Tables

Figures

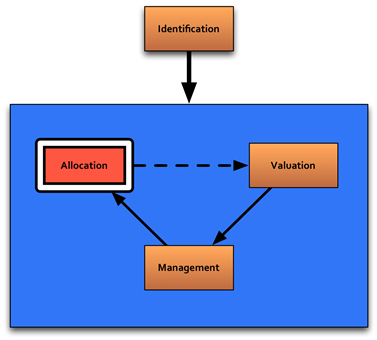

Figure 5-1 . Risk Allocation

Risk allocation (see Figure 5-1) between the public agency and private sector entity is one of the core principles of P3s. International and domestic studies show that the transfer of risk accounts for a large portion of the total forecasted VfM of the P3 approach. Therefore, the purpose of risk allocation as part of a risk assessment is to optimize this risk transfer from the public agency to the private sector.

A generally accepted principle is that risk should be allocated on the basis of both the ability and willingness of different entities to manage each risk. Risks that the private sector is more capable of managing are transferred; risks that the public agency is more capable of managing are retained.

Transferring too much risk to the private sector will result in higher risk premiums, making the project more costly and decreasing VfM. Public agencies that are starting to explore the potential of P3s for the first time may make the mistake of trying to transfer too much risk to the private sector. Conversely, transferring too little risk to the private sector constrains the magnitude of the VfM that can be achieved.

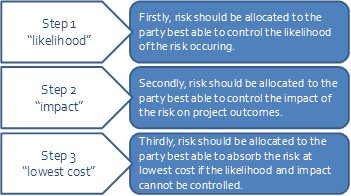

The P3 reference guide of the World Bank's Public-Private Infrastructure Advisory Facility (PPIAF) summarizes the risk allocation principles in three steps as seen below in Figure 5-2: 4

Figure 5-2 . Risk Allocation Principles

A successful P3 is not just about the party that is best able to manage the risk, but also:

Deciding which risks to allocate to which party brings up a number of questions that must be answered from the perspective of both the public agency and the private entity. For instance, it is important for the practitioner to ask: "To what extent can the public agency...

Naturally, the same questions must be asked concerning the ability of the private entity in a P3 procurement. The information above allows the most important question of all in risk allocation to be answered: "Who is best able to manage and absorb this risk?"

In addition to the above considerations, checks should be made to answer the following:

The team develops proposals for allocation of risks. The allocation proposals for risks 14-21 are shown below.

| Risk | Allocation | |

|---|---|---|

| 14 | Toll authorization procedure delayed. | The authorization procedure cannot be controlled by the contractor. The contractor can, to a certain extent, control the consequences (by preventing variable operational cost of toll operations whenever there is no toll revenue collection), which is why a sharing mechanism is applied in the P3 agreement |

| 15 | The Governor decides to change the scope because of local interests. | The risk cannot be managed by the private party at all and would be expensively priced if transferred, which is why PDOT retains this risk. |

| 16 | Costs increase because of rising oil prices. | The private party procures material in large quantities and is experienced in using hedges to mitigate cost increases. Therefore, the risk is transferred to the private party. |

| 17 | A concrete truck hits a construction worker. | The risk is related to the construction site. This is managed best by the private party. |

| 18 | Vandalism during operational period. | The private company can decrease the probability of this risk by implementing anti-vandalism measures. The risk is transferred to the private party. |

| 19 | Leakage in excavation for tunnel during construction. | The private party can influence the probability of the event by following all plans and procedures in this circumstance. Furthermore, they can mitigate the damage by applying measures to stop the leakage quickly. The risk is transferred to the private party. |

| 20 | Decision makers are unavailable during an election period. | The public party is responsible for the planning and the availability of its staff. The risk is retained by the public agency. |

| 21 | Uncertainty in cost estimates due to preliminary stage of design. | This risk can be transferred to the private party, because it is experienced at dealing with this. |

Process: Risk allocation is at the core of the structuring of any delivery method, and requires transaction experience and market knowledge. To a large extent the allocation determines the success of a contract and the VfM expected and achieved, and this is why risk allocation is an extremely important step in any P3 preparation process. The purpose of this step is not only to define the risk allocation, but also to develop the mechanisms to refine the risk allocation. An example of this is defining compensation events in the P3 agreement and also developing payment mechanisms. The financial and legal teams typically execute this because it requires both distinct disciplines.

Timing: The initial risk allocation has to be determined before the drafting of the P3 agreement is completed. In practice, the process of drafting the agreement often triggers discussions on risk allocation, and this can be facilitated by a sound risk assessment.

Information: Optimal risk allocation in a P3 is by definition project-specific and evolves over time. At the same time, 95% of the risk allocation should be similar to other projects based on the same delivery method. In order to avoid "reinventing the wheel," a good starting point is to look at earlier transactions to understand the considerations in the risk allocation. The FHWA model contracts (under development) are also a good source for further guidance on risk allocation. Optimal risk allocation in a P3 evolves over time; therefore it is advised to look at more recent and up-to-date contracts .

Defining the optimal risk allocation can be quite challenging. In a risk allocation workshop, participants are asked to jointly answer the key questions as described in section 5.2.3. There is no need to do this individually, but it is more important to jointly determine a convincing argument for a risk allocation for each of the risks. In some instances, the VfM assessment not only proves helpful for the allocation of individual risks, but more importantly for maintaining the focus on VfM as the leading principle throughout the project's development.

The next step is to define the mechanisms reflecting this risk allocation. Most mechanisms-like the definition of, and compensation for, supervening events-are standard, and have been used in most prior P3 transactions. However, the devil is in the details, and project-specific considerations may lead to adjustments in these mechanisms.

Expertise: As in all other steps in risk assessment, risk allocation requires input from a range of disciplines:

Preferably these experts have also been involved in project risk identification to ensure that everyone present has a good understanding of the specific risks.

The output of this process is an optimal risk allocation to be included in the P3 agreement, and the reflection of the risk allocation-and retained risks-in the PSC and the shadow bid. The outcome of the analysis can be used in the VfM assessment to assist in choosing the optimal delivery method.

4. PPIAF. Public Private Partnership Reference Guide. 2012. https://ppiaf.org/documents/1317?ref_site=ppiaf