« PreviousNext »

6. Financing

TIF and Financing

PAY-GO or FINANCING

- During the establishment of a TIF, it is important to determine the spending calendar associated with the TIF infrastructure project and compare that to the revenue calendar associated with the estimated tax increments. (See Section 3.5, slide #27 above)

- If requirements for spending are less than and later than the receipt of tax increment revenues, then the TIF project can probably be funded out of tax increment revenues deposited into an account dedicated for this purpose. This is pay-as-you-go (or pay-go) funding.

- If requirements for spending are greater than and/or sooner than the receipt of tax increment revenues, then financing the TIF project might make sense.

TIFs and Financing

CAPITAL PROJECTS & FINANCING

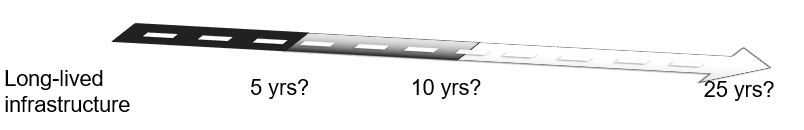

- Financing should only be pursued for the creation of assets whose useful life is longer than the financing term.

- Typically, investors are willing to make loans (or buy bonds) to provide up-front cash for infrastructure projects that will be paid back over a specified time at an agreed-upon rate of interest / return.

- Initially, tax increments are merely estimates related to future revenues that entail substantial uncertainty and risk. Uncertainty and risk cause investors to seek higher interest rates or refuse to finance.

- Special assessments or other arrangements can be created to serve as backstops for uncertain TIF revenue, thereby facilitating financing.

« PreviousNext »