This Guidebook has been developed cooperatively by the U.S. Department of Transportation's Build America Bureau and the Federal Highway Administration's (FHWA) for transportation professionals who may be involved in a Public-Private Partnership (P3) project. The Guidebook is part of a P3 Toolkit consisting of tools and guidance documents to assist in educating transportation professionals as well as public sector policymakers, and legislative and executive staff. The P3 Toolkit forms the basis of a broader P3 capacity-building program that includes a curriculum of P3 courses and webinars. The P3 Toolkit addresses Federal requirements related to P3s and four key phases in P3 implementation: (1) legislation and policy, (2) planning and evaluation, (3) procurement, and (4) monitoring and oversight. This guidebook fits into the planning and evaluation phase and is concerned with the financial assessment of P3s prior to procurement and implementation.

Table 1 shows the core components of the FHWA P3 Toolkit. This guidebook, the third to be produced for the planning and evaluation phase as part of the Toolkit, is a companion to the Financial Structuring Fact Sheet, the Financial Structuring and Assessment Primer, and the P3-VALUE 2.0 Analytical Tool. The guidebook may be used as a stand-alone reference or in conjunction with other publications and analytical tools in the FHWA P3 Toolkit. It may also be cross-referenced with FHWA's Model Public-Private Partnerships Core Toll Concessions Contract Guide. 1

| Core Components of the FHWA P3 Toolkit | Description |

|---|---|

| Fact Sheets |

|

| Primers |

|

| Guidebooks |

|

| Analytical Tools |

|

The Risk Assessment Guidebook focuses on identifying, managing, and allocating risks, which are important topics for financial assessment since the allocation of risks has important implications for financial feasibility. Risk allocation is discussed in section 2.3 from a financial perspective. This section can be cross-referenced with the Risk Assessment Guidebook.

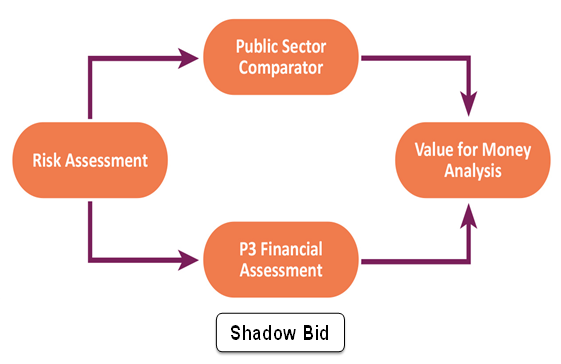

The Value for Money Analysis Guidebook focuses on comparing the public sector delivery option to the P3 delivery option. The outputs of P3 financial assessment may be used to develop a P3 option for use in value for money analysis to determine the preferred delivery option. The P3 Project Financing Guidebook may be considered a prerequisite to the Value for Money Analysis Guidebook in terms of chronological sequencing, as shown in Figure 1.

Figure 1. Value for Money Analysis Process

Flow chart for Shadow Bid:

The P3-VALUE 2.0 analytical tool analyzes the P3 option for a project. The accompanying P3-VALUE 2.0 guide can help the user navigate the features of the P3-VALUE 2.0 Tool and assist in understanding the concepts underlying the tool.

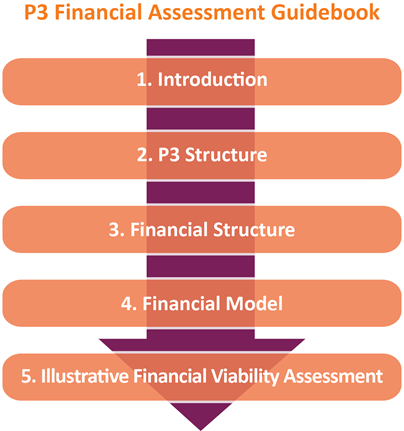

The objective of this guidebook is to increase the readers' knowledge of the concepts and skills needed to procure transportation projects using a P3 approach. The guidebook also aims to demonstrate, through practical applications, some of the techniques used to conduct a P3 financial assessment. The guidebook includes examples of real projects so the reader can understand how concepts have been applied in practice. These examples include projects that have encountered financial difficulties. Such projects provide lessons learned that have informed the approach to the financial assessment of P3s. The layout of the guidebook is shown in Figure 2.

Figure 2. Overview of Structure of the P3 Project Financing Guidebook

P3 Financial Assessment Guidebook

Many of the rationales for using P3s to implement projects have financial implications. Design-build contracts can help to control construction costs. Design-build-operate-maintain (DBOM) contracts can help to take advantage of the efficiencies of lifecycle costing. The introduction of equity financing to projects can provide financial incentives for private partners to manage projects efficiently. For these reasons, understanding the structure of P3s is essential to the financial assessment of P3s. This is the subject of Chapter 2.

Different types of P3s are suitable for different types of financing. While certain types of financing are available in many parts of the world, the US market offers financial products and strategies that may not be commonly available in other countries. Financing typically constitutes a major cost of P3s and affects the financial feasibility of P3 projects. For this reason, it is essential to understand financing strategies and structures for P3s in order to complete a robust P3 financial assessment. Financial structure is the subject of Chapter 3.

Financial models, discussed in Chapter 4, are used as tools to determine the financial feasibility of P3s. These models incorporate a range of assumptions and inputs that are then used to calculate outputs that provide indicators of financial feasibility. Knowledge and skill in financial modeling as well as the underlying financial concepts represented is essential for any practitioner engaged in the financial assessment of P3s. Chapter 5 provides a simplified example of how a P3 project undergoes financial assessment and structuring.

There are many examples of private development of transportation infrastructure throughout history. Ports, canal systems, turnpikes, and railroads have all been developed privately in the US and internationally. Currently in the US, most ports and airports feature a high level of private investment or involvement in the financing and management of facilities. Private involvement in roads, tunnels, and bridges is less common. While there are some historical examples, such as the original Pennsylvania Turnpike and the Brooklyn Bridge, this type of infrastructure historically has been provided by the public sector in the U.S.

The current P3 trend can be traced to the 1980s as an outgrowth of government reform and privatization efforts. When the Dulles Greenway opened in 1995, it was the first private toll road in Virginia since 1816. California's 1989 P3 law enabled the SR-125 and SR-91 projects. As of February 2014, 33 states and Puerto Rico have P3 legislation, according to the National Conference of State Legislatures. There are a variety of reasons for engaging in P3 projects. The private sector may offer cost savings for projects. Innovations in design, construction, operations and maintenance (O&M), and financing may offer such savings. Another rationale for P3 projects is technological and management innovation. High-occupancy toll (HOT) lanes are one example of an innovative solution being applied by the private sector on several P3 projects. The private sector may offer other innovations in the use of technology or the management of project resources.

Risk transfer is one of the most important rationales for engaging in P3 projects. While risk transfer may involve highly complex contractual and financial arrangements, the following text provides a simplified discussion. Risk is transferred from the public to the private sector mainly through contracts. Even simple construction and operations contracts feature risk transfer, as they require the private partner to perform tasks in place of the public authority, thereby releasing the public authority from many risks associated with the work. When more tasks are performed by the private partner, the level of risk transfer typically is greater. Under a full-scale P3 project, the private sector is responsible for complete project delivery and management throughout the entire project lifecycle. This is a high level of risk transfer and one that typically limits risks to the public authority.

Public authorities may conclude that the private sector is better able to manage certain project risks, or they may wish to transfer risk as a matter of policy. Public authorities may be most interested in using P3 delivery methods where they perceive project risks to be highest. Private firms that specialize in particular types of projects have the experience of implementing similar projects, perhaps not only around the country but around the world. Public authorities may have to deliver certain types of projects only once or a few times, and may be interested in P3 delivery to take advantage of the experience of firms that have delivered similar projects more often.

Despite transferring a greater amount of risk to the private sector, P3 projects never achieve 100 percent risk transfer. The public authority is always exposed to some project risks. Also, in the US, nearly all highway P3 projects feature some form of public funding support.

Public authorities may engage in P3s mainly as a way of to access financing. The US public finance market is unique in the world in that nearly every state and local government in the US has direct or indirect access to the capital market. At the state and local level, public debt is typically tax-exempt, which is another unique feature that provides a low cost of financing for many projects. These features are discussed in detail in section 3.0.

It is important to note that this guidebook focuses on new-build P3 projects. In some cases, these projects involve the upgrading and expansion of existing infrastructure and not the construction of completely new infrastructure. This guidebook does not address asset monetizations, whereby the public authority receives an upfront payment for the long-term lease of an asset and rights to related toll revenues. However, many of the concepts and issues in terms of the operations of these projects may be similar.

Financial assessment of P3 projects is typically required by several parties. The public authority wants to know how much the project will cost so it can compare its own estimates to those of private sector bidders. The private sector wants to know where it can offer efficiencies and cost advantages. Financial institutions want to know to what extent they can offer financing to the project.

As stated in section 1.1, this guidebook is intended to be used for the planning and evaluation of P3s. Financial feasibility needs to be assessed and confirmed at several stages prior to implementation. Beginning with the identification and selection phase, projects need to be screened for financial viability. Very few projects will be financially viable on their own, and the norm is for state grants and other revenues to cover a portion of capital costs for a project. To justify such grants, the economic benefits of the project may be assessed. This may be done through cost/benefit analysis and through estimation of an economic internal rate of return that can be compared to the financial internal rate of return (IRR).

Once a project passes initial screening, it may be subjected to a P3 feasibility study that lays the foundation for the project, determining the preferred delivery option using Value for Money or other types of analysis. Financial feasibility may be affected during the procurement and negotiation stages of the project cycle (see Figure 3). For example, bidders may not want to accept certain risks; therefore, financial assessment of P3s may have to continue throughout the procurement and negotiation process.

Financial market conditions may also affect financial feasibility. If interest rates differ significantly at financial close relative to when the P3 feasibility study was prepared or when bids were submitted, it may cause a project to become financially infeasible.

Figure 3. Project Cycle

View larger version of Figure 3

Project Cycle Flow Chart

Identification - Screening - Feasibility Study - Procurement - Contracts - Financing - Construction - O&M - Transfer

Some P3 projects have encountered financial difficulties not because of project-specific issues but because of broader economic and demographic issues. Some projects were built in undeveloped regions on the outskirts of metropolitan areas. In each case, the region that the road serviced was projected to grow, with planned residential and commercial developments. When that development did not occur, at least not during the period expected, actual toll revenues fell short of projected toll revenues.

Roads whose revenues rely on planned economic development feature a high level of revenue risk. In these cases, the public authority may need to identify other revenues to fund road construction and operations in initial years.

Investors and rating agencies are more wary of greenfield projects and more interested in projects that have established levels of traffic. 2 Some may be interested in greenfield projects but only where the public authority guarantees project revenues through minimum revenue guarantees or availability payments.

As already mentioned, financing costs are a major component of overall project costs. Different sources of financing feature different costs so these must be considered in the financial assessment of projects. Identifying potential sources of financing for projects is part of the financial assessment process. There are many types of financing available for P3 projects. Some are unique to the US market, such as tax-exempt Private Activity Bonds (PAB).

Financing costs will be affected by P3 structure and design. For example, financing for availability payment projects 3 procured by a creditworthy public authority typically carries a lower cost than financing for a toll concession project. Debt providers (whether lenders or bondholders) will typically charge a higher interest rate to finance a project backed by uncertain toll revenues compared to a project backed by availability payments from a creditworthy public authority. In addition, debt providers will typically be comfortable financing a larger share of an availability payment project than a toll concession project. So, toll-financed P3s typically feature a higher proportion of equity financing. Since equity financing typically is more expensive than debt financing, this drives up overall project costs.

The returns expected by both debt providers and equity investors depend on a number of factors. This includes overall economic conditions as indicated by base rates such as US Treasury bond rates and expectations for inflation. They also include project-specific factors such as the estimated level of revenue risk. Both debt providers and equity investors will demand higher rates of return for riskier projects than for less risky projects, ceteris paribus. For example, a road that has a long history of established traffic volumes and toll revenues will be viewed as less risky than a greenfield road with no traffic or revenue history. The types of investors and the returns they seek are discussed in detail in Chapter 3.

The feasibility study phase is the most important stage of the P3 project cycle in terms of financial assessment. A P3 feasibility study, also referred to as a business case or delivery options study, determines the financial viability and optimal delivery method for a project. It compares not only the extreme options of public delivery and design-build-finance-operate-maintain (DBFOM) contracts, but also intermediate options such as design-build-maintain (DBM), design-build-finance-maintain (DBFM), and design-build-operate-maintain (DBOM) in determining the scope of the project 4. The P3 feasibility study develops a risk allocation scheme for the project, defines key project performance requirements, and determines the evaluation factors to be used in the procurement. The P3 financial model (also known as the Shadow Bid) is developed as part of the feasibility study phase, and this is compared to the Public Sector Comparator using Value for Money Analysis. Spending the time required to develop a proper P3 feasibility study helps to ensure a smooth procurement and negotiation process.

The P3 feasibility study determines whether a project can or should be implemented as a P3 project and, if so, the type of P3 to use and the related contractual and risk arrangements for project implementation. The P3 feasibility study is not used to determine whether or not a project should be implemented. This is a separate exercise that is done using benefit-cost analysis to assess whether the societal economic benefits from project implementation exceed its societal economic costs. However, in some cases, a P3 delivery option may prove financially feasible where a public option is not financially feasible, if it offers significant cost savings or other innovations.

The P3 feasibility study is crucial to financial assessment and to ensuring value for money for the public authority. 5 As part of the P3 feasibility study, a detailed financial model is developed much like those that form FHWA's P3-VALUE tool. This enables the public authority to understand the key drivers of project financial viability and value for money and helps it maintain its bargaining position during the procurement and negotiation phases, particularly in terms of risk allocation.

The financial model and other project documentation that is developed as part of the P3 feasibility study phase are typically referenced and updated not only during procurement and negotiation but also throughout the implementation phase. This helps ensure that the project delivers the expected value for money. It also helps inform the public authority of issues to address in the design and procurement of other projects.

Table 2 summarizes the funding and financing for 10 examples of DBFOM transactions that occurred between 2007 and 2013. Many of these projects will be used as examples to illustrate the concepts presented. Descriptions of these projects can be found on the FHWA Office of Innovative Program Delivery website. The projects are very complicated and feature many sources of funding and financing. The amounts of those sources can change with time. For example, public authority contributions may change depending on actual bond proceeds or construction costs. Bond proceeds may be equal to the par amount of issuance or they may be more or less than the par amount of issuance. Contingencies may or may not be drawn during construction. For these reasons and others, the amounts presenting in this Guidebook may or may not conform to amounts provided by other sources of project information.

Where projects were financed with Private Activity Bonds (PAB), this Guidebook typically relies on the information in the Official Statements released as part of bond issuance, not only on amounts of project costs and sources of funding and financing but also for project arrangements and other qualitative and quantitative information. As such, this information reflects project details at financial close. Many project features may change after financial close, such as during the construction and implementation period. The Guidebook also relies on FHWA websites for some project information. Readers may wish to access other sources of project information.

| Project | P3 Concession Type | Financial Close | Subsidy | Debt | Private Equity | Tolls During Construction | Total | ||

|---|---|---|---|---|---|---|---|---|---|

| State Capital Subsidy | PABs | TIFIA | Bank Senior Debt | ||||||

| East End Crossing | AP | 3/28/13 | $677.0 | $78.0 | $755.0 | ||||

| I-95 HOT Lanes | Toll | 8/1/12 | $71.0 | $252.0 | $300.0 | $292.0 | $915.6 | ||

| Presidio Parkway | AP | 6/14/12 | $150.0 | $166.6 | $43.0 | $359.6 | |||

| Midtown Tunnel | Toll | 4/16/12 | $309.0 | $675.0 | $422.0 | $221.0 | $368.0 | $1,995.0 | |

| LBJ-635 Corridor (HOT) | Toll | 6/22/10 | $496.0 | $615.0 | $850.0 | $664.0 | $2,625.0 | ||

| North Tarrant Express (HOT) | Toll | 12/17/09 | $573.0 | $398.0 | $650.0 | $0.0 | $426.0 | $2,047.0 | |

| Port of Miami Tunnel | AP | 10/15/09 | $309.8 | $341.0 | $341.0 | $80.3 | $1,072.6 | ||

| I-595 | AP | 3/3/09 | $232.0 | $603.0 | $781.0 | $207.7 | $1,823.8 | ||

| SH-130 Segment V-VI | Toll | 3/7/08 | $430.0 | $685.8 | $209.8 | $1,325.6 | |||

| I-495 HOT Lanes | Toll | 12/20/07 | $409.0 | $589.0 | $589.0 | $0.0 | $350.0 | $1,937.0 | |

| Sources: Information on these projects was gathered from a variety of sources. For projects that were financed with Private Activity Bonds (PAB), the Official Statements (OS) provided much of the information. OS's are available for download online from the MSRB EMMA database: http://www.emma.msrb.org/. | |||||||||

These projects have some features in common. Most of them accessed Federal Transportation Infrastructure Finance and Innovation Act (TIFIA) program loans. They all feature some level of private equity financing. Most of the projects cost more than $1 billion, and several of them cost close to or more than $2 billion. The exception is the Presidio Parkway project at $360 million because it is essentially half of a project (only the northbound segments are included in Phase II that is being delivered as a P3). This project did not get an upfront subsidy, but did get a milestone payment which is not included in the table. The SH-130 project in Texas is the only project that was launched without upfront public subsidies. Four of the projects feature HOT lanes. Two projects (Presidio Parkway and Port of Miami Tunnel) are not tolled. Two are tunnels. Midtown Tunnel is the only project that relies on toll revenue during the construction period. This was possible because there is already an existing tunnel on which tolls were levied as the new tunnel is being constructed. Presidio Parkway, Port of Miami Tunnel, I-595, and East End Crossing are availability payment deals. For the other projects, the private partners accepted traffic and revenue risk, at least to some extent.

Most of the projects used long-term private activity bonds (PAB) as the source of senior debt. The I-95 HOT lanes project features PABs with principal payments spread out from year 18 to year 27. Repayment of the PABs for Midtown Tunnel is staggered from year 10 to year 30, with large payments due in Year 25 and Year 30. The LBJ-635 and North Tarrant Express PAB principal payments are spread out from year 20 to year 30. The Capital Beltway HOT Lanes PAB principal repayments are spread out year 30 to year 40.

The bank debt for Presidio Parkway and Port of Miami Tunnel was essentially in the form of construction loans. For Presidio, the loan was for 3.5 years and expected to be repaid with a milestone payment. The Port of Miami Tunnel bank debt included a $322 million, 5-year loan to be repaid with $450 million of milestone and final acceptance payments and a $22 million loan to be repaid from the first availability payment. For I-595, the bank debt was intended to serve as long-term financing. It had an original term of 10 years with the expectation of refinancing for another 12.5 years. The bank debt for SH-130 carried a 30-year term. That project came to financial close before the financial crisis. Other features of these projects will be discussed in relevant sections throughout the guidebook.

1 Available for download at: https://www.fhwa.dot.gov/ipd/pdfs/p3/model_p3_core_toll_concessions.pdf.

2 "Greenfield" refers to new or "new-build" projects whereas "brownfield" refers to the upgrading or expansion of existing projects. The "brownfield" terminology is unrelated to environmental issues such as pollution or contamination.

3 For a basic introduction to P3s of various types, the reader is directed to FHWA's Primer on P3 Concessions for Highway Projects

4 See Value for Money Analysis Guidebook for more information.

5 For detailed information on Value for Money analysis, see the FHWA P3 Toolkit Primer and Guidebook on the topic.