« PreviousNext »

3. Establishment

Establishing a TIF District

- Is TIF Authorized? What are the Criteria?

- Identifying properties & defining boundaries

- Identifying Revenue Sources

- Estimating the Tax Increment

- Termination date

- Enact Legislation or Ordinance

1. IS TIF AUTHORIZED? WHAT ARE THE CRITERIA?

- TIFs are authorized in all States except for Arizona. But is it authorized for your unit of government?

- State enabling legislation provides establishment criteria. They might include criteria for the area such as:

- Blight

- A History of Economic Stagnation

- Unlikely To Develop Without a TIF

- Other?

- And criteria for the TIF Project. Will it catalyze:

- New Economic Activity?

- New Revenues Sufficient to Pay the TIF Portion of the Project?

KEY FINDING: No Development Likely Without TIF

Some State enabling statutes require a “but for” finding – a determination that tax revenues in the affected area will not increase “but for” the improvement of specified infrastructure that will catalyze private-sector development and other economic activity.

Source: U.S. DOT

Source: City of Sioux Falls, SD

Source: Lincoln Institute of Land Policy

KEY FINDINGS:

- TIF Will Generate New Revenues Sufficient to Fund the TIF Infrastructure Project

- Economic Activity Induced by the TIF Will Not Generate Demands for Increased Government-Funded Facilities or Services Other Than the TIF-Funded project; and

- Increases in Economic Activity Within a TIF District Are Not Displacing or Inhibiting Economic Activity in Other locations.

Source: In City, Town, and Country by Paul R. Hanna, Scott, Foresman & Co., 1959

Source: In City, Town, and Country by Paul R. Hanna, Scott, Foresman & Co., 1959

Source: In City, Town, and Country by Paul R. Hanna, Scott, Foresman & Co., 1959

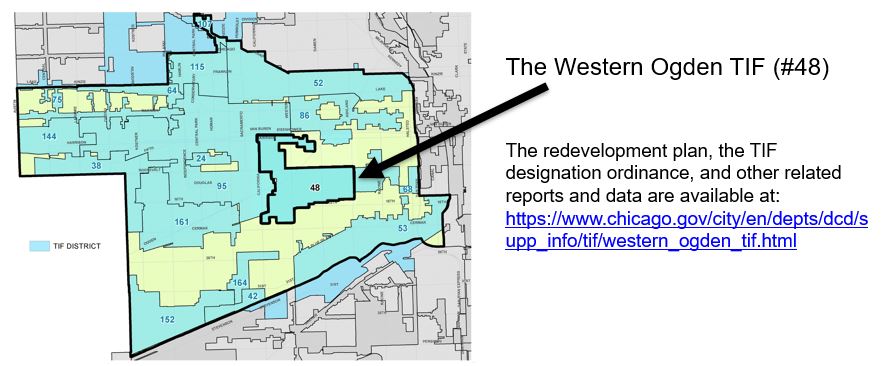

2 IDENTIFYING PROPERTIES & DEFINING BOUNDARIES

State enabling statute is always the first place to look for criteria.

Typically:

- Properties within a TIF District benefit from the TIF project.

- Properties within a TIF District will generate sufficient revenue (through higher property assessments, increased sales, or increases in other benchmarked revenues) to pay for the TIF share of the project.

- TIFs need not necessarily fund 100% of project costs (check State statute), but, if TIF provides less than 100%, the remainder will:

- Compete with other projects or programs; and/or

- Require an increase in tax rates.

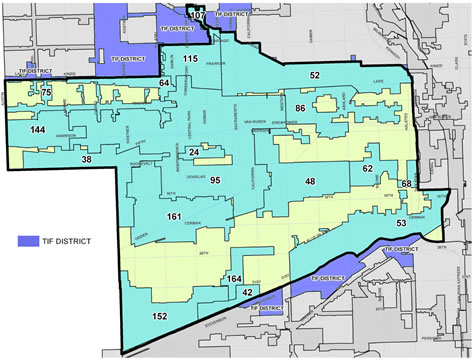

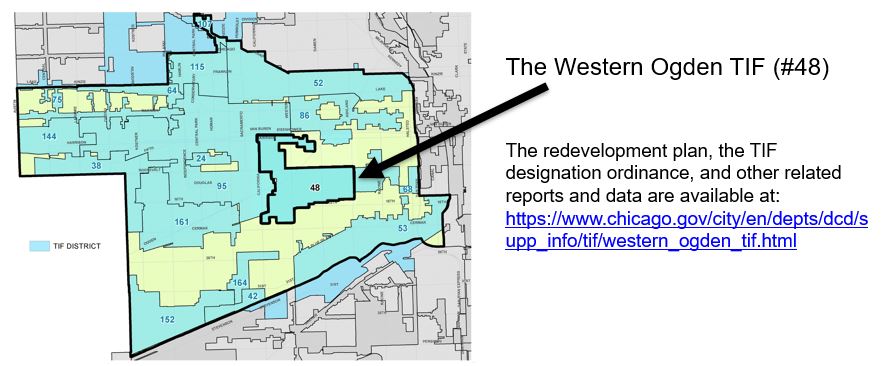

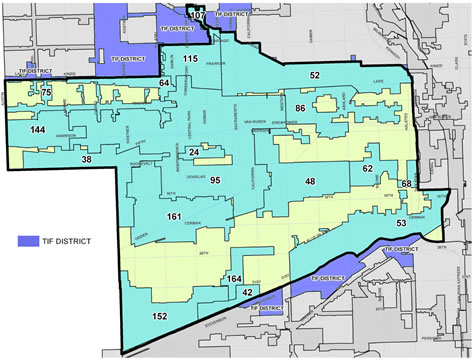

CHICAGO: West Side TIF Districts

Source: City of Chicago, West Side TIFI District Map

Numbers reflect the order that districts are designated citywide.

Source: City of Chicago, West Side TIFI District Map

3. IDENTIFYING REVENUE SOURCES

- What revenue sources are available for TIFs pursuant to the State enabling legislation?

- Is the jurisdiction implementing the TIF authorized to levy and segregate the authorized TIF revenue sources?

- Based upon the anticipated TIF redevelopment plan, which of the authorized TIF revenue sources are likely to grow as a result?

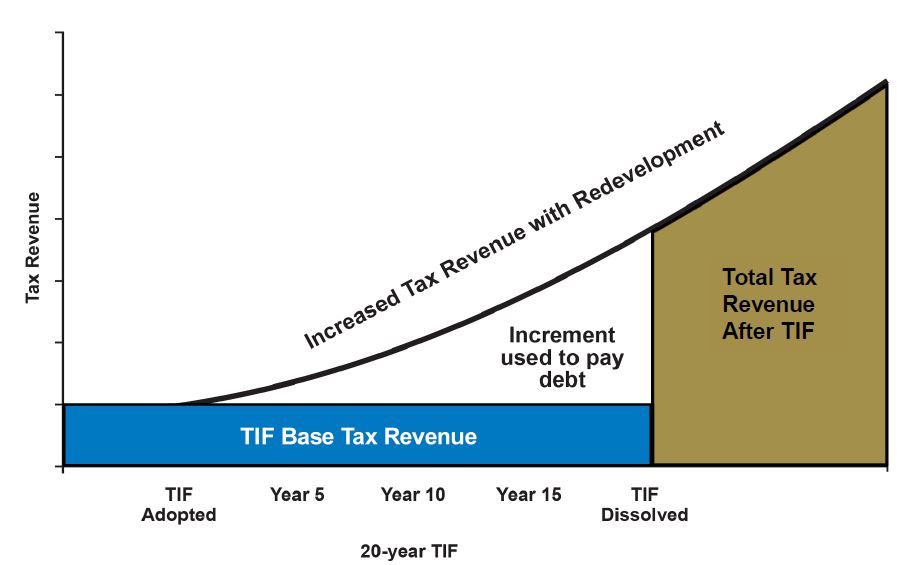

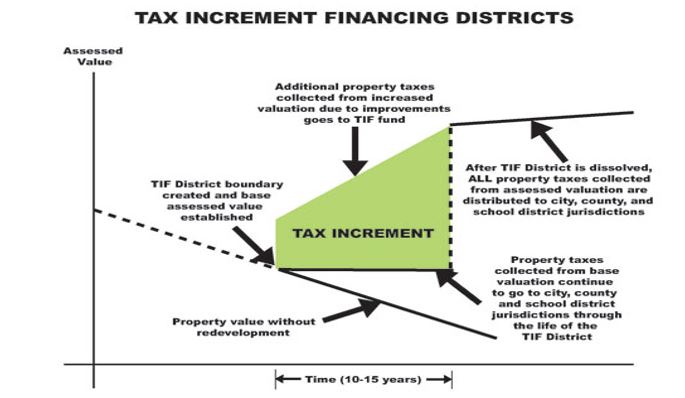

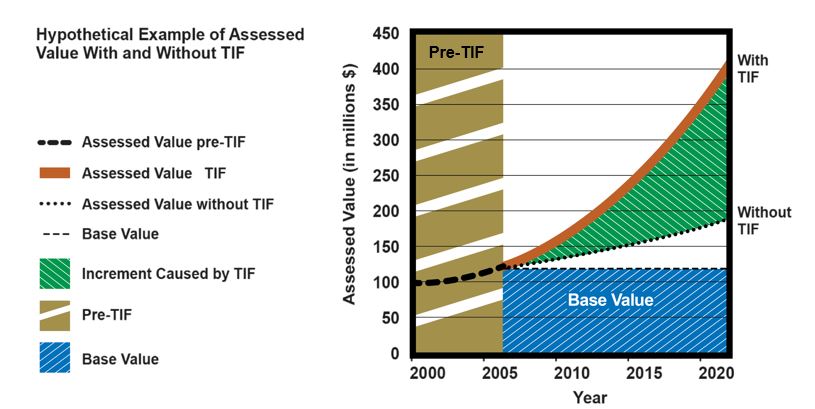

4. ESTIMATING THE TAX INCREMENT

Communities typically hire consultants to:

- Estimate the timing and extent of new development generated by TIF incentives

- What’s the range of increase in assessed values by year?

- In each year, multiply by the existing tax rate.

- Estimate the timing and magnitude of increases in economic activity (sales, income, etc.)

- In each year, multiply the base increment by the existing tax rate.

INCORPORATE RISKS IN ESTIMATES

The calculated tax increment is only an ESTIMATE.

A sensitivity analysis will determine:

- The types and probabilities of risks that could thwart the realization of the increases in development, economic activity and revenue;

- Risk assessment for the national, regional and local economies; and

- Risk assessment for the infrastructure project (cost overruns, delays, etc.) and for the anticipated catalytic results.

TAX INCREMENT CONCLUSION:

The tax increment should be expressed as a range, from:

- Low (unlikely) to

- Medium (most probable) to

- High (also unlikely)

The range of each outcome will become larger in future years because uncertainty is magnified the further into the future an estimate is made.

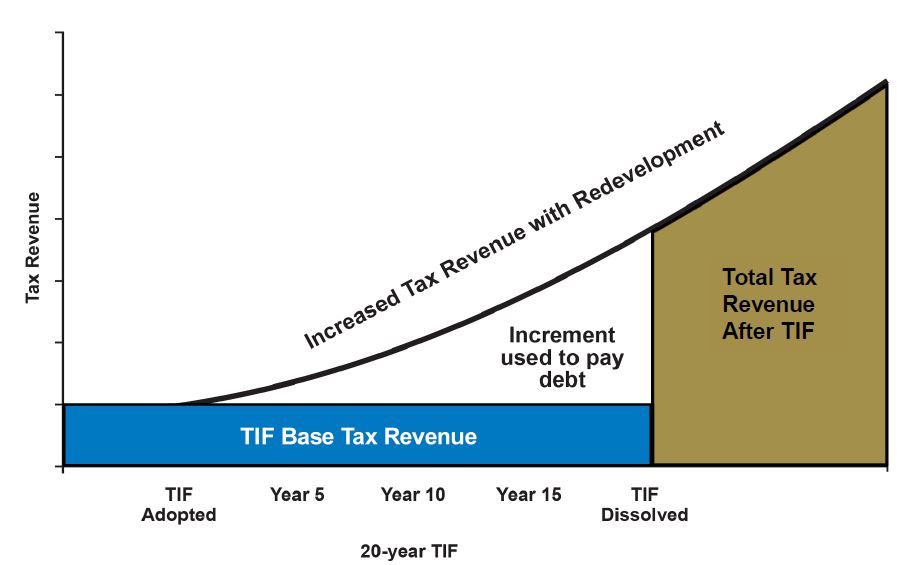

5. ESTABLISHING A TERMINATION DATE FOR THE TIF DISTRICT

Identify an infrastructure project or program to catalyze development.

Compare yearly projections of costs and of tax increment revenues.

Differences between the cost calendar and the revenue calendar (both adjusted for risk) will determine whether the TIF project can be funded on a pay-as-you-go (pay-go) basis or whether financing will be required.

This analysis will also determine when project costs will be retired. The TIF termination date is often established as the day after costs are retired.

Note: No Federal requirements pertain to these analyses.

6. NOTIFYING THE PUBLIC & ADOPTING ORDINANCES

Hearings are held to obtain input from the public. Interested persons are provided an opportunity to support, oppose or suggest changes to the proposed Redevelopment Plan and TIF Designation ordinances.

State enabling legislation will provide substantive and procedural requirements for local legislation to implement a TIF. Typically, this entails the adoption of both a “Redevelopment Plan” and a TIF Designation ordinance.

« PreviousNext »

Source: In City, Town, and Country by Paul R. Hanna, Scott, Foresman & Co., 1959