« PreviousNext »

1. Overview of Special Assessments

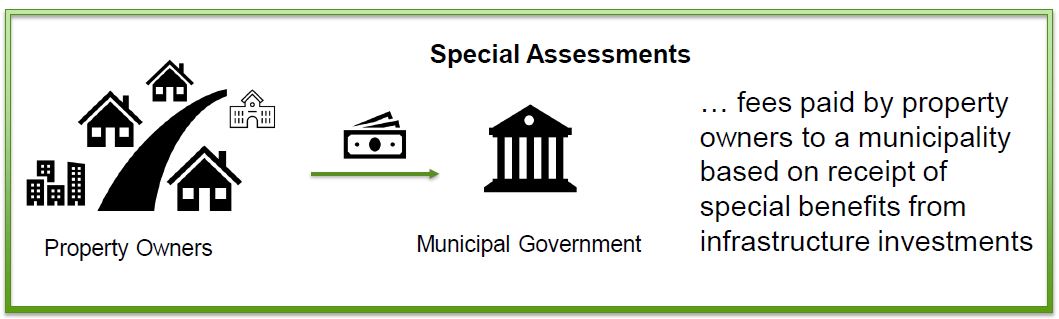

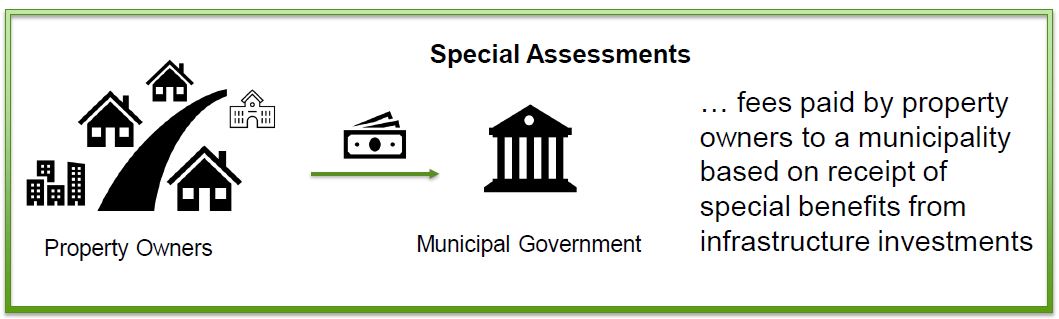

What is a Special Assessment?

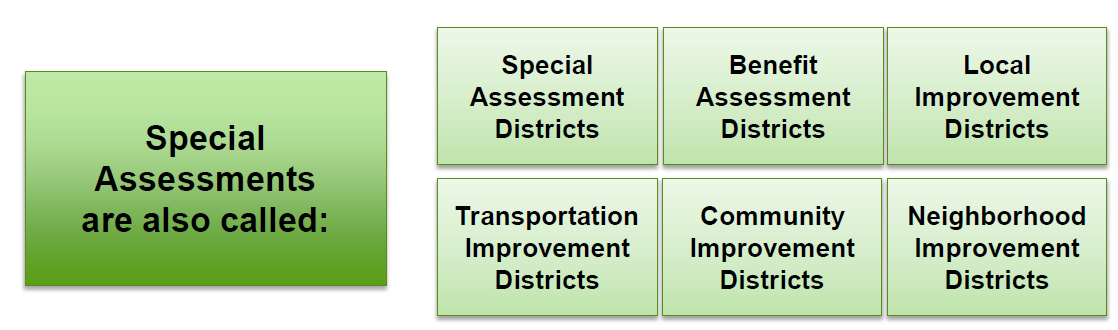

Special Assessments are also called: Special Assement Districts,Benefit Assessment Districts, Local Improvement Districts, Transportation Improvement Districts, Community Improvement Districts, Community Improvement Districts, Neighborhood Improvement Districts.

Overview: Concept behind SADs

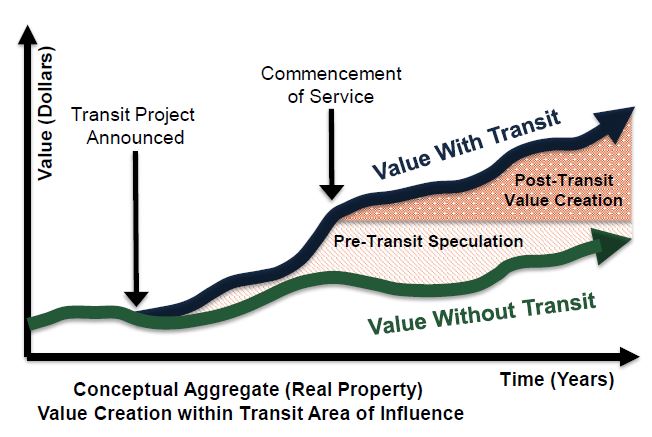

Transportation enhances property values

- New or improvedinfrastructure providesspecial benefits tonearby properties.

- Access to transportationinfrastructure createshigher land values.

- Special assessmentsreturn a portion of thisspecial benefit to thepublic sector thatcreated it.

Infographic representing a timeline of Value with Transit in years from points: Transit Project Announced, Commencement of Service, Pre-Transit Speculation and Post-Transit Value Creation. Financial value with transit trends upwards over time. Value without transit also trends upward but not as much as with transit.

Figure source: Transportation Research Board, TCRP Report 190, 2016.

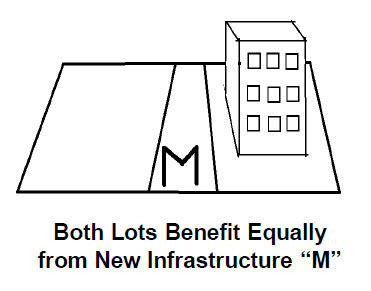

Financial beneficiaries pay in proportion to benefits received

- Even if a landowner lives elsewhereand never uses the transportationfacilities near his/her property,higher land values provide theowner with a direct benefit.

- Fees based on increased land valuewill be paid by beneficiaries inproportion to the benefits received.

Figure source: R. Rybeck, Funding Long-Term Infrastructure Needs for Growth, Sustainability, and Equity, 2013

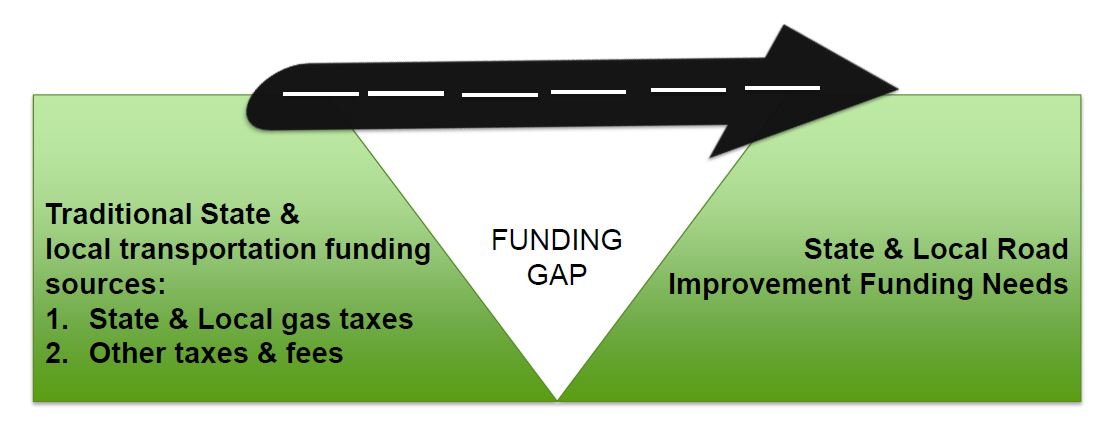

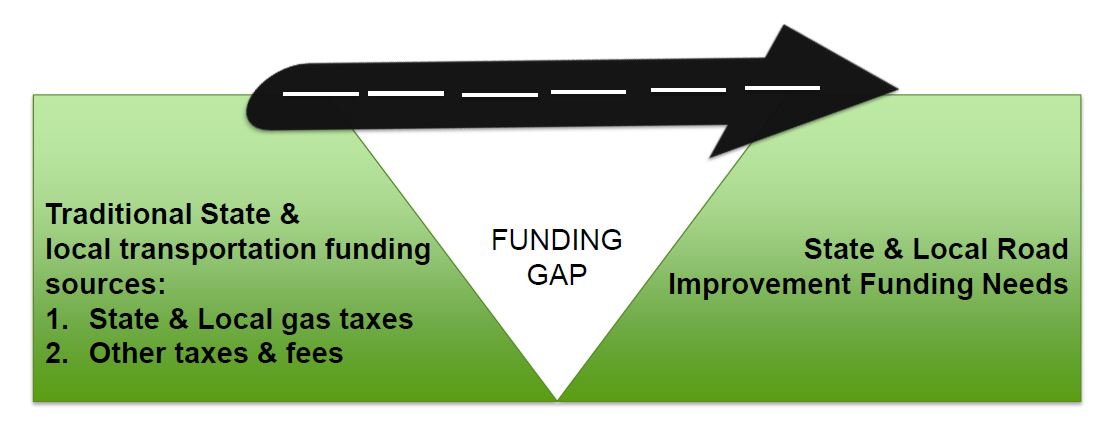

Closing Funding Gaps

Efficiency, equity, and stakeholder benefits

Economic Efficiency - Linking benefits and payments can encourage more efficient land development decisions, simple administration (property tax billing in place); Equitable - Those who benefit pay, Payments in proporiton to benefits recieved; Stakeholder Benefits - Transparencey in how Special Assessments are sprent, Transparency and accountability build trust

« PreviousNext »