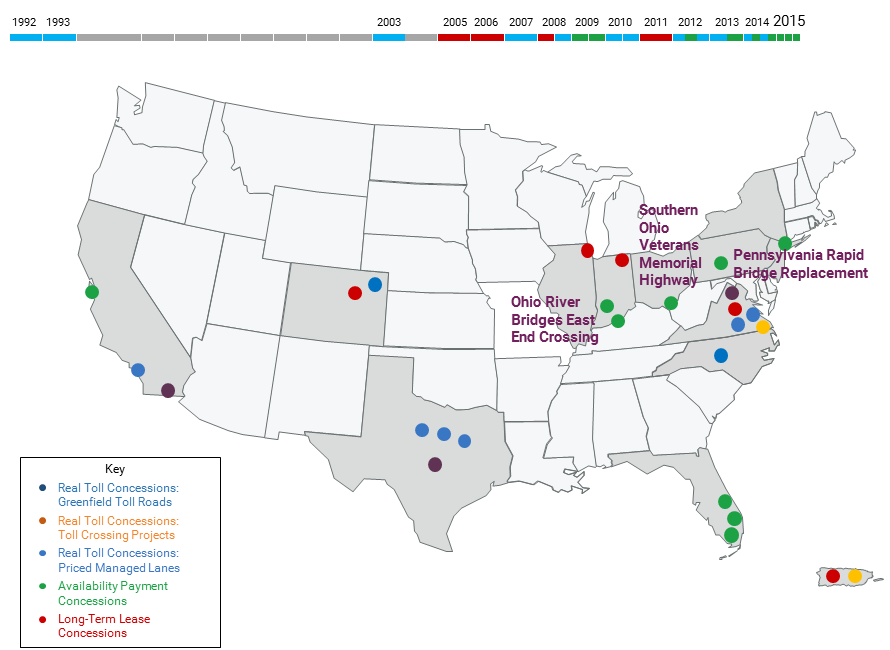

View

larger version of map

View

larger version of map

View

larger version of map

View

larger version of map

View

larger version of map

View

larger version of map

View

larger version of map

View

larger version of map

View

larger version of map

View

larger version of map

View

larger version of map

View

larger version of map

View

larger version of map

View

larger version of map

View

larger version of map

View

larger version of map

View

larger version of map

View

larger version of map

View

larger version of map

View

larger version of map

P3 Concessions in the U.S. by Type

View

larger version of map

Questions?

Submit a question using the chat box

U.S. P3 Highway Concessions

- 14 Real Toll Concessions

- 3 Greenfield Toll Roads

- 2 Fixed Crossings

- 9 Priced Managed Lanes

- 9 Availability Payment Concessions

- 5 Long-term Lease Concessions

Real Toll Concessions in the U.S.

View

larger version of map

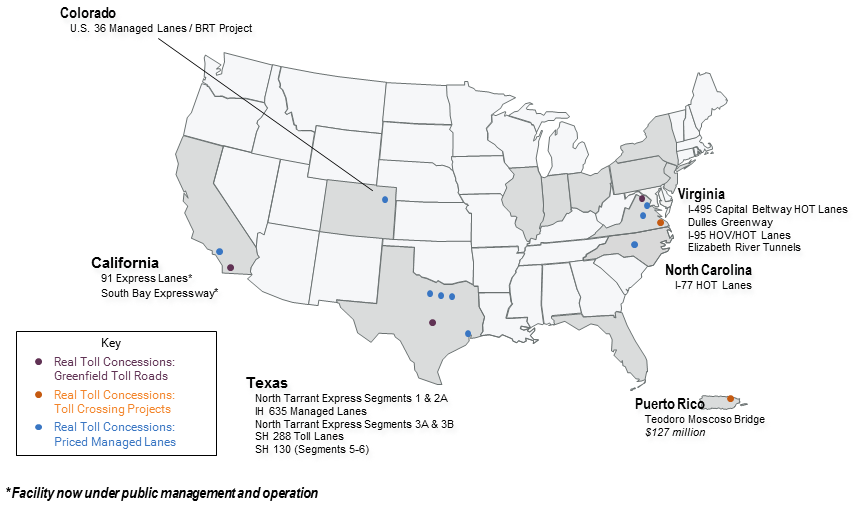

Greenfield Toll Road Concessions

View

larger version of map

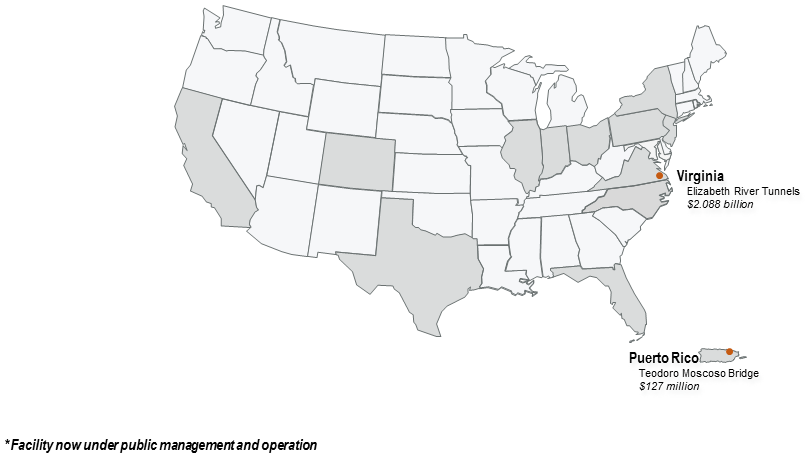

Fixed Crossing Real Toll Concessions

View

larger version of map

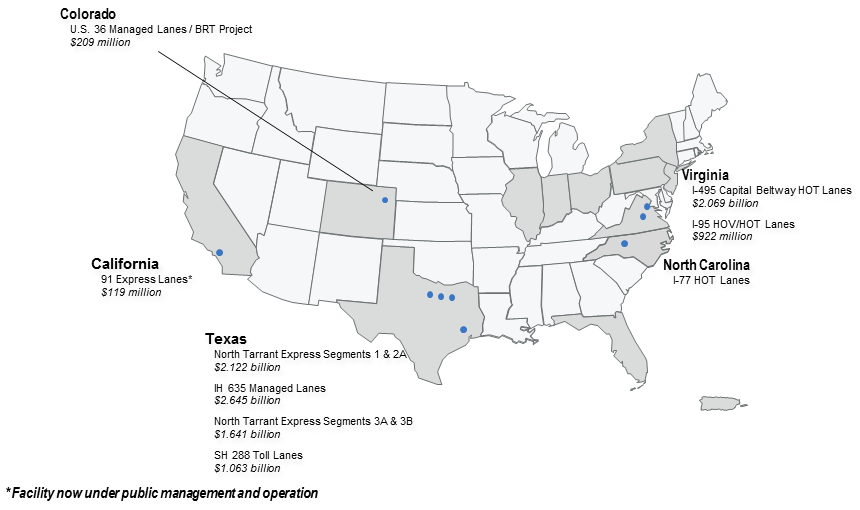

Managed Lane Toll Concessions

View

larger version of map

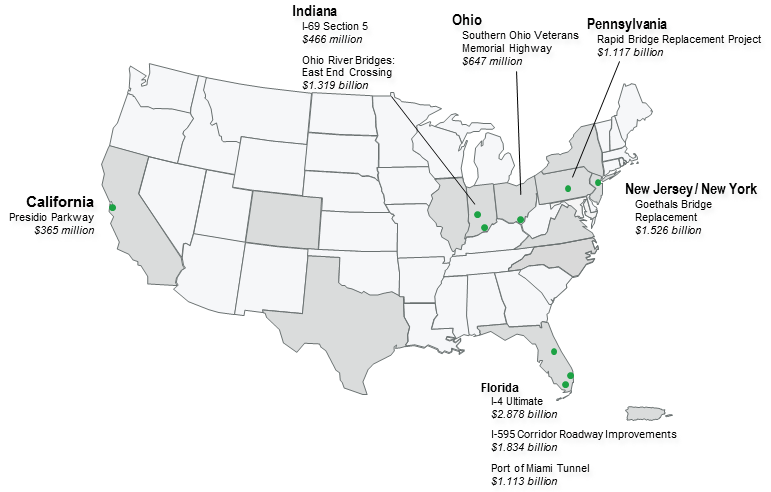

Availability Payment Concessions

View

larger version of map

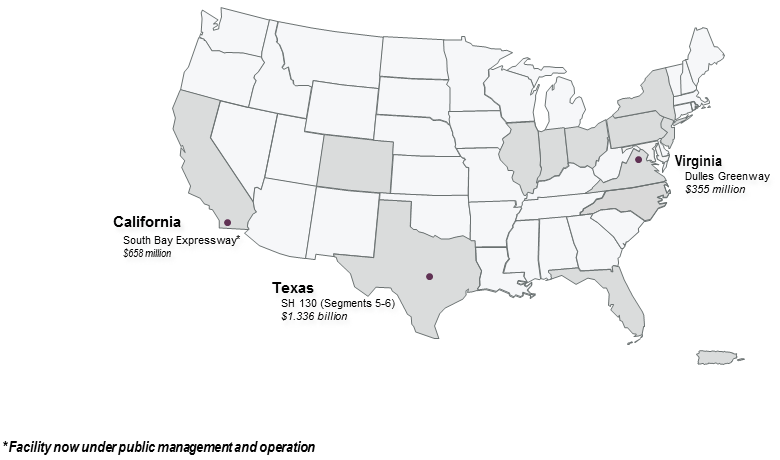

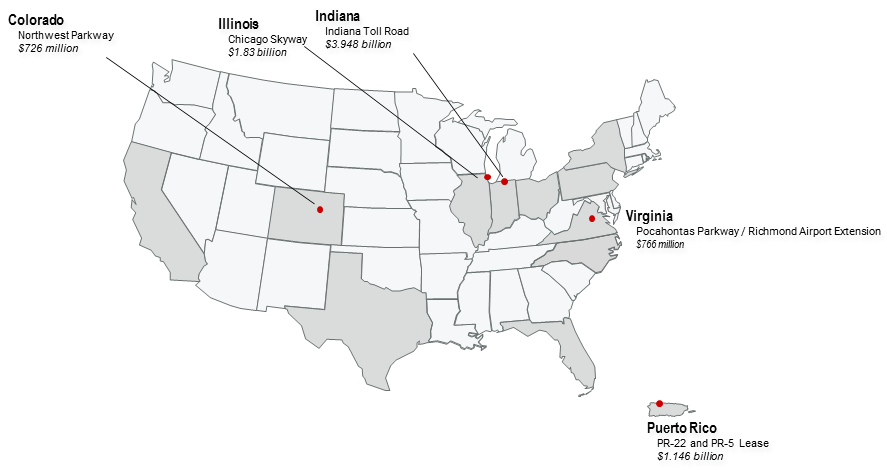

Long-term Lease Concessions

View

larger version of map

Questions?

Submit a question using the chat box

Financing P3 Concessions (Chapter 4 contd.)

Financing P3 Concessions

- Debt

- Commercial bank debt

- TIFIA credit program introduced in 1998

- PABs introduced in 2005

- Equity

- Public sector grants

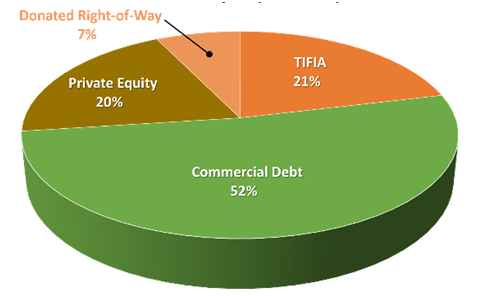

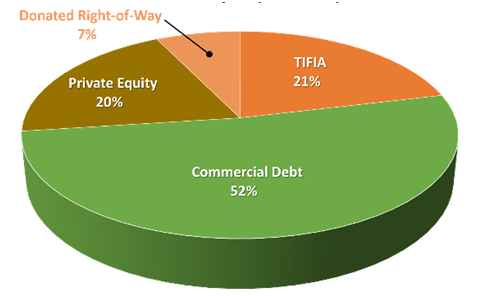

Financing Real Toll Concessions

South Bay Expressway, 2003

$658 million

- Commercial Debt - 52%

- TIFIA - 21%

- Donated Right-of-Way - 7%

- Private Equity - 20%

First TIFIA loan to a P3 project

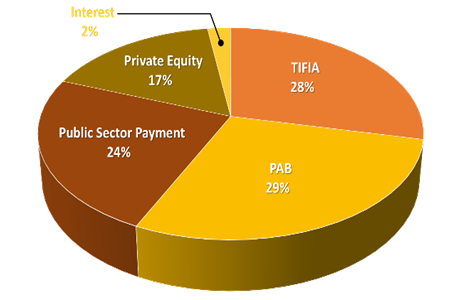

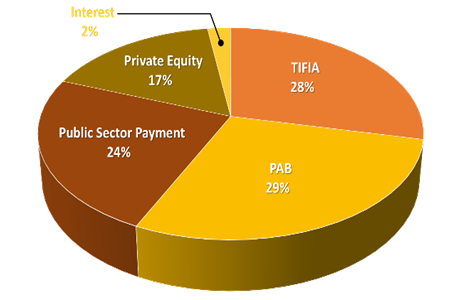

Financing Real Toll Concessions

I-495 Capital Beltway HOT Lanes, 2007

$2.069 billion

- Public Sector Payment - 24%

- PAB - 29%

- TIFIA - 28%

- Interest - 2%

- Private Equity - 17%

- Public Sector Payment - 24%

First P3 project to use PABs

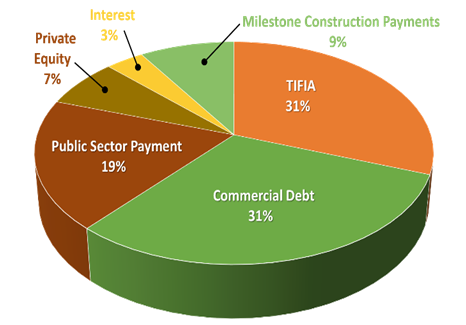

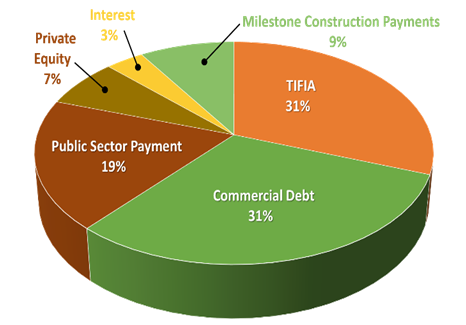

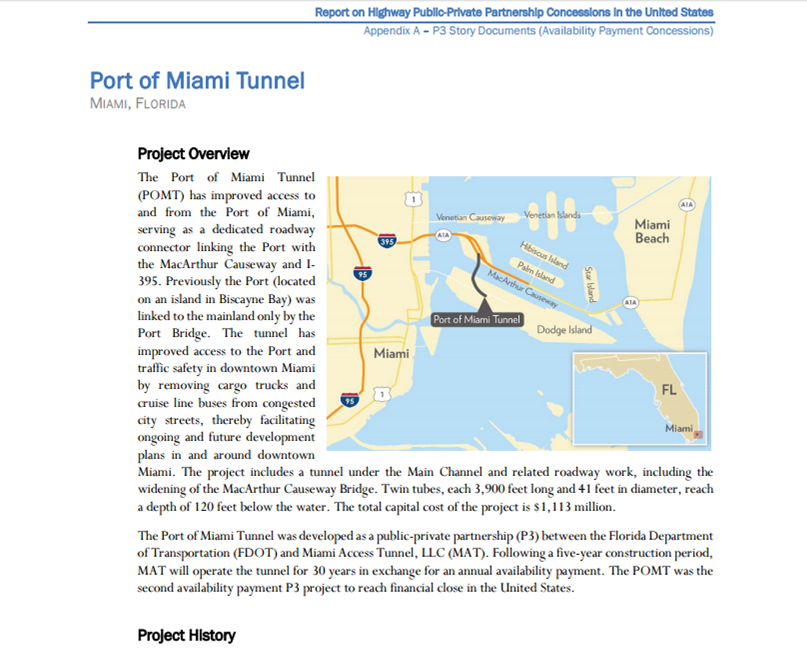

Financing Availability Payment Concessions

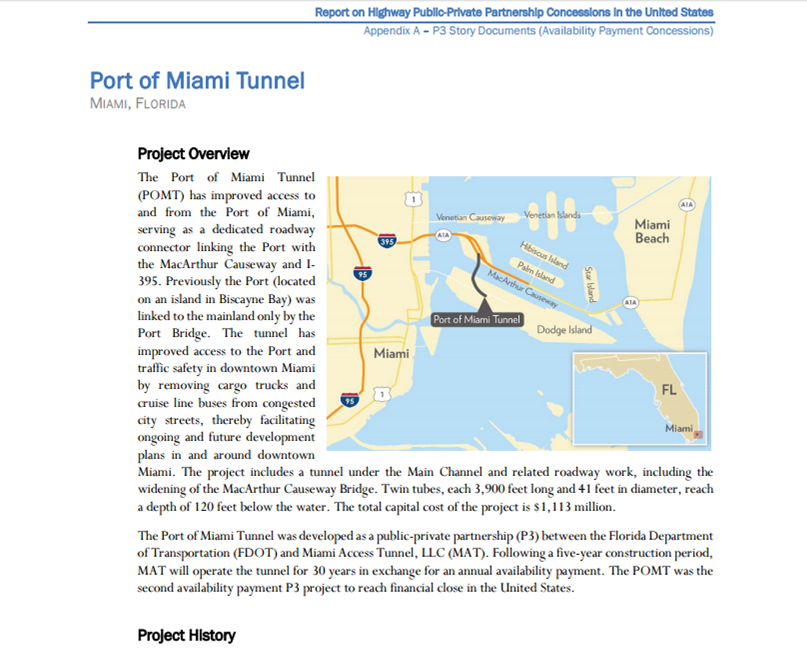

Port of Miami Tunnel, 2009

$1.113 billion

- Public Sector Payment - 19%

- Commercial Debt - 31%

- TIFIA - 31%

- Milestone Construction Payments - 9%

- Interest - 3%

- Private Equity - 7%

Project was "Federalized" in order to use TIFIA financing

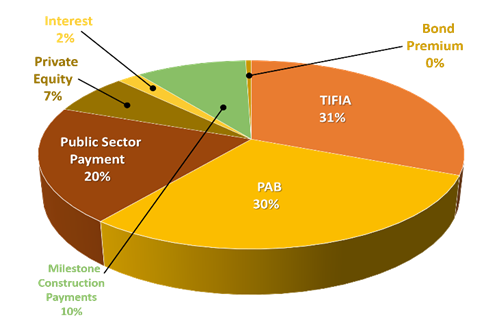

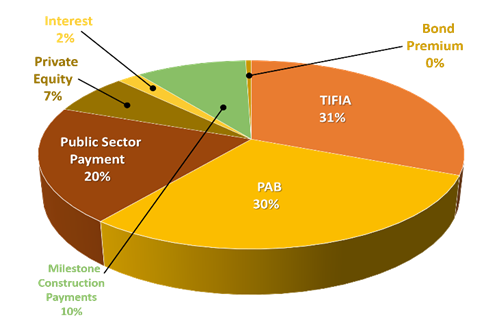

Financing Availability Payment Concessions

Goethals Bridge Replacement, 2013

$1.526 billion

- Public Sector Payment - 20%

- PAB - 30%

- TIFIA - 31%

- Bond Premium - 0%

- Milestone Construction Payments - 10%

- Interest - 2%

- Private Equity - 7%

First availability payment financing to use TIFIA and PABs

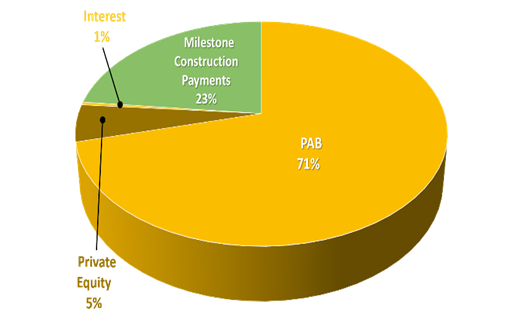

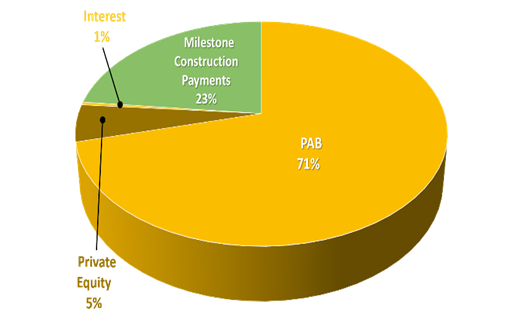

Financing Availability Payment Concessions

PA Rapid Bridge Replacement Program, 2015

$1.117 billion

- PAB - 71%

- Milestone Construction Payments - 23%

- Interest - 1%

- Private Equity - 5%

$721 million PAB - the largest PAB issue to date in the U.S.

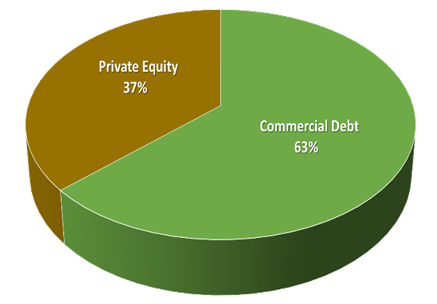

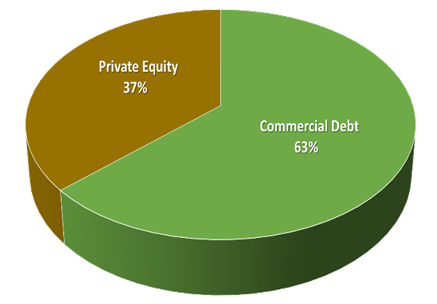

Financing Long-Term Lease Concessions

Northwest Parkway, 2008

$726 million

Private Equity - 37%

Commercial Debt - 63%

Typical long-term lease financing package

Questions?

Submit a question using the chat box

Closing

Highway P3 Project Pipeline

- Transform 66 - Outside the Beltway, VA - $2.5 to 4.0 billion

real toll

- I-55 Managed Lanes, IL - $424 million real toll

- I-70 East Viaduct, CO - $1 billion availability payment

- Hampton Roads Bridge Tunnel Crossing, VA - $6 billion possible

P3

Related P3 Project Information

FHWA P3 Toolkit: https://www.fhwa.dot.gov/ipd/p3/toolkit/

| Fact Sheets |

- Ten concise single-sheet discussions of key P3 concepts

for a non-technical audience

|

| Primers |

- P3 Concessions for Highway Projects

- Risk Assessment

- Value for Money

- Financial Structuring and Assessment

- Establishing a P3 Program

|

| Guides |

- How FHWA Reviews P3s

- Model Toll Concession Contracts

- Model Availability Payment Contracts

- P3 Project Financing

- Risk Assessment

- Value for Money

- Benefit-Cost Analysis

|

| Discussion Papers |

- Revenue Risk Sharing

- Performance Requirements for Design and Construction

in P3s

|

| Analytical Tools |

|

| Informational Reports |

- Successful Practices for P3s

- Highway P3 Projects in the U.S

|

FHWA P3 Training

Introductory

- Introduction to P3s

- Overview

- Project Development

- Procurement

- Risk Assessment

- Value for Money

- Project Financing

- Successful P3 Practices and Model Contracts

- Successful Practices Over Project Life Cycle

- Model Toll Concession Contracts

- Model Availability Payment Contracts

Advanced Analysis

- P3 Project Financing

- P3 Structuring

- Finance Viability

- Financial Models

- Risk Assessments

- Risk Identification

- Risk Analysis and Valuation

- Risk Allocation

- Value for Money

- Public Sector Comparator (PSC)

- P3 Option

- Evaluation

- P3 Benefit-Cost Evaluation

- Estimating P3 Efficiency Impacts

- Estimating Public Benefits

Contact Information

Benjamin Perez

Principal Consultant

WSP |

Parsons Brinckerhoff

(212) 613-8804

perez@pbworld.com

Mark Sullivan

Director

FHWA Center for Innovative

Finance Support

(202) 366-5785

Mark.Sullivan@dot.gov

Website: https://www.fhwa.dot.gov/ipd/p3/

Patrick DeCorla-Souza

P3 Program Manager

USDOT Build America Bureau

& FHWA Center for Innovative

Finance Support

(202) 366-4076

Patrick.DeCorla-Souza@dot.gov

Website: https://www.fhwa.dot.gov/ipd/p3/