Presenters: Jim Ziglar, Lucian Spatoliatore and Michael Mariani, Deloitte

Moderator

Mark Sullivan

Director

Center for Innovative Finance Support

Federal Highway Administration

Presenters

Jim Ziglar

Specialist Leader

Deloitte Transactions and Business Analytics LLP

Lucian Spatoliatore

Partner

Deloitte Tax LLP

Michael Mariani

Senior Manager

Deloitte Tax LLP

Presentation Outline

- Part 1: Key Public and Private Sector Considerations

- Part 2: Taxes in the Context of P3 Project Delivery Evaluation

Part 1: Key Public and Private Sector Considerations

Overview

| Public Sector - Key Considerations » |

- Understanding indirect vs. direct taxes generated by the project

- Types of direct taxes generated by the P3

- Incremental economic impact of P3s

|

| Private Sector - Key Considerations » |

- Entities usable by a P3 investment structure

- Investor-specific tax considerations

- Non-federal taxes relevant to P3 transactions

- Tax-exempt and foreign entity tax considerations

|

| Toll and Availability Payment Concessions » |

- General observations for these two common P3 delivery models

- Underlying reasons for the differences in tax treatment

|

Public Sector Sponsors: Key Considerations

Tax considerations involve evaluating overall economic impact of project, as well as parsing direct and indirect taxes generated

| Direct vs. Indirect taxes |

- Direct taxes: Local, State, Federal taxes paid by Concessionaire

- Indirect taxes: based on increased economic activity

|

| Direct taxes |

|

| Incremental Economic Impact |

- P3 lifecycle costs reduction

- P3 accelerated delivery

|

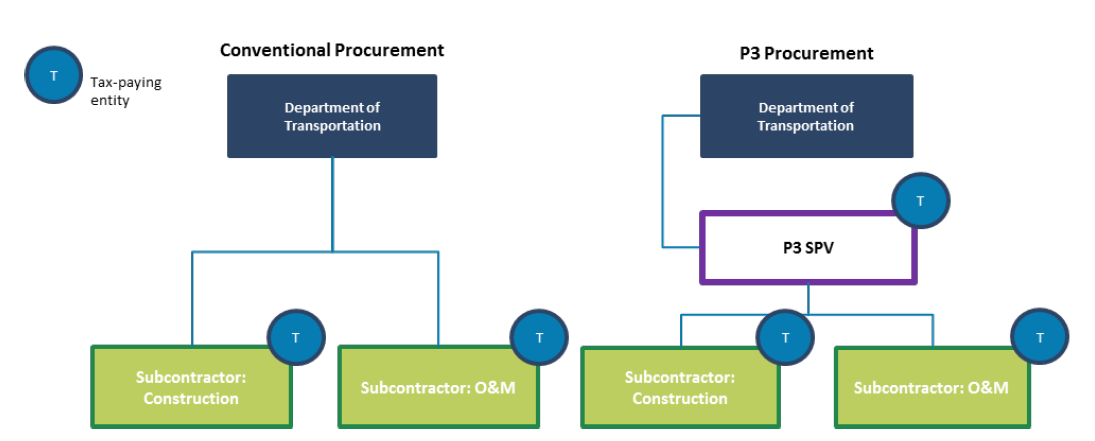

Incrementality of P3 Taxes

| Incrementality |

- P3s can create an additional tax-paying entity relative to traditional procurement

- Some exemptions given to "level the playing field"

|

View larger version of flow chart

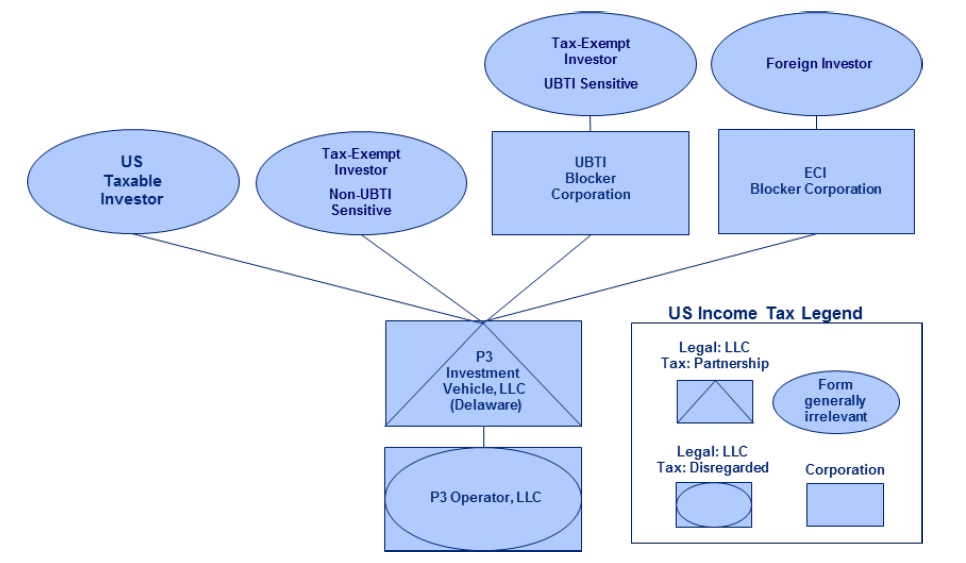

Heterogeneity of P3 Taxes

| Heterogeneity of tax treatment |

- Variety of tax rules

- Bespoke tax strategies and corporate structures

|

Private Sector - Key Considerations for Investment Structure

Private Sector Investors will typically structure the Special Purpose Vehicle (SPV) as a "pass-through" entity

| P3 Legal Entity |

- Minimize tax burden

- Increase flexibility

- SPV impacts on cash distributions

|

| Income tax for SPV |

- Limited Liability Company (LLC): pass-through to members

- C Corporation: double taxation

|

| Tax attributes |

- Treatment of Net Operating Losses (NOLs)

- Exit considerations

|

Private Sector Investors: Key Considerations

Each P3 will be unique based on the taxes levied and the tax status of the equity investors

| State & Local taxation |

- Treatment of Partnerships

- Non-residency

- Franchise tax

- Tax relief

|

| Tax-exempt investor |

- Unrelated Business Taxable Income

- Corporate Blocker (pays taxes)

|

| Foreign investor |

- U.S. taxation

- Corporate blocker (pays taxes)

|

Illustrative Legal Entity Structure

A pass-through LLC with multiple owners, each having unique tax characteristics

View larger version of flow chart

Implications of Different P3 Structures

Two common P3 concession structures are "toll concession" and "availability payment", each having unique tax characteristics

| Commonalities |

- Use of partnership by SPV for income tax purposes

|

| Toll Concession |

- Tax Losses in initial years

- Depreciation of real assets and intangible rights

|

| Availability Payments |

- Percentage Completion Method (PCM) impact on taxes

- Allocation of concession into Operating and Capital

|

Questions?

Part 2: Taxes in the Context of P3 Delivery Evaluation

Overview

| Taxes in the Context of P3 Evaluation » |

- Benefit Cost Analysis (BCA) overview

- Value for Money (VfM) analysis overview and application

|

| Methods for Tax Revenue Analysis » |

- Competitive Neutrality Adjustment (CNA) analysis overview and application

- Trade-offs between levied taxes and overall project value

- Perspectives and methods on performing VfM and CNA

|

P3 Evaluation

Valuing potential tax revenues typically depends on a robust evaluation of the project's impact and the delivery method

| Benefit Cost Analysis |

- Benefits and costs of a project over a no-build scenario

- Indirect taxes

- Early stage analysis for "go / no-go" decision

|

| Project delivery method |

- Value for Money analysis

- Public Sector Comparator vs. Shadow Bid

|

| Competitive Neutrality Adjustment |

- Adjusts for distortions to the VfM

- Taxes and risk allocation

|

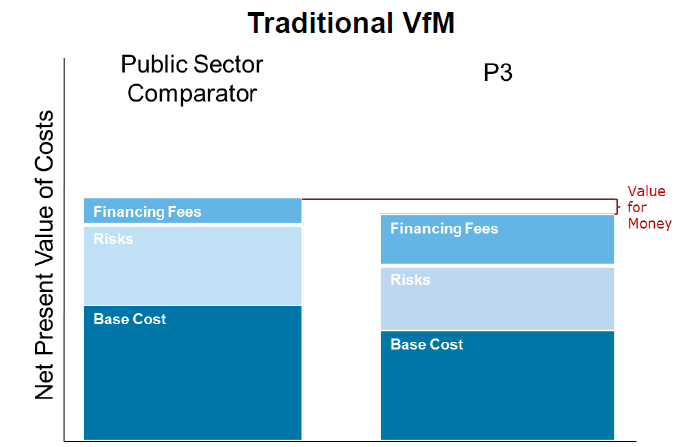

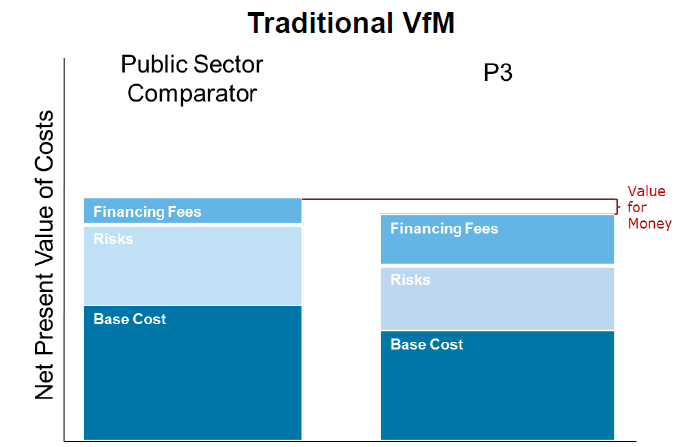

VfM in Practice - U.S. Trends

VfM analysis focuses on understanding trade-offs between options

| Public Sector Comparator |

- Increased focus on increasing the quality of PSC

- PSC used as "auction reserve price"

|

| Shadow Bid vs. Actual Bid |

- Disconnect between shadow bids and actuals

- Revenue estimates

- Discount rates

|

| Decision Tool |

- Adapting to assist public entities in making the multi-factor decisions associated with procurement

- Trade-off analysis between procurement strategies

- Quantitative and Qualitative factors

|

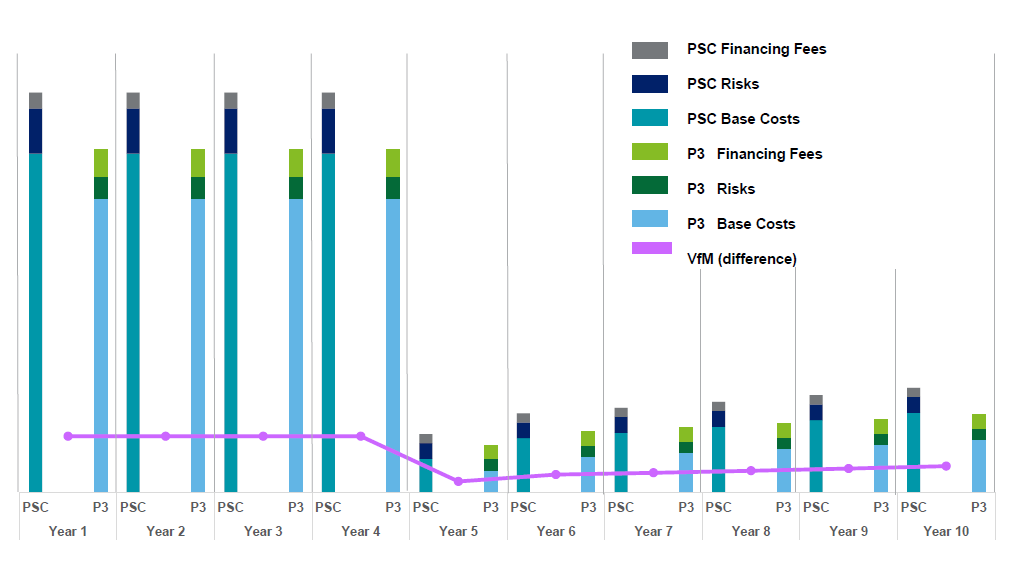

VfM in Practice - U.S. Trends, contd.

Quantitative assessments of VfM have looked beyond the traditional net present value comparison to adding a "flow" analysis

| Evolution of VfM |

- Annual VfM comparison provides additional insight

- Conventional present value analysis may "penalize" early project delivery

|

Annual VfM

View larger version of chart

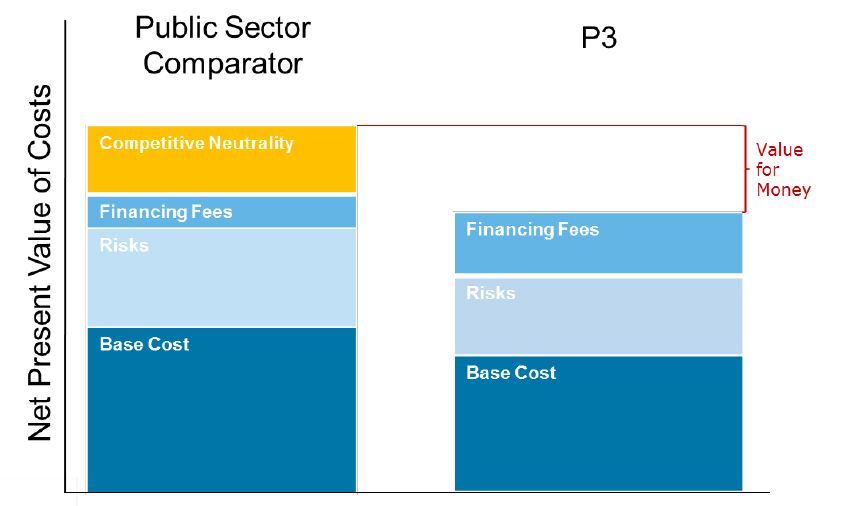

Tax Revenue Valuation for Competitive Neutrality Adjustment (CNA)

CNAs attempt to quantitatively "level the playing field" between conventional and P3 procurement

| CNA for tax revenue valuation |

- Opportunity cost of foregone taxes added to PSC

|

| Taxes included in the CNA |

- Dependent on project sponsor

- Typically, includes taxes levied at sponsor's level

- Assumption-driven

|

| Taxable debt |

- Additional tax stream for Local, State, and Federal

- P3 debt usually tax-exempt

|

Value for Money with Competitive Neutrality Adjustment

A common method for incorporating taxes into CNA is to add the opportunity cost of foregone taxes paid directly by the P3 owners to the costs of the Public Sector Comparator

View larger version of chart

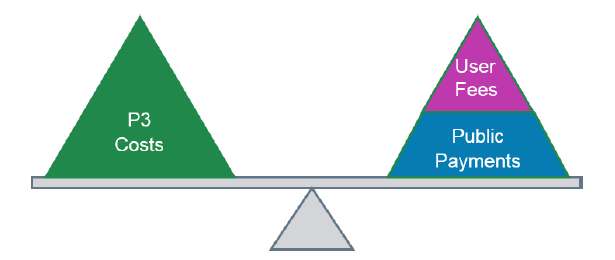

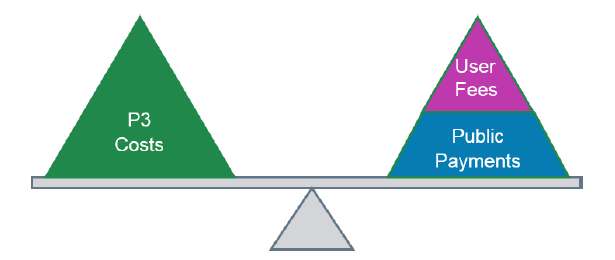

Tax Revenue Valuation: P3 Tradeoffs and Incentives

There is an inherent trade-off between the amount of taxes paid directly by a P3 and the cost of the P3 to the public broadly

| P3 impact on taxes |

- Indirect taxes not linked to procurement

- Direct taxes only relevant if collected by public sponsor

|

| Tax particulars |

- Balancing tradeoffs between value and taxes for public sponsor

- Taxes accounted as cost in private investors' bids

|

Like all P3 costs, taxes paid by P3s come from user fees or public payments

Tax Revenue Valuation - Modeling Tax Revenue Streams

| Modeling direct taxes |

- Scenario analysis to assess tax impacts

- Demand (toll) and performance (availability) analysis over time

- Assumptions made for P3 tax structure and impact

|

| Modeling indirect taxes |

- Assumptions on impact of project on tax base

- Calculations of incremental tax revenues

|

| Eye of the beholder |

- Analysis focus dependent on interest of entity performing the analysis

- Assumption-driven

- VfM and CNA as tools inform the decision

|

Questions?

Patrick DeCorla-Souza

P3 Program Manager

FHWA Center for Innovative Finance Support

Patrick.DeCorla-Souza@dot.gov

Mark Sullivan

P3 Program Director

FHWA Center for Innovative Finance Support

Mark.Sullivan@dot.gov

Download Discussion Paper: https://www.fhwa.dot.gov/ipd/p3/toolkit/publications/reports_discussion_papers/tax_issues_when_developing_evaluating/