Slide 1 - Introduction to Public-Private Partnerships (P3s)

Center for Innovative Finance Support Academy

Today's Instructor

Patrick DeCorla-Souza

P3 Program Manager

Center for Innovative Finance Support

Program Development Team

Slide 2 - Course Outline

Lesson 1 - Definitions

Lesson 2 - Benefits and Challenges

Lesson 3 - Types of P3s & Examples

Lesson 4 - Financing Tools

Course Summary

Slide 3 - Course Objectives

- Learn what P3s are and how they can play a part in project procurement

- Identify instances where different P3 arrangements have been used for highway projects

- Understand the benefits of P3s and challenges to their use

- Identify key USDOT project finance tools that work in conjunction with P3s and be able to access resources to learn more

Slide 4 - Center for Innovative Finance Support - Role in Transportation P3s

- Technical Assistance

- Educate

- Facilitate

Lesson 1: Definitions

Slide 6 - Did You Know?

Q. When were P3s first used in the United States?

A. In 1792, the first turnpike was chartered and became known as the Philadelphia and Lancaster Turnpike in Pennsylvania.

Slide 7 - What is a P3?

- Public-Private Partnerships

- P3s are contractual agreements between a public agency and a private entity that allow for greater private participation in the delivery of financing of projects

- More than Design-Bid-Build

Slide 8 - Project Procurement and Delivery

| Conventional Projects (design-bid-build) |

P3 Projects (design-build-finance-operate-maintain) |

| Public sector burden with all risks |

Risk sharing |

| Succession of separate (and multiple) contracts |

Integration of two or more project phases |

| Public Financing |

Private Financing |

| Lowest bidder |

Best suited |

| Public sector project stewardship (incl. with contract management firm) |

Private sector project stewardship |

Slide 9 - P3's Are Not. . .

- Easy

- An endless source of funds

- Privatization of public infrastructure

- The answer to all State and local problems

Slide 10 - Definitions - Terminology

- A Concession is a long term lease of public facilities to a private party (concessionaire)

- Greenfield and Brownfield Facilities

- A Special Purpose Vehicle (SPV) is a legal entity created to fulfill narrow, specified tasks

- Isolates the financial risks from the parent company or companies

- Leveraging is the degree to which an investor or business is utilizing borrowed money (debt)

- If a project is leveraged at 70/30, 70% debt and 30% equity

Slide 11 - Definitions- Terminology

- Debt is a bond or loan, with an obligation to pay interest and principal at a later date

- Obligation has payment priority over equity

- Includes Private Activity Bonds (PABs) and Transportation Infrastructure Finance and Innovation Act (TIFIA) loans

- Equity defines ownership interest in a corporation

- Requires a higher internal rate of return than debt holders as equity interest is riskier

- Can be lost in certain instances

- The Internal Rate of Return is the percentage return on investment.

- Weighted average cost of capital (WACC) of project vs. return on equity

Slide 12 - Definitions- Terminology

- Greenfield (New facility)

- Brownfield (Existing facility)

- Hybrid (Extension or expansion of existing facility)

- Availability Payments

- Payments made by the public sector sponsor based on particular milestones or facility performance standards

- Shadow Tolls

- Payments to the Concessionaire or private sector partner based on volume of traffic on a facility

Slide 13 - Why P3s Now?

- Growing congestion

- Need for new highway capacity

- Increasing costs to maintain system

- Aging infrastructure

- Increasing construction costs

- Increasing operations and maintenance costs

- Mounting budget pressures

- Revenue growth slowing

- Voter resistance to tax increases

- Poor long-term system performance

Slide 14 - Why Undertake a Project as a P3?

Answer: When the public sector can get more value using P3 approach

- "Value" can be:

- Lower construction and/or operation costs

- Time savings in construction and/or delivery

- Innovation -- cutting edge technologies or expertise

- Public Sector must assess "value":

- Value for Money Analysis

- Public Sector Comparator

- Value of risks transferred to private partner

- Potential for efficiencies

- Qualitative factors

Slide 15 - P3s: Procurement Approach

- Procurement methods may be proscribed by statute or state guidelines

- If federal funds involved, may need SEP-14

- Solicited or unsolicited proposals

- Either way, a competitive process typically results in best value

- Post unsolicited proposals to invite competing bidders

- Selection options

- Lowest NPV availability payment

- Best overall value

- Lowest public subsidy

- Largest upfront payment to project sponsor

Slide 16: Test Your Knowledge

True or False:

P3s may be only be done on greenfield facilities.

Multiple Choice:

Among the considerations for entering into a P3 are...

- Budget pressures

- Upgraded long-term performance

- Improved risk allocation

- All of the above

Slide 17 - Questions

Submit a question using the chat box Or *1 to ask a question by phone

Lesson 2 - Benefits and Challenges

Slide 19 - P3 Benefits to Public Sector

- Expedited project delivery

- Protection against some risks

- Construction and operational efficiencies

- Increased investment in transportation assets where unmet needs are the greatest

- Opportunities for "new" money (i.e. from equity investors)

- Brings together multiple financing sources required for large-scale projects

Slide 20 - P3 Benefits to Public Sector

- Enhanced cost control

- More certainty regarding cost and schedule

- Brings innovation

- Introduces life-cycle perspective - better quality up front and improved maintenance

- Improved customer focus

- Leverages each partner's strengths

- Conserves public sector debt capacity

Slide 21 - P3 Benefits to Private Sector

- Private concessionaires are looking for a return on investment that is:

- Long-term

- Stable, predictable

- Moderate risk

- Opportunity to increase return through efficiencies, innovation and managing risks

- But "profits" of private sector are generally more visible - and controversial - than the benefits to the public sector

Slide 22 - Challenges in Use of P3s

- Public acceptance

- Enabling legislation

- Organizational Capacity

- Knowledge gap

- Different oversight/contract management approach required

- High cost of private capital

- Limited access to low-cost PABs and TIFIA

Slide 23 - Challenges in Use of P3s

- Revenue constraints

- Federal and state toll restrictions

- Revenue shortfalls due to lower tax receipts

- Difficulty in predicting traffic and revenue

- Difficulty in identifying and pricing risk and proper risk allocation

- Long term nature of P3 Agreements

- Concern about loss of upside revenue potential to public

- Inability to anticipate future performance issues or public needs

- Private sector returns

Slide 24 - Summary: Key Questions for Considering a P3 Approach

- Is there the necessary legal and institutional framework in place to support a P3 arrangement?

- Does the project have a dedicated revenue stream?

- Does delivery of the project as a P3 represent a value proposition for the public sector?

Slide 25 - Test Your Knowledge

True or False:

Private capital generally has a lower cost than traditional public methods such as bonding.

True or False:

The private sector is more likely to enter into a P3 with a long-term return on investment than a short-term return. Test Your Knowledge

Slide 26- Questions

Submit a question using the chat box Or *1 to ask a question by phone

Lesson 3 - Types of P3s and Examples

Slide 28 - Types of P3s by Range of Risk Transfer

| P3 Structure |

Design Risk |

Constr. Risk |

Financial Risk |

O&M Risk |

Traffic Risk |

Revenue Risk |

| Traditional Design-Bid-Build |

|

X |

|

|

|

|

| Design-Build (DB) |

X |

X |

|

|

|

|

| Design, Build, Finance, Operate and Maintain (DBFOM) |

X |

X |

X |

X |

Yes, if toll or traffic-based payment |

Yes, if performance-based payment |

Slide 29 - Risks Associated with P3s

- P3s are designed to allocate different risks to the party best able to manage them

- Types of risk include:

- Environmental - Permitting delays; unknown conditions

- Political - Lack of public or political support leads to regulatory or financial barriers

- Demand - Less than anticipated traffic

- Financing - Access to capital and cost of capital

- Costs - Construction and O&M

- Technology - Failure of unproven tolling and enforcement technologies

Slide 30 - Types of P3s by Payment Model

- Toll Concession

- Toll Concession with revenue bands

- Toll Concession with Net Present Value of revenue

- Toll Concession with Revenue Sharing based on rate of return

- Shadow Toll

- Availability Payment

- Others

Slide 31 - Types of P3s by Project Scope

- Greenfield - New facility construction

- Brownfield - Takeover of existing facility, possibly with future enhancement

- Hybrid - New construction involving extension (new segment) or expansion (new lanes) on existing facility

Slide 32 - Greenfield Example

Dulles Greenway, Virginia

- 14-mile facility constructed for $350 million ($40 million equity)

- Opened in 1995, restructured debt in 1999

- Purchased in 2005 by Macquarie Infrastructure

- Group

- Features variably priced tolls

Example: Dulles Greenway, Virginia

Slide 33 - Brownfield Example

Asset monetization or long-term lease, involves the lease of existing, publicly-financed toll facilities to a private sector concessionaire for a prescribed concession period during which they have the right to collect tolls on the facility

Northwest Parkway, Colorado

- November 2007, agreement signed

- 99 years, $543 million to Public Highway Authority

- Responsible for O&M, receives all toll revenue

Example: Northwest Parkway, Colorado

Slide 34 - Hybrid Example

The project sponsor grants a private operator/developer a long-term lease to operate and extend or expand an existing facility

Pocahontas Parkway, Virginia

- Transurban acquired right to enhance, manage, operate, maintain, and collect tolls for 99 years on the existing facility.

- Defeased debt of development costs and committed to constructing Richmond Airport Connector, a 1.6 mile, 4-lane toll road.

- $60 million in equity, $150 million TIFIA loan

Example: Pocahontas Parkway, Virginia

Slide 35 - Test Your Knowledge

Multiple Answer:

Which of the following risks may be transferred in a P3 agreement?

- Design

- Environmental

- Construction

- Financial

- Operations & Maintenance

- Revenue

Slide 36 - Questions

Submit a question using the chat box Or *1 to ask a question by phone

Lesson 4: Financing Tools

Slide 37 - USDOT Financing Tools Supporting P3s

Federal tools to address the risks inherent in private sector participation include:

- TIFIA: Flexible, low-cost lending that addresses challenges such as revenue and ramp up risk

- PABs: Lower-cost financing that addresses high interest rates generally paid by private sector

- Other Innovative Financing Tools:

- State Infrastructure Banks

- Section 129 Loans

- Grant Anticipation Revenue Vehicles (GARVEEs)

Slide 39 - Example: I-595 Corridor

- 10.5-mile managed lanes project in Southeast Florida

- Reconstruction and widening of I-595 and frontage roads and ramps

- Construction of 3 reversible express toll lanes known as 595 Express

- Variable tolls to optimize traffic flow, and will reverse directions in peak travel times.

Slide 40 - I-595 Corridor

- 35-year concession for Design, Build, Finance, Operate, Maintain (DBFOM)

- First availability payment-based P3 in the US

- FDOT retains toll revenue and sets tolls, and provides oversight

- Series of annual and monthly payments subject to adjustment based on performance

- Project complete advanced 15 years

- Substantial cost savings

- Successful financing despite economic crisis

Slide 41 - I-595 - Project Financing

| Sources |

Amount ($000s) |

| Tranche A - Senior Bank Debt |

525,537 |

| Tranche B - Senior Bank Debt |

255,630 |

| TIFIA |

603,441 |

| Equity |

207,703 |

| Revenues |

10,374 |

| TIFIA Capitalized Interest |

74,881 |

| Total Sources |

1,677,567 |

| Uses |

Amount ($000s) |

| Construction Expenses |

1,197,000 |

| O&M Expenses |

123,142 |

| Transaction Costs and Fees |

69,255 |

| Interest during Construction |

253,267 |

| Reserve Funding |

34,902 |

| Total Uses |

1,677,567 |

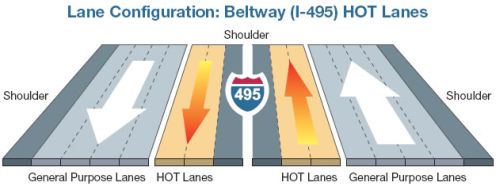

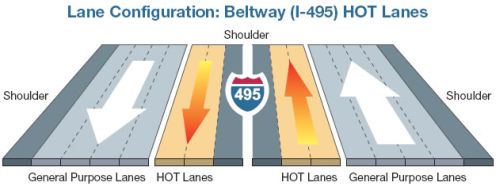

Slide 42 - Example: Capital Beltway HOT Lanes

Design, Build, Finance, Operate, Maintain

- 14-mile segment of beltway based on a fixed-price, fixed-time, design-built contract, 80-year concession

- Two new HOT lanes in each direction with variable tolls, HOV-3 free

- Congestion-free network for transit service

- Replacement of more than $260 million of aging infrastructure, including more than 50 bridges and overpasses

- Use of PABs and TIFIA loans

- Cost = $1.9 billion

Slide 43 - Route 495 - Project Financing

| Source |

Amount ($000s) |

| PABs |

589,000 |

| TIFIA |

588,922 |

| VDOT Contribution |

408,895 |

| Equity |

348,695 |

| Interest Income During Construction |

70,793 |

| Total Sources |

2,006,305 |

| Uses |

Amount ($000s) |

| Construction Costs, Oversight and Other Admin Fees |

1,508,477 |

| Development Costs |

65,936 |

| Net Financing Costs |

152,798 |

| Ramp up Reserve |

30,000 |

| Revenue Stabilization Reserve |

50,000 |

| Capex Reserve |

19,000 |

| Debt Service Reserve |

58,900 |

| Project Enhancement Fund |

15,000 |

| Contingency |

106,193 |

| Total Uses |

2,006,304 |

Slide 44 - Test Your Knowledge

True or False:

The Florida I-595 project is the first availability payment-based P3 in the U.S.

True or False:

The Capital Beltway HOT Lanes P3 concession agreement used financing from both PABs and TIFIA.

Slide 45 - Questions

Submit a question using the chat box Or *1 to ask a question by phone

Course Summary

Slide 47 - Course Summary

- P3s are not a source of free money

- P3s don't work for every project (best suited for large, costly projects)

- One size doesn't fit all - every P3 is different

- Decisions are local and State, not Federal

- P3s are more like outsourcing than pure privatization

- P3s can result in greater cost and schedule certainty and delivery of high quality projects

Slide 48 - Course Summary

- Technical Assistance

- Educate

- Facilitate P3s

Slide 49 - For More Information

Center for Innovative Finance Support Website:

www.fhwa.dot.gov/ipd/

Center for Innovative Finance Support P3 Website:

www.fhwa.dot.gov/ipd/p3/

AASHTO Center for Excellence in Project Finance:

http://www.financingtransportation.org/

By Email:

Thay.Bishop@dot.gov

Slide 50 - Upcoming Center for Innovative Finance Support Academy Webinars

- February 23: SIBs 201

- March 14: GARVEEs and SIBs Office Hours

- March 21: Intro to TIFIA

- April 4: TIFIA Application Processes

- April 11: GARVEEs 101

- April 18: TIFIA Portfolio Monitoring

- May 9: TIFIA Q&A "Meet the Experts"

Slide 51 - Contact Information

Patrick DeCorla-Souza

P3 Program Manager

Center for Innovative Finance Support

Federal Highway Administration

Department of Transportation

1200 New Jersey Avenue SE, E64-302

Washington, DC 20590

(202) 366-4076

Patrick.DeCorla-Souza@dot.gov

Slide 52 - Questions

Submit a question using the chat box Or *1 to ask a question by phone