Value Capture: Joint Development & Case Studies

Value Capture Techniques Summary

- Developer Contributions - One-time charges collected by local governments from developers to offset the cost of infrastructure and services necessitated by new development.

- Special Assessments - An additional fee or tax assessed on businesses or residents in specified geographic areas benefiting proximity to a highway or other transportation facility or corridor.

- Fees - Similar to a utility fee, transportation fees are assessed based on how individual businesses and households use transportation facilities.

- Incremental Growth - A mechanism allocating back to infrastructure from some specified portion of increased property tax revenues fostered by new infrastructure - often for a specified period of time.

- * Joint Development - Sale or lease of land or air rights on or adjacent to transportation facilities. This can include donations of land or other in-kind resources from the private sector in ongoing commercial operations.

- Concessions - Sale or lease of government owned assets - such as toll roads or bridges - to private-sector investors/operators.

- Advertising and Naming Rights - Sale of advertising space or naming rights on a transportation facility. Note: Commercial uses within Interstate Highway System right of way, including rest areas, is prohibited by law; however, they may be allowed on toll facilities and in transit stations.

*Topic of this webinar

Outline of Presentation

- Joint Development Overview & Benefits

- Why is Joint Development Needed?

- Joint Development Types

- The Federal Role

- Selected Case Studies

- Q&A

Joint Development Overview

Joint Development

- Involves a partnership between a public entity and a private sector or other public entity to develop certain infrastructure assets

- Generate revenue to reinvest in the transportation system or revitalize communities

- Plays key role in some urban projects

- Often practiced in transit agencies

Benefits

- Generates long-term revenue streams to fund transportation improvements and/or reduces costs

- Improve utilization of public assets (i.e. ROW)

- Opportunities for public-private & Public-Public Partnerships

- Economic development tool controlled by public sectors

- Provide local benefits by increasing a jurisdiction's tax base and creating new jobs

- Promote Economic/transportation-oriented development

Joint Development Types

- At-Grade (solar energy in the highway right of way)

- Below-Grade (fiber optic opportunities)

- Above-Grade (cap parks or air right development)

Why is Joint Development?

Capacity & Conditions Challenges

- Two out of every five miles of America's urban interstates are congested

- Cost the country $160 billion in wasted time and fuel

- One out of every five miles of highway pavement is in poor condition

- $836 billion backlog of highway and bridge capital needs

- 47,000 bridges in poor condition and 43% (260,000 bridges) are over 50-year old

- Pedestrian deaths on US roads increased 11% since 2015; (5,977 in 2017)

Mileage by Ownership & Federal-aid Highway System

- 45 % of America's major roads are in poor or mediocre condition.

- 15% of U.S. rural roads are rated in poor condition, while 21% are in mediocre condition

- Local owns 79%, State 18%, & Federal 3%

| Ownership | Federal-Aid Highways | Non-Federal-Aid Highways | Total |

|---|---|---|---|

| Rural | 668,082 | 2,280,612 | 2,948,696 |

| Urban | 359,767 | 875,245 | 1,235,012 |

| Total Rural & Urban | 1,027,848 | 3,155,858 | 4,183,707 |

Highway Trust Fund is Unsustainable

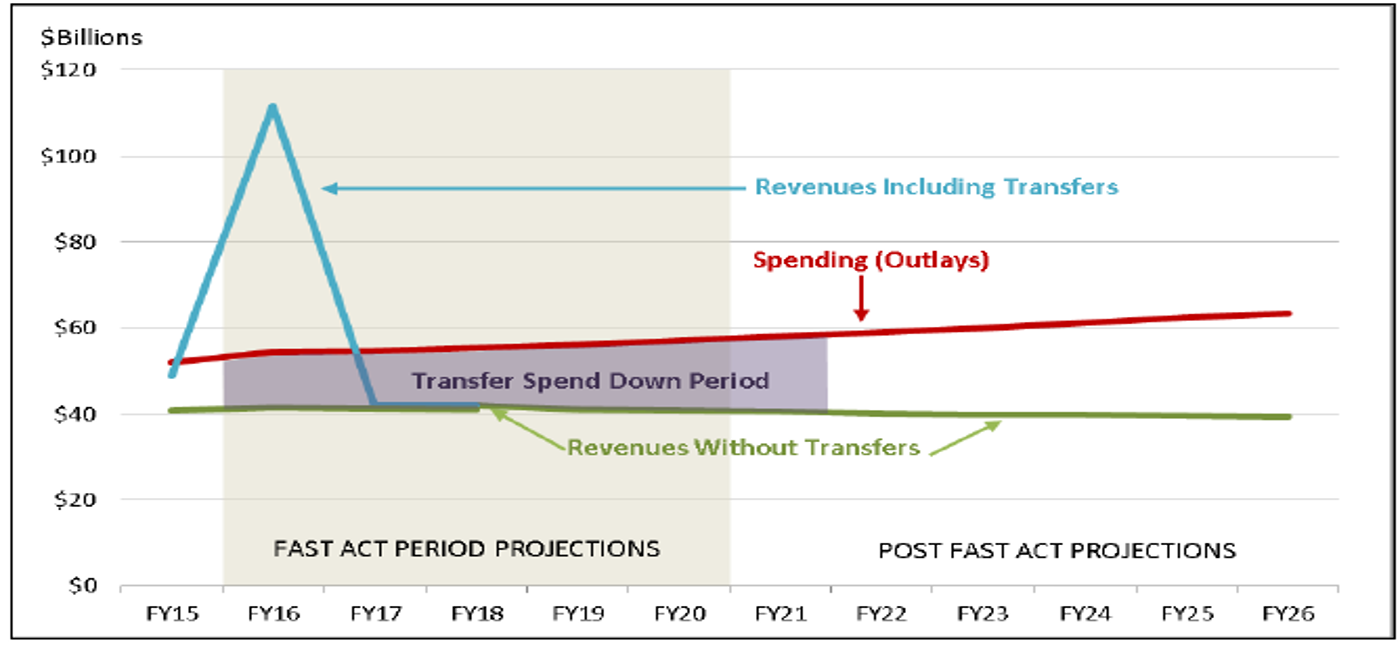

Notes: Includes highway account and mass transit accounts combined. Revenues include interest on HTF balances. The shading between spending and revenues indicates the period that the HTF balance is maintained by the transfers from the general fund and the LUST fund.

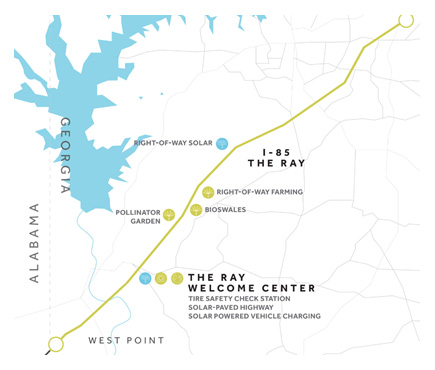

Joint Development at Grade

Solar energy in the highway right of way

- Uses existing public right-of-way for solar energy generation

- Adds value to public right-of-way asset and revenue to Department of Transportation

- Public-private partnerships can use tax benefits to deliver solar power at costs no greater than paid for electricity from the grid

- Leverage underutilized land

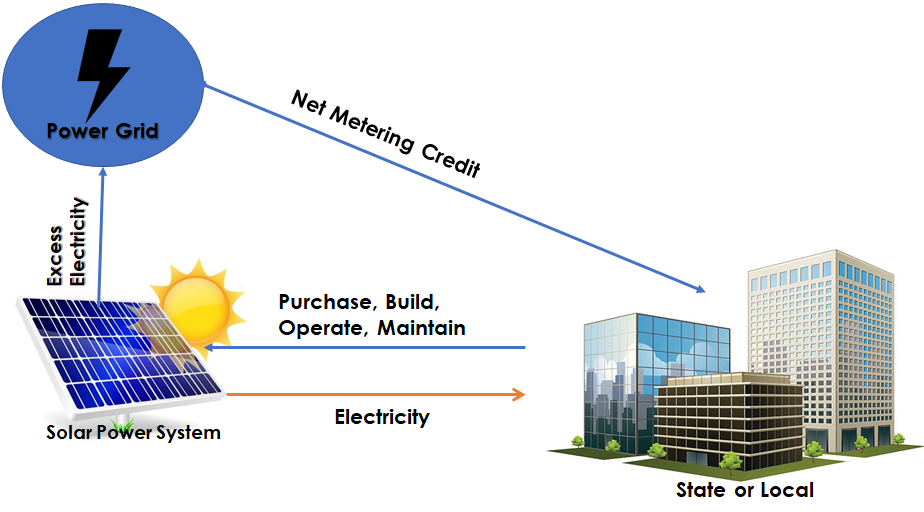

Solar Deal Structures: Direct Procurement & Ownerships

Text for diagram

Flow chart of "Solar Deal Structures: Direct Procurement and Ownership"

The Solar Power System flows electricity into the State or Local infrastructure, who has purchased, built, operates and maintains the solar power system. Excess electricity is sent to the Power Grid who also then sells to the State or Local infrastructure with Net Metering Credit.

The Solar Power System flows electricity into the State or Local infrastructure, who has purchased, built, operates and maintains the solar power system. Excess electricity is sent to the Power Grid who also then sells to the State or Local infrastructure with Net Metering Credit.

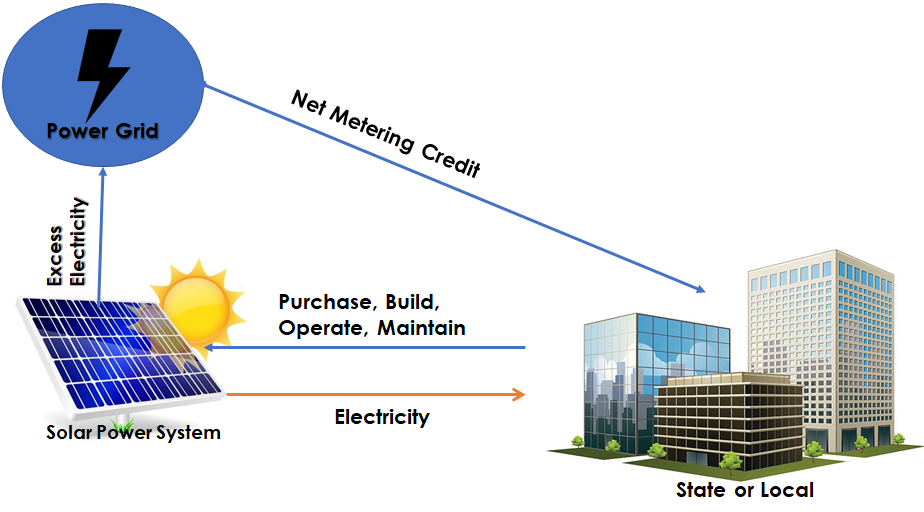

Solar Deal Structures: Public-Private Partnership

Text for diagram

Flow chart of "Solar Deal Structures: Direct Procurement and Ownership"

The Solar Power System flows electricity into the State or Local infrastructure. A Private Concessionaire takes Electricity Payment from the State or Local infrastructure, while making Land Lease Payments to the State or Local entities. The Private Concessionaire is in charge of Purchase, Build, Operate and Maintain of the Solar Power System. Excess electricity is sent to the Power Grid who also then sells to the State or Local infrastructure with Net Metering Credit.

The Solar Power System flows electricity into the State or Local infrastructure. A Private Concessionaire takes Electricity Payment from the State or Local infrastructure, while making Land Lease Payments to the State or Local entities. The Private Concessionaire is in charge of Purchase, Build, Operate and Maintain of the Solar Power System. Excess electricity is sent to the Power Grid who also then sells to the State or Local infrastructure with Net Metering Credit.

State & Federal Incentives

- State Incentives:

- Solar Renewable Energy Credit

- Net Metering Policy

- Solar Rebates & Grants

- Federal Incentives

- Federal Investment Tax Credit (30%)

- Modified Accelerated Cost Recovery System (5-year property depreciation for TX base deduction)

- Interconnection standards (grid-connected)

State of Practices

- California Highway 50 Solar Project

- Georgia Solar Road & Laboratory

- Maryland: DOT-wide Solar Program

- MassDOT Highway ROW Solar project

- Oregon Solar Highway Program

- Ohio, Along 1-280 in Toledo, Ohio

- Wyoming, I-70 Rest Area Solar Flowers in Parachute

- Nevada: Moapa Solar Energy Center, Moapa River Indian Reservation (Reservation), Clark County

Joint Development Below Grade

Fiber Broadband Deployment Approaches

One size does not fit all ...

- Publicly-owned and operated network (i.e. Santa Monica, CA)

- Privately-owned and operated network (i.e. Columbus, OH and City of Boston, MA)

- Network via public private partnership (i.e. Utah and Maryland)

Smart Cities

Text for diagram

- Internet of things

- Public Safety

- Gas & Water leak detection

- Smart EnergyWater Quality

- Traffic Management

- Smart Health

- Intelligent Shopping

- Smart Parking

- Smart Environment

- Electric Vehicle Charging

- Air Pollution

- Smart Buildings

- Open Data

- Electromagnetic Emissions

- Smart Home

- Smart Street Lights

- Waste Management

Benefits

Broadband encourages:

- Economic Growth,

- Better quality of life for the community,

- More efficient, cost effective delivery of community services

- Capitalize on fiber infrastructure investment

Note: It all runs on Fiber...

Funding

- FCC Universal Service Fund (USF)

- US Department of Agriculture (USDA): Rural Business Development Grants (RBEG), Rural Utilities Service (RUS), Community Connect Grant

- US Department of Commerce

- Economic Development Administration (EDA)

- National Telecommunications and Information Administration

- Local (Value Capture): Local Improvement Districts (LIDs), Local Utility Districts (LUDs), Community Development Block Grant (CDBG)

Financing

- Pay-as-you go

- US Department of Agriculture: Rural Utilities Service(RUS) Loan Programs

- Broadband loan program

- Electric loan program

- Community Connect

- Digital Learning and Telemedicine (DLT)

- State Revolving Funds,

- Capital Market

- Private Equity

Joint Development Above Grade

Air Right Development

- Sale or Lease of public land or the right to develop on the top of the highway or transit station

- Provide ongoing income streams and opportunity to renegotiate terms at end of lease

- Leasing retains public ownership

- Sales provide upfront capital infusion

- Income streams allow revenue sharing agreements between multiple agencies

- Often practiced in transit agencies

Opportunities

- Economic Vitality:

- Increase tax revenues, create jobs for local and regional workers, attract development

- Social Equity:

- Reconnect neighborhoods & enhance quality with public amenities and activities

- Environmental Integrity:

- Directs development onto an existing transportation corridors, reducing trips and increasing viability of all mobility/public transportation options

Example: Copley Place, Boston, MA

- Value Capture: Air Rights Development Lease

- Type: Mixed-use joint development on 9.5-acre site over the Turnpike

- Lease Term: 99 years lease

- Economic Benefit: Fund for capital, operating, & maintenance expenses of the turnpike

- Social Benefit: Reconnected urban neighborhoods of city, which were divided by the turnpike

Example: I-395 Capitol Crossing, D.C.

- Value Capture: Above Grade - Air Right Development

- Scope: 7-acre decked development site above I-395

- Economic Benefit: Create 8,000 jobs & generate $40 million in annual tax revenues

- Social Benefit: Reconnect Neighborhoods which were divided by the construction of I-395 in late 1960

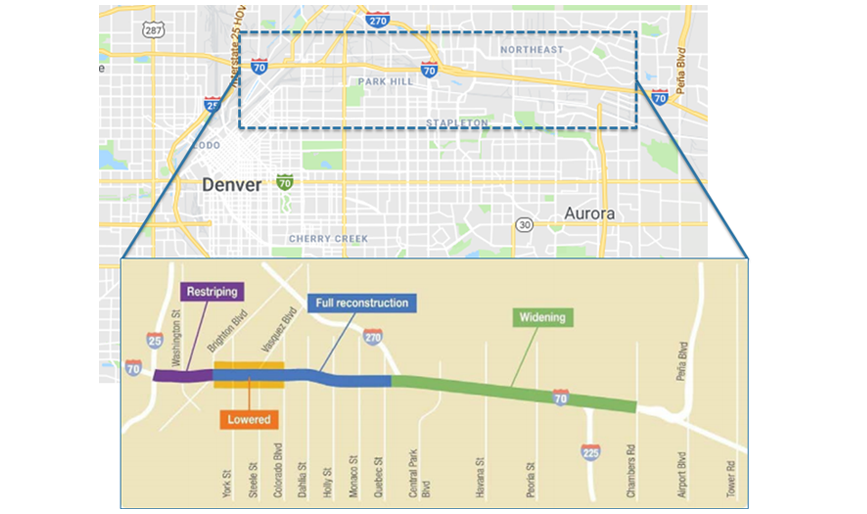

The Freeway Deck Park

- Arizona: Margaret T. Hance Park

- California: 210 Freeway Cap Park, La Canada Flintridge, Enhanced Overpass, Park 101

- Colorado: Central 70

- Georgia: 5th Street Bridge, the Stitch

- New Jersey: South River Walk Park,

- Texas: Klyde Warren Park,

- Washington: Freeway Park in Seattle, Mercer Island

- Others

Federal Roles

Federal's Role in Value Capture Strategies

Federal Regulations

- 49 Code of Federal Regulations (CFR 18.31(b): Real Property

- 23 U.S.C 111: Use and Access to Right-of-Way

- 23CFR 645 Subpart B: Accommodation of Utilities

- 23 CFR 710: Right-of-Way and Real Estate

- 23CFR 752.5: safety rest Areas

Contact: Lindsey Svendsen, FHWA Office of Planning, Environment, and Realty; lindsey.s.svendsen@dot.gov

Value Capture Implementation Team

- Co-Leads

- Thay Bishop, FHWA Office of Innovative Program Delivery

- Stefan Natzke, FHWA Office of Planning, Environment, and Realty

- Members

- Jennifer Ahlin, Virginia Department of Transportation

- Janine Ashe, FHWA District of Columbia Division

- David Cohen, FHWA Office of Project Development & Env. Review

- John Duel, FHWA Office of Planning, Environment, and Realty

- Kathleen Hulbert, FHWA Infrastructure Office

- Chip Millard, FHWA Freight Management & Operation

- Diane Mobley, FHWA Chief Counsel Office

- Kevin Moody, FHWA Resource Center

- Ben Orsbon, South Dakota Department of Transportation

- Jill Stark, FHWA Office of Planning, Environment, and Realty

- Lindsey Svendsen, FHWA Office of Planning, Environment, and Realty

- Jim Thorne, FHWA Office of Planning, Environment, and Realty

- Bingxin Yu, FHWA Transportation Policy Studies

VCIT Focus Areas

- Communication - Developing the tools to help FHWA staff and others promote Value Capture to local public agencies (Value Capture Implementation Manual)

- Technical assistance - Providing technical assistance to local public agencies interested in pursuing Value Capture (Peer Program)

- Clearing House (Clearing House website) - Identification of best practices and lessons learned and promoting further discussion on innovative funding options for local public agencies, lessons learned from past and current efforts, etc.

Value Capture Implementation Manual

- 1. Introduction

- 2. Assess funding options and need for value capture

- 3-8. Select appropriate value capture technique

- 9. Develop business and economic case and for stakeholders

- 10. Address real estate risk

- 11. Establish regulatory framework

- 12. Implement funding and financing plan

Clearinghouse for best practices/lessons learned

EDC-5 Funding Opportunities

- State Transportation Innovation Council (STIC) Incentive

- Up to $100,000 per STIC per year to standardize an innovation

- Accelerated Innovation Deployment (AID) Demonstration

- Up to $1million available per year to deploy an innovation not routinely used

Thay Bishop: thay.bishop@dot.gov or ValueCapture@dot.gov

Questions & Answers