CONTENTS

FIGURES

TABLE

This chapter presents the process of implementing a TRZ. Because of the limited implementation guidance and experience with TRZs in Utah, the information presented in this chapter is largely based on the legal requirements and implementation experience available from Texas.xxvii The TRZ implementation process in Texas consists of five sequential stages, as presented in Figure 2 (6). In Texas, experience has shown that it takes about 6 months to establish a TRZ, that is, to complete the first three stages shown in Figure 2.

Figure 2. Texas TRZ implementation stages [adapted from Leveraging the Value of Land and Landside Access to Fund Port Infrastructure in Texas.(6)

The TRZ implementation process involves a significant amount of interagency collaboration, as the information and support needed to complete the process benefits from the involvement of a number of stakeholders. In addition to the local government’s governing body and other officials, potential stakeholders include agencies such as the State Department of Transportation (DOT); the regional transportation planning body (e.g., metropolitan planning organization [MPO]); and the local appraisal district (or equivalent). As a result, developing strong stakeholder relations and agency champions is critical. The following sections describe each implementation stage in detail.

This stage consists of identifying an eligible target area for TRZ funding. According to Texas law, this is an area that may be considered unproductive or underdeveloped, and where the creation of a zone will: promote public safety; facilitate the improvement, development, or redevelopment of property and the movement of traffic; and enhance the municipality’s ability to sponsor a transportation project. At this stage, the municipality identifies a candidate project and may conduct a preliminary feasibility analysis to assess its potential as the basis for a TRZ. Also at this stage, the local government may commence internal and external stakeholder engagement to build support for the project.

Texas local governments that have implemented TRZs have generally developed one or more of the following preliminary analyses (6):

Some of the data sources that are used for these types of analyses include State DOTs, county appraisal districts, the State Comptrollers of Public Accounts, and various other economic resources and sites. The types of data may include(6):

The results of these preliminary analyses could be used to initiate a dialogue with stakeholders, such as State DOTs, MPOs, and others, to build support. Identifying a TRZ champion facilitates this process because of the significant amount of interagency collaboration required(6).

This second stage of the process consists of three steps:

The first step of this stage is to define zone boundaries and identify the parcels that will be included in the TRZ. The local government determines zone boundaries by designating a contiguous geographic area within its jurisdiction. All properties included within the TRZ boundaries are identified and listed. Next, the local government computes the tax increment base (see rectangle [b] in Figure 1) of the zone by summing the total appraised value of all taxable real property within the zone for the year in which the TRZ will be established (base year).

As noted in Section 2.3.1, Texas law does not limit the size or footprint of a TRZ if it falls within the local government’s jurisdiction and forms a contiguous geographic area. A starting point for setting TRZ boundaries is to consider the limits of the transportation project. This is critical because TRZ revenues cannot be used to fund transportation improvements outside the zone.xxix Once the approximate limits of the transportation project have been defined, the size of the buffer around the transportation project that will form the TRZ can be defined.

Research has demonstrated that the impacts of highway improvement projects on real property values concentrate in regions within 1 to 2 miles from the project(4). However, experience has shown that actual boundaries are driven by practical considerations, such as the size of the local government’s tax base within the zone relative to its total tax base. If a TRZ is too large relative to the local government’s tax base, it may have a negative impact on the local government’s general revenue fund and its ability to sustain other local services or provide future property tax relief for economic development purposes. In practice, this has meant that the boundaries of existing Texas municipal and county TRZs in most cases do not exceed a distance of 1 mile from the centerline of a corridor and are often in the range of ¼- to ½-mile (3). Chapter 6 describes how the Town of Horizon City, Texas, determined the boundaries of a TRZ.

Both Texas and Utah laws require holding a public hearing prior to establishing a TRZ.iv,xxx In Texas, the local government is required to allow at least a 60-day notice period before designating the TRZ. The local government is also required to hold a public hearing on the creation of the TRZ not later than the 30th day before the date that the TRZ is expected to be designated. Finally, it is required to publish the notice of the public hearing at least 7 days prior to the date of the hearing, and the intent to create the zone must be published in a newspaper with general circulation in the county where the zone is located.

During this 60-day period, local governments have the opportunity to refine the preliminary analyses performed during the initiation stage (stage 1) of the implementation process. The objective of this refinement is to ensure the TRZ will generate enough revenue to meet the expected financial commitments (e.g., debt service) entered into by the local government.

Once initiation and zone formation stages are completed, Texas law requires the local government to hold a public hearing on the creation and benefits of the zone, which should take place no later than the 30th day before the TRZ is designated by the local government governance body. No later than the 30th day after the hearing, the local government governance body convenes and holds a vote on the creation of the zone by order, resolution, or ordinance (depending on the type of local government creating the TRZ). The resolution or ordinance should: iv

Neither Texas nor Utah TRZs require approval from taxing entities other than those creating the TRZ. According to the Texas legislation, a TRZ requires approval only by the governing body of the local government unit setting it up (e.g., municipality, county, port authority, or navigation district). iv On the other hand, Utah Code states that approval and agreement is required from two public agencies, at least one of which has land use authority over the zone. xxx In other words, in Utah, agencies other than the two establishing the TRZ do not have an approval role in the creation of a TRZ.

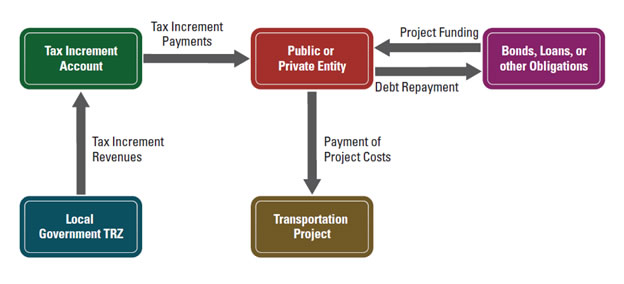

According to Texas law, once the TRZ is established in the base year, every subsequent year, the tax increment revenue generated within the zone is deposited into the local government’s TRZ tax increment account. At this stage, the local government may enter into an agreement with a public (e.g., city, county, or regional mobility authority) or private (e.g., agent) entity to implement the project. The public or private entity may also acquire financial obligations, such as bonds or loans, to fund the capital cost of the project.iv The operation stage is depicted below in Figure 3.

Figure 3. TRZ operation stage [adapted from Leveraging the Value of Land and Landside Access to Fund Port Infrastructure in Texas.(6)

The project should be located within the TRZ, and the local government may assign all or a specified amount of the tax increment revenue to fund the project. Specifically, Texas law states that local governments are not required to dedicate 100 percent of the annual tax increment revenue to the project. Rather, Texas law explicitly states that a local government may pledge and assign all or a specified amount of the tax increment revenue to the payment of the costs of the project. In this regard, Utah law states that the public entities establishing the TRZ will specify the amount of the tax increment revenue that will be dedicated to fund the project at the time of creating the TRZ. iv

Under the laws of both Texas and Utah, if there is a surplus in any given year after the bond, loan, or any other annual obligations are met, the local government can transfer the surplus to its general revenue fund and use it for a different purpose.iv, xxx This flexibility allows local governments to reap the benefits of increased tax revenues resulting from development spurred by the project once revenue within the zone exceeds the annual TRZ debt service obligations. At that point, a local government has several options for using the excess tax increment revenue, including:

Although not required by law, once a TRZ is established, experience in Texas indicates that monitoring annual tax increment revenues generated within the zone is a valuable tool for local governments to assess value capture performance (6). Local governments can use this information to evaluate actual tax increment revenues versus the estimates developed in stages 1 and 2 of the implementation process. Additionally, local governments can monitor land use dynamics, pace of development, development status of parcels located within the TRZ, and business activity, among other performance measures.

By monitoring annual tax increment revenues, the local government can also foresee potential tax increment revenue shortfalls that may compromise its ability to meet acquired obligations and develop contingency plans. For example, the local government can identify early on any non-real estate market-related issues, such as a private legal dispute between landowners, which can slow the development of a significant area within the zone. Depending on the specifics of the issue and the magnitude of its revenue impact on TRZ revenue, monitoring tax increment revenues can provide an opportunity for the municipality to facilitate a solution or develop a contingency plan (e.g., an expansion of the TRZ or a renegotiation of the terms of the loan). It is also important for a locality to know whether development is occurring faster than expected, as that may allow the municipality to renegotiate project debt and pay it off earlier.

According to Texas law, a TRZ terminates on December 31 of the year in which the local government completes any contractual requirement that included the pledge of TRZ revenue. Additionally, a TRZ terminates on December 31 of the 10th year after the year the zone was designated, if the local government has not used the zone for its designated purpose prior to that date.

iv Texas Transportation Code § 222.105–111

xxvii This section complements the legal framework discussion in Chapter 2. The legal requirements mentioned in the process described in this section have been primarily drawn from the Texas Transportation Code § 222.105—111. References to Utah law complement the text where relevant to highlight difference and similarities.

xxviii For further guidance on the evaluation of potential tax increment revenue, please refer to the sources below:

xxix In some cases, final project boundaries (e.g., a road alignment) may be unknown at the time the TRZ is established. To address this issue, the Texas Transportation Code § 222.105—107 enables local governments to expand TRZ boundaries to accommodate changes in the limits of the project for which the zone was originally created. However, removing properties from a TRZ after it has been adopted is not allowed if future revenues from those properties have been pledged to secure debt or other obligations to fund the project.

xxx Utah Code § 11-13-227