TABLE OF CONTENTS

Source: FHWA B/E Case Primer (2021)

Tax Increment Financing (TIF) - Buy-in from City and/or County regarding the extent of local tax revenue sharing

Special Assess. District (SAD) - Determination of whether assessment is tax or fee—affects voter approval requirement

Development Impact Fee (DIF) - Nexus and fee studies to determine legally defensible and market feasible fee levels

Often each VC technique is considered separately, not an integrated approach;Processes differ depending on applicable State and local laws

Source: LA Metro Value Capture Assessment Study (2020)

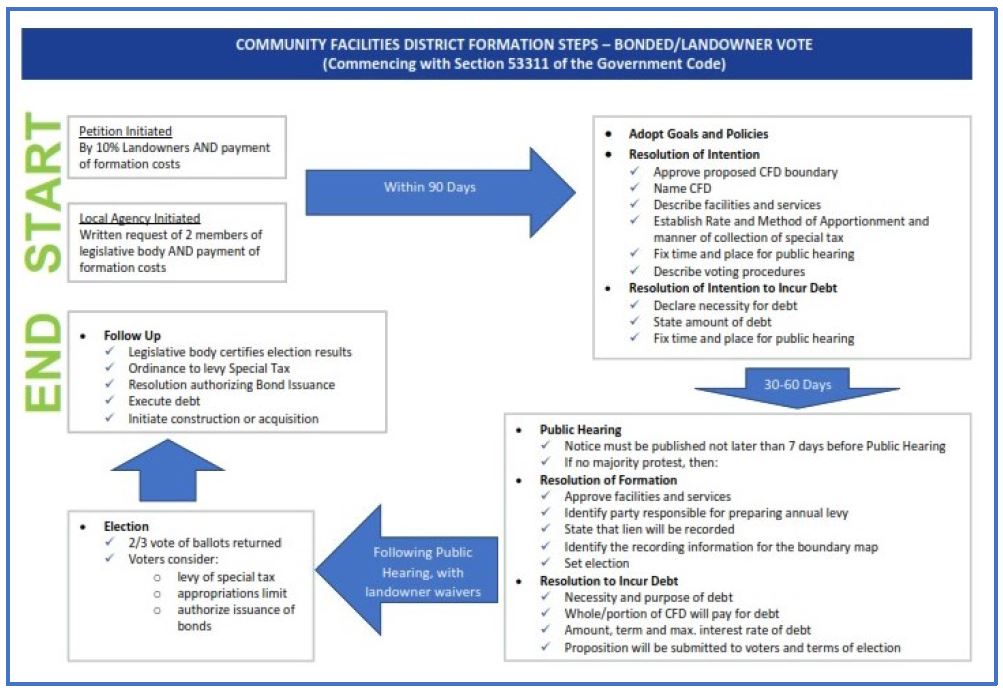

CA Community Facilities Act of 1982 (Government Code 53311-53368.3) established CFDs and their implementation processes