Presentation 1

Value Capture: Special Assessments

Value Capture Techniques Summary

- Developer Contributions - One-time charges collected by local governments from developers to offset the cost of infrastructure and services necessitated by new development.

- Special Assessments - An additional fee or tax assessed on businesses or residents in specified geographic areas benefiting proximity to a highway or other transportation facility or corridor.

- Fees - Similar to a utility fee, transportation fees are assessed based on how individual businesses and households use transportation facilities.

- Incremental Growth - A mechanism allocating back to infrastructure from some specified portion of increased property tax revenues fostered by new infrastructure - often for a specified period of time.

- Joint Development - Sale or lease of land or air rights on or adjacent to transportation facilities. This can include donations of land or other in-kind resources from the private sector in ongoing commercial operations.

- Concessions - Sale or lease of government owned assets - such as toll roads or bridges - to private-sector investors/operators.

- Advertising and Naming Rights - Sale of advertising space or naming rights on a transportation facility. Note: Commercial uses within Interstate Highway System right of way, including rest areas, is prohibited by law; however, they may be allowed on toll facilities and in transit stations.

Outline of Presentation

- Key Distinctions

- Special Assessments Overview

- Why is Special Assessment Needed?

- Transportation Improvement District

- Community Development District

- Federal Roles

- Case Studies

- Q&A

Key Distinctions: Funding vs. Financing

- Revenue/Funding: Where does the funding come from?

- Traditional: Federal-aid (HTF) & State grants

- Innovative: Other than traditional i.e. Value Capture

- Financing: Pay-As-You-Go versus Borrowing

- Pay-as-you-go

- Public borrowing (Innovative Finance)

- Private equity

- Project Delivery: Shifting responsibility & risk

- Traditional (design-bid-build)

- Construction Manager/General Contractor (CM/GC)

- Design-Build (DB)

- Public-private partnerships (P3s)

Key Distinctions: Taxes vs. Assessments

Is an assessment a tax? No.

Differences

| Taxes | Assessments |

|---|---|

| Primary purpose is to raise revenue | Primary purpose is to recover costs |

| Need not benefit property owners | Must specifically benefit property owners |

| Authorization by general law | Authorization by home rule powers |

| Legislature must prescribe a tax base | Local Governments may develop the rate of assessment and method of apportioning costs |

| Proportionality not required | "Reasonableness" required |

Why is Special Assessment Needed?

Capacity & Conditions Funding Challenges

- Two out of every five miles of America's urban interstates are congested

- Cost the country $160 billion in wasted time and fuel

- One out of every five miles of highway pavement is in poor condition

- $836 billion backlog of highway and bridge capital needs

- 35,092 people killed in motor vehicle crashes

- Pedestrian deaths on US roads increased 11% since 2015; (5,977 in 2017)

| Year Built | Age in years | Total bridges | Poor quality |

|---|---|---|---|

| No Value | No Value | 25 | 0 |

| 1899 and earlier | 119 or more | 1,731 | 514 |

| 1940-1949 | 109-118 | 5,876 | 1,840 |

| 1910-1919 | 99-108 | 5,692 | 2,055 |

| 1920-1929 | 89-98 | 17,923 | 3,895 |

| 1930-1939 | 79-88 | 41,275 | 7,057 |

| 1940-1949 | 69-78 | 25,487 | 4,034 |

| 1950-1959 | 59-68 | 63,159 | 7,664 |

| 1960-1969 | 49-58 | 99,041 | 8,996 |

| 1899-1969 | 119-49 | 260,209 | 36,055 |

| 1970-1979 | 39-48 | 81,671 | 5,390 |

| 1980-1989 | 29-38 | 78,112 | 3,043 |

| 1990-1999 | 19-28 | 81,393 | 1,486 |

| 2000-2009 | 9-18 | 71,666 | 449 |

| 2010-present | 0-8 | 43,445 | 91 |

| Total | 616,496 | 46,914 |

Condition of Roads (D+)

- 45 % of America's major roads are in poor or mediocre condition.

- 15% of U.S. rural roads are rated in poor condition, while 21% are in mediocre condition

| Ownership | Federal-Aid Highways | Non-Federal-Aid Highways | Total |

|---|---|---|---|

| Rural | 668,082 | 2,280,612 | 2,948,696 |

| Small Urban Area | 71,792 | 151,935 | 223,7327 |

| Urbanized | 287,974 | 723,310 | 1,011,285 |

| Urban | 359,767 | 875,245 | 1,235,012 |

| Total | 1,027,848 | 3,155,858 | 4,183,707 |

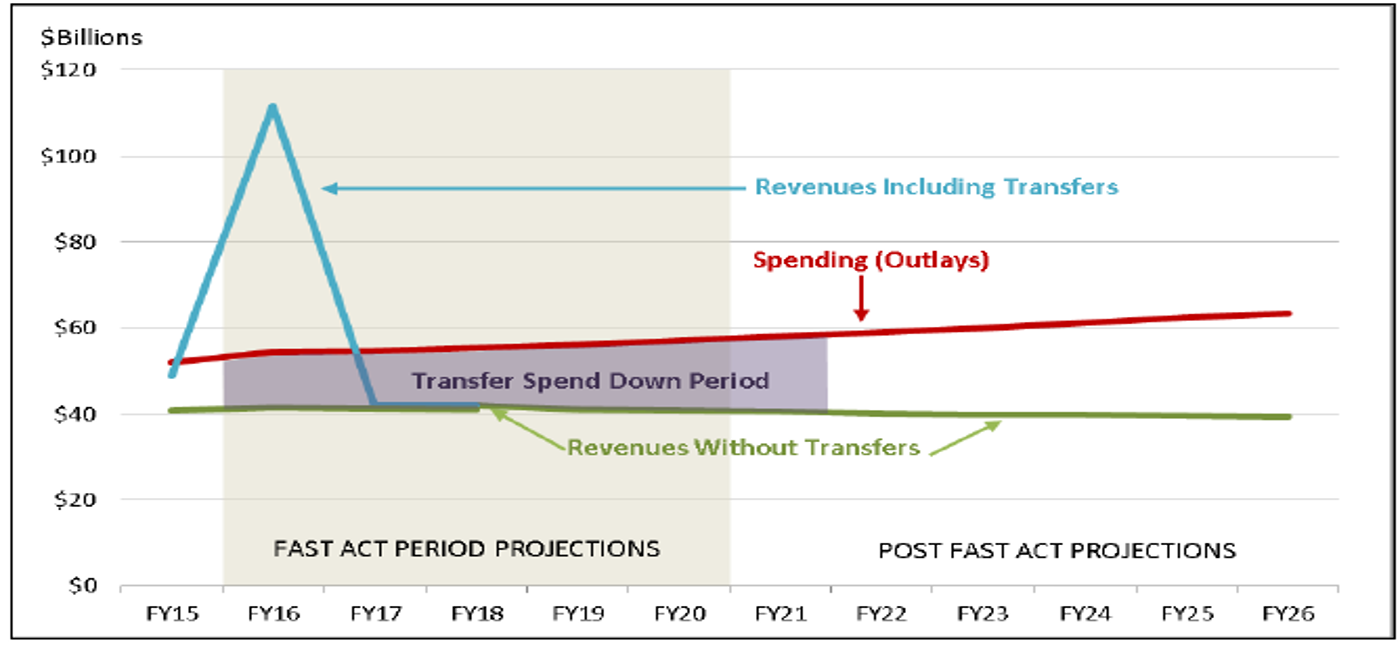

Highway Trust Fund is Unsustainable

Notes: Includes highway account and mass transit accounts combined. Revenues include interest on HTF balances. The shading between spending and revenues indicates the period that the HTF balance is maintained by the transfers from the general fund and the LUST fund.

Special Assessment Districts

Special Assessment Districts Overview

- A fee imposed on property owners to help pay for public infrastructure improvement

- Authorized in 50 States and accessed by Local Governments

- A defined geographic areas determined to benefit from special services or improvements

- Assessment must in proportion to the special benefits received from the improvements

- Must have majority support of those properties being accessed to be effective

- Operated by a separate political subdivision with a board of directors

Benefits: Special Assessment Districts

- Promotes economic development, job creation, and an increased tax base for local governments

- Alleviate burden of increase in property taxes to the entire community

- Preserves debt capacity of jurisdictions

- New source of capital funding

- Provide a reliable source of funding for local governments

- Competitive advantage among public agencies

- Access to Federal Innovative Finance Program

- Source of matching state & Federal grants

Structures/Models: Two Types

- Government Districts (Transportation Improvement District/Transportation Development District)

- Initiated by the local government (sometime self assessed)

- Establish specific assessment duration

- Community Improvement District (Business Improvement Districts/Neighborhood Districts)

- Voluntarily imposed assessment/fee by the property owners

- Establish specific assessment duration

Transportation Improvement Districts

Government Special Assessment Districts By Any Other Name...

- Special Assessment District (SAD)

- Community Facilities District (CFD)

- Community Development District (CDD)

- Special Service District (SSD)

- Transportation Improvement District (TID)

- Transportation Development District (TDD)

- Others

Overview

- Formed as a separate political subdivision with a board of directors

- Can levy special assessments and/or collect sales taxes on retail sales within the district

- Focus on transportation infrastructure improvements & services within the district

- Fixed amount of time

- Notice and public hearing is required if sales tax levy is involved, but not if only special assessment

- Must be uniformly applied to the same class of property

- Subject to voter referendum

Transportation Improvement District & Innovative Finance

- Matching Share for Federal & State grant

- Federal Credit Assistance Program

- TIFIA/RRIF

- TIFIA/State Infrastructure Bank

- Section 129 Loans

- State Infrastructure Banks

- Capital Market

- Revenue Bonds

- General Obligation Bonds

- Private Equity

- Project Delivery: DBB, DB, CMGC, P3s

Steps in Establish Special Assessment District

- Determine Boundary & Improvement (Review State, Local, and MPO Plans and Policies)

- Stakeholder/ Community Outreach

- Feasibility Study Engineer's Report (cost & budget)

- Funding Plan (Duration & Max Assessment)

- Survey Community (Public Hearings)

- Determination to Proceed Based on Survey

- Public Hearings and Balloting Process

- Implementation Initial Project Funding Procurement

Example: Street Light Assessment, Dayton Ohio

- A six-year property assessment to all property owners benefits of street light system improvements

- Applied to all property owners, residential, commercial, and industrial properties

- Project scope: Provide a standardized public street lighting system citywide that will promote safety and security in our neighborhoods, business districts, and across the city's 1,800 lane-miles of roadways.

- Project Cost $18 million for six-years

- No assessment to neighborhoods without street lighting and neighborhood-supported street lighting

U.S. Highway 36 - Interstate 72 Corridor Transportation Development District

- Value Capture: Sales & Use Tax Districts/Transportation Development District

- Voters approved a half-cent sales tax on all taxable transactions in April 2005 to construct Route 36/I-72

- Within the boundaries of the district.

- Length 15 years

- The four-lane was finished in 2010

- Repealed in August 2017 after paid off debt obligation

- Scope: 52 - mile expansion project of U.S. Highway 36 from two to four lanes

- Project Cost: $75.5 million

- $34.3 million borrowed from Missouri Transportation Finance Corporation (MTFC) in 2008

Community Improvement Districts

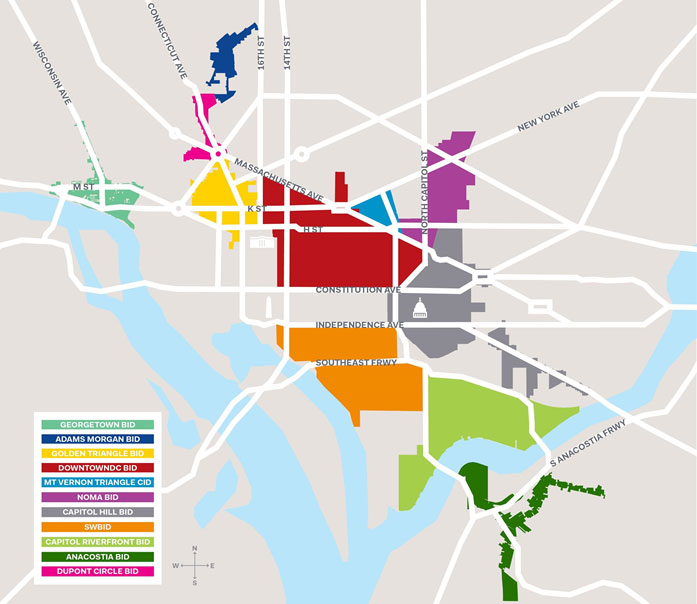

Community Improvement Districts By Any Other Name...

- Local Improvement District

- Public Improvement District

- Special Service Area (SSA)

- Community Improvement District (CID)

- Neighborhood Business District (NBT)

- Special Improvement District (SID)

- Business Improvement District (BID)

- Business Improvement Area (BIA)

- Business Revitalization Zone (BRZ)

- Tourism Public Improvement District

Community Improvement Districts

- A development tool that allocates costs according to the benefits received

- Formed by local business and property owners

- Self-imposed and self-governed assessment to fund infrastructure improvements and services

- Not a political subdivision of the state, county or municipality- No separate taxing authority

- Only property in the district impacted; No other property effected

- Requires majority support from property owners (>50%)

Benefits: Community Improvement Districts

- Can finance a wide variety of services including transportation improvements

- Provide economic development services by working to attract, retain and expand businesses

- Leveraging resources

- Can provide cap on assessments and periodic review to ensure that CID services are effective

- Creating a unified voice to increase a business district's influence

- Creating and maintaining a cleaner, safer and more attractive business district

Creation of Community Improvement District (Local Level)

- CID Enabling Legislation

- Buy-In

- Obtain Signatures from >50% of Property Owners

- Certification

- Submit Consent Forms & Map to Tax Commissioner(s) for Certification

- Petition

- Submit Tax Commissioner Certification(s) Consent Forms, and Map to Jurisdiction(s)

- Resolution

- Each Jurisdiction Approving the CID Adopts a Resolution Approving Creation of that CID

- Cooperation Agreement

- CID Elects a Board and Develops a Cooperation Agreement with Each Jurisdiction

Governance & Administration

- The CID is governed by a Board of Directors (5 - 30)

- Elected by registered voters living within the CID's boundaries, but if there are no registered voters, then the property owners within the district (who have one vote per acre of real estate owned)

- Has to be either an owner of real estate within the district or of a business operating within the district or be the authorized representative of same, or be a registered voter residing within the district

- Administration: Most have a management company or staff

What Powers Does the CID Have?

- To acquire real estate within its boundaries

- To sell real or personal property

- To borrow and loan money

- To receive grant from State, Federal and Private Sector

- To construct, install, maintain, and equip any of the public improvements and services

Ongoing CID Responsibilities

- Sunshine Law compliance

- Annual budget submittal

- Annual meeting

- Report to municipal clerk and Dept. of Economic Development

- Report to State Auditor's office

- Board member elections/appointments

- Cooperative Agreement compliance

- Accountable to those who pay consisting of property and business owners within the district

Federal Roles

Federal's Role in Value Capture Strategies

Value Capture Implementation Team

- Co-Leads

- Thay Bishop, FHWA Office of Innovative Program Delivery

- Stefan Natzke, FHWA Office of Planning, Environment, and Realty

- Members

- Jennifer Ahlin, Virginia Department of Transportation

- Janine Ashe, FHWA District of Columbia Division

- David Cohen, FHWA Office of Project Development & Env. Review

- John Duel, FHWA Office of Planning, Environment, and Realty

- Kathleen Hulbert, FHWA Infrastructure Office

- Chip Millard, FHWA Freight Management & Operation

- Diane Mobley, FHWA Chief Counsel Office

- Kevin Moody, FHWA Resource Center

- Ben Orsbon, South Dakota Department of Transportation

- Jill Stark, FHWA Office of Planning, Environment, and Realty

- Lindsey Svendsen, FHWA Office of Planning, Environment, and Realty

- Jim Thorne, FHWA Office of Planning, Environment, and Realty

- Bingxin Yu, FHWA Transportation Policy Studies

VCIT Focus Areas

- Communication - Developing the tools to help FHWA staff and others promote Value Capture to local public agencies (Value Capture Implementation Manual)

- Technical assistance - Providing technical assistance to local public agencies interested in pursuing Value Capture (Peer Program)

- Clearing House (website) - Identification of best practices and lessons learned and promoting further discussion on innovative funding options for local public agencies, lessons learned from past and current efforts, etc.

Clearinghouse for best practices/lessons learned

EDC-5 Funding Opportunities

- State Transportation Innovation Council (STIC) Incentive

- Up to $100,000 per STIC per year to standardize an innovation

https://www.fhwa.dot.gov/innovation/stic/

- Up to $100,000 per STIC per year to standardize an innovation

- Accelerated Innovation Deployment (AID) Demonstration

- Up to $1million available per year to deploy an innovation not routinely used

https://www.fhwa.dot.gov/innovation/grants/

- Up to $1million available per year to deploy an innovation not routinely used

Contact

Thay Bishop

e-mail: thay.bishop@dot.gov

Tel: 404-562-3695 or ValueCapture@dot.gov