Instructors

Patrick DeCorla-Souza

P3 Program Manager

Center for Innovative Finance Support

Marcel Ham

Vice President

IMG Rebel

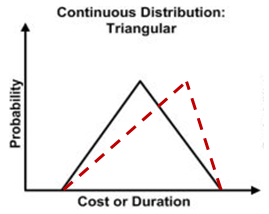

P3-VALUE 2.0 Webinars

- P3: Public Private Partnership

- P3-VALUE 2.0: Analytical tool to help practitioners

understand processes used to quantitatively evaluate P3 options

- This is one of a series of webinars on P3-VALUE

- P3 Evaluation Overview (January 25, 2016)

- Value for Money Analysis (February 8, 2016)

- Value for Money Exercise (Feb. 16, 2016)

- Project Delivery Benefit-Cost Analysis (Feb. 22)

- Project Delivery BCA Exercise (Feb. 29, 2016)

- Risk Valuation (today)

- Financial Viability Assessment

Webinar Outline

Part 1 - Categorizing Risk

Part 2 - Risk Management Process

Part 3 - Pure Risk Assessment

Part 4 - Lifecycle Performance and Revenue Uncertainty

Risk Assessment

Part 5 - Risk Allocation

Part 6 - Using P3-VALUE 2.0 for Risk Assessment

Summary

Webinar Objectives

After taking this course you should be able to:

- Categorize P3 risks

- List the steps in the risk management process

- Explain the methods for quantifying and monetizing various type

of risks

- Describe the risk allocation process

- Use P3-VALUE 2.0 to perform risk assessment

Part 1 - Categorizing P3 Risks

Purpose of Risk Assessment

- To calculate value of risks

- To design draft agreement for RFP

- To assist in negotiation with bidders

- To develop risk management plans

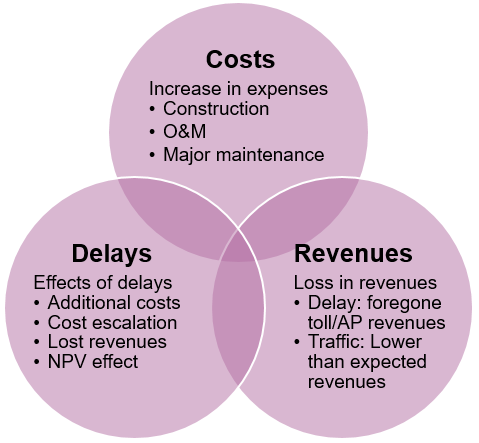

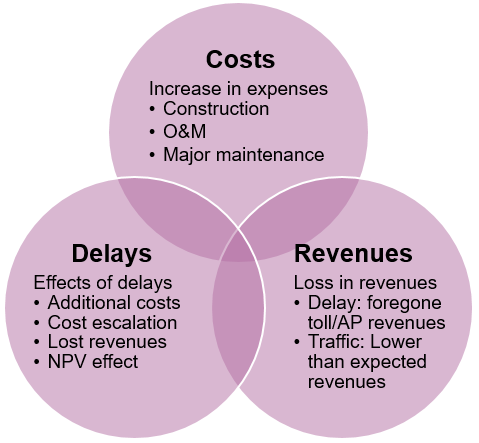

Financial Impacts of Project Risks

Costs

- Increase in expenses

- Construction

- O&M

- Major maintenance

Delays

- Effects of delays

- Additional costs

- Cost escalation

- Lost revenues

- NPV effect

Revenues

- Loss in revenues

- Delay: foregone toll/AP revenues

- Traffic: Lower than expected revenues

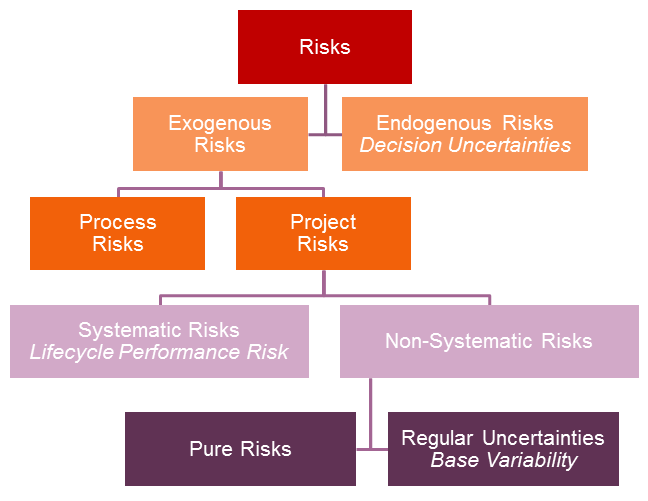

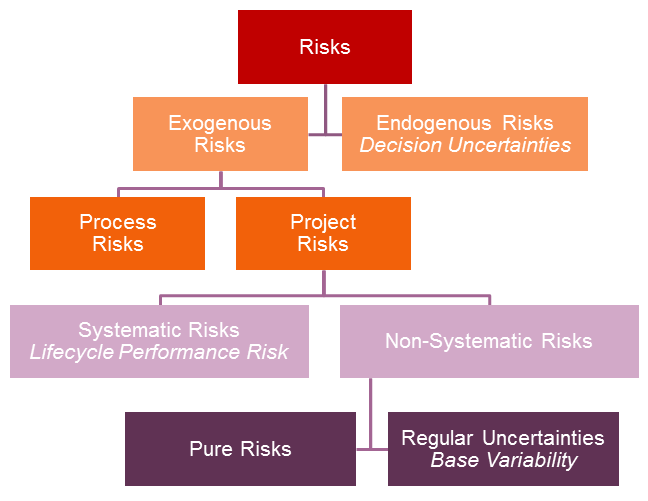

Categories of Risk

View

larger version of the Categories of Risk flow chart

P3-VALUE 2.0 Project Risk Categories

- Base Variability

Example: Uncertainty in volume of asphalt

- Pure Risks

Example: Accident at construction site, causing cost

overrun and/or delays

- Lifecycle Performance Risks & Revenue Uncertainty

Example: Conflicts between DB and O&M contractors,

supervening events exceeding liability caps, inflation, T&R

risk (for toll concessions)

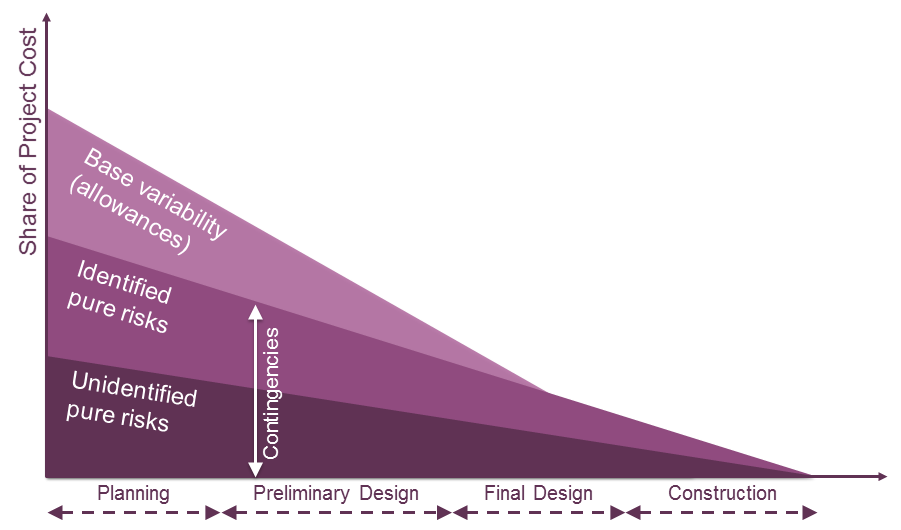

Valuing Base Variability

- Typically a percentage of costs (+ or - variation)

- May differ by project phase

- Reflects the uncertainty in cost estimates - will reduce as

the design level becomes more detailed

- P3-VALUE 2.0 uses a factor (percentage of base cost) to estimate

cost impact

- Example:

- Base variability: 20% of construction cost

- Construction cost: $200M

- Value of base variability: 20% X $200M = $40M

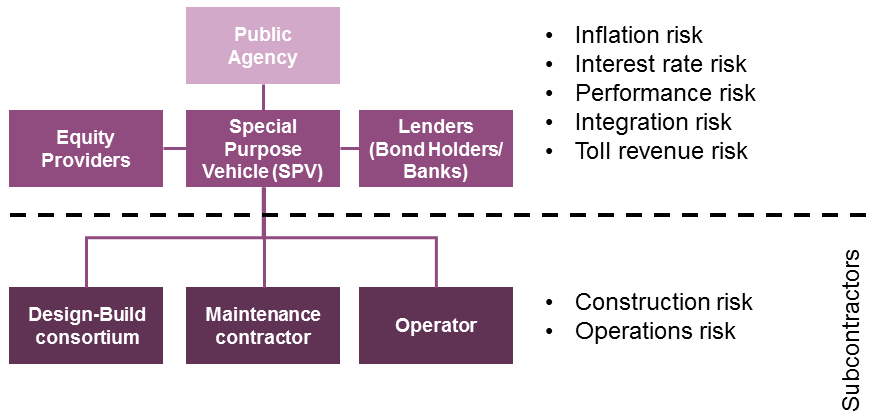

Who Bears Project Risks in a P3?

Includes both systematic and some non-systematic risks

View

larger version of the Project Risks chart

Risk through Project Completion

View

larger version of the Risk through Project Completion chart

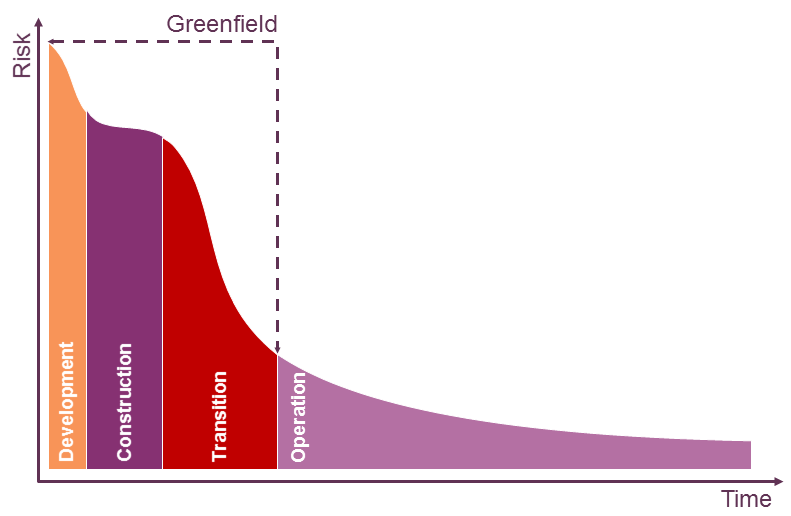

Risk over Project Life

View

larger version of the Risk over Project Life chart

Audience Feedback

True or False

- All project risks are pushed down to subcontractors of the concessionaire.

Questions?

Submit a question using the chat box

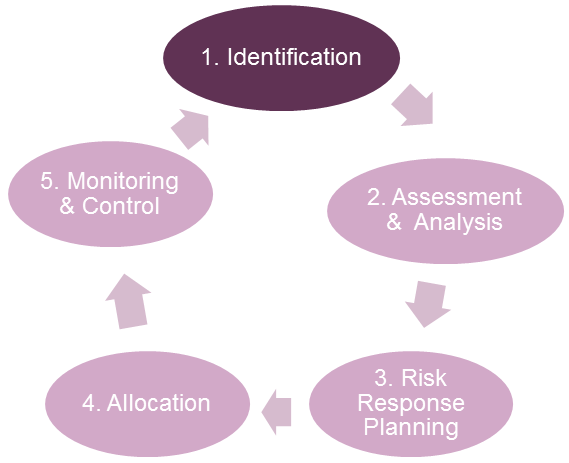

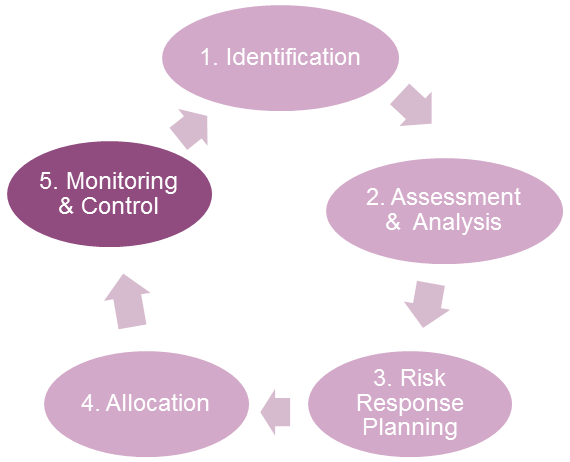

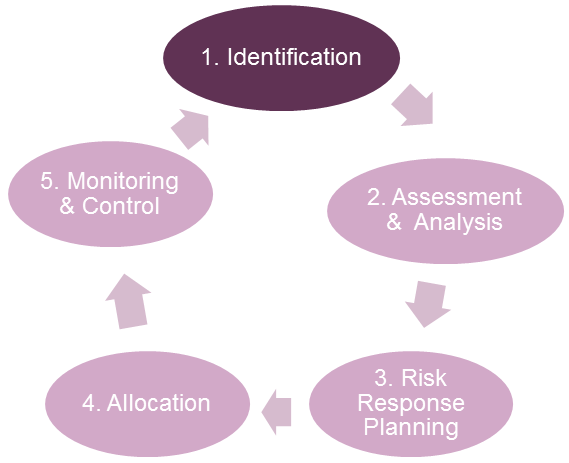

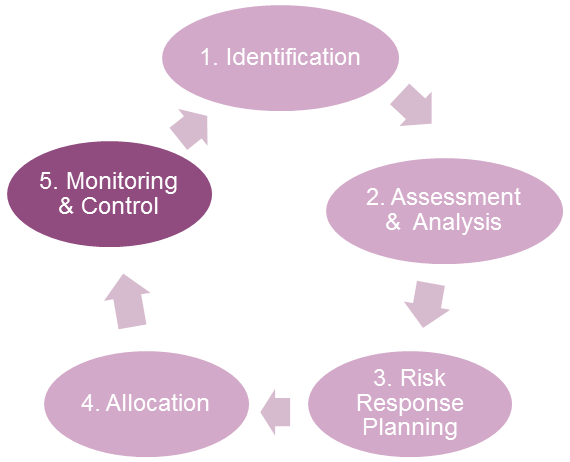

Part 2 - Risk Management Process

1. Risk Identification

Risks:

Risk Workshops

- Who?

- Facilitator

- Subject matter experts

- What tools are used?

- Risk checklist

- Risk register

2. Risk Assessment

- Probability

- Potential consequences

- Cost

- Schedule

- Scope/Quality

- Revenue

- Value

3. Risk Response Planning

Risk Response Strategies

- Avoid

- Mitigate

- Transfer/Share

- Accept

4. Risk Allocation

5. Risk Monitoring & Control

- Performance metrics to monitor risk

- Understand P3 risk management provisions

- Avoid taking back transferred risks

- Validate previous risk identification, risk assessment, and

risk response planning

Audience Feedback

True or False

- The probability and potential consequences of a specific risk

must be quantified in order to estimate its cost impact

Questions?

Submit a question using the chat box

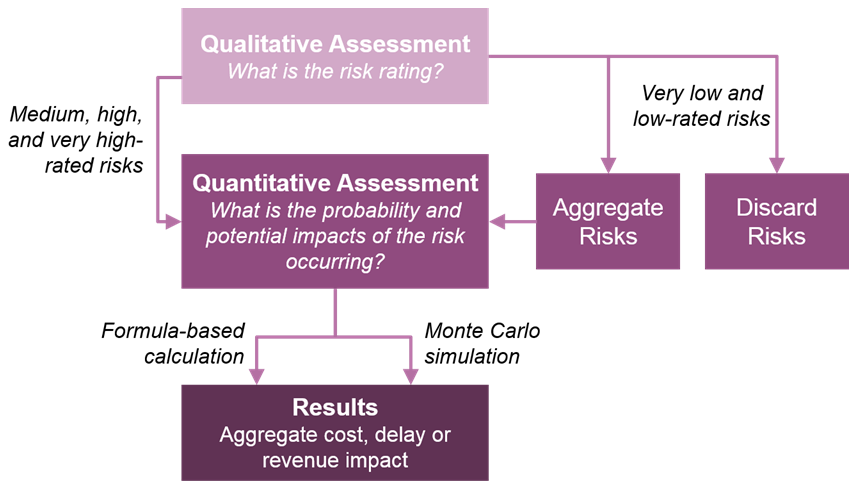

Part 3 - Pure Risk Assessment

View

larger version of the Risk Assessment flow chart

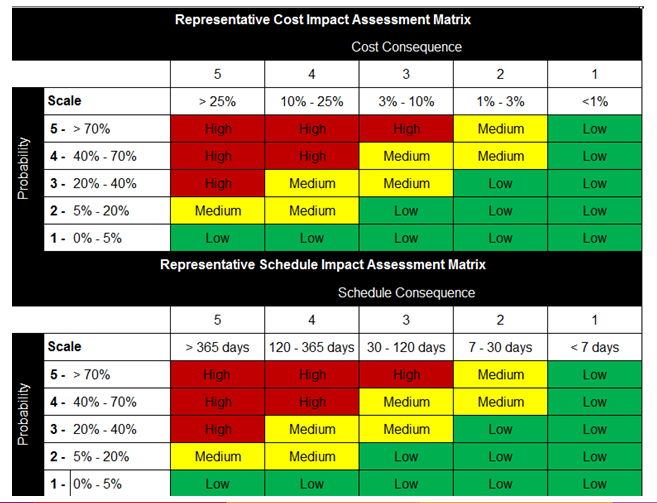

Qualitative Assessment

- Probability of risk occurrence

- Very low

- Low

- Medium

- High

- Very high

- Scale of impact if risk occurs

- Very low

- Low

- Medium

- High

- Very high

Qualitative Assessment Matrix

Example

View

larger version of the example Assessment Matrix table

Quantitative Assessment

- Probability of risk occurrence

- % probability (0% - 100%)

- Scale of impact if risk occurs

- Dollar amount or number of days of delay

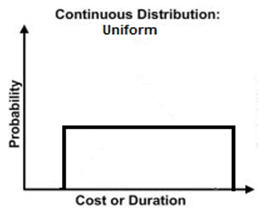

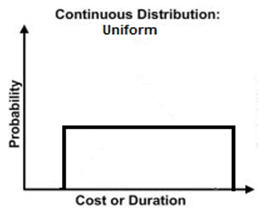

Valuing Pure Risks (Formula-Based)

- Risk Value = Probability X Impact (distribution)

- Example for uniform probabilistic impact distribution:

- Probability of occurrence: 10%

- Minimum impact: $2M

- Maximum impact: $4M

- Value = 10% x ½ x ($2M + $4M) = $0.3M

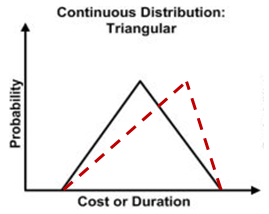

Valuing Pure Risks (Formula-Based)

- Risk Value = Probability X Impact (distribution)

- Example for triangular impact distribution:

- Probability of occurrence: 10%

- Minimum impact: $2M

- Maximum impact: $4M

- Most likely impact = $3.5

- Value = 10% x ($2M + 3.5 + $4M)/3 = $0.32M

Aggregate of Pure Risks

- Central limit theorem can be used if pure risks are independent:

- Distribution of the sum of a sufficiently large number of

independent random variables is approximately normal

- To apply central limit theory, variance and mean value of each

individual risk must be calculated and added

Central Limit Theorem Applied

Example using uniform risk distributions (P3-VALUE 2.0)

| Risk Item |

Probability A |

Most likely Impact B |

Most likely value C = A x B |

Minimum value D |

Maximum

value E |

Shape |

| Risk 1 |

20% |

$10,000k |

$2,000k |

-20% |

+50% |

Uniform |

| Risk 2 |

25% |

$4,000k |

$1,000k |

-20% |

+50% |

Uniform |

| Risk 3 |

50% |

$4,000k |

$2,000k |

-20% |

+50% |

Uniform |

| Risk Item |

Minimum value F = C - D% |

Maximum value G = C + E% |

Mean value* H = ½ x (F + G) |

Variance*

I = (G - F) 2 / 12 |

| Risk 1 |

$1,600k |

$3,000k |

$2,300k |

$163,333k |

| Risk 2 |

$800k |

$1,500k |

$1,150k |

$40,833k |

| Risk 3 |

$1,600k |

$3,000k |

$2,300k |

$163,333k |

| Total |

$4,000k |

$7,500k |

$5,750k |

$376,500k |

- Mean value: $5,750k, standard deviation of $606k

- Using Excel NORMINV function, P70 risk value: $6,068k

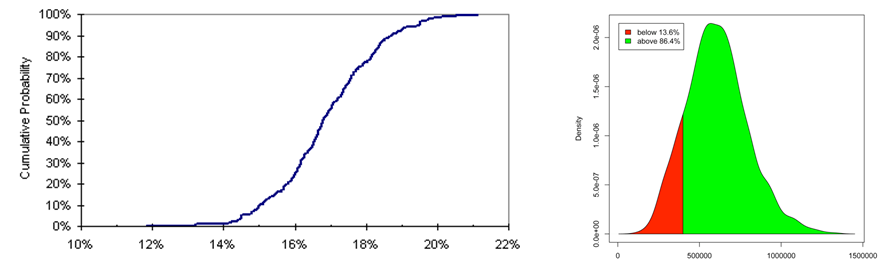

Valuing Pure Risks (Monte Carlo)

Monte Carlo simulation

- Simulation of large number of scenarios based on probabilities

of risk occurrence and probability distribution of magnitude of

impact

- Result is a probability distribution of aggregate risk value

- Provides estimates at confidence levels

View

larger version of the Monte Carlo simulation charts

Audience Feedback

True or False

- The aggregate impact of pure risks on costs may be estimated

either by using a formula-based method or by using Monte Carlo simulation.

Questions?

Submit a question using the chat box

Part 4 - Assessment of Lifecycle Performance Risk and

Revenue Uncertainty Adjustment

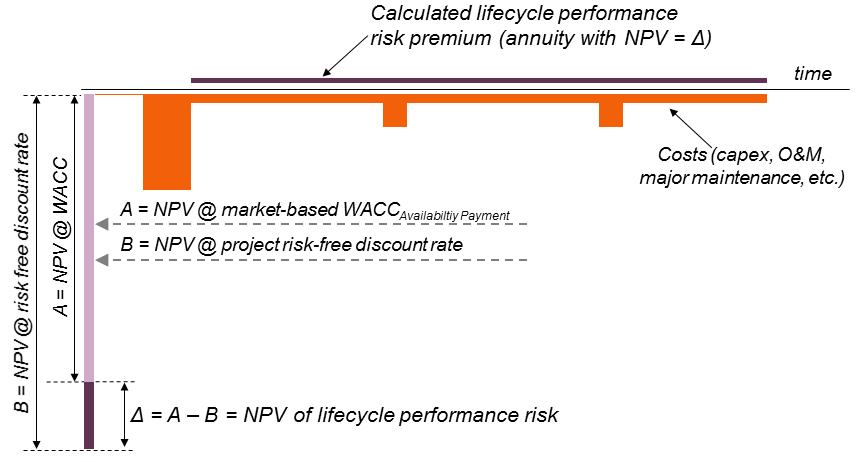

Valuing Lifecycle Performance Risks

Ways to value lifecycle performance risk

- Use information available to Agency on lifecycle performance

risk costs/cash flows

- Use market-based P3 financing conditions as a proxy to determine

the value of lifecycle performance risk

Market-based valuation:

- Calculate NPV of cost cash flows*, excluding financing:

- Using a market-based weighted average cost of capital (WACC)

that excludes revenue risk (Availability Payment WACC)

- Using project risk-free discount rate

- Calculate difference in NPVs (Δ = A - B )

* Use PSC cash flows for PSC lifecycle performance risk, and

P3 cash flows for P3 lifecycle performance risk (used only in PDBCA

and risk outputs)

Lifecycle Performance Risk Valuation

View

larger version of the Lifecycle Performance Risk Valuation chart

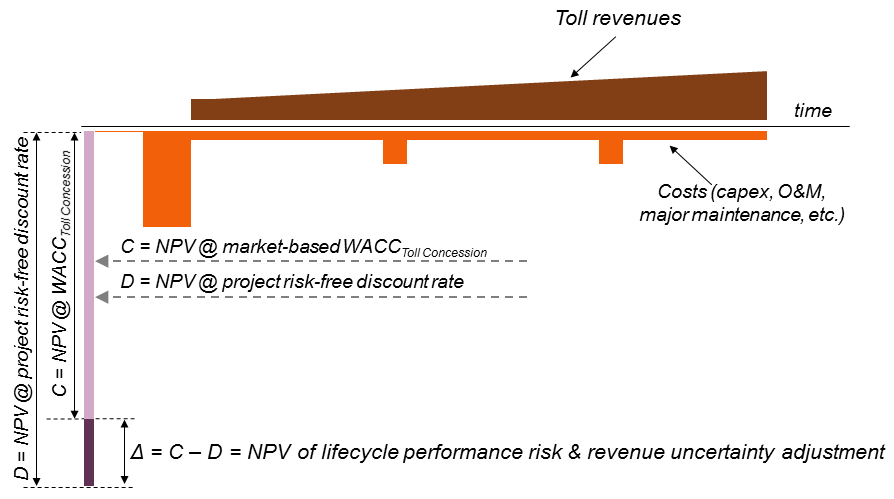

Valuing Revenue Uncertainty

Ways to value revenue uncertainty

- Apply percentage haircut to P50 traffic/revenues

- Use market-based P3 financing conditions as a proxy to determine

the value of revenue uncertainty

Market-based valuation:

- Calculate NPV of revenue and cost cash flows, excluding financing:

- Using a market-based weighted average cost of capital (WACC)

that includes revenue risk

- Using project risk-free discount rate

- Calculate difference in NPVs (Δ = C - D), which equals

the lifecycle performance risk and revenue uncertainty adjustment

combined

- NPV of revenue risk is the difference between this Δ and

the lifecycle performance risk calculated previously

Revenue Uncertainty Adjustment

View

larger version of the Revenue Uncertainty Adjustment chart

Accounting for Risk in P3-VALUE 2.0

| Risk Type |

VfM PSC |

VfM P3 |

PDBCA PSC |

PDBCA P3 |

| Base variability |

✔ |

✔ |

✔ |

✔ |

| Pure risk |

✔ |

✔ |

✔ |

✔ |

| Lifecycle performance risk |

✔ |

|

✔ |

✔ |

| Revenue risk |

✔ |

|

|

|

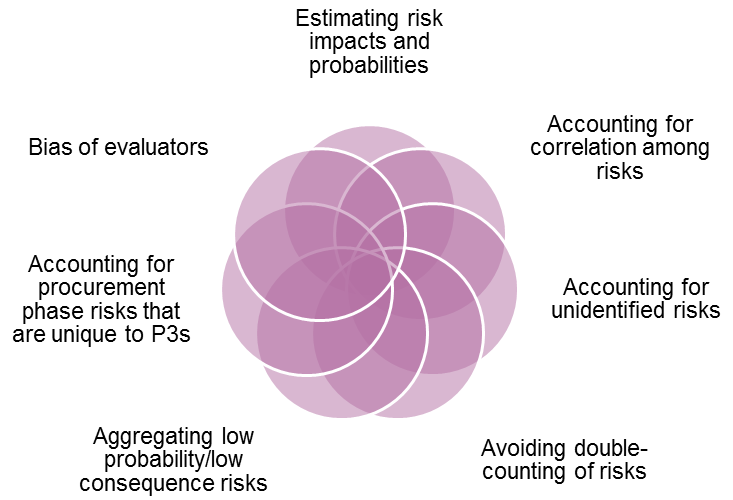

Risk Analysis Challenges

View

larger version of the Venn Diagram of Risk Analysis Challenges

- Estimating risk impacts and probabilities

- Bias of evaluators

- Accounting for procurement phase risks that are unique to P3s

- Accounting for correlation among risks

- Accounting for unidentified risks

- Aggregating low probability/low consequence risks

- Avoiding double-counting of risks

Test Your Knowledge

True or False

- The WACC for a toll concession includes a risk premium that

accounts for revenue risk as well as for lifecycle performance risks

Questions?

Submit a question using the chat box

Part 5 - Risk Allocation

Risk Transfer by Delivery Type

| Procurement Type |

Design Risk |

Construction Risk |

Financial Risk |

O&M Risk |

T&R Risk |

| Design-Build (DB) |

✔ |

✔ |

|

|

|

| Design-Build-Finance (DBF) |

✔ |

✔ |

✔ |

|

|

| Design-Build-Finance-Operate-Maintain (DBFOM) with Availability

Payment |

✔ |

✔ |

✔ |

✔ |

|

| Design-Build-Finance-Operate-Maintain (DBFOM) with Toll

Concession |

✔ |

✔ |

✔ |

✔ |

✔ |

Typical DBFOM Risk Allocation

| Risk |

Design-Bid-Build |

Availability Payment DBFOM |

Toll Concession DBFOM |

| Design errors |

Public |

Contractor |

Contractor |

| Change in scope |

Public |

Public |

Public |

| Delay in permits |

Public |

Shared |

Shared |

| Delay in right-of-way acquisition |

Public |

Public |

Public |

| Construction cost overruns |

Contractor |

Contractor |

Contractor |

| Construction risks |

Contractor |

Contractor |

Contractor |

| Archeological findings |

Public |

Public |

Public |

| Delay in relocation of cables & pipes |

Public |

Contractor |

Contractor |

| Unknown ground conditions |

Public |

Contractor |

Contractor |

| Hazardous materials |

Public |

Shared |

Shared |

| Security |

Public |

Contractor |

Contractor |

| Major maintenance cost overruns |

Public |

Contractor |

Contractor |

| Snow & ice removal cost overruns |

Public |

Contractor |

Contractor |

| Regular maintenance |

Public |

Contractor |

Contractor |

| Traffic information systems |

Public |

Public |

Public |

| Incident management |

Public |

Contractor |

Contractor |

| Toll revenue risk |

Public |

Public |

Contractor |

| Financing risks |

Public |

Contractor |

Contractor |

| Force majeure |

Public |

Shared |

Shared |

Risk Allocation Steps

| Step 1: Likelihood |

Which party is best able to control the likelihood

of the risk occurring? |

| Step 2: Impact |

Which party is best able to control the impact

of the risk? |

| Step 3: Lowest Cost |

Which party is best able to absorb the risk

at lowest cost if the likelihood and impact cannot be controlled?

|

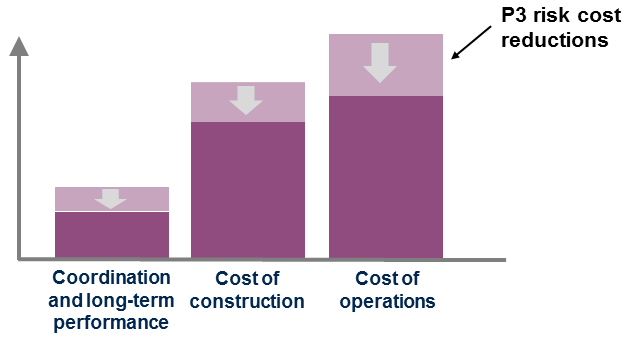

Transferred Risks

- Transferred risks include risks pushed down to subcontractors

- Efficient P3 risk management may reduce overall risk valuation

and contingencies

View

larger version of the Transferred Risks chart

Example Tunnel Project

| Risk Category |

Risk Allocation |

| Public |

Private |

Shared |

| Political |

✔ |

|

|

| Financial |

|

✔ |

|

| Traffic and Revenue |

✔ |

|

|

| Right of Way |

✔ |

|

|

| Planning and Permitting |

|

|

✔ |

| Utilities |

|

|

✔ |

| Procurement |

✔ |

|

|

| Construction |

|

✔ |

|

| Operations and Maintenance |

|

✔ |

|

| Handback |

|

✔ |

|

| Force Majeure |

|

|

✔ |

| Change in Law |

✔ |

|

|

| Geotechnical |

|

|

✔ |

Test Your Knowledge

True or False

- The public agency's goal in risk allocation should be to transfer

all risks to the private partner in a P3.

Questions?

Submit a question using the chat box

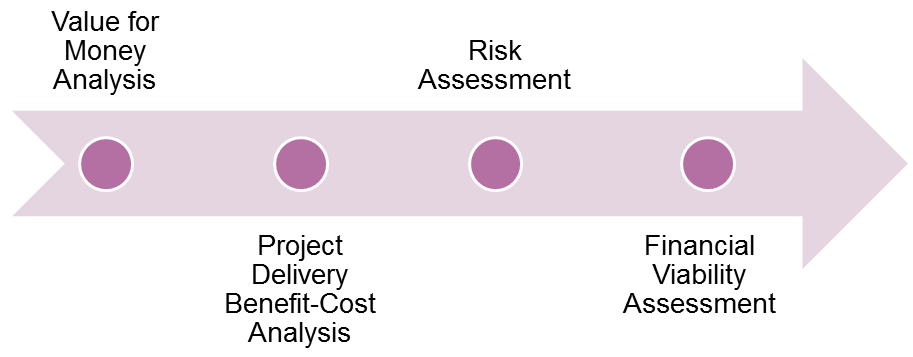

Part 6 - Using P3-VALUE 2.0 for Risk Assessment

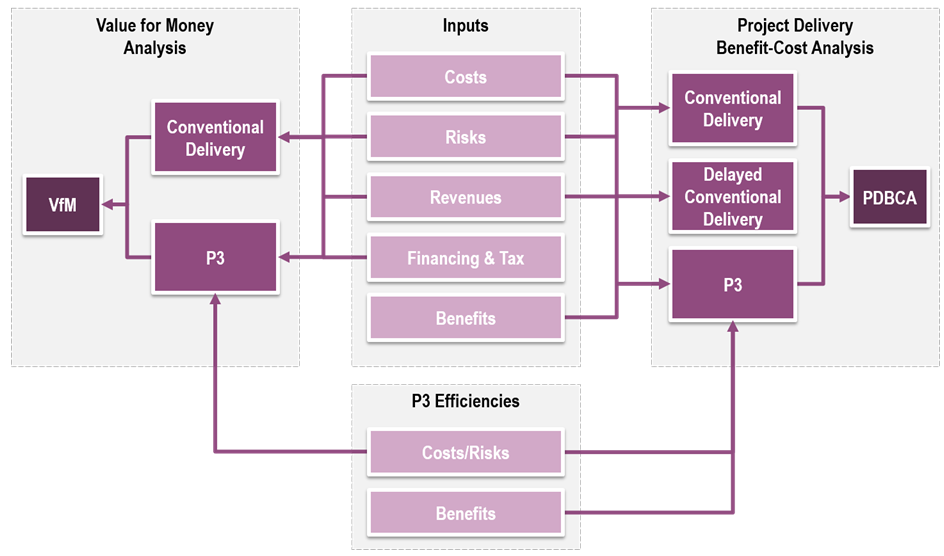

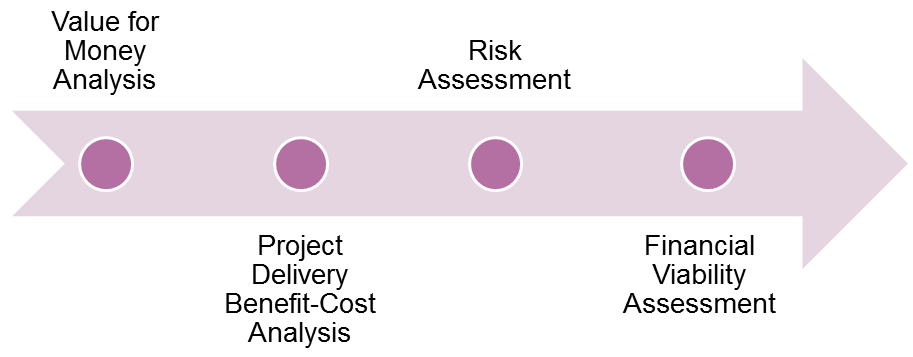

FHWA's P3-VALUE 2.0

View

larger version of the P3-VALUE 2.0 process chart

Training Modules

- Value for Money Analysis

- Project Delivery Benefit-Cost Analysis

- Risk Assessment

- Financial Viability Assessment

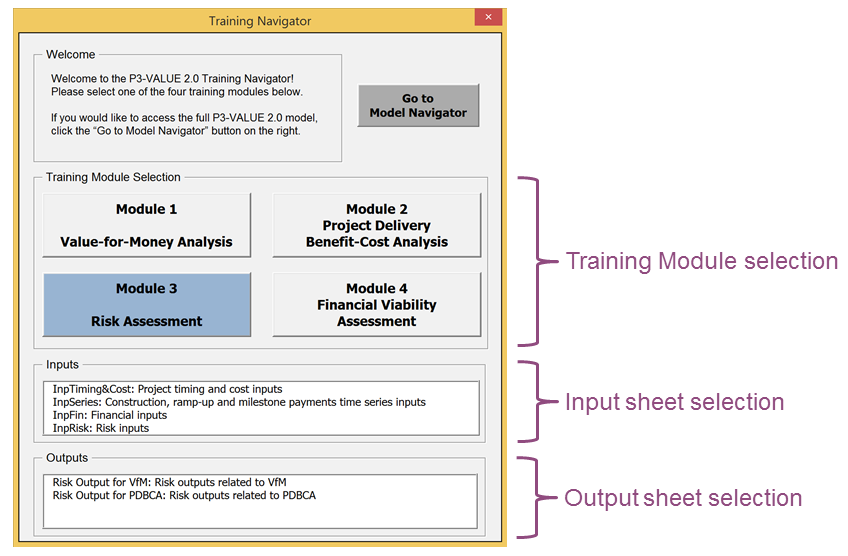

Training

Navigator User Interface

Training

Navigator User Interface

View

larger version of the User Interface screen

Demonstration of Risk Module

Please stand by as we open the Excel file

Questions?

Submit a question using the chat box

Webinar Summary

Webinar Recap

Part 1 - Categorizing Risk

Part 2 - Risk Management Process

Part 3 - Pure Risk Assessment

Part 4 - Lifecycle Performance and Revenue Uncertainty Risk Assessment

Part 5 - Risk Allocation

Part 6 - Using P3-VALUE 2.0 for Risk Assessment

Tools and References

Upcoming P3-VALUE Training

Exercise review - March 14 at 12:30pm EST

- March 21 Financial Viability Assessment

- Exercise instructions may be downloaded from the web room

- Technical assistance options:

- To access the Exercise Review webinar,

please use the following link and telephone number:

- Link:

https://connectdot.connectsolutions.com/p3

- Telephone: 1-888-363-4749, Passcode:

6139168#

Resources

FHWA's Center for Innovative Finance Support Website:

https://www.fhwa.dot.gov/ipd/

P3 Website:

https://www.fhwa.dot.gov/ipd/p3/

Questions?

Submit a question using the chat box

Contact Information

Patrick DeCorla-Souza

P3 Program Manager

Center for Innovative Finance Support

Federal Highway Administration (202) 366-4076

Patrick.DeCorla-Souza@dot.gov

Training

Navigator User Interface

Training

Navigator User Interface