July 2020

This document is intended to respond to frequently asked questions (FAQs) about two infrastructure finance tools for local governments that are often confused with each other: Transportation Reinvestment Zones (TRZs) and Texas Tax Increment Reinvestment Zones (TIRZs). The questions and answers that follow are intended to increase the reader’s understanding of these two tools while highlighting their differences and similarities.

Currently, the States of Texas and Utah are the only ones that have enacted enabling legislation for the use of the first tool, the TRZ. Texas first authorized TRZs in 2007, and the first TRZs were created in 2009. Since then, the legal framework has evolved as a result of the implementation experience, expanding their use and clarifying the process or requirements to establish one.i As of 2019, there were 14 active TRZs in Texas. The legal framework for the creation of TRZs in the State of Texas is laid out in Chapter 222 of the Texas Transportation Code, Sections 222.105-108. These provisions include relatively detailed requirements for local governments.ii

The State of Utah enacted its TRZ enabling legislation in 2018 and amended it in 2019. Since then, and as of the end of 2019, no TRZs have been created in the State. The provisions governing the legal framework for TRZs in the State of Utah are contained in Section 11-13-227 of the Utah Code.iii However, the implementation guidance included in those provisions is relatively limited compared to the legislation in Texas. As a result of the limited implementation guidance and lack of experience with TRZs in Utah, the answers to the TRZ questions presented in this document are largely based on the legal requirements and experience from the State of Texas.

The second tool, the TIRZ, is the Texas version of a tax increment financing (TIF) district, an infrastructure finance tool that is also available in most other States, with the exception of Arizona. The legal framework for the TIRZ is laid out in Chapter 311 of the Texas Tax Code, the Tax Increment Financing Act (Sections 311.001-311.021).iv As a result of their similar acronyms and underlying principles, the TRZ and the Texas TIRZ are often confused with each other. This document is not intended to address all FAQs on TIF districts. Rather, it is intended to clarify the key differences, advantages, and disadvantages that exist between TRZs and TIRZs in the context of Texas. To the extent guidance is available, relevant Utah-specific differences have also been highlighted in the answers.

TIF is a value capture revenue tool for local governments that uses taxes on future gains in real estate values to pay for infrastructure improvements. TIFs are authorized by State law in nearly all 50 States and begin with the designation of a geographic area known as a TIF district. The TIF creates funding for public or private projects by borrowing against the future increase in property-tax revenues. Plans for specific improvements within the TIF district are developed with the intent to enhance the value of existing properties and encourage new development in the district.

TIF districts are usually established for a period of 20 to 25 years, during which time all incremental real estate tax revenues above the base rate at the time the district is established flow into the TIF. The proceeds from the TIF can be used to repay bonds issued to cover up-front project development costs. Alternatively, they can be used on a pay-as-you-go basis to fund individual projects.

Thousands of TIF districts have been established around the U.S. in cities of all sizes. They are commonly used to promote housing, economic development, and redevelopment in established neighborhoods. Although TIF has not been used extensively to fund transportation infrastructure, some State laws specifically authorize the use of TIF for transportation infrastructure improvement purposes.

A TRZ is an infrastructure finance tool that relies on the principles of TIF to help pay for transportation improvements. TRZs are currently available to local governments in the States of Texas and Utah. A TRZ allows local government entities with taxing authority to set aside funding contributions for a transportation project by capturing a portion of the increase in land values and new development spurred by the transportation project. A TRZ is also the legal mechanism that allows a local jurisdiction to designate a contiguous area around a transportation project as an impact zone to capture a portion of the increment in future local property and/or sales tax revenues resulting from the growth in the zone’s tax base.v The incremental tax revenue is used to support funding and financing of the project. Thus, the land development attributable to the project is used to finance the project.

As described in the introductory section of this document, Texas enacted enabling legislation for TRZs in Texas in 2007, and a number of TRZs have been established since then. Some of the first TRZs established were the City of El Paso’s TRZ No. 2 and TRZ No. 3 in 2010, which were used to generate local match funds toward the approximately $1 billion El Paso 2008 Comprehensive Mobility Plan. The TRZs were anticipated to generate $70 million to implement projects in the plan.vi TRZ experience in Utah has been more limited because the enabling legislation was enacted more recently.vii

TIRZs are the Texas version of the traditional TIF district. TIRZs set aside property tax increments after a designated base year and dedicate these increments to fund a variety of urban improvements within a specific zone. In Texas, TIRZs can be used to fund improvements for utilities, landscaping, streetscaping, exterior facade improvements, and most other infrastructure enhancements within the zone. In some instances, TIRZs have been used for transit (e.g., transit stations) or bicycle and pedestrian improvements like sidewalks and bike paths, as in the cities of Fort Worth and Georgetown.

A TRZ is very similar to a TIRZ in that it is also a TIF mechanism used to set aside property tax increments, but a TRZ differs from a TIRZ in that the TRZ is explicitly dedicated to transportation improvements in almost every transportation mode. In addition, there are two other key differences between a TIRZ and TRZ that have made TRZs a popular tool for transportation funding.

First, TRZs are easier to create than TIRZs. According to sections 222.105-108 of the Texas Transportation Code, a TRZ can only be initiated by a local government and requires approval only from its governing body (City Council or Commissioner’s Court) after public hearings are held. On the other hand, a TIRZ has a more complex initiation mechanism. Chapter 311 of the Texas Tax Code states that a TIRZ can be initiated by a municipality, or by petition of the property owners who own the majority of the appraised property value within the zone. If initiated by the city, a majority of the property owners have to approve. Also, a TIRZ can only be initiated by a city if not more than 10 percent of the land is residential.viii Second, TRZs have a less complex governance structure. According to Texas law, a TRZ does not require creation of a separate governance or oversight structure once it has been approved by the governing body of the local government. On the other hand, the Texas Tax Code requires the creation of a TIF Board of Directors for a TIRZ.

Utah law differs from Texas law in that the Utah Code (section 11-13-227) requires that two or more public agencies–at least one of which has land use authority over the TRZ–agree and initiate a TRZ. A Utah TRZ is governed by interlocal agreement(s) between the public entities that agree to establish it.

The Texas Transportation Code (sections 222.105-108) currently allows municipalities, counties, and port authorities to establish TRZs. However, according to several Texas Attorney General opinions, Texas counties are constitutionally prevented from using TIF revenue to pledge to the repayment of debt issued for a project (including a transportation project) aimed at developing or redeveloping an area within the county.ix The office of the Texas Attorney General has made it clear that use of county TRZ revenue to secure debt could be constitutionally challenged, and that even collecting and using county TRZ funds on a pay-as-you-go basis may also be subject to constitutional challenge.

On the other hand, section 11-13-227 of the Utah Code is broader, as it allows a number of different types of public agencies to establish a TRZ. These include among others: municipalities, counties, and other political subdivisions of the State, as well as the State or any department or division of the State.

TIRZs can be used to fund a variety of infrastructure improvements, including utilities, landscaping, streetscaping, exterior facade improvements, among others. In some instances, TIRZs have been used for transit, bicycle, and pedestrian improvements, such as transit stations, sidewalks, and bike paths (e.g. cities of Fort Worth and Georgetown). Chapter 11 of the Texas Tax Code provides that the governing body of a municipality may create a TIRZ if it determines that development or redevelopment within the zone would not occur solely through private investment in the reasonably foreseeable future. Like in many States where areas must be blighted in order for a TIF district to be created, blight is a requirement to set up a TIRZ in Texas.

On the other hand, sections 222.105-108 of the Texas law allows for the creation of a TRZ for a variety of transportation projects as defined in section 370.003 of the Texas Transportation Code.x This definition includes among others, tolled and non-tolled roads, passenger or freight rail facilities, certain airports, pedestrian or bicycle facilities, intermodal hubs, parking garages, transit systems, bridges, certain border-crossing inspection facilities, and ferries. The law gives the governing body of a local government the ability to create a TRZ if it determines: 1) an area to be unproductive and underdeveloped; and 2) that the creation of the zone will: promote public safety; facilitate the improvement, development, or redevelopment of property; facilitate the movement of traffic; and enhance the municipality’s ability to sponsor a transportation project. Additionally, a finding of blight is not a requirement to set up a TRZ.

Laws governing TRZs in Utah allow the agencies to define the transportation need and proposed improvement within the zone. They do not explicitly require a finding of underdevelopment or blight as a precondition for establishing the zone. While a legal framework such as Utah’s may allow for more flexibility, the experience in Texas shows that developing further guidance in the original enabling legislation encouraged more local agencies to consider using the tool. As a result, the Texas Legislature amended the law in subsequent legislative sessions to clarify implementation steps and remove certain requirements.xi

TRZs have been used to fund projects in a variety of settings. In Texas, there are examples of them in large urban areas such as El Paso, as well as in suburban communities like the town of Horizon City. Rural communities such as El Campo have also successfully used TRZs to fund transportation improvements. As a result, the scale of improvements for which TRZs have been applied ranges from direct connect links at large interchanges on the interstate system to smaller capacity additions on the State highway system.

For the most part, TRZs are used as gap financing only. They have been used to provide only a portion of the project funding needed commensurate with the size of the local tax base and local government priorities.

When compared to other value capture techniques, the most significant advantage of TIF-type tools such as TRZs and TIRZs is that they are not a new tax or a tax increase.xii In other words, the existing tax rate does not necessarily change as a result of creating a zone. Zone revenue is only realized if the real property tax base within the zone grows through some combination of land development, land-use up-zoning, and land value increase. Another advantage of TRZs and TIRZs is that they can be used to raise funds for a wide variety of transportation projects, including highways, ports, and streets, as well as transit and pedestrian improvements. Finally, TRZs have a successful track record of providing Texas municipalities with access to State Infrastructure Bank (SIB) financing at very advantageous terms (i.e., low interest rates and long-term tenure) when TRZ revenues are pledged as collateral.

Aside from enabling legislation currently being limited to only two States (Texas and Utah), TRZs do not have relative disadvantages when compared to traditional TIF financing tools such as TIRZs. However, TRZs (and TIF districts in general), have some disadvantages compared to other value capture tools.

First, TRZ revenue is received in annual increments starting in the base year (the year in which the TRZ is created). Because annual revenues are driven by growth in the tax base within the zone relative to the base year, the initial years normally provide relatively small increments of new revenue. In those cases, there is limited flexibility when using the funds on a pay-as-you-go basis. As a result, TRZs are most effective when future TRZ revenues are pledged to secure through debt the capital needed to implement the project.xiii Because future TRZ revenue depends on local real estate market conditions, securing debt from private capital markets may be cost-prohibitive in many cases, leaving local governments with a SIB loan as their most cost-effective option.

Although SIB loans offer very advantageous conditions in terms of interest rate and tenure, they add some constraints to the type of projects that local governments can undertake using a TRZ. This is because SIBs are typically funded through a blend of Federal and State funds. Consequently, in order to access a SIB loan, a project must be eligible for funding under Title 23 of the U.S. Code (Federal Aid Highways, 23 U.S.C. 602). This usually means that a project must be on a State’s highway system and included in the statewide Transportation Improvement Plan, and a local government cannot use SIB funding for a TRZ project that is off-system. Additionally, in order to receive SIB financing the project must have successfully completed the Federal environmental process, which may add time and cost to the project.

Finally, although Texas counties are explicitly allowed to create TRZs, they are constitutionally prevented from using TIF revenue to pledge to the repayment of debt issued for a project (including a transportation project) aimed at developing or redeveloping an area within the county. Several Texas Attorney General opinions have made it clear that use of county TRZ revenue to secure debt could be constitutionally challenged, and that even collecting and using county TRZ funds on a pay-as-you-go basis may also be subject to constitutional challenge. This has rendered existing Texas counties unable to use TRZ revenue to fund transportation improvements, which effectively prevents them from considering TRZs and TIRZs as a value capture transportation funding technique option.xiv

TRZ revenues are driven by conditions in the real estate market within the zone. There are two real estate market forces driving TRZ revenue. The first is demand for the development of undeveloped land or upzoning of already developed land to a higher and better use. The second is a general increase in the value of existing property, also driven by demand. Consequently, selecting projects that demonstrate economic benefits to the region (such as significant improvements in accessibility) will in turn drive development within the zone and tax revenue. Typically, this starts with a project being identified in a long-term planning/capital improvement program.

TRZs and TIRZs are not a new tax. Creating a TRZ or a TIRZ to fund a transportation project does not require an increase in existing property or sales tax rates. Zone revenue is only realized if the real property tax base within the zone grows through: land development, up-zoning of land that is already developed, a general increase in land values, or a combination of these.

In 2007, the Texas Legislature created the legal framework for TRZs through State Senate Bill 1266. The first Texas TRZs were established between 2009 and 2010. The Texas TRZ legal framework has evolved in subsequent legislative sessions that have clarified the process and requirements to establish them, and modified or expand the uses and types of TRZs. As of 2020, more than 14 local government TRZs have been created in Texas to support a wide variety of projects. On the other hand, TIRZs have been used in Texas since 1982, but became more widespread after 1996. As of 2018, there were 298 TIRZs throughout the State.xv

In Utah, the State Senate adopted Senate Bill 136 in 2018, which, among other transportation provisions, allows the creation of TRZs. Nevertheless, no TRZs had been established in Utah as of 2019.

Only two States currently have TRZ enabling legislation, Texas and Utah, and although both are based on the same TIF principles, the specific requirements vary in each State.

The legal framework for the creation of TRZs in the State of Texas are laid out in Chapter 222 of the Texas Transportation Code, Sections 222.105-108. The law gives the governing body of a municipality the ability to create a TRZ if it determines:

On the other hand, the legal framework for the creation of TRZs in the State of Utah (Utah Code Section 11-13-227) requires the agreement of two or more public agencies (at least one of which has land use authority over the zone considered) to the basic elements of the zone, including: transportation infrastructure need and proposed improvement, boundaries and base year, and terms for sharing future tax revenue. There is no requirement for a determination of the area to be unproductive or underdeveloped, or for a finding of blight.

As for the Texas TIRZs, Chapter 311 (Sections 311.001-311.021) of the Texas Tax Code provides that the governing body of a municipality may create a TIRZ if it determines that development or redevelopment within the zone would not occur solely through private investment in the reasonably foreseeable future. Like in many States where areas must be blighted in order for a TIF district to be created, blight is a requirement to set up a TIRZ in Texas.

According to the Texas Transportation Code (sections 222.105-108), a TRZ can only be initiated by a local government and requires approval only from its governing body (City Council or Commissioner’s Court) after public hearings are held. Additionally, a TRZ is not required to have a separate governance or oversight structure, and no finding of blight within the area is required to create it.

On the other hand, Utah Code (section 11-13-227) requires the agreement of two or more public agencies (at least one of which has land use authority over the zone considered) to the basic elements of the zone, including: transportation infrastructure need and proposed improvement, boundaries and base year, and terms for sharing future tax revenue. There is no requirement for a determination of the area to be unproductive or underdeveloped, or for a finding of blight.

According to Chapter 311 of the Texas Tax Code, a TIRZ can be initiated by a municipality, or by petition of the property owners who own the majority of the appraised property value within the zone. If initiated by the city, a majority of the property owners have to approve. Also, a TIRZ can only be initiated by a city if not more than 10 percent of the land is residential. Creating a TIRZ requires setting up a TIF Board of Directors once it has been approved by the local governing body. Furthermore, in cases where the TIRZ was initiated by the property owners, its Board of Directors is required to include members from all other jurisdictions with taxing authority within the zone regardless of whether they financially participate in it.

Texas local governments that have implemented TRZs and TIRZs have generally developed one or more of the following types of analyses:

The Texas Transportation Code (sections 222.105-108) state that the boundaries of a TRZ may be amended at any time to accommodate changes in the limits of the project for which the zone was originally created. However, property already within the zone may not be removed or excluded from the zone if the local government has already assigned any part of the increment to secure debt or other obligations to fund the project. Conversely, TRZ boundaries can be expanded and properties added to the zone, provided that the local government goes through the same process required to originally create the zone (including public notices and hearings required by law).

On the other hand, relevant Utah legislation (Utah Code Section 11-13-227) does not explicitly allow or disallow changes in the boundaries of a TRZ once it has been created.

The Texas Transportation Code (sections 222.106-107) states that all or the portion of the annual tax increment flows specified by the local government within the zone must be used to fund the transportation project (or projects) for which the zone was created. The remaining portion of the tax increment may be retained by the local government and used for any other general revenue fund purposes.

After a TRZ is established, monitoring and evaluation of development and tax increment revenue become very important. Although it is not required by the Texas or Utah laws, it may be in the best interest of local governments to establish monitoring and evaluation of tax increment revenues within the zone to ensure that payment commitments are adequately met. This information can help assess how far or close financial analysis forecasts were from actual tax increment revenue. Identifying trends in taxable values, land use, and development status of the properties within a zone offer valuable insight into the dynamics of transportation infrastructure and land development. This insight can help local governments foresee potential tax increment revenue shortfalls that may compromise its ability to meet acquired obligations and develop contingency plans. For example, a non-real estate market-related issue, such as a private legal dispute between land owners, that slows down development of a significant area within the zone can be identified early on, and–depending on specifics of the issue and the magnitude of its revenue impact on TRZ revenue-provide an opportunity for the municipality to address it by facilitating a solution, or develop a contingency plan (e.g. such as an expansion of the TRZ or a renegotiation of the terms of the loan). Additionally, it is also important to understand if development is occurring faster than expected, as it may also provide an opportunity to renegotiate project debt and pay it off earlier.

The Texas Transportation Code (sections 222.106-107) states that once a TRZ is created, the law requires that annual property tax increments from property within the zone be deposited into an ad valorem tax increment account.xvi The local government may then enter into an agreement with a public or private entity to implement a project within the zone and pledge all, or a specified amount of the tax increment revenue, to the payment of the costs of that project. On the other hand, Utah Code (section 11-13-227) states that the agencies party to the TRZ agreement shall agree to the terms for sharing any increases in tax revenue, and that each agency shall annually publish a report including a statement of the tax revenue and expenditures made in accordance with the agreement.

As for Texas TIRZs, Chapter 311 of the Texas Tax Code requires local governments to establish a tax increment fund where all or part of the tax increment from the zone is to be deposited during the term of the zone. The TIRZ Board of Directors and the local government that created it may enter into agreements to implement the zone’s project and financing plan. The agreement may dedicate revenue from the tax increment fund to pay any project costs that benefit the zone. Local governments are required to submit an annual report that details the revenues into the tax increment fund and expenditures from it.

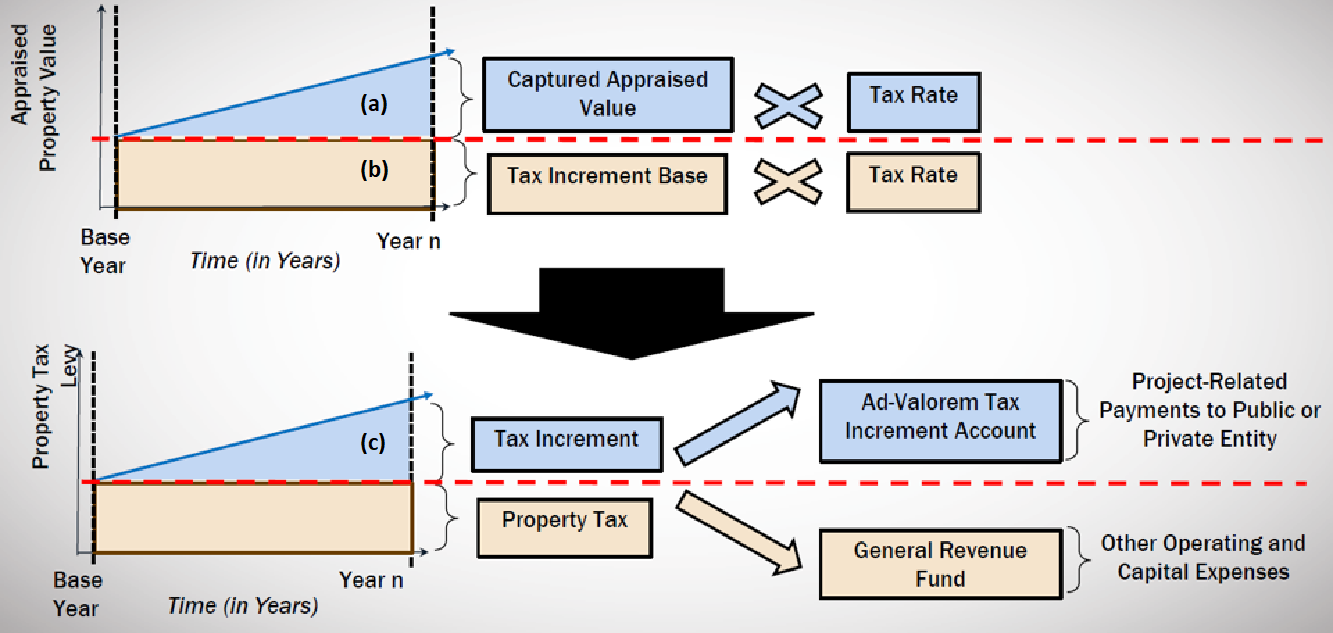

The following definitions from Section 222.1075 of the Texas Transportation Code and Figure 1 below help further demonstrate the notion of annual tax increment:

Figure 1. TRZ Definitions Illustratedxvii

The Texas Transportation Code section 222.105-108 does not limit the size or footprint of a TRZ, as long as it falls within the local government’s jurisdiction. Furthermore, research has concluded that the impacts of transportation projects on real property values are concentrated in regions within 1 to 2 miles from the project.xviii However, experience has shown that actual boundaries are driven by practical considerations, such as the size of the local government’s tax base within the zone relative to its total tax base. If a TRZ is too large relative to the local government’s tax base, it may have a negative impact on the local government’s general revenue fund, and its ability to sustain other local services or provide future property tax relief for economic development purposes. In practice, this has meant that the boundaries of existing Texas TRZs do not exceed a radius of one mile from the center line of a corridor and are often in the range of 1/4 to 1/2 mile.

Utah Code Section 11-13-227 is also mute regarding limitations on the size of the boundaries of TRZ, but given that a requirement for the creation of a TRZ is that one of the agencies has land use authority over the zone, it can be inferred that the zone boundaries must be within such agency’s jurisdiction.

The process required to create a TRZ in Texas is laid out in detail in the Texas Transportation Code, Sections 222.105-108. It can generally be organized in five consecutive stages:

This stage consists of identifying an eligible target area for TRZ funding that may be considered unproductive or underdeveloped, and where the creation of a zone will promote public safety; facilitate the improvement, development, or redevelopment of property and the movement of traffic; and enhance the municipality’s ability to sponsor a transportation project. It is at this stage that a candidate project is identified and a preliminary feasibility analysis to assess its potential is recommended. It is also at this stage that the local government may commence internal and external stakeholder engagement to build support for the project.

This second stage of the process involves the determination of zone boundaries. This stage also marks the commencement of a 60-day public notice period in which the local government declares its intent to create the TRZ and announces the date of a public hearing that must take place not later than the 30th day before the date when the TRZ is expected to be designated. Finally, it is at this stage that it is recommended that the TRZ increment capture analysis conducted in Stage 1 is updated and refined.

The public hearing on the creation and benefits of the zone should be held no later than the 30th day before the TRZ is designated by the local governing body. On the 30th day after the hearing, the local governing body convenes and holds a vote on the creation of the zone by order, resolution, or ordinance (depending on the type of local government creating the TRZ).

Every subsequent year after the TRZ base year, the annual TRZ tax increment is supposed to be transferred into the local government’s TRZ tax increment account. It is at this stage that the local government may enter into an agreement to implement a project within the zone and pledge and assign all or a specified amount of the tax increment revenue to the payment of the costs of the project. Once a TRZ has been established, research suggests that monitoring and evaluation of annual tax increment revenues and land development dynamics within the zone are recommended.xix

A TRZ terminates on December 31 of the year in which the local government completes any contractual requirement that included the pledge of TRZ revenue. Also, a TRZ terminates on December 31 of the 10th year after the year the zone was designated, if before that date the local government has not used the zone for the purpose for which it was designated.

According to the Texas Transportation Code, Sections 222.105-108, a TRZ terminates on December 31 of the year in which the local government completes any contractual requirement that included the pledge of TRZ revenue. Also, a TRZ terminates on December 31 of the 10th year after the year the zone was designated, if before that date the local government has not used the zone for the purpose for which it was designated.

According to the Texas Transportation Code, Sections 222.105-108, local governments are not required to dedicate 100 percent of the annual tax increment revenue. Rather, the law explicitly states that a local government may pledge and assign all or a specified amount of the tax increment revenue to the payment of the costs of the project. In practice, this means that local governments retain a great deal of flexibility in deciding what percent of the annual tax increment revenues are dedicated to paying for a project. Utah Code Section 11-13-227, on the other hand, states that the public agencies will agree at the time of creating the TRZ on the terms for sharing any property tax revenue increase within the zone.

Once a TRZ is designated, the annual tax increment payments from property within the zone are deposited into an ad valorem tax increment account. The local government may then contract with a public or private entity to develop, redevelop, or improve the project in the TRZ and may pledge to that entity all or a specified amount of the tax increment revenue the local government receives for the payment of the costs of that project.

Experience in Texas has shown that there are three main financing options available for TRZ revenue funds, each with its own advantages and disadvantages:xx

Texas TIRZs have access to the pay-as-you-go option as well as the municipal bond financing methods described earlier for TRZs.

Texas law does not limit the use of TRZ funds to State or Federal transportation projects.xxi In practice, this means that TRZ funds can be used on local transportation projects not linked to a State facility as long as the local government is not planning to seek SIB loan financing and is instead planning to use the pay-as-you-go or municipal bond financing options. The restriction to projects linked to a State facility is not connected to the use of TRZ funds or to the aforementioned TRZ statute, but rather is connected to the choice of SIB financing. This is because in order to obtain SIB financing in Texas, a project must be eligible for funding under Title 23 of the US Code (Federal Aid Highways, 23 U.S.C. 602). This usually means that a project must be on a State’s highway system and included in the statewide Transportation Improvement Plan.

Utah law (Utah Code Section 11-13-227) does not limit the use of TRZ funds to local, State, or Federal transportation projects.

A TRZ can be created to support a single project or multiple transportation improvements.

Both Texas and Utah laws require a public hearing prior to establishing a TRZ.xxii

Yes, a public hearing is required to establish a TIRZ according to Texas law (Texas Tax Code Section 311.003).

In Texas, experience has shown that it takes about six months to go through all stages of TRZ creation.

TRZs and TIRZs do not increase the cost of housing or property taxes. Property tax rates remain constant. The phenomenon that takes place is that the infrastructure project(s) and other improvements made within the zone may have a positive effect on land and real property values. It is this increase in value, which may in turn result in a larger tax bill assuming a constant property tax rate.

The Camino Real Regional Mobility Authority (CRRMA) in El Paso, Texas, has published on its website detailed information on the TRZs formed in the City of El Paso in 2010, which were among the first TRZs created in the State.xxiii

Additionally, the Federal Highway Administration's Center for Innovative Finance Support has published on its website examples of other TRZ projects throughout Texas.xxiv The FHWA website also has a link to a Value Capture Implementation Manual, which provides additional examples of TRZ projects.xxv

There is no legal requirement or limit on the portion of a project’s cost that can be funded using TRZ revenue. However, in practice TRZ experience to date indicates that TRZ funding is primarily used as a gap financing tool to pay only for a portion of the project cost. This is because in these cases, paying for 100 percent of the cost of the project may have put an undue burden on local government financing.

Yes, Texas experience has shown that TRZ funds may be part of a funding mix that includes other traditional and non-traditional transportation funding options.xxvi On the other hand, Utah Code (Section 11-13-227) does not explicitly mention any limitations on the use of other funding sources along with TRZ funding.

No, only the portion of the future property tax increment revenue corresponding to the local government unit that established the TRZ is pledged towards a project. The future property tax increment revenue corresponding to other taxing jurisdictions, such as school districts and county hospitals, remains intact.

No. Neither Texas nor Utah TRZs require approval by taxing entities other than the ones creating the TRZ. According to the Texas Transportation Code Sections 222.105-108, a TRZ requires only approval only by the governing body of the local government unit setting it up (e.g., municipality, county, port authority, or navigation district).

On the other hand, Utah Code (Section 11-13-227, states that approval and agreement is required from two public agencies, at least one of which has land use authority over the zone. In other words, agencies other than the two establishing the TRZ do not have an approval role in the creation of the TRZ.

Texas Transportation Code Section 222.106 explicitly allows counties to create a TRZ, and Texas Tax Code 311.003 specifically allows counties to create a TIRZ. However, there are questions as to whether the Texas constitution allows counties to create either type or zone. According to an opinion from the Texas Attorney General, the equal and uniform taxation requirement in the Texas Constitution (Article VIII, Section 1A) may prohibit a county from using revenue from a TRZ or TIRZ to pay for a project (including a transportation project) that is aimed at developing or redeveloping a specific area within the county. The creation of a zone and use of its incremental tax revenue for a project may be considered to cause an unequal distribution of the ad-valorem tax burden.xxvii

The processes for creating and implementing a TRZ involve a significant amount of interagency collaboration. The information and support needed to complete the process benefits from the involvement of a number of stakeholders, including agencies such as the State DOT and the appraisal district. It may also be reviewed with City Council representatives, county commissioners, and officials from other agencies. As a result, it is critical to develop good solid stakeholder relations and to identify agency champions.

In Texas, experience has shown that concerns are occasionally expressed about the ability of the local government to sustain services within the zone as a result of some of the incremental property tax revenue being dedicated to a transportation project. Typically, these concerns are eased when an explanation is provided as to how the transportation project is likely going to result in increased property tax revenue well beyond the TRZ boundaries, resulting in a net increase in the ability of the local government to provide services. Because no TRZs have been established in Utah yet, no experience with objections voiced at TRZ creation public hearings has been recorded.

An economic recession is likely to have a detrimental effect on property values and the real estate market in general. Depending how long the effects of the recession last, it may significantly affect future incremental property tax revenues.

https://www.fhwa.dot.gov/innovation/everydaycounts/edc_5/value_capture.cfm

https://www.fhwa.dot.gov/ipd/value_capture

https://www.fhwa.dot.gov/ipd/value_capture/defined/transportation_reinvestment_zone.asp

iFor details on the evolution of the State of Texas TRZ legal framework, please see link: Transportation Reinvestment Zones: Texas Legislative History and Implementation Final Report.

iiTexas TRZs - Texas Transportation Code, https://statutes.capitol.texas.gov/Docs/TX/htm/TX.311.htm.

iiiUtah TRZs - Utah Code, https://le.utah.gov/xcode/Title11/Chapter13/C11-13-S227_2018050820180508.pdf.

ivTexas TIRZs - Texas Tax Code, https://statutes.capitol.texas.gov/Docs/TX/htm/TX.311.htm.

vAlthough dedicating the sales tax increment within a TRZ is allowed by the Texas Transportation Code (222.105-107), none of the existing or planned TRZs in Texas to date have included sales tax increment provisions.

viAdditional information on the City of El Paso TRZs can be found in the links below:

https://www.fhwa.dot.gov/ipd/project_profiles/tx_americas_interchange.aspx and

http://legacy.elpasotexas.gov/muni_clerk/agenda/04-20-10/04201016.pdf.

viiSee introductory section for a link to Utah’s TRZ legal framework. Future implementation experience and research will help fill gaps in understanding the implementation process of Utah’s TRZs, as has been the case in Texas.

viiiSee introductory section at the beginning of this document for a link to the legal framework of the TIRZs. While a finding of blight within the area is required to create a TIF district in many States, in Texas, blight is one of the possible justifications to create a TIRZ. The Texas constitution (Article 8, Section 1-g) states that in order to be designated a TIRZ, an area must be unproductive, underdeveloped, or blighted.

ixThe Texas Attorney General cites article VIII, section l(a) of the Texas Constitution. See letter from Texas Attorney General Ken Paxton to Representative Joseph C. Pickett dated February 26, 2015: https://www2.texasattorneygeneral.gov/opinions/opinions/51paxton/op/2015/kp0004.pdf.

xTexas Transportation Code, http://www.statutes.legis.state.tx.us/GetStatute.aspx?Code=TN&Value=370.003.

xiSee report Transportation Reinvestment Zones: Texas Legislative History and Implementation Final Report.

xiiAs noted in the FHWA Value Capture Implementation Manual, because TIF value capture tools do not generally involve additional taxes, they may be less controversial than other value capture tools.

xiiiThe incremental growth nature of TRZ revenue flows also means that to adequately serve debt commitments acquired for a project, local governments may be forced to supplement TRZ revenues with general revenues to make debt payments in the early years. Over time, this situation would typically reverse as annual incremental revenues grow and exceed annual debt service commitments.

xivThe Texas Attorney General cites article VIII, section l(a) of the Texas Constitution. See letter from Texas Attorney General Ken Paxton to Representative Joseph C. Pickett dated February 26, 2015: https://www2.texasattorneygeneral.gov/opinions/opinions/51paxton/op/2015/kp0004.pdf.

xvTexas Comptroller of Public Accounts, “Biennial Registries of Reinvestment Zones for Tax Abatements and Tax Increment Financing,” 2018, https://comptroller.texas.gov/economy/docs/96-1726-tif-abate-2018-reg.pdf.

xviTexas Transportation Code Sections 222.106-107.

xviiAldrete, Rafael M., Carl James Kruse, David Salgado, Sharada R. Vadali, Abhisek Mudgal, Juan Carlos Villa, Lorenzo E. Cornejo, and Deog Sang Bae, "Leveraging the Value of Land and Landside Access to Fund Port Infrastructure in Texas," Transportation Research Record 2672, no. 11 (2018): 41-52.

xviiiResearch documented by Vadali et al. has concluded that the impacts of transportation projects on real property values are concentrated in regions within 1 mile and extended to 2 miles. Vadali, Sharada R., Rafael M. Aldrete, and Arturo Bujanda, "Financial Model to Assess Value Capture Potential of a Roadway Project," Transportation Research Record, 2115.1 (2009): 1-11.

xixAldrete, et al.

xxAldrete, R., (2019, August 22), Transportation Reinvestment Zones [PowerPoint slides], in Federal Highway Administration EDC-5 Value Capture Webinar: Value Capture Incremental Growth Techniques and Case Studies, retrieved from: https://www.fhwa.dot.gov/ipd/pdfs/value_capture/capacity_building_webinars/webinar_082219.pdf.

xxiTexas Transportation Code Sections 222.105-108.

xxiiTexas Transportation Code Sections 222.105-108 and Utah Code Section 11-13-227.

xxiiiCamino Real Regional Mobility Authority, https://www.crrma.org/information/publications.

xxivFHWA, https://www.fhwa.dot.gov/ipd/fact_sheets/value_cap_transportation_reinvestment_zones.aspx.

xxvFHWA, https://www.fhwa.dot.gov/ipd/value_capture/resources/value_capture_resources/value_capture_implementation_manual/.

xxviFor examples, please see: https://www.crrma.org/information/publications, and https://www.fhwa.dot.gov/ipd/fact_sheets/value_cap_transportation_reinvestment_zones.aspx.

xxviiSee letter from Texas Attorney General Ken Paxton to Representative Joseph C. Pickett, dated February 26, 2015, https://www2.texasattorneygeneral.gov/opinions/opinions/51paxton/op/2015/kp0004.pdf.