TABLE OF CONTENTS

LIST OF FIGURES

LIST OF TABLES

LIST OF BOXES

A resilient value capture funding strategy is key to maximizing the value generated by the transportation investment and the long-term success of value capture as a funding source. Developing a resilient value capture funding strategy is about incorporating the means to mitigate and cost-effectively deal with risk and potential deviations from expected project outcomes in each phase of the project life cycle. In the context of value capture, the focus is primarily on deviations in expected project outcomes that may affect:

The result of building resiliency into a value capture funding strategy is also called a “Risk-Adjusted Value Capture Strategy.” This section introduces the concept of resiliency and developing a risk-adjusted value capture strategy that considers potential risks in the context of their timing vis-Ã -vis different project phases and project stakeholders, incorporating appropriate mitigation strategies in each phase.

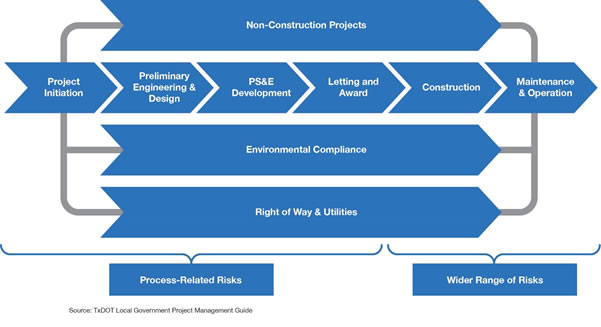

Risks in a transportation project are usually identified by reference to different project life cycle phases and/or risk categories. Figure 5 illustrates typical transportation project life-cycle phases, which in this example consist of the following: 1) project initiation; 2) preliminary engineering and design; 3) plans, specifications, and estimate (or PS&E) development; 4) letting and award; 5) construction; and 6) maintenance and operation. Running in parallel to these phases we have environmental compliance and right-of-way (ROW) and utilities processes.

Figure 5. Transportation Project Life Cycle Phases [Adapted from (55) ]

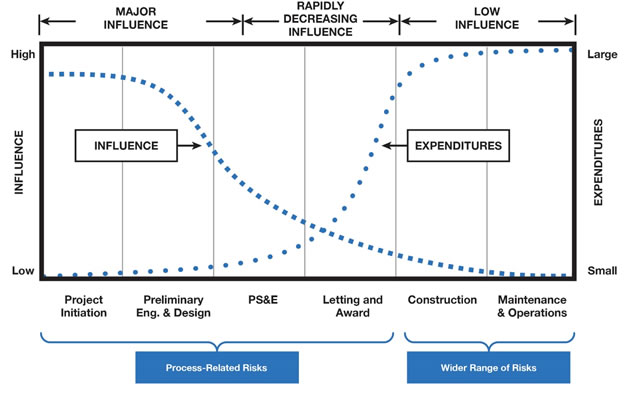

Risks that may have a bearing on successfully using value capture to fund a project may materialize in each of these six phases and processes. However, the actions that take place early in the project life cycle have a much greater influence on a project’s outcome during than the actions taken subsequently. This is illustrated in Figure 6, where the curve labeled “influence” reflects the ability to affect the outcome of a transportation project throughout its different phases. It is much easier to affect a project’s outcome during the early phases when effort and expenditures are relatively small than it is to influence it later, when cumulative expenditures and efforts are more significant. Hence, the importance of making careful plans for a successful project outcome.

Figure 6. Transportation Project Life Cycle and Risk Influence Curve [Adapted from (56) and (55) ]

The risks that a local government or other project stakeholders may face during the first four project phases are for the most part process-related (i.e., they depend on an adequate execution of the processes involved) and depend on a relatively narrow set of factors. For example, during the project initiation phase, a project selected through a rigorous and objective transportation planning process, justified by significant mobility or accessibility needs, is more likely to spur economic development than a project that is arbitrarily selected. Once the project has been selected, how early value capture funding is pursued will influence how much value can actually be captured―if it is done too late, when property appreciation has already taken place, the value capture will be more limited. In subsequent phases, sometimes as part of the environmental or right-of-way and utilities processes, risks that may affect project costs or schedule, or land development plans, may also materialize.

Although the first four phases occur prior to the project construction event starting, considering exposure to the associated risks is critical, and where possible, mitigated. In the project initiation and preliminary engineering phases, poor risk assessment and risk allocation lead to more risks materializing in subsequent phases when, as noted in Figure 6, stakeholder influence is minimal. This is because risks that occur after the project contract is awarded and construction commences vary from phase to phase and depend on a much wider range of factors (many of them out of the control of the local government and other stakeholders). For example, policy and institutional risks (e.g., environmental process delays) may affect the timeline to generate the expected value capture revenues, and exogenous economic risk events may materialize after the facility opens to traffic that influence real estate demand or economic activity (e.g., an economic downturn).

Building resiliency into a value capture strategy is about accounting for these risks and their timing early on through robust risk assessment and allocation work, along with identifying adequate mitigation measures. This is the essence of a risk-adjusted value capture strategy.

Developing a value capture funding risk-adjusted strategy is accomplished by: 1) integrating robust risk assessment and allocation early into the project development process; and 2) strategically deciding when in the project life cycle to implement the value capture techniques selected. There are two important lessons that can be drawn from past value capture applications that illustrate the importance of developing a risk-adjusted strategy early and with a long term, project life cycle perspective (57). The first is that value capture techniques have frequently been implemented too late, after a significant amount of property appreciation has already taken place. The second is that existing properties near a new project frequently enjoy significant appreciation gains without paying their fair share of the project (57).

Because of these lessons, an effective value capture approach for a major transportation corridor project is to start early when there is a general recognition of the potential of the project to generate value, and before properly assessing, negotiating, and granting the land use prerogatives for future development (57). Assessing the monetization potential of the project’s land use prerogatives for future development, based on the benefits and costs to each major stakeholder involved, prior to granting future land use prerogatives is essential to maximize the value capture potential (57). In other words, planning the value capture approach at the corridor level early on, in the project initiation phase, and well in advance of the letting and award phase is essential for stakeholders to retain the ability to take advantage of as many opportunities to capture value as possible. For example, after the ROW is acquired and the letting and award phase is concluded, a local government loses most of its negotiating leverage and incentives for developers are likely to be weaker (57).

The implication from a risk-adjusted value capture strategy standpoint is that developing a strategy to strengthen and preserve negotiating leverage early in the project initiation phase is key to reduce overall risk exposure in value capture monetization (i.e., the potential value capture revenue to fund the project) (57). In the long term, this value capture approach could be multi-layered, based on the project life cycle phase and the characteristics of the corridor’s influence area at that time. For example, initially considering value capture techniques that have the least new impact on stakeholders and lowest risks (e.g., a TIF district, which does not impose new taxes), and following with techniques that involve new charges and increasing risks (e.g., SADs or impact fees) (57). This risk-adjusted approach allows stakeholders to better bear the financial burden that the selected value capture technique(s) selected may impose on them.

Thus, developing a risk-adjusted strategy entails creating a value capture approach that identifies: 1) what value capture techniques to use; 2) when in the project life cycle to use them; 3) where in the project’s influence area to apply them; and 4) how to implement them (57). A risk-adjusted value capture approach addresses how multiple techniques are to be integrated and phased over the project’s life cycle and based on an underlying framework that takes into account: 1) equity, that is, those who benefit the most pay the most, and the costs do not disproportionally impact vulnerable stakeholders; and 2) risk, that is, risks are allocated according to the principles outlined in section 2.3 (i.e., risks are borne by the party best able to control the likelihood and/or the impact of the risk materializing, or by the party best able to absorb it at the lowest cost) (57).

In the transportation corridor example discussed earlier in this section, private real estate development along the new or improved corridor can be further stimulated initially through government-sponsored value capture techniques (e.g., a TIF district followed by a SAD, if needed) (57). As initial development builds-out, the risk to new development would gradually decrease, and the developer’s willingness to pay for exactions or contributions would increase accordingly. Establishing a transparent risk-adjusted value capture implementation approach encompassing the entire project life cycle early on would help streamline the value capture implementation process, reduce value capture risk, and maximize value capture potential (57). Pursuing such a comprehensive risk-adjusted implementation approach is particularly beneficial in projects that use multiple value capture techniques and stakeholders, which involve a complex web of regulatory and institutional requirements (57).