P3s can involve existing "brownfield" projects (i.e., the lease of an existing facility), or they can involve proposed new facilities, which are known as "greenfield" projects.

For brownfield projects, a public entity generates a capital inflow or debt payoff by transferring the rights, responsibilities, and revenues attached to an existing asset to a private sector entity for a defined period. Risks to the private entity are lower, because little or no new construction is involved, and traffic volumes and toll revenues can be more accurately projected based on existing traffic patterns.

In the case of a greenfield project, a public agency transfers all or part of the responsibility for project development, construction, and operation to a private sector entity. Greenfield projects generally present higher risks to both parties than do brownfield projects because of the greater uncertainty surrounding traffic forecasts, permitting, and construction. Given the complex role that revenue risk plays in a P3 deal, this particular risk is generally separated from other risks when considering whether to have a toll concession or an availability payment concession (discussed later in this chapter).

In the case of a hybrid project, an existing facility is in need of capital improvement (usually either extension or expansion), and a private sector entity is brought in to finance the necessary improvements and to operate the facility. Although traffic risks may be lower for a hybrid project relative to a greenfield project, they may still be significant because of difficulties in forecasting the users' willingness to pay any new or substantially increased tolls that may be proposed to cover the costs for the project. In addition, there may be contentious issues with regard to latent defects.

P3s encompass a variety of contractual structures, with various degrees of risk transfer to the private sector. The extent of risk transfer in the most common forms of project procurement is illustrated in table 1.

| P3 Structure  |  Design Risk | Construction Risk | Financial Risk | O&M and Rehab Risk | Traffic Risk | Revenue Risk |

|---|---|---|---|---|---|---|

| Design-Bid-Build (DBB) | Partly | |||||

| Design-Build (DB) | X | X | ||||

| Design-Build-Finance (DBF) | X | X | X | |||

| Design-Build-Finance- Operate-Maintain (DBFOM) |

X | X | X | X | Yes, if toll or traffic-based payment | Yes, if performance-based payment |

Note: P3 = public-private partnership, O&M = operations and maintenance, Rehab = rehabilitation.

Detailed description of Table 1

Procurement models and range of risk transfer to the private sector. This table describes the various risks associated with different types of P3 project procurement structures. Four P3 structures are listed on the far left column: Design-Bid-Build (DBB), Design-Build (DB), Design-Build-Finance (DBF), and Design-Build-Finance-Operate-Maintain (DBFOM); six types of risk are also listed: design risk, construction risk, financial risk, O&M (operations and maintenance) and rehab (rehabilitation) risk, traffic risk, and revenue risk. There is a partial construction risk associated with the DBB model. Under the DB model there are design and construction risks. DBF has associated design, construction, and financial risks. Finally, under the DBFOM model there are design, construction, financial, O&M and rehab, traffic (if toll or traffic-based payment), and revenue (if performance-based payment) risks.

The P3 structure with the lowest level of private sector involvement is DB. Under DB, the same firm is responsible for both the design as well as the construction of the facility, whereas under the conventional design-bid-build (DBB) approach, separate firms are responsible for design and construction. For both structures, the public agency remains responsible for financing and operating the project; however, a greater amount of risk is transferred to the private sector entity under a DB structure, because the contractor provides a maximum price for both design and construction. The principal reason that DB transfers significant risk away from the public owner is that many construction claims arise due to issues at the design-construction interface, including design errors and omissions and constructability problems. The DB form of contract eliminates the source for construction claims of this type by introducing single source accountability.

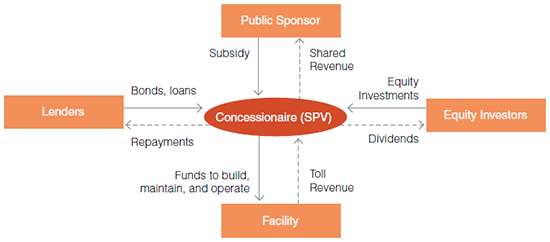

With a design-build-finance (DBF) structure, the private sector entity is in charge of financing and building the project but leaves the O&M of the facility to the public agency. Design-build-finance-operate-maintain (DBFOM) adds private financing to the design, construction, and O&M of the project (see figure 1). The public agency may have to provide a public subsidy to the project, which may require use of bond proceeds or budgetary authority, but the public agency will not usually finance the entire project under this P3 structure. This form of P3 is also called a concession.

In the case of a toll-based DBFOM concession, the private sector entity shoulders a considerable amount of risk linked to the uncertainty of traffic over the life of the project. The investment decision and the financing structure are determined based on traffic projections: If actual traffic is lower than projected, then the private sector partner is exposed to financial loss and to the risk of defaulting on project debt. If traffic and revenue are higher than expected, then the private partner could make super profits. To protect against this, a revenue-sharing clause is usually included in the P3 agreement. In some P3 agreements, the concessionaire may be protected from revenue shortfalls when lower than expected traffic is realized by allowing for "flexible term" concessions and "revenue bands." With flexible term concessions, the term of the concession ends when a specified net present value (NPV) of the gross toll revenue stream is reached. With the revenue band approach, upper and lower bounds of the expected toll revenue stream are set contractually. On one hand, if toll revenue is below the lower bound, then the public sponsor provides a subsidy to make up some of or the entire shortfall. On the other hand, revenues in excess of the upper bound are shared with or turned over entirely to the public sponsor.

Figure 1. Public-private partnership structure under a design-build-finance-operate-maintain concession. Solid lines = cash flows into project. Dotted lines = cash flows out of project. SPV = Special Purpose Vehicle.

Detailed description of Figure 1

Public-private partnership structure under design-build-finance-operate-maintain concession. The diagram illustrates cash flows going into a project (represented by solid lines) and cash flows going out of a project (represented by dotted lines). In the middle of the diagram a dark orange oval represents the Concessionaire (Special Purpose Vehicle). Surrounding the concessionaire are four lighter orange rectangles that represent the Public Sponsor, Equity Investors, Facility, and Lenders, with solid and dotted lines going to and from the concessionaire to the lighter rectangles depicting cash flows in and out. Cash flows go from the public sponsor to the concessionaire via subsidy, and go out from the concessionaire to the public sponsor via shared revenue. Cash flows go from equity investors to the concessionaire via equity investments and go back via dividends. Cash flows go from the facility via toll revenue and return from the concessionaire via funds to build, maintain, and operate. Finally, cash flows go from lenders via bonds and loans and return via repayments.

Excessive traffic risk can deter private sector entities or reduce their ability to secure financing. For greenfield projects, traffic volume is more difficult to accurately forecast than for already existing brownfield projects. Public agencies may therefore modify the P3 structure for greenfield or hybrid projects to offer guaranteed payments to the private sector partner. A shadow toll-based concession allows the public agency to compensate the private sector entity based in part on a "shadow toll" or fee 3 paid by the public agency for each vehicle that uses the facility. Such payments generally have a fixed component that guarantees partial revenue, even if traffic volume were to be below projections.

With an availability payment-based concession, the public agency retains the traffic risk by making payments directly to the private sector partner based on the availability of the facility rather than on the number of vehicles. Payments are contingent on achievement of pre-agreed performance standards; however, the private entity is exposed to long-term appropriations risk. Examples in the United States include the Interstate-595 express lanes in Florida and the Presidio Parkway in California.

3. A shadow toll is called a pass-through toll in Texas and is used primarily for interagency agreements rather than for concession agreements.