« PreviousNext »

5. Quantitative Assessment

Quantitative Assessments-Basic Components

VC Opportunity Areas and Buildout Scenarios

VC Opportunity Areas (OAs)

Identify where substantive new developments could occur:

- OA "Nodes": (1) Major highway intersections; (2) Transit stations with high growth potential

- Local GPs and SPs can help determine the extent of OA coverage

Buildout Scenarios for OAs

Incremental development potential based on up-zoning:

- Maximum allowable density by land use

- Long-term growth plans per local GPs and SPs

- TOD guidelines (e.g., recommended urban/suburban density within 1/4 & 1/2-mi radius of BRT & rail transit stations)

Maximum VC Revenue Potential

TIF

Estimate incremental tax revenues based on:

- Base year/baseline assessed value (AV)

- Buildout absorption schedule

- Future property value, AV escalation

- City/County participation levels

SAD

Estimate new special assessment revenues based on:

- Max. potential effective tax rate above existing rate

- Same as TIF assumptions on absorption, future value, AV escalation

DIF

In the absence of full nexus study, estimate revenues based on:

- Current DIF levels in adjacent areas (i.e., market-accepted rates)

- Different fee schemes: (1) urban/in-fill (marginal cost basis), (2) suburban (total cost basis)

VC Opportunity Areas and Buildout Scenarios

Cash Flow by VC Technique

For each VC technique, establish:

- Lifecycle timeframe (e.g., TI or SA district term)

- Bonding capacity based on timing of bond issuance(s) and debt financing terms

- Base year for PV analysis

TI–Tax Increment, SA–Special Assessment

Integrated Lifecycle Cash Flow

Estimate cumulative lifecycle cash flows:

- Single node: total combined cash flow for all VC techniques at an intersection or station

- Multiple nodes (corridor level): total combined cash flow for all VC techniques for multiple intersections/station

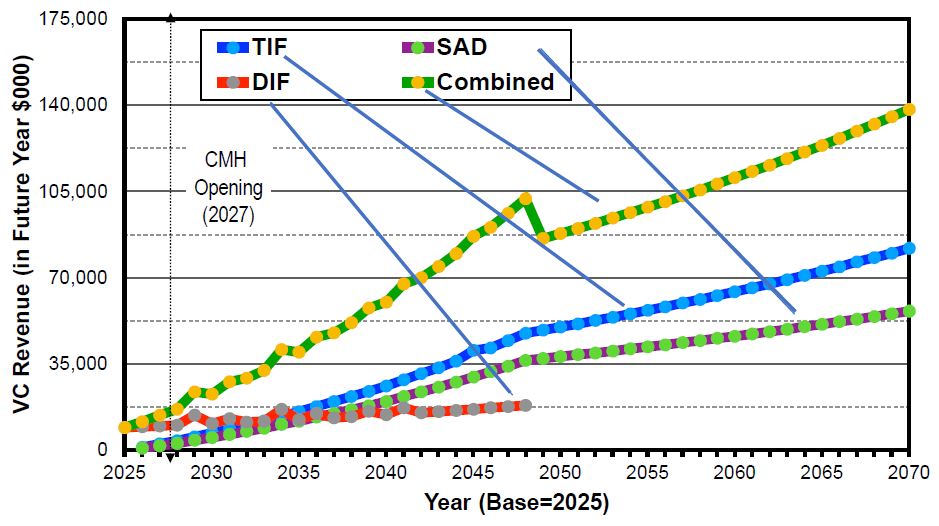

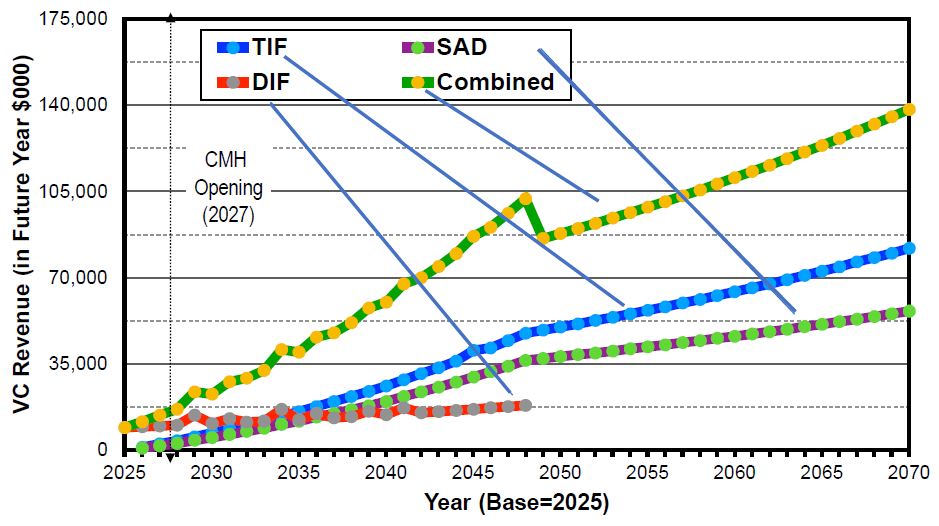

Integrated Lifecycle VC Cash Flow–Single Node San Diego Central Mobility Hub (CMH) Example

Annual Cash Flow: High Scenario

| VC Type |

Present Value (2025$) |

| 45-Year Lifecycle Cash Flow |

Potential Bond Proceeds |

| TIF |

$463.2 M |

$188.2 M |

| SAD |

$306.1 M |

$189.9 M |

| DIF |

$189.5 M |

n.a. |

| Total |

$958.8 M |

$378.1 M |

Notional Only

Source: SANDAG Central Mobility Hub Alternative Funding Strategy (2021)

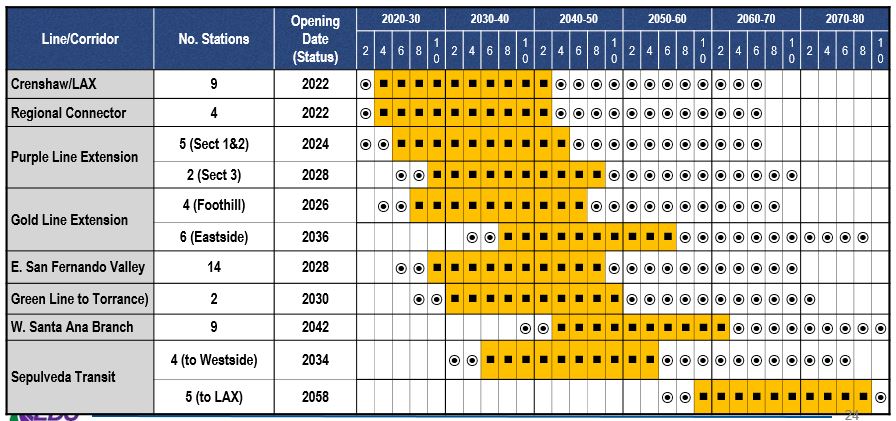

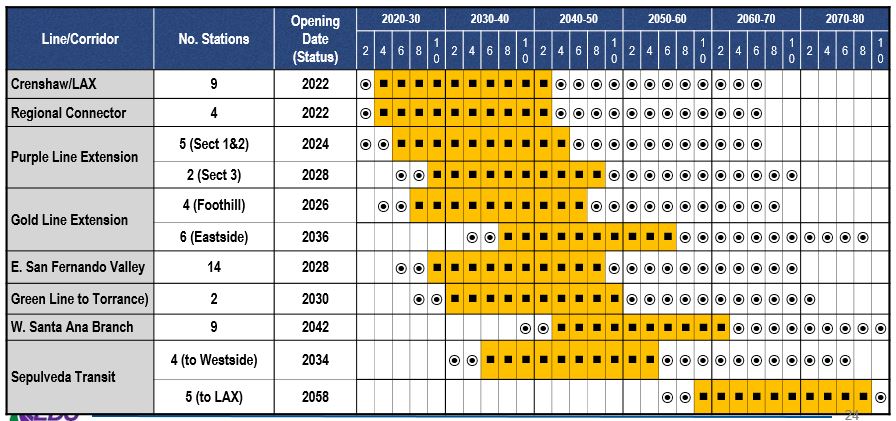

Integrated Lifecycle VC Cash Flow–System Level LA Metro New Rail Transit Corridor Example

Source: LA Metro Value Capture Assessment Study (2020)

Notional Only

« PreviousNext »