Value Capture Summary

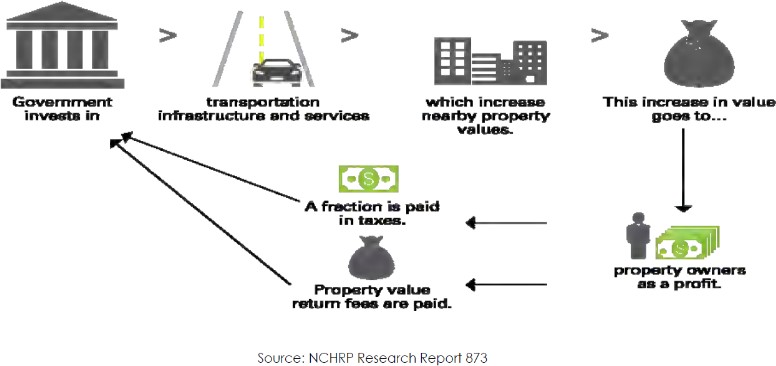

Value Capture is ...

- A set of powerful funding tools that can help address

- funding gaps (USDOT supports Value Capture)

- Can be part of the mix of funding sources for transportation improvement solutions

- Can accelerate project delivery, enhance safety, and save time and money when done properly

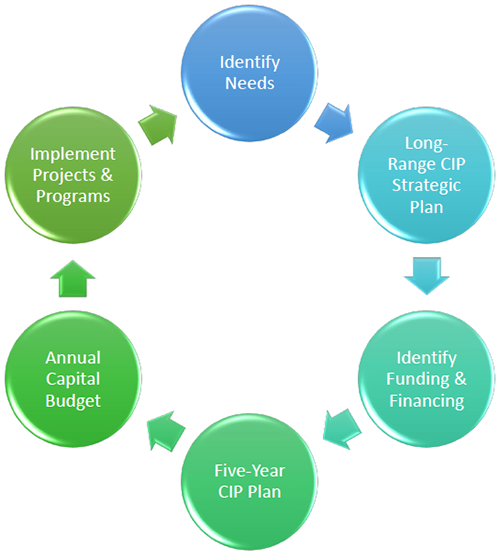

Steps to a Successful Value Capture Project

EDC-5 Funding Opportunities

- State Transportation Innovation Council (STIC) Incentive

- Up to $100,000 per STIC per year to standardize an innovation https://www.fhwa.dot.gov/innovation/stic/

- Accelerated Innovation Deployment (AID) Demonstration

- Up to $1million available per year to deploy an innovation not routinely used https://www.fhwa.dot.gov/innovation/grants

EDC-5 Value Capture Implementation Team

Thay Bishop, Senior Program Advisor Center for Innovative Finance Support

E-mail: Thay.Bishop@dot.gov

Tel: 404-562-3695

Stefan Natzke, Team Leader

National Systems & Economic Development

E-mail: Stefan.Natzke@dot.gov

Tel: 202-366-5010

Questions & Answers

Transportation Utility Fee (TUF)

Tina Bailey, PE - Transportation Division Manager

About Hillsboro

- Suburb of Portland, OR

- Population: 101,920

- 25.49 square miles

- “The Silicon Forest”

About our Roadways

- Centerline Miles of Roadway:

- At adoption: 214.08

- Current: 234.91

- Average Network Pavement Condition (PCI)

- At adoption: 79

- Current: 82

- Percent of Roads in Good to Poor Condition:

- At adoption: 10.5%

- Current: 3.1%

- Deferred Maintenance:

- At adoption: $9.1 Million

- Current: $7.55 Million

What is TUF?

- Treats roadways like other utilities.

- Monthly charge-like storm, sanitary, and water-for maintenance of roadways

- Hillsboro’s also includes an allotment for bicycle and pedestrian improvements

- Assessed in utility bill with storm, sanitary, etc.

- All customers pay based on estimated trip generation

- Other agencies have based on parking stalls, sewer equivalent dwelling units, flat rate per account, number of employees, truck deliveries, building square footage.

History

- Fee Development/Outreach: April 2007 to July 2008

- Program approved by Council: July 2008

- Effective: March 2009

- Reduced Multi Family Rate: July 2009

- First Evaluation: October 2010

- Recalibrated/Base Charge: May 2011

- Shifted cost allocation/Increased Revenue: April 2015 to April 2019

Public Official Support

- Didn’t happen overnight.

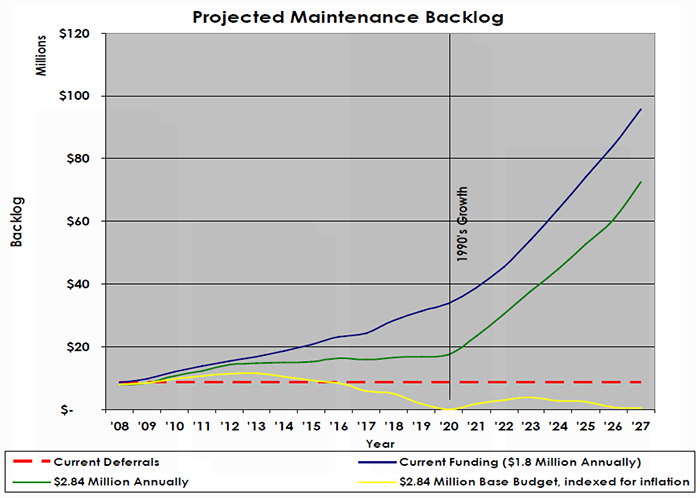

- Modeling conditions/needs was critical

- Providing a simplified understanding of pavement management.

- House Analogy

- Updating the council annually on the effects of decisions.

- Deferrals – Historical and projected

- Modeling budget scenarios

- Look for critical message.

Hillsboro’s Critical Message

Public Hearing Testimony

- Residential:

- Generally supported.

- Concerns about low income customers.

- Business Lobby Concerns:

- This is a terrible time to increases taxes.

- This is anti-business.

- More money is government’s only solution.

- We pay more than our fair-share.

- ITE overestimates our trips.

- We don’t benefit from bicycle & pedestrian facilities.

Cost Allocation

Residential/Non-Residential Share – At Adoption

- Based on Metro determination of residential, commercial, and industrial use of collectors and arterials.

- No data for local and neighborhood routes which account for the majority of Hillsboro’s network.

- Doesn’t differentiate between local streets that are residential and local streets that are commercial or industrial.

- Doesn’t account for alleys.

- Resulted in a cost allocation 52% residential/48% non-residential

Classification |

Lane Miles |

Residential |

Commercial |

Industrial |

Public |

Arterials |

17.23 |

45% |

35% |

15% |

5% |

Collectors |

125.16 |

50% |

30% |

15% |

5% |

Local/Neighborhood Routes |

324.38 |

60% |

25% |

10% |

5% |

Fee Determination

Residential

- At Adoption: Committee determined all residential units should pay the same amount.

- Fee = Monthly Revenue Target/# Dwelling Units

- Current: Reduced Multi-family Residential (MFR) to 90% of Single Family Residential(SFR)

- SFR Fee=Monthly Revenue Target/(#SFR + 0.9(#MFR))

- MFR Fee=0.9(SFR Fee)

- Residential customers pay TUF for the Pavement Management Program (PMP) and Bicycle/Pedestrian Improvements (BPCIP)

- Fee is determined for PMP & BPCIP revenue targets

Non-Residential

- Trip generation for every non-residential land use had to be determined.

- Information not readily available.

- Building footprints determined through aerial photography.

- Physically visited sites to determine the land use and number floors.

- Land uses with similar ITE trip generation characteristics grouped (bins)

| 1 Intel |

| 2 School District |

| 3 Target |

| 4 City Hall |

| 5 Wells Fargo |

| 6 McDonalds |

| 7 Regal Cinemas |

- Bin 1: <7 trips/1000 sq.ft.

- Bin 2: 7-21 trips/1000 sq.ft.

- Bin 3: 25-53 trips/1000 sq.ft

- Bin 4: 53-151 trips/1000 sq.ft.

- Bin 5: 151-400 trips/1000 sq.ft

- Bin 1: less than 7 trips/1000 sq.ft

- Bin 6: greater than 400 trips/1000 sq.ft.

- Bin 7: Special for ITE Trip generations not based on sq.ft.

- % of bin trips/total non residential trips equivalent to bins cost share of non residential fee.

- Bin 7: trip generation per business capped at 1500 trips.

- Rates:

- Bins 1-6: Bins cost share/1000 sq.ft. in bin

- Bin 7: Bins cost share/trips in bin

Rates

Category/Bin (ITE Trip Generation) |

Rate Basis |

At Adoption (‘09) |

Current |

Non-Residential |

|||

1 (< 7 trips/1000 sf) |

1000 sf |

$0.22 |

$0.34 |

2 (7-25 trips/1000 sf) |

1000 sf |

$0.53 |

$0.82 |

3 (25-53 trips/1000 sf) |

1000 sf |

$1.78 |

$3.01 |

4 (53-151 trips/1000 sf) |

1000 sf |

$3.73 |

$6.06 |

5 (151-400 trips/1000 sf) |

1000 sf |

$10.18 |

$15.91 |

6 (>400 trips/1000 sf) |

1000 sf |

$18.41 |

$39.86 |

7 (non square footage based) |

Trips (max 1500) |

$0.05 |

$.08 |

Base Charge |

n/a |

$7.91 |

|

Residential |

|||

8 (SFR) |

Dwelling Unit |

$3.10 |

$8.79 |

9 (MFR) |

Dwelling Unit |

$3.10 |

$7.91 |

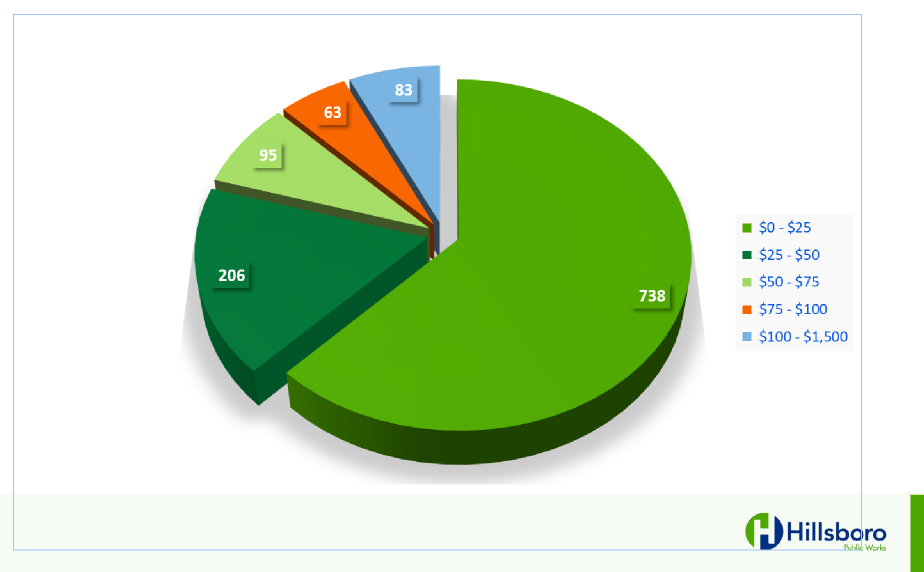

Non-Residential Customers

Monthly Bills

Revenue

Category |

Units |

Monthly |

Annual |

|

MFR |

16688 Units |

PMP |

$92,451 |

$1,109,412 |

BCPIP |

$39,446 |

$473,352 |

||

Total |

$131,897 |

$1,582,764 |

||

SFR |

23497 Units |

PMP |

$144,495 |

$1,733,940 |

BPCIP |

$61,797 |

$741,564 |

||

Total |

$206,292 |

$2,475,504 |

||

Non-Residential |

1430 Accounts |

PMP |

$87,035 |

$1,044,420 |

Total PMP |

$323,982 |

$3,887,784 |

||

Total BPCIP |

$101,243 |

$1,214,916 |

Discounts/Waivers

Single Family Residential

- Motor Vehicle Discount - 30% discount

- No vehicle registered to address.

- Transit Pass Discount - 30% discount

- Tenant has purchased annual transit pass.

- Hardship Waiver - One full year waiver

- Household income <60% of Oregon median

- Unemployment Waiver - 6 Month Waiver

- One party in household laid off within 30 days of application

Non - Residential

- Employer Transit Pass Discount - Up to a 30% discount

- Employer purchases annual transit passes.

- Employer DEQ ECO Program Discount Up to a 30% discount

- Employer programs in place to reduce vehicle trips.

- Employers can combine discounts up to a maximum combined of 30%

Potential Future Changes

- Only the Residential Hardship Waiver is being utilized by customers.

- Different program from all our other utilities hardship programs makes it confusing to customers.

- Fee is not indexed.

- Does require a “rebalance” every five years.

- Additional revenue due to new customers is the starting point for a “revenue neutral” rebalance.

- Some indication from individual councilors of an interest to expand the fee for street tree and/or sidewalk maintenance.

More Information

- City of Hillsboro TUF Website: Hillsboro-Oregon.gov/TUF

- Tina Bailey

tina.bailey@Hillsboro-Oregon.gov

Total cost $1,310,000 in special assessment bonds

Total cost $1,310,000 in special assessment bonds