The key contractual provisions in the comprehensive agreement are summarized in the following slides.

| Term |

Summary |

| Scope |

- The Developer is responsible to design, build, finance, operate and maintain the Project

|

| Term |

- 50 years from agreement date (commercial close) including design-build period

|

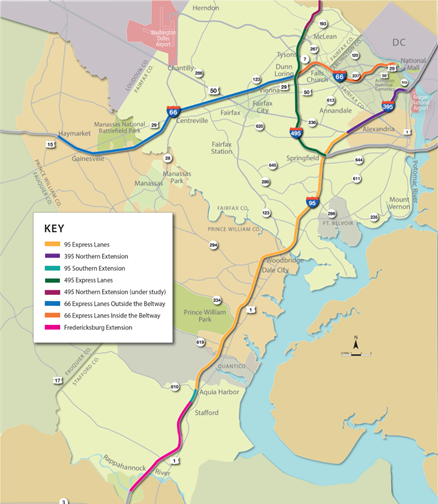

| Traffic & Revenue Risk |

- The Developer will bear 100% of the risk related to traffic and revenue (incl. HOV levels)

|

| Tolling Policy |

- Dynamic pricing: toll rates will be adjusted periodically based on traffic volumes and speed

- Minimum speed of 55 mph, posted speed of 70 mph

- Exempt vehicles: the Express Lanes will be free at all times for users in high occupancy vehicles with three or more occupants (HOV-3+) as well as buses, motorcycles, and emergency vehicles

- Heavy trucks are allowed in the Express Lanes

|

| Right of Way Acquisition |

- The Developer will bear the risk of all conditions occurring on, under or about the Project Right of Way on which the Work is performed

- Developer will be responsible for performing all activities and services necessary for the acquisition of all Project Right of Way at its sole cost and expense

- For parcels that go to condemnation, Developer will be required to place in the Project Enhancement Account an amount equal to 130% of the assessed value of the parcel plus $50,000; the Department will be responsible for any costs of condemnation that exceed 130% plus $50,000

|

| Alternative Facilities |

- Protection provided to the Developer for (i) additional general purpose lanes along the Project corridor and (ii) WMATA Orange Line expansion (first 10 years of operations)

|

| Early Works (Limited Notice to Proceed) |

- Early works, up to a maximum of $39m, to include design development and activities related to obtaining environmental permits; full notice to proceed only after obtaining key environmental permit and financial close

|

| Transit Funding |

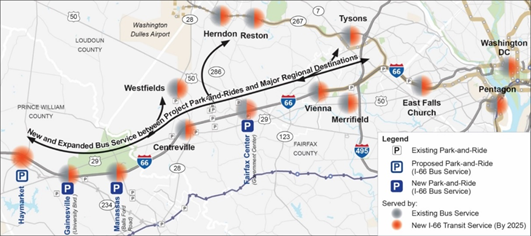

- Developer must make transit funding payments to VDOT during the operating period, according to a fixed nominal payment schedule. Developer's obligation is limited to providing the required funding only (no transit operations, maintenance, etc.)

|

| Support for Corridor Improvements |

- Developer must provide VDOT with payments totaling $350m (PV @ 6.14% discount rate as of November 2020) over the term of the concession

|

| Upside Sharing |

- An upside sharing mechanism will be structured with payments starting after reaching the base case equity IRR

|

| Operations and Maintenance (O&M) |

- Developer responsible for O&M of Express Lanes, except for snow and ice removal

|

| Intermediate Milestones |

- Intermediate parking spaces: Within 18 months of construction NTP

- Remove traffic signals on Route 28: Within 24 months of construction NTP

|