LIST OF FIGURES

LIST OF TABLES

When establishing a TUFs program, a municipality commonly takes several steps, including determining objectives, setting rates, and adopting an ordinance. This chapter discusses these steps and presents them in approximate chronological order of how they usually occur. These steps depend on applicable State and local laws, and vary from municipality to municipality.

Most municipalities have ongoing street maintenance programs funded through several sources, including gas, sales, and property taxes. These usually consist of maintenance or master plans that set out the maintenance program over a short- or medium-term period, usually 1 to 5 years. Municipal staff, sometimes in conjunction with outside specialists, develop these plans, which include a list of maintenance projects based on the city's maintenance policy. In turn, this policy is often based on the city's pavement condition index (PCI) goals (see section 0 below), which is a common measure of the physical condition of street pavement.

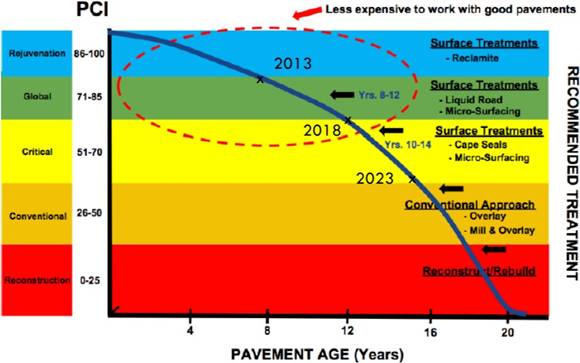

The street maintenance program may also be established to repair streets along one road, adjacent streets, or an entire neighborhood at one time. It may be further adjusted by the relative pavement deterioration curve (see figure 1, for example). Because cities' roads are in varying conditions, cities make several strategic decisions in spending their limited street maintenance monies. They may ignore one road in bad repair because maintenance is not cost-effective and simply leave it to be rebuilt, yet resurface another that, by appearances, is in good shape because that overlay can result in a much higher return on investment over the asset's life. Explaining this trade-off to policymakers and the public is an important task of staff who are implementing a TUFs program.

A final consideration in the maintenance plan is coordinating with other utilities, which often are buried in roads' rights-of-way and require access to streets to repair or install new water, wastewater, electric, telephone, and internet infrastructure. To reduce travel disruptions and reduce the frequency of street repairs, some cities coordinate their maintenance plans with other municipal and private utilities. This coordination may reprioritize some maintenance projects based on a consensus with other utilities. In the case of Loveland, CO, a project in that municipality's 5-year plan may shift by 1 or 2 years based on coordination with other utilities.10 Hillsboro, OR, has a similar approach.11

Figure 1 provides an example that the City of Killeen, TX, used to demonstrate the financial benefit of maintenance as part of a presentation on establishing a TUFs program. This curve, which formally or informally is used by many city maintenance programs, identifies those street pavements for which repair can cost-effectively prolong the life of the asset, for example, by increasing the asset's life by up to 50 percent. This compares with other road segments which are in such poor condition that they require reconstruction and therefore do not benefit from maintenance repair.

Figure 1. Pavement deterioration curve example, Killeen, TX, TUFs presentation.12

Municipalities often base their street maintenance programs on a set of principles, including a goal to achieve an expected pavement condition index (PCI), which is a standardized scale of pavement condition from 1 (worst) to 100 (best).13 Many communities seek a PCI between 70 and 80, which is considered "very good" on the ASTM scale, which is commonly used but not required under Federal regulations.14 For example, the City of Loveland, CO, seeks a PCI in the "high 70s."15 Corpus Christi, TX, seeks to use revenues from its street maintenance fund to improve roads classified as "good" (PCI 61- 80) or "fair" (PCI 41-60).16 By doing so, they focus their funding on "preventative maintenance" that extends the life of the roads and thereby minimize road reconstruction.

Due to the city's increased population and a reduction in traditional funding sources, including gas taxes, Oregon City, OR, established a TUFs program in 2007 to address a backlog of street maintenance needs. This plan has an associated budget. In Oregon City's case, the 5-year plan established both an "unconstrained" budget and a "constrained" budget. The former is the amount of preventative maintenance that needs to occur to meet the municipality's PCI or other technical goals. The constrained budget is the amount of preventative maintenance that the municipality can afford based on funds available from the TUFs and other sources. The municipality engages in a feedback process between its goals and the TUFs to ensure that it is acceptable to policymakers and the community. In other words, some municipalities first establish their maintenance program and then determine the resultant TUFs; the TUFs rates are then adjusted, usually downwards, with a consequential reduction in the maintenance program. Oregon City came up with an unconstrained plan of $31.8 million and then a constrained plan of $10.3 million, which is a two-thirds reduction.17 The differences between the unconstrained plan and the constrained plan are shown in figure 2. The unconstrained version has more streets marked to receive treatment and rehabilitation; hence, the plan shows more streets in color.

Figure 2. Unconstrained and constrained pavement maintenance plans, Oregon City.18

|

|

The street maintenance budget will vary by the availability of all funding sources, including gas taxes, sales taxes, property taxes, and TUFs. In several TUFs programs, TUFs fund, or are targeted to fund, a substantial portion of municipalities' street maintenance programs, in the range of 40 percent to

50 percent. For example, Loveland, CO, sets its TUFs to fund 40 percent of their program and is hoping to reach 50 percent.19 Hillsboro is at around 60 percent of its program.20 Corpus Christi funds 36 percent of their maintenance program with its TUFs.21

Most TUFs are designed to fund street maintenance and related infrastructure maintained by the municipality. Roads and other transportation facilities that are the responsibility of State or other agencies are usually excluded from TUFs funding. Usually, private roads are excluded from TUFs funding as well. Furthermore, many municipal TUFs ordinances explicitly exclude parking lots from receiving TUFs funding.

Most TUFs are established by municipal governments and so TUFs monies are expended in that respective jurisdiction. While it is rare that counties initiate TUFs, Clackamas County, OR, did consider establishing TUFs and invested considerable resources to study how to establish accurate TUFs. Due to individual municipalities' unhappiness with a centralized management system, the county abandoned its effort and instead individual municipalities within the county established their own TUFs programs.22 Defining the streets which will benefit from TUFs proceeds depends, in part, on the city's maintenance plan, the city's objectives for PCI, and its available budget. The Oregon City, OR, 2019 5-year pavement maintenance plan provides a good example of a typical street maintenance plan heavily funded by TUFs with a clear approach to determining the streets applicable for funding.23 All TUFs receipts are deposited in the city's Pavement Maintenance Utility Fund (PMUF) and are dedicated to funding street maintenance.24

From establishment of the PMUF, the city prepared three 5-year Pavement Maintenance Plans to prioritize the streets for annual pavement maintenance. The final document includes a list of projects organized by year, street segment, and anticipated treatment type, which can be expected to be completed with the available funding during the period of the plan.25

The plan describes how the city reached its goal of increasing its PCI to over 70, or "very good," for its average in the past decade due to the PMUF funding, as well as an increase in new streets (with higher PCIs) in the system (table 2). However, the large jump in PCI seen between 2015 and 2016 can be attributed to new development in the city.26

Table 2. Oregon City PCI over time.27

| Year | PCI |

2011 |

60 |

2012 |

Error! Bookmark not defined. |

2013 |

68 |

2014 |

67 |

2015 |

66 |

2016 |

76 |

2017 |

76 |

2018 |

75 |

Oregon City's recent plan (2020-2024) focuses on two categories: (1) preventative maintenance and

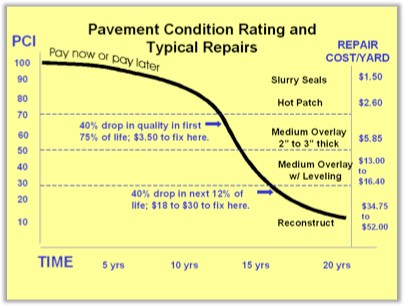

(2) rehabilitation. To develop project lists, the city uses a pavement management model/database, provided by StreetSaver, and an outside consultant. The software applies an algorithm based on existing pavement conditions, street classification, yearly maintenance budget, time period, treatment types, and treatment costs. This is then adjusted by several factors, including up-to-date construction costs, inflation, and inclusion of curb ramp replacements as required to meet the requirements of the Americans with Disabilities Act of 1990. It also translates the data into street maps that allow it to understand the actual traffic conditions that may affect the construction program and construction costs, identify other streets that can be easily grouped with the target streets, seek input from public and private utilities that need to make street cuts during the 5-year period, and assemble a street list that can fit the budget limitations, such as shown in figure 2.28 Like Killeen, TX, Oregon City presents a pavement deterioration curve showing how the typical costs to repair a yard of pavement increase as the pavement becomes more deteriorated (figure 3).

|

Figure 3. Oregon City pavement deterioration rating and repair costs.29

Municipalities often conduct studies on whether and how to implement a TUFs program. These studies are initiated and/or carried out by municipal staff, by the respective legislative body, and/or by an ad hoc citizen's group. In most cases, they are made public and used in legislative considerations of implementing TUFs.

For example, in 2008, the Ad Hoc Committee on Transportation Finance conducted a TUFs study on behalf of Hillsboro, OR, as part of that city's consideration to implement a TUFs program. The committee, aided by outside consultants who prepared a variety of issue papers, conducted nine meetings covering a variety of considerations, including how much revenue the TUFs should raise, how to assess the funding burden between residential and nonresidential customers, waivers and credits, and program oversight.30 The study came up with the following recommendations:

Many TUFs implementation initiatives devote resources to informing the public about the nature of the proposed program and soliciting feedback. Because TUFs involve the establishment of new fees, applicable laws often require municipalities to hold public hearings and publicize the new fee. This may include the following:

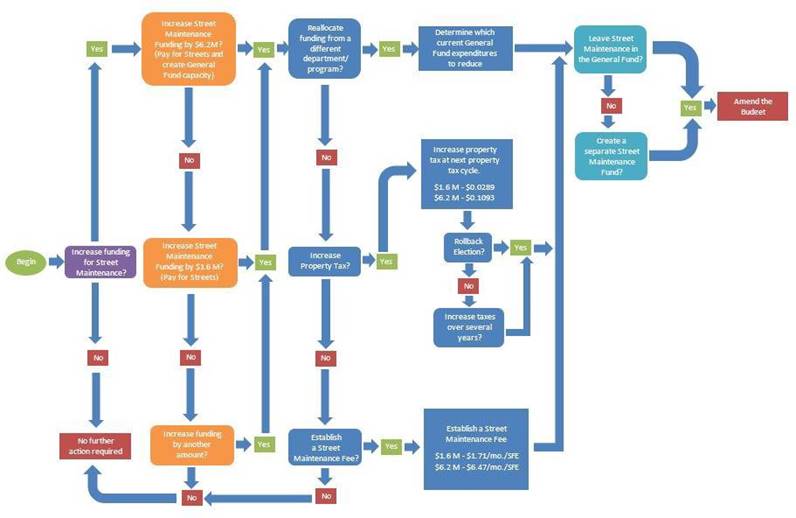

Presentations by ad hoc committee representatives, staff, and/or consultants at public meetings and/or legislative sessions. For example, Killeen, TX, prepared a 16-page presentation summarizing the city's rationale for its proposed TUFs program, including pavement preservation needs, historical street maintenance funding, alternative funding options, cost issues, land use designations, and calculation methodology.34 Killeen developed a decision matrix to describe the available policy options (figure 4).

Informational materials that summarize the TUFs program.

Websites that make available study reports and other supporting documents, such as the Hillsboro, OR, website that has current and past information on their TUFs.35

Figure 4. City of Killeen street maintenance funding policy decision matrix.37

TUFs ordinances set forth the terms of the TUFs program. They often include some or all of the following topics:

While TUFs ordinances may cover the topics discussed above, they vary considerably, even among the ordinances of Oregon municipalities, a State with many municipalities that use TUFs. These differences reflect varying public policy goals and the demographic, economic, and locational characteristics of the municipality.

Most TUFs ordinances can be found online or on a municipality's website, and example excerpts from the Hillsboro, OR, ordinance can be found in appendix A.

TUFs are generally dedicated to the purpose for which they were established and are not considered general revenue. They are commonly collected with other utility fees unless the municipality sets up a separate administrative system. There is economy-of-scale "piggybacking" onto existing fees collection, and enforcement of payment is strengthened as well.

Municipalities may adjust the TUFs after adoption. For example, Loveland, CO, revised its TUFs

9 months after establishment to create a new Retail category and to make the TUFs equivalent to other utility fees in terms of delinquency regulations. Under the new regulations, if an owner fails to pay the TUFs, the city may, after notification, turn off other utilities at the property.38

Before and after TUFs ordinances have been implemented, municipalities often devote extra effort to explain the program to the public. They may do this in a variety of ways, including the following:

Table 3. Examples of FAQs for TUFs.

| City | Website URLs | Example FAQs |

Lake Oswego, OR |

City of Lake Oswego, Street Fee Questions, https://www.ci.oswego.or.us/publicworks/street-fee- questions |

"Why a Street Maintenance Fee in Lake Oswego?: In the past, the largest funding source for maintenance of the City's street system was the State Gas Tax. The Gas Tax has been used to pay for street maintenance, as well as the energy and maintenance costs for street lights and traffic signal systems citywide. The City Council determined that the Gas Tax must be supplemented by additional funding sources to keep up with ongoing maintenance of our streets. This includes complete pavement overlays, pavement treatments, and reconstruction work that are necessary to keep the street system functioning satisfactorily...."44 |

Hillsboro, OR |

Hillsboro Public Works, Transportation Utility Fee, www.hillsboro-oregon.gov/TUF |

"How was the number of trips for a single-family home determined?: Traffic engineers rely on a "Trip Generation" manual recommended by the Institute of Transportation Engineers to figure out traffic impact on streets. Based on studies, the manual concludes that single-family homes generate, on average, nine or 10 one-way vehicle trips per day...." |

Taylor, TX |

Taylor, TX, Transportation User Fee, https://www.ci.taylor.tx.us/826/Transportation-User- Fee |

"How long will the TUF be in place?: The ordinance outlines a 3-year review period to periodically review the ordinance and TUF." |

| City | Website URLs | Example FAQs |

Newberg, OR |

City of Newburg, TUF Frequently Asked Questions, https://www.newbergoregon.gov/engineering/page/tuf-frequently-asked-questions | "How will Newberg residents and businesses benefit?: Street repairs! The city will be able to increase annual road maintenance activities. Poor pavement conditions can be damaging to tires, deter business investment, and cost the community more in the long run if not addressed...." |

Because most TUFs are an added charge to a utility bill, it is not unusual for those who pay the bill to overlook or not understand how the TUFs are different from the other utility fees, such as for water or trash service. TUFs program officials say that homeowners often ask them why utility bills have increased and fail to realize that it was the addition of the TUFs. Therefore, it is important for municipalities to anticipate and devote adequate resources to educating their legislative bodies and the public on the following:

These topics are discussed in chapters 0, 0, 0, and 0, respectively.

10 Klockeman, Dave, City of Loveland, CO, interview, June 30, 2020.

11 Bailey, Tina, Hillsboro, OR, interview, May 5, 2020.

12 City of Killeen, TX. Street Maintenance Funding, DS-18-088, October 23, 2018, https://www.killeentexas.gov/DocumentCenter/View/1084/2018-10-23---Street- Maintenance-Presentation?bidId=.

13 "The PCI is a numerical indicator that rates the surface condition of the pavement. The PCI provides a measure of the present condition of the pavement based on the distress observed on the surface of the pavement, which also indicates the structural integrity and surface operational condition (localized roughness and safety)." ASTM International. Standard Practice for Roads and Parking Lots Pavement Condition Index Surveys, ASTM D6433 - 18. http://www.astm.org/cgi-bin/resolver.cgi?D6433-18

14 Karim, Dr. Fareed M.A., Dr. Khaled Abdul Haleem Rubasi, & Dr. Ali Abdo Saleh. 2016. The Road Pavement Condition Index (PCI) Evaluation and Maintenance: A Case Study of Yemen, Organization, Technology and Management in Construction, 8(1), 1448.

15 Klockeman, Dave. City of Loveland, CO, interview, June 30, 2020.

16 Martinez, Richard. Street Maintenance Fee City of Corpus Christi Use Transportation Utility Fee (TUF) to Fund Roadway Maintenance & Enhance Safety. FHWA Virtual Peer Exchange, May 14, 2020.

17 Utility Fee Annual Report, 2012. October 6, 2014. p. 12. https://www.orcity.org/sites/default/files/fileattachments/public_works/page/4356/five_year_pavement_maintenance_plan_tech_memo.pdf

18 Ibid, Appendix A.

19 Klockeman, Dave, City of Loveland, CO, interview, June 30, 2020.

20 Bailey, Tina, City of Hillsboro, OR, interview, May 5, 2020.

21 Martinez, Richard. Street Maintenance Fee City of Corpus Christi Use Transportation Utility Fee (TUF) to Fund Roadway Maintenance & Enhance Safety, FHWA Virtual Peer Exchange, May 14, 2020.

22 Springer, Carl, & John Ghilarducci. January 2004. Transportation Utility Fee: Oregon Experience. Transportation Research Record: Journal of the Transportation Research Board, 1895(1), pp. 15-24.

23 City of Oregon City, OR. June 2019. Five-Year Pavement Maintenance Plan (2020-2024). City Project #PS18-026. https://www.orcity.org/sites/default/files/fileattachments/public_works/page/4356/five_year_pavement_maintenance_plan_tech_memo.pdf 24 Ibid, p. 2.

25 Ibid, p. 3.

26 Ibid, p. 4.

27 Ibid, p. 12.

28 Ibid, pp. 6-8.

29 Utility Fee Annual Report, 2012. October 6, 2014. p. 12. https://www.orcity.org/sites/default/files/fileattachments/public_works/page/4356/five_year_pavement_maintenance_plan_tech_memo.pdf

30 Ad Hoc Committee on Transportation Finance. April 2008. City of Hillsboro: Report to the Transportation Committee, Proposed Hillsboro Transportation Utility. https://www.hillsboro-oregon.gov/home/showdocument?id=990

31 Ibid, p. b-c.

32 Ibid, p. 2.

33 Ibid, p. 8.

34 City of Killeen, TX. October 23, 2018. Street Maintenance Funding. DS-18-088. https://www.killeentexas.gov/DocumentCenter/View/1084/2018-10-23---Street- Maintenance-Presentation?bidId=

35 Hillsboro, OR, Transportation Utility Fee. https://www.hillsboro-oregon.gov/our-city/departments/public-works/transportation/street-and-road- maintenance/transportation-utility-fee36 City of Loveland, CO. Ordinance No. 4590: An Ordinance Establishing a Street Maintenance Fee. First Reading on November 27, 2000; Second Reading on December 12, 2000. Documents provided by Dan Klockeman, City of Loveland, CO.

37 City of Killeen, TX. Street Maintenance Fee, Background Materials: Decision Matrix. https://www.killeentexas.gov/DocumentCenter/View/1085/2018-11-06--- Decision-Matrix?bidId=

38 Keough, Dan. Resolution adopting a new schedule of Street Maintenance Fees pursuant to section 16.42.040 of the Loveland Municipal Code, September 18, 2001, City of Loveland, Finance Department.

39 Komarek, Joel. October 27, 2003. City of Lake Oswego Council Report: Ordinance No. 2373, Establishing a Street Maintenance Fee.

40 Bailey, Tina, City of Hillsboro, OR, interview, May 5, 2020.

41 Komarek, Joel. October 27, 2003. City of Lake Oswego Council Report: Ordinance No. 2373, Establishing a Street Maintenance Fee.

42 Bailey, Tina, City of Hillsboro, OR, interview, May 5, 2020.

43 City of Loveland, CO, transcript of incoming utility department phone line. Materials from Dan Keough. Klockeman, Dave, Loveland, CO, interview, June 3, 2020.

44 City of Lake Oswego, OR. Street Fee Questions. https://www.ci.oswego.or.us/publicworks/street-fee-questions