Instructors

Patrick DeCorla-Souza

P3 Program Manager

Center for Innovative Finance Support

Marcel Ham

Vice President

IMG/Rebel

P3-VALUE 2.0 Webinars

- P3: Public Private Partnership

- P3-VALUE 2.0: Analytical tool to help practitioners

understand processes used to quantitatively evaluate P3 options

- This is the second of five webinars on P3-VALUE

- P3 Evaluation Overview

- Value for Money Analysis (today)

- Project Delivery Benefit-Cost Analysis

- Risk Valuation

- Financial Viability Assessment

Webinar Outline

Part 1 Introduction

Part 2 Develop Public Sector Comparator

Part 3 Develop P3 Option and Compare to Public Sector Comparator

Part 4 Value for Money Analysis in P3-VALUE 2.0

Recap Summary of Webinar

Webinar Objectives

After this webinar you should be able to:

- List the various components of the Public Sector Comparator

(PSC) and P3 Option (P3)

- Describe the methodologies used to estimate the PSC and P3 Option

- Use the P3-VALUE 2.0 tool to perform a "high-level" Value for

Money analysis

Part 1: Introduction

Definitions

- Value for Money (VfM)

The optimum combination

of life cycle costs and quality of a good or service to meet the

user's requirements

- VfM Analysis

Quantitative analysis, expressed

as dollar or % difference

- Public Sector Comparator (or PSC)

Conventional

procurement's baseline cost against which P3 option will be compared

- P3 Option (or P3)

Net cost of P3 option

to Agency, including estimated payments to private partner as well

as other costs incurred by public sponsor

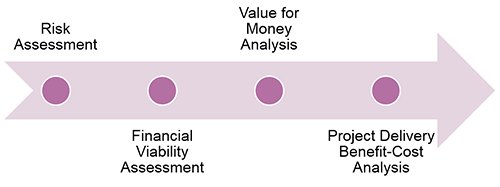

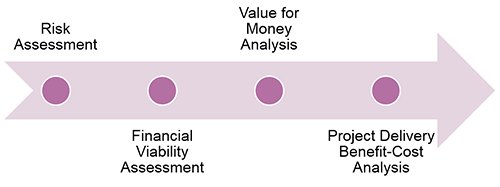

Timing of VfM Analysis

View full-size timing

chart

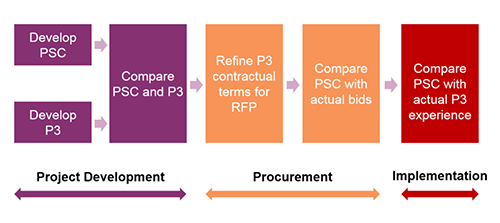

P3 Evaluation in Project Development

View full-size

P3 Evaluation in Project Development chart

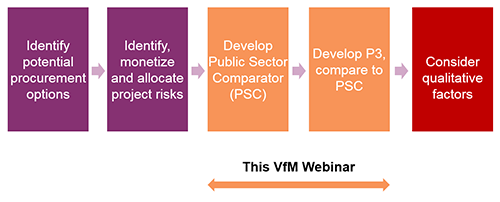

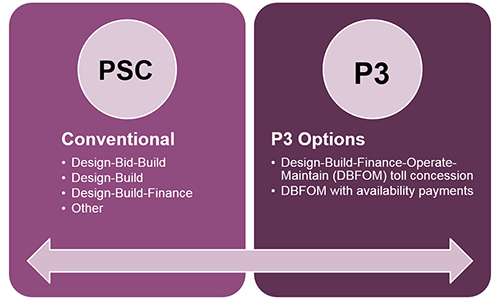

1. Identify Procurement Options

View full-size Procurement Options

chart

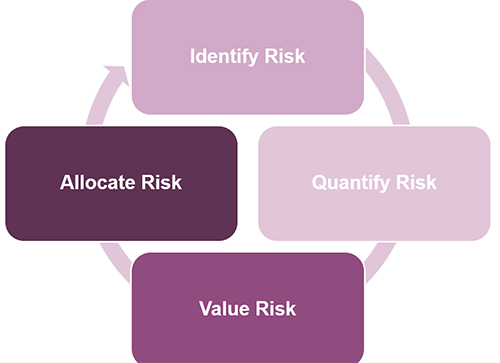

2. Risk Assessment and Allocation

View full-size

Risk Assessment and Allocation chart

3. Develop Public Sector Comparator

- Estimate present value of hypothetical, risk-adjusted costs

and revenues of conventionally procured project

- Assume project is completed to same scope and quality standards

as under P3 delivery

- Assume same timeframe as under P3 delivery

4. Develop P3 Option

Definition: Present value of net costs to Public

Agency for delivering same project as a P3

Components

- P3 contract payment

- Revenue to Agency (if any)

- Retained cost & risk

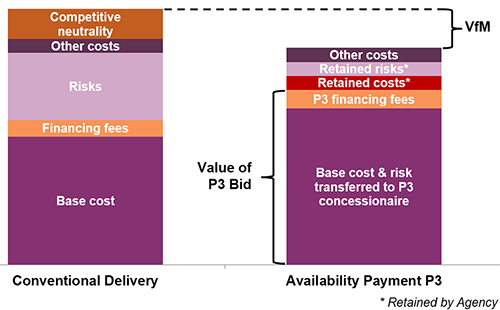

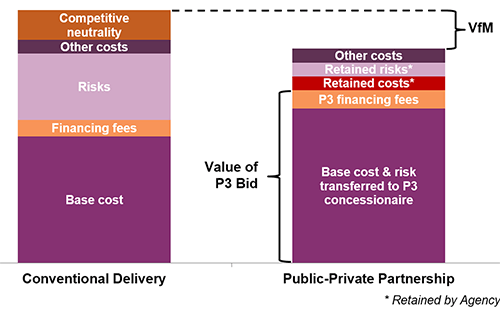

5. Compare PSC with P3

View full-size

comparison chart

6. Qualitative Assessment

- Considerations related to project goals:

- Additional (earlier) user benefits from acceleration

- Quality of service

- P3 contract-related considerations:

- Viability

- Performance

- Achievability

- Flexibility

Test Your Knowledge

True or False

- Value for Money analysis requires that the PSC have the same

scope as the P3, and be implemented in the same time frame as the

P3.

Questions

Submit a question using the chat box

Part 2: Develop Public Sector Comparator

Key Assumptions for PSC

- Same project scope as anticipated for P3 delivery

- Same quality standards as anticipated for P3 delivery

- Same time frame as anticipated for P3 delivery

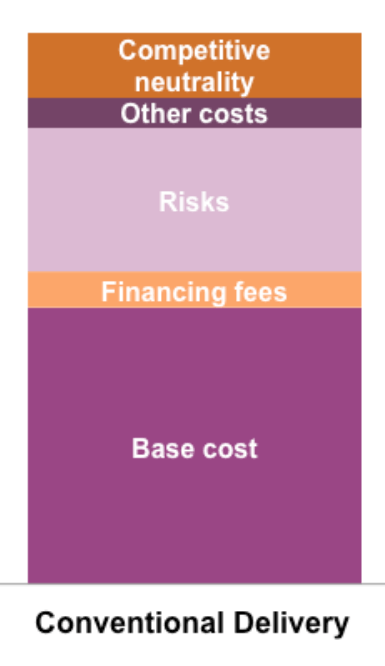

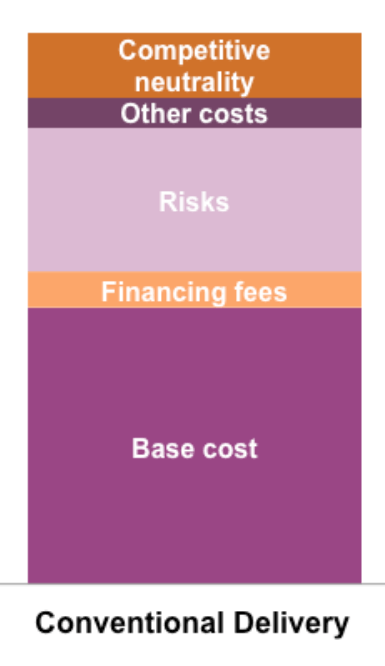

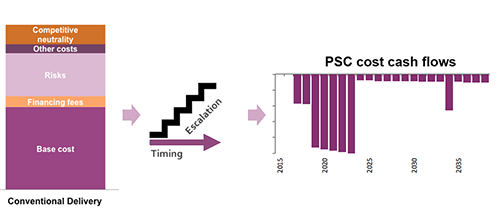

Components of PSC Estimate

- Base costs

- Design-Build phase

- Operations phase

- Risk values

- Base variability

- Pure risk

- Lifecycle performance risk

- Financing fees

- Other project costs

- Competitive neutrality

A. Base Costs

- Pre-construction and construction (capital) costs

- Operations cost

- Maintenance costs

- Reconstruction & rehabilitation costs

View full-size

Base Costs chart

B. Cost Impacts of Risk

- Base Variability

Example: Uncertainty in volume of asphalt

- Pure Risks

Example: Accident at construction site, causing

cost overrun and/or delays

- Lifecycle Performance Risks

Example: Conflicts between

DB and O&M contractors, supervening events exceeding liability caps,

inflation

C. Financing Fees on Public Debt

- Arrangement fees

- Commitment fees

- Swap fees

Note: Interest and principal payments are not included in financing

costs in the P3-VALUE model

D. Other Project Costs

- Procurement costs

- Monitoring & oversight costs

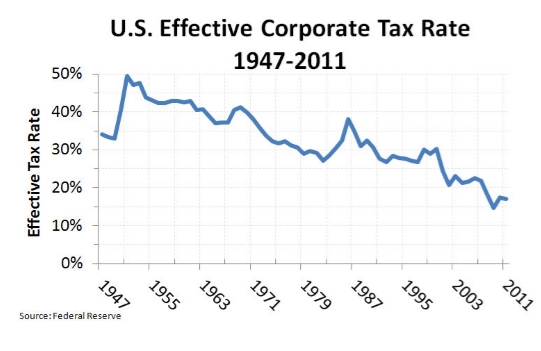

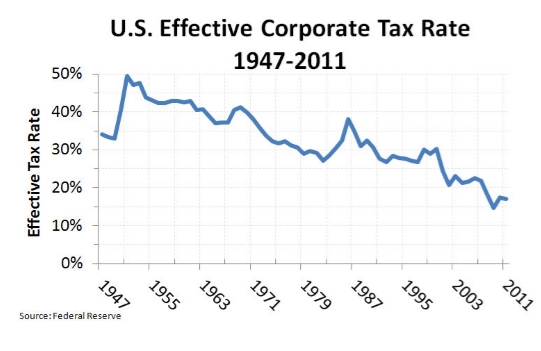

E. Competitive Neutrality Adjustment

- Adjustments made to PSC costs for tax liabilities and other

P3 costs to ensure apples-to-apples comparison

- Adjustments can include:

- Federal corporate tax to be received under P3

- State corporate tax to be received under P3

- Self-insurance cost (tort liability limits under public

operation favor public sector)

Perspective on Competitive Neutrality

| Perspective |

Competitive Neutrality Adjustment |

| Agency |

Ignore taxes from P3 that it does not receive? |

| State |

Ignore taxes paid to Federal government? |

| National |

Include subsidy cost for Federal loans and taxes paid to

Federal government? |

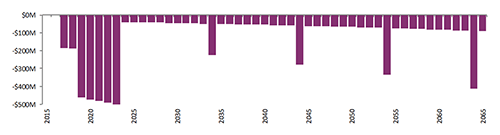

Timing and Escalation of Costs

- When discounting, timing of construction and operational expenses

is important due to the time value of money

- Cost must also be adjusted for inflation

View full-size

Timing and Escalation of Costs chart

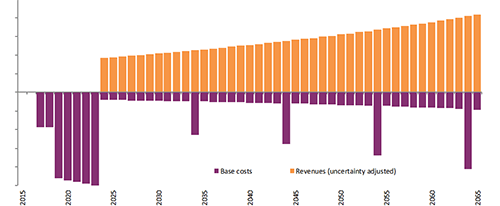

Add Toll Revenues

- If the road is tolled, toll revenues must be added to the PSC

cash flows

- Toll revenues should be adjusted for uncertainty (to be discussed

in webinar on risk)

View full-size

Toll Revenues chart

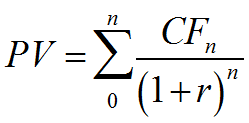

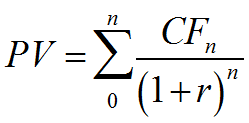

Discounting of Cash Flows

- Discounting converts future cost and revenue cash flows to "present

value" terms

- Discount rate reflects the time value of money

Where PV = Present Value

CFn = Cash Flow in year n

r = discount

rate

n = year

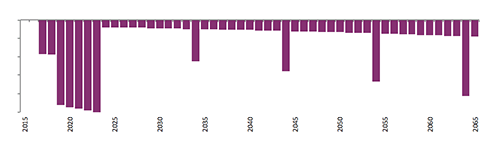

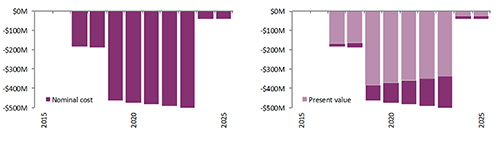

Effects of Discounting

- Cash flows later in a concession period will have a relatively

lower impact than earlier cash flows

View full-size

Effects of Discounting chart

Effect of Discount Rate

- Net present value is sum of all discounted cash flows

- A higher discount rate leads to a lower present value

View full-size

Effect of Discount Rate chart

Test Your Knowledge

Multiple answer

Which of the following are components of a PSC cost estimate in P3-VALUE

2.0:

- Construction costs

- O&M costs

- Financing fees

- Interest and principal payments

Questions?

Submit a question using the chat box

Part 3: Develop P3 Option and Compare to Public Sector

Comparator

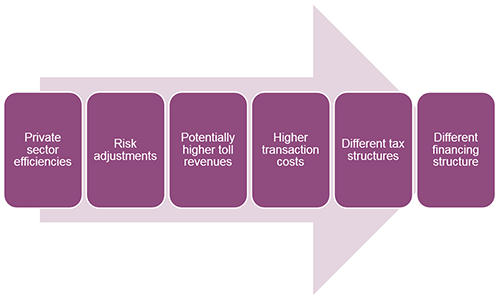

Process to Develop a P3 Option

View full-size

Process to Develop a P3 Option chart

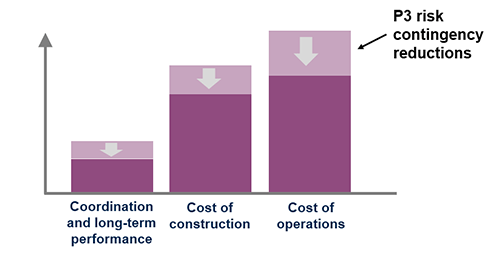

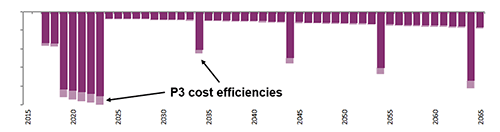

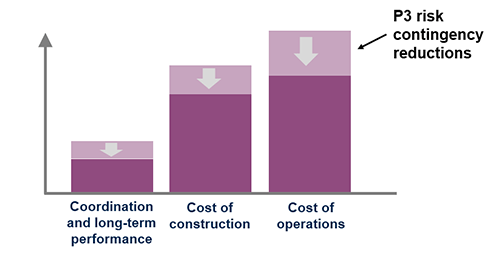

1. Private Sector Efficiencies

- Timing: Delayed start and/or accelerated construction

- Complex P3 contracting may delay project start

- P3 concessionaire may be financially incentivized to shorten

construction period

- Costs: Lifecycle costing may reduce overall

construction, operation and maintenance costs

View full-size

Private Sector Efficiencies chart

2. Costs of Transferred Risks

- Transferred risks include risks pushed down to subcontractors

- Efficient P3 risk management may reduce overall risk valuation

and contingencies

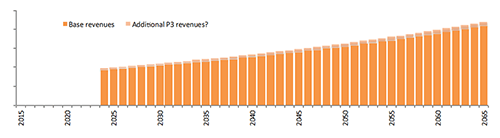

3. Possible Higher Toll Revenues

- P3 may lead to innovations such as improved access which could

have an impact on toll revenues

- P3s may carry out a more aggressive marketing campaign, resulting

in a faster ramp-up of traffic

View full-size

Higher Toll Revenues chart

4. Higher Transaction Costs

Public transaction costs:

- Develop a complex tailored P3 contract

- Oversight and monitoring of P3 concessionaire

Private transaction costs:

- Prepare bid and obtain financing

- Lengthy preparation process

- Oversight and monitoring

5. Different Tax Structure

- Concessionaire takes on additional (federal and state) tax liabilities

that would not exist under conventional delivery

- Subcontractors are subject to taxation as well, but this may

be the same as under conventional delivery

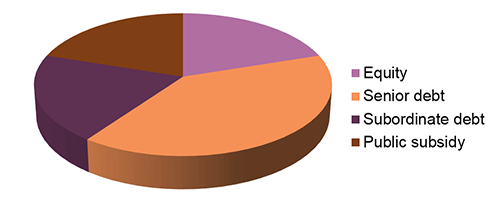

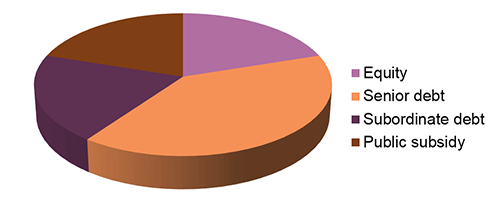

6. Different Financing Structure

P3 typically uses a combination of equity, debt and public subsidy

Estimating P3 Contract Payments

A P3 bidder will determine its desired P3 contract payments (the

"Bid") based on:

- Base lifecycle costs

- Valuation of transferred risks

- Available subsidies and financing costs

P3-VALUE 2.0 iteratively determines the required up-front subsidy

or concession fee (for toll concessions) or availability payment (for

AP concessions) to satisfy the debt terms and required equity return

- To be covered in Financial Viability Assessment webinar

Public Agency Costs under P3

Under P3, the public Agency will incur the following costs:

- Payments to P3 concessionaire

- Retained costs

- Value of retained risks

- Other costs

Compare PSC with P3

View full-size

comparison chart

Test Your Knowledge

Multiple answer

In an Availability Payment concession, which of the following are

included in the calculation of the public agency's payments to the

P3 concessionaire:

- Estimated base lifecycle costs of the concessionaire

- Costs of risks transferred to the concessionaire

- Toll revenues

Questions

Submit a question using the chat box

Part 4: Value for Money Analysis in P3-VALUE 2.0

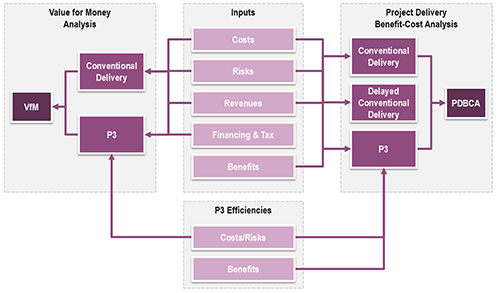

FHWA's P3-VALUE 2.0

View full-size

P3-VALUE 2.0 chart

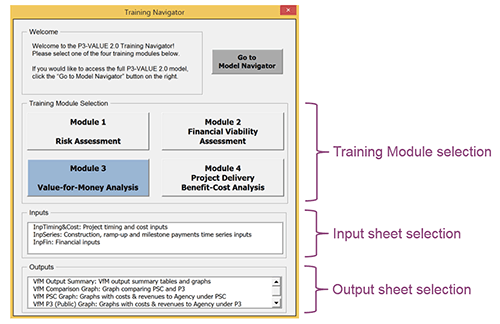

Training Modules

Training Navigator User Interface

View full-size

User Interface graphic

Demonstration of VfM Module

Please stand by as we open the Excel file

Tool and References

Webinar Summary

Webinar Recap

Part 1 Introduction

Part 2 Develop Public Sector Comparator

Part 3 Develop P3 Option and Compare to Public Sector Comparator

Part 4 Value for Money Analysis in P3-VALUE 2.0

Upcoming P3-VALUE Training

- Homework review - Tuesday, February 16, at 2:00pm

- February 22 Project Delivery Benefit Cost Analysis

- March 7 Risk Valuation

- March 21 Financial Viability Assessment

To access the Homework Review webinar, please use the following link

and telephone number:

Resources

FHWA's Center for Innovative Finance Support Website:

https://www.fhwa.dot.gov/ipd/

P3 Website:

https://www.fhwa.dot.gov/ipd/p3/

Questions?

Submit a question using the chat box