Presentation

Presenter

Sasha Page

P3 Program Manager

IMG Rebel

Overview

- Purpose of Discussion Paper

- Analytical Framework and Research Approach

- Revenue Risk Sharing Mechanisms for U.S.

Purpose of Discussion Paper

- Evaluate and categorize existing revenue risk sharing mechanisms

worldwide and in U.S.

- Address how mechanisms could work in U.S.

- Address how mechanisms could work better given:

- Need to create value for money (VfM)

- Fiscal impacts

- Financing constraints (financeability)

- Ease of implementation

- Provide guidance on selection of mechanisms

Context: Financial distress in multiple U.S. toll roads over the

past decade

View

larger version of newspaper page

- Dulles Greenway, VA

- South Bay Expressway, CA

- I-495 Capital Beltway, VA

- Pocahontas Parkway, Richmond, VA

- Indiana Toll Road, IN

- SH-130, TX

- San Joaquin Hills Transportation Corridor Agency 73 toll road,

CA

- LA 1 Expressway, LA

Most promising revenue risk mechanisms for U.S. highways

- Present Value of Revenues (PVR)

- Minimum Revenue Guarantee (MRG)

- Contingent Finance Support (CFS)

- Availability Payment (AP) & Revenue Sharing

- Innovative Finance Programs (IFP)

Analytical Framework and Research Approach

Developer perspectives on revenue risk: Lenders' and Developer/equity

investors' concerns

- Lenders receive only interest (no upside) and therefore tend

to be more conservative than Developers

- Developers/equity investors bear full upside/downside revenue

risk of volatile dividend payments:

- Therefore, Developers expect commensurate return

- However, Developers/equity investors have following priorities

(1= highest), which may explain views on revenue risk

- Obtain debt financing

- Win bid and successfully operate concession

- Earn cash flows to obtain or exceed expected equity

return

Public Agency perspectives on revenue risk: Value for money vs.

access to private capital

- Value for money (VfM):

- Optimal risk allocation: risk to be transferred to party

best positioned to manage risk at lowest costs

- Revenue risk inherently difficult to manage for both parties

- Public agency possibly somewhat better positioned to accept

revenue risk as it has (some) control over regional development

- If revenue risk is transferred, Developer will either price

risk (possibly inefficient risk pricing) or may decide not to

bid

- Retaining revenue risk may therefore create VfM

- Access to private capital (financeability and fiscal impact):

- P3 can accelerate projects through access to private capital

- Fiscal perspective, based on non-recourse off-balance sheet

benefits of P3s, may encourage Agencies to transfer revenue

risk

Discussion Paper employs four criteria to evaluate revenue risk

sharing mechanisms

- Value for money: How does proposed revenue

risk sharing mechanism affect VfM? Does it follow optimal risk allocation?

- Fiscal impacts: What are fiscal impacts of

proposed revenue risk sharing mechanism? Does it allow for off-

balance sheet financing? Direct or contingent liabilities?

- Financeability: How does proposed mechanism

affect Developer's ability to finance project? Does it help attract

private capital and/or reduce cost of capital?

- Ease of implementation: How difficult is it

to monitor proposed revenue risk sharing mechanism? Potential for

unintended bidding behavior? Ease of comparison of bids in procurement

stage?

Questions?

Submit a question using the chat box

Present Value of Revenues

Present Value of Revenues (PVR): Protects Developer but requires

flexible Lenders

Toll concession ends when present value of realized revenues to Developer

equals bid PVR. End date of concession is flexible, potentially with

cap on maximum concession length.

- VfM: Developer is protected against downside

revenue scenarios, so inefficient risk pricing is unlikely

- Fiscal: No immediate impact on Agency, but

contract extension means Agency will start receiving revenues later.

- Financeability: Lenders are protected, but

Lenders need to be flexible as repayment is made

- Implementation: Gross revenues are easily monitored;

key issue is correct weighted average cost of capital (WACC) in

PVR bid and performance penalties to incentivize Developer.

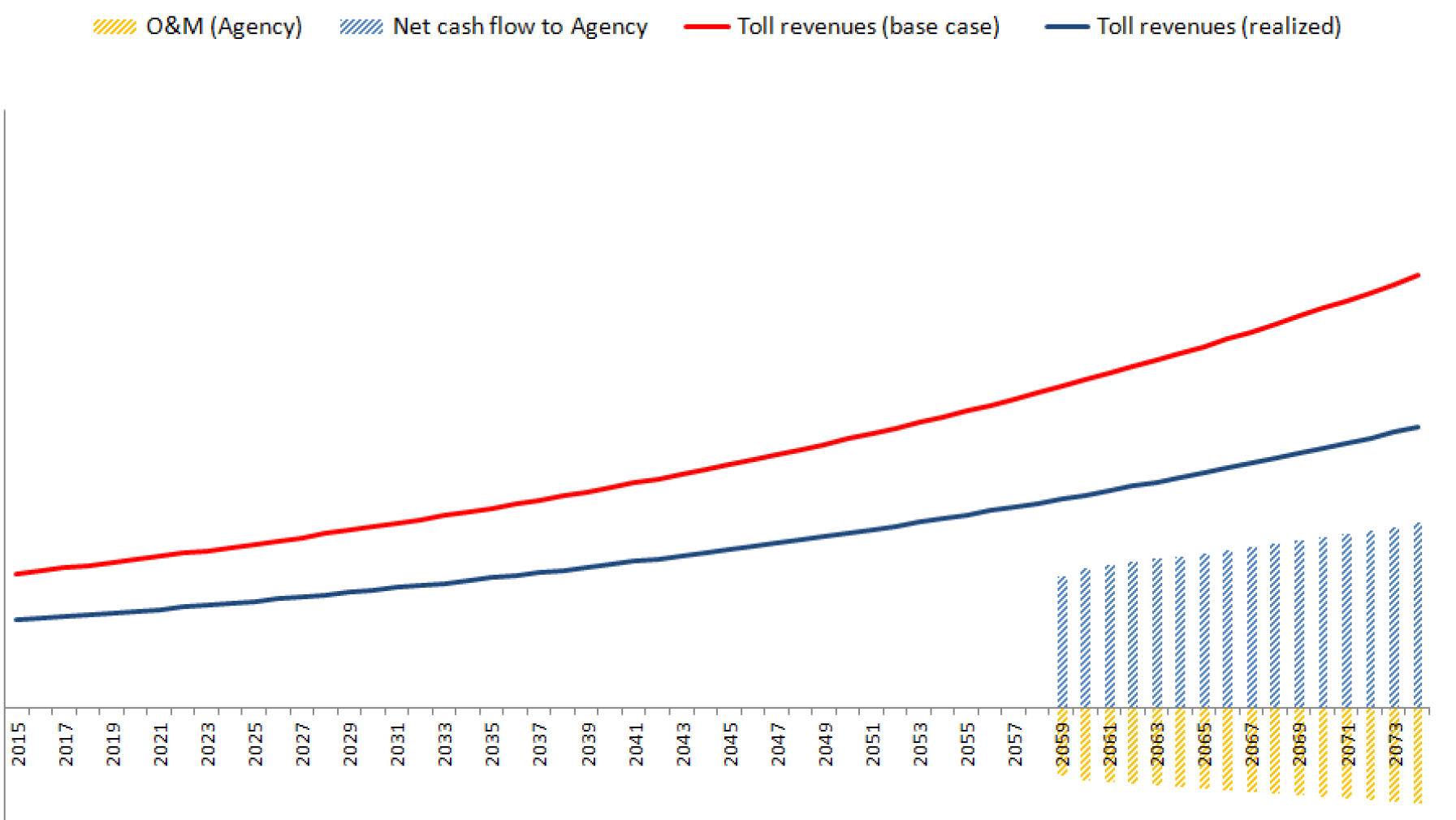

PVR: Base revenues case

Developer & Agency perspective

View

larger version of chart

PVR: Extreme downside revenues case

Developer perspective

View

larger version of chart

PVR: Extreme downside revenues case

Agency perspective

View

larger version of chart

Minimum Revenue Guarantee

Minimum Revenue Guarantee (MRG): Facilitates financing but creates

larger contingent liabilities

Agency sets minimum revenue line and pays shortfall to Developer

when realized revenues fall below guaranteed line. From reciprocity

perspective, protect not only downside, but also share in upside (revenue

sharing bands). Agencies not in position to accept significant fiscal

liabilities, combination of PVR and lower MRG could be an option.

- VfM: Developer protected so inefficient pricing

unlikely

- Fiscal: Relatively large MRG could be defensible,

yet creates immediate contingent fiscal liabilities

- Financeability: Creates certainty for Lenders

- Implementation: Very effective and transparent

mechanism that is relatively easy to implement; key challenges are

revenue guarantee level and valuation of contingent liability

MRG: Raises issues of direct vs. contingent liabilities or certain

vs. uncertain costs to Agency

- Example of direct liability: upfront subsidy to Developer (Agency will incur cost regardless of traffic)

- Example of contingent liability: Minimum Revenue Guarantee to

Developer (Agency may incur cost, depending

on realized traffic/revenue)

- Contingent liabilities can help share revenue risk between Developers

and Agencies:

- Contingent liability can cause significant fiscal burden

if traffic/revenues are lower than expected

- Uncertainty in contingent liabilities makes valuation or

fair comparison with direct liabilities difficult ($100M upfront

subsidy vs. 20 year MRG of $15M per year)

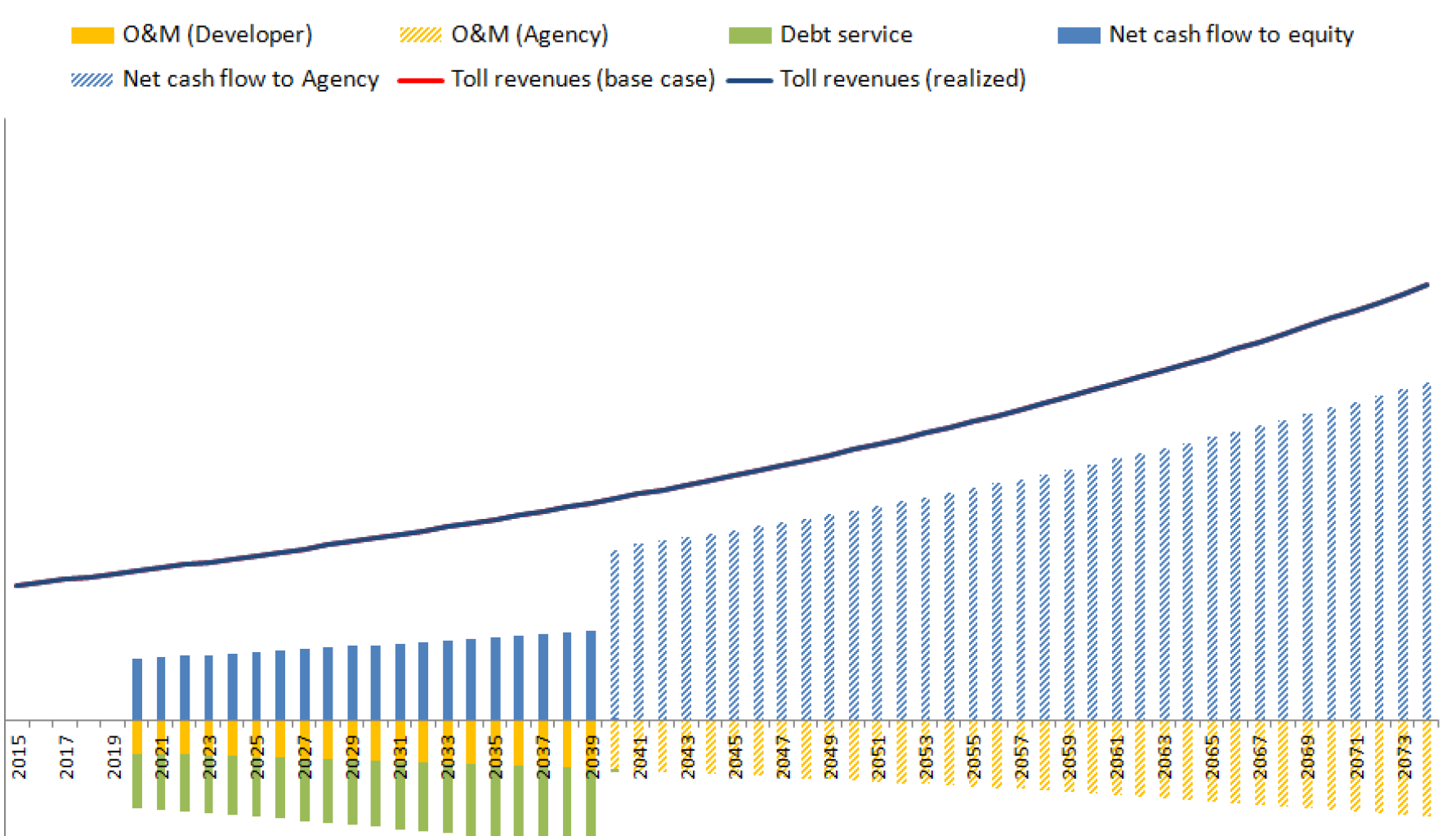

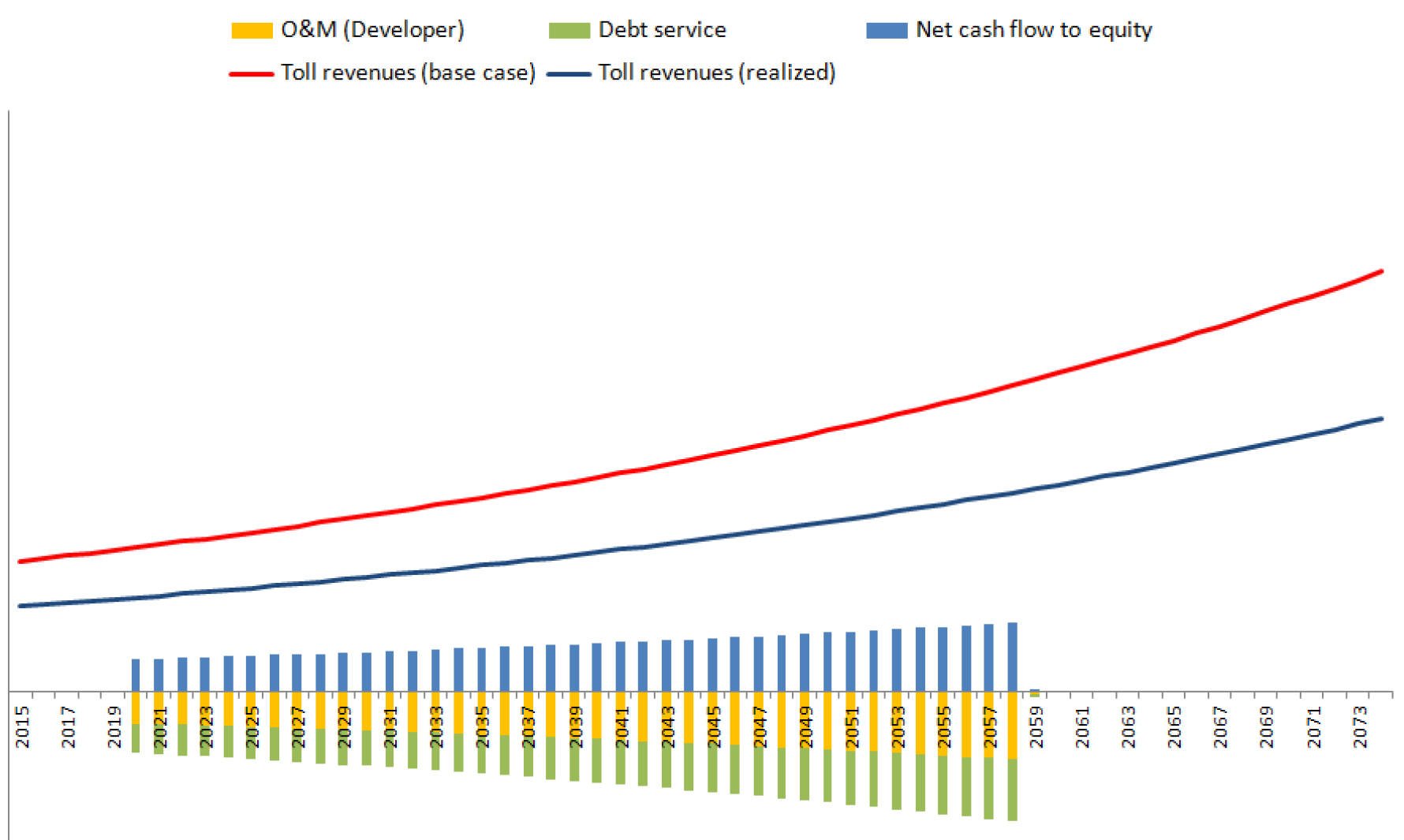

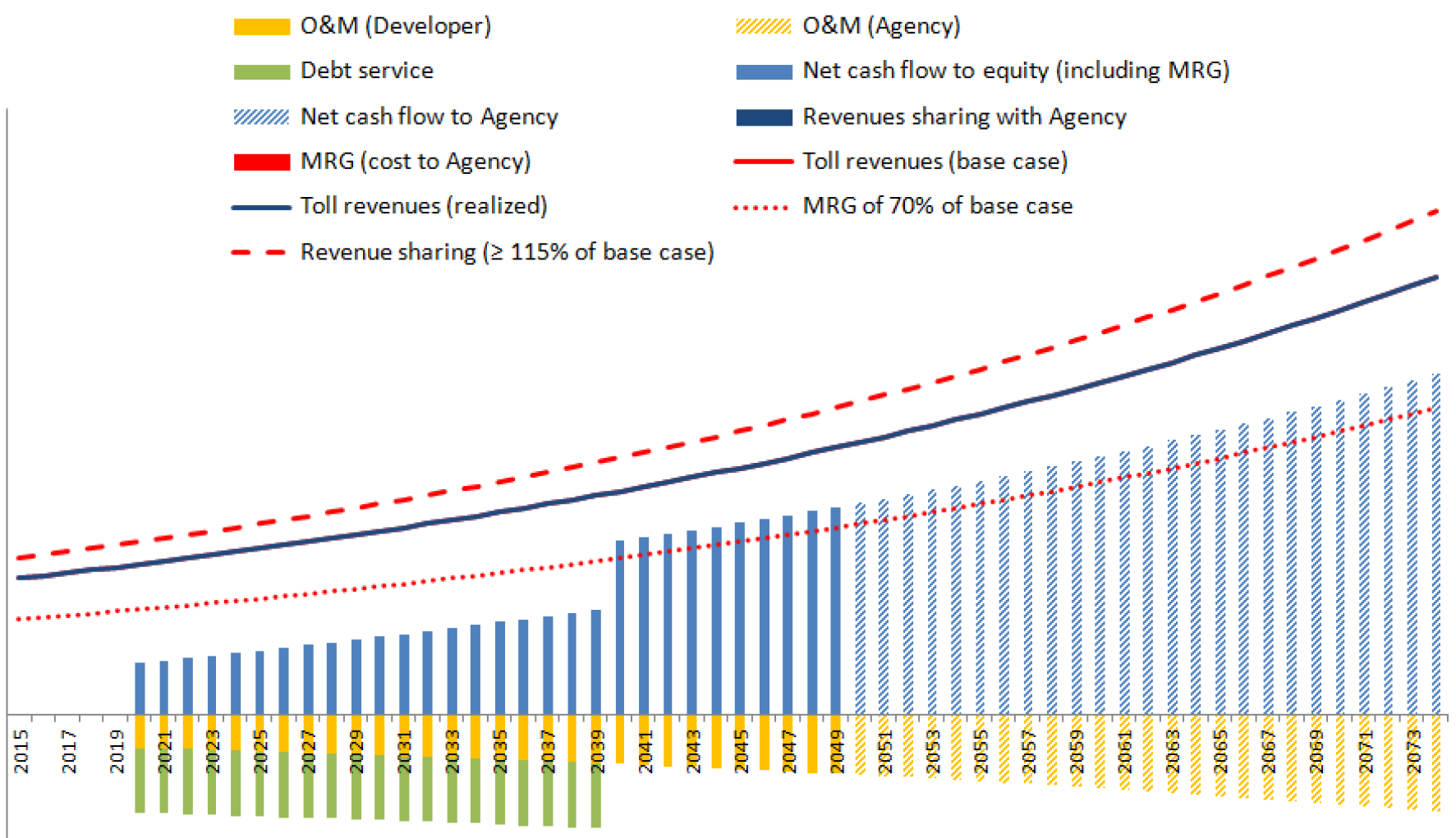

MRG: Base revenues case

Developer & Agency perspective

View

larger version of chart

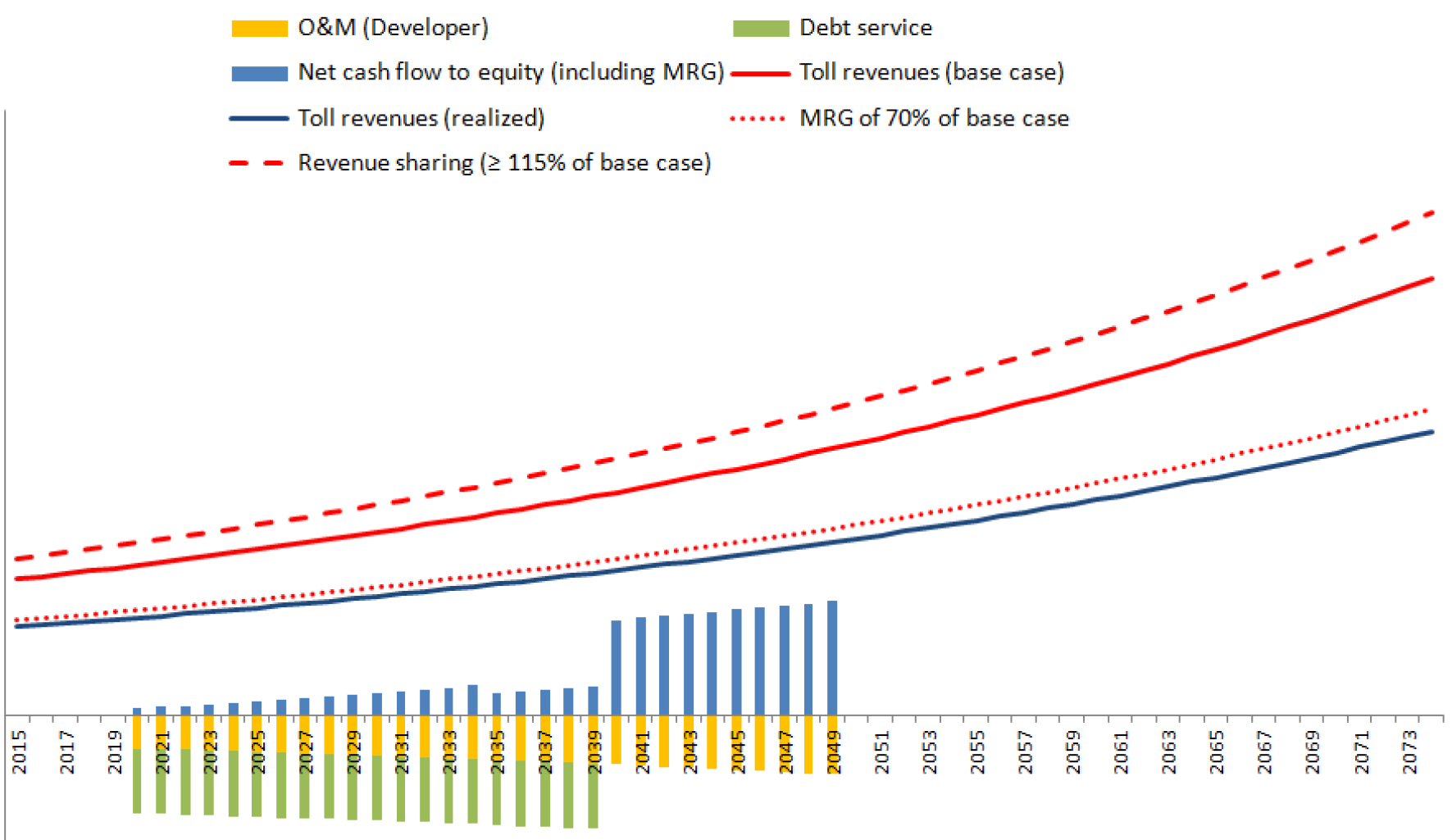

MRG: Extreme downside revenues case

Developer perspective

View

larger version of chart

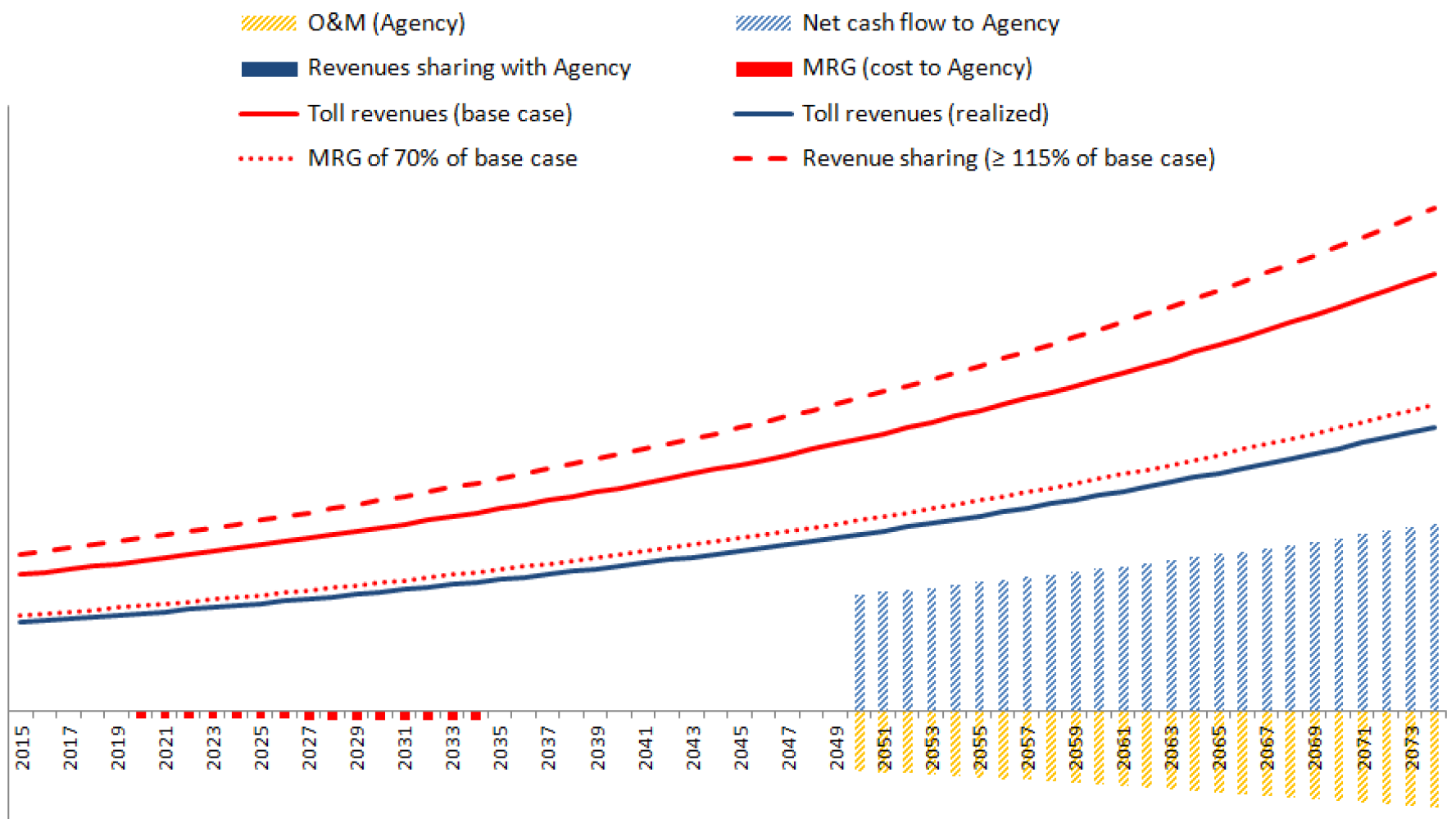

MRG: Extreme downside revenues case

Agency perspective

View

larger version of chart

Questions?

Submit a question using the chat box

Contingent Finance Support

Contingent Finance Support (CFS): Similar to MRG, also covering

O&M risks and being tested in U.S.

Under CFS, Agency guarantees that project will be able to re-pay

debt to Lenders, even under downside scenarios.

Similar to MRG, but downside scenarios could be caused by

1) lower than expected revenues (as under MRG) or 2) higher operating

costs.

- VfM: Sub-optimal compared to MRG since Developer

should be in best position to manage lifecycle costs

- Fiscal: Creates contingent liabilities

- Financeability: Lenders receive excellent protection

- Implementation: Being tested in U.S. market

(NC I-77) with average implementation issues; key challenges are

revenue guarantee level and valuation of contingent liability

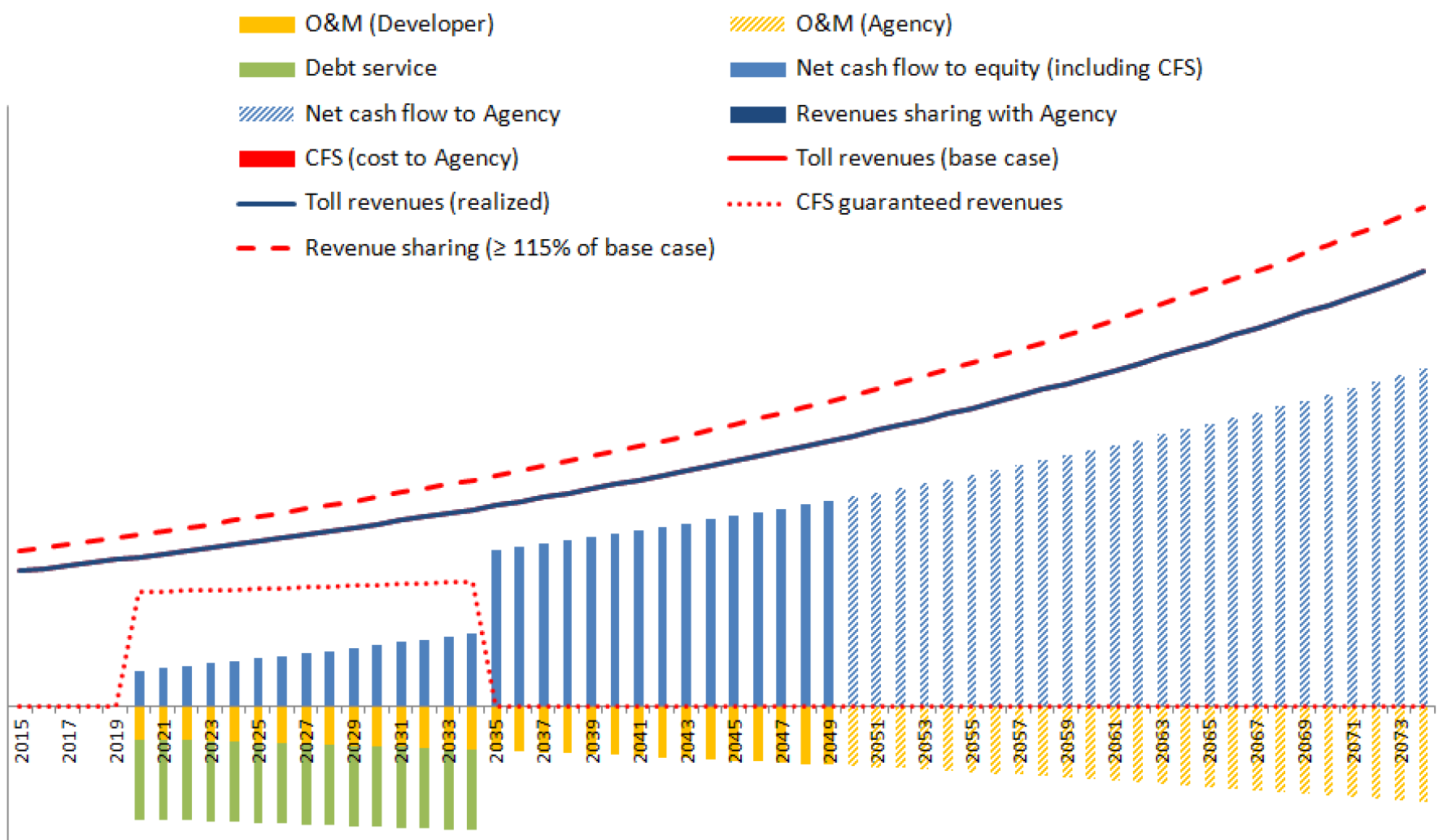

CFS: Vase revenues case

Developer & agency perspective

View

larger version of chart

CFS: Extreme downside revenues case

Developer perspective

View

larger version of chart

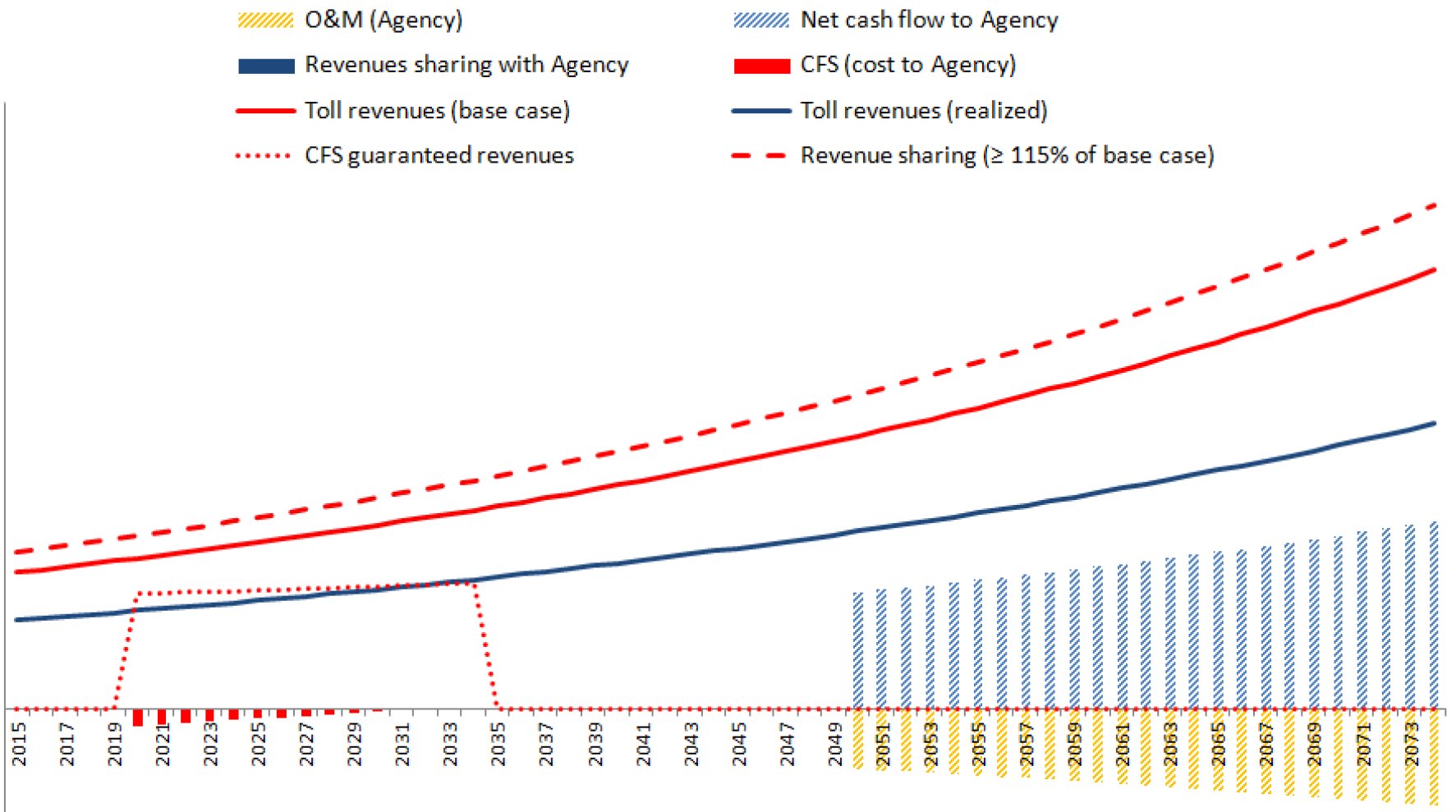

CFS: Extreme downside revenues case

Agency perspective

View

larger version of chart

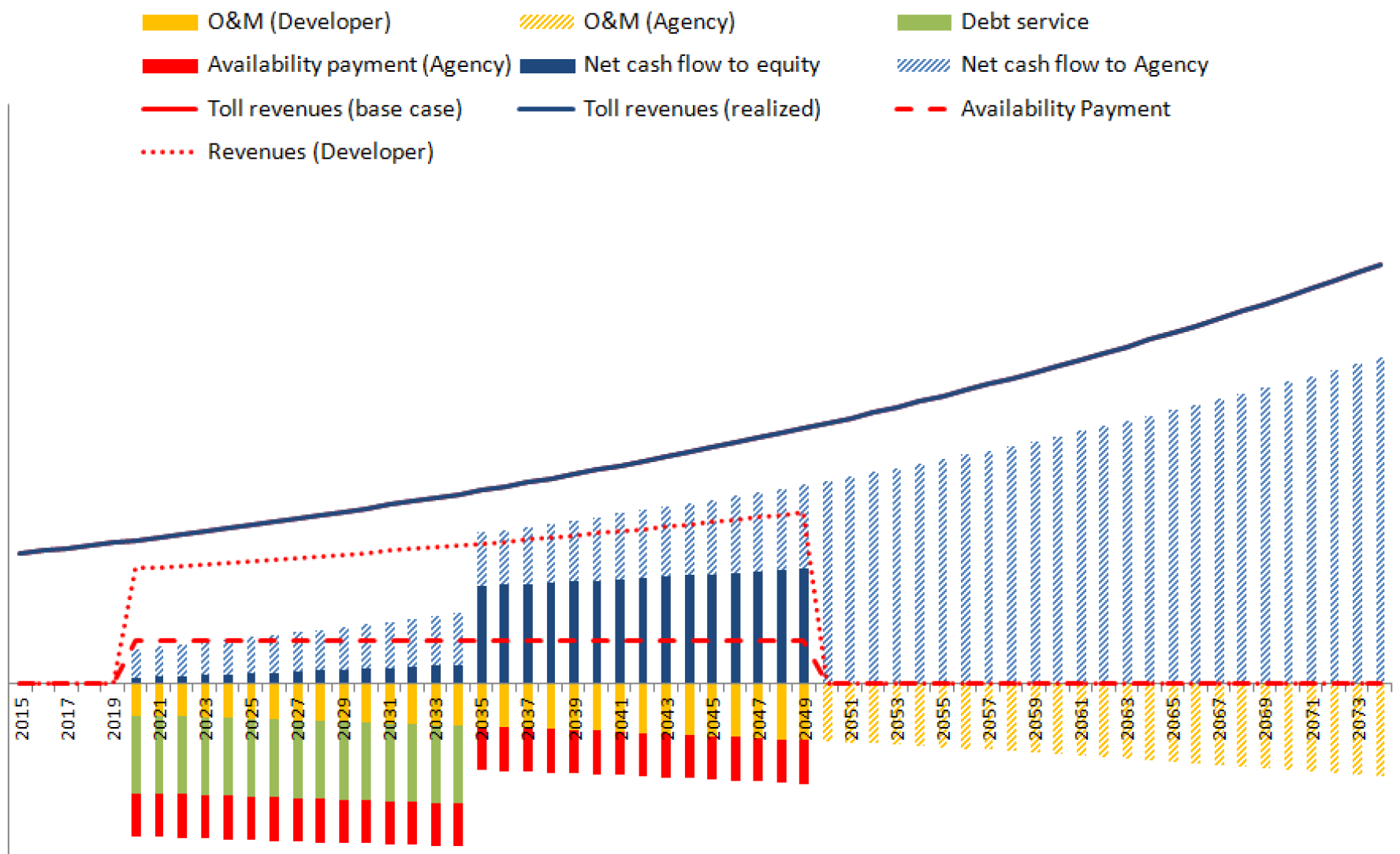

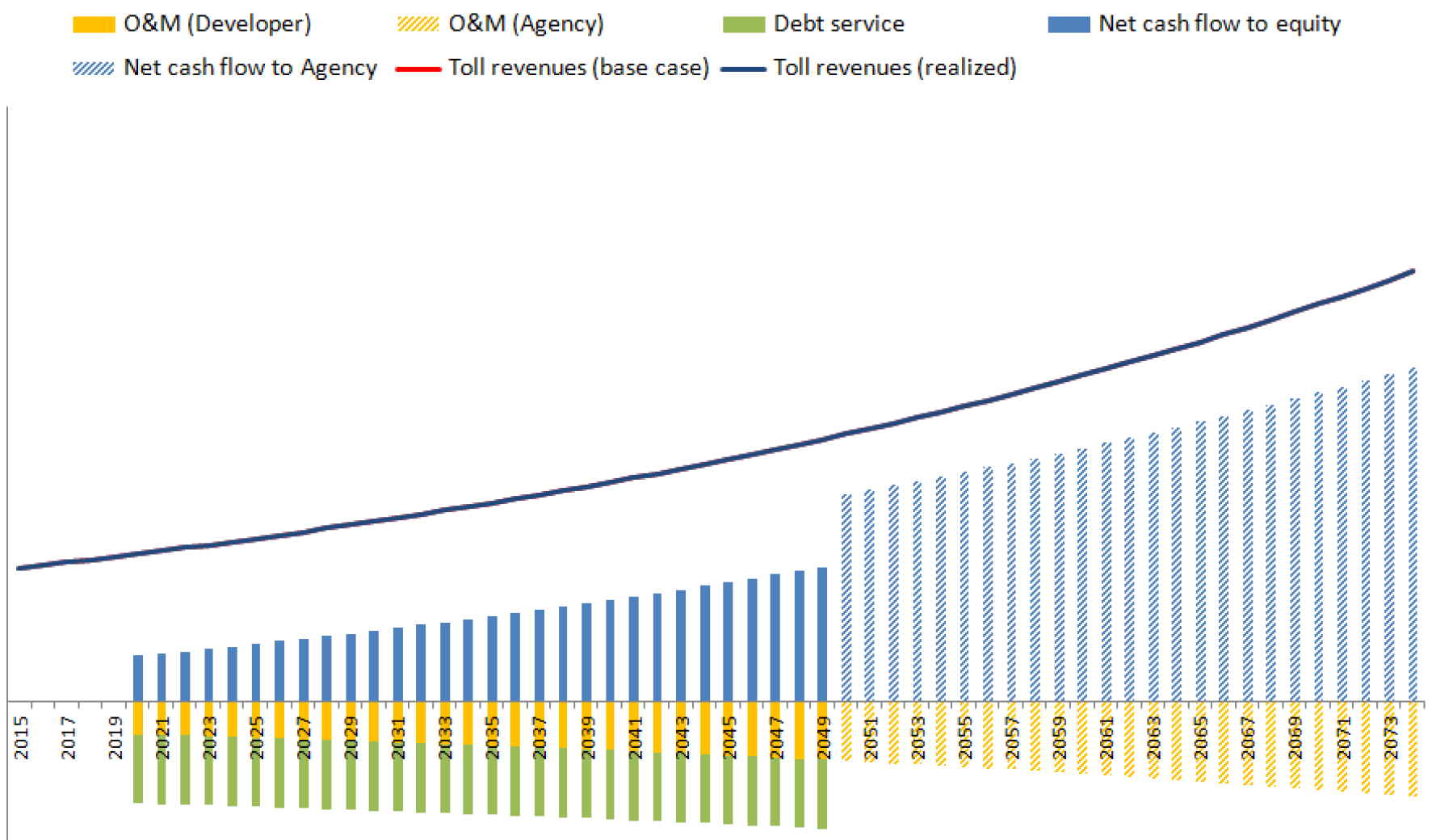

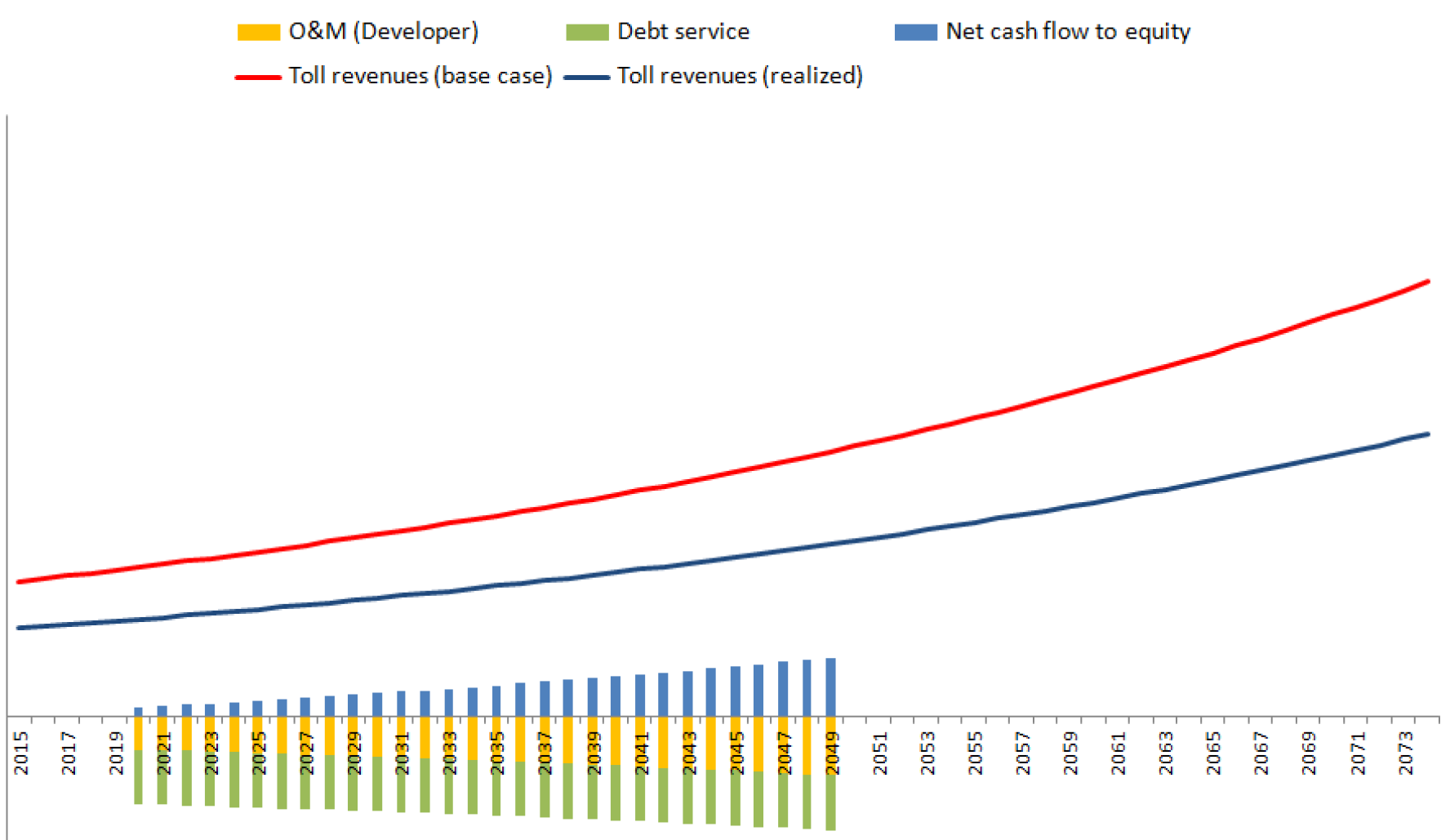

Availability Payment with Revenue Sharing

Availability Payment (AP) with Revenue Sharing: Providing level

of certainty while sharing revenues

Developer receives AP (after performance deductions) and a share

of all realized revenues, with remainder of revenues flowing to Agency.

- VfM: AP component provides certainty to Developer

and Lenders, hence reducing inefficient risk pricing while revenue

risk exposure incentives Developer

- Fiscal: Creates long-term liabilities but also

generates future revenues for Agency

- Financeability: Improved financeability compared

to full revenue risk transfer, but credit analysis uncertainty –

AP or toll?

- Implementation: Coherent procurement strategy

required, either bid AP level or level of revenue sharing

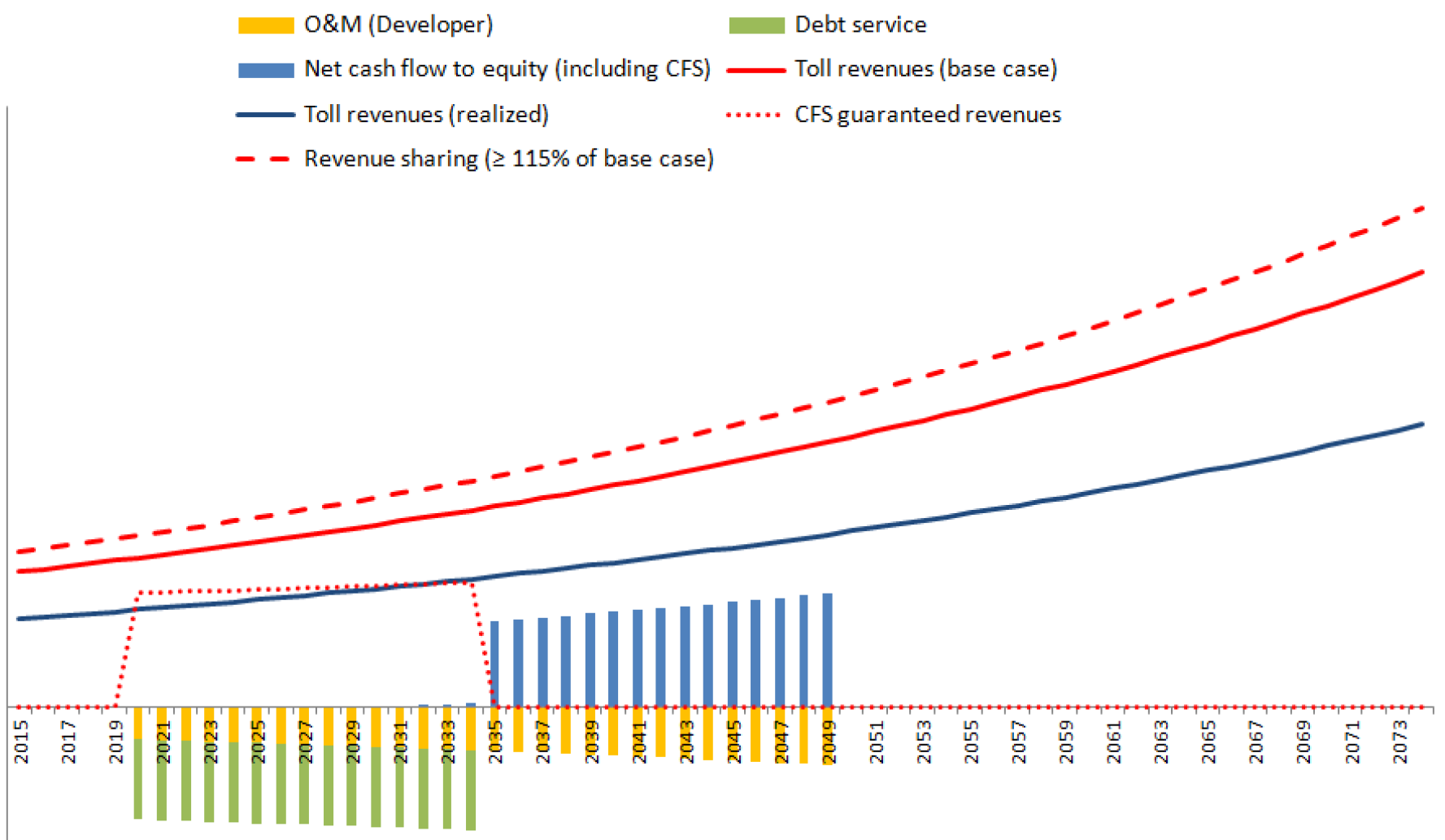

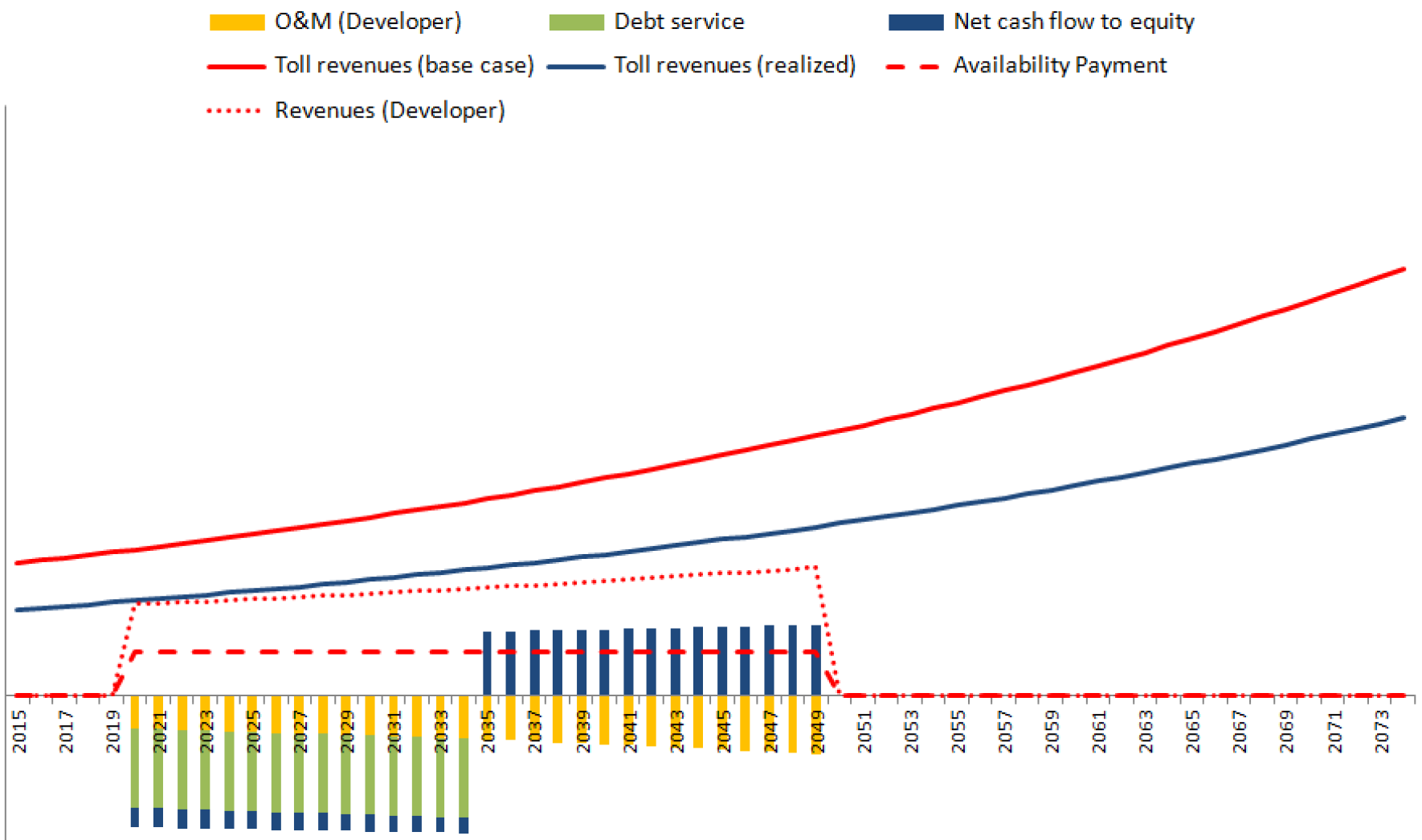

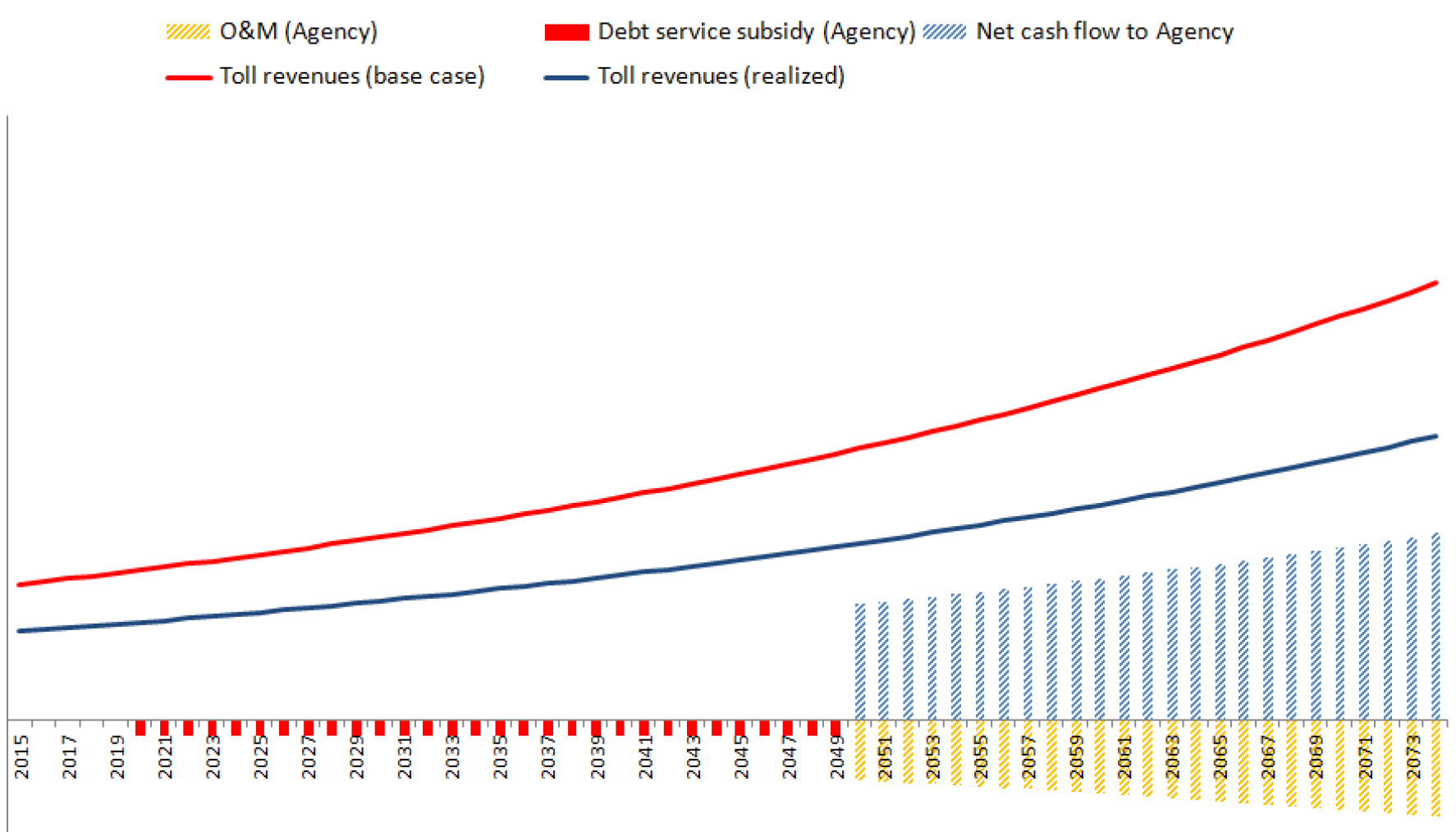

AP with Revenue Sharing: Base revenues case

Developer & Agency perspective

View

larger version of chart

AP with Revenue Sharing: Extreme downside revenues case

Developer perspective

View

larger version of chart

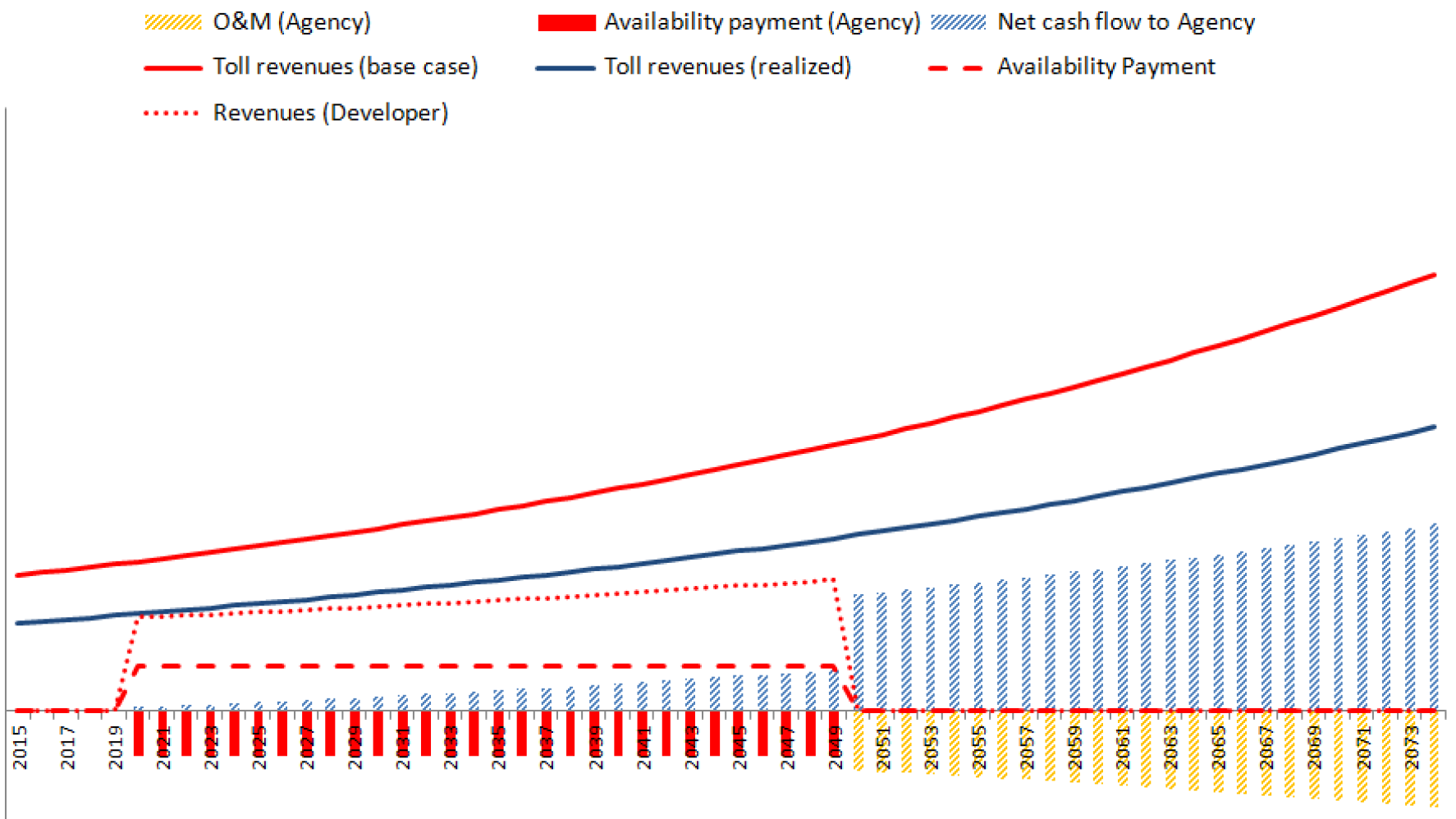

AP with Revenue Sharing: Extreme downside revenues case

Agency perspective

View

larger version of chart

Questions?

Submit a question using the chat box

Innovative Finance Programs

Innovative Finance Programs (IFP): Flexible financing terms to absorb

revenue risk

Flexible financing terms can reduce cash flow pressures: Mandatory

and scheduled debt service payments (as TIFIA), variable interest rates

depending on level of realized revenues.

- VfM: If Lenders can absorb (some) revenue risk,

IFP should indeed reduce inefficient risk pricing and improve VfM

- Fiscal: Projects receive implicit subsidy if

financing terms are not market-based, which may increase if interest

rate or debt service are linked to revenues (contingent liability)

- Financeability: If public Lenders were to provide

flexible financing terms, other Lenders may be better protected

- Implementation: IFPs do not pose major implementation

difficulties but may require changes in legislation

IFP Flexible Interest Rate: Base revenues case

Developer & Agency perspective

View

larger version of chart

IFP Flexible Interest Rate: Extreme downside revenues case

Developer perspective

View

larger version of chart

IFP Flexible Interest Rate: Extreme downside revenues case

Agency perspective

View

larger version of chart

Summary of key characteristics of revenue risk sharing mechanisms

| Criterion |

Present Value of Revenues |

Minimum Revenue Guarantee |

Contingent Finance Support |

Availability Payment & Revenue Sharing |

Innovative Finance Programs |

| Value for Money |

●●● |

●●● |

●●● |

●●● |

●● |

| Fiscal Impact |

●●● |

●● |

●● |

● |

●● |

| Financeability |

●● |

●●●● |

●●●● |

●● |

●●● |

| Ease of Implementation |

●●● |

●●●● |

●●● |

●● |

●●● |

Key: More value or benefits = ●●●● Less value or benefits = ●

Questions?

Submit a question using the chat box

Upcoming P3 Webinars

- February 2 P3 Project Financing

- February 9 Use of Performance Measures in P3s

- February 16 P3 Projects in the U.S.

To register for the webinars, please visit:

https://www.fhwa.dot.gov/ipd/p3/p3_training/webinars.aspx

Contact Information

IMG Rebel

Sasha Page - SPage@imgrebel.com

Wim Verdouw - WVerdouw@imgrebel.com

Marcel Ham - MHam@imgrebel.com

4390 East West Highway, Suite 950

Bethesda, MD 20814

Office:

(301) 907-2900

https://www.rebelgroup.com/en/offices/united-states/

Patrick DeCorla-Souza

P3 Program Manager

USDOT Build America Bureau

& FHWA Center for Innovative Finance Support

(202) 366-4076

Patrick.DeCorla-Souza@dot.gov